Quiksilver has long been a popular name in surf, skate, and snow apparel. But many still ask, who owns Quiksilver today?

The answer involves major corporate acquisitions and global restructuring. Here’s everything you need to know about Quiksilver’s ownership, leadership, and financial profile.

Quiksilver Company Profile

Quiksilver is a globally recognized surf, skate, and snowboarding apparel brand. It is currently part of Authentic Brands Group (ABG), a major brand management firm based in New York. Quiksilver, originally launched in Australia, now operates as a lifestyle brand under ABG’s action sports division. It serves customers worldwide through retail stores, e-commerce, and licensed partners.

As of 2025, Quiksilver is known for its casual and action sportswear, including boardshorts, wetsuits, jackets, and footwear. It maintains strong brand loyalty among youth and outdoor enthusiasts.

Company Details

- Current Owner: Authentic Brands Group (ABG)

- Headquarters: Huntington Beach, California, USA

- Global Reach: Distributed in 100+ countries

- Products: Surfwear, snowboard outerwear, casual clothing, footwear, accessories

- Subsidiary Brands: Roxy, DC Shoes (under ABG umbrella via Boardriders acquisition)

- Manufacturing: Outsourced globally, with sustainability goals integrated since 2022

- Sales Channels: Company-owned stores, e-commerce, wholesale, and licensed retail partners.

Since the 2023 acquisition by ABG, Quiksilver’s direct operations have been streamlined. ABG now licenses the brand to experienced partners for design, marketing, and distribution. This allows Quiksilver to scale globally while focusing on brand identity and creative direction.

Quiksilver Founders

Quiksilver was founded in 1969 by two Australian surfers:

- Alan Green – A surfboard manufacturer who envisioned a better boardshort design.

- John Law – A friend and business partner of Green with a shared vision for the surf lifestyle.

Together, they launched the brand in Torquay, Victoria, a small surf town in Australia. Their original focus was on functional boardshorts that suited the performance needs of surfers.

They later expanded the business to the U.S. through licensing. The American branch grew rapidly under Bob McKnight and Jeff Hakman, who helped solidify Quiksilver’s position in the global surf industry.

Major Milestones

1969 – Quiksilver is founded in Torquay, Australia, introducing innovative boardshorts for surfers.

1976 – Expansion into the U.S. market begins via licensing with Bob McKnight and Jeff Hakman.

1990 – Launch of Roxy, Quiksilver’s sister brand targeting women and girls in surf and snow.

2004 – Acquisition of DC Shoes, marking entry into skateboarding and broader streetwear.

2005–2014 – The brand faces declining sales, over-expansion, and rising debt due to global competition.

2015 – Quiksilver files for Chapter 11 bankruptcy protection in the U.S. amid financial struggles.

2016 – Emerges from bankruptcy and rebrands as Boardriders, Inc., consolidating its brand portfolio.

2018 – Acquires rival Billabong, uniting two of the largest surfwear brands under one roof.

2023 – Authentic Brands Group acquires Boardriders, including Quiksilver, Roxy, Billabong, and DC Shoes.

2025 – Quiksilver continues global expansion under ABG’s licensing model, focusing on sustainability, youth marketing, and growth in Asia-Pacific and Latin America.

Who Owns Quiksilver?

As of 2025, Quiksilver is fully owned by Authentic Brands Group (ABG). It is no longer an independent company but functions as a brand under ABG’s broad portfolio. The ownership structure reflects a shift from in-house retail operations to a global licensing model.

