WeWork was once a startup darling, but its journey has taken many unexpected turns. For those wondering who owns WeWork, the answer is complex due to multiple bailouts, bankruptcies, and restructuring efforts. This article explores the ownership structure, revenue, CEO, and more about the company.

WeWork Company Profile

WeWork is an American flexible workspace provider offering coworking spaces, private offices, and shared work environments. It was founded in 2010 in New York City by Adam Neumann and Miguel McKelvey. The company grew rapidly by leasing large commercial properties and transforming them into stylish, tech-enabled workspaces. Its model appealed to startups, freelancers, and large enterprises seeking flexibility.

WeWork aimed to revolutionize how people work by creating a “physical social network” for professionals. At its peak, it was valued at $47 billion, operating in more than 30 countries with over 700 locations.

Major Milestones

- 2010: WeWork was founded and opened its first location in SoHo, Manhattan.

- 2012–2015: Rapid expansion across U.S. cities and into international markets such as London and Tel Aviv.

- 2017: SoftBank invested heavily, eventually committing over $10 billion.

- 2018: Rebranded as The We Company, signaling plans to expand beyond offices (including housing and education).

- 2019: Planned IPO was pulled after scrutiny over financial losses and governance issues. Adam Neumann resigned as CEO.

- 2020: Pandemic disrupted office usage. Sandeep Mathrani became CEO and began downsizing leases and cutting costs.

- 2021: WeWork went public via a SPAC merger with BowX Acquisition Corp.

- 2023: Filed for Chapter 11 bankruptcy in the U.S. due to ongoing financial losses and unsustainable lease obligations.

- 2024: Exited bankruptcy with Yardi Systems becoming the majority owner and operator.

Company Details

- Headquarters: New York City, United States

- Industry: Commercial Real Estate / Flexible Workspace

- Founders: Adam Neumann, Miguel McKelvey

- Ownership: Privately held (as of 2024)

- Global Presence: Operations scaled back but still active in key global cities

- Business Model: Lease or manage office spaces, customize and sublet them to members on flexible terms

- Employees: Thousands at its peak, now reduced due to restructuring.

