United Airlines is one of the most recognized airlines in the world. Many travelers often wonder, who owns United Airlines? The answer is not a single individual but a diverse mix of institutional investors and shareholders. Let’s take a closer look at its history, ownership, financial performance, and leadership.

United Airlines Company Profile

United Airlines, formally United Airlines, Inc., is a major U.S. carrier based in Chicago’s Willis Tower. It operates domestic and international flights across six continents. It serves around 383 destinations with a fleet exceeding 1,000 aircraft, and is a key member of the Star Alliance.

It operates both passenger and cargo services via hubs in Chicago–O’Hare, Denver, Houston–Intercontinental, Los Angeles, Newark, San Francisco, Washington–Dulles, and even Guam.

United serves more than 383 destinations with a fleet exceeding 1,000 aircraft, making it one of the largest airlines globally.

It is a founding member of Star Alliance. The holding company, United Airlines Holdings, Inc., is publicly listed on Nasdaq.

Founders

United traces back to Varney Air Lines, founded by Walter Varney in 1926. Its first mail flight on April 6, 1926, is widely celebrated as United’s founding moment.

In 1930, Varney’s firm merged into the United Aircraft and Transport Corporation under William Boeing and others.

In 1931, United Airlines, Inc. was established as a holding company for entities including Varney Air Lines, Boeing Air Transport, Pacific Air Transport, and National Air Transport.

Here’s how its founding unfolded:

- Walter T. Varney – Founded Varney Air Lines in 1926, one of the first airmail carriers in the U.S. His airline is considered the starting point of United Airlines.

- William Boeing – Founded Boeing Air Transport in 1927, which also became part of the merger that created United Airlines.

- Clement Keys and National Air Transport – Another key player in the consolidation that shaped the early United.

- Pacific Air Transport – Founded by Vern Gorst, this airline also became part of the merger.

In 1931, these four airlines (Varney Air Lines, Boeing Air Transport, National Air Transport, and Pacific Air Transport) merged to form United Air Lines, Inc. under the umbrella of United Aircraft and Transport Corporation.

Major Milestones

United has a history marked by innovation and transformations:

- 1926 – Varney Air Lines, the predecessor to United, was founded by Walter Varney. Its first airmail flight on April 6 is considered United’s starting point.

- 1931 – United Airlines, Inc. was officially formed by combining Varney Air Lines, Boeing Air Transport, Pacific Air Transport, and National Air Transport.

- 1933 – Introduced the Boeing 247, the world’s first modern passenger airliner, pioneering coast-to-coast service.

- 1940s – Played a key role in World War II, transporting troops, equipment, and supplies.

- 1961 – Merged with Capital Airlines, becoming one of the largest U.S. carriers.

- 1985 – Acquired Pan Am’s Pacific routes, making United a major transpacific airline.

- 1991 – Took over Pan Am’s London Heathrow operations, gaining access to one of the world’s busiest airports.

- 1992 – Expanded into Latin America and the Caribbean by purchasing Pan Am’s network in the region.

- 1997 – Co-founded the Star Alliance, today the world’s largest airline alliance.

- 2002 – Filed for Chapter 11 bankruptcy following financial struggles after 9/11.

- 2006 – Emerged from bankruptcy after a major restructuring.

- 2010 – Completed a merger with Continental Airlines, creating United Continental Holdings.

- 2012 – Adopted the United Airlines name for the combined carrier and introduced a unified brand identity.

- 2016 – Introduced the Polaris business class product, focusing on premium international travel.

- 2020 – Navigated the COVID-19 pandemic with sharp capacity cuts and financial challenges; Scott Kirby became CEO.

- 2021 – Announced “United Next,” a fleet expansion plan with 500+ new aircraft orders, one of the largest in history.

- 2023 – Carried 165 million passengers, the highest in its history.

- 2024 – Reported $57.1 billion in revenue and $2.6 billion in net income, marking one of its best financial years post-pandemic.

- 2025 – Became the world’s largest airline by fleet size, surpassing 1,000 mainline aircraft. Received FAA approval for Starlink satellite Wi-Fi, with plans to equip over 300 regional jets by year-end. Launched a new nonstop Adelaide–San Francisco route, the first-ever U.S. connection for South Australia. Expanded Pacific network with new services to Bangkok, Ho Chi Minh City, and additional flights to Manila.

