Stripe is one of the most influential payment processing companies in the world. If you’re wondering who owns Stripe, you’re not alone. The company remains private but is widely followed due to its valuation and tech impact. This article breaks down Stripe’s ownership, net worth, leadership, and more.

Stripe Profile

Stripe is a global financial technology company that builds economic infrastructure for the internet. It helps individuals and businesses of all sizes accept payments, manage revenue, and scale globally. Headquartered in San Francisco and Dublin, Stripe is best known for its developer-friendly APIs and powerful payment solutions.

The company was founded in 2010 by Irish brothers Patrick and John Collison. Their goal was to simplify online payments, which were complex and fragmented at the time. Stripe’s early promise was to make online payment integration easy with just a few lines of code.

Stripe officially launched in 2011 with backing from Y Combinator. Soon after, it attracted major investors like Sequoia Capital and PayPal co-founders, including Peter Thiel and Elon Musk.

Over the years, Stripe has evolved beyond a simple payment processor. It now offers a suite of tools for billing, fraud detection, business incorporation, tax compliance, and global expansion.

Major Milestones

- 2010: Founded by Patrick and John Collison.

- 2011: Officially launched; joined Y Combinator.

- 2012: Raised Series A funding; began international expansion.

- 2015: Launched Stripe Atlas to help global founders start U.S. businesses.

- 2016: Introduced Stripe Radar for fraud detection.

- 2018: Rolled out Stripe Terminal for in-person payments.

- 2020: Expanded into banking-as-a-service with Stripe Treasury.

- 2021: Valuation reached $95 billion, making it the most valuable U.S. startup.

- 2023: Raised new funding at a $50 billion valuation; focused on profitability and product innovation.

Company Details

- Founders: Patrick Collison (CEO), John Collison (President)

- Headquarters: San Francisco, California, and Dublin, Ireland

- Founded: 2010

- Industry: Fintech (Financial Technology)

- Products: Payment APIs, Billing, Connect, Terminal, Atlas, Radar, Issuing, Treasury

- Global Presence: Available in over 40 countries with support for 135+ currencies

- Customers: Amazon, Shopify, Salesforce, Booking.com, Instacart, and Slack.

