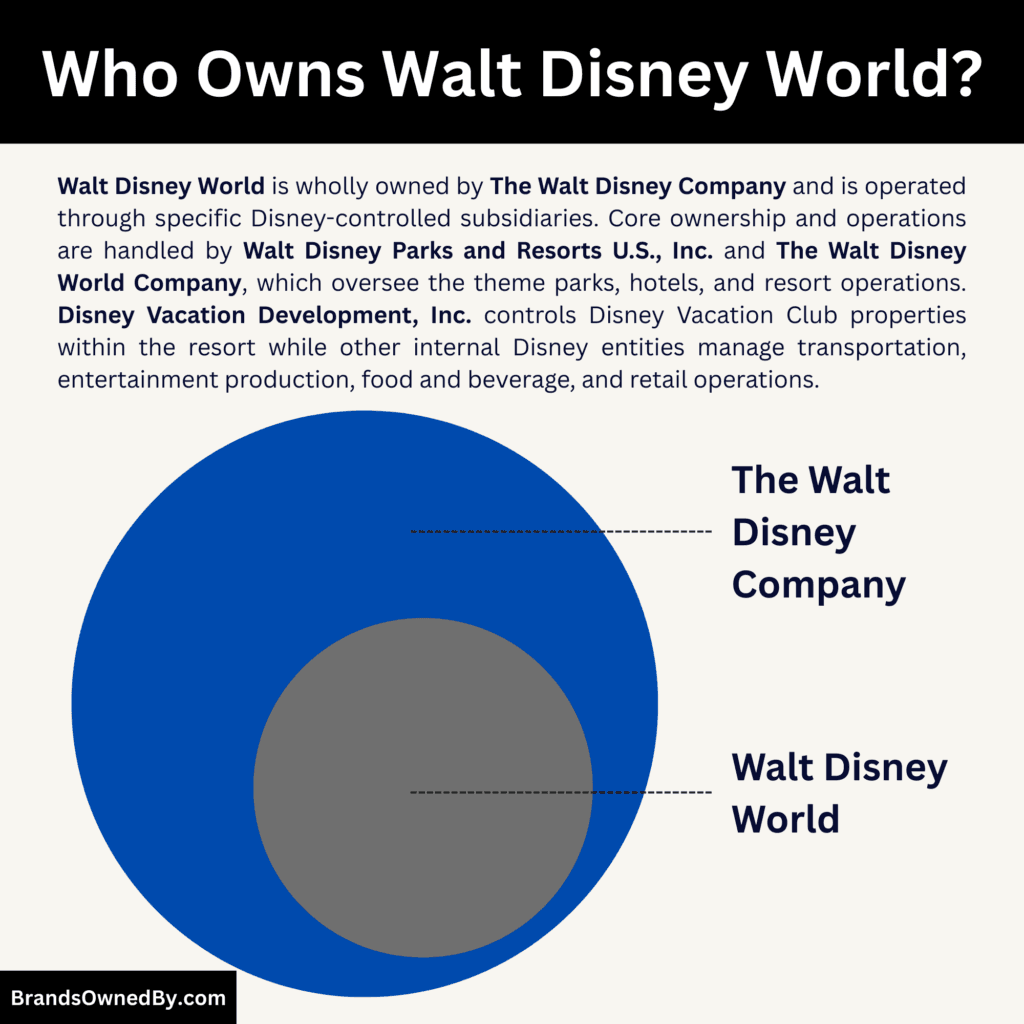

- Walt Disney World is wholly owned by The Walt Disney Company, meaning there are no joint ventures, external partners, or licensed operators involved in its ownership or control. All strategic, creative, and operational decisions flow directly from Disney’s corporate leadership.

- Ownership is indirect for investors, as Walt Disney World is not a standalone or publicly traded entity. Shareholders own the resort only through their equity stake in The Walt Disney Company.

- The Walt Disney Company’s largest shareholders are institutional investors, led by Vanguard Group (8.7%), BlackRock (7.1%), and State Street Global Advisors (4.1%) as of January 2026. These firms hold shares on behalf of millions of investors and influence governance through voting rights, not operational control.

- Centralized ownership enables long-term planning and brand consistency, allowing Walt Disney World to expand, reinvest, and integrate Disney’s intellectual property without fragmented decision-making or external influence.

