Loblaws is one of Canada’s largest and most recognizable grocery chains. If you’ve ever shopped at a Loblaws store, you may have wondered: who owns Loblaws, and what other brands are behind this retail giant?

Here’s a detailed look into the company’s ownership, leadership, revenue, and the vast empire it controls.

Loblaws Company Profile

Loblaws is a flagship brand of Loblaw Companies Limited, Canada’s largest food and pharmacy retail group. As of 2025, Loblaw operates over 2,400 stores across Canada, including supermarkets, discount stores, health and wellness outlets, and e-commerce platforms.

Loblaw is a public company listed on the Toronto Stock Exchange (TSX: L) and is headquartered in Brampton, Ontario. Its business includes grocery retail, pharmacy services, clothing (via Joe Fresh), banking (PC Financial), and loyalty rewards (PC Optimum). It serves millions of Canadians every week and employs over 220,000 people, making it one of the country’s largest private employers.

The company is structured under Loblaw Companies Limited, a subsidiary of George Weston Limited, which holds a controlling stake.

Loblaws Founders

Loblaws was founded in 1919 by Theodore Pringle Loblaw and J. Milton Cork. Their goal was to introduce a new concept: self-service grocery stores. At the time, this was revolutionary and allowed customers to choose their own items without store clerks.

The first store opened in Toronto, Ontario, and it quickly gained popularity due to its lower prices, efficient layout, and better customer experience.

Major Milestones

1919 – First Loblaws store opened in Toronto.

1947 – The company was acquired by George Weston Limited, marking the start of the Weston family’s long-term involvement.

1972 – Launch of No Frills, a discount grocery banner under the Loblaw group.

1984 – Introduction of President’s Choice brand, one of the most successful private labels in Canada.

2009 – Acquisition of T&T Supermarket, expanding into Asian grocery retail.

2013 – Loblaw acquired Shoppers Drug Mart for CAD 12.4 billion, making it the country’s largest pharmacy retailer.

2017 – Launch of PC Optimum, Canada’s largest loyalty rewards program after merging PC Plus and Shoppers Optimum.

2021–2023 – Expansion of digital services and delivery through PC Express, with investment in AI and automation for grocery fulfillment.

2023 – Appointment of Per Bank as CEO to modernize operations and increase international benchmarking in retail.

2024–2025 – Continued investment in sustainability, including reducing plastic packaging, promoting plant-based food products, and adding electric vehicle (EV) charging stations across store locations.

Today, Loblaws is not just a supermarket chain but a diversified retail and services platform that includes fashion, health care, finance, and digital commerce—all under one umbrella.

Who Owns Loblaws: Major Shareholders

Loblaws is owned by George Weston Limited, a holding company controlled by the Weston family. George Weston Limited is the largest and controlling shareholder of Loblaw Companies Limited, which is the parent company operating the Loblaws brand and many others.

George Weston Limited exercises control through its ownership of common shares in Loblaw Companies Limited. Over the years, the Weston family has maintained significant influence over the business, both operationally and through board representation.

