- The Cheesecake Factory is a publicly traded company with institutional investors owning over 90% of outstanding shares, making them the dominant ownership group rather than any single individual or parent company.

- BlackRock (13.5%), FMR LLC (10.5%), and The Vanguard Group (10.3%) are the three largest shareholders, together controlling more than 34% of total shares, which gives them substantial voting influence at the shareholder level.

- Founder, Chairman, and CEO David Overton owns approximately 7.1%, making him the largest individual shareholder and a key source of strategic continuity, despite not having majority control.

- The remaining ownership is spread across other institutional investors (40%+), additional insiders (1%), and retail shareholders (<1%), resulting in a widely distributed ownership structure with no controlling shareholder.

The Cheesecake Factory is a prominent American restaurant company. It operates a network of full-service casual dining restaurants and bakery production facilities.

The brand is widely known for its extensive menu, generous portion sizes, and a variety of signature cheesecakes. It also manages several other restaurant concepts beyond the flagship brand. The company is publicly listed on the NASDAQ under the ticker “CAKE.”

Its global presence continues to grow through both direct-operated restaurants and international licensing agreements. The Cheesecake Factory has become a staple in casual dining with a reputation for quality service, hospitality, and an experience-driven menu.

It is headquartered in Calabasas Hills, California. In addition to its restaurants, it maintains two bakery production facilities that produce cheesecakes and other baked goods for its own outlets and third-party customers. Its restaurants operate primarily in the United States and Canada, and licensed locations extend across various global markets.

Founders of The Cheesecake Factory

The origins of The Cheesecake Factory story begin with Oscar and Evelyn Overton, a couple from Detroit, Michigan. Evelyn developed a cheesecake recipe in the 1940s that became locally popular.

With this recipe, they eventually opened a small cheesecake shop, laying the foundation for a bakery business that supplied desserts to restaurants in the Los Angeles area after they moved there with their children. The bakery’s success stemmed from Evelyn’s culinary talents and Oscar’s sales efforts.

David M. Overton

David M. Overton, the son of Oscar and Evelyn, joined the family business in the early 1970s. He saw an opportunity to elevate the brand by opening a restaurant to showcase his mother’s cheesecakes. David’s vision turned the dessert-centric bakery into a full-service restaurant concept.

He opened the first location in Beverly Hills in 1978. David later became Chairman and Chief Executive Officer of the company, guiding its expansion into a national and then international restaurant chain. His leadership has been central to shaping the company’s identity and strategic direction.

Ownership Snapshot

The Cheesecake Factory is structured as a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol CAKE. This means it does not have a single private owner. Instead, ownership is distributed among many shareholders, including institutional investors, company insiders, and public investors who hold shares through trading platforms and funds.

As a public company, its ownership details are disclosed regularly through regulatory filings and financial data services, reflecting who holds significant portions of the company’s outstanding shares.

According to recent filings as of early 2026, The Cheesecake Factory has approximately 49.8 million shares outstanding.

A large portion of The Cheesecake Factory’s ownership lies with institutional investors. These are entities such as investment management firms, pension funds, and mutual funds that buy shares on behalf of clients.

The remaining shares of The Cheesecake Factory are held by retail investors and other entities. This includes individual investors who purchase shares through brokerage accounts and smaller institutional or mutual fund positions not large enough to be individually disclosed.

Ownership History

The ownership history of The Cheesecake Factory reflects a gradual and deliberate evolution rather than a sudden transformation. What began as a small, family-operated bakery eventually developed into a nationally recognized restaurant brand and, later, a publicly traded corporation.

| Period / Year | Ownership Structure | Key Owners / Controllers | What Changed |

|---|---|---|---|

| 1940s–1971 | Family-owned | Oscar Overton and Evelyn Overton | Business existed as a home-based cheesecake operation and small bakery. Ownership was entirely within the Overton family. |

| 1972–1977 | Private family business | Overton family | The Cheesecake Factory Bakery was established in California. Cheesecakes were supplied to local restaurants. No outside investors. |

| 1978–1989 | Privately held restaurant company | David M. Overton and family | First Cheesecake Factory restaurant opened. Ownership shifted from bakery-only to a full-service restaurant model, still fully family-owned. |

| 1990–1991 | Private expansion phase | Overton family | Regional expansion outside Southern California began. Business structure prepared for public markets. |

| 1992 | Public company transition | Public shareholders, founder retained leadership | The Cheesecake Factory completed its initial public offering. Ownership became distributed among public and institutional investors. |

| 1993–2018 | Publicly traded company | Institutional investors, public shareholders, insiders | Institutional ownership steadily increased. Founder influence continued through executive leadership rather than majority ownership. |

| 2019 | Public company with expanded portfolio | Same shareholder base | Acquisition of Fox Restaurant Concepts added multiple brands under corporate ownership, expanding control beyond a single brand. |

| 2020–January 2026 | Mature public ownership model | Institutional investors as largest owners | Ownership remains widely distributed. No single controlling shareholder. Governance driven by board oversight and shareholder voting. |

Family Origins and Early Business Foundations

The ownership history of The Cheesecake Factory begins as a true family enterprise. The roots trace back to the 1940s when Evelyn Overton developed a cheesecake recipe that became popular in her local community. At this stage, ownership was informal and entirely family-based.