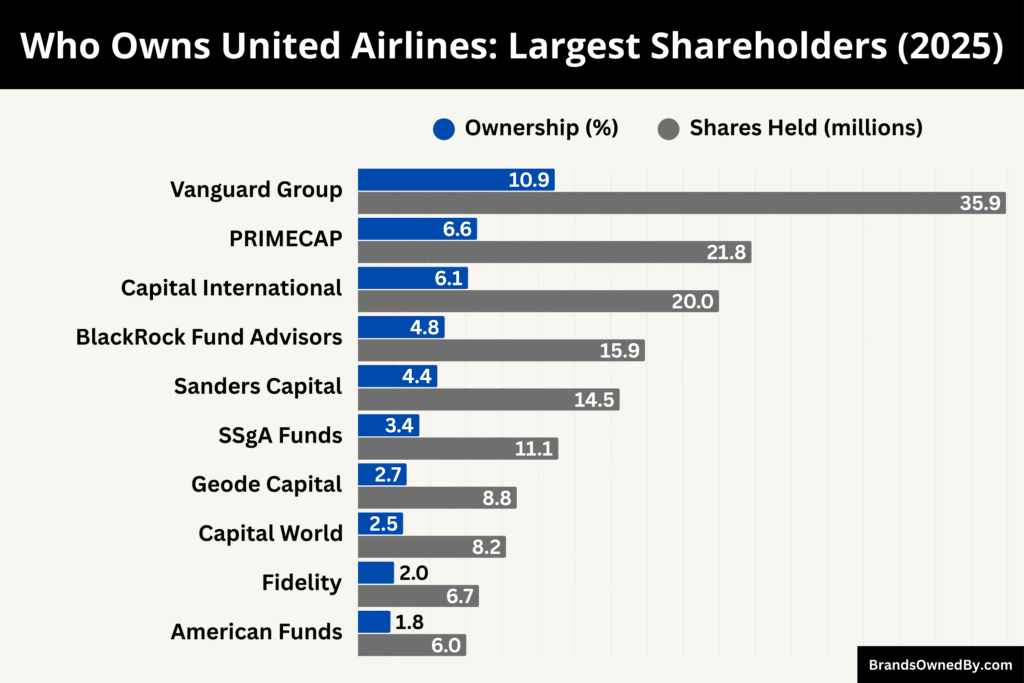

Who Owns United Airlines: Largest Shareholders

United Airlines operates under the umbrella of United Airlines Holdings, Inc., a Delaware-based holding company. It is publicly traded—listed on Nasdaq under the ticker UAL—and has a market capitalization exceeding $33 billion as of mid-2025. United Airlines, Inc., the core operating carrier, is a wholly owned subsidiary of the holding company.

The parent company of United Airlines is United Airlines Holdings, Inc. (UAL), a publicly traded airline holding company based in Chicago, Illinois, USA. It is listed on Nasdaq under the ticker UAL and is included in major stock indexes such as the S&P 500.

This entity serves as the corporate parent and umbrella organization that owns United Airlines, Inc. (the operating airline) and manages all related business interests, subsidiaries, and minority investments.

Under the holding structure, United Airlines Holdings owns or holds stakes in:

- United Airlines, Inc. – Core passenger airline.

- United Express (operated by regional partners, including minority stakes in operators like Mesa Airlines and ManaAir/ExpressJet).

- Minority interests in regional airline partners to strengthen feeder networks.

The holding company exists primarily to separate ownership from operations. Shareholders in UAL own a stake in United Airlines Holdings, not directly in United Airlines, Inc. Decisions at the parent level—such as fleet purchases, mergers, or alliances—impact the airline’s direction. The Board of Directors of United Airlines Holdings, Inc. sets strategy and oversees management.

United Airlines Holdings has significant institutional investor ownership. Roughly 70% of shares are held by institutional investors, giving them substantial influence through voting power. These top shareholders together control nearly 45% of the company’s stocks, allowing them considerable input in major governance and strategic decisions.

