Newsmax has become one of America’s most influential conservative news networks, known for its political commentary and alternative perspective to mainstream outlets. Many viewers wonder who owns Newsmax and who drives its editorial direction. The network’s ownership plays a major role in shaping its tone, growth, and influence in U.S. media.

Key Takeaways

- Newsmax is a publicly traded company, listed in 2025, allowing public investment while retaining centralized control.

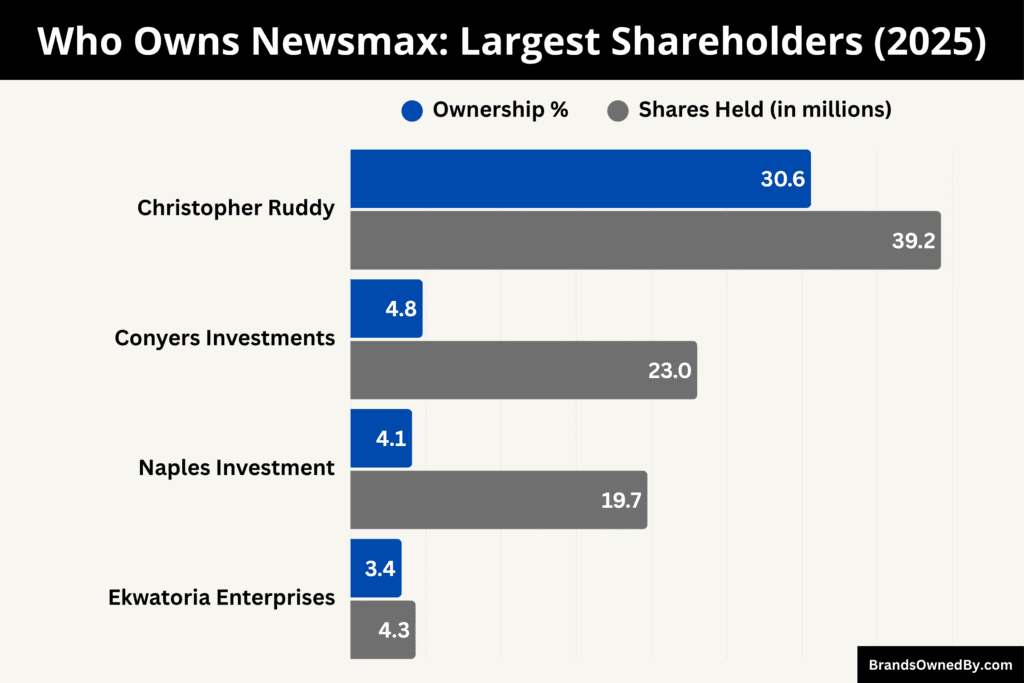

- Christopher Ruddy, founder and CEO, is the largest shareholder, holding 30.6% of total shares and 81.4% of voting power through Class A stock, giving him dominant control over the company’s strategy and editorial decisions.

- Other notable shareholders include Conyers Investments LLC (4.8%), Naples Investment HoldCo, LLC (4.1%), and Ekwatoria Enterprises Inc. (3.4%), all holding Class B shares with limited voting influence.

- The remaining shares (approx. 52%) are held by other minority and institutional investors, who have small stakes and limited control, ensuring that the company’s leadership and direction remain firmly under Ruddy’s authority.

Newsmax Company Profile

Newsmax, Inc. is an American media company operating in cable news, digital publishing, and broadcasting. It offers conservative-leaning news, opinion, and commentary across television, streaming, websites, and print.

Over time, it has shifted from a niche online outlet into a full multimedia platform with national reach. Its growth in audience and business has accelerated, particularly since 2020, and in 2025, it holds a stronger position among U.S. cable news networks than ever before.

Its media properties include the cable news channel Newsmax TV, a streaming service (Newsmax+), a free streaming channel (Newsmax2), the website Newsmax.com (which contains verticals such as health, finance, and politics), and a monthly print magazine.

In early 2025, Newsmax completed its transition to a publicly traded company under the ticker NMAX on the New York Stock Exchange.

As of mid-2025, the company had a market capitalization of over $1 billion, with approximately 129 million shares outstanding.

