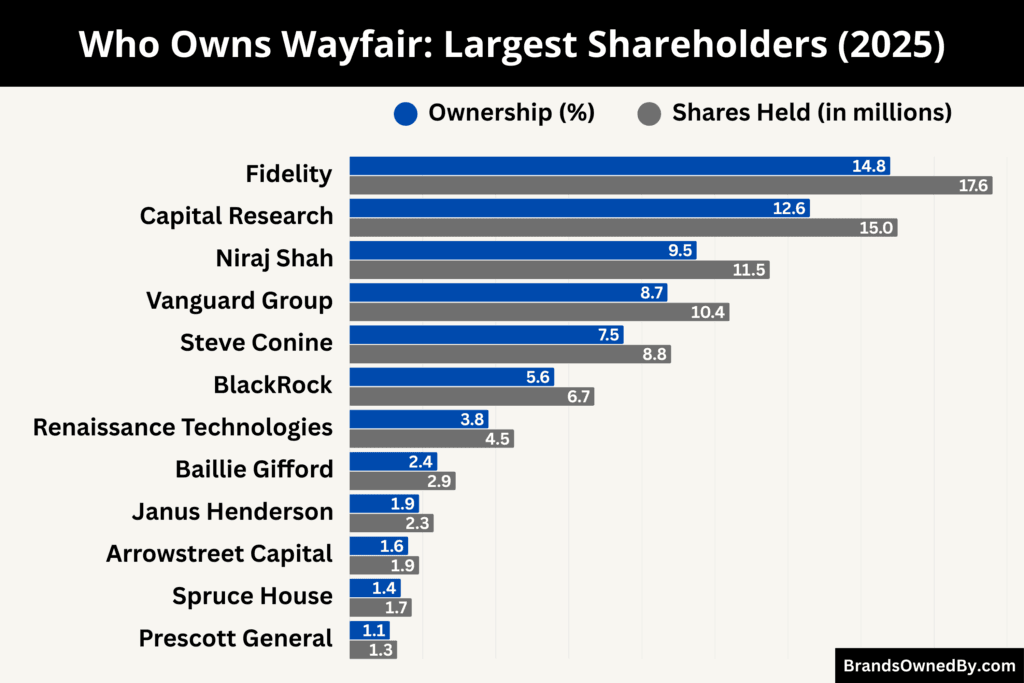

- Wayfair is a founder-led public company, with co-founders Niraj Shah (9.5%) and Steve Conine (7.5%) together holding roughly 17% of the company and retaining meaningful influence through executive and board leadership.

- Institutional investors own the largest combined stake, led by Fidelity (14.8%), Capital Research (12.6%), Vanguard (8.7%), and BlackRock (5.6%), shaping governance through voting power rather than direct management.

- Niraj Shah, as both CEO and the largest individual shareholder, remains the central decision-maker, aligning management control with long-term shareholder value.

- The remaining ownership is spread across other institutions and public shareholders, creating a structure that blends strong founder control with broad institutional oversight.

Wayfair is a U.S.-based e-commerce company that specializes exclusively in home-related products. Its platform covers furniture, décor, kitchenware, bedding, lighting, storage, outdoor items, and home improvement categories. Wayfair does not manufacture most of the products it sells. Instead, it operates as a large-scale digital marketplace that connects consumers directly with thousands of global suppliers.

The company’s core strength lies in its technology-driven retail model. Wayfair uses proprietary software, data analytics, and merchandising tools to manage a massive online catalog and personalize the shopping experience. Its logistics ecosystem is designed to handle large and bulky items, which sets it apart from general e-commerce platforms.

As of 2025, Wayfair operates primarily in the United States, Canada, the United Kingdom, and parts of Europe. The company runs multiple consumer-facing brands under one corporate structure, allowing it to target different demographics and design preferences while sharing infrastructure, suppliers, and fulfillment capabilities.

Wayfair Founders

Wayfair was founded in 2002 by Niraj Shah and Steve Conine. The two met while studying engineering at Cornell University and developed a long-term business partnership rooted in technology and entrepreneurship.