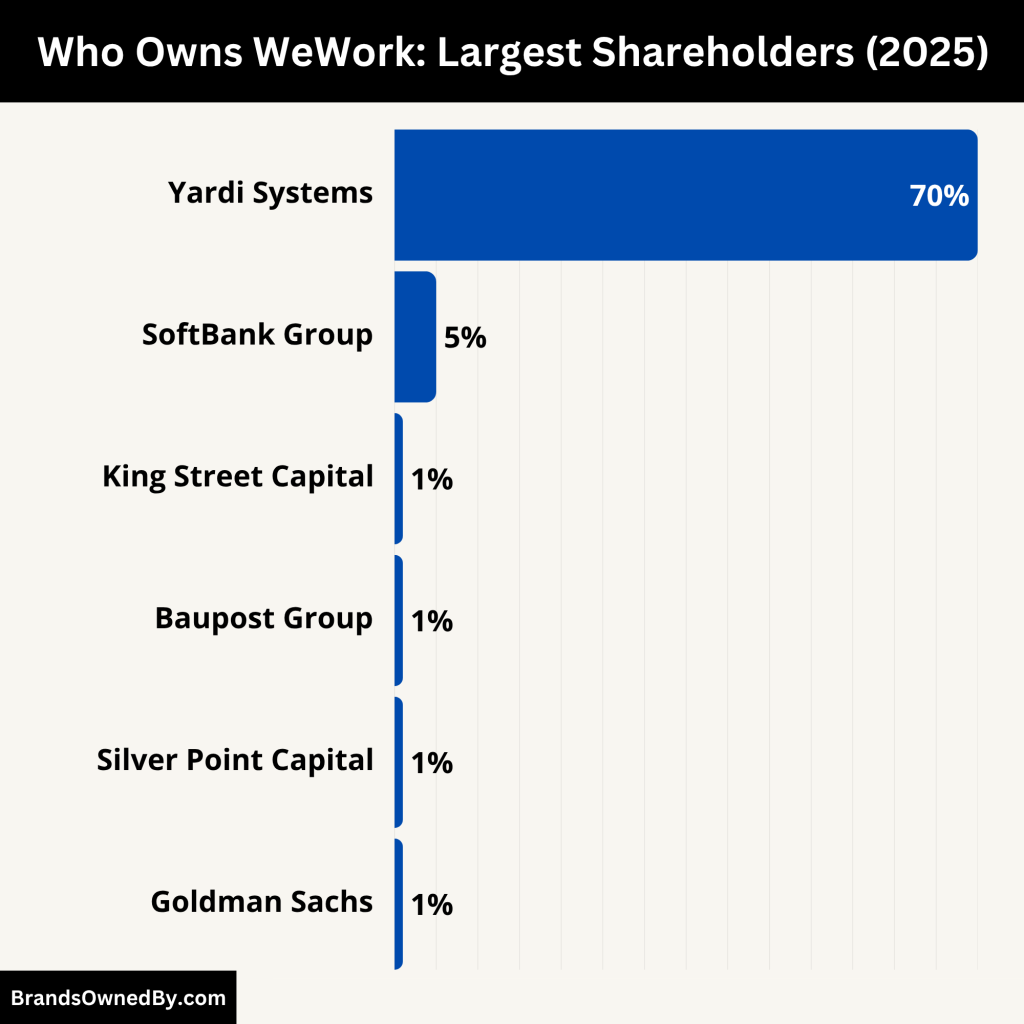

Who Owns WeWork: Major Shareholders

Currently, WeWork is privately held after exiting the public markets during its bankruptcy restructuring in 2024. The majority owner of WeWork is Yardi Systems, a property management software company that led the company’s bankruptcy exit plan. Yardi injected capital and now controls the restructured WeWork business.

Yardi took over the majority of WeWork’s operations and assets in May 2024, allowing WeWork to emerge from bankruptcy.

Prior to that, SoftBank was the largest shareholder and financier, having invested over $10 billion into the company. However, SoftBank significantly reduced its involvement after WeWork’s bankruptcy.

Below is an overview of the major shareholders of WeWork as of 2025:

| Shareholder | Estimated Ownership (%) | Role | Level of Control |

|---|---|---|---|

| Yardi Systems | 70%+ | Majority owner, operational leader | Full control |

| SoftBank Group | <5% | Former majority investor | No control |

| King Street Capital | 1–5% | Institutional creditor | No control |

| Baupost Group | 1–5% | Institutional creditor | No control |

| Silver Point Capital | 1–5% | Institutional creditor | No control |

| Goldman Sachs Asset Mgmt | 1–5% | Institutional creditor | No control |

| Adam Neumann | 0% | Former founder | No ownership or role |

| Public Shareholders (former) | 0% | Retail & institutional (pre-2024) | Ownership wiped out |

| Management & Employees | <5% (estimated) | Incentive-based equity pool | No voting or strategic power |

Yardi Systems

As of 2025, Yardi Systems is the controlling shareholder of WeWork. The company took over majority ownership in May 2024 as part of WeWork’s bankruptcy exit and restructuring plan. Yardi, a privately held real estate software company, provided fresh capital to keep WeWork operational and solvent. Although exact figures are not disclosed, Yardi is believed to own more than 70% of the restructured WeWork.

With this majority stake, Yardi has full operational control over WeWork. This includes strategic decision-making, lease negotiations, and all executive leadership appointments. The company’s goal is to stabilize WeWork and align it with real estate technology services. Yardi’s ownership ensures a strong focus on profitability, operational efficiency, and core business alignment.

SoftBank Group

SoftBank Group, once WeWork’s largest investor, now holds a small non-controlling stake in the new privately held entity. Before WeWork’s bankruptcy, SoftBank had invested over $10 billion, acquiring nearly 80% of the company. However, its ownership was severely diluted or written off during the Chapter 11 proceedings in 2023.

By 2025, SoftBank’s remaining interest in WeWork is minimal and does not give it any board representation or control. Most of its involvement ended with the restructuring deal, although it may retain residual economic interests or creditor rights.

