Vonage is a well-known name in the world of cloud communications and Voice over Internet Protocol (VoIP) services. Many people often ask who owns Vonage and how the company has evolved since its founding. Its ownership has shifted over the years as it grew from a pioneering VoIP provider into a global communications technology firm.

Vonage Company Profile

Vonage is a cloud communications pioneer. It operates as a part of Ericsson. Its platforms serve developers and enterprises with APIs, unified communications, and contact center tools. The company’s focus is on AI-enabled communications and developer-friendly solutions.

Company Details

Vonage is headquartered in Holmdel, New Jersey, United States. The company began as Min-X in 1998 and became Vonage in 2001. Vonage delivers CPaaS, UCaaS, CCaaS, network APIs, and communications APIs. It serves over 200 countries and territories and supports thousands of developers and enterprises.

Vonage has maintained strong recognition in the industry. It won “Best CPaaS Provider” at the 2025 UC Awards. It was also named a Leader in the IDC MarketScape CPaaS assessment for the fourth year running.

Founders

Vonage was founded as Min-X in 1998 by Jeff Pulver. Soon after, Jeffrey A. Citron and Carlos Bhola joined as investors and board members, each investing $1 million. The company pivoted from a VoIP exchange to a VoIP service provider. It officially rebranded as Vonage in 2001.

Jeffrey Citron became CEO, and Carlos Bhola served as president. Vonage launched its residential VoIP service in early 2002.

Major Milestones

- 1998 – The company was founded as Min-X by Jeff Pulver in Edison, New Jersey. Its original goal was to serve as a marketplace for voice minutes.

- 2000 – Jeffrey Citron and Carlos Bhola invested $1 million each, joining as co-founders and shifting the business toward consumer VoIP services.

- 2001 – Rebranded as Vonage Holdings Corp. and prepared to launch voice services directly to consumers.

- 2002 – Official launch of Vonage’s residential VoIP service, one of the first in the United States. It gave households an affordable alternative to landlines.

- 2003 – Reached 25,000 customers, showing strong demand for internet-based calling.

- 2005 – Relocated headquarters to Holmdel, New Jersey, into a large former Bell Labs facility. By this year, Vonage served over 1 million subscribers.

- 2006 – Vonage went public on the New York Stock Exchange under the ticker “VG.” The IPO raised around $531 million, though the stock struggled in the years that followed.

- 2008 – Achieved profitability for the first time, after years of heavy losses and litigation costs.

- 2010 – Expanded services to include mobile apps for iPhone and Android, entering the smartphone market.

- 2013 – Strategic pivot toward business communications. Vonage began acquiring smaller companies to move beyond consumer VoIP.

- 2014 – Acquired Vocalocity, marking its entry into the Unified Communications as a Service (UCaaS) market.

- 2016 – Acquired Nexmo, a global API communications platform. This deal established Vonage as a serious player in Communications Platform as a Service (CPaaS).

- 2018 – Acquired TokBox (video communications) and NewVoiceMedia (cloud contact center), broadening its product portfolio to serve enterprise clients.

- 2019 – Unified its acquisitions under the Vonage brand. By this year, it had fully transformed into a B2B cloud communications provider.

- 2020 – Rory Read, former Dell and AMD executive, became CEO. He accelerated Vonage’s focus on APIs and enterprise clients.

- 2021 – Ericsson announced plans to acquire Vonage for $6.2 billion to integrate Vonage’s CPaaS platform with its 5G technology.

- July 2022 – Ericsson officially completed the acquisition. Vonage was delisted from Nasdaq and became a wholly owned subsidiary of Ericsson.

- 2023 – Ericsson’s integration of Vonage faced challenges. Ericsson announced impairments linked to the acquisition, reflecting weaker performance than expected.

- 2024 – Ericsson reported total write-downs of over $4 billion related to Vonage. Despite this, Vonage’s technology remained central to Ericsson’s global communications strategy.

- 2025 – Vonage was named “Best CPaaS Provider” at the 2025 UC Awards. It was also recognized for the fourth time as a Leader in the IDC MarketScape CPaaS Vendor Assessment. Vonage continued to serve developers and enterprises with AI-powered APIs and cloud communications platforms.