Evelyn and her husband, Oscar Overton, initially operated on a very small scale. After relocating to California in the early 1970s, they formalized the business by opening The Cheesecake Factory Bakery. This bakery supplied cheesecakes to local restaurants. Ownership remained fully within the Overton family, with no outside investors or partners involved. Decision-making was centralized and personal, focused on craftsmanship and product quality rather than expansion.

Transition From Bakery to Restaurant Ownership

A major ownership shift occurred when David M. Overton joined the family business. Unlike the bakery-only model, David envisioned a restaurant concept that would showcase cheesecakes directly to customers. In 1978, he opened the first Cheesecake Factory restaurant in Beverly Hills.

At this point, ownership moved from a simple bakery operation to a hospitality business. Control became more structured but remained privately held by the Overton family. David emerged as the primary decision-maker, gradually assuming leadership over brand direction, menu expansion, and restaurant growth. This period marked the transformation of the business from a supplier into a consumer-facing brand.

Private Expansion and Consolidation During the 1980s

Throughout the 1980s, The Cheesecake Factory expanded within California. New restaurant locations were opened, and the menu grew significantly beyond desserts. Despite this growth, ownership stayed private.

The Overton family retained full control over strategic decisions, capital allocation, and brand positioning. This allowed the company to experiment with large menus, premium interiors, and a distinctive dining experience without pressure from external shareholders. The business model matured during this phase, setting the foundation for national expansion.

Initial Public Offering and Ownership Shift

The most significant ownership change came in 1992, when The Cheesecake Factory completed its initial public offering. By going public, the company fundamentally altered its ownership structure.

Shares were sold to public investors, and ownership became distributed among institutions, funds, and individual shareholders. The Overton family no longer owned the company outright. Instead, David Overton transitioned into the role of founder-CEO, leading a public corporation. This move introduced regulatory oversight, shareholder accountability, and board governance.

While public ownership diluted family control, it also provided access to capital that supported nationwide expansion and long-term growth.

Post-IPO Growth and Strategic Acquisitions

Following the IPO, The Cheesecake Factory entered a period of accelerated growth. Restaurants expanded across the United States and later into international markets through licensing agreements. Ownership during this phase became increasingly institutional, with large asset managers accumulating shares.

The company also evolved from a single-brand operator into a multi-concept restaurant group. The acquisition of Fox Restaurant Concepts marked another ownership milestone. Through this acquisition, The Cheesecake Factory became the parent company of additional restaurant brands, broadening its operational scope and strategic responsibilities.

This period reinforced the company’s identity as a diversified restaurant operator rather than a single-brand chain.

Modern Public Ownership Structure

Today, The Cheesecake Factory operates under a mature public ownership model. No individual or family holds majority control. Institutional investors collectively own the largest portion of outstanding shares. Public shareholders and insiders make up the remainder.

David Overton continues to play a central leadership role, but ownership authority is now shared among shareholders through voting rights and board representation. This structure reflects the company’s transition from family ownership to professional, market-driven governance.

Who Owns The Cheesecake Factory: List of Major Shareholders

Since becoming a public company in 1992, The Cheesecake Factory has no single majority owner. Instead, ownership is held by institutional investment firms, company insiders, and public shareholders who trade shares on the NASDAQ stock market. Institutional investors hold the largest portion of shares, giving them significant influence through voting power and long-term positions.

Company executives and directors retain meaningful insider positions that align their interests with overall shareholder value. The result is a diversified ownership structure typical of large U.S. publicly traded companies.

The ownership of The Cheesecake Factory’s stock can be viewed by type:

- Institutions (approx. 93%): The vast majority of shares are held by institutional investors such as asset managers and mutual fund companies.

- Insiders (approx. 6%–7%): Executives, directors, and founding leadership retain meaningful, although minority, ownership.

- Individual / Public (less than 1%): A small fraction of shares are held directly by retail investors or in public company accounts.

BlackRock, Inc.: Largest Institutional Shareholder

BlackRock, Inc. is the largest institutional shareholder of The Cheesecake Factory. This global asset management firm holds approximately 13.5% of all outstanding shares, making it the most significant non-insider holder. BlackRock’s ownership reflects its strategy of investing in established, consumer-oriented companies through a combination of passive index funds and actively managed accounts.