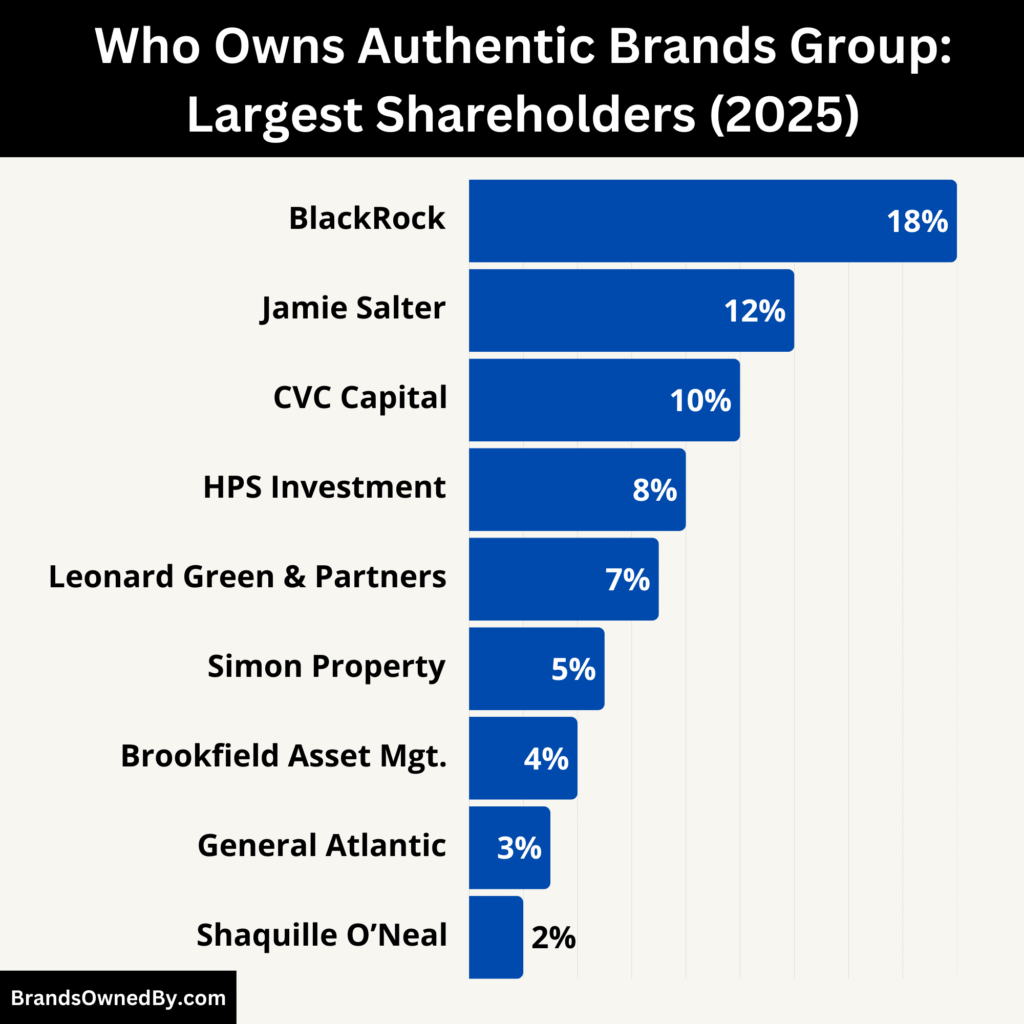

Quiksilver is no longer publicly traded. It is privately held through ABG and its financial backers. These include major private equity firms, institutional investors, and ABG’s founder.

Parent Company: Authentic Brands Group

Authentic Brands Group is a New York-based brand management company founded in 2010 by Jamie Salter, who also serves as its CEO. ABG is known for acquiring struggling or underleveraged consumer brands and revitalizing them through strategic licensing.

ABG does not operate stores or manufacture products directly. Instead, it owns the brand intellectual property (IP) and licenses it to regional or global partners. This allows for lower overhead and faster scalability. Under this model, Quiksilver is licensed to partners who handle retail, e-commerce, and marketing in various countries.

ABG’s portfolio includes more than 50 high-profile brands such as:

- Reebok

- Forever 21

- Brooks Brothers

- Nautica

- Eddie Bauer

- Juicy Couture

- Sports Illustrated

- Billabong, Roxy, and DC Shoes (via the Boardriders acquisition).

Quiksilver is now part of ABG’s Action & Outdoor Lifestyle division, one of the group’s most vibrant consumer segments.

Acquisition Insights: Boardriders Deal

Before ABG’s acquisition, Quiksilver was part of Boardriders, Inc., a company created in 2016 following Quiksilver’s bankruptcy. Boardriders emerged as a new parent company after Oaktree Capital Management took control and restructured the business.