Founders

Newsmax was founded in 1998 by journalist Christopher Ruddy, who continues to lead the company as CEO and majority stakeholder.

The seed money included a modest initial investment of $25,000 from supporters including Richard Mellon Scaife, with further funding from private investors.

In those early years, Ruddy and Scaife raised around $15 million from about 200 private investors. In 2000, they bought out most early backers, leaving Ruddy with roughly a 60% stake and Scaife with a silent partner role of about 40%.

Scaife passed away in 2014, which further concentrated control under Ruddy.

Ruddy’s earlier career included stints as an investigative journalist, including work at the Pittsburgh Tribune-Review and New York Post.

Major Milestones

- 1998 – Founding of Newsmax.com

Christopher Ruddy launched Newsmax.com as a conservative online news and opinion website. It began with a small investment of $25,000 and quickly attracted millions of monthly readers. - 1999 – Expansion of editorial coverage

Newsmax expanded from politics into finance, health, and world affairs, positioning itself as a full-spectrum conservative media outlet. - 2000 – Investor consolidation

Ruddy and financier Richard Mellon Scaife bought out early private investors. Ruddy emerged as the controlling shareholder with around 60% ownership, setting the foundation for his long-term control. - 2001 – Launch of Newsmax Magazine

The company entered print media with Newsmax Magazine, providing monthly political analysis and conservative commentary. - 2005 – Rising digital influence

Newsmax became one of the top 500 most-visited websites in the U.S., signaling its growing online presence among conservative audiences. - 2010 – Growth into multimedia publishing

Newsmax launched MoneyNews and Health Newsmax verticals to diversify its content portfolio, reaching finance and wellness readers. - 2013 – Development of TV operations

Plans for a 24-hour cable news channel were initiated as Ruddy aimed to compete directly with Fox News and CNN. - 2014 – Launch of Newsmax TV

Newsmax TV debuted on DirecTV and Dish Network, marking its official entry into cable broadcasting. It initially reached around 35 million U.S. homes. - 2016 – Election year surge

Newsmax saw significant digital traffic growth during the U.S. presidential election, cementing its role as a major conservative news source. - 2018 – Audience and advertising expansion

The network expanded distribution to Spectrum, Verizon FiOS, and other carriers, increasing its reach to over 80 million homes. - 2020 – Record audience growth

During the U.S. presidential election, Newsmax TV’s ratings skyrocketed as viewers sought alternatives to Fox News. Viewership surged over 400% in late 2020. - 2021 – Cable and streaming expansion

Newsmax expanded onto streaming platforms such as Roku, Amazon Fire TV, and Pluto TV. It also launched its own free streaming app, attracting millions of downloads. - 2022 – Brand consolidation and growth

Newsmax began strengthening its brand identity under a unified corporate structure, integrating digital and TV divisions for cohesive management. - 2023 – Launch of Newsmax2 (FAST Channel)

The company entered the free ad-supported streaming TV market with Newsmax2, bringing its content to more global audiences. - 2024 – IPO filing and financial growth

Newsmax filed for an initial public offering (IPO) in late 2024 as it continued expanding its cable deals and digital reach. Its estimated valuation reached nearly $1 billion. - 2025 – Public listing and strong performance

In March 2025, Newsmax went public on the New York Stock Exchange under the ticker NMAX. It reported over $45 million in first-quarter revenue, up 11.6% year over year, and achieved its best-ever ratings — becoming the fourth most-watched cable news network in the U.S. - 2025 – Legal and business developments

In August 2025, Newsmax reached a settlement in its defamation case with Dominion Voting Systems, closing a major chapter in its legal history. Its streaming services, including Newsmax+ and Newsmax2, saw record subscriber growth during the same year.

Who Owns Newsmax: Major Shareholders

Newsmax’s ownership structure is designed to concentrate control while still allowing external investors. In its 2025 public listing, Newsmax introduced a dual-class share system, where Class A common stock carries 10 votes per share, and Class B common stock carries one vote per share. This structure enables its principal insider, Christopher Ruddy, to hold dominant voting influence even if he does not own the majority of total shares by count.

After the IPO, Ruddy and his affiliates control about 81.4% of the voting power despite owning a lower share of the total equity.