Niraj Shah has served as Wayfair’s Chief Executive Officer since its inception. He is widely regarded as the company’s chief architect. Shah has led product strategy, technology development, and long-term vision. His leadership style emphasizes scale, experimentation, and platform efficiency. Over the years, he has remained deeply involved in operational and strategic decision-making.

Steve Conine co-founded the company alongside Shah and has played a critical role in shaping Wayfair’s culture and governance. He has served in various leadership roles, including co-chairman of the board. Conine’s focus has traditionally centered on strategy, organizational development, and maintaining founder-led oversight as the company scaled.

Both founders retained significant ownership after Wayfair went public. Their continued involvement has ensured continuity in leadership, a rarity among large public e-commerce companies. Their combined influence has helped guide Wayfair through multiple industry cycles, competitive pressures, and strategic shifts.

Major Milestones

- 2002: Niraj Shah and Steve Conine founded the company under the name CSN Stores, launching their first niche e-commerce website focused on storage and media furniture.

- 2003: CSN Stores expanded its portfolio of category-specific websites, validating demand for online home goods across multiple product segments.

- 2005: The company scaled to dozens of niche sites, building early supplier relationships and developing internal e-commerce technology systems.

- 2008: CSN Stores crossed hundreds of specialized online storefronts, covering furniture, décor, kitchenware, and home accessories.

- 2010: The founders began consolidating operations and preparing for a unified consumer brand to improve marketing efficiency and customer recognition.

- 2011: CSN Stores officially rebranded as Wayfair, merging all niche websites into a single platform and brand identity.

- 2012: Wayfair launched its first large-scale national advertising campaigns, significantly increasing brand awareness in the U.S. market.

- 2013: The company expanded its supplier network globally, strengthening its marketplace model and product selection.

- 2014: Wayfair completed its initial public offering and became a publicly traded company on the New York Stock Exchange.

- 2015: Wayfair entered the Canadian market, marking its first major international expansion.

- 2016: The company launched operations in the United Kingdom, continuing its push into international e-commerce.

- 2017: Wayfair expanded into Germany and further invested in logistics capabilities tailored for large and bulky home items.

- 2018: The company strengthened its brand portfolio with clearer positioning for Joss & Main, AllModern, Birch Lane, and Perigold.

- 2019: Wayfair increased automation and technology investments to improve delivery speed, inventory visibility, and supplier integration.

- 2020: The surge in online home shopping accelerated Wayfair’s platform usage and logistics scale, testing its fulfillment infrastructure at unprecedented levels.

- 2021: Wayfair refined its international strategy and continued expanding last-mile delivery services for large furniture items.

- 2022: The company began restructuring parts of its operations to focus on efficiency, cost discipline, and long-term sustainability.

- 2023: Wayfair emphasized supply chain optimization and improved unit economics across its core markets.

- 2024: Leadership doubled down on operational execution, technology efficiency, and selective brand investment.

- 2025: Wayfair continues to operate as a founder-led, publicly traded home e-commerce platform, focused on disciplined growth, logistics optimization, and platform scalability.

Who Owns Wayfair: Largest Shareholders

Wayfair is a publicly traded company. Ownership is spread across founders, institutional investors, and retail shareholders.

Wayfair’s ownership structure reflects a balance between founder influence and institutional oversight. The company’s shareholding base is dominated by large asset managers, while its co-founders retain sizable personal stakes that continue to shape governance and long-term strategy. This mix allows Wayfair to operate with professional investor discipline while still benefiting from founder-led vision and continuity at the executive and board level.

Below is a breakdown of Wayfair’s major shareholders as of December 2025:

Niraj Shah

Niraj Shah is Wayfair’s largest individual shareholder and its most influential insider. He holds his shares through a combination of direct ownership and affiliated entities.

As of December 2025, Shah owns approximately 9.5% of Wayfair’s outstanding shares, representing roughly 11.5 million shares on an as-converted basis. His holdings include common shares and stock subject to conversion or long-term retention arrangements.

Beyond the size of his stake, Shah’s real control comes from his dual role as co-founder, Chief Executive Officer, and board co-chair. His ownership aligns management incentives with long-term shareholder outcomes and gives him meaningful influence over strategic priorities, capital allocation, and leadership decisions.

