- Sprouts Farmers Market is a publicly traded company with no controlling owner. Institutional investors hold the majority of shares, making ownership widely distributed rather than concentrated in one entity.

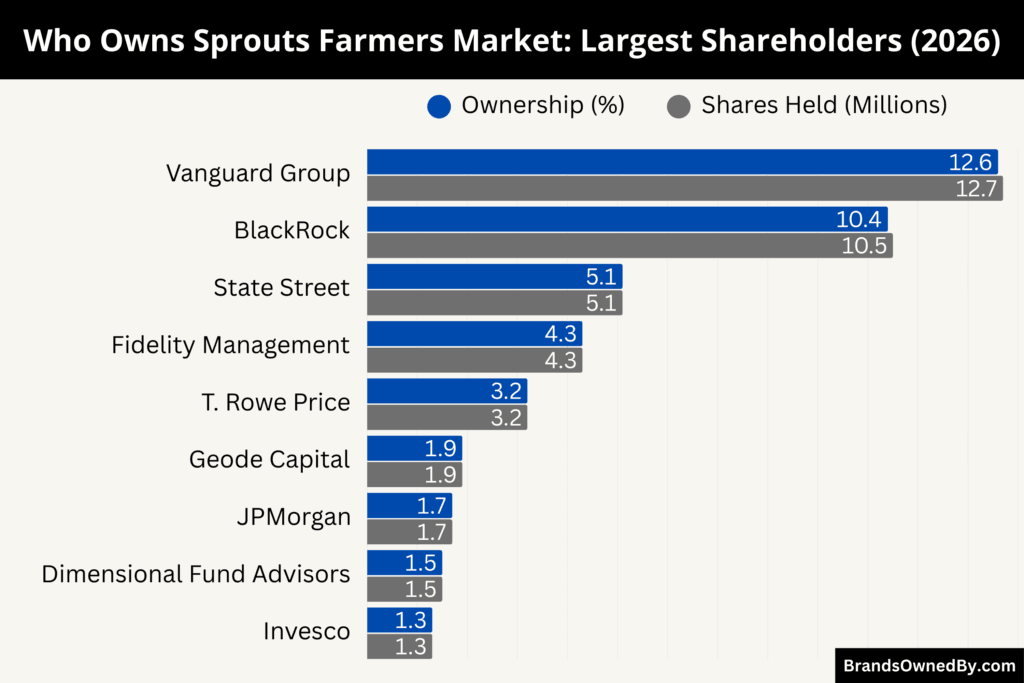

- The largest shareholder as of February 2026 is The Vanguard Group with about 12.6% ownership, followed by BlackRock with roughly 10.4% and State Street with around 5.1%, giving these firms significant influence over governance and board decisions.

- Institutional investors collectively control a substantial portion of voting power, shaping corporate strategy, executive compensation, and long-term direction, while daily operations are managed by the CEO and executive leadership.

- Insider ownership remains small at about 1.1%, aligning management with shareholder interests, while public and retail investors hold the remaining shares, completing a diversified and stable ownership structure.

Sprouts Farmers Market is a specialty grocery retailer focused on natural and organic food. The company operates across the United States with a strong presence in health-focused grocery segments. Its stores emphasize fresh produce, bulk foods, vitamins, supplements, and minimally processed products. The brand targets health-conscious consumers who want affordable organic options.

Sprouts uses a smaller store format compared to traditional supermarkets. This allows faster store expansion and lower operating complexity. The company positions itself between premium organic grocers and mainstream supermarkets. Its product mix centers on fresh, natural, and specialty grocery categories rather than conventional mass-market goods.

The company operates under a single unified brand. It focuses on private label growth, customer loyalty, and neighborhood-style grocery shopping. Its store experience highlights open produce displays, farmers-market-style layouts, and wellness-oriented merchandising.

Founders of Sprouts Farmers Market

Sprouts Farmers Market was founded in 2002 by members of the Boney family. The Boney family had deep roots in the natural grocery industry long before launching Sprouts. Their experience helped shape the company’s health-focused retail model.

Henry Boney Sr. was one of the earliest pioneers of natural food retail in the United States. In 1943, he opened a small fruit stand in California. This later evolved into a chain of health-oriented food stores. His work introduced the concept of fresh and natural grocery retail long before it became mainstream.

Henry Boney Jr. continued the family legacy. He helped expand the family’s grocery operations and played a key role in the evolution of natural food supermarkets. His leadership influenced the growth of health-focused grocery retail in the western United States.

Shon Boney, the son of Henry Boney Jr., co-founded Sprouts Farmers Market in 2002. He aimed to create a modern natural grocery chain that combined affordable pricing with fresh and organic food. His vision was to make healthy food accessible to more consumers, not just premium shoppers.