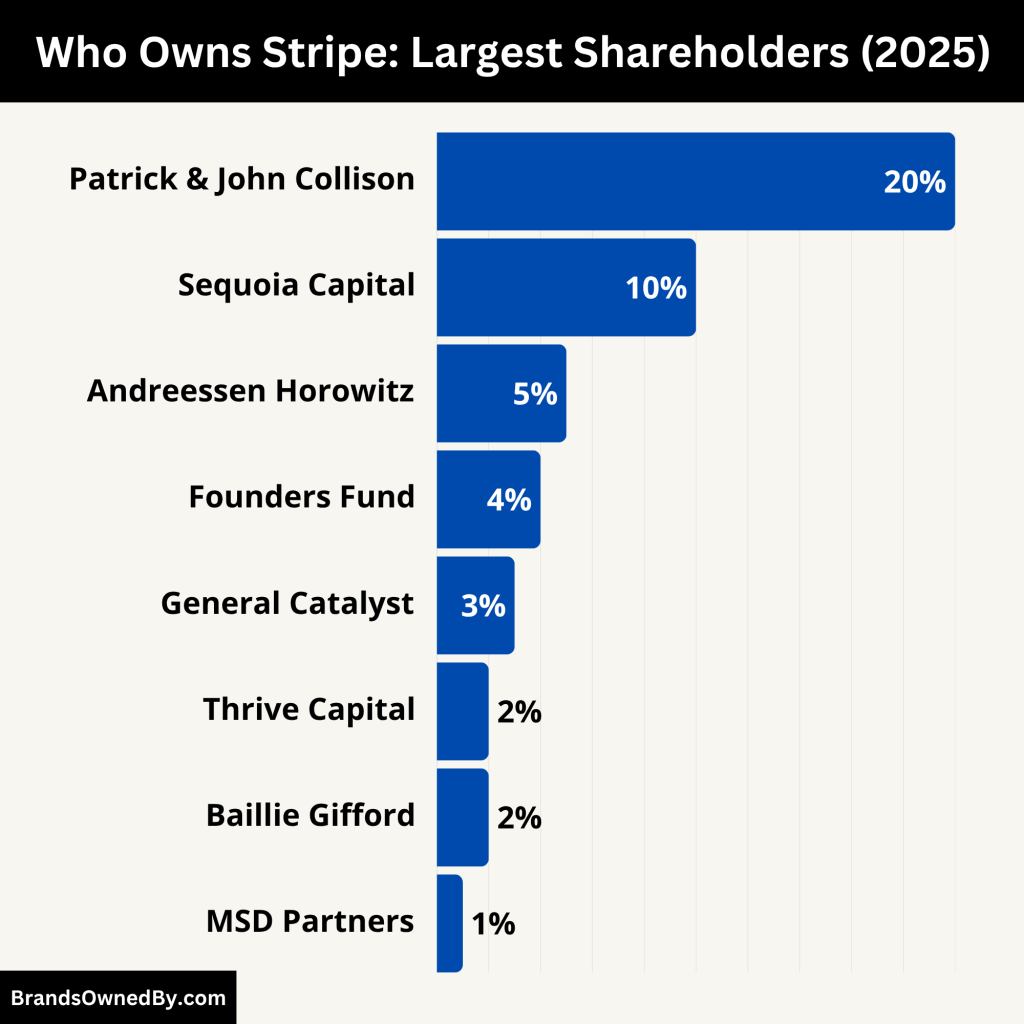

Who Owns Stripe: List of Shareholders

Stripe is a privately held company. That means it has no shares listed on a public stock exchange. Instead, ownership is divided among its founders, employees, and investors. The largest shareholders are the founders, followed by venture capital firms that participated in various funding rounds.

The Collison brothers maintain significant control over Stripe. Their ownership gives them influence over strategic decisions. Most of Stripe’s other shareholders are venture capital firms, tech investors, and employees holding stock options.

Here’s a list of the major shareholders of Stripe as of 2025:

| Shareholder | Type | Estimated Stake | Role & Involvement |

|---|---|---|---|

| Patrick & John Collison | Founders/Executives | 20%+ (combined) | Largest individual shareholders. Strong control over strategic direction. |

| Sequoia Capital | Venture Capital Firm | ~10% (estimated) | Early investor; increased stake via $861M share purchase in 2024. |

| Andreessen Horowitz (a16z) | Venture Capital Firm | ~5–7% (estimated) | Co-led $6.5B Series I round in 2023. Long-term backer. |

| Founders Fund | Venture Capital Firm | ~2–4% (estimated) | Early investor led by Peter Thiel. |

| General Catalyst | Venture Capital Firm | ~2–3% (estimated) | Participated in early and mid-stage rounds. |

| Thrive Capital | Venture Capital Firm | ~2–3% (estimated) | Active investor, part of 2023 Series I round. |

| Baillie Gifford | Institutional Investor | ~1–2% (estimated) | Long-term growth investor in Stripe and other tech companies. |

| MSD Partners | Private Investment Firm | ~1–2% (estimated) | Participated in late-stage rounds. Affiliated with Michael Dell. |

| GIC | Sovereign Wealth Fund | Undisclosed | Joined in 2023 Series I round. Singapore-based. |

| Temasek | Sovereign Wealth Fund | Undisclosed | Participated in 2023 round. Singapore government-owned investor. |

| Goldman Sachs AWM | Financial Institution | Undisclosed | Became an investor during 2023 Series I round. |

| Stripe Employees & Advisors | Internal Stakeholders | ~10–15% (estimated) | Hold equity via stock options; benefited from recent tender offers and buybacks. |

Patrick and John Collison

Patrick and John Collison, the co-founders of Stripe, remain the largest individual shareholders. While exact percentages are not publicly disclosed, their combined stake is estimated to exceed 20%. Their significant ownership underscores their continued influence over the company’s strategic direction.

Sequoia Capital

Sequoia Capital has been a pivotal investor in Stripe since its early stages, participating in multiple funding rounds. In 2024, Sequoia completed an $861 million purchase of Stripe shares from its limited partners, reflecting a strong belief in Stripe’s long-term potential.

Andreessen Horowitz (a16z)

Andreessen Horowitz, also known as a16z, has been a significant investor in Stripe, co-leading the $6.5 billion Series I funding round in 2023. The firm’s continued support highlights its confidence in Stripe’s growth trajectory.

Founders Fund

Founders Fund, led by Peter Thiel, has been an early and consistent investor in Stripe. The firm’s involvement underscores its commitment to backing transformative technology companies.

