Papa John’s is one of the most recognizable names in the pizza industry. If you’ve ever wondered who owns Papa John’s, this article breaks down everything from its corporate history to its current shareholders and leadership.

Papa John’s Company Profile

Papa John’s International, Inc. is one of the largest pizza delivery and carryout restaurant chains in the world. Known for its tagline “Better Ingredients. Better Pizza.”, the company has built a reputation for quality, consistent service, and fast delivery.

Headquartered in Atlanta, Georgia, Papa John’s operates a mix of company-owned and franchised restaurants. As of 2025, it has over 5,700 locations in more than 45 countries and territories.

The brand has a strong presence in North America and continues expanding internationally, especially in Latin America, Europe, and parts of Asia and the Middle East. Papa John’s competes with industry giants like Domino’s, Pizza Hut, and Little Caesars, but differentiates itself through premium ingredients and innovative digital platforms.

Founders of Papa John’s

Papa John’s was founded by John Schnatter in 1984. He began by converting a broom closet in the back of his father’s tavern in Jeffersonville, Indiana, into a pizza kitchen.

Using second-hand equipment and a passion for high-quality pizza, Schnatter started small but quickly gained a following. By offering better-quality pizza with fresh dough, real cheese, and fresh-packed sauce, he tapped into a niche for customers looking for something above average.

John Schnatter, also known as “Papa John,” served as the company’s CEO and public face for decades. His image became central to the brand’s identity, even as it transitioned to a global enterprise.

Major Milestones

1984: Papa John’s was founded by John Schnatter in Jeffersonville, Indiana.

1986: The first official Papa John’s franchise opens, marking the beginning of rapid growth.

1993: Papa John’s goes public with an initial public offering (IPO) on the NASDAQ under the ticker PZZA.

1997: Reaches 1,500 stores—becoming the fastest-growing pizza company in the U.S.

2001: Launches online ordering, becoming one of the first pizza chains to do so nationally.

2010s: Expands aggressively in international markets, including the UK, China, and the Middle East.

2018: John Schnatter resigns as chairman following public controversy, leading to major leadership and image changes.

2019: Rob Lynch is appointed CEO, leading a strategic turnaround with new menu innovations and technology upgrades.

2021–2024: Papa John’s continues global expansion, improves its digital platforms, and partners with third-party delivery services to increase reach.

Company Details

- Legal Name: Papa John’s International, Inc.

- Founded: 1984

- Founder: John Schnatter

- Headquarters: Atlanta, Georgia, USA

- Ticker Symbol: PZZA (NASDAQ)

- CEO (2025): Rob Lynch

- Employees: Over 12,000 corporate; many more through franchisees

- Franchise vs. Company-Owned: About 90% of stores are franchised

- Global Presence: Over 5,700 locations in more than 45 countries

- Industry: Quick-service restaurant (QSR) – Pizza

- Revenue (2024): Approx. $2.1 billion

- Market Cap (2025): Estimated around $3.5 billion.

Papa John’s has focused heavily on enhancing customer experience through digital platforms, contactless delivery, and loyalty programs. The brand has also expanded its menu beyond pizza, adding items like Papadias, chicken wings, desserts, and plant-based options.

Who Owns Papa John’s: Major Shareholders

Papa John’s is a publicly traded company. That means it is owned by institutional investors, mutual funds, retail investors, and company insiders. No single entity has full control of the company. However, a few shareholders own large portions of the stock and play influential roles.

