Take-Two Interactive is a major name in the gaming world. Known for titles like Grand Theft Auto and NBA 2K, the company has built a strong reputation. But who owns Take-Two Interactive? This article explores its ownership structure, leadership, revenue, and the companies it controls.

Take-Two Interactive Company Profile

Take-Two Interactive Software, Inc. is a leading American video game holding company. It was founded in September 1993 by Ryan Brant, the son of publisher Peter M. Brant. The company is headquartered in New York City, but its impact is global, with development studios and publishing offices spread across North America, Europe, and Asia.

Take-Two is best known for its high-quality game franchises, creative storytelling, and open-world gameplay experiences. It operates through several key labels, most notably Rockstar Games, 2K Games, Private Division, and Zynga. These labels cover console, PC, and mobile gaming across multiple genres—action-adventure, sports simulation, strategy, and casual games.

Major Milestones of Take-Two Interactive

- 1993: Take-Two Interactive is established by Ryan Brant.

- 1998: Acquires BMG Interactive assets, including the rights to Grand Theft Auto, which would later become its most iconic franchise.

- 2001: Establishes Rockstar Games as a publishing label, launching Grand Theft Auto III, a game that revolutionized open-world gaming.

- 2005: Launches 2K Games, which later introduces major franchises like NBA 2K, BioShock, and Sid Meier’s Civilization.

- 2007: CEO Strauss Zelnick joins the company and leads a strategic overhaul after a series of scandals and financial missteps.

- 2014: Acquires Private Division, a label that supports independent and mid-tier development studios.

- 2020: Releases Grand Theft Auto V on new-generation consoles, which becomes one of the best-selling games of all time with over 180 million units sold globally.

- 2022: Completes the $12.7 billion acquisition of Zynga, marking the company’s biggest push into mobile and casual gaming.

- 2023–2024: Expands global development capabilities and begins work on Grand Theft Auto VI, increasing expectations for future growth.

Take-Two has positioned itself as a creative leader in the industry. Its games frequently win awards and enjoy long life cycles, with strong post-launch support and downloadable content. Through its combination of premium console games and recurring digital revenue streams, the company maintains a robust business model.

Today, Take-Two is considered one of the top five publicly traded gaming companies in the world, alongside Activision Blizzard, Electronic Arts, Nintendo, and Ubisoft. Its strategic acquisitions and strong IP portfolio give it a competitive edge across all gaming platforms.