General Catalyst

General Catalyst participated in Stripe’s Series B funding round and has remained an active investor. Their ongoing support reflects confidence in Stripe’s business model and leadership.

Thrive Capital

Thrive Capital, founded by Josh Kushner, has made significant investments in Stripe, including participation in the $6.5 billion Series I funding round. Thrive’s strategy of making substantial bets on select companies aligns with its investment in Stripe.

Baillie Gifford

Baillie Gifford, a UK-based investment management firm, has invested in Stripe, demonstrating its interest in high-growth technology companies. The firm’s involvement adds a global dimension to Stripe’s investor base.

MSD Partners

MSD Partners, affiliated with Michael Dell, participated in Stripe’s recent funding rounds, including the Series I round in 2023. Their investment signifies confidence in Stripe’s long-term prospects.

GIC and Temasek

Singapore’s sovereign wealth funds, GIC and Temasek, joined Stripe’s investor roster during the 2023 Series I funding round. Their participation underscores Stripe’s appeal to global institutional investors.

Goldman Sachs

Goldman Sachs Asset and Wealth Management became a new investor in Stripe during the 2023 funding round. The firm’s involvement highlights Stripe’s attractiveness to major financial institutions.

Employees and Advisors

Stripe’s employees and advisors hold equity through stock options and grants. The company has facilitated liquidity events, such as the 2025 tender offer at a $91.5 billion valuation, allowing employees to realize the value of their holdings.

Who is the CEO of Stripe?

Patrick Collison is the co-founder and CEO of Stripe, a global financial technology company he launched in 2010 alongside his brother, John Collison. Born on September 9, 1988, in Dromineer, County Tipperary, Ireland, Patrick exhibited a passion for technology from a young age.

He began programming at ten and later attended the Massachusetts Institute of Technology (MIT) before leaving to pursue entrepreneurial ventures. Under his leadership, Stripe has evolved from a startup into a fintech powerhouse, processing $1.4 trillion in payments in 2024 and achieving a valuation of $91.5 billion in early 2025.

Leadership Style and Customer-Centric Approach

Patrick Collison is renowned for his hands-on leadership and commitment to innovation. In 2025, he introduced a unique initiative where customers are invited to participate in the first 30 minutes of Stripe’s bi-weekly leadership meetings. This practice allows customers to provide direct feedback to approximately 40 top managers, fostering a culture of customer empathy and continuous improvement.

Strategic Initiatives and Technological Advancements

Collison has steered Stripe into emerging areas such as artificial intelligence (AI) and cryptocurrency. In April 2025, he announced the development of a native stablecoin, a project he had envisioned for nearly a decade. This stablecoin aims to facilitate dollarized liquidity, particularly in markets outside the USA, EU, and UK, enhancing Stripe’s global payment infrastructure.

Additionally, Stripe has embraced AI technologies, partnering with companies like OpenAI and Anthropic. These collaborations have significantly contributed to Stripe’s growth, with the company reporting a 38% year-over-year increase in payment volume in 2024.

Broader Influence and Board Memberships

Beyond Stripe, Patrick Collison’s influence extends into broader technology and policy spheres. In April 2025, he joined the board of Meta Platforms, bringing his fintech expertise to one of the world’s largest social media companies. His appointment reflects a recognition of his deep understanding of digital infrastructure and economic development.

Commitment to Progress and Innovation

Patrick Collison is a proponent of “Progress Studies,” an interdisciplinary field he co-initiated to explore the drivers of societal advancement. This interest underscores his broader commitment to fostering innovation not only within Stripe but across various sectors. His leadership philosophy emphasizes challenging assumptions and seeking better solutions, a mindset that has propelled Stripe’s expansion into services like Stripe Atlas and Stripe Climate.