Steve Conine

Steve Conine is the company’s other co-founder and a major insider shareholder. He serves as co-chairman of Wayfair’s board and remains closely involved in governance and strategic oversight.

As of December 2025, Conine owns approximately 7.5% of Wayfair’s shares, equivalent to about 8.8 million shares. His stake is held through a mix of personal and affiliated holdings.

While Conine is less involved in daily operations than Shah, his ownership and board position give him substantial influence over executive leadership, corporate structure, and long-term planning. Together, the two founders represent one of the strongest insider ownership blocs in the company.

Fidelity Management & Research Company

Fidelity Management & Research Company is Wayfair’s largest institutional shareholder. Fidelity holds shares on behalf of its mutual funds, retirement accounts, and other managed investment products.

As of December 2025, Fidelity controls approximately 14.80% of Wayfair’s outstanding shares, totaling roughly 17.6 million shares.

Fidelity does not participate in day-to-day management. Its influence is exercised through proxy voting, board elections, and engagement on governance matters. Given the size of its position, Fidelity plays a critical role in shareholder approvals related to compensation, board composition, and major corporate actions.

Capital Research & Management Company

Capital Research & Management Company is another top institutional owner of Wayfair, primarily through its global and growth-focused investment funds.

As of December 2025, Capital Research holds approximately 12.60% of the company, representing about 15 million shares.

Capital Research is known for long-term equity positions and active stewardship. Its voting power gives it material influence in shareholder decisions, although it typically works behind the scenes rather than taking public activist positions.

The Vanguard Group

The Vanguard Group holds a significant stake in Wayfair through its index funds and ETFs.

As of December 2025, Vanguard owns approximately 8.7% of Wayfair’s outstanding shares, or roughly 10.4 million shares.

Vanguard’s role is primarily passive. However, its scale gives it meaningful voting authority. It regularly engages on governance standards, board independence, and long-term value creation, making it an important stabilizing shareholder.

BlackRock

BlackRock is another major institutional investor in Wayfair, holding shares across multiple asset-management products.

As of December 2025, BlackRock owns approximately 5.6% of the company, equivalent to around 6.7 million shares.

BlackRock focuses on corporate governance, risk management, and sustainability considerations. While it does not seek operational control, its voting policies can influence executive compensation structures and board accountability.

Renaissance Technologies

Renaissance Technologies holds a notable stake in Wayfair through its quantitative investment strategies.

As of December 2025, Renaissance Technologies owns approximately 3.8% of Wayfair’s shares, representing about 4.5 million shares.

Its ownership is primarily financial rather than strategic. The firm typically does not engage directly with management, but its holdings still contribute to voting outcomes on shareholder matters.

Baillie Gifford

Baillie Gifford is a long-term, growth-oriented institutional investor known for backing companies with strong founder leadership and scalable digital platforms.

As of December 2025, Baillie Gifford holds approximately 2.4% of Wayfair, equal to around 2.9 million shares. Its investment approach prioritizes long-term business potential rather than short-term market performance.

Baillie Gifford does not seek operational control. Its influence is exercised through patient capital, selective engagement with management, and proxy voting. Its continued presence signals institutional confidence in Wayfair’s long-term positioning within the home e-commerce sector.

Janus Henderson Investors

Janus Henderson Investors is an active investment manager with a focus on fundamental analysis and corporate engagement.

Janus Henderson owns roughly 1.9% of Wayfair as of December 2025, representing about 2.3 million shares. The firm’s stake is typically held across multiple actively managed funds.

Its role in Wayfair’s ownership structure centers on governance participation. Janus Henderson regularly votes on board appointments, executive compensation, and shareholder proposals. While it does not exert direct control, its active management style gives it a more engaged voice than purely passive investors.

Arrowstreet Capital

Arrowstreet Capital is a global quantitative asset manager that relies on data-driven models rather than discretionary stock selection.

Arrowstreet Capital holds an estimated 1.6% stake in Wayfair, equivalent to approximately 1.9 million shares as of December 2025.

Its ownership is primarily portfolio-driven and tactical. Arrowstreet does not engage in corporate strategy discussions or activist initiatives. However, its shares still carry voting rights, contributing to overall institutional influence in shareholder decisions.