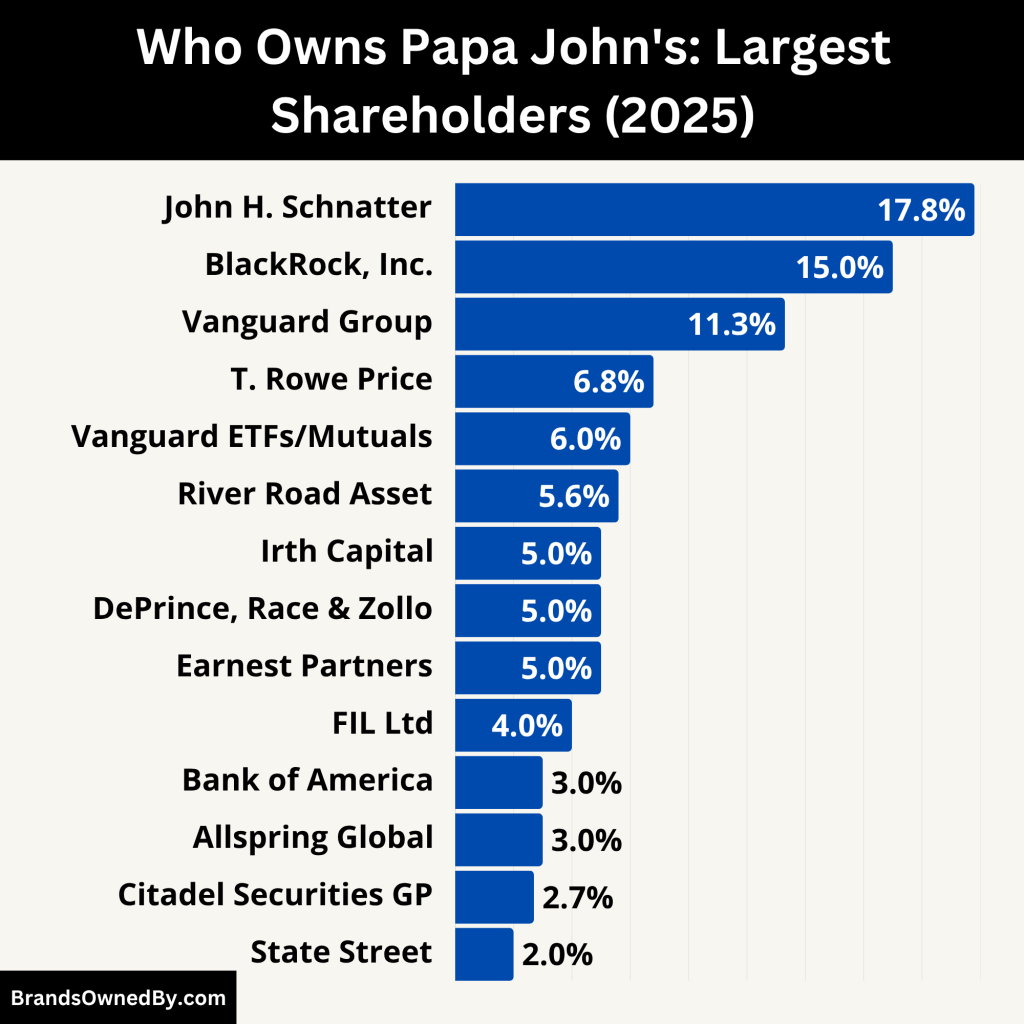

As of mid-2025, Papa John’s exhibits a diversified ownership structure. The largest single owner is founder John Schnatter (~17.8%). However, control is more institutionally driven, with BlackRock, Vanguard, T. Rowe Price, River Road, Irth, and DePrince combining for over 47% of the shares.

Citadel Securities adds to hedge fund influence, and multiple financial institutions hold smaller yet meaningful stakes. This institutional dominance ensures collective governance influence, while Schnatter retains significant share-based authority.

Here’s a summary of the shareholders and the ownership overview of Papa John’s:

- Institutional Investors: Own ~50–60% of shares.

- Mutual Funds/ETFs: Hold ~48.7%.

- Individual/Insider: John Schnatter (~17.8%), insiders collectively ~1–2%.