Bondholders and Institutional Creditors

A significant portion of WeWork’s post-bankruptcy equity is now held by former bondholders and institutional creditors. During the 2023–2024 restructuring, WeWork converted billions in unsecured and secured debt into equity. These creditors received minor equity stakes in exchange for waiving part of the company’s liabilities.

Key institutional participants include:

- King Street Capital Management

- Baupost Group

- Silver Point Capital

- Goldman Sachs Asset Management (GSAM)

Each holds a small minority stake (estimated between 1–5%), with no individual control or board influence. Collectively, they represent a block of financial stakeholders who may eventually seek to exit their holdings as the company stabilizes.

Adam Neumann (Founder and Former Shareholder)

Adam Neumann, WeWork’s co-founder and original majority shareholder, no longer owns any part of the company. He exited with a multi-million-dollar severance package in 2019 after investor backlash and corporate governance issues. His shares were bought out by SoftBank as part of a settlement.

In 2024, Neumann attempted to repurchase WeWork through his new firm, Flow Global, offering over $500 million, but his bid was rejected. He has no current ownership, influence, or role in the company.

Public Shareholders (Post-SPAC Era)

WeWork was a publicly traded company from 2021 to 2024 after merging with BowX Acquisition Corp, a SPAC. During this time, retail investors and institutional funds like Vanguard and BlackRock held small stakes. However, following the delisting and bankruptcy, all common stock was rendered worthless.

By 2025, there are no remaining public shareholders, and all prior retail or institutional holdings have been extinguished.

Management and Employee Equity

Some portion of WeWork’s restructured equity is believed to be reserved for senior management and key employees under Yardi’s direction. This form of incentive-based ownership helps retain talent and align leadership goals with long-term performance. While the exact size of this pool is not public, it is likely under 5% and structured as performance-based stock options or restricted units.

These internal shareholders do not hold any controlling power, but they participate in future gains and value creation.

WeWork Bankruptcy and Scandal

WeWork, once a celebrated startup, filed for bankruptcy in late 2023. This marked the collapse of one of the most high-profile ventures in the flexible workspace industry. Despite raising over $22 billion and reaching a peak valuation of $47 billion in 2019, the company could not sustain its financial obligations.

The Build-up to Bankruptcy

WeWork’s downfall was not sudden. It began with its failed 2019 IPO attempt. The company faced criticism over its unsustainable business model, erratic leadership under Adam Neumann, and massive operating losses.

After the IPO failure, SoftBank stepped in with a bailout. Despite leadership changes and cost-cutting efforts, WeWork could not recover fully. The COVID-19 pandemic further reduced demand for office spaces, and hybrid work models led to higher vacancy rates in its buildings.

From 2021 to 2023, WeWork continued to close underperforming locations and restructure debt. However, losses persisted. The company defaulted on some leases and had to renegotiate terms with landlords and creditors.

Official Bankruptcy Filing (Chapter 11)

On November 6, 2023, WeWork Inc. filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of New Jersey. This filing affected its U.S. and Canadian operations. Locations outside North America, such as in Latin America, Europe, and Asia, continued to operate as separate entities and were not part of the filing.

WeWork listed liabilities between $10 billion and $50 billion in the court documents, with assets ranging from $15 billion to $20 billion.

The Chapter 11 process allowed WeWork to:

- Exit costly leases.

- Reduce long-term debt.

- Focus on profitable markets.

- Restructure its ownership.

Creditors and Reorganization

As part of the bankruptcy process:

- SoftBank, the largest investor, lost significant equity.

- Bondholders such as King Street Capital and Brigade Capital emerged as major post-bankruptcy stakeholders.

- Many landlords had to renegotiate lease agreements or lost tenants altogether.

By early 2024, WeWork began exiting over 70 leases and consolidated its global footprint to focus on fewer, high-performing locations.

Emergence from Bankruptcy in 2024

WeWork emerged from bankruptcy in May 2024 after court approval of its restructuring plan. The company shed billions in debt and became privately held, with control shifting to key creditors, led by Yardi Systems and others.

The post-bankruptcy entity focused on:

- Operating profitably in fewer markets.