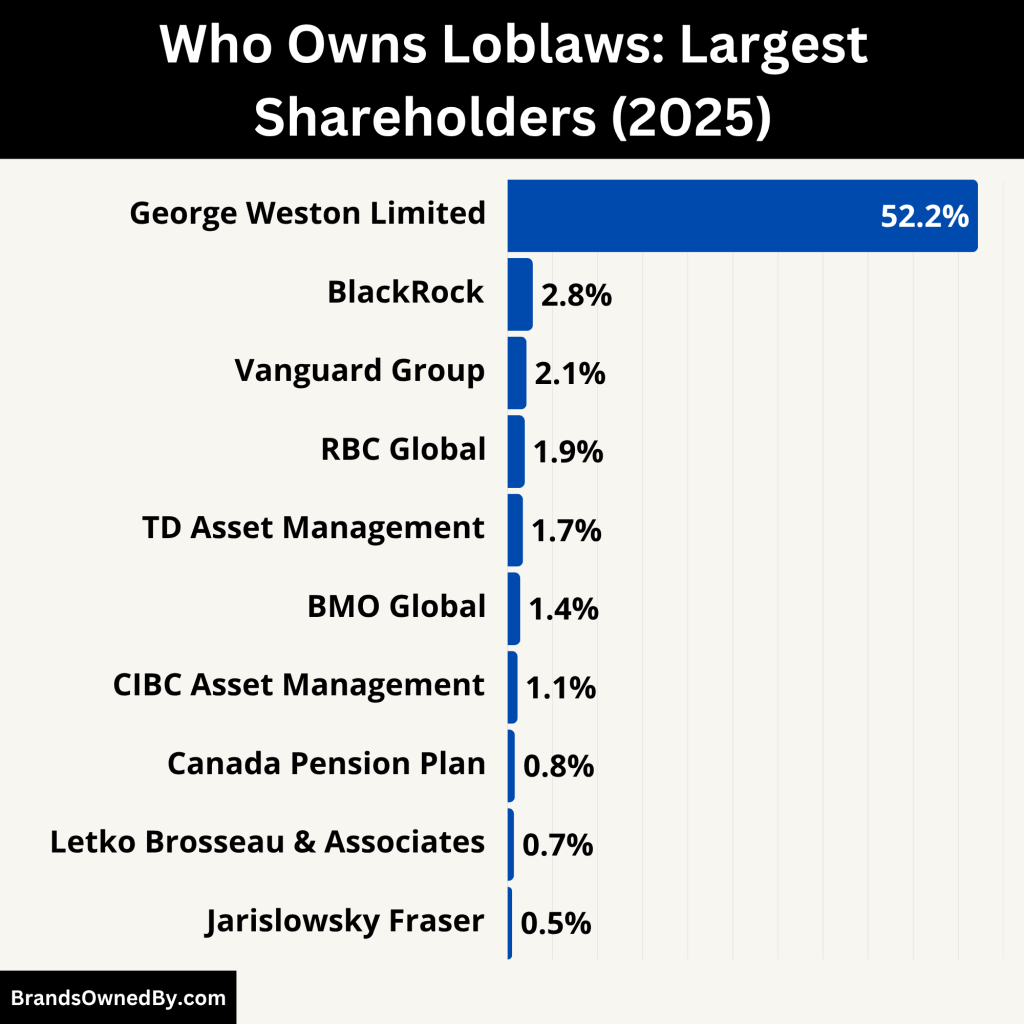

Here’s a list of the top shareholders of Loblaws as of July 2025:

| Shareholder | Ownership (%) | Type | Role/Influence |

|---|---|---|---|

| George Weston Limited | 52.2% | Holding Company | Controlling shareholder; owned by Weston family; appoints leadership |

| BlackRock Inc. | 2.8% | Institutional (Passive) | Global asset manager; voting rights through ETFs and index funds |

| Vanguard Group | 2.1% | Institutional (Passive) | U.S.-based investor; exercises proxy votes; no active control |

| RBC Global Asset Management | 1.9% | Institutional | Canadian fund manager; invests for clients; minor influence |

| TD Asset Management | 1.7% | Institutional | Passive institutional investor; voting rights on select issues |

| BMO Global Asset Management | 1.4% | Institutional | Canadian fund manager; passive shareholder |

| CIBC Asset Management | 1.1% | Institutional | Holds equity for retail and pension clients |

| Public & Retail Investors | 35–36% (total) | Public Market | Individual shareholders via TSX; collective influence, no control |

| Canada Pension Plan (CPPIB) | 0.8% | Government Pension Fund | Long-term investor; minor holding, stable interest |

| Letko Brosseau & Associates | 0.7% | Institutional | Canadian investment firm; long-term, value-oriented approach |

| Jarislowsky Fraser | 0.5% | Institutional | Passive investor for foundations and pension funds |

George Weston Limited – Controlling Shareholder

George Weston Limited is the core holding company and the largest shareholder of Loblaw Companies Limited. It owns 52.2% of Loblaw’s outstanding common shares, giving it majority voting power and control over all key decisions, including board appointments, dividends, and strategic direction.

