Pepsi is one of the most recognized beverage brands globally. People often wonder who owns Pepsi, given its wide reach and influence in the food and drink industry. This article explores the full ownership details of PepsiCo, the parent company behind the Pepsi brand.

History of Pepsi

Pepsi was first introduced as “Brad’s Drink” in 1893 by Caleb Bradham, a pharmacist in North Carolina. It was renamed Pepsi-Cola in 1898. Bradham hoped it would aid digestion, hence the name “Pepsi,” derived from the word dyspepsia.

In the 1930s, Pepsi went bankrupt during the Great Depression. It was later acquired by the Loft Candy Company, which turned the brand around. Pepsi gained major popularity during World War II. Over the decades, it expanded through innovation and aggressive marketing, positioning itself as Coca-Cola’s top competitor.

In 1965, Pepsi-Cola merged with Frito-Lay, creating PepsiCo. Since then, PepsiCo has grown into a global food and beverage empire.

Who Owns Pepsi: List of Shareholders

PepsiCo, Inc. (NASDAQ: PEP) is a publicly traded company with a diverse ownership structure. As of 2025, institutional investors hold approximately 75.6% of the company’s shares, insiders own about 0.64%, and the general public owns the remaining 24.1%.

Below is a detailed overview of the major shareholders of Pepsi as of 2025:

| Shareholder Name | Ownership (%) | Number of Shares | Estimated Value (USD) |

|---|---|---|---|

| The Vanguard Group, Inc. | 9.72% | 133.37 million | $19.82 billion |

| BlackRock, Inc. | 8.20% | 112.51 million | $16.72 billion |

| State Street Global Advisors, Inc. | 4.21% | 57.76 million | $8.58 billion |

| Geode Capital Management, LLC | 2.27% | 31.08 million | $4.62 billion |

| JPMorgan Chase & Co. | 2.25% | 30.81 million | $4.58 billion |

| Morgan Stanley | 1.98% | 27.20 million | $4.04 billion |

| Charles Schwab Investment Mgmt, Inc. | 1.84% | 25.22 million | $3.75 billion |

| Bank of America Corporation | 1.72% | 23.64 million | $3.51 billion |

| Norges Bank Investment Management | 1.31% | 17.95 million | $2.67 billion |

| Northern Trust Corporation | 1.20% | 16.40 million | $2.44 billion |

| UBS Asset Management AG | 1.28% | 17.59 million | $3.10 billion |

| BNY Asset Management | 1.01% | 13.82 million | $2.10 billion |

| Legal & General Investment Mgmt Ltd. | 0.99% | 13.55 million | $2.40 billion |

| Wellington Management Group LLP | 0.86% | 11.77 million | $1.80 billion |

| Franklin Resources, Inc. | 0.87% | 11.94 million | $1.80 billion |

| Fisher Asset Management, LLC | 0.54% | 7.43 million | $1.30 billion |

The Vanguard Group, Inc.

Vanguard is the largest shareholder of PepsiCo, holding approximately 9.72% of the company’s shares, which equates to around 133.37 million shares valued at $19.82 billion. As a leading investment firm, Vanguard’s significant stake allows it to influence corporate policies through its voting rights, although it does not engage in daily operations.

BlackRock, Inc.

BlackRock is the second-largest institutional investor in PepsiCo, owning about 8.20% of the company, which translates to approximately 112.51 million shares valued at $16.72 billion. Similar to Vanguard, BlackRock’s role is primarily in governance oversight rather than day-to-day management.

State Street Global Advisors, Inc.

State Street holds around 4.21% of PepsiCo’s shares, amounting to approximately 57.76 million shares valued at $8.58 billion. As a major institutional investor, State Street contributes to corporate governance through its voting rights.

Geode Capital Management, LLC

Geode Capital Management owns about 2.27% of PepsiCo, equating to roughly 31.08 million shares valued at $4.62 billion. Geode’s investment reflects its confidence in PepsiCo’s long-term performance.

JPMorgan Chase & Co.