Spruce House Investment Management

Spruce House Investment Management is a concentrated, long-term investment firm known for taking meaningful positions in a small number of companies.

As of December 2025, Spruce House owns approximately 1.4% of Wayfair, or about 1.7 million shares. Unlike many diversified asset managers, Spruce House often maintains positions for extended periods.

Its influence comes from conviction rather than scale. While it does not control board seats, its focused ownership and long-term horizon allow it to engage selectively with management on strategic and operational matters.

Prescott General Partners

Prescott General Partners is a hedge fund with a history of investing in consumer-facing and retail businesses.

Prescott General Partners holds roughly 1.1% of Wayfair as of December 2025, equal to about 1.3 million shares.

Although smaller than Wayfair’s largest institutional investors, Prescott’s position is still meaningful. The firm participates in proxy voting and monitors management execution closely. Its presence adds another layer of institutional oversight, particularly around performance and capital discipline.

Who is the CEO of Wayfair?

Niraj Shah is the Chief Executive Officer of Wayfair and one of its two co-founders. He has led the company since its founding in 2002 and remains the central figure behind Wayfair’s long-term strategy, technology focus, and platform-driven business model.

Shah is widely regarded as a founder-operator rather than a hired executive. His leadership style emphasizes experimentation, scale, and data-driven decision-making. Even as Wayfair grew into a large publicly traded company, Shah retained direct involvement in major strategic decisions, including logistics investments, brand positioning, and international expansion.

Role and Responsibilities as CEO

As CEO, Niraj Shah oversees Wayfair’s overall vision and execution. His responsibilities include setting long-term strategic priorities, guiding capital allocation, and shaping the company’s competitive positioning in the home e-commerce market.

Shah works closely with the board of directors and senior leadership team but remains the final decision-maker on core initiatives. This includes decisions around platform technology, fulfillment infrastructure, supplier strategy, and customer experience. His dual role as CEO and board co-chair further strengthens his influence within the company’s governance structure.

Decision-Making Structure at Wayfair

Wayfair operates under a centralized decision-making model with strong founder leadership. While the company has experienced executives across finance, operations, technology, and merchandising, strategic authority is concentrated at the top.

Shah collaborates with executive leadership but maintains oversight over company-wide priorities. Major shifts in strategy, cost structure, or market focus typically originate from the CEO’s office and are reviewed at the board level. This structure allows for faster execution but also places significant responsibility on the founder’s leadership.

CEO Compensation and Salary

Niraj Shah’s compensation structure reflects his status as a founder with substantial equity ownership. His annual base salary is relatively modest compared to executives at similarly sized companies.

As of 2025, Shah’s base salary is approximately $100,000 per year. His total annual compensation fluctuates depending on stock-based awards and long-term incentive plans. The majority of his potential earnings are tied to equity performance rather than cash bonuses.

This structure aligns Shah’s financial incentives with long-term shareholder value rather than short-term profitability targets.

Niraj Shah’s Net Worth

Niraj Shah has an estimated net worth of $1.4 billion as of December 2025. His wealth is overwhelmingly tied to his equity ownership in Wayfair rather than cash compensation or outside ventures.

The majority of Shah’s net worth comes from his personal shareholding and long-term equity awards. Because Wayfair’s stock price has experienced significant volatility over time, his net worth has fluctuated accordingly. However, his continued ownership and leadership role have kept him among the wealthiest founder-CEOs in the global e-commerce sector.

Shah’s financial profile reflects a high level of alignment with shareholders. His wealth rises and falls with the company’s market performance, reinforcing his long-term focus on platform strength, operational execution, and sustainable growth rather than short-term gains.