The company is publicly traded but is effectively controlled by the Weston family through multi-generational family trusts. These trusts safeguard the family’s ownership and influence across George Weston Limited, Loblaw Companies Limited, and Choice Properties REIT.

As of 2025, Galen Weston Jr. serves as Chairman of Loblaw and President of George Weston Limited. His leadership ensures the family remains tightly integrated in executive decision-making. The Weston family’s long-standing philosophy focuses on sustainable growth, vertical integration, and Canadian market dominance. George Weston Limited also owns strategic assets in bakery (Weston Foods until 2021) and real estate (Choice Properties REIT).

BlackRock Inc.

BlackRock is the world’s largest asset manager, and it holds a 2.8% passive stake in Loblaw Companies through its iShares ETFs and index funds. BlackRock’s position reflects its strategy of tracking major Canadian indices like the S&P/TSX Composite.

Though it doesn’t actively manage or intervene in day-to-day business, BlackRock uses its Institutional Shareholder Services (ISS) arm to vote on important governance issues such as executive compensation, climate disclosures, and board diversity. Its influence is indirect but significant in promoting ESG policies in large public firms like Loblaws.

Vanguard Group

Vanguard holds an estimated 2.1% stake in Loblaw in 2025 through its low-cost index and mutual funds. Vanguard is known for its long-term investment strategy and typically holds stocks across all major sectors for diversification purposes.

While Vanguard does not take a direct role in operations, it actively votes on shareholder resolutions. Vanguard’s influence in Loblaws lies in pushing for transparent governance and risk management policies. It is one of the largest non-Canadian institutional investors in the company.

RBC Global Asset Management

RBC GAM is one of Canada’s largest institutional asset managers and owns around 1.9% of Loblaw Companies. It manages pension funds, mutual funds, and wealth products, making Loblaws a key holding in its Canadian equity portfolios.

RBC GAM does not hold board seats, but it can influence policy decisions by supporting or opposing proposals during annual shareholder meetings. As a domestic shareholder, it is more likely to support Canadian governance standards and advocate for long-term returns rather than short-term profits.

TD Asset Management

TD Asset Management, part of the Toronto-Dominion Bank group, controls roughly 1.7% of Loblaw shares. This includes exposure through balanced funds, equity portfolios, and ETFs aimed at retail and institutional clients.

TDAM aligns with industry-wide ESG and responsible investing practices. Its stake in Loblaws is considered passive but strategic—reflecting the stock’s stability and consistent dividend returns. TD may occasionally engage in discussions related to climate policy, workforce practices, or retail innovation through shareholder advocacy.

BMO Global Asset Management

BMO GAM holds around 1.4% of Loblaw’s shares in 2025. The bank includes Loblaw in various actively managed and passive Canadian equity funds. BMO’s interest is rooted in Loblaws’ position as a core Canadian consumer stock and long-term dividend payer.

Though BMO does not influence operations, it often aligns with peer institutions in favor of improved sustainability metrics and governance disclosure. BMO is part of collaborative engagements around food waste reduction, supply chain transparency, and gender diversity in boards.

CIBC Asset Management

CIBC Asset Management owns an estimated 1.1% of Loblaws. It manages these shares across actively managed Canadian equity portfolios and RRSP/TFSA investments. CIBC’s exposure is mostly retail-client focused, aiming to capture value from Loblaws’ growth in digital retail and pharmacy services.

While passive, CIBC participates in shareholder votes and occasionally joins Canadian investment groups that seek accountability on social governance matters.

Public and Retail Investors

Together, public and retail investors own around 35–36% of Loblaws’ common shares. This group includes:

- Canadian individuals investing through the TSX

- Self-directed retirement accounts (RRSPs and TFSAs)

- Retail trading platforms like Questrade, Wealthsimple, and RBC Direct Investing

- Smaller pension funds, credit unions, and family offices

Although these investors lack coordinated control, their collective sentiment impacts the company’s market capitalization, analyst coverage, and public image. Dividend yield, stability, and brand strength make Loblaws attractive to long-term retail shareholders.