JPMorgan holds approximately 2.25% of PepsiCo, which is about 30.81 million shares valued at $4.58 billion. As a significant financial institution, JPMorgan’s investment underscores its belief in PepsiCo’s stability and growth prospects.

Morgan Stanley

Morgan Stanley owns around 1.98% of PepsiCo, translating to approximately 27.20 million shares valued at $4.04 billion. Their stake indicates a strategic investment in the consumer goods sector.

Charles Schwab Investment Management, Inc.

Charles Schwab holds about 1.84% of PepsiCo, equating to roughly 25.22 million shares valued at $3.75 billion. This investment aligns with Schwab’s diversified portfolio strategy.

Bank of America Corporation

Bank of America owns approximately 1.72% of PepsiCo, which is about 23.64 million shares valued at $3.51 billion. Their stake reflects confidence in PepsiCo’s financial health and market position.

Norges Bank Investment Management

Norges Bank holds around 1.31% of PepsiCo, amounting to approximately 17.95 million shares valued at $2.67 billion. As Norway’s sovereign wealth fund, their investment signifies a long-term commitment to stable, high-performing companies.

Northern Trust Corporation

Northern Trust owns about 1.20% of PepsiCo, translating to roughly 16.40 million shares valued at $2.44 billion. Their investment strategy focuses on long-term value creation.

Other Notable Institutional Investors

Several other institutional investors hold significant stakes in PepsiCo:

- UBS Asset Management AG: Approximately 1.28% ownership, equating to 17.59 million shares valued at $3.1 billion.

- BNY Asset Management: Around 1.01% ownership, with 13.82 million shares valued at $2.1 billion.

- Legal & General Investment Management Limited: Approximately 0.99% ownership, holding 13.55 million shares valued at $2.4 billion.

- Wellington Management Group LLP: About 0.86% ownership, with 11.77 million shares valued at $1.8 billion.

- Franklin Resources, Inc.: Approximately 0.87% ownership, holding 11.94 million shares valued at $1.8 billion.

- Fisher Asset Management, LLC: Around 0.54% ownership, with 7.43 million shares valued at $1.3 billion.

Mutual Fund Holdings

Mutual funds also play a significant role in PepsiCo’s ownership:

- Vanguard Total Stock Market Index Fund: Holds approximately 43.43 million shares, representing 3.09% of PepsiCo.

- Vanguard 500 Index Fund: Owns about 35.28 million shares, equating to 2.51% of the company.

- Invesco QQQ Trust: Holds around 27.99 million shares, representing 2.04% of PepsiCo.

- Schwab U.S. Dividend Equity ETF: Owns approximately 17.40 million shares, equating to 1.27% of the company.

- SPDR S&P 500 ETF Trust: Holds about 16.73 million shares, representing 1.22% of PepsiCo.

- iShares Core S&P 500 ETF: Owns around 16.09 million shares, equating to 1.17% of the company.

These mutual funds contribute to the diversified ownership and reflect widespread investor confidence in PepsiCo’s performance.

Who is the CEO of Pepsi?

As of 2025, Ramon Laguarta serves as the Chairman and Chief Executive Officer (CEO) of PepsiCo. He assumed the CEO role on October 3, 2018, succeeding Indra Nooyi, and became Chairman in 2019. Laguarta is the sixth CEO in PepsiCo’s history and the first Spanish national to lead a major American multinational corporation.

Born in Barcelona, Spain, Laguarta holds bachelor’s and master’s degrees in business administration from ESADE Business School and a master’s in international management from the Thunderbird School of Global Management. He joined PepsiCo in 1996, initially working in the company’s European operations. In 2014, he became CEO of the Europe and Sub-Saharan Africa (ESSA) sector, where he played a pivotal role in the $5.4 billion acquisition of Russian dairy and juice company Wimm-Bill-Dann.

Under Laguarta’s leadership, PepsiCo has focused on product innovation, sustainability, and adapting to changing consumer preferences. In 2025, the company announced plans to eliminate artificial ingredients from its popular food products by the end of the year, responding to new health regulations and public demand.