Here’s a detailed overview of the major shareholders of Papa John’s as of June 2025:

| Shareholder | Ownership (%) | Approx. Shares Held | Type | Influence/Role |

|---|---|---|---|---|

| John H. Schnatter | 17.8% | 5.82 million | Individual/Founder | Largest individual shareholder; no formal role but holds significant voting power |

| BlackRock, Inc. | 15.0% | 4.92 million | Institutional (Passive) | Key voting power; influences board decisions through index funds |

| The Vanguard Group, Inc. | 11.3% | 3.71 million | Institutional (Passive) | Major shareholder; votes on governance, compensation, and policy |

| T. Rowe Price Investment Mgmt. | 6.8% | 2.21 million | Institutional (Active) | Actively engages on strategy, operations, and long-term value |

| River Road Asset Management | 5.6% | 1.83 million | Institutional (Active) | Focuses on value investing and operational improvements |

| Irth Capital Management LP | 5.0% | 1.63 million | Institutional (Strategic) | Possible activist influence; speculative interest in corporate restructuring |

| DePrince, Race & Zollo Inc. | 5.0% | 1.62 million | Institutional (ESG Focus) | Emphasizes sustainable, ethical growth and long-term returns |

| Citadel Securities GP LLC | 2.7% | 885,105 | Hedge Fund (Active) | Smaller stake but potential for short-term or strategic moves |

| Vanguard-backed ETFs/Mutuals | 5–6% (est.) | ~2 million | ETF/MF Holdings | Strengthens Vanguard’s overall institutional influence |

| Bank of America Corp | ~2–3% | ~980,000 (est.) | Institutional | Minor influence; votes aligned with ESG and fiduciary interests |

| State Street Corp | ~2–3% | ~960,000 (est.) | Institutional (Passive) | Moderate proxy voting role; follows standard governance policies |

| Earnest Partners LLC | <5% | N/A | Institutional | Smaller stake; contributes to diversified base |

| FIL Ltd | <5% | N/A | Institutional | Small-scale institutional holder |

| Allspring Global Investments | <5% | N/A | Institutional | Part of wider institutional presence in Papa John’s |

John H. Schnatter – Founder & Former CEO

John Schnatter, also known as “Papa John,” founded the company in 1984 and once controlled over 30% of its shares. However, following a series of controversies and his resignation from the board in 2018, he gradually sold off a portion of his stake.

As of 2025, Schnatter owns approximately 5.82 million shares, which account for 17.8% of the company. This makes him the largest individual shareholder. Despite his exit from corporate leadership, Schnatter’s stake allows him to influence proxy votes and shareholder proposals. He remains a vocal critic of the company’s leadership but holds no official executive or board role.

His holdings are entirely passive at this point, yet institutional investors keep a watchful eye on his potential to rally shareholder movements or influence public sentiment.

BlackRock, Inc. – Largest Institutional Investor

BlackRock is the world’s largest asset management firm, and it holds around 4.92 million shares of Papa John’s, giving it a 15.0% ownership stake. Its influence is primarily through passive investment strategies via its ETFs and index funds.

As a long-term institutional holder, BlackRock typically supports governance stability and management accountability. It rarely initiates activist moves but votes on key board decisions and compensation policies. Its weight in proxy voting gives it a major voice in board composition and corporate policy direction.

BlackRock’s interest suggests institutional confidence in Papa John’s growth and governance under current management.

The Vanguard Group, Inc. – Major Institutional Holder

Vanguard owns around 3.71 million shares, representing approximately 11.3% of Papa John’s as of Q1 2025. Like BlackRock, Vanguard is primarily a passive investor, holding shares across various index and mutual funds.

Vanguard’s voting influence on the board and shareholder proposals is substantial. It tends to support policies that improve corporate governance and long-term value creation. Although not activist in nature, Vanguard plays a crucial role in electing board members and ratifying strategic plans.

Its ongoing investment reflects a strong belief in Papa John’s operational and financial health.