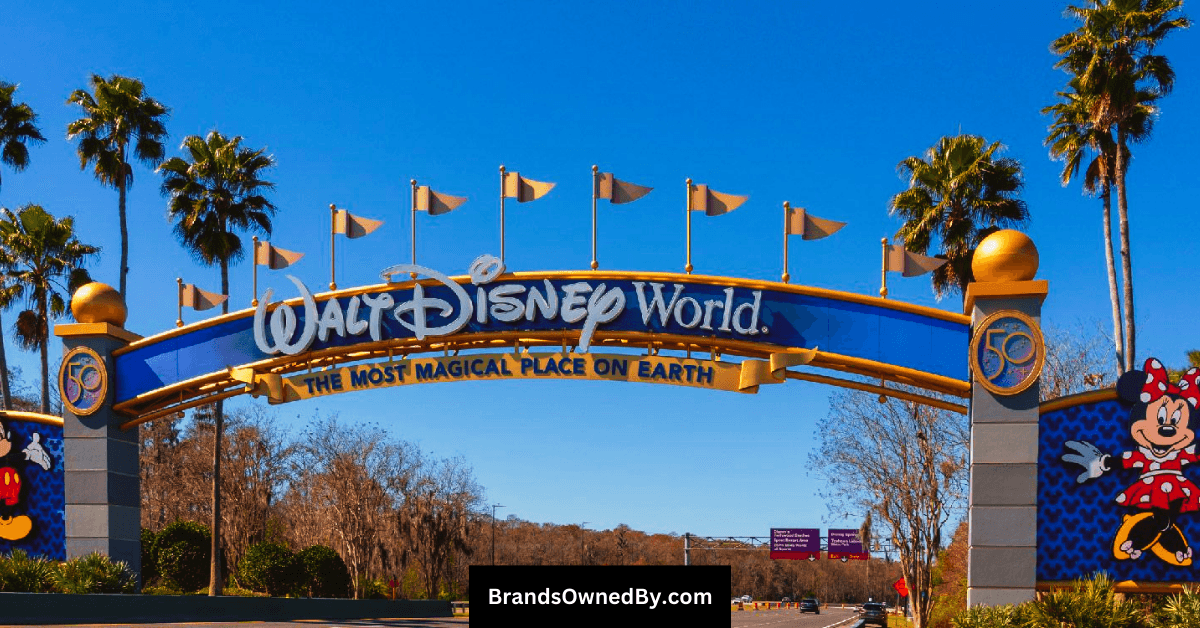

Walt Disney World is a large resort complex in Bay Lake and Lake Buena Vista, near Orlando, Florida. It is operated by subsidiaries of The Walt Disney Company, one of the world’s leading entertainment and media conglomerates. Walt Disney World is designed as an integrated destination resort.

It combines multiple theme parks, water parks, themed hotels, entertainment districts, golf courses, and transportation networks. The resort welcomes tens of millions of visitors each year from around the globe. It functions not as an independent corporation but as a major operating asset within Disney’s Parks, Experiences and Products business segment.

Walt Disney World is best known for immersive themed environments, iconic attractions, and family-oriented entertainment. Its brand identity revolves around storytelling, character experiences, and innovations in themed design. The resort landscape blends intellectual property from Disney animation, live-action franchises, and original creations into physical spaces guests explore on foot, by boat, and by train.

Walt Disney World Founder

Walt Disney World owes its existence to the vision of Walter Elias Disney and the leadership of the company he built.

Walter Elias Disney (Walt Disney)

Walt Disney was born on December 5, 1901, in Chicago, Illinois. He showed artistic talent early in life and pursued drawing and animation. In the 1920s, Walt co-founded Disney Brothers Studio with his brother Roy O. Disney.

The company was later renamed The Walt Disney Company. Walt pioneered feature animation with films like Snow White and the Seven Dwarfs (1937), which set new standards for storytelling and technical achievement.

He was deeply involved in the creation of Disneyland in California, which opened in 1955. Walt’s philosophy was to build immersive environments where stories came alive and families could share experiences together.

He personally conceptualized the Florida project in the 1960s, seeking a site where he could apply lessons from Disneyland on a larger scale and with more control over land and design.

Walt Disney passed away on December 15, 1966, before the Florida resort opened. His brother, Roy O. Disney, took on the responsibility of completing the Walt Disney World project in his honor.

Roy O. Disney

Roy Oliver Disney was born on June 24, 1893. He was Walt’s older brother and business partner. While Walt drove creative innovation, Roy focused on financial and operational leadership. He oversaw budgets, negotiations, and long-term strategy.

After Walt’s death, Roy suspended his retirement to ensure that Walt Disney World opened exactly as planned. In 1971, Roy dedicated the resort and continued to guide the company through expansion until his own retirement.

Roy passed away on December 20, 1971, just two months after the opening of Walt Disney World.

Ownership History

The ownership history of Walt Disney World is defined by long-term stability and centralized control. Unlike many large resorts that change hands or involve outside partners, Walt Disney World has remained under the same corporate ownership since its conception. From secret land purchases in the 1960s to its present-day structure, ownership has consistently stayed with The Walt Disney Company, shaping how the resort has grown and evolved over time.