As one of the world’s largest institutional investors, BlackRock typically votes its shares on corporate governance issues, such as executive compensation and board elections, influencing long-term strategy.

FMR LLC (Fidelity): Major Institutional Holder

FMR LLC, commonly known as Fidelity, is a major shareholder with approximately 10.5% of The Cheesecake Factory’s shares. Fidelity manages retirement accounts, mutual funds, and other investment vehicles on behalf of individual and institutional clients. Its sizeable ownership reflects confidence in the company’s brand strength and growth prospects.

While not as large as BlackRock’s stake, Fidelity’s position remains one of the top institutional holdings, enabling it to participate meaningfully in shareholder votes and governance discussions.

The Vanguard Group, Inc.: Index Fund Leader

The Vanguard Group, Inc. holds roughly 10.3% of outstanding shares, making it another key institutional partner. Vanguard is known for its broad-based index funds and ETFs that hold diversified portfolios of leading U.S. companies.

Its stake in The Cheesecake Factory reflects the company’s status as a mid-cap consumer services stock included in many passive fund portfolios. Like other large institutional holders, Vanguard exercises voting rights and engages with corporate leadership on governance issues.

David M. Overton: Founder-Insider Shareholder

David M. Overton, the founder, Chairman, and Chief Executive Officer, remains the largest individual insider shareholder. He holds approximately 7.1% of The Cheesecake Factory’s outstanding shares.

This insider position is significant relative to other individual executives and reflects Overton’s long-standing commitment to the brand he developed. While his ownership is smaller than the leading institutional holders, it aligns his personal financial interests with the company’s performance and future direction.

Kayne Anderson Rudnick Investment Management

Kayne Anderson Rudnick Investment Management LLC holds a meaningful stake of around 5.2%. This investment management firm focuses on long-term equity holdings and provides portfolio exposure to mid-sized companies with solid cash flow and stable competitive advantages.

Though smaller than Vanguard and Fidelity, Kayne Anderson’s position enhances the institutional base of shareholders committed to long-term performance.

Bank of America Corporation

Bank of America Corporation holds an estimated 4.8% stake. This reflects positions taken through its asset management affiliates and client-directed investment funds. Bank of America’s ownership is significant among financial institutions and adds to the diversified institutional base that supports stability in long-term share ownership.

Other Institutional and Fund Investors

Beyond the top holders listed above, a broad range of smaller institutional and mutual fund investors own the remaining shares. These include:

- Various mutual funds and ETFs that hold smaller percentages in diversified consumer sectors.

- Hedge funds and investment advisors with minor positions aimed at tactical or long-term strategies.

These investors collectively account for the bulk of shares not held by the largest institutions or insiders.

Insider Ownership Beyond the Founder

In addition to David Overton’s position, a small portion of shares is held by other executives and directors.

As of early 2026, insider ownership totals approximately 6%–7% of all shares outstanding. These include senior management positions, such as financial and operational leaders, who hold shares as part of compensation programs. This insider ownership provides alignment between executive performance and shareholder value.

Competitor Ownership Comparison

When comparing ownership across major casual dining companies, a clear pattern emerges. Most large restaurant chains operate as publicly traded companies. Ownership is typically spread across institutional investors, insiders, and public shareholders. However, the balance of control, founder influence, and private equity involvement varies by company.

The Cheesecake Factory follows a classic public-company ownership model. It has no parent company and no controlling shareholder. This structure can be compared with several key competitors in the casual and polished dining space.

| Company | Ownership Type | Largest Ownership Group | Founder Influence | Ownership Characteristics |

|---|---|---|---|---|

| The Cheesecake Factory | Public company | Institutional investors | High | No parent company. Founder-led leadership remains active. Majority institutional ownership with no controlling shareholder. |

| Darden Restaurants | Public company | Institutional investors | Low | Multi-brand holding company. Founder influence largely absent. Strong board-driven governance model. |

| Brinker International | Public company | Institutional investors | Low | Ownership concentrated around institutions. Heavy dependence on a single core brand (Chili’s). |

| Bloomin’ Brands | Public company | Institutional investors | Very low | Portfolio-focused restaurant operator. Minimal founder involvement. Strategic decisions driven by financial performance. |

| Yum! Brands | Public company | Institutional investors | None | Franchise-heavy model. Corporate ownership focused on brand management and royalties rather than operations. |

| Texas Roadhouse | Public company | Institutional investors | Moderate | Strong founder-driven culture historically. Public ownership with emphasis on internal operations and employee culture. |

Darden Restaurants Ownership Structure

Darden Restaurants is one of the largest competitors in the U.S. casual dining segment. It owns brands such as Olive Garden, LongHorn Steakhouse, and Cheddar’s Scratch Kitchen.