Canada Pension Plan Investment Board (CPPIB)

CPPIB, Canada’s largest pension fund, holds a small but stable 0.8% stake in Loblaw Companies. CPPIB’s investments are aimed at long-term, inflation-resistant assets. Loblaws’ strong cash flows, consumer defensive status, and exposure to healthcare through Shoppers Drug Mart align with CPPIB’s priorities.

CPPIB has no direct control but may vote on proposals that influence environmental disclosures or executive remuneration. It views Loblaw as a reliable core holding in its public equities strategy.

Letko Brosseau & Associates

Letko Brosseau, a Montreal-based independent investment firm, owns about 0.7% of Loblaws in 2025. Known for active investment management, Letko Brosseau emphasizes value investing and corporate engagement.

The firm manages money for pension plans, endowments, and foundations. It may engage with Loblaw’s investor relations team on long-term strategic matters and governance improvements.

Jarislowsky Fraser

Jarislowsky Fraser manages approximately 0.5% of Loblaws shares. It serves institutional clients including non-profits, academic endowments, and pension funds. The firm is known for its long-term philosophy and low portfolio turnover.

It tends to vote consistently in favor of board-recommended motions but may oppose proposals that conflict with its ESG policy. Jarislowsky Fraser contributes to broader shareholder sentiment, particularly within Canada’s asset management community.

Who is the CEO of Loblaws?

Per Bank became President and CEO of Loblaw Companies Limited in early 2023. He brought over 25 years of global retail experience, especially from his tenure at major European supermarket chains. His international background positioned him to lead Loblaw through digital transformation, supply chain optimization, and sustainable growth.

Leadership Style and Key Initiatives

As CEO in 2025, Per Bank emphasizes a customer-first strategy. He’s steering investments into e-commerce, AI-driven inventory systems, and service innovation. Under his leadership, Loblaw has expanded its PC Express same-day delivery service. He also champions sustainability goals such as reducing plastic packaging and upgrading store energy efficiency.

Reporting and Corporate Governance

Per Bank reports directly to the Board of Directors, chaired by Galen Weston Jr. He works closely with the leadership team including the CFO, Chief Operating Officer, Chief Digital Officer, and heads of Pharmacy (Shoppers Drug Mart), Supply Chain, and Brand Marketing. He is accountable for delivering financial performance, executing ESG targets, and maintaining investor confidence.

Board Chairman: Galen Weston Jr.

Role and Influence

Although not CEO, Galen Weston Jr. remains Chairman of Loblaw Companies Limited, a role that keeps him at the center of strategic decision-making. He provides leadership oversight and represents the controlling shareholder’s interests. He often leads board discussions around major investments, mergers, and long-term planning.

Past Roles with the Company

Galen Weston Jr. previously served as CEO of Loblaw (interim roles between 2019 and 2022) and has held executive and non-executive roles since the Shoppers Drug Mart acquisition in 2013. His operational and retail experience continues to influence corporate direction.

Former CEOs: Key Leaders in Recent Years

Sarah Davis (2017–2021)

Sarah Davis served as President and CEO for four years. She led the digital overhaul of Loblaw’s loyalty and e-commerce platforms. During her tenure:

- PC Optimum loyalty program was rolled out.

- Investments made in PC Express and online grocer apps.

- Focus increased on private-label expansion and partnerships.

Galen Weston Jr. (Interim CEO, 2022)

After Sarah Davis stepped down in late 2021, Galen Weston Jr. assumed interim CEO duties until Per Bank’s appointment in early 2023. During this period, he ensured leadership continuity and oversaw the integration of new digital and operational systems.

Decision-Making Structure and Leadership Team

Strategic Committees

Under Per Bank, several committees support major decisions:

- Executive Committee: Aligns corporate strategy across divisions.

- Risk and Compliance Committee: Oversees regulatory and operational risks.

- ESG Committee: Guides sustainability and community initiatives.

Leadership Development

Per Bank has implemented a mentorship program to develop mid-level leaders and accelerate diversity goals. He also prioritizes cross-functional collaboration between banners (e.g., Loblaws, Shoppers Drug Mart, Joe Fresh) to drive synergy.