- Offering partner and affiliate programs instead of direct leasing.

- Expanding asset-light models via franchising and management agreements.

Post-Bankruptcy Business Model (2025)

As of 2025, WeWork has:

- Reduced its physical footprint significantly.

- Reacquired full control of WeWork Brazil.

- Partnered with Vast Coworking Group to expand access in North America.

- Focused on flexibility, enterprise clients, and digital tools for workspace management.

The company is no longer publicly traded and is owned by a combination of real estate software firm Yardi Systems and creditor groups.

WeWork’s bankruptcy was a turning point in the flexible office space industry. While its global dominance declined, the restructured company has stabilized with a leaner, more focused model.

Who is the CEO of WeWork?

As of 2025, Peter Adamo is the CEO of WeWork. He was appointed in May 2024 as part of the company’s post-bankruptcy restructuring under the new ownership of Yardi Systems. His leadership marks a new chapter focused on financial stability, operational efficiency, and alignment with Yardi’s real estate technology ecosystem.

Peter Adamo – Current CEO (2024–Present)

Peter Adamo comes from a background in real estate operations and finance. Before becoming CEO, he held various leadership roles within Yardi Systems, where he oversaw enterprise client services and commercial property strategy. His deep experience with property management technology and scalable operations made him a natural choice for leading WeWork after its emergence from Chapter 11 bankruptcy.

As CEO, Adamo is responsible for:

- Streamlining WeWork’s global operations

- Closing unprofitable locations

- Expanding profitable regional hubs

- Integrating Yardi’s technology across WeWork’s services

- Restoring investor and landlord confidence

Under his leadership, WeWork has significantly downsized, prioritizing profitability over rapid expansion. He reports directly to Yardi’s executive board, which now controls strategic decisions for WeWork.

Leadership Structure Under Yardi

Since WeWork is now a privately held subsidiary of Yardi Systems, the traditional corporate governance structure has changed. The company no longer has a public board of directors. Instead, all executive decisions are managed through Yardi-appointed leadership.

Yardi executives and real estate advisors play key roles in setting strategic direction, while Peter Adamo and his core team handle day-to-day operations and performance.

Past CEOs of WeWork

WeWork has seen multiple leadership changes, especially after its failed IPO and financial decline. Below are the most notable CEOs in recent years:

- Adam Neumann (2010–2019): Co-founder and visionary leader who led WeWork’s rapid global expansion. He stepped down after governance concerns and was later bought out.

- Artie Minson & Sebastian Gunningham (2019): Interim co-CEOs following Neumann’s departure. Focused on stabilizing internal operations.

- Sandeep Mathrani (2020–2023): A real estate veteran recruited to restore credibility. He renegotiated leases and led cost-cutting.

- David Tolley (2023–2024): Former CFO turned interim CEO. He managed the bankruptcy process and negotiated with creditors.

- Peter Adamo (2024–Present): Appointed to lead the company post-bankruptcy, focusing on lean operations and strategic realignment.

CEO’s Strategic Focus in 2025

Peter Adamo’s tenure is characterized by:

- A shift from growth to profitability

- Focused footprint in high-demand urban markets

- Emphasis on tech-enabled workspaces using Yardi’s software solutions

- Improved relationships with landlords, partners, and creditors

- Clear goal to rebuild WeWork as a sustainable and well-integrated commercial real estate brand

Adamo is expected to lead WeWork through its most critical rebuilding years, transitioning it from a troubled unicorn into a disciplined private enterprise.

