Netflix is the world’s leading streaming platform, offering movies, TV shows, and original content. Many wonder, who owns Netflix?

The company is publicly traded, meaning ownership is spread among institutional investors and individual shareholders. This article explores the history, ownership, and control of Netflix, its revenue, competitors, and more.

History of Netflix

Netflix was founded in 1997 by Reed Hastings and Marc Randolph in California.

The idea stemmed from Hastings’ frustration with late fees from a traditional video rental store. He envisioned a business that would allow customers to rent DVDs by mail without worrying about late returns.

In 1998, Netflix launched its website and introduced a DVD rental-by-mail service with a pay-per-rental model. The company quickly evolved, adopting a subscription-based model in 1999 that allowed users to rent unlimited DVDs for a fixed monthly fee. This change laid the foundation for Netflix’s future growth.

The early 2000s were a turning point. Netflix introduced a sophisticated recommendation algorithm in 2000, improving customer experience by suggesting personalized movie choices. In 2002, the company went public with an initial public offering (IPO) at $15 per share, raising $82.5 million.

By the mid-2000s, DVD sales were declining, and Netflix saw an opportunity in digital streaming. In 2007, it launched its streaming service, allowing users to watch content instantly without waiting for DVDs. This shift revolutionized the entertainment industry, making on-demand streaming the norm.

Over the next decade, Netflix expanded globally. It entered Canada in 2010 and rapidly expanded to Latin America, Europe, and Asia. In 2013, Netflix became a content producer, releasing its first original series, House of Cards. The success of its originals like Stranger Things, The Crown, and Money Heist solidified its position as a dominant force in entertainment.

Today, Netflix continues to innovate with interactive content, gaming ventures, and partnerships with top creators worldwide. Despite increasing competition, it remains a major player in the streaming industry.

