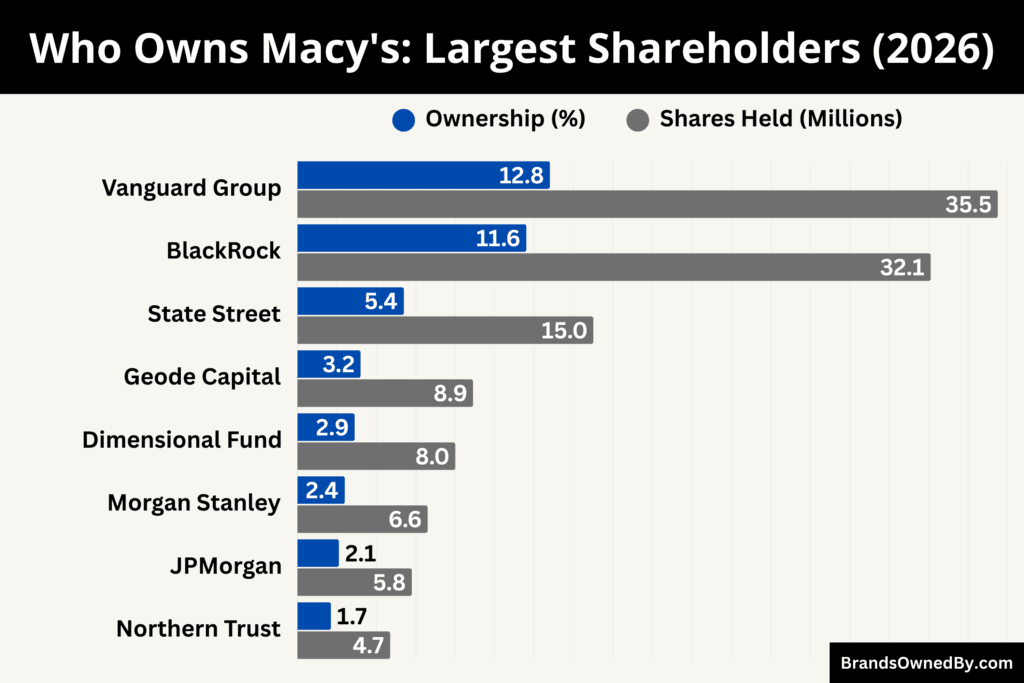

- Macy’s is a publicly traded company with no single owner. The largest shareholders are major institutional investors, led by The Vanguard Group (12.8%), BlackRock (11.6%), and State Street Corporation (5.4%), which together hold a significant portion of total voting power.

- Ownership is highly institutional, with additional stakes held by firms such as Geode Capital Management (3.2%), Dimensional Fund Advisors (2.9%), and other asset managers, while insiders and public investors hold smaller combined portions of the company.

- No founding family controls Macy’s today. Operational and strategic control is exercised by the CEO and executive leadership under the oversight of the board of directors, while major shareholders influence governance through proxy voting and board elections.

Macy’s, Inc. is an American department store holding company headquartered in New York City. The company manages multiple retail brands that target different customer segments. Its core business includes mid-range fashion, luxury retail, and beauty products.

Macy’s operates through physical stores, mobile apps, and e-commerce platforms. The company has invested heavily in omnichannel retail. This allows customers to shop online and pick up in-store. It also supports fast delivery and digital personalization.

The company is widely recognized for its flagship store in Herald Square, New York. This location is one of the largest department stores in the world. Macy’s is also known for major cultural events such as the Macy’s Thanksgiving Day Parade and Fourth of July Fireworks. These events have strengthened its brand identity for decades.

Macy’s focuses on private label brands as well as national brands. Its in-house labels help control product quality, pricing, and brand positioning. The company continues to adapt to changing retail trends by modernizing stores and expanding smaller store formats.

Macy’s Founder

Macy’s was founded by Rowland Hussey Macy in 1858. He was an American entrepreneur with a strong retail vision and persistence. Before founding Macy’s, he operated several small retail businesses. Many of these early ventures failed. However, he continued experimenting with retail concepts.

Rowland Hussey Macy opened his first successful store in New York City. He introduced fixed pricing instead of bargaining. This was unusual at the time. He also focused on quality merchandise and customer trust. These ideas helped his store grow rapidly.

Macy used a red star as his business symbol. The symbol came from a tattoo he received during his time as a sailor. The red star later became the official logo of Macy’s and remains part of its identity today.

After Rowland Hussey Macy, the Straus family played a major role in expanding the business. Isidor Straus and Nathan Straus became partners in the late 19th century. They helped transform Macy’s into a large department store operation. Their leadership expanded product variety, improved management, and strengthened brand reputation.

Over time, Macy’s evolved from a single store into a national retail institution. The founder’s focus on trust, innovation, and customer experience continues to influence the company today.

Ownership History

Macy’s ownership history reflects more than a century of retail consolidation, financial restructuring, and corporate transformation. The company evolved from a founder-led enterprise into a publicly traded corporation owned largely by institutional investors. Below is a detailed breakdown of how ownership changed over time.

Founder-Led Era (1858–Late 1800s)

Macy’s was founded in 1858 by Rowland Hussey Macy in New York City. In its early decades, the business was privately owned and operated by Macy himself. He maintained direct control over store operations, pricing strategies, and merchandising.

After Macy’s death in 1877, ownership gradually shifted. The company did not immediately become a large corporation. Instead, it continued under private leadership, with key partners playing growing roles.

During this period, the red star logo became firmly associated with the brand. The store built a reputation for fixed pricing and transparent policies. Ownership remained closely held and concentrated among early partners and investors.

The Straus Family Partnership and Expansion

In the late 19th century, the Straus family became deeply involved in Macy’s operations. Isidor Straus and Nathan Straus initially partnered with Macy’s through a department concession arrangement.