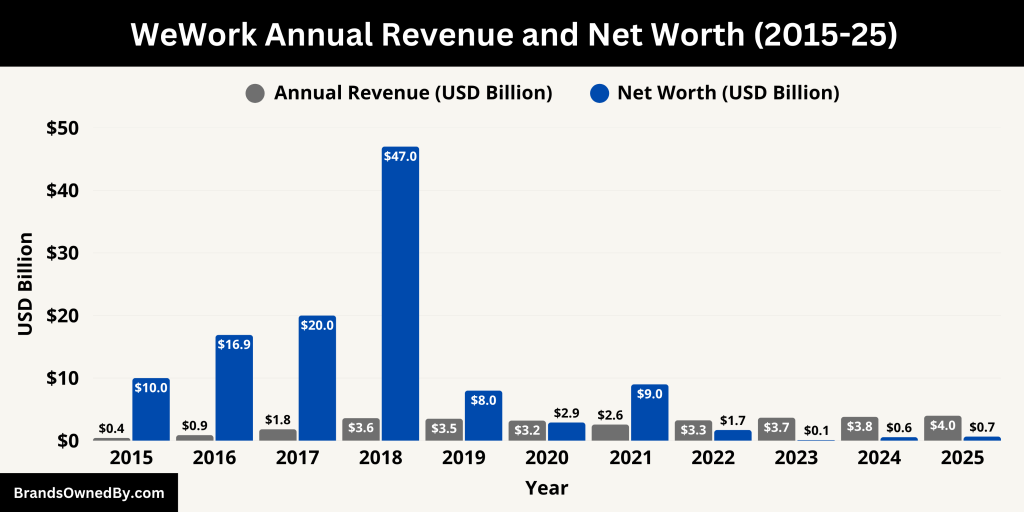

WeWork Annual Revenue and Net Worth

WeWork has undergone significant financial restructuring and operational changes since its Chapter 11 bankruptcy filing in late 2023. As of 2025, the company is showing signs of stabilization under new ownership and leadership.

2025 Revenue Performance

In 2025, WeWork reported annual revenue of $3.98 billion, marking an 8.48% increase from the previous year’s $3.67 billion. This growth reflects the company’s efforts to streamline operations and focus on profitable locations. The gross margin for 2025 was 5.28%, indicating a modest improvement in operational efficiency.

The revenue growth is attributed to several factors:

- Lease Restructuring: WeWork renegotiated or exited numerous leases, reducing future rent expenses by over 50%.

- Operational Focus: The company concentrated on high-demand urban markets, enhancing occupancy rates and member retention.

- Technology Integration: Under Yardi Systems’ ownership, WeWork integrated advanced real estate management software, improving service delivery and cost management.

Net Worth and Valuation

Post-bankruptcy, WeWork’s valuation was significantly reduced. In May 2024, the company emerged from bankruptcy with a valuation of approximately $562 million, a stark contrast to its peak valuation of $47 billion in 2019.

The restructuring plan included:

- Debt Reduction: Elimination of approximately $4 billion in debt, improving the company’s balance sheet.

- Ownership Changes: Yardi Systems acquired a 60% stake, with SoftBank and other investors holding the remaining shares.

These changes have positioned WeWork for potential profitability, with projections indicating the company may achieve positive net income in the near future.

Here’s an overview of the annual revenue and net worth of WeWork from 2015-25:

| Year | Annual Revenue (USD) | Estimated Net Worth / Valuation (USD) | Key Notes |

|---|---|---|---|

| 2015 | $436 million | ~$10 billion | Rapid global expansion begins |

| 2016 | $885 million | ~$16.9 billion | Backed by new funding rounds |

| 2017 | $1.82 billion | ~$20 billion | Expands into Asia and Latin America |

| 2018 | $3.6 billion | ~$47 billion | Peak valuation after major SoftBank investment |

| 2019 | $3.5 billion | ~$8 billion (post-IPO collapse) | IPO fails; Adam Neumann resigns |

| 2020 | $3.2 billion | ~$2.9 billion | Pandemic hits demand for office space |

| 2021 | $2.57 billion | ~$9 billion (SPAC valuation) | Goes public via SPAC merger |

| 2022 | $3.25 billion | ~$1.7 billion | Losses continue; begins cutting leases |

| 2023 | $3.67 billion | <$100 million (pre-bankruptcy) | Files for Chapter 11 in November |

| 2024 | ~$3.8 billion (estimated) | ~$562 million | Emerges from bankruptcy under Yardi |

| 2025 | $3.98 billion | ~$600–650 million (estimated) | Yardi-led recovery, improved margins |

Companies Owned by WeWork

As of 2025, WeWork operates a streamlined portfolio of brands and entities focused on flexible workspace solutions. Following its restructuring and emergence from bankruptcy in 2024, the company has concentrated on core operations, divesting non-essential assets, and reintegrating key markets to enhance its global presence.