Executive Leadership Team

Supporting Laguarta is a seasoned executive leadership team, including:

- Jamie Caulfield, Executive Vice President and Chief Financial Officer, responsible for the company’s financial strategy and operations.

- Ram Krishnan, CEO of PepsiCo Beverages North America, leading efforts to revitalize the beverage segment, including initiatives like the modernized Pepsi Challenge.

Corporate Governance and Control

PepsiCo operates under a robust corporate governance framework designed to ensure accountability and transparency. The company’s Board of Directors sets the tone at the top, emphasizing openness, honesty, fairness, and integrity.

The Board comprises a diverse group of individuals with expertise across various industries. Key members include:

- Ian M. Cook, former Chairman and CEO of Colgate-Palmolive, serving on multiple committees.

- Cesar Conde, Chairman of the NBCUniversal News Group, contributing to governance and nominating committees.

The Board’s responsibilities encompass overseeing the company’s strategic direction, risk management, and ensuring ethical conduct throughout the organization.

Who Runs Pepsi?

PepsiCo is led by a seasoned executive team, with Ramon Laguarta serving as Chairman and Chief Executive Officer (CEO). He has been at the helm since October 2018, succeeding Indra Nooyi. Under his leadership, PepsiCo has focused on sustainable growth, innovation, and expanding its global footprint.

Ramon Laguarta – Chairman and CEO

Ramon Laguarta, a Spanish business executive, has been with PepsiCo for over 25 years. He became CEO in 2018 and Chairman in 2019. Laguarta has emphasized the company’s mission to “Create More Smiles with Every Sip and Every Bite,” aligning with PepsiCo Positive (pep+), a strategy focusing on sustainability and human capital. His leadership aims to make PepsiCo “Faster, Stronger, and Better” by being more consumer-centric, transforming capabilities, and integrating purpose into the business strategy.

Ram Krishnan – CEO, PepsiCo Beverages North America

Ram Krishnan leads PepsiCo’s beverage operations in North America. Since his appointment in February 2024, Krishnan has been instrumental in revitalizing the Pepsi brand, which had seen a decline in market share. He has spearheaded efforts to enhance store presence, restructure sales operations, and reinvigorate marketing strategies, including launching campaigns like the “Undercover Cups” ad. These initiatives aim to position Pepsi as the preferred beverage choice, especially among Generation Z consumers.

Jagrut Kotecha – CEO, PepsiCo India & South Asia

Jagrut Kotecha oversees PepsiCo’s operations in India and South Asia. He has been pivotal in driving the company’s growth in these regions, focusing on expanding the product portfolio and strengthening the brand’s presence. Under his leadership, PepsiCo has reported double-digit growth in beverage volumes in India, reflecting the region’s strategic importance to the company’s global operations.

Board of Directors

PepsiCo’s Board of Directors plays a crucial role in overseeing the company’s strategic direction and governance. The board comprises a diverse group of leaders with expertise in various industries, providing guidance and ensuring accountability in decision-making processes. The board’s composition reflects PepsiCo’s commitment to strong corporate governance and ethical business practices.

Strategic Direction and Leadership Philosophy

Under the guidance of Ramon Laguarta and his executive team, PepsiCo has embraced a leadership philosophy centered on sustainability, innovation, and consumer-centric growth. The company’s pep+ strategy focuses on operating within planetary boundaries, inspiring positive change for the planet and people, and integrating purpose into its business strategy and brands.

