Liquid Death has made waves in the beverage industry with its bold branding and sustainability message. If you’ve ever wondered who owns Liquid Death, you’re not alone. This article explores the company’s profile, ownership structure, financial status, and more.

Liquid Death Company Profile

Liquid Death is a U.S.-based beverage company that sells mountain spring water and flavored sparkling water in tallboy aluminum cans. The brand is best known for its heavy-metal inspired branding, rebellious attitude, and commitment to sustainability. It operates as a mission-driven business with a core focus on reducing plastic waste by offering aluminum, which is more recyclable than plastic bottles.

The company’s motto “Murder Your Thirst” and edgy design choices have helped it stand out in the saturated beverage market. Liquid Death is not just about hydration—it’s a lifestyle brand that connects with consumers through humor, shock value, and an anti-establishment tone. Despite its disruptive image, Liquid Death is serious about environmental responsibility. A portion of its proceeds goes toward cleaning up plastic pollution and supporting nonprofits.

Liquid Death is headquartered in Los Angeles, California and has expanded its retail presence to stores like Whole Foods, Target, 7-Eleven, Walmart, and Amazon. It is one of the fastest-growing water brands in the United States and is steadily gaining a global footprint.

Founders of Liquid Death

The founder and visionary behind Liquid Death is Mike Cessario, a former creative director and marketing expert. He launched the brand in 2017, combining his background in advertising with a passion for disruptive brand building. Before creating Liquid Death, Cessario worked on campaigns for companies like Netflix, and he also dabbled in the music and entertainment scene.

Cessario noticed that many people at music festivals and concerts were drinking water out of beer cans to blend in or avoid judgment. This observation inspired him to create a water brand that looked cool and aligned with counterculture values. From that idea, Liquid Death was born—with a mission to “make health and sustainability 50 times more fun.”

Cessario remains the CEO and creative force behind the company, overseeing branding, partnerships, and growth strategies.

Major Milestones

2017 – Company Founded:

Mike Cessario officially launched Liquid Death with a bold vision. The brand initially gained traction through social media and online campaigns.

2019 – First Round of Venture Funding:

The company raised $1.6 million in seed funding from Science Ventures and other early backers. It used these funds to begin manufacturing and marketing.

2020 – Retail Expansion:

Liquid Death signed its first major retail deals with Whole Foods and other national chains, allowing the product to reach mainstream consumers.

2021 – Viral Success and Product Line Growth:

With the help of viral marketing stunts and celebrity endorsements, the brand released new products like sparkling water and limited-edition flavors. The company also sold hundreds of thousands of T-shirts and other merchandise.

2022 – Series C Funding and Valuation Jump:

Liquid Death raised over $75 million in Series C funding, pushing its valuation near $700 million. It also partnered with major distribution channels.

2023 – Reaches $263 Million in Revenue:

The brand reported an explosive jump in sales, reflecting both strong U.S. market penetration and expansion overseas.

2024 – Unicorn Status Achieved:

With its Series D round, Liquid Death’s valuation crossed $1.4 billion, officially making it a unicorn company. It also increased its presence in Europe and entered new markets.

Ongoing – Environmental Impact Campaigns:

The company continues to donate to ocean plastic cleanup programs and use recycled aluminum in its packaging. It has pledged to be carbon neutral in the near future.