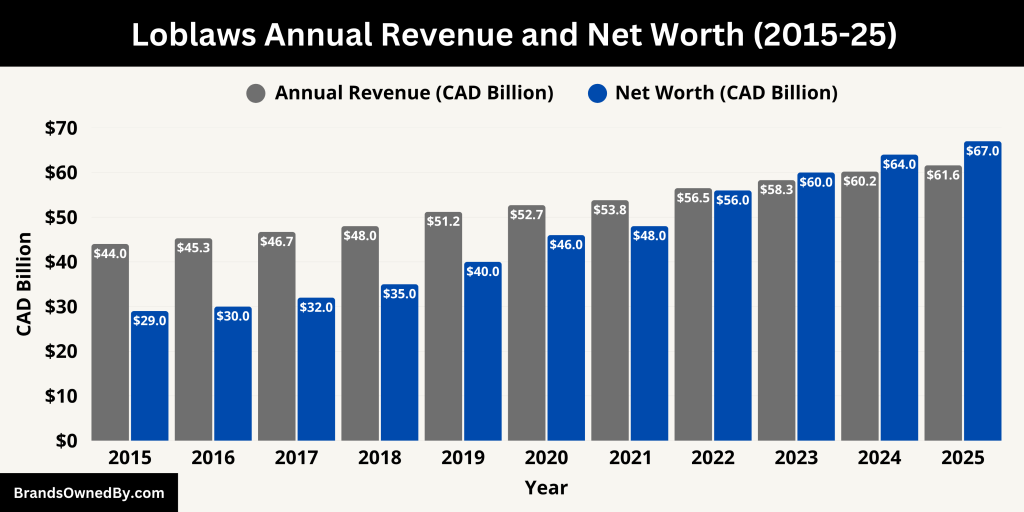

Loblaws Annual Revenue and Net Worth

Annual Revenue (2025)

In the twelve months leading up to March 2025, Loblaw Companies reported total revenues of approximately CAD 61.6 billion (USD 44.1 billion). This marks modest year-over-year growth of around 2.4%, driven by strong same-store sales at its discount New Canada banners like No Frills and Real Canadian Superstore. The first quarter alone generated roughly CAD 14.14 billion, recording a 4.1% increase compared to Q1 2024.

Much of Loblaw’s revenue stemmed from food retail, pharmacy services, and financial products through PC Financial. Growth in the pharmacy segment—especially Shoppers Drug Mart—contributed meaningfully, with comparable drug retail sales rising multiple percentage points. Grocery operations also benefited from inflation trends and consumer shifts to essential goods.

Net Worth / Market Capitalization

By July 2025, Loblaw Companies had a market capitalization between CAD 67–70 billion, reflecting strong investor confidence. Other sources report valuations ranging from CAD 66.6 billion to CAD 69.9 billion, showing consistent growth across different platforms. In U.S. dollars, this placed its worth near USD 49 billion.

The increase in market capitalization, up from around CAD 54 billion at the start of 2025, signals strong investor confidence in Loblaw’s business resilience and strategic investments.

Here is a 10-year historical overview of Loblaw Companies Limited’s revenue and estimated net worth (market capitalization) from 2015 to 2025:

| Year | Annual Revenue (CAD) | Net Worth / Market Cap (CAD) |

|---|---|---|

| 2025 | 61.6 billion | 68–70 billion |

| 2024 | 60.2 billion | 62–64 billion |

| 2023 | 58.3 billion | 58–60 billion |

| 2022 | 56.5 billion | 54–56 billion |

| 2021 | 53.8 billion | 46–48 billion |

| 2020 | 52.7 billion | 44–46 billion |

| 2019 | 51.2 billion | 38–40 billion |

| 2018 | 48.0 billion | 33–35 billion |

| 2017 | 46.7 billion | 31–32 billion |

| 2016 | 45.3 billion | 29–30 billion |

| 2015 | 44.0 billion | 28–29 billion |

Profitability, Margins, and Free Cash Flow

Loblaw’s operating income (TTM) reached roughly CAD 4 billion, with an operating margin of about 6.5%. Net income to common shareholders was approximately CAD 2.3 billion, resulting in a profit margin of around 3.6%.