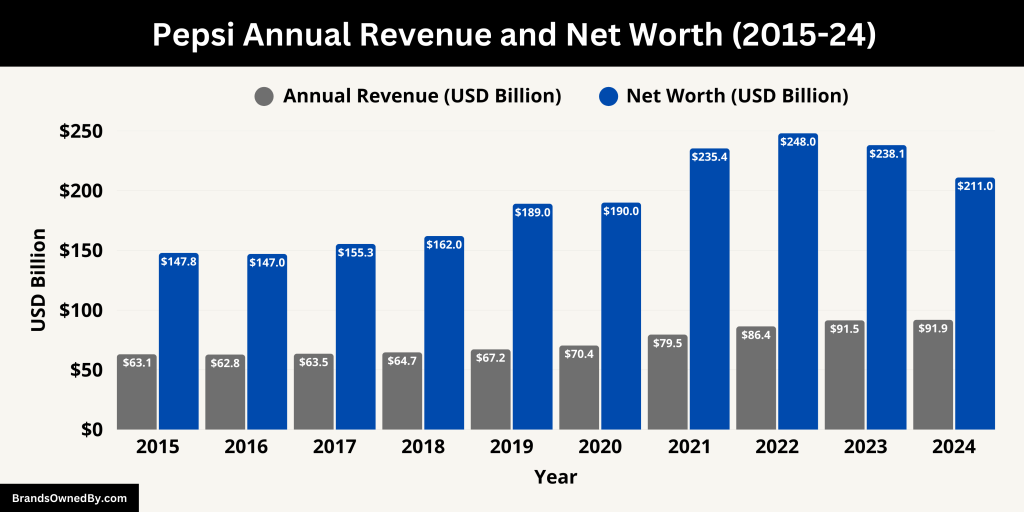

Annual Revenue and Net Worth of Pepsi

In 2024, PepsiCo reported an annual revenue of approximately $91.85 billion, marking a modest increase of 0.42% compared to the previous year. This growth was primarily driven by the PepsiCo Beverages North America segment, which contributed $27.8 billion, accounting for 30% of the total revenue. Despite challenges such as subdued demand in key markets like the U.S. and China, and a recall of Quaker Oats products, the company managed to maintain steady revenue figures.

As of May 2025, PepsiCo’s net worth, measured by its market capitalization, is estimated to be around $211.01 billion. This valuation reflects the company’s strong brand portfolio, strategic acquisitions, and ongoing investments in innovation and sustainability initiatives.

Here’s an overview of the historical revenue and net worth of PepsiCo from 2015-24:

| Year | Annual Revenue (USD) | Net Worth / Market Cap (USD) |

|---|---|---|

| 2024 | $91.85 billion | $211.01 billion |

| 2023 | $91.46 billion | $238.10 billion |

| 2022 | $86.39 billion | $248.00 billion |

| 2021 | $79.47 billion | $235.35 billion |

| 2020 | $70.37 billion | $190.00 billion |

| 2019 | $67.16 billion | $189.04 billion |

| 2018 | $64.66 billion | $162.00 billion |

| 2017 | $63.53 billion | $155.34 billion |

| 2016 | $62.80 billion | $147.00 billion |

| 2015 | $63.06 billion | $147.83 billion |

Brands and Companies Owned by Pepsi

As of 2025, PepsiCo boasts a diverse and expansive portfolio of brands and subsidiaries across the food and beverage industry. This includes iconic legacy products, strategic acquisitions, and regional powerhouses.

Below is an in-depth look at some of the major companies and brands owned by PepsiCo:

| Company/Brand | Type | Key Products/Offerings | Year Acquired/Launched | Notable Info |

|---|---|---|---|---|

| Frito-Lay North America | Subsidiary | Lay’s, Doritos, Cheetos, Ruffles, Tostitos | Founded in 1961 (PepsiCo merger) | Leader in North American snack foods; spearheads EV delivery fleet |

| Quaker Oats Company | Subsidiary | Oatmeal, cereals, granola bars, Gatorade | 2001 | Brought Gatorade to PepsiCo; faced a 2024 product recall |

| Tropicana Products | Beverage Brand | Orange juice, fruit blends | 1998 | Leading juice brand in North America and Europe |

| Sabra Dipping Company | Joint Venture (now full ownership) | Hummus, guacamole, dips | 2008 (Full control in 2024) | PepsiCo bought remaining stake from Strauss Group in 2024 for $244M |

| Siete Foods | Subsidiary | Grain-free snacks, taco shells, cookies | Pending (Announced 2024) | $1.2B acquisition to diversify PepsiCo’s multicultural food offerings |

