Spirit Airlines is one of America’s leading ultra-low-cost carriers, popular for offering affordable flights across the United States, Latin America, and the Caribbean. Many people wonder who owns Spirit Airlines and how the company is structured in terms of shareholders and management. Understanding its ownership provides insight into how the airline operates and makes decisions in a competitive aviation industry.

Spirit Airlines Company Profile

Spirit Airlines is an American ultra-low-cost carrier that provides affordable flights across the United States, Latin America, and the Caribbean. The company filed for Chapter 11 bankruptcy in November 2024 and reemerged in March 2025 after completing a major financial restructuring. It reduced its debt, secured new financing, and began reshaping its operations to remain competitive in a difficult travel market.

Company Details

Spirit Airlines is headquartered in Dania Beach, Florida, near Miami. It operates an all-Airbus fleet known as the “Fit Fleet” which is recognized for being fuel-efficient and cost-effective.

As of 2025, the airline flies to about 88 destinations and manages nearly 195 aircraft. Spirit is also investing in premium seating, onboard Wi-Fi, and new service options as part of its post-bankruptcy strategy.

Founders and Early History

Spirit traces its origins back to 1964, when Clippert Trucking Company was established before evolving into Ground Air Transfer.

In 1983, Ned Homfeld launched Charter One Airlines in Michigan, which offered charter flights to popular leisure destinations. The airline rebranded as Spirit Airlines in 1992 and transitioned into scheduled passenger service with an ultra-low-cost model.

Major Milestones

- 1964: The company starts as a trucking business.

- 1974–1983: Evolves into an aviation entity serving tour destinations.

- 1992: Rebrands as Spirit Airlines, focusing on no-frills scheduled flights.

- 2010: Becomes the first U.S. airline to charge for carry-on bags.

- 2014–2018: Expands operations and rises as the largest ultra-low-cost carrier in North America.

- 2024: Merger attempt with JetBlue blocked by regulators; files for Chapter 11 in November.

- Early 2025: Completes restructuring—equity conversion of ~$795 million in debt and $350 million in new equity; emerges from bankruptcy in March.

- Mid-2025: Launches network expansion, including 30 new routes from Miami (12 international), implements premium options and Wi-Fi, restructures workforce, but issues a stark warning about its survival.

