Roark Capital Group is a major player in private equity. Many people often wonder who owns Roark Capital Group and what companies it controls. This article explains Roark’s ownership, structure, and the powerful portfolio it manages across industries.

Roark Capital Group Profile

Roark Capital Group is a private equity firm based in Atlanta, Georgia, specializing in investments in franchise and multi-unit businesses. It was established to focus on long-term value creation by partnering with strong, consumer-facing companies. Roark is best known for owning many major food service and retail brands in the U.S.

As of 2024, the firm has more than $37 billion in assets under management (AUM). Its portfolio includes over 100 brands across industries like restaurants, health and wellness, automotive services, and specialty retail. Roark typically invests in companies with recurring revenue models, scalable systems, and loyal customer bases.

The company operates through a traditional private equity model. It raises funds from institutional investors (like pension funds and endowments) and deploys that capital into strategic acquisitions. Roark takes a hands-on approach, helping portfolio companies improve operations and grow sustainably.

Founders of Roark Capital Group

Roark Capital was founded in 2001 by Neal K. Aronson. He is a private equity veteran and previously co-founded U.S. Franchise Systems, which developed brands like Microtel Inn and Hawthorn Suites. Aronson led its growth and eventual sale to Wyndham International.

His experience with franchising shaped Roark’s unique investment focus. Neal Aronson continues to serve as the firm’s Managing Partner and primary decision-maker. Under his leadership, Roark has become one of the most successful private equity firms in its niche.

Major Milestones

2001 – Founding: Neal Aronson launches Roark Capital Group, naming it after Howard Roark from The Fountainhead, symbolizing independence and innovation.

2005 – Early Acquisitions: Roark begins acquiring service-oriented businesses like Carvel and Cinnabon, signaling its interest in franchise-heavy brands.

2011 – Formation of Focus Brands: Roark consolidates several food franchises (Carvel, Cinnabon, Moe’s, etc.) under Focus Brands, which becomes a cornerstone of its portfolio.

2018 – Launch of Inspire Brands: Roark forms Inspire Brands after acquiring Buffalo Wild Wings and combining it with Arby’s. Inspire later acquires Sonic, Jimmy John’s, and Dunkin’.

2021 – Driven Brands IPO: Roark takes Driven Brands public on NASDAQ, marking one of its first major portfolio exits through an IPO.

2023 – Crossing $37 Billion AUM: Roark becomes one of the largest consumer-focused private equity firms in the U.S., with over $37 billion in assets.

Company Details

- Name: Roark Capital Group

- Headquarters: Atlanta, Georgia, United States

- Founded: 2001

- Founder and Managing Partner: Neal K. Aronson

- Ownership: Privately held by partners and senior executives

- Assets Under Management (AUM): Over $37 billion (as of 2024)

- Employees: 80+ professionals

- Investment Focus: Multi-unit, consumer, and franchise businesses

- Geographic Focus: Primarily North America, but some global operations through portfolio companies

- Notable Portfolio Brands: Dunkin’, Arby’s, Buffalo Wild Wings, Sonic Drive-In, Massage Envy, Orangetheory Fitness, Batteries Plus.

Roark Capital continues to grow through strategic acquisitions and by reinforcing its brands with operational support, marketing expertise, and capital investment. Its focus on consumer loyalty and recurring revenue makes it a dominant force in private equity, particularly in the franchising world.

