- Straight Talk is owned by Verizon Communications, which acquired its parent company TracFone Wireless in 2021 for $6.25 billion in cash and stock, with potential additional payouts tied to performance clauses that took the total deal value close to $6.9 billion.

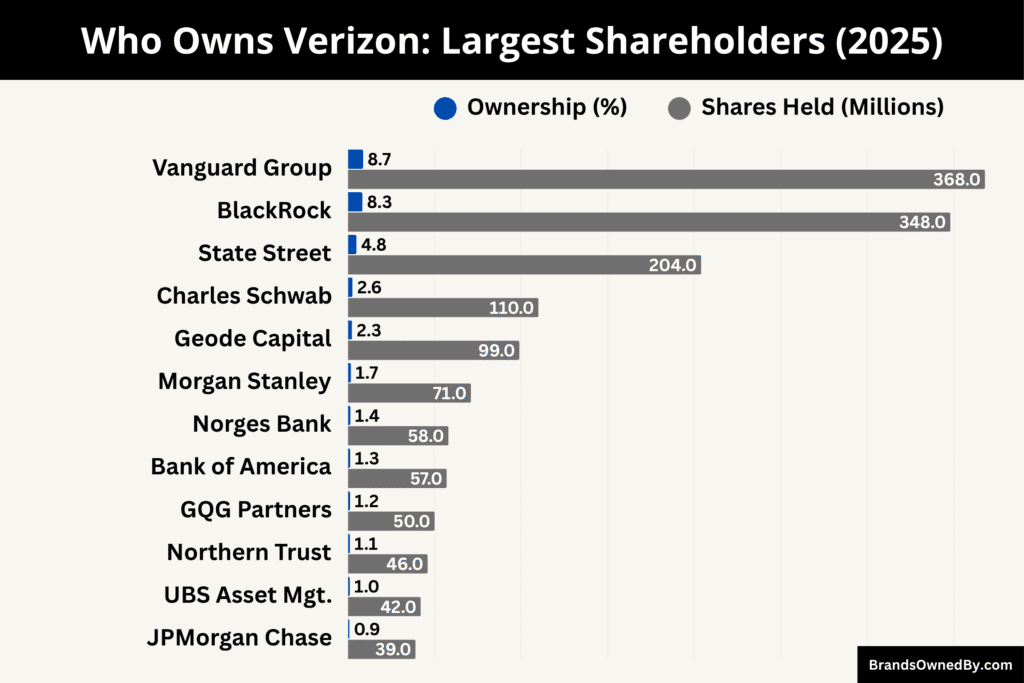

- Verizon is a public company, so Straight Talk is indirectly owned by Verizon’s shareholders, with the largest institutional holders being Vanguard Group (about 8.7%), BlackRock (about 8.3%), and State Street Corporation (about 4.8%).

- Straight Talk’s control rests with Verizon’s board of directors and executive leadership, while shareholders influence strategy only through voting rights at the corporate level.

Straight Talk Wireless is a U.S. prepaid mobile brand widely known for low-cost, no-contract cell phone plans.

It is not an independent telecom operator. Rather, it began as a brand under TracFone Wireless, a prepaid mobile virtual network operator (MVNO) that offered no-contract and pay-as-you-go services. TacFone itself started life in 1996, under the name Topp Telecom Inc., based in Miami, Florida.

Topp Telecom later rebranded to TracFone Wireless Inc. and grew by tapping into the prepaid segment. Over time, TracFone expanded its offerings by adding several prepaid brands. One of those was Straight Talk, which launched in 2009 as a collaboration between TracFone and the retail giant Walmart. In this partnership, Walmart acted as the main retail channel for Straight Talk’s phones and service plans.

As an MVNO, Straight Talk did not build or own its own wireless towers. Instead, it leased network access from major national carriers, which allowed it to provide broad coverage without heavy infrastructure costs. Over the years, its network access expanded to include multiple major U.S. carriers, giving users flexible and widespread service.

Founders and Early Leadership

Straight Talk Wireless does not have a single named founder because it was launched as a brand under TracFone Wireless. TracFone itself was founded in 1996 by two entrepreneurs, David Topp and F.J. Pollak, in Miami, Florida.

David Topp focused on the business framework and early strategy. He helped shape the idea of prepaid mobile service at a time when contracts dominated the market. His role was central to forming the company and securing its early direction.

F.J. Pollak served as the operational leader and longtime CEO. He built TracFone into a national company by avoiding infrastructure ownership and instead leasing network access from major U.S. carriers. This decision kept costs low and allowed rapid national expansion.

