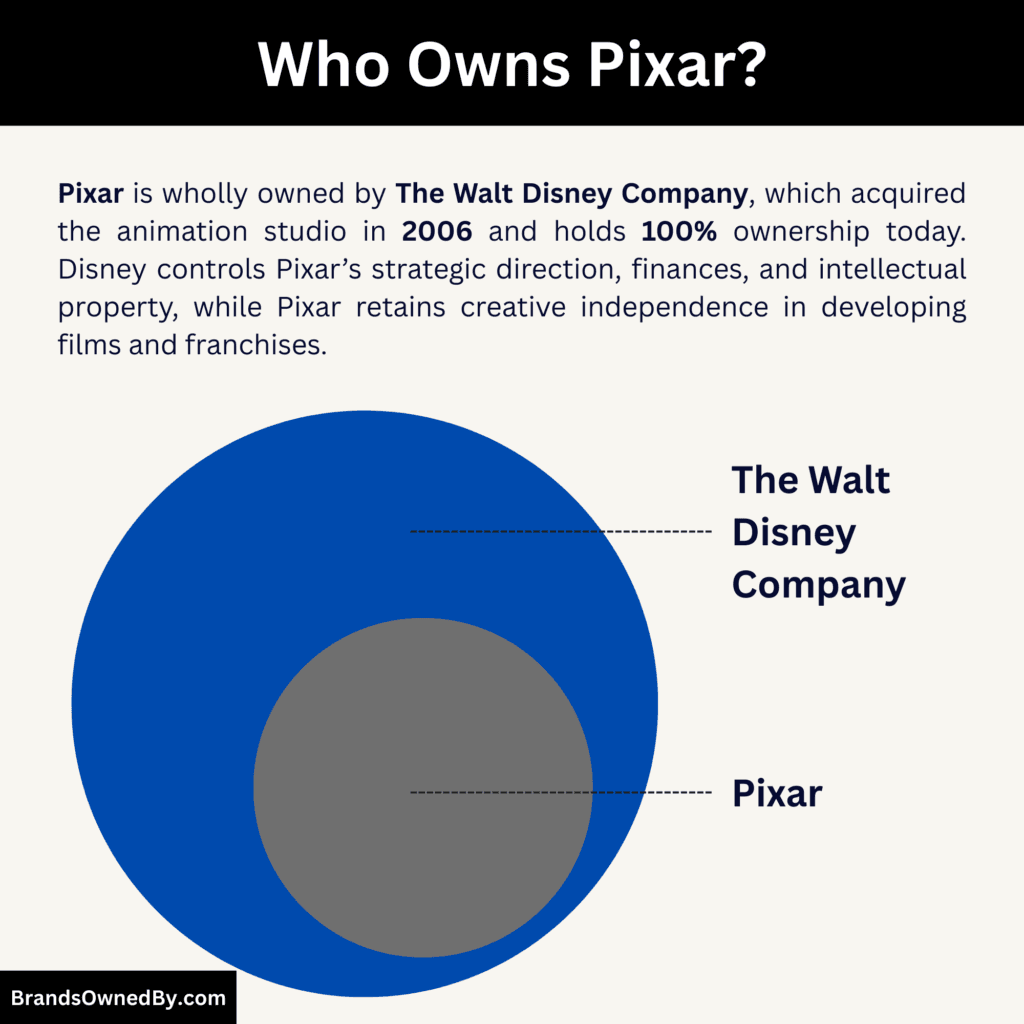

- Pixar is 100% owned by The Walt Disney Company, making it a wholly owned subsidiary with no independent shareholders, stock listing, or separate public ownership structure.

- Ownership of Pixar is exercised indirectly through Disney shareholders, with large institutional investors in Disney holding economic exposure to Pixar but no direct control over its operations or creative output.

- Disney retains full strategic, financial, and intellectual property control, while Pixar maintains internal creative autonomy over storytelling, production, and franchise development.

- Pixar’s ownership model combines corporate stability and creative independence, allowing it to build long-term, high-value franchises without shareholder-driven pressure at the studio level.

Pixar Animation Studios is a leading American animation studio known for producing pioneering and critically acclaimed computer-animated feature films. The studio is based in Emeryville, California, and operates as a creative hub within the entertainment industry. Pixar’s work spans feature films, short films, and special projects that emphasize innovative animation technology and emotionally engaging storytelling.

From its beginnings as a technology division to its status today as a key creative unit of The Walt Disney Company, Pixar has consistently pushed the boundaries of digital animation. Its films often combine compelling characters, original narratives, and cutting-edge technical achievements. Pixar’s name has become synonymous with quality storytelling and artistic excellence in modern animation.

Pixar Founders

Pixar’s early history is anchored by pioneers who shaped both its technological and creative legacy.

Edwin “Ed” Catmull

Ed Catmull is a computer scientist and one of the principal founders of what would become Pixar. He played a central role in advancing computer graphics research during the 1970s and early 1980s while at the New York Institute of Technology and later at Lucasfilm. Catmull’s work focused on creating systems to render 3D images and animate them with realism. His vision was that computers could be used not only for graphics technology but also for storytelling.

After Pixar became a stand-alone company, Catmull served as its president and later as president of both Pixar and Walt Disney Animation Studios following the Disney acquisition. He was instrumental in establishing the studio’s culture of innovation and in bridging technological development with creative processes.

Alvy Ray Smith

Alvy Ray Smith was a co-founder alongside Catmull. Smith’s contributions were foundational in computer graphics theory and practice. His work helped develop early algorithms and systems that became the basis for digital image creation. At Pixar’s earliest stages, Smith contributed to the development of its core rendering technologies.