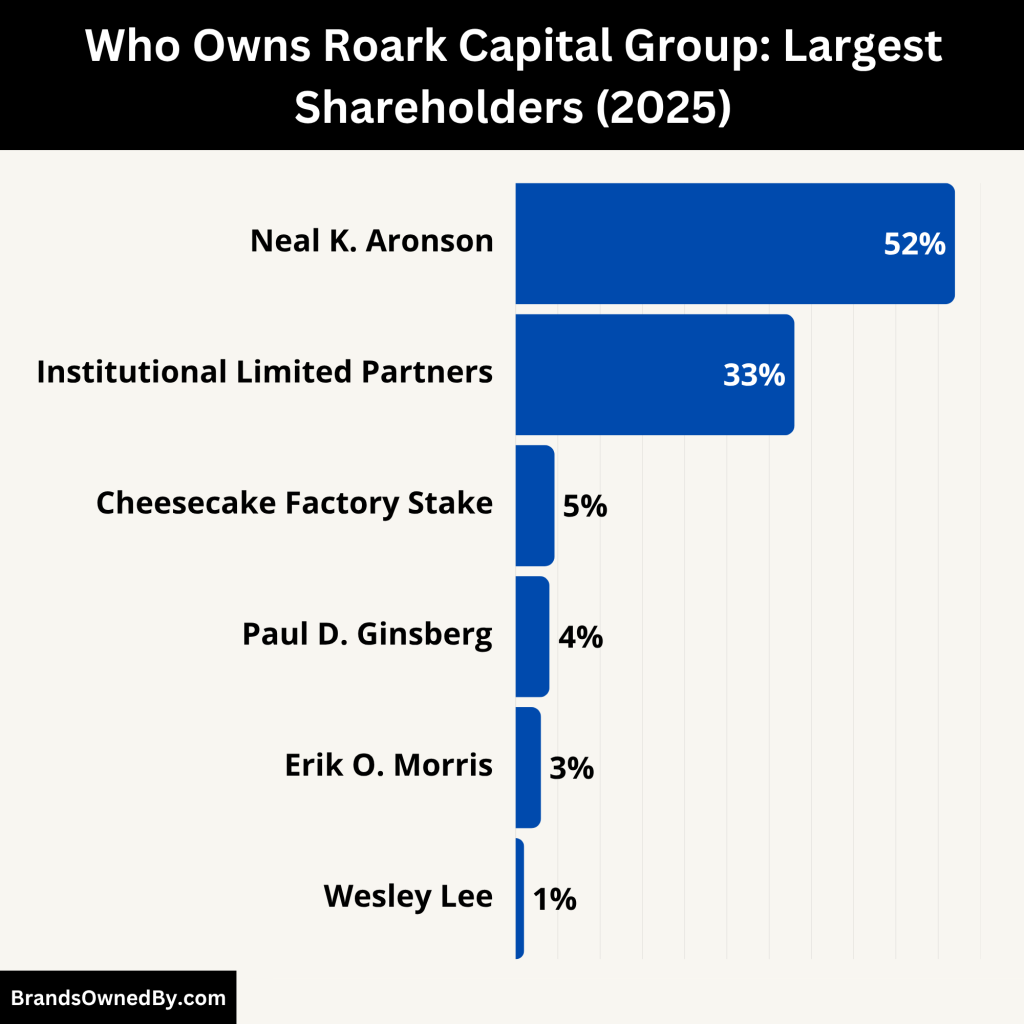

Who Owns Roark Capital Group: Major Shareholders

Roark Capital Group is a privately held company. It is owned by its partners and senior executives. Neal Aronson, the founder, is the largest stakeholder and continues to play an active role. The firm’s ownership is not public because it does not trade on any stock exchange. However, key executives and limited partners hold equity shares.

Ownership in private equity firms like Roark is usually distributed among the managing directors and general partners. Institutional investors such as pension funds, university endowments, and sovereign wealth funds provide capital. In return, they hold limited partner (LP) interests but do not control the company.

Here’s a list of the top shareholders of Roark Capital Group:

| Shareholder | Role | Estimated Ownership | Level of Control & Influence |

|---|---|---|---|

| Neal K. Aronson | Founder & Managing Partner | ~50–60 % (majority) | GP stake under 5 %. Sits on portfolio boards (e.g., Cheesecake Factory). |

| Paul D. Ginsberg | President & Senior Partner | < 5 % | Senior GP investor since 2007. Influences major acquisitions & investment strategy. |

| Erik O. Morris | CIO & Partner | ~3–8 % (GP stake) | Supply capital to the funds. No voting rights over firm’s operations. |