Early Vision and Land Acquisition

The story of Walt Disney World’s ownership begins in the early 1960s. Walt Disney was already successful with Disneyland in California. He wanted a new project. He wanted more land and more control.

Walt began searching for a large site. He needed space for multiple parks, hotels, and infrastructure. The team looked across several states. They chose central Florida for its climate and accessibility. To keep prices low and avoid land speculation, Disney used a network of shell companies to buy thousands of acres quietly.

The land was purchased mostly in secret. Very few people outside Disney leadership knew what was planned. This approach kept prices down and prevented public scrutiny.

Transition After Walt Disney’s Death

Walt Disney died in December 1966. His passing came at a critical moment. The Florida project was progressing, but work had only just begun.

After Walt’s death, leadership passed to his brother, Roy O. Disney. Roy became the key champion for completing the Florida resort. He delayed his planned retirement to focus on the project. Roy ensured the resort opened according to Walt’s vision.

On October 1, 1971, Walt Disney World officially opened. Walt never lived to see the completed project. Roy Disney dedicated the resort in honor of his brother’s legacy.

Growth and Corporate Stewardship

From day one, Walt Disney World remained fully owned by The Walt Disney Company. There were no joint ventures. No outside partners. It was, and has always been, a wholly owned asset.

Through the late 1970s and 1980s, Disney expanded its presence in Florida. New resorts and experiences were added. Disney’s approach emphasized long-term planning. Each addition reflected the company’s strategy and creative direction.

Unlike some competitors that formed partnerships for specific parks, Disney maintained full ownership and control. It kept all decision-making authority within corporate leadership.

Major Corporate Changes and Park Expansions

In the 1990s and early 2000s, The Walt Disney Company underwent changes in leadership and structure. These changes sometimes shifted corporate focus. However, ownership of Walt Disney World never changed hands.

The company continued to invest in the resort. New parks, themed lands, and attractions were developed. Every expansion reinforced Disney’s ownership. The business model remained centralized rather than fragmented.

Digital Era and Recent Developments

In the digital age, Disney adapted its operations and guest experiences. Technology became integral to park access, ticketing, and reservations. These changes were implemented under Disney’s direct ownership. There were no spin-offs or divestitures involving the core resort.

As Disney’s global business grew, Walt Disney World remained one of its most visible assets. It served as a flagship for Disney’s creative storytelling. Major intellectual properties – including Star Wars, Marvel, and Pixar – became part of the guest experience, but not part of the resort’s ownership structure.

Ownership Stability in 2026

Today, Walt Disney World remains wholly owned by The Walt Disney Company. The resort is an operating unit within a broader corporate portfolio. Decisions about expansions, operations, and long-term planning are made by Disney’s executive leadership and board of directors.

Institutional and individual shareholders own shares of The Walt Disney Company. These shareholders indirectly own Walt Disney World along with other Disney assets. No single individual or external entity holds direct ownership of the resort.

Who Owns Walt Disney World?

Walt Disney World is fully owned by The Walt Disney Company. It is not an independent or separately traded business. Instead, it functions as a major operating asset within the parent company’s global portfolio.

The Walt Disney Company groups its businesses into operating segments. Walt Disney World sits within the Parks, Experiences and Products segment. That segment includes all Disney theme parks, resorts, cruise lines, and related consumer products.

Legally, various Disney subsidiaries hold titles to land and specific assets at the resort. However, ultimate ownership resides with the parent company. Decisions about long-term investments, branding, and strategic direction are made at the corporate level.

Parent Company: The Walt Disney Company

Walt Disney World is wholly owned by The Walt Disney Company, one of the most influential entertainment companies in the world. The company was founded in 1923 by Walt Disney and Roy O. Disney and has grown from a small animation studio into a global powerhouse spanning film, television, streaming, theme parks, and consumer products.

The Walt Disney Company operates through multiple business segments. These include Entertainment, Sports, and Parks, Experiences and Products. Walt Disney World falls squarely under the Parks, Experiences and Products segment, which is responsible for all Disney theme parks, resorts, cruise operations, and experiential offerings worldwide.

Disney’s ownership of Walt Disney World is direct and complete. The resort is not franchised, licensed, or jointly owned. This gives the parent company full authority over creative direction, operational standards, expansion planning, and long-term strategy.

Corporate Control and Strategic Role

Within Disney’s corporate structure, Walt Disney World is considered a flagship asset. It plays a critical role in reinforcing Disney’s brand identity and monetizing its intellectual property through real-world experiences.

Decisions related to large-scale expansions, new themed lands, and long-term infrastructure development are made at the corporate level. These decisions align the resort with Disney’s broader storytelling, franchise, and brand strategies.

While Walt Disney World has its own management teams for daily operations, ultimate control rests with Disney’s executive leadership and board of directors.