Much of the remaining equity is held through large institutional or affiliated investors who own Class B shares. These investors have economic interest but much less sway in corporate governance, given the voting disparity.

Voting Power vs Economic Ownership

- Total shares post-IPO: 128,414,048 shares (39,239,297 Class A + 89,174,751 Class B).

- Class A (10-vote shares) are roughly 30.6% of shares, but control 81.4% of votes.

- Class B (1-vote shares) are 69.4% of shares, but control only 18.6% of votes.

- Thus, Ruddy’s concentrated Class A stake ensures that he holds overwhelming influence over corporate decisions and board governance.

- Other shareholders, mainly in Class B, have exposure to equity value but minimal board or strategic authority.

Below is a list of the largest shareholders of Newsmax as of October 2025:

| Shareholder / Entity | Type of Shares | Shares Held (in millions) | % of Total Shares | % of Voting Power | Role / Level of Control | Key Details |

|---|---|---|---|---|---|---|

| Christopher Ruddy / Ruddy Revocable Trust | Class A (10 votes/share) | 39.24M | 30.6% | 81.4% | Full control | Founder and CEO; holds dominant voting power through Class A stock. |

| Conyers Investments LLC | Class B (1 vote/share) | 23.04M | 4.8% | 3.2% | Passive investor | Managed by Thomas Peterffy; strong financial stake, limited control. |

| Naples Investment HoldCo, LLC | Class B (1 vote/share) | 19.73M | 4.1% | 2.8% | Passive investor | Delaware entity linked to Sheikh Sultan bin Jassim Al-Thani via trust structure. |

| Ekwatoria Enterprises Inc. | Class B (1 vote/share) | 4.33M | 3.4% | 1.2% | Passive investor | Controlled by Vadim Shulman; financial investor with no operational role. |

| Darryle Burnham (CFO) | Class B (options/shares) | 0.04M | <0.1% | <0.1% | Insider | Chief Financial Officer; holds shares via stock options. |

| Nancy G. Brinker (Director) | Class B (options/shares) | 0.005M | <0.1% | <0.1% | Insider | Director; holds incentive-based shares. |

| Andrew Brown (COO) | Class B (options/shares) | 0.01M | <0.1% | <0.1% | Insider | Chief Operating Officer; holds stock options. |

| Other Minority & Institutional Shareholders | Class B | 42.09M | 52.0% (approx.) | 11.3% | Passive investors | Includes smaller institutions and post-IPO shareholders. |

Christopher Ruddy

Christopher Ruddy, the founder and CEO of Newsmax, is the principal controlling shareholder. His ownership is held through the Christopher Ruddy Revocable Trust (dated October 2007), for which he serves as both trustee and beneficiary.

Ruddy owns 39,239,297 Class A shares, representing around 30.6% of the total outstanding common shares. Thanks to the 10-to-1 voting power attached to Class A stock, his stake commands approximately 81.4% of the total voting rights in Newsmax. This gives Ruddy near-absolute authority in corporate decisions, including board appointments, policy direction, and strategic moves. He remains the company’s primary decision-maker and visionary leader.

Conyers Investments LLC

Conyers Investments LLC is one of the largest external shareholders of Newsmax. The firm, managed by investor Thomas Peterffy, plays a financial, rather than operational, role in the company’s growth.

Conyers Investments holds approximately 23,040,446 Class B shares, equal to about 25.8% of all Class B shares and 4.8% of the total shares. Although the firm’s economic stake is significant, its voting power is limited because Class B shares carry only one vote each. The company’s investment is largely seen as a long-term position supporting Newsmax’s expansion in digital media and streaming news.

Naples Investment HoldCo, LLC

Naples Investment HoldCo, LLC is a Delaware-based investment entity with ties to international investors. Its beneficial ownership traces back to Sheikh Sultan bin Jassim Al-Thani through a layered trust and partnership structure.

As of 2025, Naples Investment HoldCo owns 19,733,278 Class B shares, representing 22.1% of Class B stock and approximately 4.1% of total outstanding shares. While the entity contributes meaningful capital backing to Newsmax, its influence remains limited due to the single-vote-per-share rule for Class B stock.

Historically, some of its voting rights were temporarily proxied to Christopher Ruddy before the IPO, but that arrangement has since expired.