T. Rowe Price Investment Management, Inc.

T. Rowe Price is another prominent institutional holder, owning roughly 2.21 million shares or 6.8% of the company. As an actively managed fund group, T. Rowe Price is more selective and strategic in its holdings.

Its investment signals faith in Papa John’s future earnings and leadership strategy. The firm engages more directly with management teams compared to passive firms, offering input on long-term growth initiatives, capital allocation, and ESG (Environmental, Social, and Governance) matters.

T. Rowe Price’s influence often shows up in how it votes on key board matters, executive compensation, and corporate structure proposals.

River Road Asset Management, LLC

River Road owns an estimated 1.83 million shares, translating to 5.6% ownership. Known for value investing, River Road focuses on companies it believes are undervalued but operationally strong.

This investor often supports operational efficiency, margin improvements, and strategic restructuring when necessary. While not activist, River Road has been known to express its views in private meetings with management.

Its mid-sized holding gives it some influence, especially if it aligns with other institutional shareholders on key issues.

Irth Capital Management LP

Irth Capital, holding about 1.63 million shares (roughly 5.0%), is a relatively newer stakeholder with a reputation for strategic investment and occasional activism.

Although Irth has not formally launched an activist campaign against Papa John’s, its investment sparked media speculation in 2024 about a possible acquisition or restructuring push. The firm has remained quiet publicly but has voting power that could sway decisions in board elections or strategic reviews.

Their interest suggests they may see Papa John’s as underperforming or undervalued compared to its potential.

DePrince, Race & Zollo Inc.

DePrince, Race & Zollo Inc. holds nearly 1.62 million shares, making up 5.0% of the outstanding stock. As an institutional investor focusing on ESG and value-based metrics, the firm supports sustainable growth and ethical business practices.

Their engagement with management often involves corporate responsibility, community investment, and long-term shareholder value. Though small in absolute control, their votes contribute to institutional majorities that determine corporate direction.

Citadel Securities GP LLC – Hedge Fund

Citadel Securities GP LLC, one of the more aggressive hedge fund investors, reported owning 885,105 shares in January 2025. This accounts for about 2.7% of the company.

Unlike passive investors, Citadel often takes active positions when it sees short- to mid-term opportunities. Though not currently engaged in activist tactics at Papa John’s, its ownership hints at a strategic interest in the company’s market performance or potential M&A activity.

Its presence adds an element of unpredictability in shareholder decisions, especially during earnings or leadership transitions.

The Vanguard-backed ETFs & Mutual Funds

Various mutual funds and ETFs linked to Vanguard collectively hold over 2 million shares, totaling between 5–6% of Papa John’s stock. These include funds such as:

- Vanguard Total Stock Market Index Fund

- Vanguard Small-Cap Index Fund

- Vanguard Mid-Cap Index Fund

These funds amplify Vanguard’s total ownership and voting power. Their decisions align with Vanguard’s overall corporate governance philosophy, focusing on long-term value and risk mitigation.

Other Institutional Shareholders

Several other financial institutions hold smaller but still relevant stakes:

- Bank of America Corp and State Street Corp each own between 2–3% of shares.

- Earnest Partners LLC, FIL Ltd, and Allspring Global Investments hold positions under 5%, contributing to the broader base of institutional ownership.

These firms, while individually smaller, collectively add to the stability and oversight structure of Papa John’s shareholder base.

Who is the CEO of Papa John’s?

As of 2025, Todd Penegor serves as the President and Chief Executive Officer of Papa John’s. He took the helm in August 2024, succeeding interim leadership under Ravi Thanawala. Penegor is a seasoned quick-service restaurant executive, bringing deep experience and strategic vision to Papa John’s.

Appointment and Background

Todd Penegor was named CEO effective August 1, 2024, following a comprehensive search by the board. Prior to joining Papa John’s, he most recently served as President and CEO of The Wendy’s Company from 2016 to early 2024. He also held Wendy’s CFO position and leadership roles at Kellogg and Ford Motor Company.