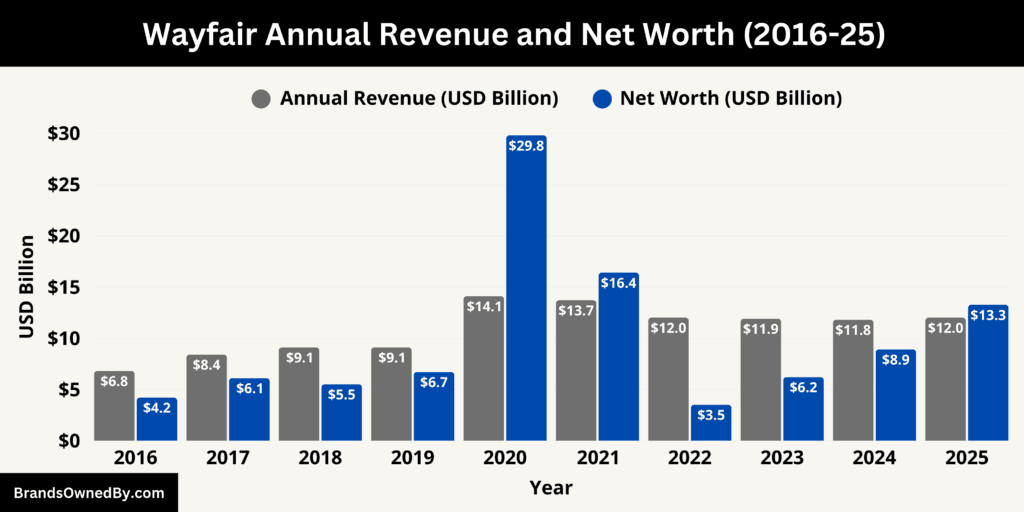

Wayfair Annual Revenue and Net Worth

As of December 2025, Wayfair reported approximately $12 billion in annual revenue, while its net worth, reflected by market capitalization, stands at $13.26 billion. Together, these figures position Wayfair among the most valuable pure-play home e-commerce companies globally.

Wayfair Revenue 2025

The largest source of Wayfair’s revenue in 2025 comes from direct product sales facilitated through its online marketplace. These sales include furniture, décor, appliances, outdoor goods, lighting, and home improvement products sold under Wayfair-operated storefronts.

In 2025, product sales generated approximately $9.4 billion, accounting for about 78% of total revenue. While Wayfair works with third-party suppliers, it records revenue on a gross basis because it controls pricing, customer checkout, and the end-to-end shopping experience.

This revenue stream is highly sensitive to order volume, average order value, and promotional intensity. Wayfair deliberately reduced unprofitable discounting in 2025, prioritizing higher-intent purchases and repeat customers rather than raw order growth.

Logistics and Fulfillment Services Revenue

Wayfair’s proprietary logistics network is a major revenue contributor and a key differentiator in large-item e-commerce. The company provides last-mile delivery, room-of-choice placement, and scheduled delivery services, particularly for bulky furniture.

In 2025, logistics and fulfillment services generated approximately $1.55 billion, representing about 13% of total revenue. This revenue is primarily derived from supplier fees and service charges embedded within order fulfillment.

This segment is strategically important because it improves delivery reliability while also capturing value that would otherwise go to third-party carriers. As logistics density improves, this revenue stream supports margin expansion and operating leverage.

Supplier Advertising and Merchandising Revenue

Wayfair operates an internal advertising ecosystem that allows suppliers and brands to pay for sponsored listings, enhanced product visibility, and performance-based placements across its platforms.

In 2025, supplier advertising and merchandising services generated approximately $720 million, accounting for around 6% of total revenue. This is one of Wayfair’s highest-margin revenue streams because it is largely digital and not tied to shipping or returns.

Advertising revenue has become increasingly important as suppliers compete for visibility within Wayfair’s massive product catalog. Growth in this segment supports overall profitability even when product sales growth slows.

Ancillary and Service-Based Revenue

Wayfair also generates revenue from ancillary services tied to the purchase experience. These include extended warranties, protection plans, installation coordination, and premium delivery options.

In 2025, ancillary services generated approximately $330 million, contributing about 3% of total revenue. While smaller in scale, this revenue improves order economics and increases average revenue per customer.

Geographic Revenue Concentration

Of the $12.0 billion total revenue in 2025, approximately $9.8 billion came from North America, primarily the United States. International markets contributed roughly $2.2 billion, with a strategic focus on fewer regions rather than broad global expansion.

Wayfair’s decision to concentrate resources in higher-efficiency markets directly influenced revenue quality and investor confidence.