Below is a list of the largest shareholders of United Airlines Holdings, the parent company of United Airlines, as of August 2025:

| Shareholder | Ownership % | Approx. Shares Held | Role & Influence |

|---|---|---|---|

| The Vanguard Group, Inc. | 10.9% | ~35.9 million | Largest shareholder; passive fund manager with strong proxy voting power and governance influence. |

| PRIMECAP Management Co. | 6.6% | ~21.8 million | Active investor focused on long-term growth; strong aviation exposure; influences strategy and profitability. |

| Capital International Investors | 6.1% | ~19.95 million | Research-driven investor from Capital Group; engages on capital allocation, debt management, and ROI. |

| BlackRock Fund Advisors | 4.8% | ~15.9 million | Global asset manager; influence mainly via ESG and corporate governance standards. |

| Sanders Capital LLC | 4.4% | ~14.5 million | Long-term conviction investor; supports financial performance and shareholder value. |

| SSgA Funds Management (State Street) | 3.4% | ~11.1 million | Passive index investor; emphasizes risk management, governance, and corporate responsibility. |

| Geode Capital Management LLC | 2.7% | ~8.8 million | Fidelity-linked index fund manager; passive ownership; contributes to institutional stability. |

| Capital World Investors | ~2.5% | ~8.2 million | Another Capital Group division; increases influence in strategic company matters. |

| FMR LLC (Fidelity) | ~2.0% | ~6.7 million | Mix of active and index holdings; provides additional institutional support. |

| American Funds | ~1.8% | ~6.0 million | Capital Group mutual funds holding; reinforces long-term investor base. |

| SPDR S&P 500 ETF Trust (SPY) | ~1.5% | ~5.0 million | Index fund; reflects United’s inclusion in the S&P 500, adds passive stability. |

| Vanguard ETFs (e.g., Total Market, S&P 500) | ~2.5% combined | ~8.2 million | Indirect holdings under Vanguard umbrella; strengthens Vanguard’s influence. |

| Insider Ownership (Executives & Board) | <1% | ~2.5 million total | CEO, executives, and board members; limited shares but high decision-making control. |

The Vanguard Group, Inc.

Vanguard is the largest institutional shareholder of United Airlines Holdings, Inc. As of 2025, it owns approximately 10.9% of outstanding shares, equal to around 35.9 million shares. Vanguard operates primarily as a passive investment manager through index and mutual funds, meaning its influence is exercised via proxy voting rather than active management.

However, its voting power gives it substantial sway over board elections, corporate governance, and shareholder proposals. Vanguard typically emphasizes long-term stability, cost efficiency, and governance best practices in its engagement with United.

PRIMECAP Management Co.

PRIMECAP Management controls around 6.6% of United’s shares, translating to 21.8 million shares. It is known for its active investment approach, focusing on long-term growth opportunities. Its position allows it to push for strategic initiatives related to profitability, operational efficiency, and competitive positioning. PRIMECAP has historically favored large positions in airlines, making it one of the more aviation-focused institutional shareholders.

Capital International Investors

Capital International Investors owns about 6.1% of United, or 19.95 million shares, placing it among the top three owners.

As part of the Capital Group, this firm takes a fundamental research-driven approach and maintains large stakes in global transportation companies. Its ownership reflects confidence in United’s long-term market positioning and global route network. Capital International exerts influence by engaging with management on capital allocation, debt management, and return on investment.

BlackRock Fund Advisors

BlackRock holds approximately 4.8% of United, equivalent to 15.9 million shares. As the world’s largest asset manager, BlackRock’s stake comes through its index-tracking funds and ETFs.

While it generally avoids direct involvement in daily business strategy, BlackRock wields influence through its corporate governance policies, particularly on ESG (environmental, social, governance) standards. This means BlackRock’s votes often impact decisions on sustainability practices, executive compensation, and shareholder transparency.

Sanders Capital LLC

Sanders Capital owns roughly 4.4% of United’s shares, or 14.5 million shares. Known as a high-conviction, long-term investor, Sanders Capital typically seeks positions in companies it sees as undervalued with strong future growth prospects.

Its ownership of United suggests confidence in the airline’s ability to sustain profitability in a competitive aviation industry. The firm’s influence is most visible in strategic decision-making around financial performance and shareholder value creation.

SSgA Funds Management, Inc. (State Street Global Advisors)

SSgA manages about 3.4% of United, which is approximately 11.1 million shares. As the world’s third-largest asset manager (after Vanguard and BlackRock), State Street plays a similar role as a passive, governance-focused shareholder.