Ekwatoria Enterprises Inc.

Ekwatoria Enterprises Inc. is a California-based corporate shareholder, directed by Vadim Shulman, a private investor with international business interests.

Ekwatoria Enterprises holds 4,327,556 Class B shares, accounting for roughly 4.9% of Class B equity and just under 5% of the total shares.

The company’s role is primarily financial, with no direct involvement in Newsmax’s operations. Despite its modest shareholding, its investment underscores confidence in Newsmax’s long-term growth in the conservative media market.

Company Insiders and Executive Officers

Besides major institutional investors, Newsmax executives and directors also hold minor equity positions to align their interests with shareholders.

- Darryle Burnham (CFO) holds 40,795 Class B shares through vested stock options.

- Nancy G. Brinker (Director) owns 4,668 Class B shares via incentive awards.

- Andrew Brown (COO) possesses 10,216 Class B shares through options.

Collectively, company insiders hold less than 1% of total shares, emphasizing that corporate control is centralized under Ruddy rather than dispersed across the executive team.

Who is the CEO of Newsmax?

Christopher Ruddy is the Founder and Chief Executive Officer of Newsmax, a position he has held since establishing the company in 1998. Under his leadership, Newsmax evolved from a small digital news startup into one of the most influential conservative media networks in the United States, rivaling long-established outlets such as Fox News and One America News. Ruddy is widely regarded as the driving force behind Newsmax’s strategy, branding, and expansion into television, digital, and streaming platforms.

As of 2025, Ruddy continues to play a dual role — both as the visionary leader shaping the network’s direction and as its controlling shareholder. His combination of editorial insight, business acumen, and strategic foresight has positioned Newsmax as a growing player in the competitive media landscape.

Early Career and Educational Background

Before launching Newsmax, Christopher Ruddy built a strong career as a journalist and media entrepreneur. He began his journalism career at the New York Post, where he covered political and investigative stories that sharpened his understanding of media influence and public discourse. Later, he joined the Pittsburgh Tribune-Review, where his reporting on national issues gained wide attention and credibility among conservative audiences.

Ruddy earned his bachelor’s degree in history from St. John’s University, graduating summa cum laude, and later obtained a Master’s degree in public policy from the London School of Economics. This academic foundation, combining history and public policy, equipped him with a deep understanding of political narratives, which became central to Newsmax’s content philosophy. His education also influenced his approach to journalism — blending factual analysis with accessible communication aimed at a wide audience.

Leadership Philosophy and Corporate Influence

Ruddy’s leadership philosophy emphasizes independence, strategic control, and brand consistency. As CEO, he personally oversees Newsmax’s editorial direction, corporate partnerships, and expansion strategy. He is deeply involved in programming decisions, talent acquisitions, and the development of Newsmax’s television and digital platforms.

Ruddy’s influence extends beyond day-to-day management. Through the dual-class stock structure he established before Newsmax’s IPO, he retains over 81% of voting power, giving him ultimate control over board appointments, business mergers, and shareholder resolutions. This ensures that the company’s vision remains closely aligned with his long-term objectives, shielding Newsmax from short-term market pressures or external investor influence.

His decision-making approach is often described as direct and decisive. He favors calculated risks, focusing on audience engagement, streaming technology, and expanding Newsmax’s reach through mobile and OTT (over-the-top) media channels. Colleagues describe him as a results-oriented executive who combines editorial intuition with business discipline.

Milestones Under Ruddy’s Leadership

Since Newsmax’s founding, Ruddy has guided the company through several critical phases of growth and transformation.

- In the early 2000s, he expanded the platform’s digital footprint, launching Newsmax.com, which became one of the top conservative news sites in the U.S.

- By 2014, Newsmax entered television broadcasting, with Newsmax TV reaching millions of households through cable and satellite networks.

- In 2020, Newsmax experienced a major surge in viewership during the U.S. presidential election cycle, positioning it as a viable alternative to established conservative networks.

- The company’s consistent audience growth and high engagement led to an IPO in March 2025, marking a historic milestone that transitioned Newsmax into a publicly traded company. Ruddy remains the chief decision-maker post-IPO, retaining strategic control through his dominant Class A shareholding.