Who Owns Spirit Airlines: Largest Shareholders

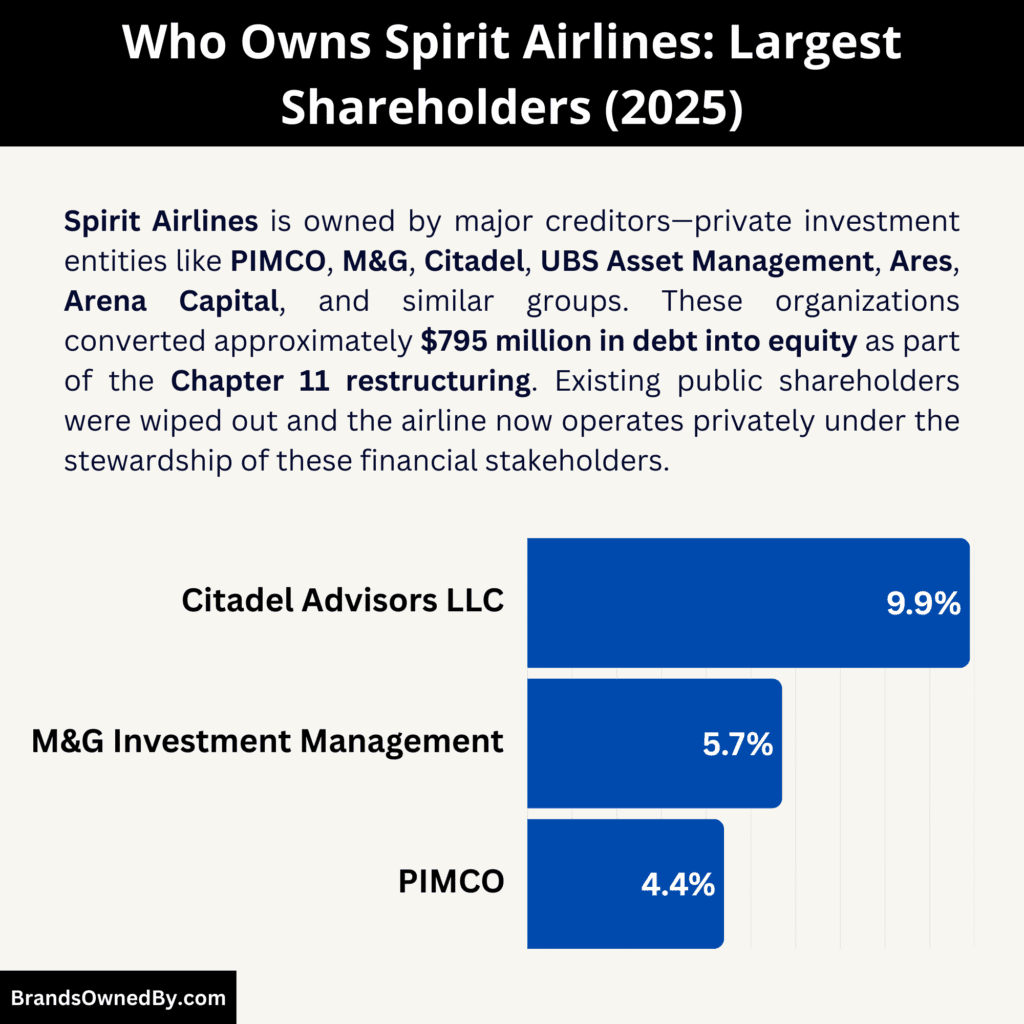

Spirit Airlines is now largely controlled by its former bondholders—major institutional investors such as M&G, Citadel, PIMCO, UBS, Arena Capital, AllianceBernstein, and Ares—who collectively hold equity following the airline’s Chapter 11 restructuring. It is not a publicly traded company anymore.

Ownership is now concentrated among the key creditors-turned-equity-holders: M&G, Citadel, PIMCO, UBS, Arena Capital, AllianceBernstein, and Ares. These institutions took equity positions as part of the debt restructuring that allowed Spirit to emerge from Chapter 11 in early 2025. They now collectively steer strategic direction, financial controls, and governance.

Retail and prior public shareholders were effectively wiped out during the reorganization. Indigo Partners retains strategic influence historically, but no longer holds equity. This shift marks a drastic transformation in the airline’s ownership structure in 2025.

Here’s a list of the major shareholders of Spirit Airlines as of August 2025:

| Shareholder | Estimated Stake (2025) | Role / Influence | Notes |

|---|---|---|---|

| M&G Investment Management | ~5.7% | Institutional investor and debt-to-equity converter. | Acquired ~1.8M shares at ~$4.99 each during restructuring. |

| Citadel Advisors LLC | ~9.9% | Largest single shareholder with voting power in governance. | Converted debt to equity; strong influence on strategy and board. |

| PIMCO | ~4.4% | Major bondholder turned equity investor. | Holds equity and shapes financial discipline and restructuring plans. |

| UBS Asset Management | Not disclosed (part of creditor pool) | Creditor turned equity holder; key in financing negotiations. | Active in restructuring agreements; monitors long-term performance. |

| Arena Capital Advisors | Not disclosed | Bondholder with smaller equity role. | Supporter of restructuring; aligned with creditor oversight. |

| AllianceBernstein L.P. | Not disclosed | Debt-to-equity participant. | Works alongside Arena Capital to ensure creditor representation. |

| Ares (Convertible Bondholders) | Not disclosed | Converted debt into equity; balances recovery interests with risk oversight. | Plays monitoring role in Spirit’s financial recovery. |

| Retail and Public Shareholders | 0% (wiped out) | No current ownership after bankruptcy. | Pre-2024 retail and institutional investors lost equity. |

| Indigo Partners (Legacy Influence) | 0% (historical only) | Shaped Spirit’s ULCC business model and fee-based strategy. | No longer a shareholder but legacy influence remains. |

M&G Investment Management

M&G’s current stake emerged via a debt-to-equity conversion as part of Spirit’s Chapter 11 restructuring earlier in 2025. While the firm reportedly acquired 1,835,681 shares at about $4.99 each, it represents a relatively modest portion of the overall equity—especially compared to larger creditor-investors.