The Boney family’s multi-generation experience shaped Sprouts’ core strategy. Their focus on fresh produce, value pricing, and natural foods became the foundation of the company’s identity.

Ownership History

Sprouts Farmers Market’s ownership has evolved from a family-run business to a widely held public company. It was founded in 2002 by Shon Boney and the Boney family, who initially controlled the company. Over time, private equity investors supported expansion, and in 2013, Sprouts went public on NASDAQ. Today, ownership is mainly held by large institutional investors such as Vanguard, BlackRock, and State Street, with no single shareholder holding full control.

Early Family Ownership and Private Beginnings

Sprouts Farmers Market began as a family-driven business. The company was founded in 2002 by Shon Boney and members of the Boney family. In the early years, ownership remained closely held among the founders and a small group of private investors. The Boney family controlled strategic decisions and shaped the company’s natural and organic grocery model.

During this period, Sprouts focused on regional growth. It expanded gradually across Arizona and nearby states. Ownership remained concentrated, which allowed faster decision-making and strong alignment with the founders’ vision of affordable healthy food.

Expansion Through Mergers and Private Equity Involvement

As Sprouts grew, ownership evolved. The company expanded through key mergers with natural grocery chains. These included Sunflower Farmers Market and later Henry’s Farmers Market. These transactions transformed Sprouts into a larger regional grocery player.

Private equity firms became involved during this phase. Investment groups provided capital to accelerate expansion and improve operations. Their involvement reduced the founders’ direct ownership percentage but strengthened the company’s growth capacity. Ownership became more structured, with institutional investors gaining influence behind the scenes.

Transition to Public Ownership

A major shift occurred in 2013 when Sprouts Farmers Market went public. The company launched its initial public offering on the NASDAQ stock exchange under the ticker SFM. This changed the ownership model completely.

After the IPO, Sprouts was no longer controlled by a single family or private group. Ownership became distributed among public shareholders. Institutional investors, mutual funds, and retail investors began acquiring shares in the open market. The founders’ ownership stake declined over time as public ownership expanded.

Rise of Institutional Investors

Following its public listing, large asset management firms steadily increased their stakes in Sprouts Farmers Market. Institutional investors became the dominant owners. Firms such as Vanguard Group, BlackRock, and State Street accumulated significant shareholdings through index funds and investment portfolios.

This marked a shift from founder-led ownership to institutionally influenced governance. These investors gained voting power in board elections and corporate matters. However, they did not manage daily operations. Their role focused on long-term value and corporate governance.

Ownership Structure in Recent Years

In recent years, Sprouts Farmers Market has remained a widely held public company. No single shareholder holds a controlling majority. Instead, ownership is spread across institutional investors, mutual funds, and individual shareholders.

The company operates with professional management rather than founder control. The board of directors represents shareholder interests. Institutional investors continue to hold the largest combined ownership stake, giving them strong influence over strategic direction.

As of 2026, Sprouts Farmers Market maintains a stable public ownership structure. It reflects a transition from family ownership to institutional dominance, while still operating as an independent grocery retailer.

Who Owns Sprouts Farmers Market: Major Shareholders

Sprouts Farmers Market is a publicly traded company with a dispersed ownership structure. No single shareholder controls the company. Instead, ownership is concentrated among large institutional investors that manage funds on behalf of millions of individuals and institutions worldwide. These investors influence governance through voting power, board elections, and strategic oversight, while daily operations remain under executive leadership.

As of February 2026, institutional investors hold the majority of Sprouts Farmers Market shares. The largest shareholder is The Vanguard Group, followed by BlackRock and State Street Corporation. Several other major asset managers and investment firms also hold meaningful stakes. Together, these shareholders shape long-term corporate direction, capital allocation, and governance standards.

The Vanguard Group

The Vanguard Group is the largest shareholder of Sprouts Farmers Market as of February 2026, holding approximately 12.6% of total outstanding shares. Vanguard’s ownership comes primarily through its index funds and exchange-traded funds that track major U.S. equity benchmarks.

Vanguard follows a passive investment strategy. It does not attempt to control daily operations. However, its large voting power gives it strong influence over corporate governance matters. Vanguard plays a key role in board appointments, executive compensation policies, and long-term strategic oversight. Its investment reflects confidence in Sprouts Farmers Market’s long-term growth and stability in the natural and organic grocery sector.

BlackRock Inc.

BlackRock is the second-largest shareholder, holding about 10.4% of Sprouts Farmers Market shares as of February 2026. BlackRock owns its stake through institutional portfolios, index funds, and ETFs such as iShares products.

BlackRock actively participates in shareholder governance. It focuses on corporate performance, sustainability, and long-term risk management. Although it does not run the company, its voting influence is significant. BlackRock’s continued investment signals strong institutional confidence in Sprouts’ operational model and market positioning.