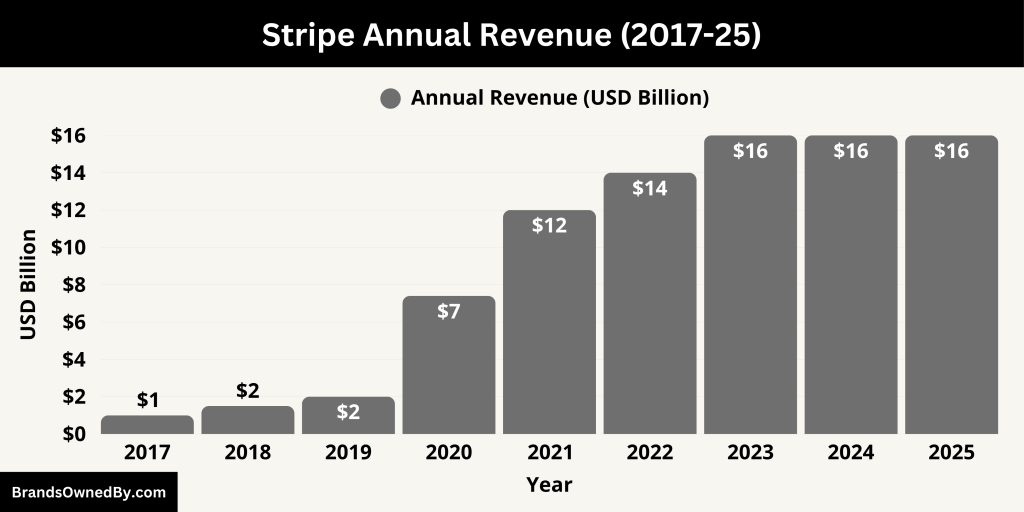

Stripe Annual Revenue 2025

Stripe’s gross revenue for 2025 is estimated to be $16 billion, reflecting a 14.29% increase from the $14 billion reported in 2023. This growth underscores the company’s continued expansion and adoption across various markets and industries.

Net revenue, which accounts for Stripe’s earnings after deducting transaction processing costs and partner fees, is estimated at $5.6 billion in 2025. This marks a 28% year-over-year increase from $4.4 billion in 2024, highlighting the company’s improved operational efficiency and profitability.

Here is a table summarizing Stripe’s annual revenue from 2015 to 2025:

| Year | Gross Revenue (USD) |

|---|---|

| 2015 | $40 million |

| 2016 | $450 million |

| 2017 | $1 billion |

| 2018 | $1.5 billion |

| 2019 | $2 billion |

| 2020 | $7.4 billion |

| 2021 | $12 billion |

| 2022 | $14 billion |

| 2023 | $16 billion |

| 2024 | $16 billion |

| 2025 | $16 billion |

Annual Recurring Revenue (ARR)

Stripe’s Annual Recurring Revenue (ARR) has surpassed $6.1 billion in 2025, driven by the widespread adoption of its subscription management and billing solutions. This metric indicates a strong and predictable revenue stream, contributing to the company’s financial stability.

Regional Revenue Distribution

The United States remains Stripe’s largest market, accounting for approximately 63% of total revenue. Europe follows with 27%, reflecting the company’s successful expansion into key European markets. The Asia-Pacific region contributes 7.9%, with significant growth observed in countries like India and Japan. Emerging markets in Latin America now contribute 8% of global revenue, up from 6% in 2022, indicating successful market penetration in these regions.

Payment Volume and Processing

In 2025, Stripe processed $1.05 trillion in total payment volume, marking a 16% year-over-year increase. The platform handled $58 billion in cross-border payments, supported by enhanced foreign exchange and localized payout tools. Mobile payment transactions via Apple Pay and Google Pay grew by 31%, now comprising 38% of Stripe’s mobile payment volume. Additionally, crypto-based payments saw a 35% increase, driven by the integration of stablecoin support and blockchain wallet capabilities.

Profitability and Operational Metrics

Stripe has maintained a net profit margin of 10.6% in 2025, reflecting its ability to balance growth with operational efficiency. The company’s fraud prevention system, Stripe Radar, blocked $2.3 billion in fraudulent activity, showcasing the effectiveness of its AI-powered security measures. The average transaction size increased to $92, attributed to a rise in enterprise-scale invoicing and B2B transactions.

Strategic Investments and Acquisitions

In 2025, Stripe invested $320 million in infrastructure, expanding its cloud and data center capacity across Europe, India, and Latin America. The company also acquired three startups focusing on AI, fraud prevention, and real-time analytics, further enhancing its platform’s capabilities. These strategic moves are expected to drive future growth and innovation.