Over time, the Straus family acquired ownership stakes in the business. By the 1890s, they effectively controlled Macy’s. Under their leadership, the company expanded significantly. They modernized operations and strengthened centralized management.

Ownership during this era was still private. The company was not yet publicly traded. Control rested within the Straus family and close associates. This family-led structure lasted well into the early 20th century.

Mid-20th Century Corporate Structure

As Macy’s grew into a national department store chain, its ownership structure became more corporate. The company expanded through acquisitions and regional store consolidation.

During the mid-1900s, Macy’s operated as a publicly traded entity. Shares were distributed among investors. However, management still maintained significant internal control. This period marked the shift from family-dominated ownership to a shareholder-based model.

Macy’s became part of the broader wave of department store consolidation in the United States. Large retail groups began acquiring regional chains. This increased competition and financial pressure across the industry.

Bankruptcy and Financial Restructuring (1992)

In 1992, Macy’s filed for Chapter 11 bankruptcy protection. The company faced heavy debt burdens and declining performance. This was a major turning point in its ownership history.

During bankruptcy, ownership interests were restructured. Creditors gained influence. The company reorganized its balance sheet and operations. After restructuring, Macy’s emerged as a leaner entity.

This phase significantly diluted prior ownership stakes. It also set the stage for acquisition by another department store group.

Acquisition by Federated Department Stores (1994)

In 1994, Federated Department Stores acquired Macy’s. This marked a decisive shift in ownership.

Federated was already a large retail holding company. It owned several regional department store brands. With the acquisition, Macy’s became a subsidiary of Federated rather than an independent company.

Ownership of Macy’s was therefore transferred to Federated’s shareholders. Macy’s brand remained strong, but corporate control moved to the parent company’s board and executives.

This acquisition reshaped the American department store landscape. It also began the transformation toward a unified national brand strategy.

Rebranding to Macy’s, Inc. (2007)

In 2007, Federated Department Stores officially changed its corporate name to Macy’s, Inc.. This decision reflected the strength and recognition of the Macy’s brand.

From this point forward, Macy’s became both the flagship brand and the corporate identity. The holding company adopted the Macy’s name. This simplified branding and consolidated operations.

Ownership now consisted of public shareholders who held stock in Macy’s, Inc. The company traded on the New York Stock Exchange. Institutional investors increasingly accumulated shares through mutual funds and exchange-traded funds.

Modern Institutional Ownership Structure

As of 2026, Macy’s ownership is widely distributed among institutional investors, retail shareholders, and company insiders. Large asset managers hold the biggest stakes. These include global investment firms that manage index funds and retirement portfolios.

There is no controlling family or single majority owner. Instead, voting power is concentrated among major institutional shareholders due to the size of their holdings.

This modern structure reflects a typical publicly traded U.S. corporation. Ownership is fragmented. Governance occurs through shareholder voting and board oversight.

Over more than 160 years, Macy’s ownership has moved from a founder-led private enterprise to a diversified public corporation. Each transition shaped how the company operates today.

Who Owns Macy’s: Top Shareholders

Macy’s, Inc. is a publicly traded company. It does not have a single owner. Ownership is spread across institutional investors, mutual funds, pension funds, and individual shareholders. Large asset managers hold the biggest stakes.

As of February 2026, Macy’s ownership is highly institutionalized. The top three shareholders alone control nearly one-third of the company. No single investor holds majority control. Instead, influence is shared among major asset managers.

Institutional investors shape governance and long-term direction through voting power. The board of directors and executive leadership manage daily operations. This structure reflects a modern publicly traded U.S. corporation with distributed ownership and centralized management.

Below is a detailed breakdown of Macy’s ownership structure and its major shareholders as of 2026:

The Vanguard Group – Largest Shareholder

The Vanguard Group is the biggest shareholder of Macy’s as of February 2026. Vanguard holds approximately 12.8% of Macy’s outstanding shares. This equals roughly 35.5 million shares.

Vanguard owns these shares through index funds and exchange traded funds. These funds track broad market indexes that include Macy’s. Vanguard does not directly run Macy’s. However, it holds strong voting influence. It plays a key role in board elections, executive compensation decisions, and major governance matters.

Because of its passive investment strategy, Vanguard focuses on long-term corporate stability and shareholder value rather than short-term management decisions.

BlackRock, Inc.

BlackRock is the second largest shareholder of Macy’s. As of February 2026, BlackRock owns about 11.6% of the company. This equals nearly 32.1 million shares.

BlackRock holds Macy’s stock through its iShares ETFs, institutional portfolios, and mutual funds. The firm is known for its strong role in corporate governance. It participates actively in proxy voting and policy direction. BlackRock supports long-term growth, risk management, and operational efficiency.

Although it does not control daily operations, BlackRock’s large stake gives it major influence alongside Vanguard.

State Street Corporation

State Street Corporation is another major institutional investor in Macy’s. As of February 2026, it holds approximately 5.4% of Macy’s shares. This represents around 15 million shares.

State Street owns shares mainly through index funds and institutional investment products. Like other passive asset managers, it focuses on governance, transparency, and long-term value creation. Its voting power contributes to institutional control over the company.

Geode Capital Management

Geode Capital Management is a significant shareholder with a strong presence in passive investment strategies. As of February 2026, Geode holds roughly 3.2% of Macy’s stock. This equals about 8.9 million shares.

Geode manages assets primarily for institutional clients and index portfolios. It rarely intervenes in operations. However, its voting rights contribute to the broader institutional governance of Macy’s.

Dimensional Fund Advisors

Dimensional Fund Advisors is another important institutional shareholder. As of February 2026, it owns about 2.9% of Macy’s shares. This represents nearly 8 million shares.

Dimensional follows research-driven, long-term investment strategies. It supports stable corporate governance and sustainable financial performance. While it does not actively control the company, its ownership adds to institutional influence.