State Street Corporation

State Street Corporation holds approximately 5.1% of Sprouts Farmers Market as of February 2026. The firm manages large index funds and institutional portfolios, including SPDR exchange-traded funds.

State Street maintains a long-term passive investment approach. It does not directly influence daily management. However, its voting rights contribute to major corporate decisions such as director elections and shareholder proposals. State Street’s presence strengthens institutional stability within Sprouts’ shareholder structure.

Fidelity Management & Research Company

Fidelity Management & Research holds about 4.3% of Sprouts Farmers Market shares as of February 2026. Unlike passive index investors, Fidelity actively manages its portfolio and adjusts holdings based on market outlook and company performance.

Fidelity’s investment reflects confidence in Sprouts’ growth strategy, store productivity improvements, and expansion in health-focused grocery segments. As an active institutional investor, Fidelity engages in governance and supports initiatives that enhance long-term shareholder value.

T. Rowe Price Associates

T. Rowe Price Associates owns approximately 3.2% of Sprouts Farmers Market as of February 2026. The firm invests through growth-oriented mutual funds and retirement portfolios.

T. Rowe Price focuses on companies with strong expansion potential and operational discipline. Its stake in Sprouts signals belief in the company’s long-term position within the natural and organic grocery market. The firm contributes to shareholder voting and governance oversight.

Geode Capital Management

Geode Capital Management holds around 1.9% of Sprouts Farmers Market shares as of February 2026. Geode manages index-based investment funds and institutional portfolios tied to major market benchmarks.

Although Geode operates passively, its ownership strengthens institutional influence. The firm participates in shareholder voting and supports governance practices aligned with long-term market performance. Its consistent presence adds stability to Sprouts’ ownership base.

JPMorgan Investment Management

JPMorgan Investment Management is another significant shareholder, holding approximately 1.7% of Sprouts Farmers Market as of February 2026. The firm invests through diversified institutional funds and actively managed portfolios.

JPMorgan evaluates companies based on growth potential, market positioning, and financial discipline. Its stake reflects confidence in Sprouts’ operational improvements and long-term expansion strategy. The firm participates in corporate governance through shareholder voting and engagement.

Dimensional Fund Advisors

Dimensional Fund Advisors owns about 1.5% of Sprouts Farmers Market as of February 2026. The firm specializes in systematic and factor-based investment strategies.

Dimensional focuses on long-term market exposure rather than short-term speculation. Its investment supports stability in Sprouts’ shareholder base. The firm contributes to governance decisions and supports shareholder-focused corporate policies.

Invesco Ltd.

Invesco holds approximately 1.3% of Sprouts Farmers Market shares as of February 2026. The firm manages global investment funds across equities, ETFs, and institutional portfolios.

Invesco’s stake reflects confidence in Sprouts’ continued growth in the natural grocery segment. The firm engages in shareholder voting and monitors corporate performance, governance, and strategic execution.

Insider and Executive Ownership

Company insiders, including executives and board members, collectively hold about 1.1% of Sprouts Farmers Market as of February 2026. While relatively small, insider ownership aligns management interests with shareholder value.

Executives receive equity-based compensation tied to company performance. This encourages leadership to focus on long-term profitability, operational efficiency, and sustainable growth. Insider ownership ensures management remains committed to enhancing shareholder returns.

Public and Retail Investors

Retail investors collectively own the remaining portion of Sprouts Farmers Market shares. These are individual investors who purchase stock through brokerage accounts and retirement portfolios.

While individual stakes are small, retail shareholders form an important part of the ownership base. They have voting rights but limited influence individually. Institutional investors remain the dominant force shaping governance and long-term corporate strategy.

Overall, Sprouts Farmers Market’s ownership structure reflects a modern publicly traded company. Institutional investors hold the majority, supported by active fund managers, insiders, and retail shareholders. This diversified ownership promotes stability while allowing professional management to operate independently.

Competitor Ownership Comparison

Sprouts Farmers Market operates in the highly competitive U.S. grocery industry. Its ownership structure differs significantly from several major rivals. Sprouts is a publicly traded and independently operated company. In contrast, some competitors are owned by global corporations, private families, or large retail conglomerates. Ownership structure affects decision-making speed, capital access, expansion strategy, and competitive positioning.