Major Shareholders of the Parent Company

Because The Walt Disney Company is publicly traded, its ownership is distributed among a wide range of shareholders. These shareholders collectively own Disney and, by extension, all of its assets, including Walt Disney World.

The largest shareholders are typically institutional investors. These firms manage assets on behalf of pension funds, mutual funds, and individual investors.

Vanguard Group: The Vanguard Group is one of Disney’s largest shareholders. It holds a significant stake through index funds and exchange-traded funds. Vanguard’s ownership represents millions of individual investors rather than direct managerial involvement.

BlackRock: BlackRock is another major institutional shareholder. Like Vanguard, BlackRock’s stake is held across various investment products. BlackRock does not manage Disney’s operations but exercises voting rights on corporate matters.

State Street Global Advisors: State Street Global Advisors also ranks among Disney’s largest shareholders. It primarily holds shares through passive investment vehicles that track major stock indices.

In addition to institutional investors, The Walt Disney Company is also owned by individual shareholders. These include retail investors and company insiders.

Senior executives and board members hold shares as part of compensation packages. This insider ownership aligns leadership incentives with long-term shareholder value, though insiders collectively hold a relatively small percentage compared to large institutions.

Shareholder Influence and Limitations

Shareholders influence Disney through voting rights, including votes on board members and major corporate actions. However, they do not participate in daily operations.

Operational decisions for Walt Disney World are made by Disney’s management teams. Shareholders benefit indirectly through the resort’s performance and its contribution to Disney’s overall business strength.

Competitor Ownership Comparison

Walt Disney World is one of the most complex and carefully structured entertainment resorts ever created. Behind the attractions and themed environments is a clear and deliberate ownership framework that has remained largely unchanged for decades. Examining how the resort is owned, controlled, and governed provides important context for understanding its long-term stability, strategic decisions, and ability to expand at a scale few competitors can match.

| Resort / Company | Owner / Parent Company | Ownership Type | Ownership Structure | Key Ownership Characteristics |

|---|---|---|---|---|

| Walt Disney World | The Walt Disney Company | Wholly owned | 100% owned and operated by parent company | Full creative, operational, and strategic control. Deep integration with Disney intellectual property and long-term planning. |

| Universal Orlando Resort | Universal Parks & Resorts (via NBCUniversal) | Corporate division | Owned by NBCUniversal, which is controlled by Comcast | Theme parks are one business unit within a larger telecom and media conglomerate. |

| SeaWorld Parks | SeaWorld Entertainment | Public company | Owned by institutional and retail shareholders | Parks operate as standalone assets without major film or media IP integration. |

| Six Flags Parks | Six Flags Entertainment Corporation | Public company | Shareholder-owned regional park operator | Focus on thrill rides and regional markets rather than destination resorts. |

| Tokyo Disneyland (comparison) | Oriental Land Company | Licensed operation | Disney licenses brand and IP, no ownership | Disney has creative input but no equity ownership or operational control. |

Walt Disney World’s Ownership Model

Walt Disney World is wholly owned and operated by The Walt Disney Company. There are no external partners. No licensing arrangements. No shared equity.

This full-ownership model allows Disney to align creative control, intellectual property, operations, and long-term planning under one corporate roof. The parks are deeply integrated with Disney’s film, television, and franchise strategy. This level of vertical integration is rare in the theme park industry.

Universal Parks and Resorts (Comcast)

A key competitor to Walt Disney World in Orlando is Universal Orlando Resort. It is operated by Universal Parks & Resorts, which is part of NBCUniversal.

NBCUniversal itself is owned by Comcast, a publicly traded telecommunications and media company.

Unlike Disney, Universal’s parks are one division within a much larger corporation whose core business is cable, broadband, and media distribution. While Universal owns valuable intellectual property, the theme park business is less central to Comcast’s overall identity than Walt Disney World is to Disney.

SeaWorld Entertainment

SeaWorld Entertainment operates SeaWorld, Busch Gardens, and several regional parks. SeaWorld Entertainment is a publicly traded company.

Ownership is spread across institutional investors, hedge funds, and individual shareholders. SeaWorld parks operate as standalone assets rather than as extensions of a broader film or television ecosystem.

Compared to Disney, SeaWorld’s ownership structure limits cross-platform storytelling and brand integration. The parks rely more on standalone attractions and animal experiences rather than global entertainment franchises.

Six Flags Entertainment Corporation

Six Flags Entertainment Corporation focuses on regional amusement parks across North America.

Six Flags is publicly traded and owned by shareholders. Its business model emphasizes thrill rides and seasonal attendance rather than immersive, multi-day destination resorts.

Unlike Walt Disney World, Six Flags does not own major entertainment intellectual property at scale. Ownership is financial rather than brand-driven, which shapes investment decisions and park development.