Strategic Vision and Early Moves

At Wendy’s, Penegor drove expansion to more than 7,000 restaurants, maintained 12 consecutive years of same-store sales growth, and spearheaded breakthroughs in digital, international, and breakfast segments. These accomplishments signaled robust leadership credentials for Papa John’s.

Role & Responsibilities

As CEO, Penegor oversees all corporate functions—operations, franchise management, marketing, finance, and digital innovation. He also joined Papa John’s Board of Directors, granting him direct influence over governance alongside the board.

Interim Transition Before Appointment

Before Penegor’s appointment, Ravi Thanawala—then CFO—served as Interim CEO starting March 21, 2024, after Rob Lynch departed to lead Shake Shack. Thanawala guided the company through a critical transition period under the board’s oversight.

Reporting and Governance

Penegor reports directly to the Board of Directors, chaired by Christopher Coleman, who praised his proven track record in product innovation, digital transformation, and franchise partnerships. Penegor also works closely with Papa John’s senior leadership—such as CFO Thanawala, CAO Oyler, and Chief Digital Officer Vasconi—to execute the “Back to Better 2.0” strategy and broader growth initiatives.

Who Decides What? – Board Control & Governance

Board of Directors

- The Board, comprised of eight directors, holds ultimate authority over strategy, CEO appointments, and governance policy.

- It includes independent directors who chair key committees (Audit, Compensation, Nominating & Governance).

- Strategic moves—like appointing interim leadership or approving compensation—require board approval.

Shareholder Influence

- Institutional investors, such as BlackRock and Vanguard, together hold over 26% of shares. Their voting power exerts pressure on board composition and corporate policy.

- The founding shareholder, John Schnatter, with ~17.8%, wields significant voting influence but lacks board or executive presence.

Executive Leadership Team

- The interim CEO works in tandem with peers—such as Caroline Miller Oyler (CAO), Joe Sieve (Chief Restaurant & Global Development Officer), and Kevin Vasconi (Chief Digital & Technology Officer).

- Key decisions involving operations, innovation, or resource allocation are made collectively by this executive team, under board oversight.

- Committees and proxy-season governance documentation reaffirm that the board keeps final say and monitors executive actions closely.

Past CEOs & Their Legacy

Rob Lynch (August 2019–May 2024)

- Came from Arby’s; led Papa John’s through a financial and reputational recovery.

- Delivered record global system‑wide sales (~$5 billion across 5,900 locations).

- Departed to head Shake Shack in May 2024.

Steve Ritchie (CEO from 2018–2019)

- Succeeded John Schnatter as CEO internally.

- Guided the company through post-controversy stabilization.

- Known for focusing on franchisee relations and operational improvement.

John H. Schnatter (1984–2018)

- Founder and CEO for over 30 years.

- Oversaw initial growth, franchising, and brand establishment.

- Resigned after controversies and stepped down from board duties in 2018.

Who Really Controls Papa John’s?

- Board of Directors: Formal strategic control rests with them.

- Institutional shareholders (BlackRock, Vanguard, T. Rowe Price, etc.) collectively influence board elections, director independence, compensation policies, and major strategic moves.

- John Schnatter, via his nearly 18% stake, holds informal influence in major votes and public sentiment, though he has no formal role.

- Executive Team: Implements day-to-day and mid-term initiatives under board-approved mandates.