| Company | Ownership Type | Main Owner(s) | Control Structure | Strategic Impact Compared to Sprouts |

|---|---|---|---|---|

| Sprouts Farmers Market | Publicly Traded | Institutional investors (Vanguard, BlackRock, State Street) | No single controlling shareholder. Board and executives manage operations. | Independent structure allows flexibility and focus on natural and organic grocery retail. |

| Whole Foods Market | Wholly Owned Subsidiary | Amazon | Fully controlled by parent company. Strategic decisions aligned with Amazon ecosystem. | Strong technology and logistics advantage but less operational independence than Sprouts. |

| Trader Joe’s | Privately Owned | Albrecht Family (Aldi Nord) | Family-controlled ownership with centralized decision-making. | Long-term brand focus without public shareholder pressure. Less transparency than Sprouts. |

| Kroger | Publicly Traded | Institutional investors (Vanguard, BlackRock, Berkshire Hathaway) | Widely held public company with strong institutional influence. | Much larger scale and diversified grocery operations compared to Sprouts. |

| Walmart Grocery | Publicly Traded Parent Company | Walton Family + Institutional Investors | Hybrid structure with strong family influence over corporate strategy. | Massive scale, supply chain power, and pricing advantage over Sprouts. |

| Albertsons | Publicly Traded | Institutional investors and private equity stakeholders | Mixed institutional and investment firm influence over governance. | Broader supermarket model and larger geographic footprint than Sprouts. |

| Natural Grocers | Publicly Traded with Family Control | Isely Family | Founding family retains strong control and strategic direction. | More focused natural grocery competitor but smaller scale than Sprouts. |

Whole Foods Market Ownership

Whole Foods Market is fully owned by Amazon. The acquisition transformed Whole Foods from an independent organic grocery chain into part of a global technology and retail ecosystem.

Amazon’s ownership provides Whole Foods with strong financial backing, advanced logistics, and deep technology integration. Strategic decisions are aligned with Amazon’s broader retail, e-commerce, and supply chain strategy. Unlike Sprouts, Whole Foods is not influenced by public shareholders. Instead, it operates under centralized corporate control.

This structure allows faster technology adoption but reduces operational independence compared to Sprouts Farmers Market.

Trader Joe’s Ownership

Trader Joe’s is privately owned by the Albrecht family of Germany. It operates under Aldi Nord, one branch of the Aldi global retail empire.

Because Trader Joe’s is privately held, it does not report to public shareholders. The company focuses on long-term brand positioning rather than short-term market pressure. Ownership concentration allows tight control over pricing, sourcing, and private label strategy.

Compared to Sprouts, Trader Joe’s has greater ownership stability but less transparency. Sprouts, as a public company, must meet shareholder expectations and disclosure requirements.

Kroger Ownership

Kroger is a publicly traded company similar to Sprouts Farmers Market. Its shares are owned primarily by institutional investors such as Vanguard, BlackRock, and Berkshire Hathaway.

However, Kroger is significantly larger and more diversified. Its ownership base includes large institutional investors with strong influence over governance. Unlike Sprouts, Kroger operates multiple grocery formats, private labels, and subsidiaries.

Both companies share a public ownership model, but Kroger’s scale gives it greater bargaining power, capital access, and market dominance.

Walmart Grocery Ownership

Walmart’s grocery business is not a separate company. It is fully owned and operated by Walmart Inc., one of the world’s largest retail corporations.

Walmart is publicly traded, but the Walton family remains the largest controlling shareholder. This gives Walmart a hybrid ownership structure combining institutional investors and strong family control.

Compared to Sprouts, Walmart has far greater scale, supply chain power, and pricing influence. However, Sprouts operates with a more strategic focus on natural and organic products rather than mass-market retail.

Albertsons Ownership

Albertsons is a publicly traded grocery company owned by institutional investors and private equity stakeholders. Its ownership has historically included investment firms such as Cerberus Capital Management.

Albertsons operates multiple supermarket brands across the United States. Its ownership structure blends institutional investment with strategic private equity influence. Compared to Sprouts, Albertsons has broader geographic coverage and a more traditional supermarket model.

Sprouts, however, maintains a specialized focus on health-oriented grocery retail rather than mass-market grocery formats.

Natural Grocers Ownership

Natural Grocers is one of the closest direct competitors to Sprouts in the natural and organic grocery segment. Unlike Sprouts, Natural Grocers remains controlled by the founding family.

The Isely family maintains significant ownership and influence over the company. This family-controlled structure allows long-term strategic planning without strong institutional pressure. However, it limits capital scale compared to Sprouts.

Sprouts benefits from larger institutional investment, enabling faster expansion and broader market reach.

Key Ownership Differences

Sprouts Farmers Market stands out as an independent public company without corporate or family control. Many competitors fall into three different ownership models.

Some competitors are owned by large corporations, such as Whole Foods under Amazon and Walmart under Walmart Inc. Others are privately owned, like Trader Joe’s and Natural Grocers. Large traditional supermarket chains like Kroger and Albertsons share Sprouts’ public ownership model but operate at much larger scale.

Sprouts’ ownership provides a balance between independence and institutional backing. It allows access to capital markets while maintaining strategic focus on natural and organic grocery retail. This structure supports steady growth, operational flexibility, and competitive positioning within the evolving grocery industry.

Who Controls Sprouts Farmers Market?