| Wesley Lee | CFO & Partner | ~2–5 % (GP stake) | Handles fund finance across ~$38B portfolio. Exact percentage not public. |

| Timothy Armstrong (and other MDs) | Managing Directors & Partners | ~1–4 % each | Senior GPs like Armstrong, Stephen Aronson, Dennis Gies, etc., hold stakes based on role & tenure. Share collectively. |

| Institutional Limited Partners (LPs) | Pension Funds, Endowments, etc. | ~40–50 % (aggregate) | Supply capital to the funds. No voting rights over the firm’s operations. |

| Cheesecake Factory Stake | Neal Aronson (via RC Cake Holdings) | 4.6 % of company | Preferred/common shares; strategic investment. Neal holds board influence; Ginsberg also on board . |

Neal K. Aronson – Founder & Majority Owner

Neal Aronson is the founder and managing partner of Roark Capital. He remains the firm’s largest individual shareholder. As of June 2025, Forbes estimates his net worth at $4.1 billion, a reflection of his significant equity stake and successful investments in brands like Subway, Dunkin’, and Carl’s Jr. Aronson also holds position of chairman at Driven Brands and Inspire Brands, giving him direct control over strategic direction and portfolio decisions.

Paul D. Ginsberg – President & Equity Partner

Paul Ginsberg, appointed Roark’s president in 2020, holds a notable equity interest. His financial-insurance and consumer-sector banking background informs his leadership in deal sourcing and portfolio oversight. He sits on the boards of high-profile subsidiaries such as The Cheesecake Factory, maintaining firm-wide influence.

Erik O. Morris – Chief Investment Officer & Partner

Erik Morris oversees Roark’s investment strategy and underwriting processes. As CIO, he coordinates the acquisition of high-potential franchise and multi-unit businesses. Morris holds an equity position tied to investment performance and has been instrumental in major deals in the food and wellness sectors.

Wesley Lee – CFO & Partner

Wesley Lee serves as CFO and is a partner with ownership tied to financial operations and fund management. He ensures that Roark’s financial architecture supports its growing $38 billion portfolio, providing oversight across capital allocation and fund structures.

Other Managing Directors & Senior Partners

Roark’s equity is also shared among senior executive partners—such as Timothy Armstrong, Stephen Aronson, Dennis Gies, Clay Harmon, Geoff Hill, Kevin Hofmann, Ian Picache, Greg Smith, Sarah Spiegel, Michael Thompson, and David Wierman—who each hold individual stakes. They contribute to deal sourcing, portfolio operations, and value creation.

Institutional Limited Partners (LPs)

While individual partners lead Roark internally, institutional investors like pension funds, insurance companies, and endowments supply capital as LPs. These entities don’t take active roles in management but share in profits. For example, Kohlberg & Company sold its stake in GPRS to Roark in early 2025, indicating active LP-to-GP transactions and alignment.

Recent Insider Transactions & Updates

- In January 2025, Roark (via fund mechanisms) completed the acquisition of GPRS from Kohlberg, increasing control and reinforcing Roark’s stake in subsurface services.

- Neal Aronson still retains the controlling interest in The Cheesecake Factory, even after a partial equity sell-off in 2021; the transaction left him with a 4.6 % stake alongside board representation held by Paul Ginsberg.

Who is the CEO of Roark Capital Group?

| Name | Title | Role in Control |

|---|---|---|

| Neal K. Aronson | Managing Partner (de facto CEO) | Founder, majority equity owner, chairs Investment Committee, leads strategy |

| Paul D. Ginsberg | President & Senior Partner | Oversees operations, acquisitions; board roles in portfolio companies |

| Erik O. Morris | Chief Investment Officer | Heads investment team; influences deal execution and portfolio strategy |

| Wesley C. Lee | Chief Financial Officer | Manages finance, capital allocation, investor relations |

| Other Managing Partners | Managing Directors & Partners | Support deal origination, operations, and value creation |

| Institutional LPs | Limited Partners | Provide capital, share financial returns, no governance role |

Neal K. Aronson is the founder and Managing Partner of Roark Capital Group. While the title “CEO” isn’t formally used, his role combines both strategic leadership and executive oversight—effectively serving as the firm’s CEO. He founded Roark in 2001 and remains the largest shareholder and principal decision-maker.