Who Owns Vonage?

Vonage is currently owned by Ericsson, the Swedish multinational telecommunications giant. Ericsson acquired Vonage in 2022 in one of its most high-profile deals. Since then, Vonage has operated as a wholly owned subsidiary under Ericsson’s Global Communications Platform business unit.

Before the acquisition, Vonage was a publicly traded company listed on Nasdaq under the ticker symbol “VG.” Its shares were widely held by institutional investors, with firms like Vanguard Group and BlackRock among its largest shareholders. After the buyout, all shares were purchased by Ericsson, and Vonage was delisted from the stock exchange.

Parent Company: Ericsson

Ericsson, founded in 1876 and headquartered in Stockholm, Sweden, is one of the world’s largest providers of telecommunications equipment and services. The company has played a crucial role in the evolution of mobile networks, from 2G to 5G.

By acquiring Vonage, Ericsson aimed to expand beyond its traditional telecom business. The deal gave Ericsson access to Vonage’s cloud communications platform and its large ecosystem of developers and enterprise clients. This move allowed Ericsson to combine its advanced 5G technology with Vonage’s Communications Platform as a Service (CPaaS) capabilities.

Acquisition Insights

The acquisition was announced in late 2021 and completed in July 2022 for $6.2 billion. The all-cash deal was one of Ericsson’s largest in decades. The company positioned the purchase as a way to unlock new enterprise services and create synergies between 5G networks and cloud communications.

However, the integration was not without challenges.

In 2023 and 2024, Ericsson reported significant write-downs linked to Vonage, totaling over $4 billion. This raised concerns among analysts about the long-term financial return of the deal. Despite this, Ericsson continues to view Vonage as a strategic asset that strengthens its position in enterprise communications.

Vonage continues to operate under its own brand but is fully aligned with Ericsson’s global strategy. Its services are now integrated with Ericsson’s portfolio to create next-generation communication tools powered by AI and 5G.

The acquisition also shifted Vonage’s role in the market. Once best known as a residential VoIP pioneer, Vonage now serves as Ericsson’s core platform for cloud-based communication services. This includes CPaaS, UCaaS, and CCaaS solutions, along with APIs that power voice, video, messaging, and verification services.

Vonage’s ownership by Ericsson represents a major shift in the communications industry. It reflects how traditional telecom leaders are moving aggressively into cloud and enterprise solutions to stay competitive in the 5G era.

Who is the CEO of Vonage?

As of 2025, the CEO of Vonage is Niklas Heuveldop. He was appointed effective February 1, 2024, after the departure of Rory Read. Alongside his role at Vonage, he is Senior Vice President and Head of Business Area Global Communications Platform at Ericsson, making him one of Ericsson’s most influential executives.

His appointment reflected Ericsson’s commitment to fully integrating Vonage within its core business areas. With this dual role, Heuveldop ensures that Vonage is not treated as a separate company but as an essential pillar of Ericsson’s future strategy.

Background and Career of Niklas Heuveldop

Niklas Heuveldop has a long history with Ericsson. Before becoming Vonage’s CEO, he served as Head of Market Area North America from 2017 until 2024. In that role, he oversaw Ericsson’s largest market, which included strategic deals with U.S. telecom operators such as AT&T and Verizon.

His leadership was critical during Ericsson’s 5G rollout in North America, helping Ericsson secure multi-billion-dollar contracts. This experience positioned him well to lead Vonage, whose future lies in bridging telecom networks with enterprise cloud communications.

Earlier in his career, Heuveldop held senior positions in strategy, sales, and marketing across Ericsson’s global operations. He is known internally as a leader who balances commercial growth with long-term innovation.

Responsibilities and Role at Vonage

As CEO, Heuveldop oversees Vonage’s Communications Platform, which includes CPaaS, UCaaS, and CCaaS products. His role is to:

- Drive Vonage’s integration into Ericsson’s technology roadmap.

- Expand the use of network APIs, allowing enterprises and developers to access 5G network capabilities through Vonage’s platform.

- Strengthen Vonage’s developer ecosystem, ensuring that companies can build scalable communication tools with AI, voice, video, and messaging.