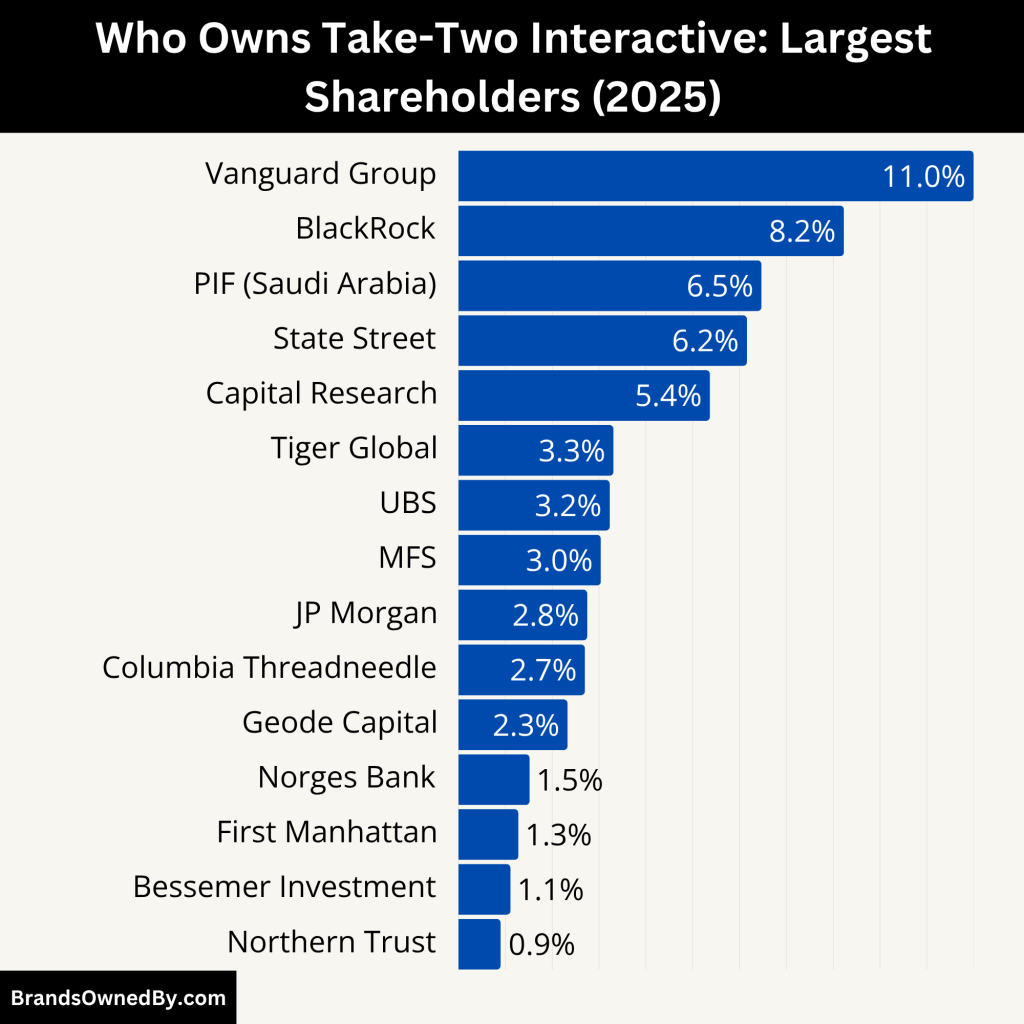

Who Owns Take-Two Interactive: Major Shareholders

Take-Two Interactive is a publicly traded company listed on NASDAQ under the ticker TTWO. It is owned by a mix of institutional investors, mutual funds, and retail shareholders. No single person or entity owns the entire company. However, a few major institutions hold significant stakes. These investors have the power to influence company decisions through their voting rights.

Here’s a list of the major shareholders of Take-Two Interactive as of June 2025:

| Shareholder | Ownership (%) | Shares Held | Estimated Value (USD) |

|---|---|---|---|

| The Vanguard Group, Inc. | 11.00% | 19,359,463 | $4.36 billion |

| BlackRock, Inc. | 8.23% | 14,526,235 | $3.20 billion |

| Public Investment Fund (Saudi Arabia) | 6.47% | 11,414,680 | $2.50 billion |

| State Street Global Advisors | 6.16% | 10,874,483 | $2.40 billion |

| Capital Research and Management Company | 5.37% | 9,485,022 | $2.10 billion |

| Tiger Global Management, LLC | 3.31% | 5,839,256 | $1.30 billion |

| UBS Asset Management AG | 3.23% | 5,691,985 | $1.20 billion |

| Massachusetts Financial Services (MFS) | 3.04% | 5,358,309 | $1.20 billion |

| JP Morgan Asset Management | 2.75% | 4,856,733 | $1.10 billion |

| Columbia Threadneedle Investments | 2.70% | 4,770,044 | $1.00 billion |

| Geode Capital Management | 2.33% | 4,110,469 | $902.2 million |

| Norges Bank Investment Management | 1.52% | 2,689,517 | $590.3 million |

| First Manhattan Co. LLC | 1.28% | 2,250,602 | $494.0 million |

| Bessemer Investment Management LLC | 1.11% | 1,967,301 | $431.8 million |

| Northern Trust Global Investments | 0.90% | 1,588,067 | $348.6 million |

| Ninety One UK Limited | 0.85% | 1,504,967 | $330.3 million |

| DNB Asset Management AS | 0.85% | 1,504,918 | $330.3 million |

| Invesco Capital Management LLC | 0.85% | 1,498,023 | $328.8 million |

| ZMC Advisors L.P. | 0.81% | 1,423,088 | $312.4 million |

| Balyasny Asset Management L.P. | 0.80% | 1,404,640 | $308.3 million |

| JPMorgan Chase & Co (Private & Investment Banking) | 0.78% | 1,379,682 | $302.8 million |

| Alyeska Investment Group, L.P. | 0.76% | 1,347,150 | $295.7 million |

| Teachers Insurance and Annuity Assoc. (TIAA-CREF) | 0.75% | 1,324,973 | $290.8 million |

| Dimensional Fund Advisors LP | 0.74% | 1,311,942 | $288.0 million |

| Citadel Advisors LLC | 0.74% | 1,305,058 | $286.5 million |

The Vanguard Group, Inc.