Nonetheless, M&G holds a strategic position, with influence in governance decisions through its newly acquired shares.

Citadel Advisors LLC

Citadel Advisors holds approximately 9.9% of Spirit’s total shares, amounting to around 1.625 million shares. Their equity position stems from their involvement as a creditor in restructuring. This nearly 10% stake gives Citadel substantial sway in shareholder matters and board-level strategy, especially during Spirit’s post-bankruptcy transition.

Pacific Investment Management Company (PIMCO)

PIMCO owns roughly 4.42% of Spirit. As a heavy bondholder and investment fund, its influence extends beyond equity to debt restructuring negotiations, shaping the airline’s financial stability.

UBS Asset Management

UBS represents one of Spirit’s key creditor groups turned equity holders following the restructuring. Its role is tied closely to decisions during Spirit’s emergence from bankruptcy and the direction of its new ownership structure.

Arena Capital Advisors & AllianceBernstein L.P.

These firms were among the bondholders whose debt was converted into equity during the Chapter 11 restructuring. While their combined share is smaller, their participation was critical in supporting the restructuring plan.

Ares (Convertible Bondholders and Noteholders)

Ares, among other convertible bondholders, now holds equity interest following the reorganization. They gained a stake in the company through debt conversion and play a monitoring role in Spirit’s financial recovery.

Retail and Public Shareholders

The bankruptcy plan wiped out the old public shareholders when equity was canceled. Today, most retail and institutional public shareholders no longer hold significant stakes, as ownership has shifted to restructuring creditors.

Indigo Partners (Legacy Influence)

Although no longer a major shareholder, Indigo Partners strongly influenced Spirit’s ultra-low-cost strategy in earlier years. Its legacy remains visible in the airline’s operational model and cost structure.

Spirit Airlines Bankruptcy

Spirit Airlines filed for bankruptcy in 2023 after years of financial turbulence and rising operational costs. The decision came as the airline struggled to balance its ultra-low-cost business model with mounting debt, high fuel prices, and intense competition from both low-cost and legacy carriers.

The bankruptcy was a pivotal moment in Spirit’s history, reshaping its strategy, ownership structure, and future outlook.

Reasons Behind the Bankruptcy

The bankruptcy was driven by several key factors. Persistent cost inflation eroded Spirit’s thin profit margins, while operational disruptions and customer dissatisfaction weighed heavily on revenue stability.

The failed merger attempt with JetBlue in 2022 left Spirit without the financial backing it had hoped for, adding pressure on its standalone operations. Rising interest rates also made refinancing debt more expensive, pushing the airline closer to insolvency.

Bankruptcy Filing and Legal Process

Spirit filed for Chapter 11 bankruptcy protection in U.S. courts. Chapter 11 allowed the airline to continue operations while restructuring its debt obligations and renegotiating contracts. The filing outlined Spirit’s intention to protect jobs, maintain its fleet, and ensure flights continued during restructuring. Courts approved debtor-in-possession financing, giving Spirit access to short-term liquidity while it reorganized.

Impact on Shareholders and Investors

The bankruptcy had a profound impact on Spirit Airlines’ shareholders. Equity holders saw the value of their shares significantly diluted. Many institutional investors faced losses, while others shifted focus to recovery opportunities post-bankruptcy.

Creditors became central stakeholders in the restructuring process, with some converting debt into equity ownership.

Despite the bankruptcy, Spirit worked to protect its workforce. Jobs were retained with adjustments in labor contracts to ensure cost savings.

For passengers, the airline continued normal operations, with flights, loyalty programs, and bookings unaffected. Spirit emphasized stability to avoid losing customer trust during the restructuring period.

Recovery and Post-Bankruptcy Strategy

By 2024 and into 2025, Spirit emerged from bankruptcy with a leaner cost structure and renewed focus on operational efficiency.