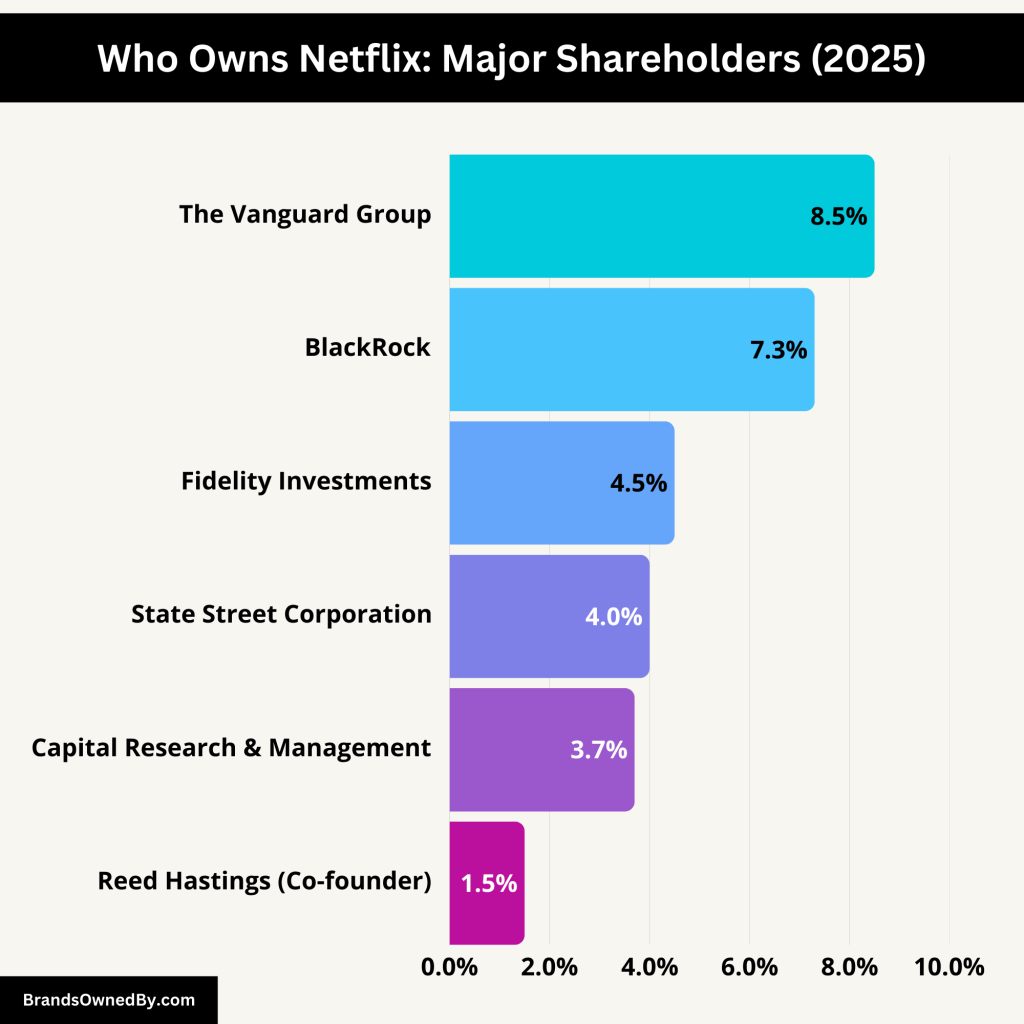

Who Owns Netflix: Largest Shareholders

Netflix is a publicly traded company listed on the NASDAQ under the ticker symbol NFLX. Its ownership is divided among institutional investors, company executives, and individual shareholders.

The largest shareholders are institutional investors, with The Vanguard Group and BlackRock among the top holders. However, Netflix’s ownership structure is dynamic, as shares are actively traded in the stock market.

List of Netflix Shareholders

Here’s a list of the major shareholders of Netflix:

| Shareholder | Ownership Percentage | Role & Influence |

|---|

| The Vanguard Group | ~8.5% | Largest shareholder; passive investor with voting power |

| BlackRock Inc. | ~7.3% | Second-largest shareholder; influences corporate governance |

| FMR LLC (Fidelity Investments) | ~4.5% | Major institutional investor; actively manages investments |

| State Street Corporation | ~4.0% | Holds shares through ETFs and index funds; votes on company policies |

| Capital Research & Management | ~3.7% | Long-term investor; engages with company leadership |

| Reed Hastings (Co-founder & Executive Chairman) | ~1.5% | Founder and key strategic advisor |

| Greg Peters (Co-CEO) | Varies | Leads technology and expansion strategies |

| Ted Sarandos (Co-CEO) | Varies | Oversees content strategy and production |

| Other Institutional & Retail Investors | Remaining shares | Includes hedge funds, pension funds, and individual investors |

The Vanguard Group – Largest Shareholder of Netflix

The Vanguard Group is the largest shareholder of Netflix, owning approximately 8.5% of the company’s outstanding shares. Vanguard is one of the world’s largest asset management firms, overseeing trillions in assets across various industries.

As a passive investor, Vanguard does not directly influence Netflix’s daily operations. However, due to its significant stake, it has voting power in key decisions, including board appointments and corporate governance policies. The firm primarily holds Netflix stock through its index funds and exchange-traded funds (ETFs), making it a major force in the company’s financial stability.

BlackRock Inc. – Second-Largest Shareholder

BlackRock is another major institutional investor in Netflix, holding about 7.3% of the company’s shares. BlackRock is the world’s largest asset management company, managing over $10 trillion in global investments.

Like Vanguard, BlackRock is a passive investor, primarily holding Netflix stock in its ETFs and mutual funds. However, its voting power allows it to influence corporate governance, environmental policies, and executive compensation. BlackRock’s consistent investment in Netflix reflects confidence in the company’s long-term growth.

FMR LLC (Fidelity Investments) – A Key Stakeholder

FMR LLC, also known as Fidelity Investments, owns around 4.5% of Netflix. Fidelity is a major financial services firm known for its mutual funds, retirement plans, and investment management services.