The Vanguard Group is the largest shareholder, holding approximately 11% of Take-Two Interactive’s outstanding shares, equating to 19,359,463 shares valued at around $4.36 billion. Vanguard’s investment is primarily through its index funds, such as the Vanguard Total Stock Market Index Fund and the Vanguard 500 Index Fund.

As a passive investor, Vanguard does not engage in daily management but holds significant voting power for shareholders.

BlackRock, Inc.

BlackRock holds about 8.23% of Take-Two Interactive, translating to 14,526,235 shares valued at approximately $3.2 billion. Similar to Vanguard, BlackRock’s stake is mainly through its various ETFs and index funds. While not involved in daily operations, BlackRock’s substantial holdings grant it considerable influence over corporate governance matters.

Public Investment Fund (PIF)

The Public Investment Fund of Saudi Arabia owns 6.47% of Take-Two Interactive, amounting to 11,414,680 shares valued at around $2.5 billion. PIF’s investment reflects its strategy to diversify Saudi Arabia’s economy by investing in global entertainment and technology sectors. While PIF does not participate in daily management, its significant stake positions it as a key institutional investor.

State Street Global Advisors

State Street holds approximately 6.16% of Take-Two Interactive, equivalent to 10,874,483 shares valued at about $2.4 billion. As a major asset manager, State Street’s investment is primarily through its index funds. The firm maintains a passive investment approach but exercises voting rights on significant corporate matters.

Capital Research and Management Company

Capital Research and Management Company owns about 5.37% of Take-Two Interactive, totaling 9,485,022 shares valued at approximately $2.1 billion. Known for its active management style, Capital Research may engage more directly with company management compared to passive investors.

Tiger Global Management, LLC

Tiger Global Management holds 3.31% of Take-Two Interactive, amounting to 5,839,256 shares valued at around $1.3 billion. As a hedge fund, Tiger Global is known for its investments in technology and internet companies, indicating a strategic interest in the gaming sector.

UBS Asset Management AG

UBS Asset Management owns approximately 3.23% of the company, translating to 5,691,985 shares valued at about $1.2 billion. UBS’s stake is part of its diversified investment portfolio, and while it does not engage in daily operations, it holds voting rights in shareholder meetings.

Massachusetts Financial Services Company (MFS)

MFS holds about 3.04% of Take-Two Interactive, equating to 5,358,309 shares valued at approximately $1.2 billion. As an active investment manager, MFS may engage with company management to influence strategic decisions.

JP Morgan Asset Management

JP Morgan Asset Management owns around 2.75% of the company, totaling 4,856,733 shares valued at about $1.1 billion. As a significant institutional investor, JP Morgan holds voting rights and may participate in major corporate decisions.

Columbia Threadneedle Investments

Columbia Threadneedle holds approximately 2.7% of Take-Two Interactive, amounting to 4,770,044 shares valued at around $1.0 billion. The firm is known for its active investment strategies and may engage with company leadership on governance matters.

Other Notable Shareholders

- Geode Capital Management: Owns about 2.33% (4,110,469 shares) valued at $902.2 million.

- Norges Bank Investment Management: Holds 1.52% (2,689,517 shares) valued at $590.3 million.

- First Manhattan Co. LLC: Owns 1.28% (2,250,602 shares) valued at $494.0 million.

- Bessemer Investment Management LLC: Holds 1.11% (1,967,301 shares) valued at $431.8 million.

- Northern Trust Global Investments: Owns 0.9% (1,588,067 shares) valued at $348.6 million.

- Ninety One UK Limited: Holds 0.85% (1,504,967 shares) valued at $330.3 million.

- DNB Asset Management AS: Owns 0.85% (1,504,918 shares) valued at $330.3 million.

- Invesco Capital Management LLC: Holds 0.85% (1,498,023 shares) valued at $328.8 million.

- ZMC Advisors L.P.: Owns 0.81% (1,423,088 shares) valued at $312.4 million.