The restructuring allowed the airline to shed debt, renegotiate supplier agreements, and invest in key areas such as its Fit Fleet, Wi-Fi services, and premium seating products.

Spirit also expanded its Miami hub and restructured routes to focus on high-demand leisure travel markets. The recovery strategy positioned the airline for long-term survival in the highly competitive U.S. aviation market.

Who is the CEO of Spirit Airlines?

As of August 2025, Dave Davis serves as President and Chief Executive Officer of Spirit Airlines. This appointment comes at a pivotal time as Spirit implements its post-bankruptcy transformation and seeks financial stability and strategic repositioning.

- Interim leadership held the fort post-bankruptcy until a permanent CEO could be appointed.

- Dave Davis officially assumed the role of President & CEO on April 21, 2025, bringing deep airline financial and operational experience.

- His mandate centers on restructuring Spirit’s image, operations, and financial foundation.

- Ted Christie stepped down in early April 2025 after six challenging years, making way for a new direction amid extreme financial hardship for the airline.

Interim Leadership Team

Following the abrupt departure of Ted Christie, Spirit’s Board established an interim leadership structure called the Office of the President. This included Chief Financial Officer Fred Cromer, Chief Operating Officer John Bendoraitis, and General Counsel Thomas Canfield. This trio steered the airline during the search for a permanent CEO.

New CEO: Dave Davis

Dave Davis joins Spirit from Sun Country Airlines, where he held dual roles as President and Chief Financial Officer. Prior to that, he served as Chief Financial Officer at Northwest Airlines, offering extensive experience across both low-cost and legacy airline operations.

Davis is tasked with leading Spirit’s strategic overhaul. Key priorities include shifting the airline’s brand from ultra-low-cost to a more premium positioning, improving its reward program, and stabilizing operations post-bankruptcy. His role is critical to redefining the airline’s direction and financial health.

Spirit’s Chairman praised Davis’s “wealth of experience and solid track record” and emphasized his ability to guide the airline’s transformation. Davis himself expressed commitment to collaborating with Spirit’s workforce to deliver value for customers, stakeholders, and communities.

Departure of Ted Christie

Ted Christie served as Spirit’s CEO from 2019 until April 7, 2025. His leadership spanned critical phases—COVID-19 response, restructuring initiatives, and the Chapter 11 process. His departure was sudden and coincided with high financial pressure and restructuring efforts.

Christie stepped down just before becoming eligible for a $3.8 million retention bonus; his exit included a separation payment. The Board commended him for guiding the airline through numerous crises, yet the scale of Spirit’s financial challenges prompted a leadership overhaul.

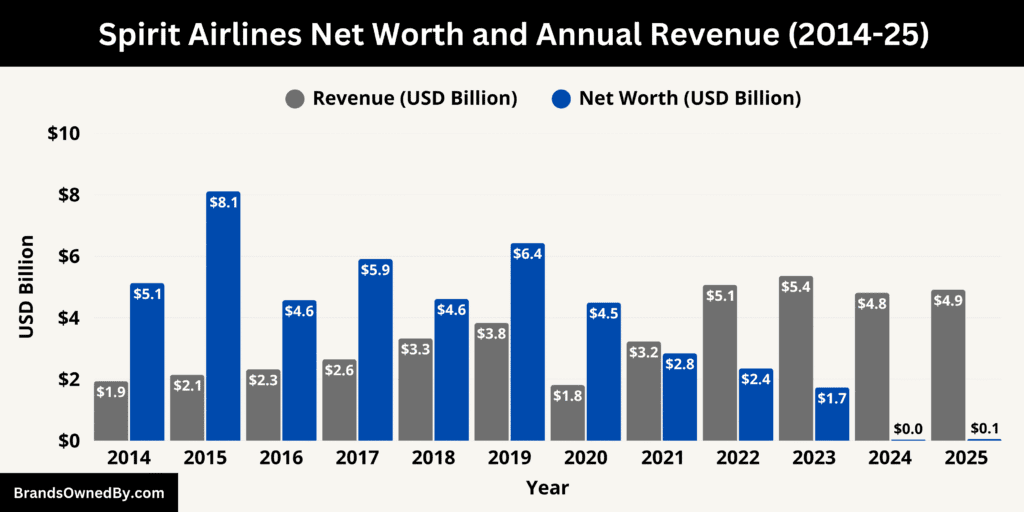

Spirit Airlines Annual Revenue and Net Worth

Spirit Airlines’ 2025 financial snapshot is stark. Annual revenue hovers around $4.91 billion, but the airline logged a staggering $1.23 billion net loss over the latest twelve months. Market capitalization has collapsed to $50 million as of August 2025, indicating a diminished investor confidence.