While Smith left the company before its major commercial successes, his early work influenced the studio’s technical direction and its approach to integrating art and computation.

Steve Jobs

Steve Jobs is often the figure most publicly associated with Pixar’s rise, though he was not a technical founder. In 1986, Jobs purchased the computer graphics division from Lucasfilm for $10 million and became the majority shareholder. He provided crucial financial backing and business direction during Pixar’s early years as an independent studio.

Jobs believed that Pixar could transform animated filmmaking. He supported a long-term strategy that focused on quality over quantity, even when success was not yet assured. Under his stewardship, Pixar established a distribution partnership with The Walt Disney Company and later produced the first computer-animated feature film, Toy Story. Jobs remained deeply involved in Pixar’s growth until its acquisition by Disney in 2006.

Major Milestones

Below is a chronological list of major milestones in Pixar’s history:

- 1979: The Graphics Group is formed as part of Lucasfilm’s Computer Division, focusing on computer animation and graphics research.

- 1986: Steve Jobs acquires the division from Lucasfilm, renames it Pixar, and establishes it as an independent company.

- 1988: Pixar signs a contract with Disney to produce and distribute a series of animated feature films.

- 1995: Toy Story is released as the world’s first feature-length computer-animated film. It becomes a breakthrough success and establishes Pixar’s reputation.

- 1998: A Bug’s Life is released, further showcasing Pixar’s storytelling and technological capabilities.

- 1999: Toy Story 2 debuts, reinforcing the studio’s ability to produce compelling sequels.

- 2001: Monsters, Inc. is released and receives critical and commercial acclaim.

- 2003: Finding Nemo wins the Academy Award for Best Animated Feature.

- 2004: The Incredibles becomes a cultural phenomenon, blending family themes with superhero action.

- 2006: Pixar is acquired by The Walt Disney Company; Ed Catmull and John Lasseter assume leadership roles across both Pixar and Disney Animation.

- 2007: Ratatouille releases, reinforcing Pixar’s reputation for original storytelling.

- 2009: Up earns multiple Academy Awards and becomes one of Pixar’s most emotionally resonant films.

- 2010: Toy Story 3 is released, concluding the original trilogy with widespread acclaim.

- 2012: Brave marks Pixar’s first film with a female protagonist in a leading role.

- 2015: Inside Out is praised for its innovative approach to exploring human emotions.

- 2017: Coco celebrates Mexican culture and wins multiple Oscars.

- 2018: Incredibles 2 continues a beloved franchise with strong box office performance.

- 2020: Soul premieres, exploring existential themes and expanding Pixar’s narrative depth.

- 2022: Lightyear offers an origin story for a key Toy Story character.

- 2023–2026: Pixar continues releasing new original films and sequels while advancing animation techniques and storytelling approaches within Disney’s broader ecosystem.

Ownership Snapshot

Pixar Animation Studios operates today as a wholly owned subsidiary of The Walt Disney Company. Since the acquisition in 2006, Pixar has not existed as a separate public company with its own shares. Instead, it is legally and financially part of Disney’s corporate framework.

The acquisition was structured as an all-stock deal, which transferred ownership of Pixar into Disney’s corporate umbrella. As a subsidiary, Pixar retains its name, creative culture, and studio location while aligning with Disney’s broader strategic and operational goals.

Corporate Structure and Role

Within Disney, Pixar belongs to the Disney Entertainment division. This segment oversees most of Disney’s narrative content creation, including live-action, animated, and streaming content. Pixar works closely with Disney’s distribution and marketing arms to release films globally. Pixar’s films are branded under the “Disney·Pixar” label, reflecting this integrated relationship.

Because Pixar is wholly owned by Disney, it does not issue stock independently. Instead, Pixar’s ownership flows through Disney’s equity structure. Disney itself is publicly traded on the New York Stock Exchange under the ticker symbol DIS. Therefore, anyone who owns Disney stock indirectly participates in the ownership of Pixar and all other Disney subsidiaries.

Major Disney Shareholders

Disney’s share structure is broadly held, meaning no single entity controls a majority of voting power outright.

Most shares are held by institutional investors, which collectively own a large portion of Disney’s stock. Vanguard Group, BlackRock, and State Street are among the largest institutional holders.

Other major entities, including JPMorgan Investment Management and various mutual funds, also hold material stakes. Individual shareholders and company insiders own smaller portions relative to institutions.

Institutional shareholders hold the greatest influence over Disney’s corporate governance. They appoint board members, influence executive oversight, and help shape long-term strategy through voting at annual meetings.

Because Disney owns Pixar, these institutional stakeholders indirectly influence Pixar’s oversight as part of Disney’s overall portfolio. However, they do not manage Pixar’s operational decisions day-to-day.

Continuing Cultural Autonomy

Part of Disney’s acquisition agreement preserved Pixar’s internal culture and creative processes. Disney agreed to maintain Pixar’s location, name, and core policies, ensuring that the studio’s unique approach to animation and storytelling remained intact despite the change in ownership.

This structural distinction has allowed Pixar to innovate while benefiting from the financial and distribution strength of a global entertainment leader.

Ownership History

Pixar’s ownership history is closely tied to the evolution of modern computer animation. It reflects a gradual shift from research-driven experimentation to creative independence and finally to full integration within a global entertainment company.

Each ownership phase shaped how Pixar operated, how much control it had over its creations, and how it positioned itself in the animation industry. Understanding this timeline provides deeper clarity on how Pixar moved from a small graphics unit to a cornerstone studio within Disney.