Darden is publicly traded. Ownership is heavily concentrated among institutional investors, similar to The Cheesecake Factory. Large asset managers hold significant stakes, while insiders own a relatively small percentage. Unlike The Cheesecake Factory, Darden operates as a multi-brand holding company with a stronger focus on standardized concepts and scale-driven efficiencies.

Founder influence at Darden is minimal today. Strategic control is exercised primarily through its board of directors and executive leadership team, reflecting a more corporate-style governance structure.

Brinker International Ownership Structure

Brinker International, the owner of Chili’s Grill & Bar and Maggiano’s Little Italy, is also publicly traded.

Brinker’s ownership profile mirrors The Cheesecake Factory in many ways. Institutional investors dominate the shareholder base. There is no single controlling owner. Insider ownership exists but does not represent a decisive voting block.

A key difference is brand concentration. Brinker relies heavily on Chili’s as its primary revenue driver. This increases shareholder sensitivity to the performance of a single core brand, whereas The Cheesecake Factory benefits from a more diversified concept portfolio.

Bloomin’ Brands Ownership Structure

Bloomin’ Brands owns Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, and Fleming’s Prime Steakhouse.

Bloomin’ Brands is publicly traded with institutional investors holding the majority of shares. Ownership is widely dispersed. No founder or individual shareholder maintains meaningful long-term control.

Compared to The Cheesecake Factory, Bloomin’ Brands operates more as a brand management platform. Strategic decisions often focus on portfolio optimization, closures, and brand repositioning rather than founder-led brand preservation.

Yum! Brands Ownership Structure

Yum! Brands represents a different ownership and operating model. It owns KFC, Taco Bell, and Pizza Hut.

Yum! Brands is publicly traded and institutionally owned. However, its business model relies heavily on franchising rather than company-owned restaurants. This shifts operational risk to franchisees while corporate ownership focuses on brand management, real estate strategy, and royalties.

In contrast, The Cheesecake Factory maintains a higher proportion of company-owned locations. This results in more operational control but also greater exposure to labor and cost pressures.

Texas Roadhouse Ownership Structure

Texas Roadhouse offers a closer cultural comparison.

Texas Roadhouse is publicly traded, but founder involvement remains significant. Founder Kent Taylor held substantial influence over brand culture and operations prior to his passing, and the company continues to emphasize internal culture and operational consistency.

Similarly, The Cheesecake Factory benefits from continued founder leadership through David Overton. This founder presence differentiates both companies from peers that are purely institutionally managed.

Private Equity Versus Public Ownership

Unlike some restaurant competitors that have undergone private equity buyouts or leveraged recapitalizations, The Cheesecake Factory has remained publicly traded without private equity control.

This absence of private equity ownership reduces pressure for short-term margin extraction or aggressive cost-cutting. It supports a long-term brand investment approach, particularly in menu development, restaurant design, and employee retention.

Key Differences in Competitive Ownership

Several distinctions stand out when comparing ownership structures:

- The Cheesecake Factory has stronger founder continuity than most peers.

- Its ownership is highly institutional but not dominated by a single fund.

- It operates independently without a parent holding company.

- It balances public-market discipline with founder-led strategic vision.

These factors influence how the company competes, invests, and responds to industry changes.

Who Controls The Cheesecake Factory?

Control of The Cheesecake Factory is not determined by a single owner or shareholder. While institutional investors own large portions of the company’s stock, they do not manage daily operations. Actual control is exercised through a structured corporate governance system that includes executive leadership, the board of directors, and shareholder voting rights.

This separation between ownership and control is typical for publicly traded companies. Shareholders influence major decisions indirectly, while executives and directors handle strategy, operations, and long-term planning.

Control of The Cheesecake Factory is shaped by several interconnected layers:

- Executive leadership directs daily operations and strategy.

- The CEO and Chairman roles provide centralized vision and continuity.

- The board of directors ensures oversight and accountability.

- Shareholders influence governance through voting rights.

Together, these elements create a balanced control system. It allows The Cheesecake Factory to operate independently, preserve founder leadership, and remain accountable to public investors.

Role of the Chief Executive Officer

The most influential figure in the control structure is the Chief Executive Officer. The current CEO is David Overton, who is also the company’s founder and Chairman of the Board.

As CEO, David Overton is responsible for overall strategic direction, brand stewardship, and operational oversight. He plays a central role in menu development philosophy, restaurant experience standards, and long-term growth initiatives. His continued leadership provides consistency and institutional knowledge that is uncommon among large restaurant chains.

Because Overton is both founder and CEO, he exercises more influence than a typical hired executive. However, his authority is still balanced by the board of directors and shareholder accountability.