Under Boardriders, several iconic surf and skate brands were united, including:

- Quiksilver

- Roxy

- DC Shoes

- Billabong

- RVCA

- Element

- Von Zipper.

Boardriders consolidated operations, closed underperforming stores, and focused on digital channels. By 2022, it had become a major player in the global action sports apparel market.

2023 Acquisition by Authentic Brands Group

In March 2023, ABG announced the acquisition of Boardriders. The deal officially closed later in 2023. This acquisition brought seven major surf, skate, and snowboarding brands into ABG’s control. The terms of the deal were undisclosed, but estimates placed the value at over $1.2 billion.

With this move, ABG further expanded into the performance and lifestyle sportswear industry. It also gained access to a strong international footprint in Australia, Europe, and the Americas.

Post-Acquisition Changes

After the acquisition, ABG implemented its licensing model across all former Boardriders brands. Quiksilver’s global operations are now handled by regional licensees and wholesale partners. This includes:

- Product development and design

- Manufacturing

- Distribution

- Localized marketing.

ABG retains brand control and creative direction but outsources execution. This model increases efficiency and helps scale Quiksilver across global markets without direct overhead.

Headquarters and Operations

Quiksilver’s original Australian identity remains part of its branding, but its global headquarters is in Huntington Beach, California, historically its strongest U.S. market. It also maintains operational presence in Europe and Asia-Pacific via licensed partners.

As of 2025, Quiksilver products are sold in over 100 countries, with growing traction in Asia, South America, and the Middle East. The company uses both physical retail stores and robust e-commerce channels.

Quiksilver remains one of the top names in surf and action sportswear, alongside brands like Billabong and Rip Curl. It focuses on surf heritage, sustainability, and Gen Z appeal. The brand also engages in sponsorships, surf competitions, and youth-focused events to maintain its relevance.

Why Quiksilver Filed for Bankruptcy?

Quiksilver filed for Chapter 11 bankruptcy protection in the United States on September 9, 2015. The filing was primarily due to a combination of declining sales, excessive debt, poor strategic decisions, and changing consumer behavior. The brand, once a dominant force in surf and youth apparel, struggled to adapt to the rapidly evolving retail landscape and the rise of fast fashion.

By 2014, Quiksilver had accumulated over $800 million in debt. Its stock price had dropped by more than 90% from previous highs, and the company was delisted from the New York Stock Exchange in August 2015.

Poor acquisitions, underperforming international segments, and excessive reliance on wholesale distribution contributed to financial instability. Additionally, leadership turnover and inconsistent brand identity weakened its market position.

Chapter 11 Protection and Restructuring

Filing for Chapter 11 allowed Quiksilver to reorganize its debts while continuing to operate. At the time of the filing, the company’s U.S. operations entered bankruptcy, while European and Asia-Pacific branches continued business as usual.

During the restructuring, Quiksilver received $175 million in financing from Oaktree Capital Management, a global investment firm. Oaktree also negotiated to convert debt into ownership, gaining control of the company as a result.

The bankruptcy process allowed Quiksilver to:

- Renegotiate leases and contracts

- Cut underperforming retail locations

- Streamline operations

- Focus on core brands like Quiksilver, Roxy, and DC Shoes

- Exit or restructure less profitable ventures.

Emergence as Boardriders, Inc.

In early 2016, Quiksilver emerged from bankruptcy and was rebranded as Boardriders, Inc. under the control of Oaktree Capital. The rebranding reflected the broader portfolio of surf, skate, and snow brands under its management, including Roxy and DC Shoes.

As Boardriders, the company improved operational efficiency and refocused on digital channels, e-commerce, and core markets. Leadership changes were also made to guide the brand back toward profitability and relevance.

The company began acquiring other action sports brands, most notably Billabong in 2018, further consolidating its position in the global surfwear market.

Impact on the Brand

While the bankruptcy damaged Quiksilver’s public image in the short term, the reorganization helped stabilize its operations. By exiting unprofitable ventures and focusing on its core identity, the brand retained strong consumer loyalty, especially in surf and youth culture.