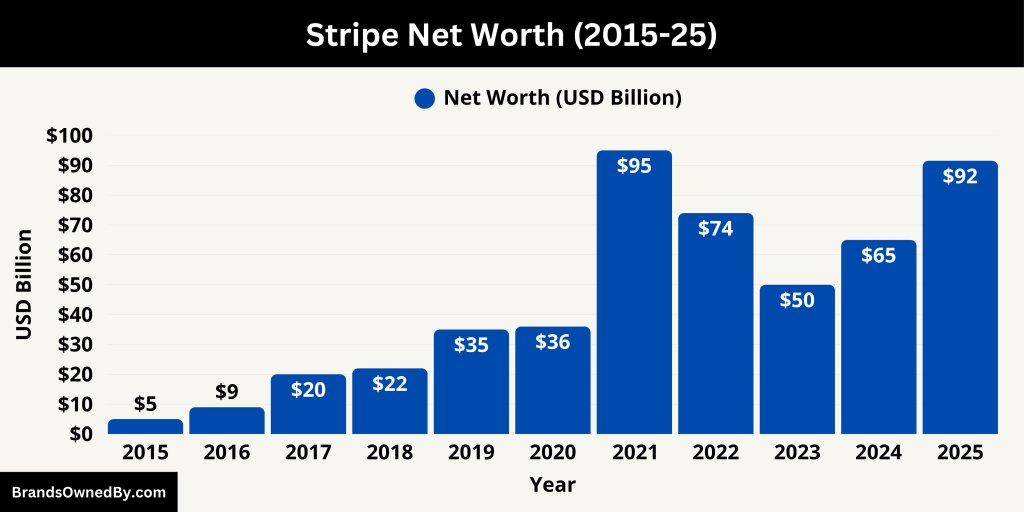

Stripe Net Worth

As of early 2025, Stripe’s valuation stands at $91.5 billion, marking a significant rebound from its previous valuation of $50 billion in 2023. This resurgence is attributed to a combination of factors, including increased demand from AI companies, strategic investments in stablecoin technology, and a robust financial performance in 2024.

In 2024, Stripe processed $1.4 trillion in total payment volume, reflecting a 38% year-over-year increase. This growth underscores the company’s expanding footprint in the global payments landscape.

The company’s valuation trajectory over recent years is as follows:

- 2021: Peaked at $95 billion during a $600 million funding round.

- 2023: Dropped to $50 billion following a $6.5 billion investment round.

- 2024: Rose to $65 billion amid a recovering venture capital environment.

- 2025: Reached $91.5 billion through a tender offer providing liquidity to employees and early investors.

Despite nearing its previous peak valuation, Stripe remains a private company with no immediate plans for an IPO. The company’s leadership emphasizes long-term growth and innovation over short-term financial milestones.

Below is an overview of Stripe’s net worth from 2015-25:

| Year | Estimated Net Worth (Valuation) | Key Events / Funding Milestones |

|---|---|---|

| 2015 | ~$5 billion | Valued during $100M Series D round led by Visa, Kleiner Perkins, and American Express. |

| 2016 | ~$9 billion | Grew through international expansion and strong merchant growth. |

| 2017 | ~$20 billion | Series E funding; continued global expansion and platform development. |

| 2018 | ~$22 billion | Minor valuation increase; growth continued steadily. |

| 2019 | ~$35 billion | Series F round raised $250M led by General Catalyst and others. |

| 2020 | ~$36 billion | Steady growth; positioned well during COVID-19-driven e-commerce surge. |

| 2021 | $95 billion | Record-breaking valuation after $600M Series H round; Stripe became the most valuable US startup. |

| 2022 | ~$74 billion (internal mark-down) | Internal adjustments by some investors amid broader tech downturn. |

| 2023 | $50 billion | Stripe raised $6.5 billion in Series I; valuation dropped amid VC market correction. |

| 2024 | ~$65 billion | Rebounded as Stripe served more AI companies and resumed growth. |

| 2025 | $91.5 billion | Tender offer raised valuation; demand from private investors and strong business performance. |

Companies Owned by Stripe

As of 2025, Stripe has strategically expanded its portfolio through a series of acquisitions and the development of in-house platforms. These initiatives have enhanced its capabilities in payment processing, compliance, developer tools, and global commerce.