Morgan Stanley Investment Management

Morgan Stanley Investment Management is also among Macy’s top shareholders. As of February 2026, it holds approximately 2.4% of the company. This equals about 6.6 million shares.

Morgan Stanley manages these shares through institutional funds and investment portfolios. It plays a role in governance through proxy voting. The firm typically supports long-term strategy and operational improvements.

JPMorgan Asset Management

JPMorgan Asset Management is another key institutional investor. As of February 2026, it owns about 2.1% of Macy’s stock. This equals nearly 5.8 million shares.

JPMorgan invests through mutual funds, pension funds, and institutional accounts. Its ownership contributes to overall institutional dominance in Macy’s shareholder structure.

Northern Trust Corporation

Northern Trust is also a notable shareholder. As of February 2026, it holds roughly 1.7% of Macy’s shares. This equals about 4.7 million shares.

Northern Trust focuses on asset servicing and institutional investment management. It participates in governance decisions but does not influence daily operations directly.

Insider Ownership – Executives and Directors

Macy’s executives and board members collectively hold a small portion of company shares. As of February 2026, insider ownership is estimated at around 1% to 1.5% of total shares.

Senior leadership, including the CEO and top executives, receive stock based compensation and long-term incentives. Insider ownership aligns management interests with shareholder value. However, insiders do not control the company due to relatively small holdings.

Retail and Public Shareholders

Thousands of individual investors also own Macy’s shares. Retail investors collectively hold a meaningful but smaller percentage compared to institutions. Their ownership reflects Macy’s status as a publicly traded company with distributed shareholding.

Retail investors participate in shareholder voting. However, their influence is limited compared to large institutional investors.

Competitor Ownership Comparison

Macy’s operates in a competitive department store and retail landscape. Its ownership model is highly institutional. No family controls the company. No single shareholder holds majority power. Many competitors follow different ownership patterns. Some have strong founding family control. Others are privately owned or influenced by activist investors.

| Company | Ownership Type | Major Shareholder Profile | Family / Insider Control | Public or Private | Governance Characteristics |

|---|---|---|---|---|---|

| Macy’s, Inc. | Highly Institutional | Vanguard (~12.8%), BlackRock (~11.6%), State Street (~5.4%) | No founding family control. Low insider ownership (~1–1.5%). | Public | Board-led governance. Institutional investors dominate voting power. No single controlling shareholder. |

| Kohl’s Corporation | Institutional with Activist Activity | Vanguard, BlackRock, State Street among top holders | No family control. Limited insider concentration. | Public | Similar to Macy’s but more exposed to activist investor campaigns and board pressure in recent years. |

| Nordstrom, Inc. | Hybrid (Institutional + Family Influence) | Institutional investors plus Nordstrom family | Yes. Nordstrom family holds meaningful stake and influence. | Public | Family influence remains strong in governance and strategic direction despite public trading status. |

| Dillard’s, Inc. | Concentrated Family Ownership | Dillard family significant stake | Strong insider and family control | Public | Centralized decision making. Family voting power provides long term strategic continuity. |

| JCPenney | Private Ownership | Privately held investors | Control concentrated among private owners | Private | Strategic decisions made internally. No public shareholder voting. Limited market transparency. |

| Walmart Inc. | Hybrid (Institutional + Founding Family Control) | Institutional investors + Walton family | Strong founding family ownership through Walton family stake | Public | Long term family influence combined with institutional capital. More centralized ownership power compared to Macy’s. |

| Target Corporation | Institutional | Vanguard, BlackRock, State Street | No family control. Dispersed insider ownership. | Public | Institutional governance similar to Macy’s but with historically stronger operational stability. |

Kohl’s Corporation – Dispersed Institutional Control with Activist Pressure

Kohl’s has an ownership structure close to Macy’s, but with notable differences in shareholder dynamics. Like Macy’s, Kohl’s is publicly traded and largely owned by institutional investors such as Vanguard, BlackRock, and State Street. No single investor controls the company.

However, Kohl’s has faced repeated pressure from activist investors. These investors pushed for board changes, strategic restructuring, and even company sale discussions in recent years. Activist involvement created periods of instability and leadership turnover.

Macy’s has also experienced investor pressure, but its shareholder base is more stable compared to Kohl’s. Large passive investors dominate Macy’s ownership, while Kohl’s has seen stronger activist intervention. This difference affects strategic consistency and governance style.

Nordstrom, Inc. – Public Company with Strong Founding Family Influence

Nordstrom’s ownership is more concentrated than Macy’s due to the continued involvement of the Nordstrom family. While institutional investors own a large portion of shares, the Nordstrom family holds a meaningful combined stake. This gives them a stronger influence over strategic direction.

Family members have historically served as executives and board members. Their long term involvement shaped company culture, brand positioning, and premium retail strategy. The family has also participated in discussions about taking the company private in the past, showing its continued control influence.

Macy’s, in contrast, has no founding family ownership today. Decision making is fully institutional and board driven. This makes Macy’s governance more corporate, while Nordstrom maintains a hybrid structure combining family legacy with public ownership.

Dillard’s, Inc. – Highly Concentrated Family Ownership and Voting Power

Dillard’s stands out for its strong insider and family control. The Dillard family owns a significant portion of the company, including high voting power through insider shareholding. This concentrated ownership allows the family to influence major corporate decisions directly.

Unlike Macy’s, where institutional investors dominate, Dillard’s leadership is closely tied to family ownership. This creates long term strategic continuity but limits external shareholder influence. Institutional investors hold smaller stakes compared to Macy’s.

Because of this structure, Dillard’s operates with more centralized control. Macy’s, on the other hand, must balance the interests of multiple large institutional investors rather than a single dominant shareholder group.

JCPenney – Private Ownership After Bankruptcy Restructuring

JCPenney has a completely different ownership model compared to Macy’s. After financial collapse and bankruptcy restructuring, the company was acquired by private owners and removed from public stock markets.