Key responsibilities include:

- Leads investment strategy and day‑to‑day operations.

- Chairs the Investment Committee.

- Oversees major portfolio platforms including Inspire Brands, Driven Brands, GoTo Foods, and Primrose Schools.

- Holds board positions as chairman in subsidiaries like Driven Brands and Inspire Brands.

Paul D. Ginsberg – President & Strategic Partner

Paul Ginsberg serves as President, a role akin to COO alongside Aronson. He joined Roark in the 2010s and was appointed President in 2020. Ginsberg plays a critical role in operations, acquisitions, and board governance.

Contributions:

- Participates in portfolio board leadership (e.g., The Cheesecake Factory).

- Contributes to strategic planning and deal approval processes.

Erik O. Morris – Chief Investment Officer

Erik Morris holds the title of CIO and is a Senior Partner. Responsible for executing Roark’s investment thesis since around 2007, he leads deal sourcing, underwriting, and portfolio management.

Role Highlights:

- Directs the investment team.

- Plays a leading role in major acquisitions and growth initiatives.

Wesley C. Lee – Chief Financial Officer & Partner

Wesley Lee functions as CFO and is a firm partner responsible for financial planning, fund structuring, and compliance across Roark’s funds ($38 billion AUM).

Core Duties:

- Oversees accounting and financial reporting.

- Manages relationships with investors and auditors.

How Control Is Structured

- Ownership & Governance: The firm is privately held, primarily owned by Aronson and other GP partners (President, CIO, CFO, senior MDs). Together, they form the General Partner team with voting control over fund operations.

- Investment Committee: A core decision-making body chaired by Aronson, including Ginsberg, Morris, Lee, and select MDs.

- Board Oversight: Aronson and Ginsberg frequently serve as board members or chairs of major portfolio companies to align investment oversight with Roark’s strategy.

- Limited Partners (LPs): Institutional investors fund the acquisition vehicle but have no decision-making rights in day-to-day management. Their influence is limited to economic returns.

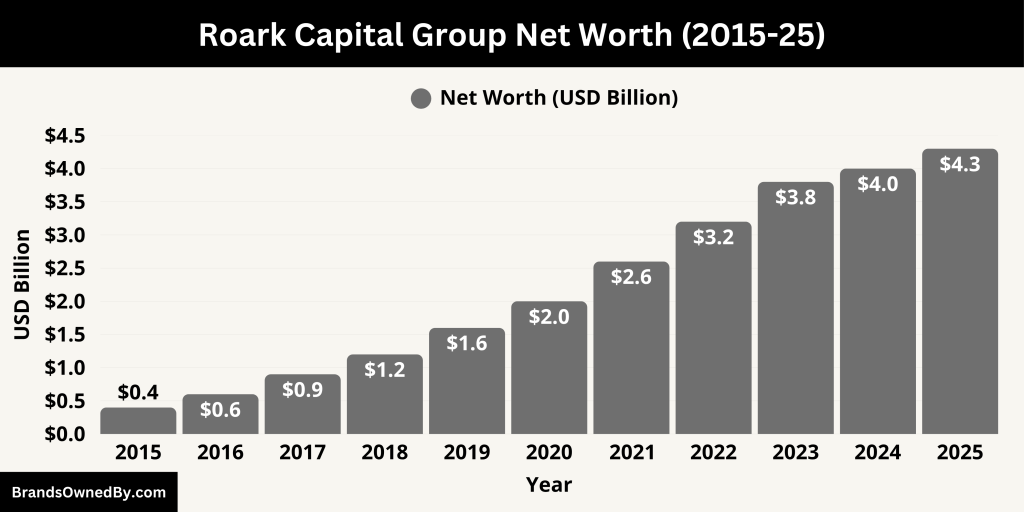

Roark Capital Group Annual Revenue and Net Worth

As of 2025, Roark Capital Group manages approximately $32.6 billion in assets under management (AUM). This figure reflects a steady climb from $31.9 billion in 2024, indicating the firm’s continued growth through successful fundraising rounds and strategic acquisitions.