Sprouts Farmers Market is controlled through a structured corporate governance system rather than by a single owner. The company is publicly traded, so control is shared among three key groups: executive leadership, the board of directors, and major institutional shareholders. No shareholder holds a controlling majority. Strategic authority is exercised through board oversight and shareholder voting, while operational control rests with management.

The board approves major corporate actions. These include long-term strategy, executive compensation, capital allocation, and governance policies. Shareholders elect directors and vote on key matters during annual meetings. Institutional investors hold the largest voting power and therefore influence governance outcomes.

Chief Executive Officer and Executive Authority

Jack Sinclair serves as Chief Executive Officer of Sprouts Farmers Market as of February 2026. He has led the company since 2019. He is responsible for overall corporate strategy, operational performance, and long-term growth execution.

Under his leadership, Sprouts sharpened its focus on fresh produce, private label expansion, and store productivity. The company optimized its smaller store format and streamlined product assortment toward natural and health-focused categories. Digital grocery partnerships and supply chain improvements were also strengthened to support modern retail demand.

The CEO directs the executive leadership team, which includes senior officers responsible for operations, merchandising, supply chain, marketing, and finance. These executives manage day-to-day business activities and implement company strategy across all store locations and corporate functions.

Board of Directors and Strategic Oversight

The board of directors provides the highest level of control over Sprouts Farmers Market. It oversees corporate governance, monitors executive performance, and approves long-term strategy. The board evaluates business performance, risk exposure, and leadership effectiveness.

Directors are elected by shareholders. Institutional investors influence board composition through voting power. The board approves major decisions such as leadership appointments, corporate policies, and long-term expansion strategy. While management runs operations, the board ensures accountability and alignment with shareholder interests.

Institutional Shareholder Influence

Institutional investors play a major role in controlling Sprouts Farmers Market through voting rights rather than operational authority. As of February 2026, large asset managers such as The Vanguard Group, BlackRock, and State Street collectively control a significant portion of voting shares.

These investors influence board elections, governance standards, and executive compensation policies. They focus on long-term performance, risk discipline, and shareholder value. Although they do not manage daily operations, their voting power shapes corporate direction and governance stability.

Executive Management and Operational Control

Daily operational control lies with the executive management team. This group executes corporate strategy, manages store performance, oversees supply chain operations, and drives merchandising decisions. The leadership team ensures consistent execution across hundreds of store locations in the United States.

Operational control includes inventory planning, pricing strategy, private label growth, and customer experience management. Management decisions directly impact revenue growth, store productivity, and competitive positioning in the natural and organic grocery market.

How Control is Structured

Control of Sprouts Farmers Market is distributed across governance, ownership, and management. The CEO and executive team manage daily operations. The board of directors provides oversight and strategic direction. Institutional shareholders influence governance through voting power.

This balanced structure prevents concentration of control while maintaining accountability. It allows professional management to operate independently while ensuring alignment with shareholder interests and long-term corporate performance.

Sprouts Farmers Market Annual Revenue and Net Worth

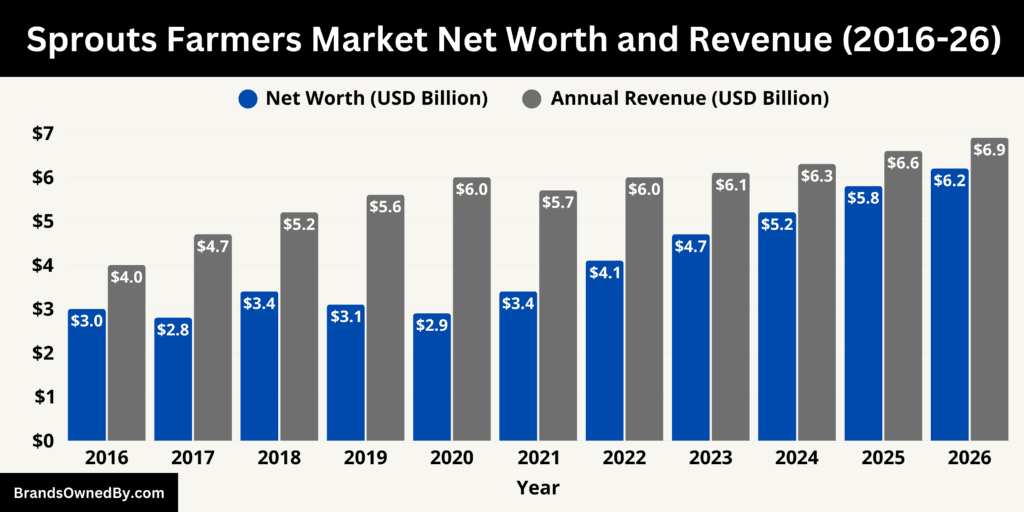

As of February 2026, Sprouts Farmers Market generated approximately $6.9 billion in annual revenue and holds an estimated market capitalization of about $6.2 billion. The company operates more than 410 stores across the United States. Revenue growth is driven by comparable store sales, new store openings, and strong performance in fresh and private label categories. Its market value reflects steady profitability, disciplined expansion, and investor confidence in the natural and organic grocery segment.