Wayfair Net Worth in 2025

Wayfair’s net worth of $13.26 billion as of December 2025 reflects market expectations around sustainable profitability rather than revenue scale alone. Investors value Wayfair based on its ability to monetize logistics, supplier services, and repeat customer behavior within a difficult retail category.

The valuation incorporates Wayfair’s intangible assets, including its proprietary technology platform, supplier ecosystem, and large-item fulfillment infrastructure. These assets are expensive to replicate and act as long-term competitive barriers.

Founder-led leadership and significant insider ownership further support valuation stability. Markets view this alignment as a positive signal during periods of operational restructuring and margin optimization.

Brands Owned by Wayfair

Wayfair operates a portfolio of in-house brands and business entities that are fully owned and controlled by the company itself. These brands are not independent subsidiaries or spin-offs. They function as strategically differentiated divisions built on a shared technology, supplier, and logistics infrastructure.

Below is a list of the major brands owned by Wayfair as of December 2025:

| Company / Brand | Category | Target Segment | Core Focus | Strategic Role |

|---|---|---|---|---|

| Wayfair | Flagship Consumer Brand | Mass-market consumers | Furniture, décor, appliances, home essentials | Primary revenue engine and main customer acquisition platform |

| Joss & Main | Consumer Brand | Style-conscious shoppers | Curated collections, trend-led home décor | Design-forward positioning and higher perceived brand value |

| AllModern | Consumer Brand | Younger, urban buyers | Modern and contemporary furniture | Competes in modern design without diluting flagship brand |

| Birch Lane | Consumer Brand | Traditional households | Classic, farmhouse, and timeless styles | Captures family-oriented and traditional décor demand |

| Perigold | Luxury Consumer Brand | High-income and premium buyers | Designer and luxury furniture | Entry point into high-end home furnishings market |

| Wayfair Professional | B2B Platform | Businesses and professionals | Contract-grade furniture, bulk orders | Expands revenue into commercial and repeat-purchase segments |

| Wayfair Logistics Network | Internal Operating Entity | Suppliers and consumers | Large-item delivery and last-mile fulfillment | Improves delivery reliability and monetizes logistics services |

| Supplier Marketplace Platform | Internal Operating Entity | Global manufacturers | Product listing, pricing, supplier tools | Enables scalable marketplace model |

| Technology & Data Infrastructure | Internal Operating Entity | All Wayfair brands | Personalization, analytics, pricing, logistics tech | Core competitive advantage and operational backbone |

| Wayfair Basics | Private Label Brand | Budget-conscious shoppers | Affordable home essentials | Entry-level pricing and margin protection |

| Andover Mills | Private Label Brand | Mainstream homeowners | Traditional and transitional furniture | High-volume classic furniture offering |

| Three Posts | Private Label Brand | Farmhouse-style buyers | Rustic and country-inspired furniture | Complements traditional brand positioning |

| Mercury Row | Private Label Brand | Younger and urban consumers | Mid-century modern designs | Appeals to modern design trends at accessible prices |

| Zipcode Design | Private Label Brand | Renters and small homes | Space-saving and budget furniture | Drives order volume and repeat purchases |

| Wade Logan | Private Label Brand | Mid-market modern buyers | Contemporary upscale designs | Bridges mass-market and premium categories |

| Greyleigh | Private Label Brand | Traditional elegance seekers | Refined classic furniture | Higher-end traditional styling without luxury pricing |

| Foundry Select | Private Label Brand | Industrial-style buyers | Metal, wood, loft-inspired furniture | Serves industrial and urban décor niche |

| Ebern Designs | Private Label Brand | Minimalist buyers | Functional, modern furniture | Clean design and practical living solutions |

| Kelly Clarkson Home | Private Label Brand | Lifestyle and celebrity-driven buyers | Modern farmhouse and vintage styles | Brand storytelling and customer engagement |

| Latitude Run | Private Label Brand | Contemporary households | Sleek, functional furniture | Supports modern living category depth |

| Red Barrel Studio | Private Label Brand | Rustic and lodge-style buyers | Vintage and character-driven furniture | Adds depth to rustic and heritage aesthetics |

Wayfair (Flagship Brand)

Wayfair is the company’s core and largest brand. It serves as the primary revenue engine and customer acquisition platform.