Papa John’s Annual Revenue and Net Worth

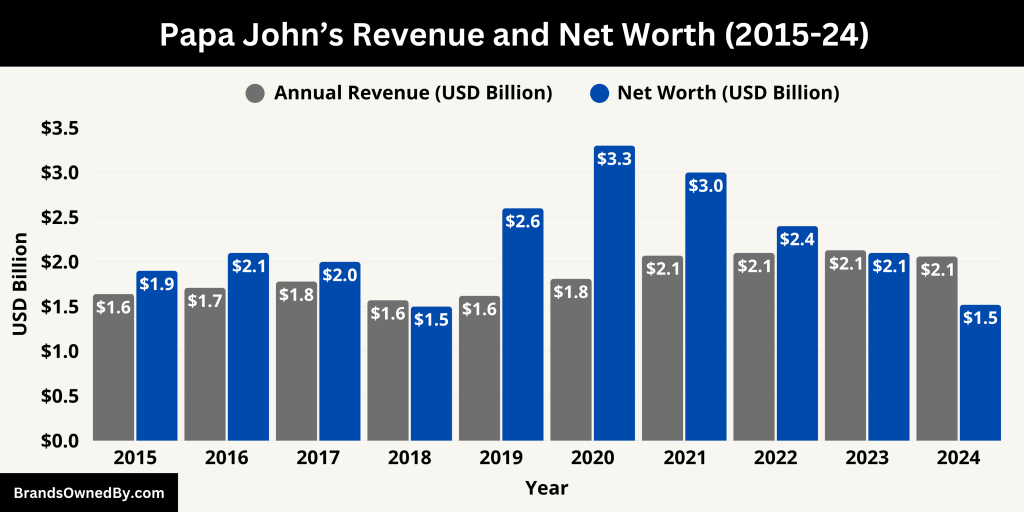

In 2025, Papa John’s reported a trailing twelve-month (TTM) revenue of approximately $2.06 billion. This reflects a modest 3.6% year-over-year decline compared to its 2023 revenue of around $2.14 billion. While overall sales dipped, the company demonstrated signs of stabilization. The first quarter of 2025 showed promise, with Q1 revenue reaching $518.3 million, marking a slight increase from the same quarter in the previous year.

Revenue growth was mainly driven by gains in the commissary business and the advertising fund segment. However, the company-owned restaurant segment experienced a 5% decline, and North American franchised sales dropped by about 2%. International performance remained strong and helped offset some of the North American weakness.

Despite mixed regional trends, Papa John’s reaffirmed its full-year guidance, projecting system-wide sales growth between 2% and 5%, and comparable store sales (both in North America and internationally) ranging from flat to up 2%.

Net Worth and Market Capitalization

As of June 2025, Papa John’s has a market capitalization of approximately $1.52 billion. This valuation is based on its total outstanding shares of around 32.7 million and a trading stock price hovering between $46 and $50. Though this is significantly lower than the company’s pandemic-era peak market cap of over $4.8 billion in 2021, it reflects a modest recovery from its 2024 lows, when the market cap briefly fell near $1.3 billion.

The company’s price-to-earnings (P/E) ratio stands at about 20 to 21 times its trailing earnings, which aligns with average valuations within the restaurant and casual dining industry. Additionally, Papa John’s estimated enterprise value (EV) ranges between $2.4 billion and $2.6 billion. This implies that the company maintains a balanced capital structure, with moderate debt and continued profitability.

Financial Outlook and Analysis

While revenue has declined slightly year-over-year, Papa John’s remains profitable. In Q1 2025, it reported a net income of $9 million, supported by an adjusted EBITDA of $50 million. The company’s financial performance shows resilience, especially in a challenging North American market affected by inflation and shifting consumer preferences.

With steady international expansion, focus on digital channels, and operational improvements, Papa John’s is gradually regaining investor confidence. The current financial figures indicate that while growth has slowed, the brand still holds strong potential for long-term performance—especially if it continues to balance cost efficiency with innovation and expansion.