Below is a detailed overview of the companies, brands, and entities owned and operated by Stripe:

| Company/Brand | Year Acquired | Description / Focus | Purpose / Strategic Value |

|---|---|---|---|

| Bridge | 2025 | Stablecoin orchestration platform | Enables cross-border payments using stablecoins; expands Stripe’s crypto payments capabilities |

| Lemon Squeezy | 2024 | Merchant of record for digital goods | Simplifies global tax and legal compliance for digital sellers |

| Octane | 2024 | Revenue platform for SaaS businesses | Enhances Stripe’s subscription and billing tools |

| Supaglue (Supergrain) | 2024 | Developer tool for app integrations | Strengthens third-party app integration for developers |

| Okay | 2023 | Analytics for engineering performance | Optimizes Stripe’s internal and customer engineering teams |

| BBPOS | 2022 | Hardware manufacturer for mobile POS systems | Powers Stripe Terminal with in-house hardware solutions |

| OpenChannel | 2021 | App ecosystem platform | Builds Stripe’s partner and developer marketplace |

| Recko | 2021 | Payment reconciliation platform | Provides financial accuracy tools and compliance support |

| Bouncer | 2021 | Credit card fraud detection | Boosts Stripe Radar’s fraud prevention system |

| TaxJar | 2021 | Automated sales tax calculation and filing | Supports tax compliance for e-commerce sellers |

| Paystack | 2020 | African fintech for online payments | Expands Stripe’s footprint in African markets |

| Touchtech Payments | 2019 | Payment authentication startup | Enhances 3D Secure and payment verification technologies |

| Index | 2018 | POS software developer | Formed the base for Stripe Terminal |

| Payable | 2017 | Contractor payments and tax reporting platform | Supports gig economy and freelance payment workflows |

| Indie Hackers | 2017 | Entrepreneurial community and content site | Engages startup founders and supports Stripe’s developer relations |

| RethinkDB | 2016 | Real-time database platform | Bolstered Stripe’s backend infrastructure capabilities |

| Runkit | 2016 | Cloud-based code execution platform | Offers interactive JavaScript environments for Stripe documentation and demos |

| Kickoff | 2013 | Team collaboration and task management app | Early internal team productivity acquisition |

Bridge

Acquired in February 2025 for $1.1 billion, Bridge is a stablecoin orchestration platform. It enables developers to integrate stablecoin transactions into existing payment systems, facilitating cross-border transfers. Bridge’s technology is utilized by organizations like SpaceX’s Starlink for processing payments in countries such as Argentina and Nigeria. This acquisition positions Stripe to compete in the emerging stablecoin market.

Lemon Squeezy

In July 2024, Stripe acquired Lemon Squeezy, a merchant of record service specializing in digital product sales. This acquisition enhances Stripe’s capabilities in handling global sales tax compliance and legal processing for digital goods, providing a comprehensive solution for digital merchants.

Octane

Acquired in March 2024, Octane is a revenue platform designed for software businesses. It offers tools for managing subscriptions, billing, and revenue analytics, allowing Stripe to provide more robust financial infrastructure for SaaS companies.

Supaglue

Formerly known as Supergrain, Supaglue was acquired by Stripe in January 2024. It is an open-source developer platform that facilitates user-facing integrations. This acquisition strengthens Stripe’s developer tools, enabling more seamless integration of third-party applications.

Okay

In May 2023, Stripe acquired Okay, a low-code analytics software platform. Okay provides tools for tracking engineering team performance, aiding in productivity and operational efficiency.

BBPOS

Stripe acquired BBPOS in January 2022, a company specializing in the design and manufacture of mobile point-of-sale (POS) solutions. This acquisition allowed Stripe to bring hardware development in-house, enhancing its Terminal product line for in-person payments.

OpenChannel

In December 2021, Stripe acquired OpenChannel, a platform that enables businesses to build and manage app ecosystems. This acquisition supports Stripe’s efforts to foster a broader developer and partner ecosystem around its platform.

Recko

Acquired in October 2021, Recko is an Indian-based payments reconciliation software company. Its platform helps businesses track and reconcile incoming and outgoing payments, ensuring financial accuracy and compliance.

Bouncer

In May 2021, Stripe acquired Bouncer, a company focused on credit card fraud detection technology. Bouncer’s tools enhance Stripe’s fraud prevention capabilities, providing more secure transaction processing.

TaxJar

Stripe acquired TaxJar in April 2021, a subscription-based service that automates sales tax filing for e-commerce businesses. This acquisition simplifies tax compliance for Stripe’s merchants, particularly those operating across multiple jurisdictions.

Paystack

In October 2020, Stripe acquired Paystack, a Nigerian fintech company providing payment solutions across Africa. This acquisition marked Stripe’s expansion into the African market, leveraging Paystack’s existing infrastructure and customer base.