Private ownership concentrates control among a small group of stakeholders. Strategic decisions are made without public shareholder voting or market pressure. This allows faster restructuring but reduces transparency.

Macy’s remains publicly traded with distributed ownership and institutional governance. This gives Macy’s greater market accountability but also exposes it to investor expectations and stock market fluctuations.

Walmart – Hybrid Ownership with Strong Founding Family Control

Walmart operates under a hybrid ownership structure. It is publicly traded and widely owned by institutional investors. However, the Walton family still holds a large ownership stake, giving them substantial long-term control.

The Walton family’s ownership ensures continuity in corporate strategy and governance. Even with institutional investors holding large positions, family voting power remains influential. This is very different from Macy’s, where no founding family ownership exists.

Macy’s governance depends on institutional investor consensus and board oversight. Walmart benefits from both institutional capital and strong founding family control, creating a more stable but centralized ownership model.

Target Corporation – Institutional Ownership with Strong Corporate Governance

Target has an ownership structure closer to Macy’s. The company is publicly traded and primarily owned by institutional investors. No family controls the company. Governance is handled by the board and executive leadership.

However, Target has historically maintained stronger financial stability and fewer activist disruptions compared to many department store peers. Institutional investors support long-term strategy and operational discipline.

Macy’s ownership is similar in structure, but it operates in a more volatile department store segment compared to Target’s broader retail positioning. This makes Macy’s more exposed to investor pressure during retail downturns.

Overall Competitive Ownership Position

Macy’s represents a fully institutional and widely distributed ownership structure. No family controls the company. No single investor dominates. Governance depends on major institutional shareholders and board leadership.

Some competitors like Kohl’s and Target share a similar institutional model but differ in activist pressure and stability. Others like Nordstrom and Dillard’s maintain strong family influence. Companies like Walmart combine institutional ownership with founding family power. Private retailers like JCPenney operate under concentrated ownership outside public markets.

This comparison shows that Macy’s sits firmly within the institutional ownership category, with governance shaped by large asset managers rather than families or private owners.

Who Controls Macy’s?

Control of Macy’s, Inc. is structured through a formal corporate governance framework. Shareholders own the company, but they do not manage it. Control is exercised through executive leadership, overseen by the board of directors, and influenced indirectly by major institutional investors. Macy’s follows the standard U.S. public company governance model, where authority flows from shareholders to the board and then to management.

Below is a detailed explanation of how control is structured and exercised inside Macy’s as of 2026:

Chief Executive Officer – Strategic and Operational Authority

The primary executive authority at Macy’s rests with the CEO, Tony Spring. As Chief Executive Officer, he is responsible for defining corporate strategy, allocating capital, driving profitability, and positioning the company competitively within the evolving retail landscape.

The CEO sets enterprise-wide priorities. These include store portfolio optimization, digital transformation, supply chain efficiency, private label brand development, and cost discipline. He oversees both the Macy’s and Bloomingdale’s segments, as well as specialty retail operations like Bluemercury.

Operational control includes approving major investments, restructuring initiatives, pricing strategies, and merchandising direction. The CEO also serves as the public face of the company to investors, analysts, and financial markets. While the board appoints the CEO, day-to-day command authority resides at the executive level.

Board of Directors – Governance, Oversight, and Accountability

The board of directors provides governance oversight rather than operational management. Its role is supervisory and fiduciary. The board represents shareholder interests and ensures that management decisions align with long-term value creation.

The board approves high-level strategic initiatives, including major acquisitions, divestitures, restructuring plans, and capital allocation policies such as share repurchases or debt management. It also sets executive compensation structures and evaluates CEO performance.

Board committees play specialized roles. The audit committee oversees financial reporting and compliance. The compensation committee determines executive pay structures. The governance committee monitors board composition and ethical standards.

Directors are elected annually by shareholders. Large institutional investors influence board composition through proxy voting. However, once elected, directors are legally obligated to act in the best interests of all shareholders, not individual institutions.

Executive Leadership Team – Functional Control Across Business Units

Operational control is distributed across Macy’s executive leadership team. This team includes senior leaders responsible for finance, merchandising, supply chain, digital operations, real estate, and human resources.

The Chief Financial Officer controls financial planning, liquidity management, debt structure, and investor relations. This role is central to maintaining capital discipline and ensuring financial stability.

The Chief Merchandising Officer manages product assortment strategy, vendor partnerships, and private label development. This function directly impacts margins and brand positioning.

Digital and technology leadership controls e-commerce platforms, data analytics, personalization systems, and omnichannel integration. Given the competitive retail environment, digital strategy is a core control function within Macy’s corporate structure.

Supply chain leadership oversees sourcing, logistics, and inventory management. These decisions directly affect cost structure and operational efficiency.

Each executive reports to the CEO, creating a centralized management hierarchy.

Influence of Institutional Shareholders

Although institutional investors do not manage Macy’s directly, they exert meaningful influence through governance mechanisms. Firms such as Vanguard, BlackRock, and State Street collectively hold significant voting power.

Their control is indirect but substantial. They vote on director elections, executive compensation proposals, and shareholder resolutions. If performance declines or governance standards weaken, institutional investors can apply pressure on the board.

This pressure can include voting against directors, supporting governance reforms, or backing activist proposals. While they do not dictate daily decisions, they shape accountability and long-term strategic discipline.

Separation of Ownership and Managerial Control

Macy’s reflects a classic separation between ownership and managerial control. Shareholders supply capital and elect directors. The board establishes oversight and strategic boundaries. The CEO and executive team execute strategy and manage operations.

There is no controlling family. There is no majority shareholder. Control is institutional, procedural, and governed by corporate law and fiduciary duties.