Early Roots Inside Lucasfilm (1979–1985)

Pixar’s story began inside Lucasfilm, not as a movie studio but as a research-focused graphics group. The division was created to explore advanced computer imagery for film and visual effects. At the time, computer animation was experimental and costly. There was no proven commercial model for feature-length CGI films.

The team focused on developing rendering techniques, image compositing tools, and early 3D animation systems. Much of this work laid the technical foundation for modern digital filmmaking. However, Lucasfilm viewed the group as a research expense rather than a core revenue driver. This eventually led to the decision to sell the unit.

Independence Through Steve Jobs’ Acquisition (1986)

In 1986, Steve Jobs purchased the Graphics Group from Lucasfilm. This transaction formally created Pixar Animation Studios as an independent company. Jobs became the majority owner and chairman. His involvement was critical because Pixar was not profitable at the time.

During this period, Pixar focused on selling high-end graphics computers and animation software. The company also produced short films to showcase its technology. These shorts helped establish Pixar’s creative identity, even though the business model remained uncertain. Jobs funded Pixar for years with little financial return, allowing the team to prioritize long-term vision over short-term results.

Strategic Partnership With Disney (Early 1990s)

Pixar’s ownership remained private, but its future changed after forming a distribution partnership with The Walt Disney Company. The deal allowed Pixar to produce feature-length animated films while Disney handled marketing and distribution.

Although Pixar created the films, Disney retained significant control over distribution and sequel rights under the original agreement. Pixar was still independently owned, but its commercial success became tied to Disney’s infrastructure. This phase proved that computer-animated films could succeed at a global scale, beginning with Toy Story.

Rising Success and Ownership Tensions (Late 1990s–2005)

As Pixar released hit after hit, its bargaining power increased. Films such as Finding Nemo and The Incredibles transformed Pixar into one of the most respected studios in Hollywood. Despite this success, ownership-related tensions emerged.

Pixar sought greater control over its intellectual property and a more balanced financial arrangement. Disney wanted to protect its animation dominance and retain sequel rights. These disagreements did not end the partnership, but they highlighted the limitations of Pixar remaining independent while relying heavily on Disney for distribution.

Disney’s Full Acquisition of Pixar (2006)

In 2006, Disney acquired Pixar in an all-stock transaction. This deal made Pixar a wholly owned subsidiary of Disney. Pixar shareholders exchanged their shares for Disney stock, effectively ending Pixar’s status as an independent company.

The acquisition was structured to preserve Pixar’s creative culture. Key Pixar leaders were integrated into Disney’s animation leadership. This was not a traditional absorption. Instead, Disney positioned Pixar as a creative driver for its broader animation strategy.

Ownership Structure After the Acquisition (2006–Present)

Since the acquisition, Pixar has remained fully owned by Disney. It does not issue stock, have outside investors, or operate as a separate public entity. All ownership flows through Disney’s corporate structure.

While Disney owns Pixar outright, Pixar retains internal decision-making authority over storytelling and production processes. Major corporate decisions, budgets, and long-term strategy are approved at the Disney level. This hybrid structure allows Pixar to function creatively as a studio while benefiting from Disney’s scale and global reach.

Who Owns Pixar in 2026?

Pixar Animation Studios is a wholly owned subsidiary of The Walt Disney Company. Disney holds 100% ownership of Pixar, meaning Pixar has no independent equity, no public stock, and no outside investors.

Pixar does not operate as a separate legal corporation for ownership purposes. It is fully consolidated into Disney’s corporate structure. All assets, intellectual property, trademarks, film libraries, and future productions are legally owned by Disney.

Pixar therefore does not have its own shareholders, annual shareholder meetings, or independent filings. Any ownership interest in Pixar exists only indirectly through ownership of Disney stock.

Parent Company: The Walt Disney Company

Pixar sits within Disney’s studio and content operations as a standalone creative studio, not as a general internal department. This distinction is critical.

Pixar operates from its dedicated campus in Emeryville, California. It maintains its own production pipelines, proprietary animation tools, internal review systems, and long-term creative planning processes. Disney does not manage Pixar at the scene-by-scene or script level.

At the same time, Pixar is deeply integrated into Disney’s broader ecosystem. Disney oversees:

- Capital allocation and long-term investment planning

- Global theatrical and streaming distribution

- Marketing, licensing, and merchandising

- Theme park and experiential integration

- Franchise expansion across platforms.

This structure allows Pixar to remain creatively autonomous while Disney handles scale, monetization, and global reach.

Acquisition Background and Pre-Deal Context

Before the acquisition, Pixar was independently owned but commercially dependent on Disney. Pixar and Disney operated under distribution agreements that governed how Pixar films were released, marketed, and monetized.

While Pixar created the films, Disney controlled distribution and retained significant sequel and branding rights under earlier contracts. As Pixar’s films became increasingly successful, this imbalance became a growing point of tension.

Negotiations between the two companies became strained in the early 2000s. Pixar sought greater control over its intellectual property and long-term creative future. Disney, meanwhile, recognized that Pixar had become central to its animation success.

This environment set the stage for acquisition discussions rather than continued contract renegotiations.

Acquisition Terms, Cost, and Agreement Structure

Disney officially acquired Pixar in 2006 through an all-stock transaction valued at approximately $7.4 billion at the time of announcement.