Touchtech Payments

Acquired in April 2019, Touchtech Payments is a payment authorization fintech startup. Its technology enhances Stripe’s authentication processes, improving transaction security.

Index

In March 2018, Stripe acquired Index, a point-of-sale software company. This acquisition contributed to the development of Stripe Terminal, enabling businesses to accept in-person payments.

Payable

Stripe acquired Payable in April 2017, a platform for onboarding and tracking contractor payments. This acquisition expanded Stripe’s capabilities in managing contractor and freelancer payments.

Indie Hackers

Also in April 2017, Stripe acquired Indie Hackers, a community forum for entrepreneurs. This acquisition aimed to support and engage with the startup community, fostering growth and innovation.

RethinkDB

In October 2016, Stripe acquired RethinkDB, a distributed database designed for real-time applications. This acquisition enhanced Stripe’s data infrastructure capabilities.

Runkit

Acquired in September 2016, Runkit is a platform that allows developers to run code snippets in the cloud. This acquisition supported Stripe’s developer engagement and tooling.

Kickoff

In March 2013, Stripe made its first acquisition by purchasing Kickoff, a team task management and collaboration app. This acquisition laid the groundwork for Stripe’s collaborative tools and internal operations.

Final Thoughts

Understanding who owns Stripe helps explain the company’s vision and resilience. It remains tightly controlled by its founders, supported by a group of top-tier investors. Even as it grows globally, Stripe has stayed private, allowing it to focus on long-term goals rather than short-term market pressures. Its leadership, net worth, and product ecosystem place it among the most influential fintech firms today.

FAQs

Is Stripe owned by Elon Musk?

No, Stripe is not owned by Elon Musk. Stripe was founded by Irish brothers Patrick and John Collison in 2010. Elon Musk has no ownership or investment stake in Stripe. He is more closely associated with companies like Tesla, SpaceX, X (formerly Twitter), and Neuralink.

Who owns the Stripe company?

Stripe is privately owned by a mix of its founders, employees, and a range of venture capital firms and institutional investors. As of 2025, the largest shareholders include Patrick and John Collison, Sequoia Capital, Andreessen Horowitz, Founders Fund, Fidelity, Thrive Capital, and Goldman Sachs. Patrick Collison remains the largest individual shareholder.

Is Stripe owned by PayPal?

No, Stripe is not owned by PayPal. Stripe and PayPal are two separate and competing companies in the payments industry. Both operate globally but serve somewhat different user bases and platforms. Stripe is known for its strong focus on developers and API-driven payments infrastructure, while PayPal is more consumer-facing.

Who is Stripe’s biggest competitor?

Stripe’s biggest competitors include PayPal, Adyen, Square (now known as Block, Inc.), and Braintree (a PayPal-owned company). Adyen is a strong competitor in Europe and the enterprise market. Stripe also faces increasing competition from newer players like Checkout.com and legacy financial institutions moving into fintech.

Is Stripe bigger than PayPal?

In terms of valuation and market share in 2025, Stripe and PayPal are comparable. Stripe is privately valued at around $91.5 billion, while PayPal, a public company, has a market cap fluctuating between $60–90 billion in recent years. While PayPal processes more consumer transactions, Stripe dominates in developer integrations, startup ecosystems, and infrastructure-level services.

Which country owns Stripe?

Stripe is a U.S.-based private company, incorporated and headquartered in South San Francisco, California. It was founded by Irish entrepreneurs, and while it has a global footprint and offices in multiple countries, it is not owned by any specific country or government.

Is Stripe publicly traded?

As of 2025, Stripe is not publicly traded. It remains a private company. There have been multiple rumors about a potential IPO, but the company has not yet gone public. It has, however, conducted secondary share sales and tender offers to allow liquidity for employees and early investors.

What is Stripe’s founder’s net worth?

As of May 2025, Patrick Collison, the CEO and co-founder of Stripe, has an estimated net worth of $10.1 billion, while John Collison, his brother and co-founder, has a net worth of $9.9 billion. Their wealth primarily stems from their large ownership stakes in Stripe, whose private valuation has rebounded to $91.5 billion.

Who founded Stripe?

Patrick and John Collison, Irish entrepreneurs, founded Stripe in 2010.

Is Stripe a public company?

No. Stripe is privately held and has not gone public as of 2025.