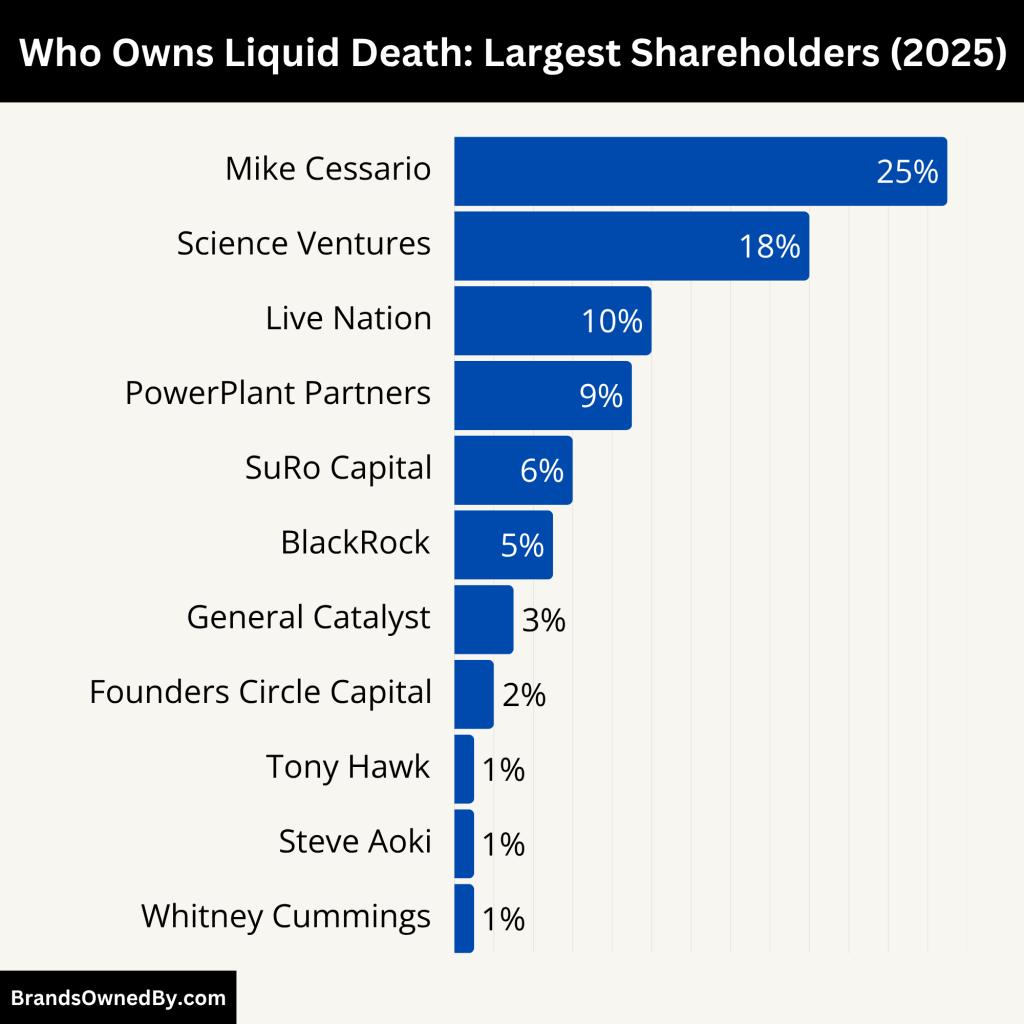

Who Owns Liquid Death: Top Shareholders

Liquid Death is privately owned. It is backed by a combination of venture capital firms, celebrity investors, and the founder. The largest shareholder is founder and CEO Mike Cessario, who has maintained significant control over the brand’s vision and direction. The company has gone through multiple funding rounds, with each adding new institutional and individual investors.

Below are the major shareholders and their roles in the company’s direction and growth:

| Shareholder / Entity | Role in Company | Estimated Ownership % | Type of Investor | Influence / Control | Strategic Contribution |

|---|---|---|---|---|---|

| Mike Cessario | Founder & CEO | 20–25% | Individual / Founder | High – retains creative and strategic control | Drives brand vision, product development, and public image |

| Science Ventures | Lead VC & Early Investor | 15–18% | Venture Capital | High – board representation and voting power | Provided initial seed funding and growth capital; strategic scaling expertise |

| Live Nation | Strategic Partner | 8–10% | Corporate Investor | Medium – distribution and event marketing influence | Exclusive event access and distribution through concerts and festivals |

| PowerPlant Partners | Growth-Stage Investor | 7–9% | Private Equity / ESG Focused | Medium – board advisory role | Supports international expansion, ESG governance, and supply chain sustainability |