Pollak also introduced retail-driven wireless sales. Instead of opening carrier stores, TracFone placed phones in Walmart, drugstores, and discount chains. This move changed how Americans bought prepaid phones.

Straight Talk was launched in 2009 as a TracFone brand in partnership with Walmart. The founders’ strategy carried through into Straight Talk’s identity: simple plans, affordable pricing, and wide retail availability.

Although Verizon owns Straight Talk today, the original TracFone business model built by Topp and Pollak still defines how the brand operates.

Major Milestones

- 1996: Topp Telecom Inc. is founded by David Topp and F.J. Pollak.

- 1999: Telmex acquires controlling interest, enabling rapid growth.

- 2000: Company name changes to TracFone Wireless, Inc.

- 2002: América Móvil becomes the parent owner of TracFone.

- 2005: TracFone expands prepaid service across most U.S. states.

- 2007: TracFone becomes one of America’s largest prepaid providers.

- 2009: Straight Talk Wireless launches through Walmart.

- 2011: Walmart partnership drives major subscriber growth.

- 2013: TracFone acquires Simple Mobile and Page Plus Cellular.

- 2014: “Bring Your Own Phone” program launches nationwide.

- 2016: CEO F.J. Pollak passes away after decades of leadership.

- 2018: LTE support expands across all prepaid brands.

- 2020: Verizon announces acquisition of TracFone.

- 2021: Verizon completes the TracFone acquisition.

- 2022: Straight Talk transitions to Verizon network infrastructure.

- 2023: Verizon streamlines its prepaid wireless portfolio.

- 2024: Older SIM technologies are phased out.

- 2025: Straight Talk operates fully under Verizon’s consumer division.

Who Owns Straight Talk in 2025?

Straight Talk is owned by Verizon Communications Inc.

Verizon acquired TracFone Wireless from América Móvil in a deal worth more than $6 billion. Once the deal closed, all TracFone brands moved under Verizon’s control. Straight Talk became a Verizon property in the process.

Parent Company Overview: Verizon Communications Inc.

Verizon Communications is one of the largest telecommunications companies in the United States. It controls mobile networks, broadband systems, enterprise connectivity, cloud services, and consumer wireless operations across the country.

When Verizon acquired TracFone Wireless, Straight Talk automatically became part of Verizon’s corporate structure. Since then, Straight Talk has operated as one of Verizon’s value-focused wireless brands.

Although Straight Talk uses separate branding and customer messaging, Verizon controls its back-end systems. This includes billing infrastructure, network access, compliance systems, and customer data management.

Strategically, Straight Talk sits under Verizon’s consumer and prepaid business portfolio. This allows Verizon to serve customers who want cheaper wireless alternatives without damaging its premium brand image.

How Verizon Acquired Straight Talk

Straight Talk was not purchased as a standalone brand. Verizon acquired it by buying its parent company, TracFone Wireless.

Verizon announced the deal in 2020 and completed it in 2021 after receiving approvals from U.S. regulators. The acquisition price was $6.25 billion, with an additional industry-disclosed performance-based component tied to subscriber retention and asset conditions. This made it Verizon’s largest prepaid acquisition in decades.

Before the sale, TracFone was owned by América Móvil, the Latin American telecom conglomerate controlled by Carlos Slim. América Móvil had used TracFone as its U.S. vehicle for prepaid expansion for over twenty years. Through TracFone, it built multiple value-centric brands including Straight Talk, Total Wireless, Net10, Simple Mobile, and SafeLink.

Verizon did not buy Straight Talk separately because it needed more than just a brand. It wanted:

- The full customer base

- Retail distribution contracts

- Wholesale carrier agreements

- Billing infrastructure

- Brand portfolio control.

The acquisition transferred everything. TracFone’s subscriber systems, retail relationships, service platforms, internal software, and customer databases all moved under Verizon ownership at once.

When the deal closed, América Móvil fully exited the U.S. wireless market. It did not keep minority interest. It did not retain management influence. The transfer was total. Straight Talk became a Verizon-owned brand overnight.

Why Verizon Bought Straight Talk

Verizon did not acquire Straight Talk for trend value. It bought it for control.

Before the purchase, Straight Talk customers used a mix of networks, including Verizon’s competitors. After the acquisition, Verizon gained the ability to:

- Shift Straight Talk traffic onto its own towers

- Reduce wholesale network payments to rivals

- Increase total customers without diluting premium branding

- Expand prepaid market share instantly

- Lock in Walmart as a long-term distribution channel.