The brand targets mass-market consumers looking for a wide selection of home goods at competitive prices. It offers millions of SKUs across furniture, décor, appliances, lighting, storage, outdoor, and home improvement categories. Wayfair is designed to be a one-stop destination for home shopping, emphasizing convenience, fast delivery options, and broad price accessibility.

Most first-time customers enter the Wayfair ecosystem through this flagship platform before migrating to more specialized brands based on style or budget preferences.

Joss & Main

Joss & Main is a style-focused brand positioned around curated collections and limited-time assortments.

The brand emphasizes trend-forward design, seasonal launches, and editorial-style merchandising. Unlike the core Wayfair platform, Joss & Main offers a more controlled and inspirational shopping experience. It appeals to customers who value aesthetics and discovery rather than sheer product volume.

Joss & Main plays a strategic role in attracting design-conscious shoppers while maintaining higher perceived brand value within the Wayfair portfolio.

AllModern

AllModern is Wayfair’s modern and contemporary furniture brand.

It targets younger, urban, and design-oriented consumers seeking clean lines, minimalist aesthetics, and contemporary home solutions. The brand focuses heavily on modern furniture, lighting, and décor, with a tighter product assortment compared to the flagship Wayfair site.

AllModern allows Wayfair to compete directly with modern design retailers without diluting the broader appeal of its main platform.

Birch Lane

Birch Lane is positioned around classic, traditional, and farmhouse-inspired home décor.

The brand focuses on timeless design rather than trends. It emphasizes comfort, family-oriented living, and long-lasting styles. Birch Lane appeals strongly to homeowners and suburban households looking for cohesive, traditional interiors.

Within Wayfair’s ecosystem, Birch Lane captures a demographic that might not identify with modern or trend-driven brands, expanding overall market reach.

Perigold

Perigold is Wayfair’s luxury and premium brand.

It targets high-income customers and design professionals seeking high-end furniture, designer brands, and upscale home furnishings. Perigold offers a more selective assortment, premium materials, and elevated customer service expectations.

The brand serves as Wayfair’s entry point into the luxury home market. It allows the company to compete with established high-end retailers while maintaining clear separation from its mass-market offerings.

Wayfair Professional

Wayfair Professional is a specialized business-to-business entity within Wayfair.

It serves commercial customers such as interior designers, property managers, hospitality businesses, offices, and real estate developers. The platform offers bulk pricing, tax-exempt purchasing, dedicated account management, and contract-grade products.

Wayfair Professional expands the company’s reach beyond individual consumers and adds stability through repeat commercial purchasing behavior.

Wayfair Logistics and Delivery Network

Wayfair operates its own proprietary logistics and delivery ecosystem designed specifically for large and bulky home items.

This entity is not a consumer-facing brand but a critical internal operation. It includes last-mile delivery services, scheduled delivery, room-of-choice placement, and supplier fulfillment coordination. The logistics network supports both Wayfair-owned brands and supplier partners.

Control over logistics is a major competitive advantage, enabling Wayfair to improve delivery reliability and monetize fulfillment services.

Technology and Platform Infrastructure

Wayfair owns and operates proprietary technology platforms that power merchandising, pricing, personalization, supplier integration, and logistics coordination.

These internal entities are responsible for data analytics, machine learning systems, customer experience optimization, and supplier tools. They are not separate companies but function as dedicated operational units within Wayfair.

This technology backbone allows Wayfair to scale millions of SKUs efficiently and personalize the shopping experience across all brands.

In-House and Private Label Brands Owned by Wayfair

Wayfair owns and operates an extensive portfolio of in-house and private label brands that are developed, priced, and merchandised internally. These brands are fully controlled by Wayfair and play a critical role in margin management, pricing flexibility, and assortment differentiation. Unlike third-party supplier brands, Wayfair’s private labels allow tighter control over design direction, quality standards, and customer targeting.

- Wayfair Basics: Entry-level private label focused on affordable home essentials, furniture, bedding, and everyday household items.

- Andover Mills: Traditional and transitional furniture brand emphasizing practicality, comfort, and classic design at accessible price points.