Its engagement is primarily through proxy voting and board elections, emphasizing corporate responsibility and risk management. State Street’s presence consolidates institutional influence within United’s shareholder base.

Geode Capital Management LLC

Geode Capital Management owns around 2.7% of United, equal to 8.8 million shares. Geode is best known as the sub-advisor for Fidelity’s index funds, meaning its position in United is largely passive.

While it does not actively pressure management, Geode contributes to the strong institutional base of investors that stabilizes United’s shareholding structure. Its strategy mirrors broader market movements, reflecting United’s inclusion in major stock indexes.

Additional Institutional Investors

Beyond the top holders, several other funds and institutions own significant stakes in United:

- Capital World Investors – A large active investor that strengthens Capital Group’s overall influence in United.

- FMR LLC (Fidelity) – Holds exposure through its active funds and index products, further expanding institutional ownership.

- American Funds – Another Capital Group division with positions in the United via mutual funds.

- SPDR S&P 500 ETF Trust (SPY) – Includes United as part of its index holdings, contributing to passive institutional ownership.

- Other Vanguard-linked ETFs – Such as the Vanguard Total Stock Market Fund and S&P 500 ETF, which collectively increase Vanguard’s indirect control.

Combined, institutional investors own nearly 70% of United Airlines Holdings, giving them collective power in shaping board composition and governance outcomes.

Insiders: Executives & Board Members

Insiders, including executives and board members, collectively hold under 1% of shares. While their ownership is small, their influence is disproportionately large due to their roles in day-to-day decision-making, strategic planning, and governance.

CEO Scott Kirby, along with other top executives, guides United’s direction through board participation and management oversight. Insider holdings also signal alignment with shareholder interests, though institutional investors dominate actual voting power.

Who is the CEO of United Airlines?

As of 2025, Scott Kirby is the Chief Executive Officer of United Airlines Holdings, Inc. and its operating airline, United Airlines, Inc. He assumed the CEO position in May 2020, succeeding Oscar Munoz.

Kirby brought extensive industry experience, having previously served in senior roles at America West, US Airways, and American Airlines before joining United as President in 2016.

Kirby is known for his analytical decision-making, operational focus, and long-term strategy to strengthen United’s competitiveness globally. Under his leadership, the airline has pursued aggressive fleet modernization, network expansion, and digital innovation.

Executive Team Under Kirby

Supporting Scott Kirby is a team of senior leaders shaping United’s operations:

- Michael Leskinen – CFO

- Andrew Nocella – Chief Commercial Officer

- Toby Enqvist – Chief Operations Officer

- Linda Jojo – Chief Customer Officer & Digital Transformation Head.

This leadership structure ensures a balance between financial oversight, operational efficiency, and customer-focused innovation.

Leadership Style and Vision

Scott Kirby has emphasized three key strategic pillars:

- Customer-Centric Transformation: Enhancing passenger experience through new aircraft, improved seating, Wi-Fi connectivity, and digital services.

- Fleet and Network Growth: United’s “United Next” initiative aims to add hundreds of new aircraft and expand international and domestic routes.

- Sustainability and Innovation: Commitment to achieving net-zero carbon emissions by 2050, investing in sustainable aviation fuel (SAF), and exploring next-generation aircraft technology.

Kirby is considered one of the most influential figures in global aviation today, particularly for his bold growth initiatives despite industry volatility.

Decision-Making Structure

United Airlines operates under the umbrella of United Airlines Holdings, Inc. The CEO works closely with the Board of Directors, which provides oversight and approves major strategic decisions. Key executives, including the Chief Financial Officer, Chief Commercial Officer, and Chief Operating Officer, report directly to Kirby.

While shareholders have voting power through the holding company, strategic and operational decisions are largely concentrated in Kirby’s leadership team.

Past CEOs of United Airlines

United Airlines has had several notable leaders who shaped its growth over the decades:

- Oscar Munoz (2015 – 2020): Focused on cultural transformation and customer service improvements after a series of public controversies.

- Jeff Smisek (2010 – 2015): CEO during the Continental-United merger, overseeing integration, but later resigned amid a federal investigation.

- Glenn Tilton (2002 – 2010): Led United through bankruptcy reorganization and into its merger with Continental Airlines.