| SuRo Capital | Institutional Investor | 5–6% | Venture Capital | Low – passive investor | Financial exposure to pre-IPO growth, minimal operational input |

| BlackRock Ventures | Institutional VC (2025) | 3–5% | Global Asset Manager | Medium – late-stage investment oversight | Adds IPO-readiness support and market credibility |

| General Catalyst | Series E Investor | 2–3% | Venture Capital | Low – strategic input only | Helps build infrastructure for scaling and potential M&A |

| Founders Circle Capital | Secondary Market Investor | 1–2% (estimated) | Private Equity | Low – liquidity provider | Offered liquidity to early employees and minor shareholders |

| Tony Hawk | Celebrity Investor | <1% | Individual / Public Figure | Very low – no governance role | Brand ambassador; leveraged for skate, youth culture, and viral promotions |

| Steve Aoki | Celebrity Investor | <1% | Individual / Entertainer | Very low – non-operational | Promotes brand during global tours and music events |

| Whitney Cummings | Celebrity Investor | <1% | Individual / Comedian | Very low – media collaboration | Appeared in ad campaigns, adds humor and pop culture appeal |

| Other Minor Investors | Misc. Angels & Small Funds | <5% combined | Mixed | Very low – silent or non-voting | Provide financial backing and minor strategic support |

| Employees (ESOP) | Early Employees & Executives | 5–8% combined (estimated) | Internal | Medium – depends on role | Aligns internal leadership incentives with long-term success |

Mike Cessario – Founder and Largest Shareholder

Ownership stake (estimated): 20–25%

Role: Founder, CEO, Creative Director

Mike Cessario is the original founder and remains the largest single shareholder. While he has diluted some of his equity in exchange for venture funding across multiple rounds, he still retains significant control—especially over brand direction, leadership decisions, and long-term vision. As both CEO and majority stakeholder, his voice carries the most weight in strategic planning and creative development.

Science Inc. / Science Ventures

Ownership stake (estimated): 15–18%

Role: Lead Early Investor, Board Member

Science Inc., a venture capital firm known for backing disruptive consumer brands, was one of Liquid Death’s first institutional investors. It led the seed round and has participated in later rounds. The firm continues to guide key operational and fundraising strategies. Science Ventures is believed to hold one or more board seats, giving it influence over governance and business development.

Live Nation

Ownership stake (estimated): 8–10%

Role: Strategic Investor, Distribution Partner

Live Nation invested in Liquid Death to integrate the brand into its massive network of music festivals and live events. As a strategic partner, Live Nation ensures the water brand appears at high-profile concerts and entertainment venues. This investment is more about synergy and long-term brand exposure than direct control.

PowerPlant Partners

Ownership stake (estimated): 7–9%

Role: Growth-Stage Investor, ESG Advisor

PowerPlant Partners joined in later-stage funding rounds. The firm focuses on health, wellness, and environmentally responsible companies. It helped guide Liquid Death’s expansion into broader retail channels and international markets. Its involvement also emphasizes sustainability reporting and impact measurement.

SuRo Capital

Ownership stake (estimated): 5–6%

Role: Institutional Shareholder

SuRo Capital, a publicly traded venture capital firm, disclosed its stake in Liquid Death through its investor filings. As a financial investor, its role is mostly passive, but its investment signals institutional interest in the brand’s valuation growth. SuRo likely does not hold board influence but benefits from the company’s exit or future IPO potential.

Tony Hawk

Ownership stake (estimated): Less than 1%

Role: Brand Ambassador, Cultural Influencer

Tony Hawk was an early celebrity investor and also collaborated with Liquid Death on limited-edition merchandise and viral marketing campaigns. While his financial stake is small, his cultural impact helps boost the brand’s popularity, especially among younger audiences and the skateboarding community.

Steve Aoki

Ownership stake (estimated): Less than 1%

Role: Celebrity Investor, Collaborator

DJ Steve Aoki joined a round of celebrity funding and has promoted the brand during his live shows and on social media. His influence among music fans aligns well with Liquid Death’s festival-heavy marketing strategy. His role is non-operational but valuable for outreach and visibility.