Key details of the agreement included:

- Pixar shareholders received 2.3 shares of Disney stock for every Pixar share they owned

- No cash was exchanged

- Pixar ceased to exist as an independent publicly traded company

- Pixar equity was fully absorbed into Disney.

The deal instantly transformed Pixar shareholders into Disney shareholders. This made Pixar’s long-term success directly tied to Disney’s overall performance rather than to a separate corporate entity.

Strategic Objectives Behind the Acquisition

For Disney, the acquisition secured permanent ownership of Pixar’s creative engine. It eliminated reliance on external contracts for animated features and ensured that Pixar’s talent, technology, and storytelling pipeline would remain in-house.

Disney also used the acquisition to reinvigorate its animation leadership. Pixar had consistently delivered both critical acclaim and cultural relevance at a time when Disney’s internal animation output was uneven.

For Pixar, the acquisition delivered stability. It removed the uncertainty of renegotiating distribution agreements and allowed Pixar to focus entirely on storytelling without concerns over ownership of sequels or franchise continuity.

Leadership and Governance Commitments

The acquisition was not structured as a traditional takeover. Pixar’s leadership played a central role in shaping the deal.

As part of the agreement:

- Pixar’s leadership assumed senior creative authority across Disney animation

- Pixar retained its studio identity, name, and location

- Pixar’s internal culture and production philosophy were contractually respected.

This governance approach was deliberate. Disney recognized that Pixar’s value was inseparable from its culture. Absorbing Pixar too aggressively risked damaging the very asset Disney was acquiring.

Post-Acquisition Ownership Integration

After the acquisition closed, Pixar became a fully consolidated Disney subsidiary for accounting, governance, and reporting purposes.

All Pixar films, including those created before 2006, became Disney-owned intellectual property. Disney gained full control over:

- Licensing and merchandise rights

- Theme park usage and attractions

- Global brand exploitation

- Streaming distribution and platform exclusivity.

Pixar continued to manage creative development internally. However, release strategies, franchise planning, and long-term investment decisions were coordinated with Disney’s corporate leadership.

Indirect Ownership Through Disney Shareholders

Because Disney is publicly traded, Pixar is indirectly owned by Disney’s shareholders. These include institutional investors, asset managers, pension funds, and individual investors.

No shareholder owns Pixar directly. Ownership influence exists only at the Disney level through corporate governance mechanisms such as board elections and executive oversight.

Pixar’s creative operations are insulated from shareholder involvement. Investors do not influence scripts, directors, or story decisions.

Creative Autonomy Within Ownership Control

One of the defining characteristics of Pixar’s ownership structure is the balance between full corporate ownership and creative independence.

Pixar controls:

- Story development and original concepts

- Director and creative team selection

- Internal review and iteration processes

- Production methodology and technology.

Disney controls:

- Budget approvals and capital investment

- Distribution channels and release timing

- Franchise extensions and brand strategy

- Cross-platform integration.

This division of control has allowed Pixar to remain creatively distinct while operating inside a global media corporation.

Pixar’s ownership is considered highly stable. As a cornerstone of Disney’s animation strategy and a source of enduring intellectual property, Pixar is not positioned for divestment, spin-offs, or restructuring.

Disney views Pixar as a long-term creative asset rather than a financial holding. This makes any change in ownership extremely unlikely under current conditions.

Competitor Ownership Comparison

Understanding who owns Pixar becomes clearer when it is compared with how other major animation studios are owned and structured. Pixar’s position as a fully owned subsidiary of a diversified media conglomerate is common in the industry, but the degree of creative autonomy it enjoys is relatively distinctive.

| Animation Studio | Parent Company | Ownership Type | Level of Creative Autonomy | Ownership Stability | Key Ownership Characteristics |

|---|---|---|---|---|---|

| Pixar Animation Studios | The Walt Disney Company | Wholly owned subsidiary | High | Very high | Fully owned by Disney but operates as an independent creative studio with its own campus, leadership, and storytelling authority |

| Walt Disney Animation Studios | The Walt Disney Company | Internal division | Moderate | Very high | Always part of Disney; more directly integrated into corporate animation strategy |

| DreamWorks Animation | NBCUniversal (Comcast) | Wholly owned subsidiary | Moderate | Medium | Ownership influenced by broader Comcast strategy; creative direction has shifted over time |

| Illumination | NBCUniversal (Comcast) | Wholly owned subsidiary | Lower | High | Operates under a cost-efficient, franchise-first model with strong financial oversight |

| Sony Pictures Animation | Sony Group Corporation | Wholly owned subsidiary | Moderate | Medium | More decentralized creative strategy; output varies based on market performance |

| Warner Bros. Animation | Warner Bros. Discovery | Internal studio division | Moderate | Lower | Ownership shaped by mergers and restructuring; creative continuity can be affected |

Pixar vs. Walt Disney Animation Studios

Pixar and Walt Disney Animation Studios are often grouped together, but their origins and ownership histories differ.

Pixar is an acquired studio that became part of The Walt Disney Company in 2006. Walt Disney Animation Studios, by contrast, has always been an internal Disney unit.

Both studios are now fully owned by Disney. However, Pixar retains a more independent studio culture, separate leadership structures, and its own production campus. Disney Animation is more tightly integrated into Disney’s corporate hierarchy. This difference influences how films are developed, reviewed, and approved.

Pixar vs. DreamWorks Animation

DreamWorks Animation is owned by NBCUniversal, which itself is a subsidiary of Comcast.

DreamWorks operates as a label within a large corporate structure similar to Pixar’s relationship with Disney. However, DreamWorks has experienced more frequent strategic shifts. These include changes in leadership, release strategies, and increased emphasis on franchise-driven content.