As of 2026, Macy’s control rests with its executive leadership under board supervision, with institutional shareholders influencing governance through structured voting power rather than operational involvement.

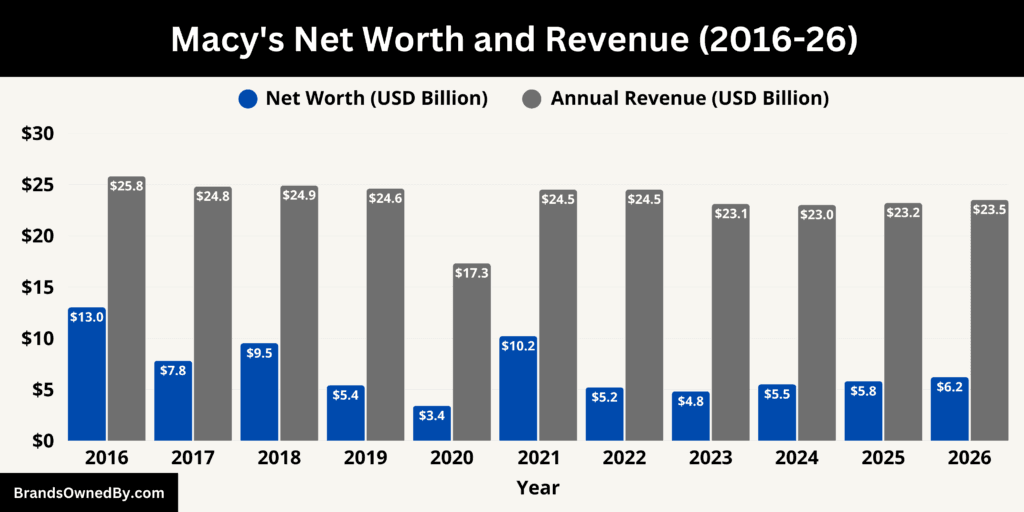

Macy’s Annual Revenue and Net Worth

As of fiscal year 2026, Macy’s, Inc. generated approximately $23.5 billion in annual revenue. The company’s public market valuation stands near $6.2 billion as of February 2026, based on roughly 279 million outstanding shares and an average share price range of $22–$23 during early 2026. Macy’s operates as a mature national retailer with stable sales volume, moderate margins, and significant real estate backing. Its financial structure reflects steady operating cash flow rather than rapid expansion-driven valuation.

Revenue Structure (2026)

Macy’s total revenue of about $23.5 billion is driven primarily by its core Macy’s banner, which produced approximately $19.7–$19.9 billion, representing around 84% of company revenue. This includes full-line Macy’s stores and Macy’s Backstage. The Bloomingdale’s segment generated roughly $2.35–$2.45 billion, accounting for close to 10% of total revenue. Bluemercury contributed approximately $1.2–$1.3 billion, or about 6%, supported by strong demand in premium beauty and skincare.

From a channel perspective, physical stores generated approximately $16.3–$16.6 billion, representing around 69–71% of total sales. Macy’s continues operating over 500 store locations across all formats, with selective closures and productivity optimization. Digital commerce generated approximately $6.8–$7.2 billion, accounting for nearly 29–31% of total revenue. Digital penetration has more than doubled compared to pre-2020 levels, supported by centralized fulfillment, same-day pickup, and data-driven personalization.

From a product category standpoint, apparel generated roughly $11.0–$11.3 billion, representing about 47–48% of revenue. Beauty, cosmetics, and fragrance produced approximately $4.4–$4.6 billion, or nearly 19%. Home goods and furniture contributed roughly $3.9–$4.1 billion, about 17% of total revenue. Footwear and accessories generated approximately $2.5–$2.7 billion, or 10–11%, while jewelry and other categories accounted for the remaining $1.0–$1.2 billion. Higher margin categories such as beauty and private label brands continue supporting profitability.

Net Worth

Macy’s estimated market capitalization of about $6.2 billion reflects its valuation as a mid-cap U.S. retailer. The company’s total asset base remains significantly larger than its market value due to real estate holdings and inventory assets.

- Estimated Total Assets (2026): $18.6–$19.0 billion

- Estimated Total Liabilities: $13.2–$13.8 billion

- Estimated Shareholder Equity: $5.0–$5.8 billion.

The company continues generating annual operating cash flow between $1.1 billion and $1.3 billion. Free cash flow remains positive after capital expenditures, allowing Macy’s to maintain dividends, manage debt, and reinvest in digital infrastructure.

Macy’s flagship Herald Square property alone is estimated by analysts to represent a multi-billion-dollar underlying asset value. Real estate continues to act as a financial stabilizer within the company’s balance sheet.

Margin, Profitability, and Cost Structure

Gross margin in 2026 is estimated around 39–40%, supported by private label expansion and controlled markdown activity. Operating margin is estimated between 5.5% and 6.2%, reflecting disciplined expense management and improved inventory turnover.

Selling, general, and administrative expenses remain near $8.5–$9.0 billion, while inventory levels remain controlled within the $5.0–$5.5 billion range. Macy’s continues improving supply chain efficiency, which has reduced excess stock and improved cash conversion cycles.

Macy’s revenue reached $25.8 billion in 2016, gradually declined to $24.6 billion in 2019, dropped sharply to $17.3 billion in 2020, then rebounded to $24.5 billion in 2021 and 2022. Since 2023, revenue has stabilized between $23.0 billion and $23.5 billion, showing resilience despite structural retail shifts.

Market capitalization has been more volatile, falling below $4 billion during pandemic stress, then recovering to above $6 billion in 2026. The volatility reflects investor sentiment toward department stores rather than dramatic revenue decline.

Revenue Forecast Through 2030

- 2027: Expected revenue approximately $23.8–$24.0 billion driven by incremental digital growth and improved store productivity.

- 2028: Projected revenue near $24.2–$24.4 billion supported by stronger beauty segment expansion and private label penetration.