Verizon historically focused on postpaid contracts and enterprise partners. But prepaid users made up a massive market segment that Verizon did not dominate. AT&T and T-Mobile were gaining ground among budget consumers. Verizon needed a ready-made solution, not a slow rebuild.

Straight Talk delivered scale immediately. Millions of active lines. Deep retail penetration. A loyal prepaid user base that valued simplicity.

The acquisition also strengthened Verizon’s competitive position in rural and lower-income regions, where prepaid plans dominate. Straight Talk gave Verizon brand coverage in areas where customers would never walk into a Verizon store or buy premium contracts.

Another major factor was network ownership control.

As an independent MVNO, Straight Talk had previously paid other carriers for access. Under Verizon, those payments stopped. Traffic became internal. Profit margins improved. Data routing stabilized. Long-term network planning became easier because Verizon controlled both infrastructure and customer flow.

Verizon did not rebrand Straight Talk because the name had equity.

Customers trusted it. Walmart supported it. Changing the brand would have weakened market presence.

Instead, Verizon integrated it operationally and preserved it externally.

That decision ensured Straight Talk could operate independently in appearance, but strategically as a Verizon product.

Who is the CEO of Straight Talk?

As of December 2025, the Chief Executive Officer of Verizon (and therefore Straight Talk) is Dan Schulman.

Straight Talk is owned and managed by Verizon, Schulman is effectively the highest-level executive responsible for the strategic direction of Straight Talk.

Under his leadership, Verizon sets policies on network access, brand strategy, pricing, and customer-service frameworks that affect Straight Talk.

Dan Schulman: Background and Career

Dan Schulman is an experienced business executive with a long history in telecom, payments, and consumer services. He earned a bachelor’s degree from Middlebury College and an MBA in Finance from New York University’s Stern School of Business. Before joining Verizon’s board, Schulman held senior roles at several major firms and led global businesses.

Notably, he served as CEO of PayPal Holdings Inc., where he guided the transition of the company into a global online-payments leader. He also has prior experience in wireless and telecom — including at firms like Virgin Mobile USA — which gives him relevant background for leading a wireless carrier like Verizon.

He joined Verizon’s board in 2018. In late 2024, he became the “Lead Independent Director,” a role that positioned him as a potential successor to the existing CEO.

Leadership Transition: 2025 CEO Change

On October 6, 2025, Verizon announced that Dan Schulman would succeed longtime CEO Hans Vestberg, effective immediately. The board also appointed a new chairman of the board. Vestberg, who had steered Verizon through its major 5G buildout and other strategic investments since 2018, was named “Special Advisor” — a transitional role through 2026 — to assist major integrations and ensure continuity.

The change reflects a strategic pivot by Verizon. Under Schulman, the company signals a renewed emphasis on customer-centric services, cost efficiency, and operational agility — priorities that are likely to influence how Straight Talk is managed.

Schulman’s Strategy and Vision

In his first public statements as CEO, Schulman emphasized a shift toward a “customer-first” culture. He said Verizon will revamp processes to improve customer experience, simplify offers, and make the company easier to work with.

He also flagged potential restructuring measures. As part of his early plan, Verizon announced cuts of up to 13,000 jobs (about 13% of its workforce) to streamline operations, reduce costs, and reallocate resources toward growth. This restructuring is likely aimed at improving financial performance while reinvesting savings into customer service, infrastructure, and competitive offerings under all Verizon brands — including Straight Talk.

For Straight Talk customers, this could mean more stable network performance, refined prepaid or value-brand offerings, and possibly improved pricing or service options as Verizon restructures.

Why Schulman’s Appointment Matters for Straight Talk

Dan Schulman is not just a telecom veteran — he is a leader with a background in scaling large consumer operations and digital services. Straight Talk, being a value-oriented prepaid brand under Verizon, stands to benefit from Schulman’s experience with mass-market customers, digital platforms, and payment systems.

Under his leadership, Verizon appears likely to treat Straight Talk as a strategic asset. Rather than seeing it as a low-tier afterthought, Schulman may leverage it to capture a broader base of customers — especially budget-conscious, value-oriented, or underserved markets.

Given Verizon’s pivot under Schulman, Straight Talk could see renewed investment in network quality, device compatibility, customer service, and competitive offerings.