Pixar, in comparison, benefits from a more stable ownership environment. Disney positions Pixar as a long-term creative engine rather than a flexible production label, which allows Pixar to take more narrative risks.

Pixar vs. Illumination

Illumination is also owned by NBCUniversal. Unlike Pixar, Illumination follows a lean production model focused on cost efficiency and broad commercial appeal.

Illumination’s ownership structure places a stronger emphasis on financial performance and franchise scalability. Pixar, while commercially successful, is allowed greater freedom to pursue emotionally complex stories and experimental concepts.

This contrast highlights how ownership philosophy influences creative output. Pixar’s Disney-backed model prioritizes brand longevity and storytelling depth over rapid production cycles.

Pixar vs. Sony Pictures Animation

Sony Pictures Animation is owned by Sony Group Corporation.

Sony Pictures Animation operates within Sony’s film and television segment. It competes directly with Pixar in theatrical animation but often relies on stylistic experimentation and partnerships.

Sony’s ownership approach is more decentralized. Studios may shift creative direction based on performance cycles. Pixar, by contrast, benefits from Disney’s long-term commitment to animation as a core business pillar.

Pixar vs. Warner Bros. Animation

Warner Bros. Animation is owned by Warner Bros. Discovery.

Warner Bros. Animation spans theatrical films, television, and streaming-focused content. Its ownership structure has been shaped by mergers and restructurings, which can affect creative continuity.

Pixar’s ownership under Disney has been comparatively stable. This stability allows Pixar to plan multi-year development cycles without major disruptions caused by corporate restructuring.

Key Differences in Ownership Models

Across the animation industry, most major studios are owned by large media conglomerates. The key differences lie in how ownership is exercised.

Pixar stands out because Disney deliberately limits interference in Pixar’s creative decision-making. Other studios often face tighter financial controls, faster production mandates, or frequent shifts in leadership direction.

Pixar’s ownership model blends full corporate control with creative insulation. This balance is one of the primary reasons Pixar has maintained a consistent brand identity despite operating inside one of the world’s largest entertainment companies.

Competitive Implications

From a competitive standpoint, Pixar’s ownership gives it structural advantages. Disney’s global distribution network, marketing scale, and franchise infrastructure amplify Pixar’s reach.

At the same time, Pixar’s creative independence allows it to compete not just on brand power, but on storytelling quality. This combination places Pixar in a uniquely strong position relative to other animation studios with more restrictive or volatile ownership arrangements.

Who Controls Pixar?

Control of Pixar is layered. It combines Disney’s corporate authority with Pixar’s internal creative leadership. This structure explains why Pixar feels independent while still operating inside a global media company.

Ultimate Corporate Control by Disney

At the highest level, Pixar is controlled by The Walt Disney Company. Disney owns Pixar outright and therefore holds final authority over governance, long-term strategy, and major corporate decisions.

Disney’s board of directors and senior executives approve high-level matters that affect Pixar. These include long-term investment planning, release strategies, integration with Disney’s streaming platforms, and franchise expansion into theme parks and consumer products.

However, Disney does not manage Pixar’s creative work directly. Its control is exercised at a strategic and structural level rather than at a day-to-day production level.

Pixar’s Internal Leadership Structure

Pixar operates with its own internal leadership team that manages daily operations, creative development, and studio culture. This internal structure is critical to how Pixar maintains its identity.

Pixar does not have a traditional standalone CEO. Instead, leadership responsibilities are distributed among senior creative and operational executives who report to Disney’s studio leadership.

The most influential internal role at Pixar is the Chief Creative Officer.

Role of the Chief Creative Officer

The Chief Creative Officer of Pixar is Pete Docter. He oversees all creative output at the studio. This includes story development, director selection, film greenlighting, and overall creative direction.

Pete Docter is deeply involved in Pixar’s internal review process, often referred to as the “brain trust” model. This system emphasizes peer feedback, iteration, and long-term story refinement rather than top-down mandates.

In addition to his Pixar role, Docter also serves as Chief Creative Officer of Walt Disney Animation Studios. This dual position gives him influence across Disney’s animation strategy while still protecting Pixar’s creative autonomy.

Production and Operational Management

Beyond creative leadership, Pixar has senior executives responsible for production, technology, and studio operations. These leaders manage schedules, staffing, animation pipelines, and internal tools.

Operational decisions are made inside Pixar, not at Disney headquarters. This includes how films are produced, how teams are structured, and how technology is developed.

Disney’s involvement at this level is limited to budget approvals and long-term capacity planning rather than operational micromanagement.

Disney Studio-Level Oversight

Pixar ultimately reports to Disney’s studio entertainment leadership. Senior Disney executives coordinate release timing, marketing strategy, and alignment with Disney’s broader content calendar.

This layer ensures that Pixar films fit within Disney’s global distribution and branding strategy. It also allows Disney to coordinate Pixar releases with other major studio projects to avoid internal competition.

While Disney has approval authority at this level, it typically does not override Pixar’s creative decisions unless they involve significant strategic or brand-level implications.

Historical Leadership and Control Evolution

Pixar’s current control structure is shaped by its leadership history.

Ed Catmull played a foundational role in defining Pixar’s management philosophy. As president for many years, he emphasized collaboration, creative trust, and technological innovation.

John Lasseter was another key figure in Pixar’s creative leadership. He helped establish Pixar’s storytelling standards and internal review culture during its formative years.