International Disney Parks as a Contrast

Even within Disney’s own portfolio, Walt Disney World stands apart.

Some international Disney parks operate under licensing or joint venture models. Tokyo Disneyland, for example, is operated by an external company under license rather than owned by Disney.

Walt Disney World does not follow this model. Disney chose full ownership in Florida to maintain total control over land use, expansion, and brand execution. This decision has proven critical to the resort’s long-term consistency.

Ownership Concentration vs Shared Risk

Competitors often use shared ownership or licensing to reduce risk. This can limit upfront investment but also reduce control.

Disney assumed full risk with Walt Disney World. In return, it retained full upside and decision-making authority. This concentration of ownership allows Disney to pursue decades-long development strategies that competitors with fragmented ownership may avoid.

Disney’s ownership model supports long-term planning. Entire lands can be built around single franchises. Infrastructure investments can span decades. Brand standards remain uniform.

Competitors, by contrast, often balance park investments against unrelated corporate priorities or investor expectations tied to short-term returns.

Who Controls Walt Disney World?

Walt Disney World is controlled by The Walt Disney Company through a top-down governance structure. Strategic authority rests with Disney’s board and CEO. Operational oversight flows through the Parks, Experiences and Products division. Daily execution is handled by resort-level leadership. This layered but centralized control model ensures stability, consistency, and alignment with Disney’s global strategy.

Ultimate Control at the Corporate Level

Walt Disney World is controlled by The Walt Disney Company. As the sole owner, the parent company has full authority over the resort’s direction, policies, and long-term planning.

This means control does not sit with a local board or an independent management company. Instead, it is embedded within Disney’s global governance framework. Major decisions such as park expansions, new themed lands, brand integrations, and infrastructure development are approved at the corporate level.

Role of the Board of Directors

The board of directors of The Walt Disney Company provides the highest level of oversight. The board represents shareholder interests and is responsible for approving major strategic initiatives.

For Walt Disney World, this includes approving large capital projects, long-term investment plans, and leadership appointments within the parks division. The board does not manage daily operations, but it sets boundaries and expectations that shape how the resort evolves.

CEO Leadership and Executive Authority

Day-to-day executive authority flows from the CEO of The Walt Disney Company. The current CEO, Bob Iger, plays a central role in setting company-wide priorities.

While the CEO is not involved in routine park operations, he influences decisions that directly affect Walt Disney World. These include how Disney’s intellectual property is deployed in parks, how aggressively the company invests in new attractions, and how the parks align with Disney’s broader storytelling and franchise strategy.

The CEO works closely with senior executives across divisions to ensure that Walt Disney World supports Disney’s long-term brand and business goals.

Parks, Experiences, and Products Division

Operational control of Walt Disney World sits within Disney’s Parks, Experiences, and Products division. This division oversees all Disney theme parks, resorts, cruise lines, and related experiences globally.

The division’s leadership is responsible for translating corporate strategy into operational reality. This includes guest experience standards, safety policies, staffing models, technology systems, and park-level innovation.

Executives within this division have significant autonomy in managing the resort, but they remain accountable to Disney’s top leadership.

Resort-Level Management

At the ground level, Walt Disney World has its own executive and management teams. These leaders handle daily operations across the resort’s parks, hotels, transportation systems, and entertainment districts.

Their responsibilities include park operations, guest services, maintenance, scheduling, and on-site decision-making. While they manage the complexity of daily activity, they operate within frameworks set by corporate leadership.

Local management does not make unilateral decisions on major expansions or brand changes. Those decisions require approval from higher levels of Disney leadership.

Why Centralized Control Matters

Centralized control allows Walt Disney World to operate with a unified vision. Creative consistency, brand integrity, and operational standards are maintained across the entire resort.

It also enables long-term planning. Disney can invest in projects that take years or decades to mature, without relying on external partners or short-term licensing agreements.

This structure is a key reason Walt Disney World has remained cohesive despite its size and complexity.