- Restore financial stability and market confidence after Ericsson reported over $4 billion in impairments related to the acquisition in 2023–2024.

Unlike previous Vonage CEOs, Heuveldop is not focused solely on Vonage as an independent brand. Instead, his task is to position Vonage as the central hub of Ericsson’s enterprise services strategy.

Transition from Rory Read

Niklas Heuveldop succeeded Rory Read, who had been CEO since July 2020. Rory Read guided Vonage through its acquisition by Ericsson and was key in stabilizing operations during the transition. However, by early 2024, Ericsson opted for a new leadership approach that would align Vonage more closely with its internal business structure.

Rory Read stepped down in Q1 2024 and later took on new opportunities outside Ericsson. His departure marked a shift from a standalone, U.S.-based executive model to a more integrated global Ericsson leadership approach under Heuveldop.

Leadership Challenges and Opportunities

Heuveldop’s leadership comes at a critical time. Ericsson’s $6.2 billion acquisition of Vonage was initially met with optimism, but slower-than-expected revenue growth led to major financial write-downs. This has raised questions about Vonage’s long-term role.

Key challenges under his leadership include:

- Restoring investor confidence in Vonage’s financial contribution to Ericsson.

- Proving the value of network APIs and demonstrating how Vonage’s CPaaS platform can monetize 5G investments.

- Expanding enterprise adoption of Vonage’s cloud services in a competitive market with rivals such as Twilio, RingCentral, and Zoom.

- Driving AI innovation in communications, making Vonage more attractive to developers and businesses in 2025.

Despite these challenges, opportunities are significant. If successful, Vonage under Heuveldop could make Ericsson a leader not just in telecom infrastructure but also in enterprise communications.

Vision and Strategic Direction

Niklas Heuveldop’s vision centers on bridging telecom and enterprise worlds. He emphasizes that the future of communications lies in programmable networks, where businesses can directly access advanced capabilities such as ultra-low latency, network slicing, and AI-driven services.

By 2025, his leadership is steering Vonage toward becoming the core platform for enterprise-grade 5G applications, making it not just a cloud communications provider but also a strategic gateway for the next wave of digital transformation.

Vonage Annual Revenue and Net Worth

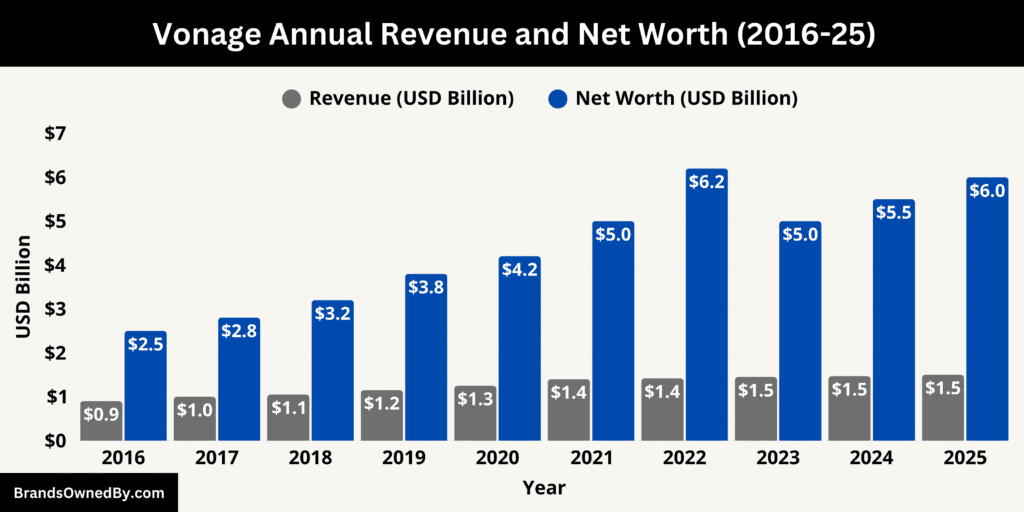

As of 2025, Vonage generates an estimated $1.5 billion in annual revenue and holds a net worth valued at approximately $6 billion under its parent company, Ericsson. While the company is no longer independently listed on the stock exchange, these figures reflect its position within Ericsson’s financial reports and its value in the global communications industry.