Fidelity’s stake in Netflix represents its commitment to technology and media stocks. As an active investor, it may engage with Netflix’s leadership on financial and strategic decisions. Fidelity’s investment signals confidence in Netflix’s ability to maintain subscriber growth and expand its content offerings.

State Street Corporation – A Major Institutional Investor

State Street Corporation holds about 4.0% of Netflix shares. It is a prominent financial services and asset management company, overseeing trillions in assets.

State Street primarily holds Netflix shares through its ETFs and index funds. While it does not directly control Netflix’s operations, it plays a role in shareholder voting and corporate governance decisions. Its steady investment in Netflix indicates long-term confidence in the company’s profitability.

Capital Research & Management – Long-Term Investor

Capital Research & Management owns approximately 3.7% of Netflix. It is part of Capital Group, one of the world’s oldest and most respected investment management firms.

Unlike passive investors, Capital Research is known for actively managing its investments. This means it may work closely with Netflix’s leadership to ensure strong financial performance and shareholder returns. Capital Research’s stake reflects its belief in Netflix’s content strategy and expansion efforts.

Reed Hastings – Netflix Co-Founder and Former CEO

Reed Hastings, Netflix’s co-founder and former CEO, owns around 1.5% of the company’s stock. While his stake is smaller compared to institutional investors, he remains an influential figure in Netflix’s strategic direction.

Hastings co-founded Netflix in 1997 and served as CEO for over two decades before stepping down in 2023. He now serves as Executive Chairman, advising Netflix’s leadership on innovation, content strategy, and global expansion. His continued involvement ensures that Netflix stays true to its original vision.

Greg Peters – Co-CEO and Insider Shareholder

Greg Peters, Netflix’s current co-CEO, holds a smaller but significant stake in the company. While his exact share percentage fluctuates, as an insider, he has a vested interest in Netflix’s success.

Peters has been with Netflix since 2008 and played a key role in the company’s international expansion. His leadership focuses on content, pricing strategies, and technological advancements. As co-CEO, he helps drive Netflix’s long-term growth and innovation.

Ted Sarandos – Co-CEO and Content Visionary

Ted Sarandos, the other co-CEO of Netflix, also owns a stake in the company. Sarandos has been with Netflix since 2000 and is credited with transforming it into a content powerhouse.

His expertise in entertainment and production has led to the creation of hit shows like Stranger Things, The Crown, and Squid Game. As co-CEO, he is responsible for content strategy, partnerships, and maintaining Netflix’s competitive edge in the streaming industry. His ownership stake aligns his interests with the company’s long-term success.

Other Institutional and Retail Investors

In addition to these major shareholders, Netflix’s ownership is distributed among other institutional investors and millions of individual shareholders. Hedge funds, pension funds, and retail investors collectively hold a significant portion of Netflix’s stock.

The stock’s liquidity allows constant trading, meaning ownership percentages can shift frequently. However, institutional investors consistently hold the majority stake, shaping Netflix’s corporate decisions and long-term strategies.

Who Controls Netflix?

Although Netflix is publicly traded, its strategic decisions are made by the leadership team and board of directors. Institutional investors like Vanguard and BlackRock hold significant ownership, they do not manage daily operations. Instead, control rests with Netflix’s executive leadership, board members, and key decision-makers.

Executive Leadership Team – The Primary Decision-Makers

Netflix operates under a dual-CEO structure, with Ted Sarandos and Greg Peters leading the company. Both CEOs share responsibilities but focus on different aspects of Netflix’s operations.

- Ted Sarandos (Co-CEO) – Oversees Netflix’s content strategy, acquisitions, and partnerships. He plays a crucial role in deciding what movies, TV shows, and original productions Netflix invests in. Sarandos has been instrumental in turning Netflix into a major content producer, securing blockbuster hits like Stranger Things, The Crown, and Squid Game.

- Greg Peters (Co-CEO) – Focuses on technology, international expansion, and monetization strategies. He led Netflix’s global expansion, helping the company enter new markets. He is also responsible for pricing strategies, advertising initiatives, and user experience improvements.