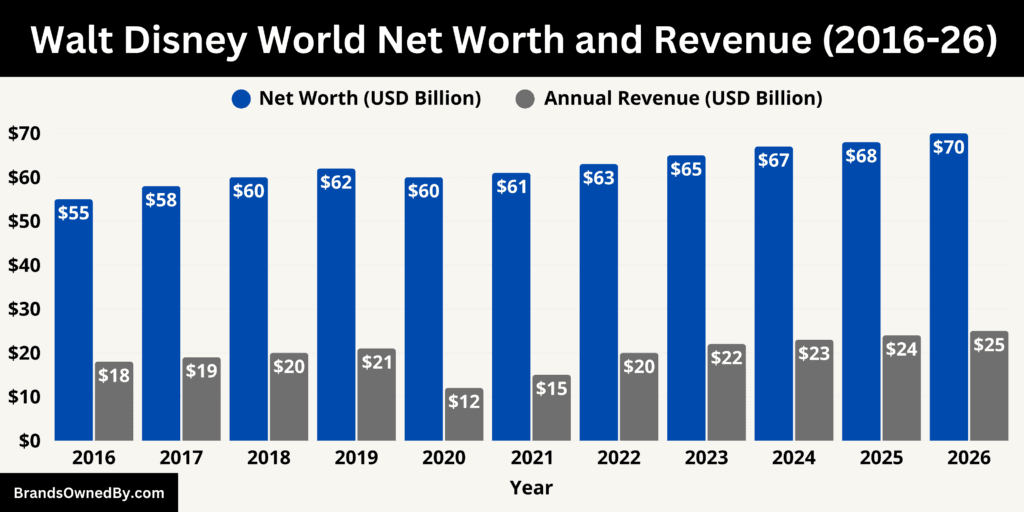

Walt Disney World Annual Revenue and Net Worth

As of January 2026, Walt Disney World remains one of the highest-earning and most valuable entertainment resorts in the world. The resort generated an estimated $25 billion in annual revenue, while its overall net worth is estimated at around $70 billion. These figures reflect its scale, pricing power, land value, and strategic importance within its parent company’s global portfolio.

Revenue 2026

Theme park admissions account for approximately $11.2 billion, representing around 45% of total revenue. This category includes single-day tickets, multi-day passes, park-hopper upgrades, and premium access products. Dynamic pricing has materially increased average ticket yield per guest, making pricing the primary growth driver rather than attendance volume.

Resort hotels and accommodations generate an estimated $7.5 billion, or about 30% of total revenue. Walt Disney World operates more than 30 on-property hotels across value, moderate, and deluxe tiers. Revenue growth in this segment is driven by high year-round occupancy, longer average stays, bundled vacation packages, and higher average daily rates at deluxe properties.

Food, beverage, and merchandise contribute approximately $4.5 billion, accounting for roughly 18% of revenue. This includes table-service dining, quick-service restaurants, character dining, specialty snacks, and franchise-driven merchandise. This segment benefits from strong margins and emotionally driven purchasing behavior.

Other revenue streams generate an estimated $1.8 billion, or about 7% of total revenue. This includes parking fees, after-hours events, guided tours, special festivals, transportation services, and premium add-on experiences.

Revenue Growth Analysis

In 2016, Walt Disney World generated an estimated $18 billion in annual revenue. By 2026, revenue has increased by roughly 39% over a ten-year period.

Attendance growth during this period was moderate. Revenue growth significantly outpaced attendance growth, indicating a structural shift toward higher per-guest monetization. Average guest spending is estimated to have increased by 45–50% over the decade due to pricing optimization, premium experiences, and bundled offerings.

This confirms that Walt Disney World now operates on a yield-optimized revenue model rather than a volume-driven one.

Net Worth and Asset Valuation

As of January 2026, Walt Disney World’s estimated $70 billion net worth reflects long-term asset value rather than annual earnings performance.

Land holdings represent an estimated $25–28 billion, accounting for approximately 38–40% of total net worth. The resort controls around 25,000 acres in central Florida, with a significant portion remaining undeveloped. Land scarcity and zoning control significantly enhance long-term value.

Physical infrastructure accounts for an estimated $30–32 billion, or around 43–45% of total net worth. This includes theme parks, water parks, hotels, internal transportation systems, utilities, and entertainment districts. Replacement cost valuation substantially exceeds historical investment levels.

Brand and intellectual property integration contributes an estimated $10–12 billion, representing roughly 15–17% of net worth. Attractions tied to globally dominant franchises increase lifetime earnings potential and protect the resort from competitive replication.

Net Worth Growth

In 2016, Walt Disney World’s estimated net worth stood at approximately $55 billion. By 2026, it has increased by around 27%, despite revenue disruptions earlier in the decade.

This growth demonstrates that asset value is driven primarily by land appreciation, infrastructure expansion, and brand strength rather than short-term operating performance.

Future Outlook Through 2030

Looking ahead to 2030, Walt Disney World’s growth trajectory is expected to remain disciplined, margin-focused, and strategically aligned with its parent company’s long-term priorities. The outlook below reflects projected trends based on pricing strategy, asset utilization, and long-term planning rather than short-term fluctuations.

- 2027: Revenue expected to move toward the $26–27 billion range, driven primarily by higher average ticket prices, expanded premium add-ons, and continued strength in on-property hotel pricing.

- 2028: Revenue projected to approach $27–28 billion, supported by refreshed attractions, increased monetization of special events, and further optimization of per-guest spending across food, beverage, and merchandise.

- 2029: Revenue growth likely to moderate but remain positive, reaching approximately $28–29 billion as pricing power stabilizes and growth is driven more by experience upgrades than capacity expansion.