- Three Posts: Farmhouse and rustic-style private label offering warm finishes, traditional silhouettes, and cozy home furnishings.

- Mercury Row: Mid-century modern–inspired brand targeting younger and urban buyers with clean lines and contemporary designs.

- Zipcode Design: Budget-focused, high-volume brand specializing in space-saving furniture and simple designs for renters and small homes.

- Wade Logan: Modern, upscale-inspired private label positioned between mass-market and premium furniture categories.

- Greyleigh: Refined traditional brand blending classic elegance with modern comfort and decorative detailing.

- Foundry Select: Industrial-style brand featuring metal accents, reclaimed wood looks, and urban loft-inspired furniture.

- Ebern Designs: Minimalist, modern brand focused on functional furniture with streamlined forms and neutral palettes.

- Kelly Clarkson Home: Celebrity-backed exclusive brand combining modern farmhouse and vintage-inspired design elements.

- Latitude Run: Contemporary private label offering sleek, functional furniture designed for modern living spaces.

- Red Barrel Studio: Rustic and lodge-style brand emphasizing distressed finishes and character-driven furniture designs.

Final Thoughts

Understanding who owns Wayfair provides clarity on how the company is governed and why founders still matter. Wayfair is not controlled by a parent corporation. It remains founder-led, with significant institutional oversight.

Niraj Shah and Steve Conine retain meaningful ownership and influence. Institutional investors provide capital and governance pressure. This balance shapes Wayfair’s long-term strategy, risk tolerance, and growth priorities.

FAQs

Who is the largest shareholder of Wayfair?

The largest shareholder of Wayfair is Fidelity Management & Research Company, which owns about 14.8% of the company. Among individuals, Niraj Shah is the largest shareholder with a 9.5% stake.

How much of Wayfair does Niraj Shah own?

Niraj Shah owns approximately 9.5% of Wayfair as of December 2025. This makes him the largest individual shareholder and the most influential insider.

Is Wayfair American-owned?

Yes. Wayfair is an American company founded and headquartered in the United States. While it has international operations, ownership remains primarily with U.S.-based founders and institutional investors.

Is Wayfair owned by Walmart?

No. Walmart does not own Wayfair. The two companies operate independently and compete in overlapping home goods categories.

Is Wayfair owned by Amazon?

No. Amazon does not own Wayfair. Wayfair is a standalone public company and one of Amazon’s competitors in online furniture and home décor.

Who owns Wayfair Canada?

Wayfair Canada is owned and operated directly by Wayfair. It is not a separate company. The Canadian business functions as a regional operation under Wayfair’s global corporate structure.

Who owns Wayfair UK?

Wayfair UK is also owned by Wayfair itself. Like Canada, the U.K. operation is a regional extension of the parent company and not an independent entity.

Who is Wayfair owned by?

Wayfair is owned by a combination of founders, institutional investors, and public shareholders. Major owners include Niraj Shah, Steve Conine, Fidelity, Capital Research, Vanguard, and BlackRock.

Who is Wayfair affiliated with?

Wayfair is not affiliated with any parent corporation or retail group. It operates independently and partners with thousands of third-party suppliers and manufacturers worldwide.

How was Wayfair founded?

Wayfair was founded in 2002 by Niraj Shah and Steve Conine. The company originally operated as CSN Stores, a collection of niche e-commerce websites focused on home goods, before rebranding as Wayfair in 2011.

Who owns Wayfair furniture?

Wayfair does not manufacture most of the furniture it sells. The furniture is produced by third-party manufacturers and suppliers, while Wayfair owns the brands, marketplace platform, pricing strategy, and customer experience.

When was Wayfair founded?

Wayfair was founded in 2002.

Why is it called Wayfair?

The name Wayfair was adopted in 2011 during the company’s rebrand from CSN Stores. The name was chosen to reflect ease, accessibility, and a broad journey through home shopping.

Where is the headquarters of Wayfair?

Wayfair is headquartered in Boston, Massachusetts, United States.

Where does Wayfair get its furniture from?

Wayfair sources furniture from a global network of thousands of manufacturers, distributors, and suppliers. Products are made in multiple countries, including the United States, China, Vietnam, Malaysia, and parts of Europe, depending on the supplier and product category.