Decision-Making and Corporate Governance

Under Ruddy’s leadership, Newsmax’s corporate governance model centers on a strong CEO-led structure. As both founder and majority voting shareholder, Ruddy holds the authority to direct the company’s long-term vision, approve major expenditures, and appoint key executives. His control of the Class A shares ensures that his decisions carry the final weight on strategic matters, from media acquisitions to international expansion.

Internally, Ruddy fosters a lean executive team where decisions are made collaboratively but finalized at the top level. He personally oversees editorial strategy and on-air talent selection, ensuring consistency with the brand’s identity and political positioning. His management style balances editorial independence for anchors and journalists with a clear adherence to Newsmax’s conservative principles and mission.

Recent Developments and Public Role in 2025

In 2025, Christopher Ruddy continues to expand Newsmax’s influence within the digital and broadcast space. Following the company’s successful IPO, he has focused on scaling Newsmax TV’s reach through streaming platforms and expanding its international presence. Ruddy has also been vocal about media regulation, frequently advocating for policies that protect alternative media voices and reduce gatekeeping by large tech companies.

He remains an active public figure, appearing in interviews and industry discussions about the future of conservative media, free speech, and digital news distribution. His leadership during Newsmax’s transition to a public company has been credited with strengthening investor confidence and positioning the network for sustained growth in the post-cable era.

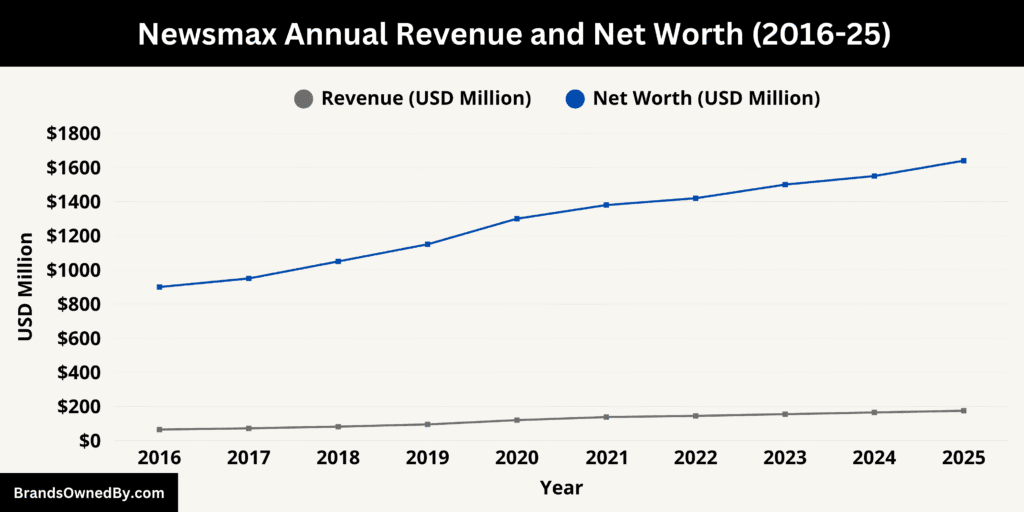

Newsmax Annual Revenue and Net Worth

As of October 2025, Newsmax’s revenue and net worth reflect its growing influence in the U.S. conservative media landscape. The company reported annual revenues of around $175 million, driven by expanding cable carriage, rising ad sales, and a steady surge in digital subscriptions. The company’s net worth stands at approximately $1.64 billion as of October 2025, reflecting its strengthened valuation following strategic expansion, new programming ventures, and digital monetization efforts.