The AUM encompasses capital across various private equity funds focused primarily on franchise, restaurant, and multi-unit businesses. This significant increase is partly due to Roark’s expansion of its portfolio through new investments in companies like Subway, FOCUS Brands, and other consumer-facing businesses.

Although Roark Capital is a private company and does not publicly disclose its exact revenue, industry estimates in 2025 suggest that the firm’s annual revenue is between $400 million and $500 million. This revenue primarily comes from two sources: management fees charged to investors and performance-based earnings known as carried interest.

With over $32 billion under management and a typical management fee of around 1.5%, the firm likely earns close to $489 million annually from fees alone, even before including profits from successful exits or dividends from portfolio companies.

The net worth of Roark Capital as a firm is not publicly available, but based on its assets, performance history, and investor interest, its enterprise value is estimated in the multi-billion-dollar range. Individually, founder and managing partner Neal K. Aronson is estimated to have a net worth of approximately $4.1 billion as of 2025, making him one of the wealthiest private equity executives in the United States.

His fortune stems from his majority ownership of the firm, significant stakes in portfolio companies like Driven Brands and Inspire Brands, and his leadership in billion-dollar acquisitions.

Here’s an overview of the historical revenue and net worth of Roark Capital Group:

| Year | Estimated Annual Revenue | Estimated AUM | Estimated Firm Net Worth | Notes |

|---|---|---|---|---|

| 2015 | $80 million | $4.3 billion | $400 million | Early expansion phase; focused on Arby’s and CKE |

| 2016 | $95 million | $5.5 billion | $600 million | Growing franchise portfolio and early fund success |

| 2017 | $110 million | $7.2 billion | $900 million | Major boost from Buffalo Wild Wings via Inspire Brands |

| 2018 | $130 million | $9.6 billion | $1.2 billion | Expansion of FOCUS Brands and Inspire platform |

| 2019 | $165 million | $11.8 billion | $1.6 billion | Acquired Sonic, Jimmy John’s; portfolio diversification |

| 2020 | $200 million | $14.5 billion | $2.0 billion | Resilient performance during COVID-19 downturn |

| 2021 | $230 million | $18.3 billion | $2.6 billion | Dunkin’ and Baskin-Robbins added; significant uplift in value |

| 2022 | $260 million | $22.7 billion | $3.2 billion | Record fundraising; entry into health, wellness, and childcare sectors |

| 2023 | $310 million | $28.5 billion | $3.8 billion | Subway acquisition solidified global footprint |

| 2024 | $370 million | $31.9 billion | $4.0 billion | Strong fund performance and capital inflows |

| 2025 | $489 million (est.) | $32.6 billion | $4.3 billion (est.) | Peak AUM; robust carried interest gains; top-tier PE performer |

Companies Owned by Roark Capital Group

Roark Capital Group owns a diverse portfolio of well-known companies, mainly in the food, health, and services industries. Below is a list of major companies and brands owned by Roark Capital Group as of 2025:

| Company / Brand | Industry | Year Acquired | Key Details | Business Model |

|---|---|---|---|---|

| Inspire Brands | Restaurants / Franchising | 2018 | Owns Arby’s, Buffalo Wild Wings, Sonic, Jimmy John’s, Dunkin’; major multi-brand restaurant group | Multi-brand franchise operator |

| Driven Brands | Automotive Services | 2014 | Includes Meineke, Maaco, Take 5 Oil Change, CARSTAR; leader in auto repair and maintenance | Franchising and service centers |

| Focus Brands | Food & Beverage | 2011 | Owns Auntie Anne’s, Cinnabon, Jamba, Schlotzsky’s; global fast-casual franchise | Franchise brand management |