Below is a detailed overview of the companies and brands owned by WeWork in 2025:

| Company/Brand | Type | Acquisition Year | Current Status (2025) | Key Details |

|---|---|---|---|---|

| WeWork (Core Brand) | Coworking & Flex Office | Founded 2010 | Active | Operates over 150 locations globally; core business model. |

| WeWork Brazil | Regional Subsidiary | Stake reacquired 2025 | Active | Now 100% owned by WeWork; expanded LATAM footprint. |

| Coworking Partner Network | Affiliate Network | Launched 2024 | Active | Partner spaces added via Vast Coworking Group; expands reach in U.S./Canada. |

| Managed by Q | Workplace Management Platform | 2019 | Active (Limited Integration) | Tools for handling cleaning, staffing, and repairs; now partially integrated. |

| Teem | Workplace Analytics | 2018 | Active | Offers meeting room and desk booking; enhances office efficiency. |

| Naked Hub | Coworking (Asia) | 2018 | Integrated into WeWork | Expanded WeWork’s presence in China and Asia-Pacific. |

| Flatiron School | Coding Bootcamp | 2017 | Sold (2020) | Provided tech education programs; divested during cost-cutting. |

| Conductor | SEO/Content Platform | 2018 | Sold Back to Founders (2019) | Boosted WeWork’s marketing capabilities. |

| Spacious | Coworking in Restaurants | 2019 | Shut Down (2019) | Turned restaurants into workspaces; closed as non-core. |

| Meetup | Social Event Platform | 2017 | Sold (2020) | Focused on community building; divested. |

| SpaceIQ | Workplace Management Software | 2019 | Sold (2020) | Helped companies manage real estate; sold to Archibus + Serraview. |

| MissionU | Alternative Education | 2018 | Shut Down | Briefly integrated into Flatiron; dissolved post-acquisition. |

| Designation Labs | Design Bootcamp | 2018 | Sold | Complemented Flatiron’s curriculum; later sold. |

| FieldLens | Construction Mgmt Software | 2017 | Internal Use or Dormant | Streamlined WeWork’s internal construction workflows. |

| Unomy | Marketing Intelligence | 2017 | Integrated or Dormant | Provided sales data; limited long-term impact. |

| Case | Building Design (BIM) | 2015 | Integrated | Improved architectural design during rapid expansion. |

| Welkio | Visitor Management Software | 2016 | Integrated | Visitor sign-in software used at WeWork locations. |

| Euclid Analytics | Location Analytics | 2019 | Possibly Dormant or Integrated | Tracked foot traffic and user behavior in office spaces. |

| Islands Media | Messaging App | 2019 | Shut Down | College-focused chat app; little integration into WeWork. |

| Prolific Interactive | Mobile Product Agency | 2019 | Shut Down or Sold | Aimed to boost mobile app development; results unclear. |

| Waltz | Real Estate Access Startup | 2019 | Dormant or Internal Use | Developed building access control solutions. |

| LTB (UK) | Office Design Firm | 2018 | Possibly Integrated or Sold | Enhanced interior design for enterprise clients. |

WeWork Core Brand

The primary brand, WeWork, continues to offer flexible coworking spaces, private offices, and enterprise solutions across major metropolitan areas worldwide. With a presence in over 154 locations across 35 countries, WeWork serves a diverse clientele ranging from freelancers to large corporations. The company’s focus remains on providing adaptable workspace solutions that cater to the evolving needs of modern businesses.

WeWork Brazil

In February 2025, WeWork completed the acquisition of the remaining 49.9% stake in its Brazilian operations from the SoftBank Latin America Fund, achieving full ownership. This reintegration signifies WeWork’s commitment to consolidating its presence in Latin America, allowing for unified management and streamlined operations in a key growth market.

Coworking Partner Network

Launched in October 2024, the Coworking Partner Network is an affiliate program that expands WeWork’s reach by collaborating with third-party coworking spaces. The inaugural partnership with Vast Coworking Group, the world’s largest privately-owned franchisor of coworking spaces, added over 75 locations across the U.S. and Canada to WeWork’s network. This initiative enhances flexibility for members, especially in suburban markets, and is powered by Yardi Kube technology.