Annual Revenue

In the year leading up to mid-2025, Spirit Airlines recorded approximately $4.91 billion in revenue. This figure reflects continued demand across its ultra-low-cost leisure segments, although pricing pressures and reduced leisure travel volumes have limited recovery momentum. The revenue reflects the airline’s reliance on ancillary fee-based income and capacity expansion strategies despite operating in a highly competitive domestic market.

Net Loss and Profitability Challenges

Spirit’s financial performance remains under pressure. In the trailing twelve months, the airline posted a net loss of around $1.23 billion, overshadowing its top-line revenue. Elevated operating costs, weak pricing power, and substantial restructuring-related expenses have contributed to this sizable negative bottom line.

2025 Quarterly Losses

In 2025, quarterly results continued the downward trend. For Q1, the airline incurred a $143 million net loss, while Q2 losses widened to $245.8 million. The airline explicitly warned of “substantial doubt” regarding its ability to continue operations over the next year unless additional funding is secured.

These recurring losses underscore the tenuous post-bankruptcy recovery, with cash burn persisting despite efforts to trim costs and expand ancillary offerings.

Net Worth

Spirit’s market capitalization in 2025 has plummeted compared to previous years. As of August, market value stands at roughly $50 million, indicating a steep decline from the multi-billion dollar valuations seen just a few years prior.

Some sources report valuations ranging from $16 million to $50 million, depending on the exchange and data provider.

This sharp contraction in market cap reflects investor skepticism around the airline’s viability amid ongoing financial fragility.

Cash flow has been a persistent concern even after Spirit’s emergence from Chapter 11 in March 2025. The company faces liquidity constraints and must meet credit agreements and obligations to its credit-card processor.

It has explored asset sales, including aircraft, gates, and real estate, and trimmed capacity and personnel to conserve cash. Despite these steps, Spirit cautions it might not remain a going concern through late 2025 or beyond without new capital.

Brands Owned by Spirit Airlines

Below is a list of brands, entities, and divisions owned by Spirit Airlines as of August 2025:

Free Spirit Loyalty Program

The Free Spirit program is Spirit Airlines’ in-house loyalty and rewards platform. It allows frequent fliers to earn points on qualifying flights, card spend, and bonus promotions. Points can be redeemed for flights, seat upgrades, and select ancillary services. This program has evolved significantly in recent years, with Spirit introducing tiered benefits and limited elite status levels to reward high-frequency travelers. Although lightweight compared to more extensive rewards programs, Free Spirit plays a strategic role in customer retention and ancillary revenue generation.

Fit Fleet (All-Airbus Fleet)

Spirit’s Fit Fleet refers to its proprietary fleet configuration of Airbus A320-family aircraft. Designed for efficiency and cost control, the Fit Fleet features dense seating layouts, reduced turnaround times, and streamlined maintenance protocols. Spirit retains full operational control over this fleet, enabling a unified service experience and recurring cost savings. As of 2025, the airline operates nearly 195 of these aircraft, making the Fit Fleet the backbone of its operational model.

Wi-Fi and In-Flight Services

Spirit has invested in onboard Wi-Fi services across its Fit Fleet, branded under its own service offering. The airline provides tiered Wi-Fi access, including free basic browsing and premium speed tiers for a fee. This service now covers most of the fleet. Spirit manages and markets this service directly, aiming to boost customer satisfaction and ancillary offerings such as streaming access.