- Balyasny Asset Management L.P.: Holds 0.8% (1,404,640 shares) valued at $308.3 million.

- JPMorgan Chase & Co, Private Banking and Investment Banking Investments: Owns 0.78% (1,379,682 shares) valued at $302.8 million.

- Alyeska Investment Group, L.P.: Holds 0.76% (1,347,150 shares) valued at $295.7 million.

- Teachers Insurance and Annuity Association-College Retirement Equities Fund: Owns 0.75% (1,324,973 shares) valued at $290.8 million.

- Dimensional Fund Advisors LP: Holds 0.74% (1,311,942 shares) valued at $288.0 million.

- Citadel Advisors LLC: Owns 0.74% (1,305,058 shares) valued at $286.5 million.

Collectively, these top institutional investors own a significant portion of Take-Two Interactive, influencing its strategic direction through their voting rights and investment decisions.

Who is the CEO of Take-Two Interactive?

As of 2025, Strauss Zelnick serves as the Chairman and Chief Executive Officer of Take-Two Interactive. He has held the CEO position since 2007, marking over 14 years of leadership. Zelnick is also the founder and managing partner of ZMC, a private equity firm specializing in media and communications investments.

Leadership and Strategic Vision

Under Zelnick’s guidance, Take-Two Interactive has achieved significant milestones, including the successful launches of major titles like Grand Theft Auto V and Red Dead Redemption 2. He emphasizes the importance of human creativity in game development, expressing skepticism about the role of AI in creating blockbuster titles. Zelnick believes that while AI can enhance efficiency, it cannot replace the unique vision and innovation brought by human creators.

Decision-Making Structure

Take-Two Interactive’s governance structure combines the roles of Chairman and CEO, both held by Zelnick. To balance this concentration of authority, the company has appointed a Lead Independent Director, currently Ms. LaVerne Srinivasan. She serves as the principal liaison between the independent directors and the Executive Chairman, ensuring effective oversight and governance.

Past CEOs

Before Zelnick’s tenure, the company was led by its founder, Ryan Brant, who served as CEO from its inception in 1993 until 2001. Brant’s leadership laid the foundation for Take-Two’s growth in the gaming industry.

Zelnick’s extensive experience in media and entertainment, combined with his strategic leadership, continues to drive Take-Two Interactive’s success in the dynamic gaming market.

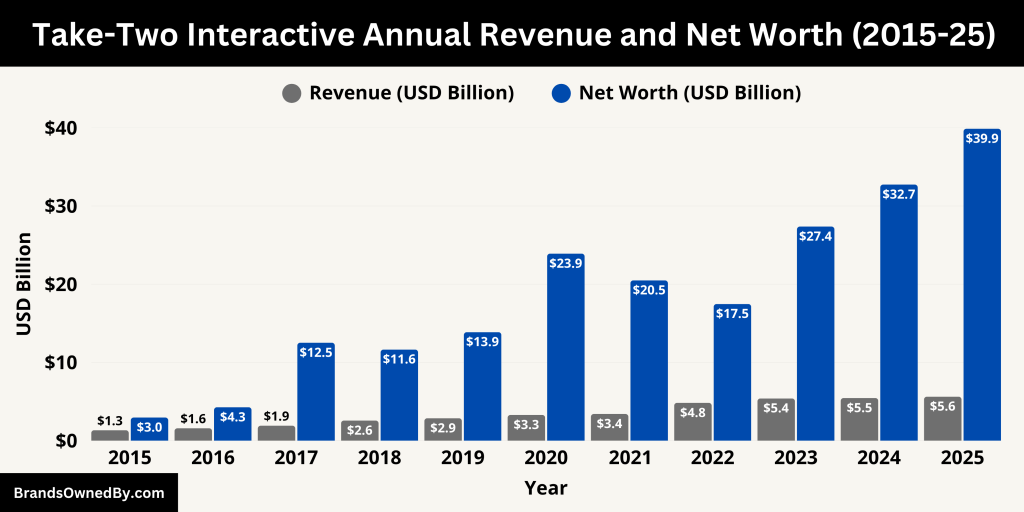

Take-Two Interactive Annual Revenue and Net Worth

For the fiscal year ending March 31, 2025, Take-Two Interactive reported total net revenue between $5.57 billion and $5.67 billion. This marks a slight increase from the previous year’s revenue of $5.35 billion. The company’s net bookings for the same period are projected between $5.55 billion and $5.65 billion, reflecting a modest growth compared to $5.33 billion in fiscal 2024.