- James Goodwin (1999 – 2001): Short tenure marked by financial challenges and operational struggles.

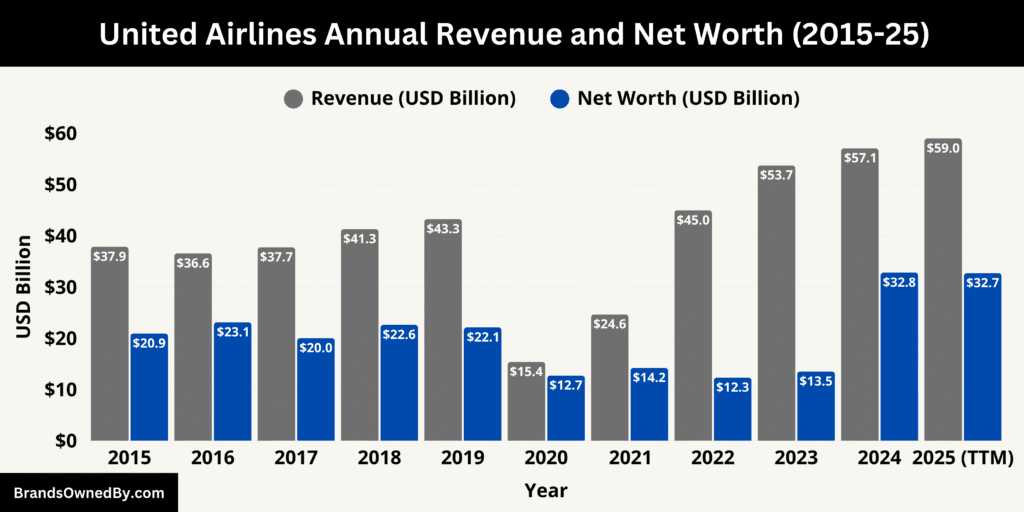

United Airlines Annual Revenue and Net Worth

United Airlines has reached a strong financial position in 2025, supported by growing passenger demand, international expansion, and strategic investments. The company generated an estimated $59 billion in annual revenue this year, while its net worth stands at approximately $32.7 billion as of August 2025, reflecting market capitalization and overall financial health.

Here’s an overview of the annual revenue and net worth of United Airlines from 2015-25:

| Year | Revenue (USD billions) | Net Worth / Market Cap (USD billions) |

|---|---|---|

| 2015 | 37.86 | ~20.9 |

| 2016 | 36.56 | ~23.1 |

| 2017 | 37.74 | ~20.0 |

| 2018 | 41.30 | ~22.6 |

| 2019 | 43.26 | ~22.1 |

| 2020 | 15.36 | ~12.7 |

| 2021 | 24.63 | ~14.2 |

| 2022 | 44.96 | ~12.3 |

| 2023 | 53.72 | ~13.5 |

| 2024 | 57.06 | ~32.8* |

| 2025** | ~59.0 (TTM estimate) | ~32.7 |

Revenue Performance in 2025

United Airlines recorded around $59 billion in revenue during 2025, showing steady growth compared to recent years. This increase has been driven by surging international travel, especially across transatlantic and Asia-Pacific routes, alongside the recovery of corporate travel.

The “United Next” strategy, which added new aircraft and expanded seating capacity, further boosted revenue. Ancillary income from premium seating, baggage, and loyalty programs played an important role, while cargo operations contributed as a secondary but stable income stream.

Net Worth 2025

As of August 2025, United Airlines Holdings, Inc. has a net worth estimated at $32.7 billion, supported by a strong stock market valuation. This reflects investor confidence in the company’s growth plans and improved earnings potential.

Debt taken on during the pandemic is gradually being reduced through refinancing and liquidity management, strengthening United’s balance sheet. The company’s improved credit outlook further reassures investors and positions it for long-term financial resilience.

Long-Term Financial Outlook

United Airlines is focused on sustainable growth and profitability. Investments in fuel-efficient aircraft and sustainable aviation fuel (SAF) are expected to help reduce long-term operating costs while appealing to environmentally conscious travelers.

The airline continues to expand its international presence and leverage its loyalty program to secure recurring revenue. Despite challenges like fuel price volatility and global market fluctuations, analysts see United’s financial future as stable, with opportunities for revenue growth as global travel demand continues to rise.