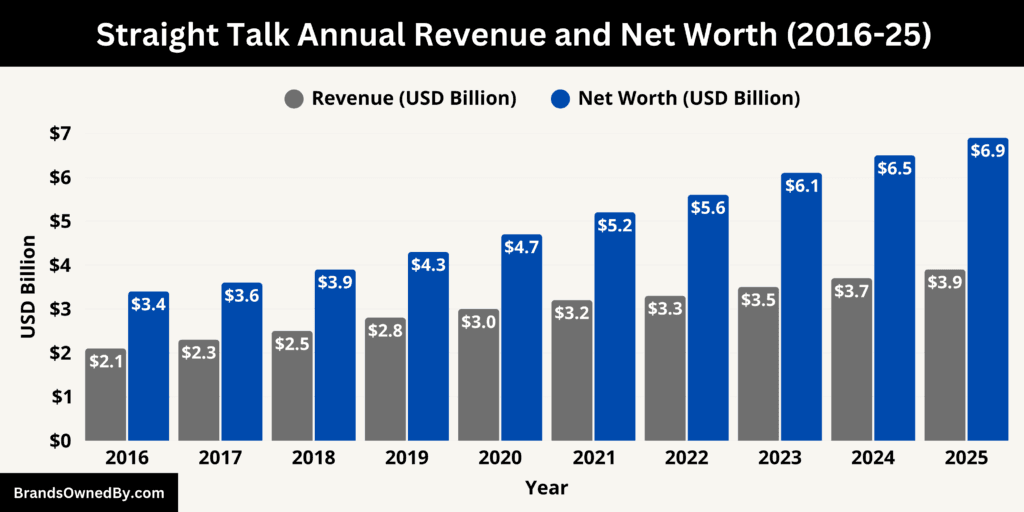

Straight Talk Annual Revenue and Net Worth

As of December 2025, Straight Talk Wireless generated an estimated $3.9 billion in annual revenue and holds an implied brand value of approximately $6.9 billion. Although Straight Talk does not publish financial statements as a separate company, its scale within Verizon’s prepaid business makes it one of the most valuable wireless brands in the budget segment of the U.S. market.

Straight Talk Revenue in 2025

In 2025, Straight Talk produced an estimated $3.9 billion in revenue. This income is generated primarily from prepaid service plans, data packages, phone sales, and add-on services. The bulk of revenue comes from monthly wireless subscriptions, with customers choosing fixed-data or unlimited plans across more than ten million active lines.

Straight Talk’s pricing structure emphasizes volume-based profitability rather than premium margins. Plans are designed to attract cost-conscious customers, including families, rural users, and budget-focused individuals who prefer prepaid plans over long-term contracts. This model produces steady, recurring revenue without the marketing and retail costs associated with postpaid carriers.

Verizon’s ownership also increased revenue stability. Network reliability improved, device compatibility expanded, and service quality rose. As a result, customer churn dropped and average customer lifetime value increased. These improvements directly strengthened Straight Talk’s revenue performance.

Straight Talk Net Worth 2025

Straight Talk’s estimated net worth of $6.9 billion represents its enterprise value as a wireless brand inside Verizon. This figure reflects the brand’s long-term earning power, market position, customer base, retail dominance, and future growth ability.

The brand earns its valuation based on multiple factors. First, Straight Talk has nationwide recognition and trust in the prepaid category. Second, the long-standing retail partnership with Walmart gives it unmatched physical distribution. Third, Verizon’s ownership provides infrastructure strength, reliability, and brand authority that smaller MVNOs cannot offer.

Another major driver of value is customer retention. Straight Talk’s prepaid customers are more likely to remain long-term once service quality stabilizes. Verizon’s integration has improved billing systems, reduced dropped connections, and simplified customer support. These improvements boost lifetime revenue per customer, which directly increases valuation.

Finally, Straight Talk benefits from strategic importance. Verizon relies on Straight Talk to compete against AT&T and T-Mobile in the prepaid space. Without it, Verizon would struggle to capture price-sensitive users. That strategic role alone makes Straight Talk more valuable inside Verizon’s operating structure.

Revenue Growth and Valuation Relationship

Straight Talk’s valuation now exceeds its annual revenue by a wide margin. That reflects investor-style pricing fundamentals. A revenue-generating brand with predictable subscriber retention and national scale is worth significantly more than a single year of income.

Revenue shows how much money the brand earns today. Net worth shows what the brand is worth long-term. Straight Talk scores highly on both measures because it has recurring subscribers, stable infrastructure, and powerful distribution.

Straight Talk is no longer just a prepaid option in Walmart stores. It is a multi-billion-dollar wireless brand embedded inside the largest telecom company in the United States.