Here is a table showing Papa John’s historical annual revenue and market capitalization (net worth) for the last 10 years (2015–2024):

| Year | Annual Revenue (USD) | Net Worth / Market Cap (USD) | Notes |

|---|---|---|---|

| 2024 | $2.06 billion | ~$1.52 billion | Slight decline due to North American softness |

| 2023 | $2.13 billion | ~$2.1 billion | Strong digital and international growth |

| 2022 | $2.10 billion | ~$2.4 billion | Rebound post-COVID, high delivery demand |

| 2021 | $2.07 billion | ~$3.0 billion | Record performance; strong brand recovery |

| 2020 | $1.81 billion | ~$3.3 billion | COVID-19 pandemic boosted delivery sales |

| 2019 | $1.62 billion | ~$2.6 billion | Rob Lynch became CEO mid-year |

| 2018 | $1.57 billion | ~$1.5 billion | Schnatter controversy; revenue dropped |

| 2017 | $1.78 billion | ~$2.0 billion | Pre-controversy peak revenue |

| 2016 | $1.71 billion | ~$2.1 billion | Continued growth in North America |

| 2015 | $1.64 billion | ~$1.9 billion | Steady global expansion and franchise growth |

Brands Owned by Papa John’s

Below are detailed descriptions of the companies, brands, and entities owned and operated by Papa John’s International, Inc. as of 2025:

| Entity/Division Name | Type | Function/Description | Ownership | Operational Scope |

|---|---|---|---|---|

| Commissary & Dough Production Centers | Internal Operations | Produces fresh dough and supplies ingredients to stores | Fully owned by Papa John’s | 11+ regional centers across North America |

| National Marketing Fund | Internal Entity | Manages pooled franchise marketing and advertising budgets | Controlled by Papa John’s | Supports U.S. and select global markets |

| Franchise Division | Internal Business Unit | Manages global franchise sales, training, and support | Fully owned by Papa John’s | 50+ countries with franchise presence |

| Technology & Digital Platform | Internal Department | Oversees digital ordering, app development, and online customer experience | Fully owned by Papa John’s | Global (app, web, voice platforms) |

| Supply Chain Services | Internal Operations | Manages procurement, logistics, and ingredient sourcing | Fully owned by Papa John’s | Global coverage |

| International Joint Ventures | Investment Partnerships | Minority ownership in select international or regional ventures | Partial stakes retained | Markets like China, Spain, and Latin America |

| Corporate-Owned Restaurants | Direct Operations | Company-run Papa John’s restaurants, test innovations and ensure brand consistency | Fully owned by Papa John’s | ~550 global units (U.S., UK, select countries) |

Commissary & Dough Production Centers

Papa John’s owns and operates a network of approximately 11 regional commissaries in North America. These centers produce fresh dough, sauces, and other key ingredients. They supply both company-owned restaurants and U.S. franchisees. The centralized system ensures consistent quality and cost efficiency while helping maintain the brand promise of “Better Ingredients, Better Pizza.”

Advertising & Marketing Fund

Papa John’s oversees a National Marketing Fund sourced from franchisee contributions. While the fund itself isn’t a standalone brand, it is an internal entity that manages pooled advertising budgets. It plans and executes national campaigns, sponsorships, and digital promotions, supporting both corporate and franchise-owned units.

Papa John’s International Franchise Division

This division handles franchise sales, onboarding, and training globally. It is responsible for expanding the brand footprint, enforcing standards, and providing operational support. As of 2025, it oversees growth in over 50 countries, coordinating major development deals in regions such as China, Europe, and Latin America.

Papa John’s Technology & Digital Platform

Papa John’s maintains its proprietary digital ecosystem, which includes its website, mobile app, loyalty program, and integrated voice ordering systems. It is managed as an internal technology arm led by Chief Digital & Technology Officer. This segment focuses on enhancing online ordering, AI-driven personalization, and seamless customer experience across all digital channels.

Supply Chain Services

A core internal operation, Papa John’s Supply Chain Services manages ingredient sourcing, quality control labs, and vendor relationships. It oversees everything from farm to pizza box, working directly with growers, processors, and logistics providers to ensure regulatory compliance and ingredient integrity.