Despite the revenue growth, Take-Two posted a net loss ranging from $674 million to $606 million for fiscal 2025. This loss is primarily attributed to a $3.55 billion goodwill impairment charge related to previous acquisitions.

Market Capitalization and Net Worth

As of June 2025, Take-Two Interactive’s market capitalization stands at approximately $39.95 billion. This represents a significant increase of 66.56% over the past year, indicating strong investor confidence in the company’s future prospects.

The company’s enterprise value is estimated at $42.84 billion, reflecting its total value, including debt and excluding cash. This growth in market capitalization is largely driven by anticipation for upcoming major releases, particularly Grand Theft Auto VI, scheduled for release in fall 2025.

Looking ahead, Take-Two Interactive expects to achieve record levels of net bookings in fiscal years 2026 and 2027. This optimism is fueled by a robust pipeline of game releases, including titles like Sid Meier’s Civilization VII, Mafia: The Old Country, and Borderlands 4. The company continues to invest in its development pipeline and remains confident in its ability to deliver high-quality gaming experiences that drive financial growth.

Below is an overview of the historical revenue and net worth of Take-Two Interactive:

| Fiscal Year | Revenue (USD) | Market Capitalization (USD) |

|---|---|---|

| 2015 | $1.33 billion | $2.95 billion |

| 2016 | $1.58 billion | $4.27 billion |

| 2017 | $1.91 billion | $12.52 billion |

| 2018 | $2.57 billion | $11.64 billion |

| 2019 | $2.86 billion | $13.87 billion |

| 2020 | $3.29 billion | $23.91 billion |

| 2021 | $3.41 billion | $20.49 billion |

| 2022 | $4.83 billion | $17.47 billion |

| 2023 | $5.39 billion | $27.37 billion |

| 2024 | $5.45 billion | $32.74 billion |

| 2025* | $5.62 billion | $39.88 billion |

Companies Owned by Take-Two Interactive

Take-Two Interactive operates a diverse portfolio of subsidiaries, publishing labels, and development studios across console, PC, and mobile platforms. As of 2025, the company has made several strategic acquisitions and divestitures to align with its focus on high-quality, immersive gaming experiences.

Here’s a list of the major companies and brands owned by Take-Two Interactive:

| Company/Brand | Description | Key Titles/Functions | Location/Status |

|---|---|---|---|

| Rockstar Games | Core label focused on high-end console and PC games | Grand Theft Auto, Red Dead Redemption | Multiple global studios |

| Rockstar North | Flagship studio under Rockstar Games | GTA series lead developer | Edinburgh, Scotland |

| Rockstar San Diego | Major development studio | Red Dead Redemption series | Carlsbad, California |

| Rockstar Leeds | Support studio | Various GTA handheld titles | United Kingdom |

| Rockstar India | Development support | Multi-project assistance | Bangalore, India |

| Rockstar Dundee | Formerly Ruffian Games | Development support | Dundee, Scotland |

| Rockstar Australia | Acquired as Video Games Deluxe in 2025 | VR and console development | Australia |

| 2K | Major publishing label | NBA 2K, WWE 2K, BioShock, Civilization | Global presence |

| Firaxis Games | Strategy game studio | Civilization, XCOM | Hunt Valley, Maryland |

| Visual Concepts | Sports simulation games | NBA 2K, WWE 2K | Novato, California |

| Hangar 13 | Action game studio | Mafia franchise | US, Czech Republic, UK |

| Cloud Chamber | Narrative-driven games | Upcoming BioShock title | California & Canada |

| 31st Union | New IP development | Untitled ambitious IP | California & Spain |

| Cat Daddy Games | Casual/mobile games | Various mobile games | Kirkland, Washington |

| HB Studios | Sports games | PGA Tour 2K | Nova Scotia, Canada |

| Gearbox Software | Acquired in 2024 | Borderlands, Homeworld, Duke Nukem | Frisco, Texas |

| Mass Media | Support and co-development | Multiple 2K titles | Moorpark, California |