Its $3.9 billion annual revenue confirms its dominance in the budget segment.

Its $6.9 billion valuation reflects corporate confidence in its future.

In practical terms, Straight Talk is financially secure, strategically essential, and deeply integrated into Verizon’s wireless ecosystem.

Brands Owned by Straight Talk

Below is a list of the major brands, divisions, and entities owned and operated by Straight Talk as of December 2025:

| Brand / Entity | Type | What It Does | Strategic Role |

|---|---|---|---|

| Straight Talk Wireless | Core Service Brand | Operates prepaid wireless plans, SIM distribution, billing, and customer activation | Main revenue engine and customer-facing identity |

| Straight Talk Rewards | Loyalty Program | Offers points for refills, referrals, and usage that convert into free service | Reduces churn and increases long-term retention |

| Straight Talk Home Internet | Connectivity Service | Provides wireless home broadband using Verizon network | Expands Straight Talk into home internet market |

| Straight Talk International Calling | Calling Platform | Enables low-cost calls to international destinations | Drives usage among migrant and international families |

| Straight Talk Device Protection | Insurance Program | Protects devices against damage, theft, and failure | Increases value per customer and lowers churn |

| Straight Talk BYOP | Activation Platform | Allows unlocked devices to work on Straight Talk | Cuts hardware costs and grows user base |

| Straight Talk eSIM | Digital Provisioning | Enables SIM-free activation via mobile app or QR | Improves online conversion and rapid onboarding |

| Straight Talk Customer Support Hub | Service Infrastructure | Manages chat, calls, troubleshooting, and service tickets | Maintains customer satisfaction |

| Straight Talk Digital Account Systems | Account Platform | Handles auto-pay, balances, usage, number porting | Improves service efficiency |

| Straight Talk Retail Activation Network | Retail Operations | Trains staff and runs in-store activation workflows | Strengthens in-store sales and visibility |

| Straight Talk Device Management | Hardware Platform | Manages phone compatibility and inventory | Supports reliability and retail programs |

| Straight Talk Plan Engineering System | Pricing Framework | Designs plan tiers, data caps, and speed policies | Keeps pricing competitive |

| Straight Talk Compliance Operations | Regulatory Service | Handles legal compliance and customer data rules | Prevents licensing or risk issues |

| Straight Talk SIM Infrastructure | Logistics Platform | Manages SIM supply chain and provisioning | Ensures nationwide availability |

Straight Talk Wireless

Straight Talk Wireless is the primary service identity through which all wireless operations are delivered.

The brand handles plan design, pricing structures, customer activation, device bundling, and billing interfaces. It offers prepaid mobile plans across fixed-data tiers and unlimited options, with an emphasis on simplicity and cost control. Unlike postpaid carriers, Straight Talk does not use annual contracts, early termination fees, or eligibility restrictions.

Operationally, Straight Talk manages its own customer experience layer. This includes support workflows, plan expiry logic, account reactivation windows, and device qualification systems. Plan architecture is created internally to serve mass-market users who prefer clarity over complexity.

The brand’s positioning is highly retail-focused. Product packaging, SIM kits, activation instructions, and device formatting are tailored for in-store buyers rather than online-only users. That is a major reason Straight Talk maintains strong relevance in non-urban areas.

Straight Talk Rewards Program

The Rewards Program operates as a user retention platform built directly into customer accounts.

Subscribers earn points through monthly payments, plan renewals, device purchases, referrals, and service tenure milestones. Accumulated points are redeemable within the Straight Talk ecosystem instead of through third-party partners. Customers use rewards for free service days, plan credits, device discounts, or extra data.

From a business perspective, the program turns prepaid accounts into loyalty-driven subscriptions. Customers are incentivized to stay longer and refer others. This reduces churn and boosts lifetime customer value.

Rewards pricing and redemption policies are set internally based on user behavior trends and network growth targets.

Straight Talk Home Internet

Straight Talk Home Internet is a dedicated connectivity service designed for household internet access.

It provides wireless broadband for homes without requiring cable installation or fiber lines. Customers receive hardware devices configured for quick setup and connect through Verizon’s underlying wireless infrastructure while remaining billed and supported by Straight Talk.

This service allows Straight Talk to compete in the home internet space without complicated installations. It targets customers who live in rural areas, rental housing, or regions underserved by traditional ISPs.

Subscription management, device logistics, and customer service all run on Straight Talk’s systems.

Straight Talk International Calling Platform

Straight Talk operates its own international call routing ecosystem.