Revenue Breakdown and Performance

In fiscal 2026, Sprouts reported revenue of about $6.9 billion, representing continued growth from the prior year. Comparable store sales increased by roughly 4.5%, supported by stable customer traffic and higher average transaction value. The company operated approximately 410–415 stores during the year, with new store openings contributing incremental revenue.

Fresh produce remained the largest revenue segment, accounting for nearly 24% of total sales, or about $1.65 billion. Packaged natural and organic grocery products generated roughly $2.2 billion, making it the largest overall category. Vitamins, supplements, and wellness products contributed approximately $780 million. Meat, seafood, deli, and bakery together generated around $1.3 billion. Frozen foods, dairy, and other grocery categories accounted for the remaining portion of total revenue.

Private label products represented close to 23% of total company sales in 2026, equaling about $1.6 billion. This segment grew faster than national brands and contributed to margin expansion. Digital and online grocery sales accounted for roughly 9% of total revenue, or about $620 million, supported by pickup and delivery growth.

2026 Net Worth

As of February 2026, Sprouts Farmers Market has an estimated market capitalization of approximately $6.2 billion. The company has around 101 million outstanding shares, with share price performance driving valuation changes throughout the year. Market value increased compared to the previous year due to stable earnings growth, improving operating margins, and consistent same-store sales performance.

Operating income margins improved to roughly 6.5% in 2026, supported by private label growth and better supply chain efficiency. The company maintained stable free cash flow and continued reinvestment into store development, technology upgrades, and merchandising improvements. Institutional investors continued to hold the majority of shares, supporting long-term ownership stability.

Historical Growth Trend Context

Sprouts Farmers Market has delivered steady and disciplined growth over the past decade. Revenue increased from about $4.0 billion in 2016 to approximately $6.9 billion in 2026, reflecting nearly 72% total growth. This expansion was driven by consistent comparable store sales, improved product mix, and gradual national store expansion rather than aggressive scaling.

Store count grew from roughly 270 locations in 2016 to more than 410 stores by February 2026. The company maintained a focused expansion strategy, opening around 12 to 18 new stores annually in high-demand suburban markets. Its smaller-format stores helped increase sales productivity while controlling operating costs.

Private label growth played a major role in strengthening financial performance. Private label penetration increased from below 15% of total sales in 2016 to about 23% in 2026, generating nearly $1.6 billion in revenue. Higher-margin private label products improved profitability and reduced reliance on national brands.

Market capitalization also reflected this steady progress. The company’s valuation rose from around $3.0 billion in 2016 to approximately $6.2 billion in February 2026. Growth was supported by consistent revenue expansion, stronger margins, and disciplined operational execution. Overall, Sprouts Farmers Market achieved balanced, fundamentals-driven growth while maintaining its focus on natural and organic grocery retail.

Revenue Forecast Through 2030

Sprouts Farmers Market is expected to continue steady growth driven by store expansion, private label penetration, and rising consumer demand for natural and organic foods. Based on the current growth trajectory and store development strategy, the projected revenue outlook is as follows:

- 2027: Expected revenue around $7.2 billion, supported by 12–15 new store openings and continued comparable sales growth near 4%.

- 2028: Projected revenue approximately $7.6 billion as private label share approaches 25% of total sales and digital grocery penetration expands further.

- 2029: Revenue forecast near $8.0 billion driven by improved store productivity, supply chain efficiency, and expanded product assortment in health and wellness categories.

- 2030: Expected revenue around $8.5 billion assuming continued national expansion beyond 460 stores, steady same-store sales growth, and sustained demand for natural and organic grocery products.

Long-term growth is supported by increasing consumer focus on health, nutrition, and fresh food consumption. The company’s smaller store format, disciplined expansion strategy, and strong private label performance position it for stable revenue growth through 2030.

Brands Owned by Sprouts Farmers Market

Sprouts Farmers Market operates primarily under a focused single-brand structure. Unlike diversified retail conglomerates, it does not own many separate subsidiaries. Instead, it expands through internal brands, operating entities, and previously integrated acquisitions. As of 2026, it controls several business segments, private label programs, and legacy entities that together support its nationwide natural and organic grocery operations.