- 2030: Annual revenue projected to reach around $29–30 billion, assuming stable operating conditions, ongoing capital reinvestment, and continued dominance of Disney-owned intellectual property within park experiences.

From a valuation perspective, net worth is expected to rise steadily over this period. By 2030, Walt Disney World’s estimated net worth could reasonably move into the $75–80 billion range, supported by land appreciation, infrastructure reinvestment, and the compounding value of brand-driven attractions.

Overall, the outlook through 2030 reinforces Walt Disney World’s position as a long-term, high-value asset. Growth is expected to be gradual, predictable, and margin-led, with emphasis on yield, premium experiences, and strategic brand integration rather than aggressive expansion in physical footprint.

Brands Owned by Walt Disney World

Walt Disney World operates as a fully integrated destination resort rather than a collection of loosely connected attractions. As of 2026, it directly owns and operates theme parks, water parks, resort hotels, entertainment districts, transportation systems, and large-scale recreational facilities. These entities function together under a unified operational structure, allowing centralized control over guest experience, logistics, staffing, and long-term planning.

| Entity / Brand | Type | Primary Function | Operational Role Within Walt Disney World |

|---|---|---|---|

| Magic Kingdom Park | Theme park | Flagship theme park | Core demand driver of the resort. Anchors multi-day visits, seasonal events, and brand identity. Highest attendance and central to pricing strategy. |

| EPCOT | Theme park | Culture and innovation park | Supports festivals, dining, and adult-focused experiences. Drives repeat visitation and extended park time. |

| Disney’s Hollywood Studios | Theme park | Franchise and media-based park | Platform for immersive franchise lands and high-capacity attractions. Key for IP monetization and crowd distribution. |

| Disney’s Animal Kingdom Theme Park | Theme park / zoological park | Conservation and themed entertainment | Land-intensive asset combining animal care, education, and attractions. Differentiates the resort globally. |

| Disney’s Blizzard Beach | Water park | Seasonal water attractions | Absorbs guest capacity during peak periods. Enhances family appeal and length of stay. |

| Disney’s Typhoon Lagoon | Water park | Leisure and recreation water park | Complements Blizzard Beach with year-round and event-based offerings. |

| Disney Springs | Retail and entertainment district | Shopping, dining, nightlife | Generates revenue independent of park tickets. Attracts both resort guests and local visitors. |

| Walt Disney World Resort Hotels | Hospitality portfolio | On-property accommodations | Drives length of stay, bundled vacations, and pricing segmentation across guest demographics. |

| Disney Vacation Club Properties | Vacation ownership | Timeshare-style lodging | Encourages repeat visitation and long-term guest relationships. Provides stable demand. |

| ESPN Wide World of Sports Complex | Sports complex | Event and tournament hosting | Drives group travel, off-season occupancy, and non-theme-park visitation. |

| Walt Disney World Transportation Systems | Infrastructure | Internal guest transportation | Includes buses, monorails, boats, and gondolas. Critical to resort logistics and guest flow. |

| Disney Golf Courses and Recreation | Recreational facilities | Golf and leisure activities | Targets adult guests, corporate groups, and extended-stay visitors. Diversifies offerings. |

| Internal Operations and Services | Integrated operations | Food, retail, entertainment, maintenance | Vertically integrated service divisions ensuring quality control, efficiency, and brand consistency. |

Magic Kingdom Park

Magic Kingdom is the centerpiece of Walt Disney World and its most strategically important operating asset. It anchors guest demand and serves as the primary driver of multi-day visitation.

The park is structured around multiple themed lands, each with its own attractions, dining, retail, and entertainment operations. Magic Kingdom also plays a central role in seasonal events, nighttime spectaculars, and brand-defining experiences that shape the overall perception of the resort.

EPCOT

EPCOT operates as a dual-purpose park focused on global culture and future-oriented storytelling. It supports year-round festivals, large-scale events, and international programming that attract repeat and adult visitors. EPCOT also functions as a platform for long-duration guest engagement, with dining, exhibitions, and rotating experiences that extend average park time and spending.

Disney’s Hollywood Studios

Disney’s Hollywood Studios is a franchise-driven park built around immersive storytelling and high-capacity attractions. It plays a key role in leveraging Disney-owned film and television properties through themed lands, shows, and retail. The park is designed to support high guest throughput while maintaining long dwell times, making it a critical revenue and crowd-distribution asset within the resort.

Disney’s Animal Kingdom Theme Park

Disney’s Animal Kingdom operates as both a theme park and a conservation-focused zoological facility. It encompasses large tracts of land dedicated to animal habitats, research, and education. The park’s scale and operational complexity make it one of the most land-intensive assets owned by Walt Disney World. It also differentiates the resort by blending environmental themes with entertainment.