Below is an overview of the annual revenue and net worth of Vonage from 2016-25:

| Year | Revenue (Approx.) | Net Worth / Valuation (Approx.) | Key Notes |

|---|---|---|---|

| 2016 | $0.9 billion | $2.5 billion | Revenue driven by VoIP and early business acquisitions. |

| 2017 | $1.0 billion | $2.8 billion | Growth from expanding UCaaS and international services. |

| 2018 | $1.05 billion | $3.2 billion | Acquisitions of TokBox and NewVoiceMedia boosted enterprise valuation. |

| 2019 | $1.15 billion | $3.8 billion | Unified brand under Vonage, stronger B2B focus. |

| 2020 | $1.25 billion | $4.2 billion | Pandemic-driven demand for remote communication tools. |

| 2021 | $1.4 billion | $5.0 billion | Strong API growth made Vonage attractive to Ericsson. |

| 2022 | $1.42 billion | $6.2 billion | Ericsson acquired Vonage for $6.2 billion in July. |

| 2023 | $1.45 billion | $5.0 billion | Ericsson recorded impairments, lowering book value. |

| 2024 | $1.47 billion | $5.5 billion | Stabilized revenue, still facing slower-than-expected growth. |

| 2025 | $1.5 billion | $6.0 billion | Recovery and recognition as Best CPaaS Provider; strong developer adoption. |

Historical Revenue Performance

Before its acquisition, Vonage consistently reported annual revenues in the range of $1.2 to $1.4 billion. Its revenue base came primarily from its transition away from residential VoIP into enterprise-grade cloud services. This shift allowed Vonage to stabilize its financial performance, even as competition from other VoIP providers eroded its original market.

In 2021, the year prior to its acquisition, Vonage reported revenue of around $1.4 billion. This performance made it an attractive target for Ericsson, which saw potential for stronger growth when combined with 5G-enabled services.

Revenue Under Ericsson Ownership

After Ericsson’s $6.2 billion acquisition in 2022, Vonage no longer reported revenue independently. Instead, its financial results were consolidated into Ericsson’s Global Communications Platform business area. This made direct tracking more complex, but estimates suggest steady growth in enterprise services despite integration challenges.

By 2023 and 2024, Ericsson acknowledged weaker-than-expected financial returns from Vonage, resulting in impairment charges totaling over $4 billion. These write-downs reflected concerns about monetization speed rather than Vonage’s long-term strategic value.

2025 Revenue Insights

In 2025, Vonage’s revenue is estimated at $1.5 billion, showing modest growth compared to pre-acquisition levels. The growth is largely driven by demand for Communications Platform as a Service (CPaaS) offerings, developer-focused APIs, and enterprise adoption of AI-powered communication tools.

A significant contributor in 2025 has been network APIs, which allow businesses to directly access mobile network capabilities. This area, tightly linked to Ericsson’s 5G rollout, is expected to be Vonage’s biggest revenue growth driver in the coming years.

Vonage Net Worth

Vonage’s net worth is valued at approximately $6 billion in 2025, close to the acquisition price Ericsson paid in 2022. Despite earlier financial write-downs, Vonage continues to hold strong intangible value through its technology, customer base, and developer ecosystem. Its acquisitions of Nexmo, TokBox, and NewVoiceMedia remain central to its enterprise offerings, and its brand continues to be recognized globally.

The net worth reflects not just its annual revenue stream but also its strategic role in enabling Ericsson to diversify beyond telecom infrastructure. For Ericsson, Vonage is considered an investment into the future of programmable communications and enterprise-grade cloud services, giving the company relevance in markets far beyond traditional telecom.

Strategic Financial Outlook

Vonage’s financial future depends heavily on how effectively it integrates with Ericsson’s broader platform. The company’s revenue is expected to grow steadily if it can expand developer adoption and enterprise partnerships. With the global CPaaS market projected to grow rapidly, Vonage has an opportunity to contribute significantly to Ericsson’s enterprise business in the years ahead.