Whitney Cummings

Ownership stake (estimated): Less than 1%

Role: Celebrity Investor, Marketing Contributor

Comedian Whitney Cummings also invested in Liquid Death early on and has appeared in promotional content. Like other celebrity investors, her stake is minor, but her media presence supports brand humor and outreach.

Bam Margera (Former Stakeholder)

Ownership stake: Previously held an undisclosed minor stake

Status: Reportedly divested or inactive

Skateboarder and media personality Bam Margera was briefly affiliated with the company. However, his stake appears to have been short-term or symbolic, and he no longer plays a visible role in the company’s branding or ownership as of 2025.

New Institutional Investors (2025 Update)

In 2025, Liquid Death closed another round of funding to fuel international expansion, particularly in Europe and Asia. Several institutional and crossover funds participated:

- BlackRock Ventures (estimated stake: 3–5%): Entered in the 2025 Series E round, likely a preparatory move before potential IPO.

- General Catalyst (estimated stake: 2–3%): Participated in recent rounds, focusing on consumer brand scaling.

- Founders Circle Capital (estimated stake: undisclosed): Invested with a focus on secondary shares, offering liquidity to early employees or investors.

Who is the CEO of Liquid Death?

As of 2025, Mike Cessario is the CEO of Liquid Death. He is not only the chief executive but also the original founder and creative brain behind the brand. Under his leadership, Liquid Death transformed from a viral concept into a billion-dollar beverage company disrupting the bottled water industry. His stronghold on the company’s culture, branding, and growth trajectory makes him one of the most influential figures in modern consumer branding.

Background of Mike Cessario

Mike Cessario comes from a background in advertising and marketing. Before founding Liquid Death, he worked as a creative director on major campaigns for companies like Netflix and produced viral video content. He also played in punk and hardcore bands, which inspired the edgy, music-driven tone of Liquid Death.

His unique understanding of branding, combined with street culture and digital trends, allowed him to craft a product that speaks to younger consumers tired of traditional wellness messaging.

Leadership Style and Decision-Making

Cessario’s leadership is unconventional but effective. He leads with a mix of creative risk-taking, intense brand loyalty, and consumer-first thinking. Decision-making at Liquid Death is centralized under his guidance, especially in brand direction, marketing strategy, product innovation, and company voice.

He encourages experimentation, humor, and bold messaging, all while keeping the company’s mission — reducing plastic pollution — at the core.

He is known to work closely with the company’s creative, operations, and marketing teams, and he approves most high-level brand partnerships and campaigns himself.

Notable Achievements as CEO

- Built a $1.4 billion company from a brand that started as a meme-inspired concept.

- Pioneered aluminum water packaging in a market dominated by plastic.

- Attracted celebrity investors like Tony Hawk and Steve Aoki.

- Secured nationwide retail partnerships with Walmart, Target, Whole Foods, and Amazon.

- Led global expansion into Europe and Asia by 2024–2025.

- Maintained majority creative control while bringing in strategic investors.