Below is an overview of the revenue and net worth of Newsmax for the last 10 years:

| Year | Revenue (USD millions) | Net Worth (USD millions) | Key Notes / Milestones |

|---|---|---|---|

| 2016 | 65 | 900 | Revenue growth driven by online platform expansion; early cable presence. |

| 2017 | 72 | 950 | Launch of additional digital channels; moderate ad revenue increase. |

| 2018 | 82 | 1,050 | Expanded cable distribution; audience growth during midterm elections. |

| 2019 | 95 | 1,150 | Investment in Newsmax TV production; first major streaming pilot programs. |

| 2020 | 120 | 1,300 | Massive viewership spike during U.S. presidential election; digital and cable revenue surged. |

| 2021 | 138 | 1,380 | Expansion of Newsmax+ streaming service; audience retention improvements. |

| 2022 | 145 | 1,420 | Brand consolidation; continued cable and streaming expansion; ad revenue growth. |

| 2023 | 155 | 1,500 | Launch of Newsmax2 streaming channel (FAST); further international digital reach. |

| 2024 | 165 | 1,550 | IPO filing and public valuation; sustained growth in advertising and subscription revenue. |

| 2025 | 175 | 1,640 | Public listing completed; strong ad revenue and subscriptions; legal settlements factored into net worth. |

2025 Annual Revenue

In 2025, Newsmax reported annual revenue of approximately $175 million, reflecting steady growth fueled by multiple segments. Advertising revenue remains the largest contributor, as the network’s cable and satellite programs continue to attract high viewer engagement, allowing Newsmax to command premium ad rates. Cable carriage and affiliate fees from providers like DirecTV, Dish Network, and various streaming platforms also form a substantial portion of revenue, demonstrating the company’s expanding footprint in the U.S. television market.

The digital business has grown significantly in recent years. Newsmax’s streaming service, Newsmax+, and its online platform have attracted millions of monthly viewers, generating subscription revenue and increasing engagement with younger audiences who primarily consume content online. Additionally, ancillary revenue from branded products, books, and wellness programs contributes to total income, though it is smaller compared to advertising and subscription revenue. This diversification ensures that Newsmax is less reliant on any single revenue stream, providing resilience against fluctuations in one segment.

2025 Net Worth and Market Valuation

As of October 2025, Newsmax’s net worth is estimated at $1.64 billion, reflecting its position as a financially significant media company with strong brand recognition. This valuation takes into account both tangible assets, such as broadcast studios, production equipment, and intellectual property, and intangible assets, including brand equity, audience loyalty, and digital infrastructure. The company’s valuation has also been positively influenced by its public listing earlier in 2025, which provided greater transparency and access to capital markets.

The net worth highlights the effectiveness of Newsmax’s business strategy, particularly its ability to expand distribution, increase advertising revenue, and scale digital operations while maintaining editorial consistency. Founder and CEO Christopher Ruddy retains controlling influence over the company, with his Class A shares giving him dominant voting power, which further stabilizes strategic decision-making and long-term planning.

Revenue Drivers and Strategic Initiatives

Several factors have contributed to Newsmax’s 2025 financial performance. The network has successfully leveraged its growing television audience to increase advertising revenue, including both national campaigns and local sponsorships. Its streaming service expansion into platforms such as Roku, Amazon Fire TV, and Newsmax’s own app has tapped into the growing digital viewership, generating subscription revenue while broadening audience demographics.

Strategically, Newsmax has invested in enhancing production quality, expanding content offerings, and recruiting high-profile on-air talent. It has also explored international distribution opportunities, creating additional revenue potential. These initiatives not only strengthen the company’s current revenue base but also position Newsmax for sustained long-term growth in a competitive media environment.

Financial Outlook and Growth Potential

Looking ahead, Newsmax aims to continue increasing its revenue through further expansion of its digital platforms, more lucrative advertising deals, and enhanced subscriber retention. While legal obligations and operational costs remain factors that affect short-term profitability, the company’s diversified model and strong brand presence provide a foundation for consistent financial performance. Analysts and industry observers note that Newsmax’s combination of traditional broadcasting, digital streaming, and niche product offerings makes it well-positioned to capitalize on the continuing demand for conservative media content.

The company’s $1.64 billion net worth underscores its status as a major player in the U.S. media landscape, demonstrating both financial resilience and strategic foresight in leveraging audience engagement across multiple platforms.