Companies Owned by United Airlines

United Airlines Holdings, Inc. operates as the parent company of United Airlines, which itself controls a range of subsidiaries, regional affiliates, and business entities. These companies support the airline’s passenger operations, cargo logistics, maintenance services, and customer experience.

As of 2025, United’s portfolio focuses on aviation, travel services, and regional partnerships that extend its network reach and operational efficiency. Below is a list of the major companies and brands owned by United Airlines via its holding company:

| Company/Entity | Type | Role/Function | Key Details (2025) |

|---|---|---|---|

| United Express | Regional Airline Brand | Operates feeder and regional flights under United branding | Network of regional partners including CommutAir, GoJet, Mesa Airlines, Republic Airways, and SkyWest Airlines. Provides connectivity to hubs like Chicago, Houston, Newark, and Denver. |

| United Cargo | Cargo & Logistics Division | Freight transport and global logistics | Handles pharmaceuticals, perishables, electronics, and animals. Generates significant revenue through international and domestic cargo operations. |

| MileagePlus Holdings, LLC | Loyalty Program Subsidiary | Frequent flyer and rewards program | Operates United’s loyalty platform. Partners with banks for co-branded credit cards. Generates billions in revenue annually through partnerships. |

| United Ground Express (UGE) | Ground Services Subsidiary | Provides airport services | Manages passenger assistance, baggage handling, ramp operations, and customer service at smaller airports, improving cost efficiency and control. |

| United Aviate Program | Pilot Training & Recruitment | Pilot career development initiative | Builds future pilot pipeline through partnerships with universities and flight schools. Expanded globally to address pilot shortages. |

| United Private Screening | Inflight Entertainment Platform | Passenger experience brand | Offers movies, TV, music, and streaming onboard. Enhances customer satisfaction and strengthens brand identity. |

| United Maintenance & Technical Operations | MRO Facilities | Fleet maintenance, repair, and overhaul | Major facilities in San Francisco, Houston, and Chicago. Handles engine overhauls, safety checks, and fleet upkeep. |

| Regional & Codeshare Partnerships under United Express | Strategic Partnerships | Extended regional flight operations | Contracts with regional carriers. United controls branding, scheduling, and customer experience across partner-operated flights. |

United Express

United Express is the brand name for United Airlines’ regional services. It is not a single airline but a network of contracted regional carriers that operate flights under the United Express banner.

These carriers include CommutAir, GoJet Airlines, Mesa Airlines, Republic Airways, and SkyWest Airlines. United Express provides essential feeder traffic from smaller cities to United’s major hubs, such as Chicago, Newark, Houston, and Denver.

This structure enables United to serve markets that would not be financially viable with larger aircraft.

United Cargo

United Cargo is the freight and logistics arm of United Airlines. It transports a wide range of goods including pharmaceuticals, perishables, live animals, and high-value electronics. In recent years, United Cargo has become an important revenue contributor, especially during periods of fluctuating passenger demand.

By leveraging United’s vast passenger network, the cargo division offers global shipping solutions and continues to expand with the adoption of advanced tracking technology and sustainable logistics practices.

MileagePlus Holdings, LLC

MileagePlus is United Airlines’ loyalty program and one of its most valuable assets. Operated through MileagePlus Holdings, LLC, it allows customers to earn and redeem miles across flights, hotels, car rentals, and retail partners.

The program also generates significant revenue through partnerships with credit card companies, particularly co-branded credit cards.

In 2025, MileagePlus continues to be a key driver of customer retention and financial performance, offering premium experiences and expanding its non-airline reward ecosystem.

United Ground Express (UGE)

United Ground Express is a wholly owned subsidiary that provides ground handling services at airports. It offers passenger assistance, ramp operations, baggage handling, and customer service.

By operating its own ground services company, United can better control service quality and reduce costs at smaller airports where contracting with third parties may be less efficient.

United Aviate Program

The Aviate Program is United’s in-house pilot career development initiative. It partners with universities, flight schools, and regional carriers to build a pipeline of future United pilots. This program reflects United’s commitment to addressing pilot shortages while ensuring consistent training standards.

In 2025, Aviate has expanded globally, attracting talent from international training academies.