Chairman of the Board and Dual Leadership Structure

David Overton also serves as Chairman of the Board. This dual role gives him significant influence over both management and governance.

As Chairman, he sets board agendas, guides strategic discussions, and helps align executive decisions with shareholder interests. While some public companies separate the CEO and Chairman roles, The Cheesecake Factory has maintained a combined structure. This approach reflects confidence in founder-led leadership and long-term brand vision.

Despite this dual role, the board includes independent directors who provide oversight and challenge management decisions when necessary.

Board of Directors and Governance Oversight

The board of directors serves as the primary governing body responsible for oversight and accountability. It represents shareholders and ensures that management acts in the company’s best interests.

The board approves major decisions such as executive compensation, long-term strategy, acquisitions, leadership appointments, and corporate policies. Independent directors form a majority of the board, which limits unilateral control by any single executive.

Committees within the board focus on audit oversight, compensation, governance, and risk management. These committees further distribute control and reduce the concentration of power.

Executive Leadership Team Influence

Beyond the CEO, control is shared with the executive leadership team. This group includes senior executives overseeing operations, finance, development, supply chain, and human resources.

Each executive is responsible for translating strategic goals into operational execution. While they do not individually control the company, their collective input shapes performance, expansion decisions, and cost management.

Executive authority is delegated by the CEO but remains subject to board review and performance evaluation.

Shareholder Voting Power and Influence

Shareholders exercise control through voting rights attached to their shares. Institutional investors, due to their large holdings, have a meaningful influence during shareholder votes.

These votes cover board elections, executive compensation approvals, and major corporate actions. While institutional investors do not manage daily operations, they can influence leadership composition and governance standards over time.

Because ownership is widely distributed, no single shareholder can dictate outcomes independently. Control emerges from consensus among large institutional holders and proxy voting mechanisms.

Absence of a Controlling Shareholder

One defining aspect of The Cheesecake Factory’s control structure is the absence of a controlling shareholder. No individual, family, or institution owns a majority of shares.

This prevents takeover-style control and reinforces governance through collective decision-making. It also means that long-term control stability depends on leadership performance rather than ownership dominance.

Founder influence exists through leadership roles, not majority equity ownership.

Founder-Led Control in a Public Company Context

The Cheesecake Factory stands out among competitors due to sustained founder involvement. David Overton’s continued leadership allows the company to maintain a consistent brand identity, menu philosophy, and customer experience.

At the same time, public company controls limit unilateral decision-making. Financial reporting requirements, board oversight, and shareholder expectations create checks and balances around founder authority.

This hybrid model blends founder-driven vision with institutional governance discipline.

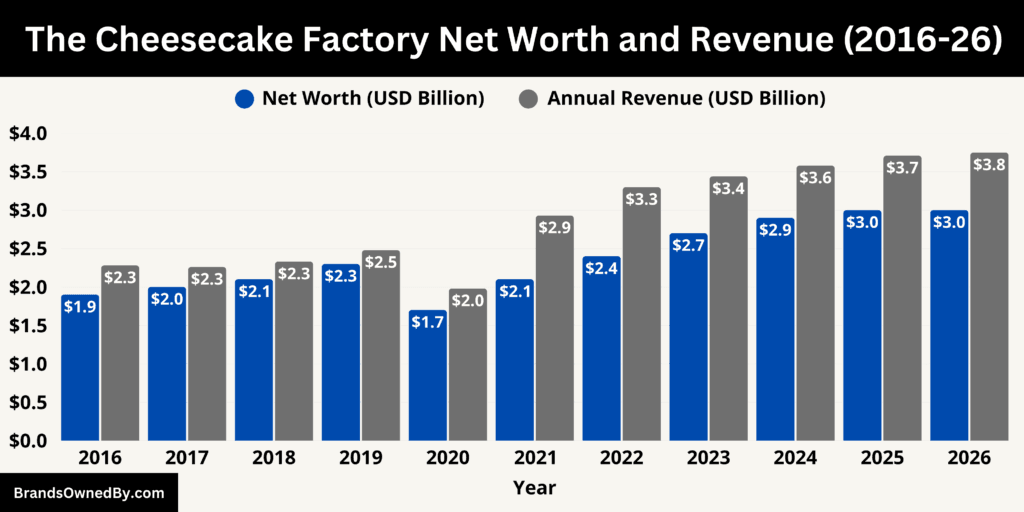

The Cheesecake Factory Annual Revenue and Net Worth

As of January 2026, The Cheesecake Factory continues to demonstrate strong financial scale within the casual dining industry. The company reports trailing twelve-month revenue of approximately $3.75 billion. Its estimated net worth stands at around $3 billion. These figures reflect the brand’s recovery, expansion, and sustained relevance in a highly competitive restaurant market.