Companies Owned by Vonage

Vonage directly owns and operates a diverse portfolio of communications platforms and services. Through acquisitions such as Nexmo, TokBox, and NewVoiceMedia, as well as the integration of earlier companies like iCore Networks and SimpleSignal, Vonage has transformed itself into a global CPaaS and UCaaS leader.

Below is a list of the major companies acquired and owned by Vonage as of 2025:

| Company/Brand | Year Acquired/Founded | Acquisition Cost | Focus Area | Current Status (2025) |

|---|---|---|---|---|

| Nexmo | 2016 | $230 million | Communications APIs (SMS, voice, verification, messaging) | Fully integrated into Vonage API Platform, still central to developer ecosystem |

| TokBox (OpenTok) | 2018 | $35 million | Real-time video communications, WebRTC APIs | Operates under Vonage API Programmable Video, widely used in telehealth and education |

| NewVoiceMedia | 2018 | $350 million | Cloud contact center solutions, CRM integrations | Branded as Vonage Contact Center, provides AI-driven customer engagement |

| iCore Networks | 2015 | $92 million | Hosted communications and cloud services | Technology integrated into Vonage Business, brand phased out |

| SimpleSignal | 2015 | Undisclosed | Cloud-based unified communications (UCaaS) | Integrated into Vonage Business Communications |

| Vonage Business Communications (VBC) | Developed internally | — | Unified communications: voice, video, SMS, messaging | Flagship product with AI-powered UCaaS features |

| Vonage API Platform | Built through acquisitions (2016–2018) | — | CPaaS: APIs for voice, SMS, video, and verification | Global developer platform, core to Vonage’s business |

| Vonage Contact Center (VCC) | Enhanced via NewVoiceMedia | — | Cloud-based customer service and CRM integration | Standalone enterprise product with AI analytics |

| OpenTok (part of TokBox) | 2018 | Part of TokBox deal | Programmable video API | Still widely used for embedding live video into apps |

Nexmo

Nexmo was acquired by Vonage in 2016 for around $230 million. It became the foundation of Vonage’s Communications Platform as a Service (CPaaS) business. Nexmo provided APIs for SMS, voice, messaging apps, and phone verifications, making it popular among developers and businesses. After the acquisition, Nexmo was integrated into Vonage’s API Platform but retained its developer community identity. As of 2025, Nexmo’s technology remains central to Vonage’s developer-first strategy, powering scalable communications for enterprises across industries like healthcare, finance, and retail.

TokBox

TokBox, acquired in 2018, specialized in real-time video communications and WebRTC technology. Its flagship product, OpenTok, allowed businesses to embed live video, voice, and messaging directly into websites and apps. This acquisition strengthened Vonage’s video API portfolio and gave it an edge during the pandemic when demand for embedded video solutions surged. In 2025, TokBox continues to be part of Vonage’s programmable video offerings, supporting telehealth platforms, e-learning companies, and enterprise collaboration tools.

NewVoiceMedia

Vonage acquired NewVoiceMedia in 2018 for approximately $350 million. This UK-based company provided cloud contact center solutions and integrated customer engagement tools. The acquisition enhanced Vonage’s Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) capabilities. By 2025, NewVoiceMedia’s technology is deeply integrated into Vonage Business Communications, offering AI-powered customer support, CRM integration, and analytics. It remains a key driver of Vonage’s enterprise solutions.

Vonage Business Communications (VBC)

Vonage Business Communications is Vonage’s flagship unified communications platform. It integrates voice, video, SMS, and messaging into a single enterprise-grade platform. VBC is designed for small, medium, and large businesses looking to streamline their internal and external communications. By 2025, VBC includes AI-enhanced features such as smart transcription, automated workflows, and advanced analytics. It remains a cornerstone of Vonage’s enterprise offerings.

Vonage API Platform

The Vonage API Platform consolidates its acquisitions, including Nexmo, TokBox, and NewVoiceMedia, into one ecosystem for developers and enterprises. It enables companies to build custom communications tools directly into apps and services using APIs for voice, video, SMS, verification, and messaging. In 2025, the API Platform is recognized globally as one of the most flexible and developer-friendly CPaaS solutions. It is widely adopted in fintech, healthcare, e-commerce, and logistics.