Free cash flow (TTM) stood near CAD 4.2 billion, enabling the continuation of dividend payouts, share repurchase programs, and capital expenditure initiatives, including new store builds and EV charging infrastructure. Loblaw also reaffirmed its forecast for high single-digit growth in adjusted earnings per share for 2025.

Companies Owned by Loblaws

As of 2025, Loblaw Companies Limited operates a broad portfolio of retail, health, fashion, financial, and digital businesses, each tailored to different consumer segments and regional markets. These brands are fully owned and operated by Loblaw (not its parent, George Weston Limited), and collectively serve as the foundation of its multi-channel strategy and national retail dominance.

Here is the detailed breakdown of companies and brands owned by Loblaw as of 2025:

| Brand/Company | Type | Description | Primary Focus |

|---|---|---|---|

| Loblaws | Grocery Store Chain | Full-service supermarkets offering a wide selection of groceries, pharmacy, and fresh foods | Mid- to upper-income consumers |

| No Frills | Discount Grocery Chain | Franchise-based discount stores with low prices and essential product offerings | Budget-conscious shoppers |

| Real Canadian Superstore | Hypermarket | Large-format stores combining groceries with general merchandise | One-stop bulk and family shopping |

| Shoppers Drug Mart | Pharmacy Retail Chain | Canada’s largest pharmacy chain offering health, wellness, cosmetics, and over-the-counter items | Pharmacy and health services |

| Joe Fresh | Apparel Brand | In-house fashion label offering affordable clothing for all ages | Fashion and apparel |

| T&T Supermarket | Asian Grocery Chain | Specialty chain focusing on Asian foods, live seafood, and prepared meals | Asian Canadian communities |

| Fortinos | Supermarket Chain | Ontario-based chain with a European market feel and specialized counters | Local fresh food and customer service |

| Zehrs | Supermarket Chain | Ontario-focused stores with a mix of national and private labels | Suburban families and regional shoppers |

| Valu-Mart | Small-town Grocery Stores | Franchise stores located in rural and less-populated areas | Local community convenience |

| City Market | Urban Grocery Store | Smaller-format stores in city centers offering curated grocery and ready-to-eat items | Urban professionals and small households |

| PC Financial | Financial Services | Offers PC Money Account, credit cards, and limited insurance services integrated with PC Optimum | Banking and rewards programs |

| PC Optimum | Loyalty Program | Unified points-based rewards system across all Loblaw banners and services | Customer retention and data personalization |

| Your Independent Grocer | Franchise Grocery Stores | Community-based stores operated independently under Loblaw’s umbrella | Independent business owners |

| Wholesale Club | Cash-and-Carry Retail | Warehouse-style stores for businesses and bulk buyers | Foodservice and small businesses |

| Extra Foods | Regional Grocery Stores | Smaller grocery stores found mainly in Western Canada | Regional food retail |

| Dominion | Regional Banner | Supermarkets in Newfoundland and Labrador under Loblaw’s ownership | Atlantic Canada grocery needs |

| Loblaw Digital | Technology Division | Manages e-commerce platforms, delivery apps, loyalty systems, and digital tools | Online retail and digital health |

| Loblaw Health | Healthcare Division | Emerging segment focused on clinics, virtual care, and wellness integration | Retail health transformation |

Loblaws

Loblaws is the company’s core full-service grocery store chain. It operates large-format locations across Canada with a focus on fresh produce, bakery, meat, and in-store services. The stores often include optical centers, dietitian services, and pharmacy counters. Loblaws targets middle- to upper-income families and is known for integrating the PC Optimum loyalty program at checkout.

No Frills

No Frills is Loblaw’s popular discount grocery banner. It operates on a franchise model, offering essential grocery items at low prices by using a no-frills shopping experience—limited staff, basic store design, and large-volume inventory. It appeals primarily to value-conscious customers and has grown significantly in lower-income urban and suburban areas.