2026 Revenue

The $3.75 billion TTM revenue figure reflects the most recent four reported quarters entering 2026. This represents an increase of roughly $170 million compared to the estimated full-year 2024 revenue of $3.58 billion and about $40 million above the estimated 2025 revenue of $3.71 billion.

Over ten years, revenue has grown from approximately $2.28 billion in 2016 to $3.75 billion in 2026. This equals a compound growth of roughly 5.1% annually. Growth has been uneven, with a sharp contraction in 2020, followed by a multi-year recovery and stabilization phase rather than aggressive expansion.

Revenue Breakdown by Brand and Business Segment

The Cheesecake Factory’s revenue is highly concentrated in its flagship brand.

Approximately $3.05 billion to $3.15 billion, or about 82%–84% of total revenue, is generated by Cheesecake Factory branded restaurants. These locations are primarily company-owned and produce some of the highest average unit volumes in U.S. casual dining.

North Italia contributes an estimated $380 million to $420 million in annual revenue, representing roughly 10%–11% of total revenue. While materially smaller than the flagship brand, North Italia has higher per-unit growth rates and a more upscale pricing profile.

Flower Child generates approximately $160 million to $190 million in revenue, accounting for about 4%–5% of total revenue. Its contribution is smaller but strategically important due to faster traffic growth and lower average build-out costs.

The remaining $60 million to $80 million, or roughly 2% of revenue, comes from bakery operations and international licensing. Licensing revenue carries higher margins because it does not include full operating costs.

Average Unit Economics and Revenue Density

The Cheesecake Factory operates with unusually high revenue per location. Average annual sales per Cheesecake Factory restaurant exceed $12 million, compared to $4–6 million for many casual dining peers.

This revenue density allows the company to generate higher total revenue with fewer locations. It also explains why revenue growth is driven more by pricing, mix, and efficiency than by rapid unit expansion.

North Italia locations generate lower absolute revenue per unit than Cheesecake Factory but show higher same-store sales growth rates. Flower Child locations generate lower revenue per unit but achieve faster throughput and lower labor intensity.

Cost Structure

Food and beverage costs represent approximately 22%–24% of total restaurant revenue. Labor costs account for roughly 34%–36%. Occupancy and operating expenses make up an additional 18%–20%.

Combined restaurant-level operating costs therefore consume about 74%–78% of revenue. This leaves restaurant-level margins in the high-teens to low-twenties percentage range before corporate overhead.

Menu pricing adjustments implemented since 2021 have increased average check size by an estimated 15%–18% over four years, helping offset labor and commodity inflation without materially reducing traffic.

Net Worth in 2026

The estimated $3 billion net worth as of January 2026 is primarily derived from market capitalization, adjusted for balance-sheet structure.

Market capitalization accounts for roughly $2.4 billion to $2.6 billion of total value, based on outstanding shares and prevailing stock price ranges entering 2026. The remaining value is supported by tangible assets, cash balances, and brand equity.

Tangible assets include company-owned real estate, bakery production facilities, equipment, and leasehold improvements. These assets contribute several hundred million dollars in replacement value.

Brand value is a significant component of net worth. The Cheesecake Factory brand alone supports more than $3 billion in annual consumer spending, which materially exceeds the company’s book value. This gap explains why net worth remains stable even during periods of slower revenue growth.

Net Worth to Revenue Ratio and Peer Context

With $3 billion in net worth and $3.75 billion in revenue, the company’s net worth-to-revenue ratio is approximately 0.8x.

This ratio is typical for mature, company-owned restaurant operators and lower than franchise-heavy brands, which often trade at higher multiples due to royalty-driven margins. The Cheesecake Factory’s lower multiple reflects higher operating intensity but greater control over the guest experience.

Long-Term Revenue and Valuation Trajectory

From 2016 to 2026, revenue increased by roughly $1.47 billion. Net worth expanded by more than $1 billion over the same period, despite a significant downturn in 2020.

Looking ahead, revenue growth is expected to remain modest but consistent. Based on historical compound growth of approximately 4%–5% during stable periods, projected revenue for 2027 is estimated in the range of $3.85 billion to $3.90 billion.

By 2028, revenue is likely to reach approximately $4.0 billion, assuming low single-digit same-store sales growth and selective unit openings.

By 2029, revenue could approach $4.1 billion to $4.2 billion if pricing power and traffic stability are maintained.

Net worth is expected to follow a similar gradual trajectory. From the current $3 billion level in January 2026, valuation is projected to rise to approximately $3.2 billion in 2027, driven by incremental revenue growth and stable margins.

By 2028, net worth could reach $3.35 billion to $3.4 billion, assuming no major deterioration in operating costs or consumer demand.