- 2029: Estimated revenue around $24.6–$24.8 billion as supply chain efficiency and omnichannel integration improve sales conversion.

- 2030: Forecast revenue approaching $25.0–$25.3 billion assuming stable consumer demand, continued digital penetration near 35%, and margin stabilization above 6%.

Macy’s long-term financial trajectory suggests stable revenue with gradual efficiency-driven improvement rather than high-growth expansion. The company’s strategy centers on margin discipline, digital scaling, and premium segment strengthening rather than store count expansion.

Brands Owned by Macy’s

As of February 2026, Macy’s, Inc. directly owns and operates a diversified portfolio of retail chains, specialty businesses, private label brands, and internal commercial entities. All brands listed below operate under Macy’s corporate structure:

| Company / Brand | Type | Segment | Core Focus | Strategic Role in Macy’s |

|---|---|---|---|---|

| Macy’s | Flagship Retail Chain | Mid-market Department Store | Apparel, beauty, accessories, home goods, omnichannel retail | Primary revenue driver generating over 80% of total sales. Core national retail presence and logistics backbone. |

| Macy’s Backstage | Off-Price Retail | Discount Department Store | Discounted apparel, footwear, home goods | Clears excess inventory, attracts price-sensitive customers, improves inventory turnover and store traffic. |

| Bloomingdale’s | Luxury Department Store | Premium / Luxury Retail | Designer fashion, luxury beauty, upscale home products | High-margin premium segment, strengthens brand positioning and profitability. |

| Bloomingdale’s The Outlet | Off-Price Luxury | Discount Luxury Retail | Discounted luxury merchandise | Supports inventory management while preserving Bloomingdale’s full-price brand perception. |

| Bloomie’s | Small-Format Luxury Store | Curated Retail Concept | Personalized styling, curated premium assortment | Future-focused retail model with lower operating cost and higher productivity per square foot. |

| Bluemercury | Specialty Beauty Retailer | Beauty and Skincare | Premium cosmetics, skincare, wellness, spa services | High-margin growth segment strengthening Macy’s position in prestige beauty retail. |

| INC International Concepts | Private Label Brand | Fashion Apparel | Contemporary fashion for men and women | Drives margin through in-house design and mid-market positioning. |

| Alfani | Private Label Brand | Apparel | Business casual and professional clothing | Core wardrobe brand with strong customer loyalty and stable demand. |

| Charter Club | Private Label Brand | Apparel & Home | Classic women’s wear and home essentials | Long-standing private label supporting repeat customers and consistent margins. |

| Style & Co. | Private Label Brand | Casual Apparel | Everyday women’s fashion | Affordable casualwear brand targeting broad consumer base. |

| Club Room | Private Label Brand | Men’s Apparel | Classic menswear and essentials | Strengthens Macy’s core men’s apparel offering. |

| Hotel Collection | Private Label Brand | Home Goods | Premium bedding, linens, and décor | Higher-margin home category brand inspired by luxury hotel styling. |

| Martha Stewart Collection | Licensed / Owned Retail Brand | Home & Lifestyle | Kitchenware, bedding, home décor | Strong brand recognition in home category driving steady sales. |

| Tools of the Trade | Private Label Brand | Kitchen & Cookware | Affordable cookware and kitchen essentials | Value-focused home goods brand supporting volume sales. |

| Bar III | Private Label Brand | Contemporary Fashion | Modern urban apparel | Targets younger consumers with trend-driven styling. |

| Ideology | Private Label Brand | Activewear | Performance apparel and athleisure | Expands Macy’s presence in fitness and lifestyle fashion segment. |

| And Now This | Private Label Brand | Casual Fashion | Youth-focused fashion and basics | Designed for younger demographic and fast-moving fashion trends. |

| Epic Threads | Private Label Brand | Children’s Apparel | Kids clothing and casualwear | Strengthens Macy’s presence in children’s wear segment. |

| First Impressions | Private Label Brand | Infant Apparel | Baby clothing and essentials | Covers newborn and infant apparel category. |

| GreenStreet Real Estate Initiatives | Internal Entity | Real Estate Development | Property redevelopment and asset optimization | Unlocks value from flagship real estate and diversifies revenue beyond retail. |

| Macy’s Media Network | Internal Commercial Platform | Retail Media / Advertising | Digital and in-store advertising network | Generates high-margin advertising revenue and strengthens vendor partnerships. |

Macy’s

Macy’s is the core operating banner and the largest revenue contributor, generating roughly $19.5–$20 billion annually. The brand operates full-line department stores across the United States, along with smaller format stores introduced to improve productivity and reduce operating costs. Macy’s product mix includes apparel, footwear, accessories, beauty, jewelry, and home merchandise.

The brand operates a fully integrated omnichannel ecosystem. Customers can purchase through stores, website, or mobile app, with fulfillment through centralized distribution, ship-from-store, and same-day pickup systems. Macy’s also uses its store network as a logistics asset, enabling faster delivery and inventory turnover.

Macy’s operates several in-house services including personal styling, registry platforms, and loyalty programs. The Macy’s Star Rewards loyalty system has millions of active members and plays a major role in repeat customer retention and promotional targeting.

Macy’s Backstage

Macy’s Backstage is the company’s off-price retail division. It operates both standalone locations and in-store shop-in-shop formats within full-line Macy’s stores. Backstage focuses on discounted branded apparel, footwear, home goods, and accessories.

This format allows Macy’s to clear slow-moving inventory without heavy markdowns in its core stores. It also attracts price-sensitive customers and increases traffic to underperforming locations. Backstage plays a strategic role in inventory optimization and margin protection rather than pure revenue growth.

Bloomingdale’s

Bloomingdale’s is Macy’s premium and luxury department store chain. It operates in major metropolitan markets and serves higher-income consumers. The brand focuses on designer fashion, luxury beauty, premium accessories, and upscale home goods.