Real Canadian Superstore

Real Canadian Superstore combines grocery and general merchandise in one retail format. These large stores offer food, clothing, electronics, housewares, and pharmacy services under one roof. The brand operates across western Canada and Ontario and caters to large households and families seeking bulk or one-stop shopping.

Shoppers Drug Mart

Acquired in 2013, Shoppers Drug Mart is Canada’s largest pharmacy chain. It operates under its own banner and includes in-store pharmacy services, cosmetics counters, convenience food, and health products. The brand also offers HealthWATCH services and virtual care. It has expanded its footprint into health clinics, telehealth, and wellness centers under Loblaw’s guidance.

Joe Fresh

Joe Fresh is Loblaw’s fashion and apparel brand. Originally launched as an in-house clothing line, it has grown into a full-fledged fashion label offering clothing for men, women, children, and babies. It is sold online and in select Loblaws, Real Canadian Superstore, and Shoppers Drug Mart locations. Joe Fresh focuses on affordability, seasonal trends, and basic essentials.

T&T Supermarket

T&T Supermarket is Canada’s largest Asian grocery store chain, acquired by Loblaw in 2009. It offers a wide range of Asian food products, live seafood, in-house bakery, and ready-to-eat meals. The chain has expanded across major metropolitan cities and now includes online ordering and delivery in several provinces.

Fortinos

Fortinos is a regional supermarket chain in Ontario, known for its European-style shopping experience. It features specialized counters such as a butcher, bakery, floral, and deli section. Fortinos focuses on customer service and local community engagement, and it operates under the Loblaw corporate umbrella with a unique brand identity.

Zehrs

Zehrs is another Ontario-based supermarket chain operated by Loblaw. It offers a mix of national brands and private labels including President’s Choice and No Name. Zehrs stores serve mid-size communities and emphasize local sourcing, full-service grocery offerings, and pharmacy integration.

Valu-Mart

Valu-Mart is a smaller-scale grocery banner primarily found in smaller towns across Ontario. These stores are independently franchised and are designed to serve rural or less densely populated markets. They provide essential groceries and drugstore items with a focus on community-level convenience.

City Market

City Market stores are urban-format locations operated by Loblaw in high-density city areas. These stores offer a curated assortment of fresh foods, ready meals, and gourmet products aimed at professionals, small households, and on-the-go consumers.

PC Financial

President’s Choice Financial (PC Financial) is Loblaw’s financial services brand. It offers PC Money Accounts, PC Mastercards, and banking tools that are integrated with the PC Optimum loyalty program. While it no longer operates as a full-service bank, it provides no-fee spending accounts, rewards credit cards, and select insurance services.

PC Optimum

PC Optimum is Canada’s largest loyalty rewards program, combining Loblaw’s President’s Choice loyalty with Shoppers Drug Mart’s Optimum program. It allows customers to earn and redeem points across all Loblaw banners, including groceries, pharmacies, fashion, and financial services. PC Optimum is a strategic digital asset and contributes significantly to customer retention and data analytics.

Choice Properties REIT (Retail Properties)

While Choice Properties Real Estate Investment Trust is officially a subsidiary of George Weston Limited, Loblaw still plays a major operational role in it. Loblaw is the anchor tenant across hundreds of properties owned by Choice Properties, including shopping plazas, grocery-anchored retail centers, and mixed-use developments. Loblaw stores operate within and lease a significant portion of this REIT portfolio.

Independent City Markets and Franchise Banners

Loblaw also operates a number of independently branded or co-branded banners that function as franchise partners. These include:

- Your Independent Grocer (YIG) – mid-sized supermarkets in small towns and suburban communities

- Wholesale Club – Loblaw’s business-to-business cash-and-carry offering for restaurants and small retailers

- Extra Foods – primarily in Western Canada, a smaller-format grocery store

- Dominion – operating only in Newfoundland and Labrador under the Loblaw umbrella

Loblaw Digital

Loblaw Digital is a separate operating division responsible for developing the company’s e-commerce, delivery logistics, mobile apps, and digital health solutions. It manages the online presence for PC Express, Shoppers Drug Mart, Joe Fresh, and PC Optimum. In recent years, it has launched AI-based personalization tools and health scheduling platforms.