After Disney acquired Pixar, both Catmull and Lasseter were given authority across Disney animation. This decision ensured that Pixar’s leadership philosophy influenced Disney rather than being diluted by it.

Decision-Making Model at Pixar

Pixar uses a collaborative decision-making model rather than a strict executive hierarchy. Creative decisions emerge through internal reviews, director feedback sessions, and collective problem-solving.

Final creative calls rest with Pixar’s internal leadership, not Disney executives. This model is intentionally designed to reduce creative risk and encourage experimentation.

Disney’s role is to evaluate outcomes, not dictate creative inputs.

Control vs. Ownership Distinction

A key distinction in understanding who controls Pixar is separating ownership from control.

Disney owns Pixar completely. That ownership gives Disney ultimate authority. However, control over creative content, storytelling, and production remains largely within Pixar.

This separation is one of the main reasons Pixar has maintained a consistent creative identity despite being part of a large corporation.

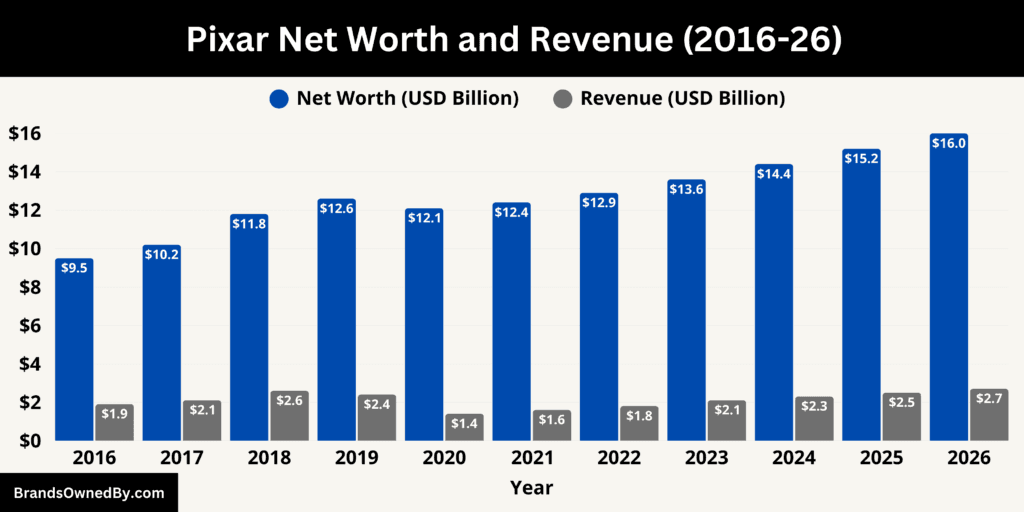

Pixar Annual Revenue and Net Worth

As of January 2026, Pixar remains one of the most commercially powerful animation studios in the global entertainment industry. Pixar’s estimated annual revenue in 2026 is around $2.7 billion, while its overall brand net worth is estimated at approximately $16.0 billion. These figures reflect the studio’s multi-decade film library, globally recognized franchises, and continued demand across theaters, streaming platforms, consumer products, and theme park experiences.

Although Pixar operates under its parent company, The Walt Disney Company, its revenue and brand value can be assessed independently based on Pixar-specific films, characters, and franchises.

Pixar Revenue 2026

Pixar’s $2.7 billion estimated revenue in 2026 is distributed across four primary channels.

Theatrical box office accounts for approximately $1.05 billion, representing about 39% of total revenue. This includes Pixar feature film releases in global theaters, international box office runs, and residual theatrical income from late-cycle releases.

Streaming and digital distribution contribute roughly $620 million, or 23% of total revenue. This figure reflects the attributed value of Pixar titles on Disney’s streaming platforms, including exclusive releases, library consumption, and subscriber retention impact directly linked to Pixar content.

Consumer products and licensing generate an estimated $710 million, making up 26% of total revenue. This includes toys, apparel, publishing, digital games, and licensed merchandise tied to Pixar franchises such as Toy Story, Cars, Monsters, Inc., and Inside Out.

Theme parks, attractions, and experiential revenue contribute about $320 million, or 12% of total revenue. This comes from Pixar-branded rides, themed lands, live experiences, and character integrations across Disney parks and resorts globally.

This revenue structure shows that Pixar is no longer box-office dependent. Over 60% of its 2026 revenue comes from non-theatrical, recurring sources.

Historical Revenue Trend (2016–2026)

Pixar’s revenue growth over the last decade shows a clear structural evolution rather than volatility.

In 2016, Pixar’s estimated revenue stood at $1.9 billion, with nearly 58% coming from theatrical releases. By 2019, revenue had grown to $2.4 billion, driven by franchise sequels, with theatrical still accounting for over 50%.

During 2020–2021, revenue declined to a low of $1.4–$1.6 billion due to industry disruption. However, streaming and licensing increased their combined share to over 55%, preventing deeper contraction.

From 2022 onward, Pixar entered a recovery phase. Revenue rose steadily from $1.8 billion in 2022 to $2.5 billion in 2025, supported by a return to theaters and expanding consumer products.

By 2026, Pixar reached $2.7 billion, with theatrical revenue reduced to under 40% of total income. This marks a fundamental shift toward a diversified, lower-risk revenue model.

Pixar Net Worth in 2026

Pixar’s estimated $16.0 billion net worth, as of January 2026, reflects the standalone value of its intellectual property portfolio and brand equity.

Approximately $9.8 billion (61%) of Pixar’s net worth is attributed to its film library and franchises. This includes long-term monetization rights from more than 25 feature films, many of which continue generating value decades after release.