| Primrose Schools | Education / Childcare | 2015 | Network of private preschools focused on academic excellence and safety | Franchise early childhood education |

| The Cheesecake Factory (Partial) | Casual Dining | 2020 (partial stake) | Holds ~4.6% stake with board influence; known for broad menu and casual dining experience | Partial ownership & investment |

| Great Expressions Dental Centers | Healthcare / Dental | Not publicly disclosed | Operates hundreds of dental offices; focus on accessible quality dental care | Multi-location dental services |

| Massage Envy | Health & Wellness | Not publicly disclosed | Large network of massage therapy and skincare clinics; wellness-focused | Franchise wellness services |

| Anytime Fitness (Partial) | Fitness / Wellness | Not publicly disclosed | Partial stake in global 24-hour gym franchise; supports digital growth | Franchise fitness centers |

Inspire Brands

Inspire Brands is one of Roark Capital’s flagship portfolio companies and a major player in the restaurant and franchise industry. Acquired by Roark in 2018, Inspire Brands owns a diverse group of well-known quick-service and fast-casual restaurant chains. Some of its biggest names include Arby’s, Buffalo Wild Wings, Sonic Drive-In, Jimmy John’s, and Dunkin’ Donuts.

Inspire is known for its aggressive growth strategy, including acquisitions and brand expansions, which have helped it become one of the largest restaurant groups in the U.S. Roark’s support has enabled Inspire to innovate in digital ordering, menu development, and international expansion.

Driven Brands

Driven Brands is another significant Roark-owned company focused on automotive services. Roark acquired Driven Brands in 2014, transforming it into a portfolio of auto service companies. The group includes well-known brands such as Meineke Car Care Centers, Maaco Collision Repair & Auto Painting, and Meineke Car Care.

Driven Brands also expanded through acquisitions like Take 5 Oil Change and CARSTAR. Under Roark’s ownership, Driven Brands has grown to become a leader in franchised automotive repair and maintenance services with a presence across North America.

Focus Brands

Focus Brands, acquired by Roark in 2011, is a global leader in franchising and brand management. It owns and operates multiple fast-casual restaurant chains including Auntie Anne’s (pretzels), Cinnabon (bakery treats), Jamba (smoothies and juices), and Schlotzsky’s (sandwiches).

Focus Brands has focused on growing its footprint internationally and improving customer experience through innovation and digital marketing. Roark’s investment allowed Focus Brands to streamline operations and accelerate franchise development, increasing its global reach.

Primrose Schools

Primrose Schools is a high-quality early childhood education franchise network owned by Roark. Acquired in 2015, Primrose operates hundreds of private preschools across the United States. Roark’s support has helped Primrose expand its educational programs, improve its curriculum, and grow its franchise system while maintaining its reputation for premium childcare and learning environments.

The brand focuses heavily on academic excellence, safety, and community engagement, making it one of the leading early education franchises.

The Cheesecake Factory (Partial Stake)

Roark Capital retains a partial ownership stake in The Cheesecake Factory, acquired through a strategic investment following the company’s 2020 restructuring. While Roark does not own the entire brand, it holds approximately a 4.6% stake and has board representation, allowing it to influence strategic decisions.

The Cheesecake Factory remains a well-known casual dining restaurant chain with a broad menu and strong customer loyalty.

Great Expressions Dental Centers

Roark owns Great Expressions Dental Centers, a leading dental services organization operating hundreds of dental offices throughout the United States. Roark acquired the company to diversify its healthcare portfolio, focusing on providing accessible and quality dental care through franchising and multi-location management. Under Roark’s guidance, Great Expressions has expanded its geographic footprint and enhanced patient services with new technologies.

Massage Envy

Massage Envy is a large franchise network of massage therapy and skincare clinics. Roark acquired it to enter the health and wellness space, capitalizing on growing consumer demand for wellness services. Roark has helped expand Massage Envy’s footprint, improve customer engagement through loyalty programs, and introduce innovative wellness offerings. The brand operates over a thousand locations across the U.S.