Reed Hastings – The Guiding Force

Reed Hastings, Netflix’s co-founder and former CEO, now serves as Executive Chairman. While he no longer runs daily operations, his role involves guiding long-term strategy and innovation.

Hastings has a strong influence on Netflix’s future direction, advising the leadership team on competition, technology, and content investments. His presence ensures continuity in Netflix’s vision, even as new leaders take charge.

Netflix Board of Directors – Oversight and Governance

The Netflix Board of Directors oversees corporate governance, financial strategies, and major business decisions. The board consists of industry experts, business executives, and independent members who ensure accountability and strategic growth.

Key Members of the Board of Directors

- Reed Hastings (Executive Chairman) – Provides strategic guidance and industry expertise.

- Ted Sarandos (Co-CEO & Board Member) – Represents Netflix’s leadership in board decisions.

- Greg Peters (Co-CEO & Board Member) – Helps shape Netflix’s business model and expansion.

- Ann Mather – Serves as Lead Independent Director and head of the Audit Committee.

- Jay Hoag – Co-founder of TCV, a venture capital firm that was an early Netflix investor.

- Mathias Döpfner – CEO of Axel Springer SE, bringing media expertise.

- Timothy Haley – Managing Director at Redpoint Ventures, with experience in tech investments.

Institutional Investors’ Influence on Control

Although Vanguard, BlackRock, and other institutional investors own large portions of Netflix, they do not directly control operations. Their influence is primarily through voting rights and shareholder meetings, where they can support or oppose executive decisions.

However, if institutional investors lose confidence in Netflix’s leadership, they could push for board changes or management shifts. This ensures that Netflix remains accountable to its shareholders while maintaining operational independence.

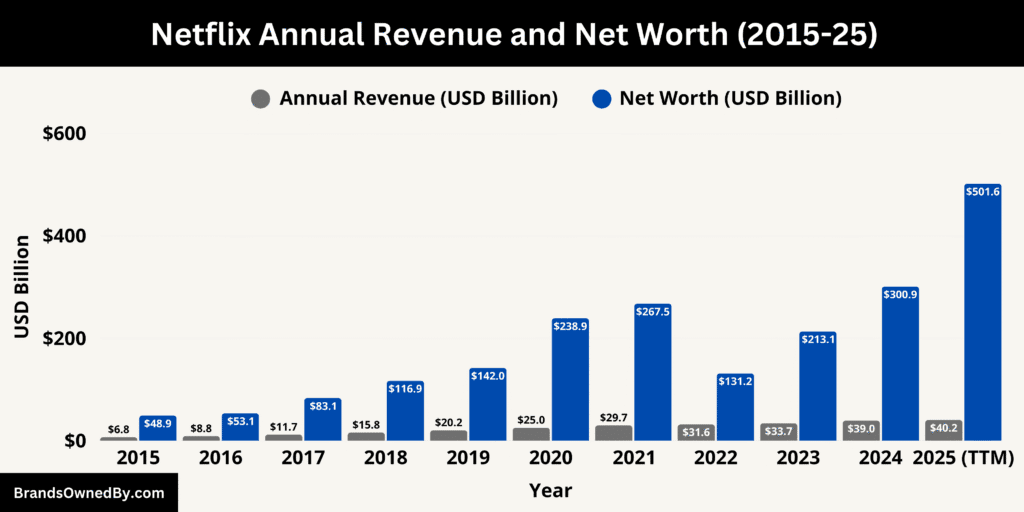

Annual Revenue and Net Worth of Netflix

Netflix generates billions in revenue through subscriptions and licensing deals. In 2024, Netflix reported over $39 billion in revenue. Its net income stood at approximately $5 billion.

As of March 2025, the net worth of Netflix is well over $407.3 billion.