About $3.9 billion (24%) is attributed to consumer brand equity, which reflects Pixar’s ability to command premium licensing rates, sustained merchandise demand, and cross-generational appeal.

Roughly $1.5 billion (9%) is tied to theme park and experiential integration value, representing the long-term earning power of Pixar properties embedded in physical attractions and destination entertainment.

The remaining $800 million (6%) reflects future IP pipeline value, covering announced sequels, new original concepts, and brand expansion potential already embedded in Pixar’s valuation.

Long-Term Financial Position and Forward Outlook

Pixar’s long-term financial position in 2026 is anchored in the durability of its intellectual property rather than short-term release volume. An estimated 70–72% of Pixar’s $16.0 billion net worth is tied to franchises and films released more than five years ago.

This includes long-established properties such as Toy Story, Cars, Monsters, Inc., Finding Nemo, The Incredibles, and Inside Out. These legacy franchises alone are estimated to represent $11.2–$11.5 billion in cumulative brand value.

This concentration in mature intellectual property significantly reduces risk. Unlike studios that rely on frequent new releases to sustain revenue, Pixar continues to monetize older assets at scale through streaming, licensing, and theme park usage.

In 2026, legacy titles account for approximately 64% of Pixar’s total annual revenue, or roughly $1.7 billion of the $2.7 billion estimated total.

Revenue Stability and Recurring Income Base

Pixar’s revenue profile has shifted decisively toward recurring income. In 2026, an estimated 61–63% of total revenue comes from repeatable sources rather than new theatrical releases. This includes library streaming consumption, merchandise tied to existing franchises, and long-term licensing agreements.

Streaming and library-driven revenue alone is estimated at $620 million in 2026, and this figure is expected to rise steadily even without major new releases. Consumer products tied to existing franchises contribute approximately $520–$560 million annually, with minimal volatility year to year. Theme park–related revenue linked to Pixar properties adds another $300–$340 million, largely insulated from film release schedules.

This recurring base creates a revenue floor of roughly $1.5–$1.7 billion per year, even in periods with fewer theatrical launches.

Future Revenue Outlook (2027–2030 Estimates)

Looking ahead, Pixar’s revenue is projected to grow at a compound annual rate of 4–6% under conservative assumptions. Based on current franchise strength and release cadence:

- 2027 estimated revenue: $2.8–$2.9 billion

- 2028 estimated revenue: $3.0–$3.1 billion

- 2029 estimated revenue: $3.2–$3.3 billion

- 2030 estimated revenue: $3.4–$3.6 billion.

This growth is expected to be driven less by theatrical expansion and more by incremental gains in streaming value, international licensing, and franchise extensions.

By 2030, non-theatrical revenue is projected to exceed 68–70% of total revenue, further stabilizing Pixar’s financial profile.

Future Net Worth Outlook

Pixar’s brand net worth is projected to continue compounding due to attachment to long-lived IP. Assuming modest franchise expansion and continued global demand, Pixar’s estimated net worth could reach:

- $17.2–$17.8 billion by 2027

- $18.5–$19.0 billion by 2028

- $20.0–$21.0 billion by 2030.

More than 75% of this projected valuation is expected to remain tied to established franchises rather than unproven new properties, reinforcing Pixar’s low-risk, high-durability model.

Strategic Financial Implications

Pixar’s long-term financial strength lies in predictability. With a recurring revenue base exceeding $1.5 billion annually, rising brand value, and full backing from Disney’s distribution ecosystem, Pixar operates with lower volatility than most animation competitors.

This structure allows Pixar to prioritize creative development timelines without financial pressure to overproduce. From a financial standpoint, Pixar functions less like a traditional film studio and more like a premium intellectual property platform with multi-decade monetization cycles.

As of 2026, this combination of stable cash generation, compounding brand equity, and future-proof revenue mix places Pixar among the most financially resilient creative studios in the global entertainment industry.

Franchises Owned by Pixar

Pixar’s long-term value is driven primarily by its franchise portfolio. Unlike studios that rely on short-lived hits, Pixar owns a concentrated set of franchises that generate recurring revenue across films, streaming, merchandise, and theme park experiences.

Below is a list of Pixar’s major franchises as of January 2026:

| Rank | Franchise | Estimated Lifetime Value |

|---|---|---|

| 1 | Toy Story | $14–$15 billion |

| 2 | Cars | $12–$13 billion |

| 3 | Monsters, Inc. | $6.5–$7.0 billion |

| 4 | Finding Nemo | $6.0–$6.5 billion |

| 5 | The Incredibles | $5.5–$6.0 billion |

| 6 | Inside Out | $3.5–$4.0 billion |

| 7 | Up, Ratatouille, others (combined) | $2.0–$2.5 billion |

Toy Story Franchise

Toy Story is Pixar’s most valuable and enduring franchise.

In 2026, Toy Story–related activity is estimated to generate $750–$800 million annually, representing roughly 28–30% of Pixar’s total revenue. This includes ongoing merchandise sales, streaming performance, licensing, and theme park attractions.

In terms of lifetime value, Toy Story is estimated to have generated $14–$15 billion since its debut. Its characters are among the most monetized in animation history, with consistent demand across multiple generations. The franchise’s value is driven more by consumer products and brand licensing than by theatrical releases alone.

Cars Franchise

Cars is Pixar’s most merchandise-driven franchise.

In 2026, Cars contributes an estimated $620–$680 million annually, accounting for approximately 23–25% of Pixar’s revenue. A large majority of this revenue comes from consumer products rather than films.