OpenTok

OpenTok, originally developed by TokBox, continues as a standalone brand within Vonage’s portfolio. It provides a programmable video API for developers and enterprises. As of 2025, OpenTok remains popular for embedding secure video chat features into applications, particularly in telemedicine, education, and customer service industries. Its advanced features like screen sharing, recording, and encryption keep it competitive.

Vonage Contact Center

The Vonage Contact Center, built on technology from NewVoiceMedia, delivers cloud-based customer engagement tools. It integrates with CRMs like Salesforce, allowing businesses to manage customer interactions seamlessly across multiple channels. In 2025, VCC is enhanced with AI-driven analytics, real-time monitoring, and predictive engagement tools. It remains critical for enterprises with high customer service demands.

iCore Networks

Acquired in 2015, iCore Networks was a provider of hosted communications and cloud services for businesses. While the brand name was phased out, its technology was merged into Vonage Business offerings. By 2025, iCore’s legacy continues to strengthen Vonage’s enterprise-grade hosted VoIP and cloud communications infrastructure.

SimpleSignal

SimpleSignal, acquired in 2015, specialized in cloud-based unified communications solutions. Although the brand no longer operates independently, its innovations laid the foundation for Vonage’s growth in UCaaS. Its technology is still embedded in Vonage Business Communications today, particularly in supporting multi-location enterprises and SMBs.

Final Words

Vonage has come a long way from being a pioneer in VoIP services to becoming a major force in cloud communications. Today, Vonage is owned by Ericsson, which acquired the company to strengthen its 5G and enterprise communication portfolio. With its acquisitions and continued innovation, Vonage remains a key player in the communications technology industry.

FAQs

Who owns Vonage phone company?

Vonage is owned by Telefonaktiebolaget LM Ericsson (Ericsson), a Swedish multinational telecommunications giant. Ericsson acquired Vonage in 2022 in an all-cash deal worth $6.2 billion. Since then, Vonage operates as a wholly owned subsidiary under Ericsson while maintaining its brand identity.

Who owns Vonage and Ericsson?

Vonage is owned by Ericsson. Ericsson itself is a publicly traded company listed on the Nasdaq Stockholm and NASDAQ (U.S.). Its ownership is spread among institutional investors, mutual funds, and retail shareholders. No single entity owns Ericsson outright.

Does Vonage still exist?

Yes, Vonage still exists in 2025. It operates as a subsidiary of Ericsson and continues to offer cloud communications, APIs, and unified communications services under the Vonage brand name.

Who founded Vonage?

Vonage was founded in 2001 by Jeff Pulver. He was an early pioneer of Voice over Internet Protocol (VoIP) technology and helped shape the internet telephony industry.

Where is Vonage located?

Vonage is headquartered in Holmdel, New Jersey, United States. Its operations are global, with offices and data centers in multiple regions to serve enterprise clients and developers worldwide.

Is Vonage still in business?

Yes, Vonage is still in business in 2025. While its residential VoIP business has diminished, its cloud communications, APIs, and enterprise services remain its primary focus.

What is Vonage Holdings?

Vonage Holdings Corp. was the public holding company that owned Vonage before its acquisition. After the 2022 Ericsson buyout, Vonage Holdings ceased to exist as a separate publicly traded company.

Who bought out Vonage?

Ericsson bought out Vonage in July 2022 for $6.2 billion. The acquisition was strategic, aimed at expanding Ericsson’s presence in the cloud communications and enterprise software markets.

Is Vonage owned by AT&T?

No, Vonage is not owned by AT&T. It is fully owned by Ericsson.

Why did Ericsson acquire Vonage?

Ericsson acquired Vonage to expand into enterprise cloud communications and 5G-enabled services. Vonage’s API platform and developer ecosystem allow Ericsson to bridge telecom networks with digital applications, creating opportunities for advanced 5G monetization.

How much did Vonage sell for?

Vonage sold for $6.2 billion in an all-cash acquisition completed by Ericsson in 2022.

Is Vonage part of Ericsson?

Yes, Vonage is part of Ericsson. It operates as a wholly owned subsidiary, retaining its branding but strategically aligned with Ericsson’s global enterprise and 5G initiatives.