By 2029, the estimated net worth may approach $3.5 billion, reflecting cumulative earnings growth and sustained brand equity.

These projections assume no major structural changes, such as large-scale franchising shifts, divestitures, or private equity involvement. They also assume continued dominance of the flagship Cheesecake Factory brand, which currently accounts for more than 80% of total revenue and anchors overall valuation.

Overall, the long-term trajectory suggests that The Cheesecake Factory is no longer a high-growth restaurant chain, but a high-scale, cash-generating operator. Future value creation is expected to come from operational consistency, selective concept expansion, and preservation of premium positioning rather than rapid top-line acceleration.

Brands Owned by The Cheesecake Factory

As of 2026, The Cheesecake Factory operates as a multi-concept restaurant company. It directly owns and manages several restaurant brands and operating entities. These brands are owned at the corporate level and are not subsidiaries of a separate parent company. Each plays a specific role in revenue generation, market diversification, or operational support.

| Company / Brand | Business Type | Ownership Status | Primary Role | Key Operational Details |

|---|---|---|---|---|

| The Cheesecake Factory Restaurants | Full-service casual dining | Wholly owned and operated | Core flagship brand | Represents over 80% of total revenue. Large-format restaurants with average annual sales exceeding $12 million per location. Mostly company-owned in North America. |

| North Italia | Upscale casual dining | Wholly owned and operated | Secondary growth brand | Modern Italian concept. Lower unit count but strong same-store sales growth. Targets higher-income and urban markets. |

| Flower Child | Fast-casual dining | Wholly owned and operated | Portfolio diversification | Health-focused concept with lower build-out and labor costs. Appeals to younger and wellness-driven consumers. |

| Fox Restaurant Concepts | Restaurant development platform | Wholly owned operating entity | Brand incubation and innovation | Internal platform supporting concept development, culinary innovation, and leadership talent. No longer a broad consumer-facing portfolio. |

| Cheesecake Factory Bakery Operations | Food production | Wholly owned and operated | Vertical integration | Produces cheesecakes and desserts for company restaurants. Ensures consistency, supply control, and incremental wholesale revenue. |

| International Licensing & Brand Management | Brand management entity | Wholly owned | Global brand expansion | Oversees licensed international restaurants. Retains IP ownership, menu control, and operating standards without owning physical locations abroad. |

| Corporate & Support Entities | Corporate operations | Wholly owned | Infrastructure and scale | Includes real estate strategy, IT systems, procurement, training, and supply chain management supporting all brands. |

The Cheesecake Factory Restaurants

The Cheesecake Factory Restaurants represent the company’s flagship and largest business segment. This brand accounts for more than 80% of total consolidated revenue.

The company directly owns and operates the vast majority of its Cheesecake Factory locations in the United States and Canada. These restaurants are known for large-format dining spaces, extensive menus, and high average unit volumes. Most locations generate annual sales exceeding $12 million per restaurant, placing them among the highest-grossing casual dining units in the industry.

International Cheesecake Factory restaurants are primarily operated through licensing agreements. While the company does not directly own these locations, it retains brand ownership, menu control, and quality standards. Licensing allows global expansion with limited capital exposure while preserving brand integrity.

North Italia

North Italia is a modern Italian dining concept owned and operated by The Cheesecake Factory. The brand focuses on handmade pasta, chef-driven menus, and a premium yet approachable dining experience.

North Italia operates as a company-owned concept rather than a franchise system. It serves a more upscale demographic compared to the flagship brand. Revenue per location is lower than Cheesecake Factory restaurants, but unit growth rates and same-store sales trends are stronger.

The brand plays a strategic role by diversifying revenue away from large-box casual dining and positioning the company within the polished-casual segment. North Italia has become the company’s second-largest revenue contributor.

Flower Child

Flower Child is a fast-casual, health-focused restaurant concept owned by The Cheesecake Factory. The brand emphasizes organic ingredients, customizable bowls, salads, and wellness-oriented meals.

Flower Child targets younger consumers and urban markets where demand for lighter and faster dining options is higher. Average check sizes are lower than the company’s full-service brands, but labor and build-out costs are also lower.

The concept provides portfolio balance by reducing reliance on full-service dining occasions. It also positions the company to compete in the fast-casual segment without diluting the Cheesecake Factory brand.

Fox Restaurant Concepts

Fox Restaurant Concepts operates as an internal restaurant development and management platform within The Cheesecake Factory organization. While many Fox concepts were divested or closed after acquisition, the operating entity continues to house culinary development, brand incubation, and operational talent.

Fox Restaurant Concepts serves as the foundation from which North Italia and Flower Child were scaled nationally. It also functions as an internal innovation engine, allowing The Cheesecake Factory to test new restaurant ideas without risking its flagship brand.