Lifetime franchise value for Cars is estimated at $12–$13 billion. Despite fewer theatrical releases, Cars remains one of the most profitable animated franchises due to its dominance in toy and vehicle-based merchandise, particularly among younger audiences.

Monsters, Inc. Franchise

Monsters, Inc. is a highly expandable franchise with strong cross-platform performance.

In 2026, the franchise contributes approximately $380–$420 million annually, or around 14–15% of Pixar’s total revenue. Revenue sources are balanced between streaming engagement, merchandise, and theme park usage.

Lifetime value is estimated at $6.5–$7.0 billion. The franchise’s flexible universe allows Pixar to extend it through series, shorts, and spin-offs without relying heavily on theatrical sequels.

Finding Nemo Franchise

Finding Nemo remains one of Pixar’s most globally recognized properties.

In 2026, it generates an estimated $300–$330 million annually, contributing about 11–12% of total revenue. Its strength lies in international markets, educational licensing, and long-term streaming demand.

The lifetime franchise value is estimated at $6.0–$6.5 billion. The aquatic theme and family appeal give the franchise strong longevity despite a relatively small number of films.

The Incredibles Franchise

The Incredibles is Pixar’s premier action-oriented franchise.

In 2026, it contributes approximately $260–$290 million annually, or 9–10% of Pixar’s revenue. The franchise benefits from appeal to both family and older demographics, expanding licensing categories beyond traditional children’s products.

Lifetime value is estimated at $5.5–$6.0 billion. The franchise has significant future upside due to its open-ended narrative structure and sequel potential.

Inside Out Franchise

Inside Out represents Pixar’s most successful newer-generation franchise.

In 2026, Inside Out contributes an estimated $190–$220 million annually, accounting for 7–8% of total revenue. Streaming performance and publishing-related products are key drivers.

Lifetime value is currently estimated at $3.5–$4.0 billion, with strong growth potential. Compared to older franchises, a higher percentage of its value is expected to be realized in the future rather than already captured.

Prestige and Single-Film Franchises (Up, Ratatouille, Others)

Prestige franchises such as Up and Ratatouille contribute smaller but stable revenue.

Combined, these properties generate approximately $90–$120 million annually, or 3–4% of Pixar’s revenue. Their value is driven primarily by theme park integration, brand recognition, and limited licensing rather than frequent new content.

Combined lifetime value for these franchises is estimated at $2.0–$2.5 billion.

Final Thoughts

The question of who owns Pixar often sounds simple, but the answer reveals a much deeper story. Pixar is fully owned by The Walt Disney Company, yet it operates very differently from a typical subsidiary. Ownership gives Disney control over strategy and distribution, but Pixar’s creative decisions, franchise building, and storytelling direction remain firmly in-house.

This structure has allowed Pixar to mature into a long-term intellectual property engine rather than a studio dependent on short-term box office cycles. Its franchises continue to grow in value years after release, and its revenue is spread across films, streaming, merchandise, and experiences. That stability is not accidental. It is the result of ownership that prioritizes durability over volume.

So when people ask who owns Pixar, the more meaningful answer is not just a name. It is an ownership model that protects creative identity while maximizing global reach, and that balance is a key reason Pixar remains one of the most influential studios in animation today.

FAQs

Who is the current owner of Pixar?

Pixar is currently owned by The Walt Disney Company. Disney owns 100% of Pixar and controls its assets, intellectual property, and long-term strategy, while Pixar operates as a creative studio within Disney’s structure.

Does Steve Jobs still own Pixar?

No. Steve Jobs no longer owns Pixar. He sold his ownership when Disney acquired Pixar in 2006. As part of the deal, Jobs became Disney’s largest individual shareholder at the time, but Pixar itself became fully Disney-owned.

Who was Pixar founded by?

Pixar was founded by Edwin “Ed” Catmull and Alvy Ray Smith. Steve Jobs was not a founder, but he became Pixar’s majority owner in 1986 and played a critical role in financing and shaping the company’s early direction.

How much did Disney pay for Pixar?

Disney acquired Pixar in an all-stock deal valued at approximately $7.4 billion. No cash was paid. Pixar shareholders received Disney shares in exchange for their Pixar stock.

Who owned Pixar before Disney?

Before Disney, Pixar was majority owned by Steve Jobs. He acquired the company in 1986 after purchasing it from Lucasfilm and remained its controlling shareholder until the Disney acquisition in 2006.

What year was Pixar founded?

Pixar was founded in 1986, when it was spun off from Lucasfilm and established as an independent company.

How did Pixar begin?

Pixar began as the Graphics Group within Lucasfilm’s Computer Division. Its original focus was computer graphics research and technology. After becoming independent in 1986, Pixar gradually shifted from selling hardware and software to producing animated films.

When did Disney get Pixar?

Disney acquired Pixar in 2006. The deal was announced in January 2006 and completed later that year after shareholder approvals.

Is Pixar owned by Disney?

Yes. Pixar is fully owned by The Walt Disney Company and operates as a wholly owned subsidiary within Disney’s animation and entertainment operations.

How much did Steve Jobs sell Pixar for?

Steve Jobs sold Pixar as part of Disney’s $7.4 billion all-stock acquisition. In return, he received Disney shares, which made him the largest individual shareholder of Disney at that time.

Does Apple still own Pixar?

No. Apple has never owned Pixar. Steve Jobs’ involvement with Pixar was personal, not through Apple. Pixar is now entirely owned by Disney, and Apple has no ownership stake in the studio.