| Poppi | Subsidiary | Prebiotic sodas | 2025 | Acquired for $1.65B; part of better-for-you drink strategy |

| Rockstar Energy | Subsidiary | Energy drinks | 2020 | Acquired for $3.9B; supports energy beverage growth |

| SodaStream | Subsidiary | Home carbonation machines | 2018 | $3.2B deal; part of sustainability and home-beverage strategy |

| Pioneer Foods | Subsidiary | Cereals, juices (Ceres, Bokomo) | 2020 | $1.7B acquisition; expanded footprint in Africa |

| Varun Beverages | Bottling Partner | PepsiCo beverage bottling in Asia & Africa | Not owned, strategic partner | Acquired PepsiCo’s South African bottler Bevco in 2023 |

| Grupo GEPP | Bottling Partner (20% stake) | Pepsi, 7 Up, Gatorade | Ongoing partnership | Bottler and distributor in Mexico |

| Sabritas | Subsidiary | Snacks like Cheetos, Doritos (Mexico market) | 1966 | Controls ~80% of Mexican snack market; owns Sonric’s & Alegro Internacional |

| Starry | In-house Brand | Lemon-lime soda | 2023 | Replaced Sierra Mist; Pepsi’s answer to Sprite targeting Gen Z consumers |

Frito-Lay North America

Frito-Lay is PepsiCo’s flagship snack division, producing some of the most popular snack brands in the United States, Canada, and Mexico. Its portfolio includes Lay’s, Doritos, Cheetos, Ruffles, Tostitos, Fritos, and SunChips. Frito-Lay also leads PepsiCo’s sustainability efforts, with over 700 electric delivery vehicles deployed across the U.S. as part of its PepsiCo Positive initiative.

Quaker Oats Company

Acquired in 2001, Quaker Oats brought the Gatorade brand into PepsiCo’s portfolio. Quaker produces cereals, oatmeal, granola bars, and rice snacks. Despite a recent recall of some Quaker products in 2024, the brand remains a cornerstone of PepsiCo’s health-focused offerings.

Tropicana Products

Tropicana, acquired in 1998, is PepsiCo’s flagship juice brand. It offers a wide range of fruit juices and blends, including Tropicana Pure Premium and Tropicana Essentials. The brand has a strong presence in North America and Europe.

Sabra Dipping Company

Sabra is a leading producer of Middle Eastern-style dips and spreads, including hummus and guacamole. In November 2024, PepsiCo acquired full ownership of Sabra by purchasing the remaining stake from Strauss Group for $244 million. As of 2024, Sabra holds a 36% market share in the U.S. hummus market.

Siete Foods

In October 2024, PepsiCo announced the acquisition of Siete Foods, a Mexican-American food company known for its grain-free tortilla chips, taco seasonings, and Mexican cookies. The $1.2 billion deal aims to diversify PepsiCo’s multicultural food offerings and is expected to close in the first half of 2025.

Poppi

In March 2025, PepsiCo acquired Poppi, a prebiotic soda brand, for approximately $1.65 billion. Poppi offers health-focused sodas made with apple cider vinegar and prebiotics, aligning with PepsiCo’s strategy to expand its “better-for-you” beverage portfolio.

Rockstar Energy

PepsiCo acquired Rockstar Energy in March 2020 for $3.9 billion. The brand offers a variety of energy drinks and has been integrated into PepsiCo’s global beverage distribution network.

SodaStream

In August 2018, PepsiCo acquired SodaStream, a company specializing in home carbonation products, for $3.2 billion. This acquisition allows PepsiCo to tap into the growing market for at-home beverage solutions.

Pioneer Foods

PepsiCo acquired South Africa-based Pioneer Foods in 2020 for $1.7 billion. The acquisition expanded PepsiCo’s presence in sub-Saharan Africa and added brands like Bokomo cereals and Ceres fruit juices to its portfolio.