| Company / Brand / Entity | Type | Core Focus | Key Details | Operational Role |

|---|---|---|---|---|

| Sprouts Farmers Market Stores | Core Operating Business | Natural and organic grocery retail | Operates 410+ stores across the United States with farmers-market style layout and smaller store format | Primary revenue generator and main business entity |

| Sprouts Private Label | Internal Brand Portfolio | Natural, organic, and wellness products | Accounts for ~23% of total sales (~$1.6B revenue) across packaged foods, supplements, and household goods | Improves margins, strengthens brand loyalty, and differentiates from competitors |

| Sprouts Brand | Private Label Line | Everyday grocery essentials | Core in-house label covering pantry staples, snacks, frozen foods, and beverages | High-volume private label driving consistent sales |

| Sprouts Organic | Private Label Line | Certified organic food products | Focuses on organic produce, packaged foods, and clean-label grocery items | Supports organic positioning and premium natural food demand |

| Sprouts Farmers Market (Label) | Private Label Identity | Core branded food and grocery products | Used across multiple categories to reinforce company branding | Strengthens brand recognition across product portfolio |

| Sprouts Healthy Living | Private Label Line | Health and wellness-focused foods | Includes nutrition-focused, functional, and clean-label products | Targets health-conscious consumers and wellness segment growth |

| Sprouts Kids | Private Label Line | Family and child nutrition | Offers healthier snacks and organic food options for children | Expands family-oriented product category |

| Sprouts Vitamins and Supplements | Internal Wellness Brand | Vitamins, supplements, and natural health | Covers multivitamins, probiotics, herbal supplements, and sports nutrition | High-margin wellness category supporting health-focused positioning |

| Sprouts E-Commerce and Digital Operations | Internal Business Segment | Online grocery and digital retail | Supports online ordering, pickup, and digital customer engagement systems | Expands customer reach and supports omnichannel growth |

| Heritage Natural Foods (Legacy Entity) | Historical / Integrated Entity | Early natural grocery operations | Early operational structure integrated into Sprouts supply chain foundation | Contributed to early sourcing and natural food positioning |

| Henry’s Farmers Market (Integrated Acquisition) | Acquired and Merged Chain | Natural grocery retail | Acquired in 2012 and fully converted into Sprouts stores | Expanded California presence and accelerated national growth |

| Sunflower Farmers Market (Merged Entity) | Merged Chain | Natural grocery retail | Merged in 2011 and integrated into Sprouts brand | Strengthened scale, purchasing power, and regional expansion |

| Sprouts Distribution and Supply Chain Operations | Internal Infrastructure | Distribution and logistics | Includes distribution centers, sourcing systems, and inventory management | Supports nationwide store operations and cost control |

| Sprouts Real Estate and Store Development | Internal Corporate Entity | Store expansion and location strategy | Manages site selection, store design, and expansion planning | Enables disciplined growth and optimized store performance |

Sprouts Farmers Market Stores

Sprouts Farmers Market Stores form the core operating entity of the company. As of 2026, the company operates more than 410 supermarket locations across the United States. These stores specialize in fresh produce, natural and organic groceries, vitamins, supplements, and wellness-focused products.

The store model is smaller than traditional supermarkets, typically around 23,000 to 30,000 square feet. This format allows lower operating costs, faster expansion, and higher sales productivity per square foot. Stores are designed around a farmers-market concept, with open produce displays and health-focused merchandising. This core retail operation generates the majority of company revenue and represents the primary business entity owned and operated by Sprouts.

Sprouts Private Label

Sprouts Private Label is one of the company’s most important internal brand portfolios. It includes a wide range of natural, organic, and health-focused products sold exclusively in Sprouts Farmers Market stores.

As of 2026, private label products account for about 23% of total company sales, generating approximately $1.6 billion in annual revenue and playing a key role in margin expansion and brand differentiation.

It operates several flagship private label lines under the broader Sprouts brand architecture. Major private label names include Sprouts Brand, Sprouts Organic, Sprouts Farmers Market, Sprouts Healthy Living, and Sprouts Kids. These labels cover multiple product categories including organic pantry staples, snacks, frozen foods, beverages, dairy alternatives, vitamins, supplements, and natural household products.

Sprouts Brand Vitamins and Supplements

Sprouts operates a dedicated internal brand for vitamins, supplements, and wellness products. This segment focuses on health-conscious consumers and includes multivitamins, herbal supplements, sports nutrition, probiotics, and natural health remedies.

The wellness category is one of the fastest-growing segments within the company. It generates hundreds of millions in annual sales and supports Sprouts’ positioning as a health-focused grocery retailer. The in-house supplement line allows the company to control product quality, pricing, and customer trust while maintaining strong margins.

Sprouts Farmers Market E-Commerce and Digital Operations

Sprouts owns and operates its digital grocery and e-commerce infrastructure. This includes online ordering, curbside pickup, and digital customer engagement platforms. Although delivery is supported through third-party partnerships, the digital commerce system itself is controlled by the company.

Digital grocery contributes a growing share of total revenue and improves customer convenience. The company continues investing in digital inventory systems, personalized promotions, and loyalty-based data analytics. This digital business segment supports long-term growth and modern retail competitiveness.