| Zynga | Mobile game publishing & development | CSR Racing, FarmVille, Words With Friends | San Francisco, CA |

| NaturalMotion | Mobile game studio | CSR Racing, Clumsy Ninja | UK |

| Small Giant Games | Mobile game developer | Empires & Puzzles | Finland |

| Peak Games | Casual puzzle games | Toon Blast, Toy Blast | Turkey |

| Rollic | Hyper-casual games | Multiple titles | Turkey/Global |

| StarLark | Mobile sports games | Golf Rival | China |

| Chartboost | Ad tech and monetization | Mobile ad platform | San Francisco, CA |

| Echtra Games | Action RPG developer | Torchlight III | USA |

| Storemaven | Mobile growth/ASO tool | App store optimization | Israel |

| Private Division | Indie game publishing label (divested in 2024) | Kerbal Space Program, OlliOlli World | Sold – only 1 title retained |

| No Rest for the Wicked | Retained publishing rights | Action RPG | Ongoing under Take-Two |

Rockstar Games

Rockstar Games is renowned for developing critically acclaimed franchises such as Grand Theft Auto and Red Dead Redemption. The label emphasizes creating a limited number of high-quality titles with long market lifespans, fostering opportunities for sequels and additional revenue streams.

Key studios under Rockstar Games include:

- Rockstar North: Based in Edinburgh, Scotland, known for leading the development of the Grand Theft Auto series.

- Rockstar San Diego: Located in Carlsbad, California, instrumental in developing the Red Dead Redemption series.

- Rockstar Leeds: Based in the UK, contributed to various handheld titles and supporting roles in major projects.

- Rockstar India: Located in Bangalore, provides support across multiple Rockstar projects.

- Rockstar Dundee: Formerly Ruffian Games, acquired in 2020, contributes to various Rockstar titles.

- Rockstar Australia: Established in 2025 following the acquisition of Video Games Deluxe, expanding Rockstar’s development capabilities.

2K

2K is a prominent publishing label under Take-Two Interactive, known for a diverse portfolio of popular entertainment properties across multiple platforms and genres. The label includes both internally owned franchises and sports simulation titles.

Key studios and franchises under 2K include:

- Firaxis Games: Based in Hunt Valley, Maryland, known for the Sid Meier’s Civilization and XCOM series.

- Visual Concepts: Headquartered in Novato, California, responsible for the NBA 2K and WWE 2K franchises.

- Hangar 13: With studios in Novato, California; Brno and Prague, Czech Republic; and Brighton, England, known for the Mafia series.

- Cloud Chamber: Located in Novato, California, and Montreal, Canada, currently developing the next installment in the BioShock series.

- 31st Union: Based in San Mateo, California, and Valencia, Spain, working on an ambitious and inspired original IP.

- Cat Daddy Games: Located in Kirkland, Washington, known for casual and mobile games.

- HB Studios: Based in Lunenburg, Nova Scotia, Canada, acquired in 2021, known for PGA Tour 2K21.

- Gearbox Software: Acquired in 2024, headquartered in Frisco, Texas, renowned for the Borderlands franchise.

- Mass Media: Located in Moorpark, California, contributes to various 2K projects.

Zynga

Zynga, acquired by Take-Two Interactive in 2022, is a leading mobile game developer and publisher. The acquisition significantly bolstered Take-Two’s mobile gaming portfolio, with popular titles like CSR Racing, FarmVille, and Words With Friends now under its umbrella.

Key studios and acquisitions under Zynga include:

- NaturalMotion: Known for CSR Racing and Clumsy Ninja.

- Small Giant Games: Developers of Empires & Puzzles.

- Peak Games: Known for Toon Blast and Toy Blast.

- Rollic: Specializes in hyper-casual games.

- StarLark: Developers of Golf Rival.

- Chartboost: A mobile programmatic advertising and monetization platform.

- Echtra Games: Known for Torchlight III.

- Storemaven: Acquired in 2022, focuses on app store optimization.

Private Division

Private Division was established to bring titles from leading creative talent to market, focusing on supporting independent developers. Notable titles published under Private Division include Kerbal Space Program and OlliOlli World. However, in 2024, Take-Two sold Private Division to an undisclosed buyer, retaining only the publishing rights to “No Rest for the Wicked.”