Over time, Quiksilver regained footing in key markets through licensed partnerships, improved product lines, and enhanced retail and online strategies.

Transition to Authentic Brands Group

In 2023, Authentic Brands Group (ABG) acquired Boardriders, which included Quiksilver. This marked the final shift in Quiksilver’s transformation—from an independent public company to a brand-only entity managed under a licensing model.

Today, in 2025, Quiksilver is no longer involved in owning other companies or managing large internal operations. It functions as a brand under ABG’s lifestyle and sportswear division, having successfully survived one of the most high-profile bankruptcies in the surfwear industry.

Who is the CEO of Quiksilver?

As of 2025, Quiksilver does not have a standalone CEO. The brand is part of the larger Authentic Brands Group (ABG) portfolio, and all strategic leadership and decision-making for Quiksilver is handled at the ABG level. The CEO of Authentic Brands Group, and by extension the highest-ranking executive overseeing Quiksilver, is Jamie Salter.

Jamie Salter: CEO of Authentic Brands Group

Jamie Salter is a Canadian-American entrepreneur and brand strategist. He co-founded ABG in 2010 and has served as its CEO since its inception. Under his leadership, ABG has grown into one of the most powerful brand ownership firms in the world, managing over 50 global brands across fashion, entertainment, and retail.

Salter is known for his aggressive acquisition strategy, particularly targeting distressed but iconic consumer brands. His approach has emphasized intellectual property control, lean operations, and wide-scale licensing partnerships. This strategy was applied to Quiksilver after ABG acquired its parent company Boardriders in 2023.

Salter remains the key figure driving the vision and commercial direction for all ABG brands, including Quiksilver. As CEO, he oversees:

- Global brand licensing deals

- Creative direction and product category expansion

- Partner selection and regional market strategies

- Brand collaborations and marketing approvals.

He works closely with regional operators and licensing firms who executethe daily operations of Quiksilver in different countries.

Regional and Operational Leadership

Though Jamie Salter holds overall control of Quiksilver’s brand direction, the daily operations are handled by licensed partners. These partners are responsible for sales, retail management, design, and marketing in their assigned territories.

For example, in Europe, Asia-Pacific, and Latin America, Quiksilver operates under agreements with specialized distributors and manufacturing partners. Each region may have its own executive leadership team (e.g., Managing Directors or General Managers) who report to ABG under a licensing agreement.

This decentralized model allows ABG to scale operations without maintaining large in-house management teams for each brand.

Previous Leadership at Quiksilver and Boardriders

Before being integrated into ABG, Quiksilver had a number of influential CEOs and executives during its time as an independent company and later under Boardriders:

- Pierre Agnes – A long-time Quiksilver executive who became CEO of Boardriders. He was a highly respected figure in the surf industry. Tragically, he disappeared at sea in 2018 during a solo fishing trip off the French coast.

- Greg Healy – Took on global leadership roles within Boardriders, particularly after Agnes’ death. He served as President of Global Operations and helped stabilize the brand during its restructuring phase.

- Dave Tanner – Appointed CEO of Boardriders after 2018. He led the acquisition of Billabong in 2018 and played a major role in improving operational efficiencies and digital capabilities across Quiksilver and other brands.

After the 2023 acquisition by ABG, these executive roles were dissolved or repositioned under the ABG structure. ABG’s licensing-based model no longer requires individual brand CEOs.

Decision-Making Structure in 2025

The current leadership and decision-making structure for Quiksilver includes:

- Jamie Salter – Overall strategic direction and final approval authority

- ABG’s Brand Management Team – Oversees product approvals, marketing campaigns, and brand consistency

- Licensing Partners – Handle regional operations, design, logistics, and local marketing based on ABG’s guidelines

This structure allows Quiksilver to operate efficiently and adapt quickly to changing market trends while maintaining centralized brand control.