Disney’s Blizzard Beach Water Park

Blizzard Beach is a themed water park operated directly by Walt Disney World. It functions as a seasonal demand stabilizer, absorbing guest capacity during peak travel periods. The park adds value to extended stays and family-focused vacations, while also supporting premium ticketed experiences during high-demand seasons.

Disney’s Typhoon Lagoon Water Park

Typhoon Lagoon complements Blizzard Beach and operates on a rotating seasonal schedule. It focuses on leisure-oriented attractions, wave-based experiences, and family recreation. The park also hosts special events and private functions, adding flexibility to Walt Disney World’s entertainment portfolio.

Disney Springs

Disney Springs is a large-scale retail, dining, and entertainment district fully owned and operated by Walt Disney World. It generates revenue independent of theme park admission and attracts both resort guests and local visitors. The district supports extended guest spending through dining concepts, entertainment venues, and branded retail while functioning as a nightlife and leisure hub.

Walt Disney World Resort Hotels

Walt Disney World owns and operates one of the largest on-property hotel portfolios in the hospitality industry. Its resorts span value, moderate, deluxe, and villa categories, allowing price segmentation across a wide demographic range. On-property hotels are strategically integrated with park access, transportation, and vacation packaging, making them central to guest retention and length-of-stay optimization.

Disney Vacation Club Properties

Disney Vacation Club properties within Walt Disney World operate under a vacation ownership model. These properties are designed to encourage repeat visitation and long-term guest relationships. They provide stable occupancy levels and predictable demand while remaining fully integrated into the resort’s transportation and park access systems.

ESPN Wide World of Sports Complex

This multi-venue sports complex is owned and operated by Walt Disney World and hosts amateur, collegiate, and professional sporting events. It plays a strategic role in driving group travel, tournament-based visitation, and off-peak hotel occupancy. The complex expands the resort’s appeal beyond traditional theme park guests.

Walt Disney World Transportation Systems

Walt Disney World operates its own internal transportation infrastructure, including buses, monorails, watercraft, and aerial gondola systems. These systems are critical operational assets rather than ancillary services. They enable large-scale guest movement, reduce congestion, and support the resort’s self-contained design.

Disney Golf Courses and Recreation

The resort owns and operates championship golf courses and additional recreational facilities. These assets cater to adult guests, corporate groups, and extended-stay visitors. They also support premium offerings and diversify the resort’s revenue base beyond theme park-centric experiences.

Internal Operations and Service Divisions

Walt Disney World directly operates all core service functions, including food and beverage, merchandise retail, entertainment production, maintenance, security, and guest services. These are vertically integrated operations rather than outsourced businesses. This structure allows consistent quality control, operational efficiency, and rapid implementation of resort-wide initiatives.

Final Thoughts

Walt Disney World stands as a uniquely structured entertainment empire built on unified ownership, centralized control, and long-term strategic planning. Understanding who owns Walt Disney World reveals why the resort has been able to scale consistently, protect its brand integrity, and evolve without fragmented decision-making.

With full ownership under The Walt Disney Company, tightly integrated operations, and a diversified revenue base, the resort continues to function as both a high-performing business and a long-term asset, positioning it for sustained growth and relevance well beyond 2026.

FAQs

Who is the owner of Disney World?

Walt Disney World is owned entirely by The Walt Disney Company. The resort is not a separate company and is not independently owned. It operates as a wholly owned asset within Disney’s Parks, Experiences and Products segment.

Who is Disney’s largest shareholder?

As of January 2026, Disney’s largest shareholder is Vanguard Group, holding approximately 8.7% of the company’s outstanding shares. Other major institutional shareholders include BlackRock (about 7.1%) and State Street Global Advisors (about 4.1%). These firms hold shares on behalf of millions of investors and do not manage Disney’s daily operations.

Does Elon Musk buy Disney World?

No, Elon Musk does not own and has not bought Walt Disney World. There has been no acquisition, purchase, or ownership stake by Elon Musk in Walt Disney World or in The Walt Disney Company.

What are the 5 parks at Disney World Orlando?

Walt Disney World Orlando has four theme parks and two water parks. The four theme parks are Magic Kingdom, EPCOT, Disney’s Hollywood Studios, and Disney’s Animal Kingdom. The two water parks are Disney’s Blizzard Beach and Disney’s Typhoon Lagoon. When people refer to “five parks,” they are often combining theme parks and water parks informally, but officially there are four theme parks.

Who owns Disney after Walt died?

After Walt Disney died in 1966, ownership of the company remained with its shareholders. Leadership passed to his brother Roy O. Disney, who ensured Walt Disney World opened as planned. Over time, The Walt Disney Company evolved into a publicly traded corporation, and today it is owned by public shareholders rather than the Disney family.