Recent Acquisitions and Divestitures

- Gearbox Entertainment: In 2024, Take-Two acquired Gearbox Entertainment for $460 million. The acquisition included Gearbox Software and its franchises like Borderlands, Tiny Tina’s Wonderlands, Homeworld, Risk of Rain, Brothers in Arms, and Duke Nukem. Gearbox operates under the 2K label.

- Video Games Deluxe: Acquired in 2025, this studio became Rockstar Australia, expanding Rockstar’s development capabilities.

- Private Division: Sold in 2024 to an undisclosed buyer, with Take-Two retaining only the publishing rights to “No Rest for the Wicked.”

Final Thoughts

Take-Two Interactive is a powerhouse in the video game industry. The company is controlled by a group of institutional shareholders, with Vanguard being the largest. Under the leadership of Strauss Zelnick, it has expanded into mobile and diversified its gaming portfolio. With Rockstar, 2K, and Zynga under its wing, Take-Two remains a dominant force.

FAQs

Is Take-Two owned by Rockstar?

No, Rockstar Games is not the owner of Take-Two Interactive. It is actually a subsidiary owned by Take-Two Interactive. Take-Two is the parent company, and Rockstar Games operates under its umbrella as one of its most prominent labels.

Who is the largest shareholder of Take-Two Interactive?

As of 2025, the largest shareholder of Take-Two Interactive is Zhongzhi Enterprise Group, holding approximately 10.5% of the company’s shares. Institutional investors like The Vanguard Group and BlackRock also own significant stakes.

Who is the CEO of Take-Two Interactive?

The CEO of Take-Two Interactive as of 2025 is Strauss Zelnick. He has been leading the company since 2007 and is responsible for strategic decisions and overall management.

Who is the CEO of Rockstar?

The CEO of Rockstar Games is Sam Houser, who co-founded Rockstar and continues to oversee its creative direction and major projects.

Who is 2K owned by?

2K is a publishing label owned by Take-Two Interactive. It operates as a division within Take-Two, managing various studios and franchises.

Who are the main competitors of Take-Two Interactive?

Take-Two’s main competitors include Electronic Arts (EA), Activision Blizzard (now part of Microsoft), Ubisoft, CD Projekt, and Tencent’s gaming divisions. These companies compete in various segments of the video game market, including console, PC, and mobile.

Does Take-Two own GTA?

Yes, Take-Two Interactive owns the Grand Theft Auto (GTA) franchise through its subsidiary Rockstar Games.

Does Take-Two publish GTA?

Yes, Take-Two Interactive publishes the GTA series via Rockstar Games, which develops and manages the franchise.

Why did Dan Houser leave Rockstar?

Dan Houser left Rockstar Games in early 2020 for personal reasons, including wanting to explore new creative ventures outside of the company he co-founded. His departure marked a significant shift in Rockstar’s leadership, but Sam Houser remained at the helm.

What are the major Take-Two Interactive subsidiaries?

Major subsidiaries include Rockstar Games, 2K, and Zynga. These encompass multiple development studios and publishing labels.

Is Take-Two Interactive owned by Microsoft?

No, Take-Two Interactive is an independent publicly traded company and is not owned by Microsoft.

When did Take-Two buy Rockstar?

Take-Two Interactive acquired Rockstar Games in 1998, integrating it as one of its flagship labels.

Does Take Two own Rockstar?

Yes, Rockstar Games is fully owned by Take-Two Interactive.

What are popular games owned by Take-Two?

Popular games owned by Take-Two include Grand Theft Auto, Red Dead Redemption, NBA 2K, Civilization, Borderlands, and Sid Meier’s Civilization.

Who founded Take-Two Interactive?

Take-Two Interactive was founded by Ryan Brant in 1993.

Is 2K owned by EA?

No, 2K is not owned by Electronic Arts (EA). It is owned by Take-Two Interactive.

Is Take-Two Interactive privately owned?

No, it is a publicly traded company on NASDAQ.

Does Strauss Zelnick own Take-Two?

Strauss Zelnick does not own the company but leads it as CEO and Chairman through Zelnick Media Capital.

How much is Take-Two Interactive worth?

As of 2025, its market cap is around $23 billion.