Heritage Natural Foods

Heritage Natural Foods is a legacy operational entity linked to the company’s early natural grocery roots. While not a separately branded retail chain today, its operational structure contributed to Sprouts’ early development and supply chain foundation. Elements of this legacy structure were integrated into Sprouts’ broader operations over time.

The legacy entity helped shape the company’s early sourcing strategy for natural and organic products. Although fully absorbed into current operations, it remains part of the company’s historical corporate structure.

Henry’s Farmers Market

Henry’s Farmers Market was acquired and merged into Sprouts in 2012. This acquisition significantly expanded Sprouts’ store base and strengthened its presence in California and western U.S. markets. After integration, Henry’s stores were converted into the Sprouts brand.

Although Henry’s no longer operates as a separate retail chain, the acquisition remains a major milestone in Sprouts’ expansion history. It contributed to scaling operations, strengthening supplier relationships, and accelerating national growth.

Sunflower Farmers Market

Sunflower Farmers Market merged with Sprouts in 2011. This merger created a stronger regional natural grocery chain and expanded store presence across multiple southwestern states. Sunflower’s operations were fully integrated into the Sprouts brand following the merger.

The merger improved purchasing power, supply chain efficiency, and brand scale. While Sunflower Farmers Market no longer exists as a standalone brand, its integration played a major role in building Sprouts into a national grocery retailer.

Sprouts Distribution and Supply Chain Operations

Sprouts owns and operates internal distribution and supply chain infrastructure supporting its nationwide store network. These operations include distribution centers, product sourcing systems, and inventory management platforms.

The company’s supply chain focuses heavily on fresh produce sourcing, organic product procurement, and efficient store replenishment. Internal distribution capabilities help control costs, maintain product quality, and support consistent store operations across regions.

Sprouts Farmers Market Real Estate and Store Development Entity

Sprouts controls its store development and real estate strategy through internal corporate operations. This includes site selection, store design, and expansion planning. The company typically leases most store locations but manages the development process directly.

This internal real estate function supports disciplined expansion into high-growth suburban markets. It ensures consistent store format, cost control, and optimized location performance.

Final Words

Sprouts Farmers Market is a publicly owned company controlled by institutional investors and managed by professional executives. The largest shareholder is typically Vanguard Group, followed by other major asset managers. The company remains independent and focused on natural and organic groceries. Its leadership, financial growth, and strong brand position continue to shape its future in the competitive supermarket industry.

FAQs

Who is the parent company of Sprouts?

Sprouts Farmers Market does not have a parent company. It is an independent, publicly traded company listed on NASDAQ under the ticker SFM. Ownership is distributed among institutional investors, mutual funds, and public shareholders rather than a single parent corporation.

Who owns Sprouts supermarket?

Sprouts supermarket is owned by its shareholders because it is a public company. The largest owners as of February 2026 are major institutional investors such as The Vanguard Group, BlackRock, and State Street Corporation. No single entity owns a controlling majority.

Who are the shareholders of Sprouts Farmers Market?

The main shareholders of Sprouts Farmers Market are institutional investors. The largest include The Vanguard Group, BlackRock, State Street Corporation, Fidelity Management & Research, T. Rowe Price Associates, Geode Capital Management, JPMorgan Investment Management, Dimensional Fund Advisors, and Invesco. Executives and public investors also hold smaller stakes.

Where is Sprouts headquarters?

Sprouts Farmers Market is headquartered in Phoenix, Arizona, United States. The headquarters manages corporate strategy, operations, merchandising, and national store expansion.

Is Sprouts owned by Walmart?

No. Sprouts Farmers Market is not owned by Walmart. It operates independently as a publicly traded grocery company with its own management and shareholder base.

Is Sprouts owned by Kroger?

No. Sprouts Farmers Market is not owned by Kroger. Both companies are separate publicly traded grocery retailers that compete in the U.S. supermarket industry.

What is the story behind Sprouts Farmers Market?

Sprouts Farmers Market was founded in 2002 in Chandler, Arizona by Shon Boney and the Boney family, who had decades of experience in natural grocery retail. The company focused on making fresh and natural food affordable. It expanded through mergers with Sunflower Farmers Market and the acquisition of Henry’s Farmers Market. Over time, it grew into a national natural and organic grocery chain and went public in 2013.

What is the controversy with Sprouts Farmers Market?

Sprouts Farmers Market has faced occasional controversies related to product labeling, supplier practices, and labor concerns. Some past criticism involved organic labeling clarity and pricing transparency. Like many grocery retailers, it has also faced scrutiny over employee working conditions in certain locations. However, none of these issues significantly altered its long-term growth or market position.

How many Sprouts stores are there?

As of February 2026, Sprouts Farmers Market operates more than 410 stores across the United States, with ongoing expansion into new suburban and metropolitan markets.