Bloomingdale’s generates about $2.3–$2.5 billion in annual revenue and produces stronger operating margins than Macy’s core brand due to higher average selling prices. The chain operates full-line stores, digital platforms, and curated luxury assortments.

Bloomingdale’s also maintains exclusive brand partnerships, limited-edition collections, and personalized customer services such as private styling and appointment shopping.

Bloomingdale’s The Outlet

Bloomingdale’s The Outlet is the off-price extension of the Bloomingdale’s brand. It sells excess and past-season luxury merchandise at reduced prices. This format helps preserve the premium image of full-price Bloomingdale’s stores while improving inventory efficiency.

The Outlet segment contributes incremental revenue and supports brand ecosystem balance between full-price and discount retail.

Bloomie’s

Bloomie’s is a small-format luxury retail concept launched by Bloomingdale’s. These stores are significantly smaller than traditional department stores and are located in lifestyle and suburban markets.

Bloomie’s emphasizes curated assortments, experiential retail, and personalized services rather than large inventory volume. The format reflects Macy’s shift toward flexible retail models with lower operating costs and higher sales productivity per square foot.

Bluemercury

Bluemercury is Macy’s specialty beauty and skincare retail chain. It operates standalone beauty stores and an integrated digital platform. Bluemercury focuses on premium skincare, cosmetics, fragrance, and wellness products.

The brand generates over $1.2 billion annually and delivers higher margins than apparel categories. Bluemercury also operates in-store spa and facial services, creating an experiential retail model that increases customer retention and average transaction value.

Bluemercury has become a strategic growth pillar due to rising demand in prestige beauty and skincare segments.

Macy’s Private Label Brand Portfolio

Macy’s operates one of the largest private label ecosystems in U.S. retail. These brands are designed, sourced, and controlled internally. Private labels improve gross margins, strengthen pricing control, and reduce dependence on external brand suppliers.

INC International Concepts

INC International Concepts is a major contemporary fashion brand owned by Macy’s. It focuses on trend-driven apparel for men and women. The brand targets mid-market consumers seeking fashion-forward styles at moderate price points.

Alfani

Alfani is one of Macy’s most established private label apparel brands and plays a central role in the company’s core clothing assortment. The brand focuses primarily on modern professional and business-casual fashion for both men and women. Its product range includes dress shirts, blazers, suits, trousers, blouses, knitwear, shoes, and accessories. Alfani is positioned as a dependable wardrobe brand designed for everyday office wear and semi-formal occasions.

The brand targets middle-income professionals seeking affordable yet polished clothing. Pricing is typically below premium designer labels but above entry-level private labels, allowing Macy’s to capture customers looking for quality at accessible prices. Alfani is widely distributed across Macy’s stores and digital platforms and contributes steady, predictable sales due to repeat purchasing behavior. The brand supports Macy’s margin structure by being fully internally controlled from design to sourcing.

Charter Club

Charter Club is one of Macy’s longest-running private label brands and is strongly associated with consistency, comfort, and classic styling. The brand focuses primarily on women’s apparel, but it also extends into bedding, bath linens, and select home goods. Charter Club apparel includes sweaters, blouses, sleepwear, coats, and everyday essentials designed with timeless styling rather than fast fashion trends.

The brand’s core strength lies in customer loyalty. Many repeat Macy’s shoppers rely on Charter Club for reliable sizing, durable fabrics, and consistent quality across seasons. The home category under Charter Club includes soft home products such as cotton bedding and towels, offering dependable mid-range alternatives to premium brands. Strategically, Charter Club provides stable recurring revenue and strengthens Macy’s connection with long-term customers.

Style & Co.

Style & Co. is a casual lifestyle apparel brand focused on everyday women’s fashion. The brand emphasizes comfort, affordability, and practicality. Its product range includes denim, casual tops, loungewear, knitwear, and seasonal fashion basics designed for daily use rather than formal or office wear.

Style & Co. is positioned toward value-conscious consumers who want fashionable but comfortable clothing at moderate prices. The brand plays a key role in Macy’s casualwear category and helps the company compete with mass-market apparel retailers. Its broad distribution across stores and online channels ensures strong volume sales, making it an important contributor to steady apparel revenue.

Club Room

Club Room is Macy’s core men’s private label brand focused on classic and versatile menswear. The brand offers sweaters, button-down shirts, polos, trousers, jackets, and knitwear designed for everyday wear. Club Room is positioned between formal businesswear and casual fashion, making it suitable for work, social, and weekend use.

The brand targets middle-income male shoppers seeking traditional, reliable clothing rather than trend-driven fashion. Its consistent quality and wide size availability support repeat purchases. Club Room plays a foundational role in Macy’s men’s apparel segment and helps maintain stable core clothing sales.

Hotel Collection

Hotel Collection is Macy’s premium home goods brand, inspired by luxury hotel living. The brand focuses on high-quality bedding, Egyptian cotton sheets, comforters, pillows, towels, and home décor items designed to create an upscale home environment. Materials and finishes are positioned above mid-range home brands, targeting customers seeking premium comfort and aesthetics.

The brand contributes higher margins compared to standard home products due to premium pricing and perceived quality. Hotel Collection strengthens Macy’s position in the home category and competes with luxury home goods retailers. Its products are often marketed through lifestyle branding that emphasizes comfort, softness, and hotel-inspired luxury.

Martha Stewart Collection

The Martha Stewart Collection operates within Macy’s through brand rights and licensing arrangements. It includes kitchenware, cookware, bedding, furniture accents, and home décor products inspired by Martha Stewart’s lifestyle brand. The collection focuses on practical design, functionality, and classic home aesthetics.

The brand benefits from strong consumer recognition and trust, particularly in the home and kitchen segment. It attracts customers interested in organized, elegant, and functional home living. Strategically, it enhances Macy’s credibility in the home category while supporting consistent mid-to-high range home goods sales.