United Private Screening and Onboard Services

While not a separate corporate entity, United has built strong proprietary onboard brands such as United Private Screening, its in-flight entertainment platform.

These services are managed internally and play a role in branding, customer satisfaction, and differentiating United from competitors. They highlight the company’s investment in passenger experience beyond just air travel.

United Maintenance Facilities and Technical Operations

United owns and operates major maintenance, repair, and overhaul (MRO) facilities in hubs such as San Francisco, Houston, and Chicago. These technical operations divisions handle the upkeep of United’s fleet, engine overhauls, and safety inspections.

Operating in-house MRO facilities reduces dependence on third-party contractors and helps maintain strict safety standards.

Regional and Codeshare Partnerships under United Express

Although not owned outright, United maintains long-term contracts and partial control over certain operations with its United Express partners. These agreements allow United to extend its branding and customer experience across flights operated by regional carriers.

While each partner airline remains independent, their operations under the United Express umbrella are strategically controlled by United through scheduling, marketing, and route decisions.

Final Words

Understanding who owns United Airlines provides a clear view of how one of the world’s largest carriers is structured and controlled. The company operates under United Airlines Holdings, Inc., with ownership spread across major institutional investors, individual shareholders, and management leadership.

United has expanded its global presence through strategic mergers, acquisitions, and the development of subsidiaries like United Express, United Cargo, and MileagePlus. With a strong market position, rising revenues, and a diversified portfolio of operations, United Airlines remains a dominant force in the aviation industry.

Its ownership and leadership continue to shape the airline’s strategy, growth, and competitive edge in 2025 and beyond.

FAQs

Where did United Airlines begin?

United Airlines began in Boise, Idaho, in 1926 as Varney Air Lines, founded by Walter T. Varney. It started as an airmail service before evolving into a passenger airline. Over time, mergers with other carriers, including Boeing Air Transport, National Air Transport, and Pacific Air Transport, led to the creation of United Air Lines in 1931.

What airlines are owned by United Airlines?

United Airlines operates under United Airlines Holdings, Inc. and directly owns United Airlines itself, along with its subsidiaries such as United Express (operated through regional partner agreements) and United Cargo. It also owns the MileagePlus frequent flyer program. However, United does not own other major airlines outside its brand, as it mainly expands through partnerships and alliances rather than acquisitions.

Who owns United Airlines Holdings?

United Airlines Holdings, Inc. is a publicly traded company listed on the NASDAQ under the ticker UAL. Its ownership is spread among major institutional investors, including Vanguard Group, BlackRock, Capital Research Global Investors, State Street, and Primecap Management. No single entity fully owns it, but these shareholders collectively hold significant influence.

What is United Airlines?

United Airlines is one of the largest airlines in the world, based in Chicago, Illinois. It operates an extensive domestic and international network, serving six continents. United is a founding member of the Star Alliance, the world’s largest airline alliance. It provides passenger travel, cargo transport, and operates through subsidiaries like United Express.

Who owns Continental United Airlines?

Continental Airlines merged with United Airlines in 2010, creating the largest airline in the world at that time. After the merger, Continental ceased to exist as a separate brand. Today, its legacy continues under the United Airlines name, owned by United Airlines Holdings, Inc.

Who founded United Airlines?

United Airlines was originally founded as Varney Air Lines in 1926 by Walter T. Varney. Through a series of mergers in 1931, Varney Air Lines joined with Boeing Air Transport, Pacific Air Transport, and National Air Transport to officially form United Air Lines. Varney is often credited as the founder, but United’s origins are tied to multiple aviation pioneers.

Is United Airlines British or American?

United Airlines is American. It is headquartered in Chicago, Illinois, and operates primarily from U.S. hubs including Denver, Houston, Newark, San Francisco, Chicago, and Washington D.C.

Does Boeing own United?

No, Boeing does not own United Airlines. Boeing is one of the world’s largest aircraft manufacturers and supplies many of United’s airplanes, but the two companies are separate. United is owned by shareholders under United Airlines Holdings, Inc.

Does United own Emirates?

No, United Airlines does not own Emirates. Emirates is owned by the government of Dubai through the Investment Corporation of Dubai. United and Emirates are separate carriers, though both are international competitors in the long-haul aviation market.