Managed by Q

Acquired in April 2019, Managed by Q is a workplace management platform that offers companies a centralized system to handle office tasks and services. The integration aimed to create a seamless operating experience for businesses to grow and scale within WeWork spaces.

Teem

In September 2018, WeWork acquired Teem, a cloud-based workplace analytics platform, for $100 million. Teem provides tools for meeting room booking, desk management, and workplace analytics, enhancing the efficiency of office spaces. This acquisition aligned with WeWork’s strategy to incorporate technology-driven solutions into its offerings.

Naked Hub

WeWork expanded its footprint in Asia by acquiring Naked Hub, a Shanghai-based coworking company, in April 2018 for $400 million. This move bolstered WeWork’s presence in the Chinese market, adding numerous locations and members to its network.

SpaceIQ

Acquired in August 2019, SpaceIQ is a workplace management software platform that assists organizations in optimizing their office spaces. However, in May 2020, WeWork sold SpaceIQ to Archibus + Serraview as part of its efforts to streamline operations and focus on core business areas.

Spacious

In August 2019, WeWork purchased Spacious, a startup that transformed restaurants into coworking spaces during off-peak hours. Despite the innovative concept, WeWork shut down Spacious by the end of 2019 as part of its strategic refocusing.

Meetup

WeWork acquired Meetup, a platform for organizing group events, in November 2017 for $200 million. The acquisition aimed to foster community engagement among WeWork members. However, in 2020, WeWork sold Meetup to a consortium of investors led by AlleyCorp.

Flatiron School

In October 2017, WeWork acquired Flatiron School, a coding bootcamp, to offer educational programs to its members. The acquisition was part of WeWork’s broader strategy to provide professional development opportunities. Flatiron School was sold in June 2020 as WeWork shifted focus back to its core business.

Conductor

WeWork acquired Conductor, an SEO and content marketing platform, in March 2018. The acquisition was intended to enhance WeWork’s digital marketing capabilities. In December 2019, Conductor’s executives bought back the company, returning it to independent operation.

MissionU

In May 2018, WeWork acquired MissionU, an alternative education startup, to integrate educational offerings into its ecosystem. However, the program was short-lived, and MissionU was shut down shortly after the acquisition.

Designation Labs

WeWork expanded its educational services by acquiring Designation Labs, a design bootcamp, in August 2018. The acquisition complemented Flatiron School’s offerings, providing a broader range of tech education programs. Designation Labs was later sold as part of WeWork’s divestiture of non-core assets.

FieldLens

In June 2017, WeWork acquired FieldLens, a construction field management software company, to enhance its building operations and project management capabilities. The acquisition aimed to streamline construction processes for WeWork’s rapid expansion.

Unomy

WeWork acquired Unomy, an Israeli marketing and sales intelligence platform, in August 2017. The acquisition was intended to bolster WeWork’s sales strategies and customer acquisition efforts.

Case

In August 2015, WeWork acquired Case, a building information modeling (BIM) consultancy, to improve its architectural and construction processes. The acquisition supported WeWork’s in-house design and development capabilities during its expansion phase.

Welkio

WeWork acquired Welkio, an office sign-in software startup, in March 2016. The acquisition aimed to enhance the visitor management experience in WeWork locations.

Euclid Analytics

In February 2019, WeWork acquired Euclid Analytics, a location analytics company, to gain insights into workspace utilization and member behavior. The acquisition supported data-driven decision-making for space optimization.

Islands Media

WeWork acquired Islands Media, a location-based messaging app for college students, in April 2019. The acquisition was part of WeWork’s efforts to engage younger demographics and expand its community offerings.

Prolific Interactive

In June 2019, WeWork acquired Prolific Interactive, a mobile-focused product agency, to enhance its digital product development capabilities. The acquisition aimed to improve WeWork’s mobile app and member experience.

Waltz

WeWork acquired Waltz, a real estate access control startup, in June 2019. The acquisition was intended to integrate seamless access solutions into WeWork’s buildings.