Netflix’s revenue has grown significantly over the past decade, reflecting its successful expansion into international markets and original content production.

| Year | Annual Revenue (Billion $) | YoY Growth (%) |

|---|

| 2014 | $5.50 | — |

| 2015 | $6.78 | +23.3% |

| 2016 | $8.83 | +30.3% |

| 2017 | $11.69 | +32.4% |

| 2018 | $15.79 | +35.1% |

| 2019 | $20.15 | +27.6% |

| 2020 | $24.99 | +24.0% |

| 2021 | $29.70 | +18.9% |

| 2022 | $31.61 | +6.4% |

| 2023 | $39.40 | +24.7% |

Key Drivers of Netflix’s Financial Growth

- Subscriber Growth – Netflix’s global expansion, particularly in Asia, Europe, and Latin America, has fueled revenue increases.

- Original Content Investment – Hit shows like Stranger Things, The Witcher, and Squid Game have attracted millions of subscribers.

- Price Increases – Netflix has gradually increased subscription fees, boosting revenue despite competition.

- Ad-Supported Tier – Launched in 2022, the lower-cost ad-supported plan has added new revenue from advertisers.

- Password-Sharing Crackdown – Netflix’s efforts to monetize shared accounts have led to increased subscriptions.

Netflix Market Share and Competitors

Netflix holds a significant share of the global streaming market. As of 2024, it controls around 20% of the streaming market, making it the industry leader. However, competition is fierce, with several major rivals.

Top Competitors

Disney+

Disney+ holds about 18% of the market. Backed by Disney’s vast library, it has grown rapidly since its 2019 launch.

Amazon Prime Video

Amazon Prime Video has around 16% market share. It competes by bundling streaming with Amazon Prime memberships.

Hulu

Hulu, owned by Disney, controls 10% of the market. It offers a mix of live TV and on-demand streaming.

HBO Max (Now Max)

Max, owned by Warner Bros. Discovery, has 9% market share. It is known for high-quality original programming.

Apple TV+

Apple TV+ holds about 6% of the market. It focuses on original content rather than a vast library.

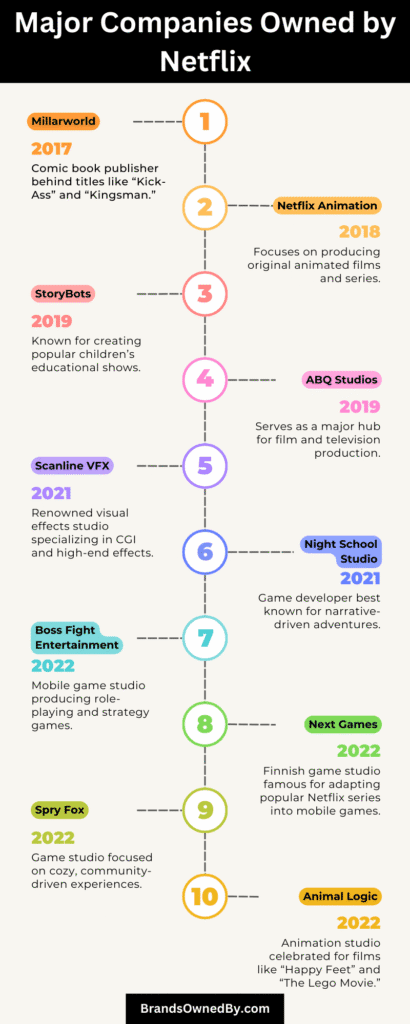

Brands Owned by Netflix

Netflix primarily operates under its own brand, but it owns several subsidiaries and production studios to enhance content creation. Here’s a list of the major brands, companies, and subsidiaries owned by Netflix:

Night School Studio

Also in September 2021, Netflix acquired Night School Studio, an independent video game developer known for its debut game, Oxenfree. This acquisition marked Netflix’s entry into the video game industry, aligning with its plans to launch a video game streaming service and offering subscribers interactive content experiences.

Next Games

Expanding into the gaming industry, Netflix acquired Next Games, a Finland-based mobile game developer, in 2022. Next Games specializes in creating interactive games based on popular entertainment franchises.