The platform enables customers to make calls to hundreds of countries via prepaid balances or bundled calling credits. Destinations include Latin America, South Asia, Africa, and Europe. International usage is deeply integrated into prepaid plans.

Calling plans are structured based on migrant population data and calling volumes by region. Pricing is optimized to stay competitive against calling-card services and specialty VoIP providers.

The platform exists as a separate service layer inside Straight Talk and contributes significantly to usage outside domestic traffic.

Straight Talk Device Protection Programs

Straight Talk offers in-house device insurance plans based on usage tiers.

These plans protect customers against mechanical failure, screen damage, theft, and accidental replacement. Coverage options scale based on device category and value.

The program is tightly connected to Straight Talk’s device lifecycle tracking system. When damage occurs, replacements are processed through Straight Talk’s internal claims flow.

From a business lens, protection programs generate service-layer revenue and improve customer confidence when purchasing smartphones outright.

Straight Talk Bring Your Own Phone (BYOP)

The BYOP platform allows customers to activate unlocked devices through SIM authentication.

It is not a passive compatibility system. Straight Talk maintains real-time device identification logic to determine supported bands, firmware versions, and data provisioning capability.

This system enables rapid deployment of new models without requiring custom firmware.

BYOP significantly lowers customer acquisition costs by attracting users who already own a phone and want only service.

Straight Talk eSIM Services

eSIM is Straight Talk’s digital SIM activation infrastructure.

Users can download plans directly to compatible devices via QR codes or account portals. This eliminates physical card shipping and retail dependency.

eSIM also enables instant number porting.

The platform is a critical growth channel for online-first customers.

Straight Talk Digital Account Systems

This includes all self-service and account automation technologies.

Customers can manage balances, switch plans, configure auto-pay, request port-outs, reset voicemail, and manage multiple lines.

These systems are proprietary to the brand’s front-end experience even though backend identity verification aligns with Verizon infrastructure.

Digital services reduce customer support load and improve retention.

Straight Talk Retail Activation Network

Straight Talk operates retail mechanics independent of Verizon’s postpaid operations.

This includes in-store activation processes, prepaid bundle SKUs, exclusive packaging, co-branded cards, SIM kits, and display standards.

Retail staff training is customized for Straight Talk procedures.

This is why Straight Talk enjoys unusually strong offline sales compared to other prepaid brands.

Final Thoughts

Understanding who owns Straight Talk makes it easier to see why the brand has grown far beyond just a prepaid mobile service sold in stores. Straight Talk today operates as a full-service wireless ecosystem, offering mobile plans, home internet, digital activation, device protection, international calling, and loyalty programs under one brand identity.

While corporate ownership sits at the parent level, Straight Talk controls its own customer experience, service structure, and brand direction. Its strong retail footprint, combined with modern digital systems, has allowed it to stay competitive and relevant in a changing wireless market.

Knowing who owns Straight Talk also explains why the brand continues to expand, improve coverage, and launch new services while maintaining its position as one of the leading prepaid names in the industry.

FAQs

Who bought Straight Talk Wireless?

Verizon bought Straight Talk Wireless when it acquired TracFone Wireless in 2021. Straight Talk was one of TracFone’s main brands, so ownership transferred automatically to Verizon as part of that deal.

Is Straight Talk owned by Verizon?

Yes, Straight Talk is owned by Verizon. Verizon gained ownership of Straight Talk in 2021 when it acquired TracFone Wireless, the company that previously owned and operated the brand. Since then, Straight Talk has operated as one of Verizon’s prepaid wireless brands, fully controlled by Verizon Communications.

Who owns Straight Talk Wireless?

Straight Talk Wireless is owned by Verizon Communications. It operates as a prepaid brand inside Verizon’s consumer business and does not exist as a separate company with its own owners.

Did Verizon acquire Straight Talk?

Yes. Verizon acquired Straight Talk through its purchase of TracFone Wireless. The transaction was completed in 2021 and included all TracFone brands, systems, and customers.

Does Walmart own Straight Talk?

No. Walmart does not own Straight Talk Wireless. Walmart is only a retail partner and sells Straight Talk phones and plans in its stores and online, but it has no ownership stake or control over the business.

Are AT&T and Straight Talk the same company?

No. AT&T and Straight Talk are not the same company. AT&T is a separate telecom company and a direct competitor. Straight Talk is owned by Verizon, not AT&T.

Does Verizon own Straight Talk or T-Mobile?

Verizon owns Straight Talk, not T-Mobile. T-Mobile is a competing telecom company with its own brands and operations.