LTB

In April 2018, WeWork acquired LTB, a UK-based office design firm, to strengthen its interior design and build-out services. The acquisition supported WeWork’s ability to customize spaces for enterprise clients.

Final Thoughts

The question of who owns WeWork has gone through many changes in just a few years. From founder control to SoftBank dominance, and now Yardi Systems, WeWork’s ownership reflects its dramatic transformation. While the future is still uncertain, the company is now leaner and under new leadership, focused on survival and stability.

FAQs

Who currently owns WeWork?

As of 2025, WeWork is privately owned primarily by Yardi Systems, a real estate software company, and several creditor groups including bondholders from King Street Capital and Brigade Capital. SoftBank, once the largest investor, lost significant equity after the 2023 bankruptcy restructuring.

Is the WeWork guy still rich?

Adam Neumann, the co-founder and former CEO, made hundreds of millions from selling shares before the company’s collapse. However, his net worth dropped significantly after he left. He remains wealthy but is no longer involved with WeWork’s operations.

Why did WeWork fail?

WeWork failed due to an unsustainable business model that led to massive losses, poor corporate governance, and an unsuccessful IPO attempt in 2019. The COVID-19 pandemic accelerated problems by reducing demand for office space. High fixed costs and aggressive expansion also contributed.

Why was Adam kicked out of WeWork?

Adam Neumann was forced to step down in 2019 amid investor concerns over his erratic leadership style, conflicts of interest, and governance issues. His management decisions raised doubts about the company’s viability and contributed to the failed IPO.

Who lost money on WeWork?

Many investors, including SoftBank and public bondholders, lost large sums. Early investors and employees who held shares during the downturn also suffered losses. Landlords who leased properties to WeWork faced missed payments and renegotiations.

What happened to WeWork founder’s wife?

Rebekah Neumann, Adam’s wife and former executive at WeWork, left the company before its collapse. She faced public scrutiny but has since focused on personal projects and philanthropy. She no longer has a role at WeWork.

Who purchased WeWork?

Post-bankruptcy in 2024, WeWork was effectively purchased by Yardi Systems and creditor groups through a debt-for-equity swap. SoftBank lost majority control during this process.

Did Miguel from WeWork make any money?

Miguel McKelvey, co-founder and former Chief Culture Officer, left before bankruptcy. He reportedly made money from early share sales but no public information confirms large earnings after the company’s restructuring.

Did Adam get money from SoftBank?

Yes, Adam Neumann received a substantial payout from SoftBank during its 2019 bailout. Reports suggest he got nearly $1.7 billion from share sales and settlements.

Why did Yardi buy WeWork?

Yardi bought a controlling stake in WeWork to integrate its flexible workspace platform with its real estate software services. This move strengthens Yardi’s footprint in property management and workplace solutions.

What happened to Adam Neumann?

After stepping down in 2019, Adam Neumann left WeWork but remains active in other ventures and investments. His public profile has diminished, but he continues entrepreneurial activities outside WeWork.

What happened to the WeWork founder?

The founders, Adam Neumann and Miguel McKelvey, both exited leadership roles by 2020. Adam faced criticism but secured financial gains. Miguel moved on to new projects. Neither is involved in WeWork’s current operations.

What is WeWork worth today?

As of 2025, after bankruptcy and restructuring, WeWork is estimated to be worth between $3 billion and $5 billion. This is a significant decrease from its 2019 peak valuation but reflects a leaner, more stable business.

Who is the current owner of WeWork?

Yardi Systems is the majority owner after WeWork’s exit from bankruptcy in 2024.

Did SoftBank lose control of WeWork?

Yes. SoftBank lost its controlling stake during the 2023 bankruptcy process and no longer owns WeWork.

Is WeWork still a public company?

No. WeWork exited the public markets in 2024 and is now privately held.

Is Adam Neumann still involved in WeWork?

No. Adam Neumann left WeWork in 2019 and has no current involvement or ownership.

What is WeWork’s business model now?

WeWork provides flexible office space and shared workspaces. It has exited expensive leases and focuses on profitable locations.