Loblaw Health (Emerging Division)

Loblaw is expanding into healthcare services under the Loblaw Health division. This includes:

- Connected health platforms

- Virtual care services

- In-store walk-in clinics

- Health & wellness products

This division integrates Shoppers Drug Mart’s clinical services with digital health technology and is expected to grow significantly through 2026.

Conclusion

So, who owns Loblaws? The answer lies in the Weston family and their holding company, George Weston Limited. Through majority shareholding and leadership influence, they control Canada’s largest grocery empire. With a strong mix of private-label brands, regional stores, pharmacy chains, and digital tools, Loblaws continues to shape how Canadians shop. Its legacy of innovation and expansion remains strong under its current leadership.

FAQs

Who is Loblaws owned by?

Loblaws is owned by Loblaw Companies Limited, which is a public company. The majority of its shares are held by George Weston Limited, giving it controlling ownership.

Who is the largest shareholder of Loblaws?

The largest shareholder of Loblaws is George Weston Limited, which owns approximately 52.2% of Loblaw Companies’ common shares.

Is Loblaws 100% Canadian-owned?

Yes, Loblaws is majority Canadian-owned. George Weston Limited, its parent and controlling shareholder, is a Canadian company controlled by the Weston family. However, some minority shares are held by international investors like BlackRock and Vanguard.

Why are Canadians boycotting Loblaws?

In recent years, some Canadians have called for boycotts of Loblaws over concerns such as rising food prices, alleged price fixing in the bread market, and perceptions of corporate profiteering during inflationary periods. The boycott reflects broader frustration with the cost of living and grocery sector competition.

Which family owns Loblaws?

The Weston family owns Loblaws through George Weston Limited. They have been involved in the business since the late 1940s and continue to play a leadership role.

Is Loblaw only in Canada?

Yes, Loblaw Companies Limited operates exclusively in Canada. All its retail banners, including Loblaws, Shoppers Drug Mart, No Frills, and others, are located within Canadian provinces and territories.

Does Loblaws own Shoppers Drugs?

Yes, Loblaws owns Shoppers Drug Mart. It was acquired by Loblaw Companies in 2013, and it remains one of the company’s largest and most profitable divisions.

How many brands does Loblaws own?

As of 2025, Loblaws owns and operates more than 20 retail brands, which include grocery banners (like Loblaws, No Frills, Real Canadian Superstore), pharmacies (Shoppers Drug Mart), clothing (Joe Fresh), financial services (PC Financial), loyalty programs (PC Optimum), and digital divisions.

What is the mother company of Loblaws?

The parent company of Loblaws is Loblaw Companies Limited. The holding company that controls Loblaw Companies is George Weston Limited.

Who owns the Real Canadian Superstore?

Real Canadian Superstore is fully owned and operated by Loblaw Companies Limited, making it part of the broader Loblaws group of retail banners.

Where is the headquarters of Loblaws?

The headquarters of Loblaws is located in Brampton, Ontario, Canada. This is also the head office for Loblaw Companies Limited.

Is Sobeys owned by Loblaws?

No, Sobeys is not owned by Loblaws. Sobeys is a separate grocery company owned by Empire Company Limited, a different Canadian retail group.

How many Loblaws stores in Canada?

As of 2025, there are over 2,400 stores operated under the Loblaw Companies umbrella across Canada, including Loblaws, No Frills, Real Canadian Superstore, Shoppers Drug Mart, and other regional banners.

Who owns Food Basics?

Food Basics is not owned by Loblaws. It is a discount grocery banner owned by Metro Inc., another major Canadian grocery company based in Montreal.

Is Loblaws privately owned?

No, it is a publicly traded company. However, it is majority-controlled by George Weston Limited, which is also publicly listed but controlled by the Weston family.

Who is the CEO of Loblaws in 2025?

Per Bank is the CEO of Loblaw Companies Limited as of 2025.

Does the Weston family still own Loblaws?

Yes, the Weston family controls George Weston Limited, which in turn owns the majority of Loblaws.

When was Loblaws founded?

Loblaws was founded in 1919 in Toronto, Ontario.