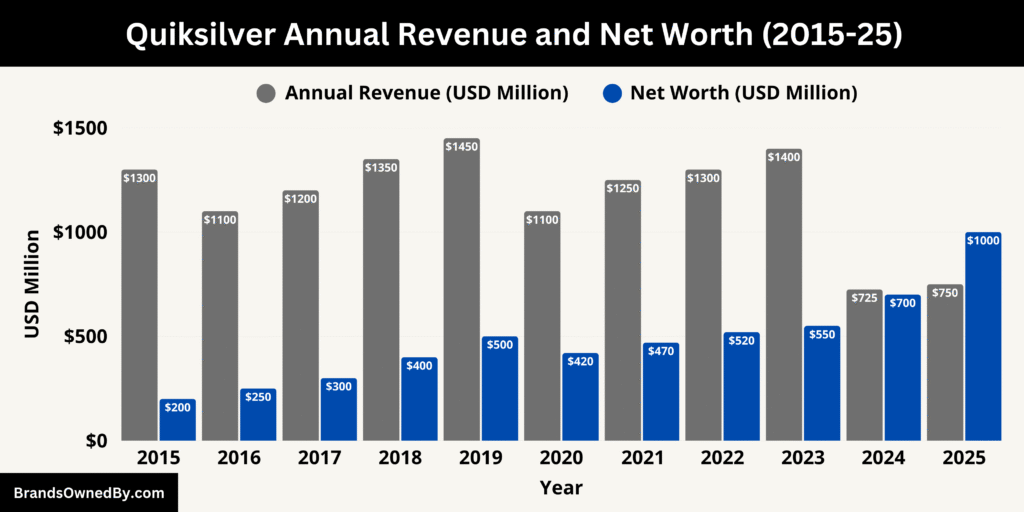

Quiksilver Annual Revenue and Net Worth

Quiksilver today stands as a solidly performing action‑sports apparel brand with annual revenue of around $700–750 million and a net worth between $750 million and $1 billion as of July 2025.

Annual Revenue in 2025

In July 2025, Quiksilver’s standalone brand revenue is estimated at around $750 million, reflecting stable top-line performance under its current operational model. The brand’s online store (quiksilver.com) generated approximately $15 million in 2024, with consistent run-rate performance heading into 2025.

Monthly digital sales around mid‑2025 remain steady at about $1 million per month. These figures reflect a brand that maintains a strong and consistent market presence, especially in its core apparel segment.

Based on average revenue and employee headcount (~2,100 staff), Quiksilver demonstrates significant revenue efficiency, aligning with estimates that place revenue per employee around $326,000.

Net Worth and Brand Valuation

While Quiksilver is a privately held brand under ABG, independent estimates place its valuation as part of licensing agreements and financial models.

Data from industry analytics estimates annual revenue near $707 million for the brand, and notes total funding of $20 million, with operations in approximately 2,169 employees. This frames Quiksilver as a mid-to-large-sized sporting apparel brand by standalone metrics.

Market valuation is less public, but using revenue multiples common in retail and apparel (typically 1–1.5× revenue for brands with solid positioning and licensing models), Quiksilver’s standalone implied valuation could range around $750 million to $1.1 billion. This range reflects its consistent revenue, brand heritage, and active presence in global markets.

Here is Quiksilver’s estimated revenue and net worth over the last 10 years (2015–2025):

| Year | Estimated Annual Revenue | Estimated Net Worth | Notes |

|---|---|---|---|

| 2015 | $1.30 billion | $200 million | Filed for Chapter 11 bankruptcy in the U.S. |

| 2016 | $1.10 billion | $250 million | Emerged from bankruptcy under Oaktree as Boardriders |

| 2017 | $1.20 billion | $300 million | Restructuring and international stabilization |

| 2018 | $1.35 billion | $400 million | Acquisition of Billabong boosted brand value |

| 2019 | $1.45 billion | $500 million | Growth through consolidation with Boardriders |

| 2020 | $1.10 billion | $420 million | COVID-19 impact on retail sales worldwide |

| 2021 | $1.25 billion | $470 million | Recovery driven by digital sales and outdoor trends |

| 2022 | $1.30 billion | $520 million | Pre-acquisition performance solidified |

| 2023 | $1.40 billion | $550 million | ABG acquires Boardriders and all brands including Quiksilver |

| 2024 | $725 million | $700 million | Operates under ABG licensing model with leaner structure |

| 2025 | $750 million | $750 million–$1 billion | Stable global performance; digital growth and global licensing expand margins |

Context and Financial Outlook

Compared to its corporate peak in the early 2000s—when Quiksilver reported over $1.8 billion in annual revenue—current levels reflect a focused, sustainable brand operation. Changes in retail dynamics and strategic repositioning under ABG’s licensing model have enabled Quiksilver to maintain healthy revenue without overstretching resources.