Although Fox Restaurant Concepts is no longer consumer-facing as a broad portfolio, it remains an owned and operated entity supporting brand development and strategy.

The Cheesecake Factory Bakery Operations

The Cheesecake Factory owns and operates its bakery production facilities. These facilities produce cheesecakes, specialty desserts, and baked goods used across company-owned restaurants.

The bakery operations are vertically integrated into the business. This structure ensures quality control, consistency, and supply reliability. It also supports limited external wholesale distribution, which contributes incremental revenue.

Ownership of bakery production differentiates The Cheesecake Factory from many competitors that rely on third-party suppliers. It also strengthens margins and brand consistency across locations.

International Licensing and Brand Management Entity

The Cheesecake Factory retains ownership of its international brand rights and operates centralized brand management for licensed markets. While physical restaurants abroad are not company-owned, the intellectual property, menus, recipes, and operating standards remain under corporate control.

This entity manages partnerships, oversees menu localization, and ensures brand compliance. It allows the company to scale internationally without owning physical assets overseas.

Corporate and Support Entities

The company also owns and operates internal corporate entities responsible for real estate strategy, supply chain management, technology systems, and employee training.

These entities do not generate direct consumer revenue but are critical to operations. Centralized control over procurement, IT systems, and training enables consistency across brands and improves cost efficiency at scale.

Conclusion

The question of who owns The Cheesecake Factory often leads to a deeper understanding of how the company is structured and operated. Rather than being controlled by a single owner or parent group, The Cheesecake Factory functions as an independent public company with ownership spread across institutional investors, insiders, and public shareholders. This structure allows the business to access capital markets while retaining long-term strategic continuity through founder-led leadership.

At the same time, the company’s ownership model supports disciplined decision-making, operational control, and brand consistency across its restaurants and concepts. With a diversified portfolio that includes full-service, upscale casual, and fast-casual brands, The Cheesecake Factory has built a resilient operating framework. Understanding who owns The Cheesecake Factory ultimately highlights a balance between shareholder accountability and centralized leadership that has enabled the brand to scale, adapt, and remain competitive well into 2026.

FAQs

Who is the owner of Cheesecake Factory?

The Cheesecake Factory is not owned by a single person or company. It is a publicly traded company owned by a broad mix of institutional investors, insiders, and public shareholders. The largest shareholders are major investment firms, while the company is led by its founder and CEO.

Who owns the Cheesecake Factory in the United States?

In the United States, Cheesecake Factory restaurants are primarily company-owned and operated by The Cheesecake Factory Incorporated itself. Ownership is shared among public shareholders, with institutional investors holding the majority of outstanding shares.

Who owns Cheesecake Factory restaurants?

Most Cheesecake Factory restaurants in North America are directly owned and operated by the company. International locations are generally operated by local partners under licensing agreements, while the brand, menu, and intellectual property remain owned by The Cheesecake Factory.

When was Cheesecake Factory founded?

The Cheesecake Factory was founded in 1978, when the first restaurant opened in Beverly Hills, California.

What restaurants does Cheesecake Factory own?

The Cheesecake Factory owns and operates several restaurant concepts, including Cheesecake Factory Restaurants, North Italia, and Flower Child. It also owns bakery production operations and internal restaurant development entities.

Where did Cheesecake Factory originate?

Cheesecake Factory originated in California. Its first restaurant location opened in Beverly Hills, marking the transition from a bakery business to a full-service restaurant brand.

What restaurant chain owns Cheesecake Factory?

No restaurant chain owns Cheesecake Factory. It operates independently as a public company and is not a subsidiary of any other restaurant group.

Is Cheesecake Factory American or Italian?

Cheesecake Factory is an American restaurant chain. While its menu includes Italian-inspired dishes, the brand is based in the United States and reflects American casual dining rather than traditional Italian cuisine.

What is the sister company to Cheesecake Factory?

North Italia and Flower Child are considered sister brands under the same corporate ownership. They are owned and operated by The Cheesecake Factory and function as part of its broader restaurant portfolio.

Is Cheesecake Factory only in the US?

No. While most Cheesecake Factory restaurants are located in the United States, the brand also operates internationally through licensed locations in multiple countries.

Who is the owner of Cheesecake Factory in the UAE?

Cheesecake Factory restaurants in the UAE are operated by a local licensee. The physical locations are owned by the regional partner, but the Cheesecake Factory brand, recipes, and operating standards remain owned by The Cheesecake Factory Incorporated.

How many Cheesecake Factories are there?

As of 2026, there are more than 320 Cheesecake Factory restaurants worldwide, including company-owned locations in North America and licensed restaurants in international markets.