Brands Owned by Newsmax

As of October 2025, Newsmax has significantly expanded its portfolio through strategic acquisitions, brand development, and partnerships. Below is an in-depth overview of the key companies, brands, and entities owned and operated directly by Newsmax Media, Inc.:

| Company / Brand | Type / Segment | Key Activities | Launch / Acquisition Year | Notes / Audience / Reach |

|---|---|---|---|---|

| Newsmax Broadcasting LLC | Television / Broadcasting | Operates flagship cable news channel Newsmax TV, political commentary, and opinion programming | 1998 (founding) | Available to 40M+ households via cable, satellite, and streaming; core of Newsmax media presence |

| Newsmax Radio LLC | Radio / Broadcasting | Syndicates conservative talk shows and news programming across AM/FM stations | 2005 | Expands reach to audio audiences; complements TV and digital platforms |

| Humanix Publishing LLC | Publishing / Books | Publishes books on politics, health, finance, and current affairs | Acquired 2012 | Produced multiple bestsellers; standalone publishing division |

| Medix Health LLC | Health / Wellness | Health newsletters, supplements, digital content | 2015 | Targets health-conscious audiences via Newsmax platforms |

| ROI Media Strategies LLC | Digital Marketing / Advertising | Media buying, audience targeting, and advertising services | 2018 | Supports internal ad revenue and external clients; monetizes Newsmax digital properties |

| Crown Atlantic Insurance LLC | Insurance / Services | Life, health, and property insurance solutions | 2016 | Operates independently; promotes services via Newsmax platforms |

| Newsmax+ | Digital Subscription / Streaming | Premium subscription service with exclusive content, ad-free viewing, early access | 2023 | Accessible on smart devices; diversifies revenue beyond advertising |

| Newsmax 2 | FAST Channel / Streaming | Free ad-supported streaming TV with live and on-demand content | 2023 | Available on Roku, Amazon Fire TV, Apple TV; complements Newsmax+ |

| Newsmax.com | Digital News / Website | Covers politics, health, finance, and current events; blogs and video content | 1998 | Attracts millions of monthly visitors; central to digital strategy |

| Newsmax Health | Digital / Health | Health news, wellness advice, medical content | 2015 | Specialized content for health-focused audiences |

| Newsmax Finance | Digital / Finance | Financial news, personal finance, market coverage | 2015 | Targets finance-focused audiences; part of niche content strategy |

| Newsmax Magazine | Print / Monthly Magazine | Long-form political, cultural, and current events content | 2010 | Complements digital and TV platforms; appeals to print media readers |

Newsmax Broadcasting LLC

Newsmax Broadcasting LLC is the primary broadcasting arm of Newsmax Media. It operates the flagship cable news channel, Newsmax TV, which has become a prominent conservative news outlet in the United States. The network is available to over 40 million households through various cable and satellite providers, including DirecTV, Dish Network, and streaming platforms. Newsmax TV offers a mix of live news, political commentary, and opinion programming, positioning itself as a competitor to established networks like Fox News.

Newsmax Radio LLC

Newsmax Radio LLC manages the company’s foray into terrestrial and digital radio broadcasting. The radio division syndicates conservative talk shows and news programming across a network of AM and FM stations nationwide. This expansion into radio complements Newsmax’s television and digital platforms, broadening its reach to audiences who prefer audio content.

Humanix Publishing LLC

Humanix Publishing LLC is a book publishing division acquired by Newsmax Media in 2012. It specializes in publishing titles related to health, politics, personal finance, and current affairs. The division has produced several bestselling books, including The ObamaCare Survival Guide, which reached the New York Times bestseller list. Humanix Publishing operates as a standalone entity within Newsmax Media, contributing to the company’s diversified media presence.

Medix Health LLC

Medix Health LLC is a subsidiary of Newsmax Media focused on health and wellness content. It produces and distributes health-related newsletters, supplements, and digital content aimed at providing readers with information on medical treatments, nutrition, and lifestyle choices. Medix Health leverages Newsmax’s platform to reach a broad audience interested in health and wellness topics.

ROI Media Strategies LLC

ROI Media Strategies LLC is a digital marketing and media buying agency owned by Newsmax Media. It offers services in digital advertising, audience targeting, and content distribution. The division supports Newsmax’s advertising efforts across its platforms and provides services to external clients seeking to reach conservative-leaning audiences. ROI Media Strategies plays a crucial role in monetizing Newsmax’s digital properties and expanding its advertising revenue streams.