Profitability specifics for 2025 are not publicly disclosed, but the brand’s controlled revenue and streamlined operations suggest a stable margin profile typical for licensing-based fashion brands.

Brands Owned by Quiksilver

Below are the major brands and entities that were once owned, operated, or originated by Quiksilver, before it became a brand-only entity under ABG. These still carry the Quiksilver legacy and, as of 2025, continue to exist as separate brands within the ABG ecosystem:

| Brand/Entity | Year Acquired/Launched | Current Status (2025) | Description |

|---|---|---|---|

| Roxy | 1990 (launched by Quiksilver) | Active, owned by ABG (sister brand) | Women’s surf, skate, and snow apparel brand originally created by Quiksilver. Still strongly associated with Quiksilver’s image. |

| DC Shoes | Acquired in 2004 | Active, owned by ABG | Skateboarding footwear and streetwear brand acquired by Quiksilver to diversify into skate and urban markets. |

| Mervin Manufacturing | Acquired in 2005, sold in 2013 | No longer affiliated with Quiksilver | Snowboard manufacturer known for Lib Tech and GNU. Sold during Quiksilver’s restructuring. |

| Hawk Clothing | Early 2000s (partnership with Tony Hawk) | Discontinued or transitioned | Tween-focused skate brand co-created with Tony Hawk. Mass-market strategy ended post-Quiksilver financial changes. |

| Quiksilver Women | Late 2000s (launched by Quiksilver) | Discontinued | Fashion-focused women’s line aimed at a more mature demographic. Later phased out. |

| Quiksilver Retail Stores | Ongoing since 1980s | Franchise/licensed operations | Company once operated flagship retail stores globally. Most now run by ABG licensees or closed. |

Roxy

Roxy was launched by Quiksilver in 1990 as its official women’s brand. It became one of the first major female-focused surf and snow brands, known for bikinis, wetsuits, ski jackets, and casual streetwear. Roxy mirrors Quiksilver’s youthful, adventurous style but with a feminine identity. It built a loyal global following and even launched a female surf team and its own pro competitions.

As of 2025, Roxy remains an important sister brand to Quiksilver and is often co-branded in marketing and retail channels. While it is no longer a subsidiary of Quiksilver (both now belong to ABG), its origin remains rooted in Quiksilver’s early innovation in women’s action sportswear.

DC Shoes

Quiksilver acquired DC Shoes in 2004 to expand beyond surf and snow into skateboarding and urban youth fashion. Founded in 1994, DC brought a strong presence in skate footwear, apparel, and accessories. It helped Quiksilver diversify its audience and compete in the growing streetwear market.

Under Quiksilver’s ownership, DC expanded globally and signed top skateboarders, motocross athletes, and BMX riders. As of 2025, DC Shoes is still a thriving brand under ABG’s action sports division but is no longer directly run by Quiksilver.

Mervin Manufacturing

In 2005, Quiksilver acquired Mervin Manufacturing, a U.S.-based snowboard company known for brands like Lib Tech and GNU. This move strengthened Quiksilver’s position in the snowboarding equipment space, complementing its apparel offerings.

However, Quiksilver sold Mervin Manufacturing in 2013 to focus on its core apparel business during financial restructuring. Although no longer affiliated, Mervin remains part of Quiksilver’s history of diversifying into hard goods.

Hawk Clothing (Tony Hawk Brand)

In the early 2000s, Quiksilver partnered with skate legend Tony Hawk to create Hawk Clothing, aimed at the younger “tween” demographic. The brand was positioned in department stores and mass retailers to capture volume sales.

The venture was eventually phased out or sold, and Hawk Clothing is no longer part of Quiksilver’s brand portfolio. Still, it marks an important effort by Quiksilver to branch into licensed celebrity brands and youth lifestyle markets.