Go Comfy / Premium Seating

As part of its transformation away from strictly ultra-low-cost positioning, Spirit introduced a premium seating product known as “Go Comfy.” These are extra-legroom seats located in a dedicated zone, available at additional cost. Owned and operated by Spirit, Go Comfy provides a higher comfort level without full business-class amenities. The brand exists within the Spirit product suite and is sold directly by the airline through its reservation systems.

Route Network—Miami Expansion Hub

While not a “brand” in the traditional sense, Spirit now operates a standalone, expansion-focused route network centered on its Miami International Airport hub. This network is wholly owned and operationally controlled by Spirit. It includes 30 new routes—12 of them international—launched post-bankruptcy, reflecting Spirit’s strategic repositioning and authority over its route planning and market deployment.

Spirit Charitable Foundation

Spirit Airlines manages the Spirit Charitable Foundation, a non-profit entity that supports community projects and philanthropy. While separate in structure, the foundation is fully owned and funded by Spirit Airlines. It organizes charitable giving, volunteer programs for employees, and community engagement initiatives in Spirit’s operating regions.

Final Thoughts

Spirit Airlines has remained one of the most recognizable ultra-low-cost carriers in the United States. Despite facing financial struggles, a failed merger with JetBlue, and a bankruptcy restructuring, the airline continues to operate independently under its own brand. When asking who owns Spirit Airlines, the answer lies in its status as a publicly traded company with ownership spread among institutional investors, mutual funds, and individual shareholders rather than a single parent company.

Its future depends on how well it adapts to competitive pressures, restructures operations, and regains customer trust in the years ahead.

FAQs

Who founded Spirit Airlines?

Spirit Airlines was founded in 1983 as Charter One by Ned Homfeld before rebranding into Spirit Airlines in 1992.

Does JetBlue own Spirit?

No, JetBlue does not own Spirit Airlines. A merger deal was announced in 2022, but it was blocked by U.S. courts in 2023 due to antitrust concerns. Spirit continued to operate as an independent airline, later filing for bankruptcy and restructuring without becoming part of JetBlue.

Where is Spirit Airlines based?

Spirit Airlines is based in Miramar, Florida. The airline operates across the United States, Latin America, and the Caribbean, with major hubs in Fort Lauderdale, Orlando, Las Vegas, Detroit, and Dallas-Fort Worth.

Is Spirit Airlines bought by JetBlue?

Spirit Airlines was not bought by JetBlue. While a deal was signed between the two airlines, legal challenges prevented the acquisition from being completed. Spirit remained an independent ultra-low-cost carrier.

Who bought out Spirit Airlines?

As of 2025, no company has bought out Spirit Airlines. It remains a publicly traded independent airline. Its bankruptcy restructuring shifted more control to creditors and institutional investors, but there was no outright buyout.

Who is the parent company of Spirit Airlines?

Spirit Airlines does not have a parent company. It is operated by Spirit Airlines, Inc., a publicly traded company listed on the New York Stock Exchange under the ticker symbol SAVE.

Is Spirit Airlines Canadian or American?

Spirit Airlines is an American airline. It was founded in 1983 in Michigan and later moved its headquarters to Florida.

Is Spirit still publicly traded?

Yes, Spirit Airlines is still publicly traded on the New York Stock Exchange under the ticker SAVE. However, its share value has fluctuated significantly due to the failed merger and its bankruptcy filing.

Is Spirit made by Boeing?

No, Spirit Airlines is not made by Boeing. Spirit Airlines is an airline company, not an aircraft manufacturer. Its fleet primarily consists of Airbus aircraft, including A319, A320, and A321 models.

Why did Boeing buy Spirit?

This question refers to a different company, Spirit AeroSystems, which manufactures aircraft parts and was originally part of Boeing. Spirit Airlines has no connection to Boeing’s ownership of Spirit AeroSystems.

Why did Spirit Airlines go out of business?

Spirit Airlines did not completely go out of business, but it filed for bankruptcy in 2023. The bankruptcy was caused by rising costs, operational challenges, and the collapse of its merger deal with JetBlue. Spirit restructured its debt and continued flying after bankruptcy.

Where is Spirit Airlines headquartered?

Spirit Airlines is headquartered in Miramar, Florida, United States.