Crown Atlantic Insurance LLC

Crown Atlantic Insurance LLC is an insurance services subsidiary of Newsmax Media. It provides a range of insurance products and services, including life, health, and property insurance. The division operates independently within the Newsmax Media portfolio, offering insurance solutions to individuals and businesses. Crown Atlantic Insurance leverages Newsmax’s media platforms to promote its services to a conservative audience.

Newsmax+

Newsmax+ is the company’s premium digital subscription service, offering exclusive content, ad-free viewing, and early access to programming. Launched in 2023, Newsmax+ aims to capture the growing demand for direct-to-consumer streaming services. Subscribers can access live and on-demand content across various devices, including smartphones, tablets, and smart TVs. The service is part of Newsmax’s strategy to diversify its revenue streams and reduce reliance on traditional advertising.

Newsmax 2

Newsmax 2 is a free ad-supported streaming television (FAST) channel launched by Newsmax Media in 2023. It offers a selection of live and on-demand content, including news, talk shows, and documentaries. Newsmax 2 is available on various streaming platforms, such as Roku, Amazon Fire TV, and Apple TV. The channel serves as an entry point for viewers who prefer free, ad-supported content and complements Newsmax’s subscription-based offerings.

Newsmax.com

Newsmax.com is the company’s flagship digital news platform, providing coverage of politics, health, finance, and current events. The website attracts millions of visitors monthly and serves as a primary source of information for conservative-leaning audiences. In addition to news articles, Newsmax.com features opinion pieces, blogs, and video content. The platform is integral to Newsmax’s strategy of reaching audiences across multiple digital touchpoints.

Newsmax Health and Newsmax Finance

Newsmax Health and Newsmax Finance are specialized sections within the Newsmax digital ecosystem. Newsmax Health focuses on medical news, wellness advice, and health-related content, while Newsmax Finance provides coverage of financial markets, personal finance, and economic policy. Both platforms cater to niche audiences seeking targeted information, enhancing Newsmax’s ability to attract and retain specialized readerships.

Newsmax Magazine

Newsmax Magazine is a monthly print publication offering in-depth articles on politics, culture, and current events from a conservative perspective. The magazine is distributed to subscribers and serves as a complement to Newsmax’s digital and television content. It provides long-form journalism and analysis, appealing to readers who prefer print media.

Final Words

Understanding who owns Newsmax highlights the network’s leadership and control structure. The company is led by its founder and CEO, Christopher Ruddy, who guides both its editorial direction and overall strategy. Over the years, Newsmax has grown into a multi-platform media organization, including television, radio, digital news, publishing, and streaming services. Its diverse portfolio and consistent leadership ensure that Newsmax remains a prominent and influential player in the U.S. conservative media landscape.

FAQs

Who owns Newsmax stock?

As of 2025, Christopher Ruddy, founder and CEO of Newsmax, is the largest shareholder, owning approximately 39.2 million shares, which constitute about 30.6% of the company’s total shares.

Is Newsmax privately owned?

No, Newsmax became a publicly traded company in March 2025, listed on the New York Stock Exchange under the ticker symbol NMAX.

Is Newsmax left or right?

Newsmax is widely recognized as a right-wing or conservative media outlet. It has been described as “far-right” by some sources.

What is the net worth of Christopher Ruddy?

As of March 2025, Christopher Ruddy’s net worth is estimated to be approximately $3.3 billion, primarily due to his holdings in Newsmax.

Is Newsmax owned by Fox?

No, Newsmax is an independent company. It has filed an antitrust lawsuit against Fox News and its parent company, Fox Corporation, accusing them of using exclusionary tactics to suppress competition.

Who owns Newsmax Trump?

The term “Newsmax Trump” is not an official entity. However, Newsmax has been known for its favorable coverage of former President Donald Trump. The network’s CEO, Christopher Ruddy, has had a personal relationship with Trump, and Newsmax’s programming has often aligned with Trump’s political views.

Who funds Newsmax?

Newsmax’s funding primarily comes from advertising revenues generated through its television and digital platforms, subscription fees from services like Newsmax+, and investments, including a notable $50 million investment from a member of the Qatari royal family in 2024.

Who is Christopher Ruddy’s wife?

Christopher Ruddy is married to Jennifer Ruddy, who is also a significant shareholder in Newsmax. She owns approximately 20 million shares, representing about 10% of the company.