Tools of the Trade

Tools of the Trade is Macy’s value-focused cookware and kitchen essentials brand. It includes pots, pans, cooking utensils, bakeware, and kitchen accessories designed for everyday household use. The brand targets budget-conscious consumers who want reliable kitchen products at affordable prices.

This brand supports volume-driven sales rather than premium margins. It plays an important role in attracting price-sensitive home goods customers and complements Macy’s higher-end kitchen brands. Tools of the Trade helps Macy’s maintain a complete pricing spectrum within the home and kitchen category.

Bar III

Bar III is a contemporary fashion brand owned by Macy’s that targets younger, urban consumers. The brand blends modern, trend-driven fashion with versatile styling suitable for both casual and semi-formal wear. Its product line includes dresses, suits, outerwear, knitwear, footwear, and accessories.

Bar III is positioned between fast fashion and premium designer labels, offering stylish clothing at accessible prices. It plays a strategic role in attracting younger demographics and modernizing Macy’s fashion image. The brand also contributes to Macy’s seasonal fashion turnover and trend-driven product cycles.

Ideology

Ideology is Macy’s in-house activewear and performance apparel brand. It focuses on athleisure, fitness wear, and sports-inspired clothing for women. The product range includes leggings, sports bras, workout tops, and performance jackets designed for both exercise and everyday casual wear.

The brand supports Macy’s expansion into the growing activewear and wellness market. Ideology is positioned as affordable performance wear competing with mid-tier athletic brands. It helps Macy’s capture customers interested in fitness-focused lifestyle clothing and supports consistent demand in the athleisure segment.

And Now This

And Now This is a newer Macy’s private label apparel brand targeting younger and digitally engaged consumers. The brand focuses on trend-responsive fashion, casualwear, and everyday essentials designed with contemporary styling. It includes T-shirts, denim, knitwear, and casual outfits aligned with modern fashion preferences.

The brand is positioned toward younger shoppers seeking affordable, stylish clothing. It supports Macy’s efforts to remain relevant among new-generation consumers and strengthens the company’s presence in entry-to-mid price fashion categories.

Epic Threads

Epic Threads is Macy’s children’s apparel brand offering affordable, durable clothing for kids. The brand includes everyday wear such as T-shirts, pants, jackets, school clothing, and seasonal outfits designed for comfort and durability.

Epic Threads targets families seeking reliable children’s clothing at moderate prices. The brand contributes steady sales through consistent demand in the kidswear category. It supports Macy’s ability to serve entire family segments rather than only adult apparel.

First Impressions

First Impressions is Macy’s infant and babywear brand focused on newborn clothing and essentials. The product range includes baby outfits, sleepwear, blankets, and soft fabric apparel designed for comfort and safety.

The brand strengthens Macy’s coverage across all age categories, from infants to adults. It targets families shopping for newborn essentials and contributes consistent demand in the baby apparel segment.

GreenStreet Real Estate Development

GreenStreet represents Macy’s real estate development and asset optimization initiatives. The company owns valuable urban retail properties, including flagship locations such as Herald Square in New York. Through redevelopment and property optimization, Macy’s aims to unlock real estate value and diversify revenue beyond retail operations.

These initiatives may include mixed-use development, leasing space, and urban redevelopment planning. Real estate remains a strategic financial asset supporting Macy’s balance sheet and long-term valuation.

Macy’s Media Network

Macy’s Media Network is the company’s internal retail advertising platform. It allows consumer brands to advertise directly through Macy’s website, mobile app, and in-store digital displays. The platform uses customer data and purchase behavior to deliver targeted advertising.

This business generates high-margin revenue independent of merchandise sales. It also strengthens relationships with vendor brands by offering marketing visibility within Macy’s ecosystem. Retail media has become an important emerging revenue stream supporting profitability and digital monetization.

Final Words

Macy’s remains one of the most recognized names in American retail, operating through a diversified portfolio of department stores, luxury retail, beauty, and private label brands. For those wondering who owns Macy’s, the company is publicly held and primarily owned by large institutional investors, while its leadership and board guide strategy and operations.

Its strength comes from brand recognition, a broad merchandise ecosystem, and control over its own private labels. With a balanced mix of physical retail and digital commerce, Macy’s continues to adapt to changing consumer behavior while maintaining its position as a major national retailer.

FAQs

Who owns Macy’s Inc.?

Macy’s, Inc. is a publicly traded company owned by institutional investors, mutual funds, insiders, and public shareholders. No single individual or family owns the company. The largest ownership stakes are held by major asset management firms.

Who is the largest shareholder of Macy’s?

The largest shareholder of Macy’s is The Vanguard Group, which holds the biggest institutional stake in the company and exercises significant voting influence in shareholder matters.

Who owns Macy’s department stores?

Macy’s department stores are owned and operated by Macy’s, Inc. The company directly manages all Macy’s branded retail locations, along with its other retail businesses such as Bloomingdale’s and Bluemercury.

Who bought Macy’s?

Macy’s was acquired by Federated Department Stores in 1994 after emerging from bankruptcy restructuring. In 2007, Federated changed its corporate name to Macy’s, Inc., making Macy’s the primary corporate identity.

Did Macy’s file for bankruptcy?

Yes, Macy’s filed for Chapter 11 bankruptcy in 1992 due to heavy debt and financial pressure. The company later restructured successfully and returned to stable operations.

Who is the CEO of Macy’s?

The CEO of Macy’s is Tony Spring. He became Chief Executive Officer in 2024 and leads the company’s strategy, operations, and long-term transformation.

Who owns Macy’s and Bloomingdale’s?

Both Macy’s and Bloomingdale’s are owned by Macy’s, Inc. Bloomingdale’s operates as a luxury retail division within the same corporate structure.