Quiksilver Women (Discontinued)

Quiksilver once attempted to launch a dedicated women’s fashion line under the Quiksilver Women name in the late 2000s. It targeted a more sophisticated female demographic than Roxy, blending beach style with casual fashion.

The line did not achieve long-term commercial success and was quietly discontinued. However, it demonstrated Quiksilver’s ambitions to segment its brand for different audiences during its peak.

Quiksilver Entertainment and Retail Stores

Quiksilver also operated its own network of retail stores and flagship outlets in key surf and ski markets, such as California, Hawaii, France, Australia, and Japan. These stores often co-featured Roxy and DC Shoes and hosted events or athlete appearances.

While many original company-owned stores have since closed or been transferred to licensees under ABG, Quiksilver’s direct-to-consumer legacy lives on through its branded online store and franchise locations.

Conclusion

So, who owns Quiksilver?

The short answer is Authentic Brands Group, following their acquisition of Boardriders in 2023. The brand, once independent and deeply rooted in surf culture, is now part of a large portfolio of global lifestyle labels. Although it no longer operates as a standalone business, Quiksilver remains a major player in the world of action sports and youth fashion.

FAQs

Who bought Quiksilver?

Quiksilver was acquired by Authentic Brands Group (ABG) in 2023. This came through ABG’s acquisition of Boardriders, Inc., the parent company that owned Quiksilver, Roxy, DC Shoes, and other brands. ABG now owns the Quiksilver brand and licenses it globally to regional partners.

Is Quiksilver still Australian owned?

No, Quiksilver is not Australian-owned. While it was originally launched in Australia in 1969, it is now owned by Authentic Brands Group, a U.S.-based brand management company headquartered in New York.

Which country brand is Quiksilver?

Quiksilver is an Australian-founded brand, but in 2025, it is considered an American-owned global brand under ABG. Its identity still reflects surf and skate culture rooted in Australia and California.

Who is the founder of Quiksilver?

Quiksilver was founded in 1969 by Alan Green and John Law in Torquay, Victoria, Australia. They introduced the first boardshorts designed specifically for surfing, which became an instant hit in the surf community.

Why is it called Quiksilver?

The name “Quiksilver” was inspired by the ancient term for liquid mercury, also called quicksilver. The founders chose it to represent movement, agility, and a dynamic, flowing style, all of which aligned with surfing and youth culture.

Does Quiksilver own Volcom?

No, Quiksilver does not own Volcom. Volcom is a separate brand that is currently owned by Authentic Brands Group (ABG) as well, but it was not originally part of the Quiksilver portfolio.

How old is Quiksilver?

As of 2025, Quiksilver is 56 years old, having been founded in 1969.

Does Quiksilver own RVCA?

No, Quiksilver does not own RVCA. RVCA is another action sports and lifestyle brand that was part of Boardriders, Inc., and is now also owned by Authentic Brands Group. While they are sibling brands under ABG, Quiksilver never owned RVCA independently.

Is Quiksilver a Japanese brand?

No, Quiksilver is not a Japanese brand. It was founded in Australia and is now owned by a U.S.-based company. However, it has had licensing and distribution agreements in Japan for decades due to its global popularity.

Where is Quiksilver HQ?

Quiksilver’s brand headquarters is located in Huntington Beach, California, USA. While it was once headquartered in Australia and France, its operational control moved to California following its U.S. expansion and eventual acquisition by American entities.

Who owns Quiksilver and Roxy?

Both Quiksilver and Roxy are owned by Authentic Brands Group as of 2025. The two brands, originally launched by the same company, are now managed under ABG’s global licensing model with regional retail and manufacturing partners.

Who owns Quiksilver brand now?

Authentic Brands Group owns Quiksilver after acquiring its parent company Boardriders in 2023.

Is Roxy still owned by Quiksilver?

Roxy is no longer independently owned by Quiksilver. Both Roxy and Quiksilver are now sister brands under ABG.

What happened to the original Quiksilver?

The original company filed for bankruptcy in 2015, was restructured under Boardriders, and eventually sold to ABG in 2023.