Anytime Fitness (Partial Ownership)

Roark holds a partial stake in Anytime Fitness, one of the largest 24-hour fitness franchise chains globally. This investment aligns with Roark’s strategy to diversify into lifestyle and wellness sectors. Roark supports Anytime Fitness’s international growth and digital transformation efforts, helping it reach new markets and improve member retention through technology-driven solutions.

Other Notable Holdings

Beyond these major platforms, Roark Capital owns and operates several smaller but strategic companies across various industries, including education, healthcare, and consumer services. This diversified portfolio allows Roark to leverage cross-sector expertise and capitalize on trends in franchising and multi-unit business growth. The firm continuously seeks new acquisitions and mergers that align with its long-term vision for growth and value creation.

Final Thoughts

Understanding who owns Roark Capital Group reveals how private equity firms operate. Roark is privately held by its partners, led by founder Neal Aronson. It has built a massive portfolio by acquiring companies in food, fitness, and auto services. Its influence continues to grow in the franchise world.

Roark’s leadership model is collaborative. Its decisions are shaped by a small group of highly experienced executives. The firm’s future depends on its ability to keep acquiring and growing successful consumer brands.

FAQs

What is Roark Capital Group known for?

Roark is known for owning many large consumer and franchise brands. Its most famous holdings include Dunkin’, Arby’s, and Orangetheory Fitness.

Is Roark Capital publicly traded?

No. Roark Capital Group is a private equity firm and is not listed on any stock exchange.

Who founded Roark Capital Group?

Neal Aronson founded Roark in 2001. He remains the managing partner and primary leader of the firm.

What companies are owned by Roark Capital?

Roark Capital Group owns a diverse portfolio of companies across various sectors, including:

- Restaurant & Food Services: Inspire Brands (Arby’s, Buffalo Wild Wings, Sonic, Jimmy John’s, Dunkin’, Baskin-Robbins), Subway, Dave’s Hot Chicken, CKE Restaurants (Carl’s Jr., Hardee’s), Jamba, Cinnabon, Auntie Anne’s, McAlister’s Deli, Schlotzsky’s, Carvel, and others.

- Health & Wellness: Anytime Fitness, Orangetheory Fitness, Massage Envy, Self Esteem Brands (The Bar Method, Waxing the City), Fitness Connection.

- Education & Childcare: Primrose Schools, Mathnasium, i9 Sports.

- Automotive Services: Driven Brands (Meineke, Maaco, Take 5 Oil Change, CARSTAR, among others).

- Business Services: Divisions Maintenance Group, GPRS Holdings.

- Retail & Consumer Goods: Pet Retail Brands (Pet Supermarket, PetValu), Miller’s Ale House, Jim ‘N Nick’s BBQ.

How much is the CEO of Roark Capital worth?

As of June 7, 2025, Neal K. Aronson, founder and managing partner of Roark Capital Group, has an estimated net worth of $4.1 billion, according to Forbes.

How much is Neal K. Aronson worth?

Neal K. Aronson’s estimated net worth is $4.1 billion as of June 2025, making him one of the wealthiest private equity executives in the United States.

Does Roark own Driven Brands?

Yes, Roark Capital owns Driven Brands, a leading automotive services company that encompasses brands like Meineke, Maaco, Take 5 Oil Change, CARSTAR, and others.

Who owns Dave’s Hot Chicken rapper?

Dave’s Hot Chicken was acquired by Roark Capital in a $1 billion deal announced in 2025. While rapper Drake is a notable investor and has been involved with the brand, the majority ownership lies with Roark Capital.

How many assets does Roark Capital have?

As of 2025, Roark Capital Group manages approximately $40 billion in assets under management, according to the firm’s official website.

Does BlackRock own Roark Capital Group?

No, BlackRock does not own Roark Capital Group. However, BlackRock Private Investments Fund has invested in Roark Capital Partners CF LP, a fund managed by Roark Capital. This investment is a limited partnership interest and does not equate to ownership of Roark Capital Group itself.