International Joint Ventures & Re‑franchising Agreements

Though not direct brand ownership, Papa John’s retains equity stakes and control roles in select international markets—notably through joint ventures and refranchising initiatives. For example, Papa John’s previously co-owned a joint venture with Blue & Silver Ventures in Texas; in 2022, it sold a majority stake in these 90 stores to Sun Holdings, maintaining a minority interest to support ongoing brand standards in that region.

Corporate-Owned Restaurants (North America & International)

Papa John’s directly operates around 550 company-owned locations worldwide, with autonomy over operations, staffing, and local marketing. These units serve as innovation testbeds and benchmarks for best practices before wider franchise rollout. Any breakthroughs in menu items or technology are first piloted in these corporate stores.

Final Thoughts

Understanding who owns Papa John’s gives insight into its corporate stability and future direction. While the founder is no longer the dominant force, large investment firms and experienced executives now drive decisions. The company has transformed itself in recent years and continues to grow through innovation and brand loyalty. It remains a strong player in the global pizza market.

FAQs

Who is the main owner of Papa John’s?

The main owner of Papa John’s as of 2025 is The Vanguard Group, which holds the largest institutional stake in the company. No single individual holds a majority stake. Ownership is divided among public shareholders, institutional investors, and some executives.

Is Shaq part-owner of Papa John’s?

Yes, Shaquille O’Neal is a part-owner. He owns 9 Papa John’s franchise locations in Atlanta and also serves on the company’s Board of Directors. He has been involved in branding, marketing, and community engagement since 2019.

Who owns the majority of Papa John’s?

There is no single majority owner. The company is publicly traded, and its largest shareholders are institutional investors like Vanguard, BlackRock, and mutual fund groups. Combined, institutional investors own over 85% of the company.

Is John Schnatter a billionaire?

As of 2025, John Schnatter is no longer a billionaire. His net worth is estimated to be around $500 million to $600 million, largely due to his past holdings in Papa John’s and real estate. He lost majority ownership and influence in the company in 2018.

Is Papa John’s halal?

Papa John’s is not globally certified as halal, but some international outlets, particularly in Muslim-majority countries like the UAE, Saudi Arabia, and Malaysia, offer halal-certified menus. In the U.S., the chain is not officially halal.

What does John Schnatter do now?

John Schnatter currently runs a private venture called the “Papa John Schnatter Foundation” and is involved in real estate and media appearances. He has distanced himself from the pizza business but remains publicly vocal about his departure from the company.

Which celebrity owns 9 Papa John’s?

Shaquille O’Neal owns 9 Papa John’s locations in Atlanta. He also plays an active role in promoting the brand as both a franchisee and board member.

What is John Schnatter’s net worth?

As of 2025, John Schnatter’s net worth is estimated at $500–600 million. He once owned about 30% of Papa John’s but has since sold most of his shares and exited the board.

Who was the original owner of Papa John’s?

The original owner and founder of Papa John’s is John H. Schnatter, also known as “Papa John.” He started the company in 1984 by converting a broom closet in his father’s tavern into a pizza kitchen.

What is Papa John’s parent company?

Papa John’s International, Inc. is a standalone public company. It does not have a parent company, although it partners with large franchisee groups like Sun Holdings in certain markets.

Where is John Schnatter now?

As of 2025, John Schnatter lives in Kentucky and continues to manage his private investments. He occasionally appears in interviews or publishes opinion pieces but is no longer affiliated with Papa John’s.

Who founded Papa John’s?

John Schnatter founded Papa John’s in 1984. He started by converting a broom closet in his father’s tavern into a pizza shop.

Is Papa John’s privately owned?

No, Papa John’s is a publicly traded company listed on NASDAQ under the ticker PZZA.

Who is the CEO of Papa John’s in 2025?

Rob Lynch is the current CEO of Papa John’s.

Does Papa John’s own other restaurant brands?

No, Papa John’s focuses solely on its pizza business and does not own other major restaurant brands.