Before the acquisition, the company had developed games like Stranger Things: Puzzle Tales and two The Walking Dead mobile games. This acquisition aligns with Netflix’s strategy to diversify user engagement by integrating gaming experiences tied to its original content.

Millarworld

In 2017, Netflix acquired Millarworld, a comic book publishing company established by Mark Millar. Millarworld is renowned for creating popular titles such as Kingsman and Kick-Ass.

This acquisition granted Netflix access to a rich library of intellectual property, enabling the development of original series and films based on these narratives. This move marked Netflix’s initial venture into owning proprietary comic book content, aiming to expand its original programming portfolio.

Scanline VFX

In 2021, Netflix acquired Scanline VFX, a visual effects company acclaimed for its advanced CGI work in major Hollywood productions. By bringing Scanline VFX in-house, Netflix aimed to enhance its production capabilities for original films and series, ensuring high-quality visual effects and maintaining a competitive edge in content creation.

StoryBots

In 2019, Netflix acquired the StoryBots franchise, targeting educational content for children aged 3 to 8. The franchise’s original series, Ask the StoryBots, premiered on Netflix in 2016. The acquisition aimed to expand Netflix’s educational offerings and strengthen its appeal to younger audiences.

Animal Logic (Partnership)

Netflix entered into a strategic partnership with Animal Logic, an animation studio known for producing hits like The Lego Movie. This collaboration focuses on co-producing animated films, enriching Netflix’s slate of family-friendly content and appealing to a broader audience demographic.

The Roald Dahl Story Company

In September 2021, Netflix made its largest acquisition to date by purchasing the Roald Dahl Story Company for over $700 million.

This acquisition provided Netflix with access to a treasure trove of beloved children’s stories, including Charlie and the Chocolate Factory, Matilda, and The BFG. The deal allows Netflix to adapt these classic tales into new films and series, further expanding its original content library.

Albuquerque Studios

To bolster its production infrastructure, Netflix purchased Albuquerque Studios in 2018 for $30 million. Located in New Mexico, this facility has served as the primary filming location for several Netflix original movies and shows, including Stranger Things Season 4. The acquisition underscores Netflix’s commitment to expanding its production capabilities.

Boss Fight Entertainment

In March 2022, Netflix acquired Boss Fight Entertainment, a Texas-based mobile game developer. This acquisition is part of Netflix’s broader strategy to expand into the gaming industry, offering subscribers a diverse range of entertainment options beyond traditional streaming.

Spry Fox

Furthering its gaming ambitions, Netflix acquired Spry Fox, a Seattle-based game development studio, in October 2022. Known for creating unique and engaging games, Spry Fox’s addition to Netflix’s portfolio signifies the company’s commitment to enhancing its gaming offerings.

Conclusion

Netflix remains a dominant force in entertainment. While publicly traded, it is largely owned by institutional investors like Vanguard and BlackRock. Co-CEOs Ted Sarandos and Greg Peters lead the company, while Reed Hastings retains influence. With billions in revenue and a strong market position, Netflix continues to shape the future of streaming.

FAQs

Who is the largest shareholder of Netflix?

Vanguard Group Inc. is the largest shareholder, holding around 8% of the company.

Is Netflix owned by Disney?

No, Netflix is an independent company. Disney is one of its biggest competitors through Disney+.

Does Reed Hastings still own Netflix?

Reed Hastings owns about 1.5% of Netflix. While he stepped down as CEO, he remains chairman of the board.

What is Netflix’s net worth?

Netflix’s market capitalization is over $400 billion, and it generates annual revenue exceeding $39 billion.

Who controls Netflix?

Netflix is controlled by its board of directors and executive team, including co-CEOs Ted Sarandos and Greg Peters.

Is Netflix owned by Jewish?

No, Netflix is not owned by any specific religious or ethnic group, including Jewish individuals or organizations. It is a publicly traded company listed on the NASDAQ under the ticker NFLX. The ownership of Netflix is distributed among institutional investors, mutual funds, and individual shareholders.