Varun Beverages

Varun Beverages Limited is one of PepsiCo’s largest bottling partners outside the United States. Based in India, it manufactures and distributes PepsiCo beverages across several countries, including Nepal, Sri Lanka, and various African nations. In December 2023, Varun Beverages acquired PepsiCo’s South African bottler Bevco for ₹1,320 crore.

Grupo GEPP

Grupo GEPP is a Mexican beverage company in which PepsiCo holds a 20% stake. GEPP bottles and distributes PepsiCo products like Pepsi, 7 Up, and Gatorade in Mexico. It is the second-largest bottler in Mexico, behind Coca-Cola FEMSA.

Sabritas

Sabritas is PepsiCo’s snack food subsidiary in Mexico, producing popular brands like Cheetos, Doritos, and Ruffles. It controls around 80% of the Mexican snacks market and also operates the Sonric’s candy brand and Alegro Internacional, which offers flavored water and dry powder mixes.

Starry

Launched in January 2023, Starry is PepsiCo’s lemon-lime soda brand that replaced Sierra Mist. Aimed at competing with Sprite, Starry is available in regular and zero-sugar varieties and is targeted toward Gen Z consumers.

Final Thoughts

Understanding who owns Pepsi involves looking beyond the brand to PepsiCo’s broader structure. It is owned by many shareholders, with large stakes held by financial institutions. The company is led by a strong executive team and a strategic board. PepsiCo also owns several of the world’s best-known snack and beverage brands. Its massive revenue and diverse holdings make it a dominant force in the global market.

FAQs

Who is the real owner of Pepsi?

PepsiCo is a publicly traded company, so it doesn’t have a single “real owner.” Instead, it is owned by institutional investors, mutual funds, and individual shareholders. The largest shareholder as of 2025 is The Vanguard Group, holding over 9% of the company.

Is Pepsi now owned by Coca-Cola?

No, Pepsi is not owned by Coca-Cola. PepsiCo and Coca-Cola are two separate, competing multinational corporations. Both are independently operated and publicly traded.

Which country owns Pepsi?

PepsiCo is an American company. It was founded and is headquartered in the United States. The ownership lies with shareholders worldwide, but the company is incorporated and operated under U.S. law.

Is Pepsi bigger than Coke?

In terms of overall revenue, PepsiCo is bigger. PepsiCo reported over $91 billion in annual revenue in 2024, compared to Coca-Cola’s estimated $45–50 billion. However, Coca-Cola leads in the global soft drink market share, especially in carbonated beverages.

Who founded Pepsi?

Pepsi was created by Caleb Bradham, a North Carolina-based pharmacist, in 1893. It was originally called “Brad’s Drink” and was later renamed “Pepsi-Cola” in 1898.

Did Coke try to buy Pepsi?

Yes, Coca-Cola tried to acquire Pepsi several times during Pepsi’s bankruptcy periods in the 1920s and 1930s. However, antitrust concerns and corporate resistance prevented the merger. Pepsi eventually recovered and emerged as a strong competitor.

What is Pepsi’s CEO’s salary?

As of 2024, Ramon Laguarta, the CEO of PepsiCo, earned a total compensation package of around $25 million. This includes base salary, bonuses, stock awards, and other incentives.

Who runs PepsiCo?

PepsiCo is run by its Chief Executive Officer, Ramon Laguarta, who has held the position since 2018. The company is overseen by a Board of Directors and a senior leadership team responsible for strategic and operational decisions.

Which is older, Pepsi or Coke?

Coca-Cola is older. It was invented in 1886 by Dr. John Pemberton in Atlanta, Georgia. Pepsi was formulated in 1893 and renamed Pepsi-Cola in 1898.

What is the full form of Pepsi?

Pepsi is not an acronym, so it does not have a full form. However, some believe it stands for “Pay Every Penny to Save Israel,” a rumor with no factual basis. The name “Pepsi” is believed to come from the word “dyspepsia,” meaning indigestion, which the drink was originally intended to help with.

Where’s Pepsi headquartered?

PepsiCo is headquartered in Purchase, New York, United States. It operates in more than 200 countries and territories around the world.