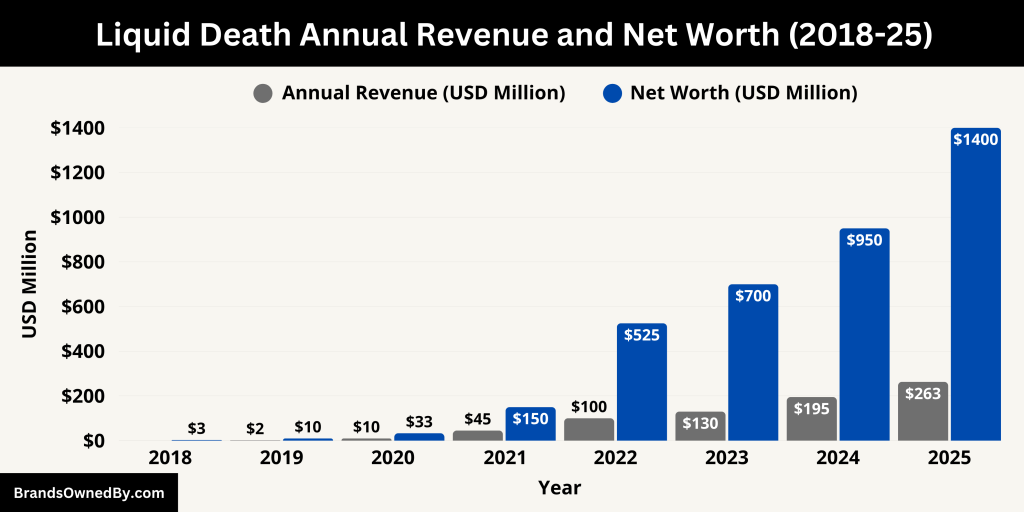

Liquid Death Annual Revenue and Net Worth

As of 2025, Liquid Death has solidified its position as one of the fastest-growing beverage brands in the U.S. and abroad. With a bold marketing strategy, strong retail partnerships, and viral product appeal, the company has crossed major financial milestones, both in revenue and valuation. Here’s a detailed breakdown of Liquid Death’s financial status in 2025.

Liquid Death Revenue in 2025

Liquid Death’s estimated annual revenue in 2025 is approximately $263 million, marking a significant increase from previous years. The company has shown explosive year-over-year growth:

- 2020: ~$10 million

- 2021: ~$45 million

- 2022: ~$100 million

- 2023: ~$130 million

- 2024: ~$195 million

- 2025: ~$263 million

This revenue surge is driven by:

- Expansion into major retail chains across the U.S. and Europe

- Increased sales of new products, including flavored sparkling water and branded merchandise

- Direct-to-consumer (DTC) sales via their website and subscription model

- Exclusive beverage deals at music festivals, concerts, and sports events

The brand’s non-traditional marketing—often focused on humor, shock value, and celebrity collaborations—has consistently translated into high conversion rates and loyal repeat buyers.

Net Worth in 2025

In June 2025, Liquid Death is valued at approximately $1.4 billion, officially giving it unicorn status. This valuation was finalized during its Series E funding round, which brought in several late-stage institutional investors such as BlackRock Ventures and General Catalyst.

The valuation reflects:

- Rapid revenue growth over a five-year period

- Strong brand equity and market presence

- High consumer engagement rates and viral marketing efficiency

- Sustainable packaging and ESG-focused business model

- Solid unit economics, with each can reportedly yielding strong profit margins

Factors Driving Financial Growth

- Retail Expansion: Product availability has extended to Walmart, Target, Kroger, CVS, and international outlets in the UK, Germany, and Canada.

- Product Diversification: Introduction of limited-edition sparkling flavors, iced tea alternatives, and apparel lines has increased average order values.

- Cultural Branding: Collaborations with musicians, comedians, and extreme sports athletes keep the brand culturally relevant and boost organic visibility.

- E-commerce Growth: Subscriptions and DTC sales continue to contribute significantly to revenue without heavy dependence on retailers.

Profitability Status

Liquid Death is still in its high-growth investment phase. While it is not yet consistently profitable, it has narrowed losses significantly due to scale efficiencies and high repeat customer rates. Profitability is expected in the next 12–24 months, especially if IPO plans advance.

Here is a detailed 10-year financial history of Liquid Death, including annual revenue and estimated company valuation (net worth) from its early startup phase through 2025:

| Year | Estimated Annual Revenue (USD) | Estimated Company Valuation / Net Worth (USD) | Key Milestone / Event |

|---|---|---|---|

| 2017 | $0 | ~$1 million | Company founded; early branding developed |

| 2018 | ~$100,000 | ~$3 million | Initial seed funding raised |

| 2019 | ~$2 million | ~$10 million | Product launched online and at select events |

| 2020 | ~$10 million | ~$33 million | Retail partnerships begin; Series A funding |

| 2021 | ~$45 million | ~$150 million | Viral growth; expansion into national retail chains |

| 2022 | ~$100 million | ~$525 million | Series C funding; product line expansion |

| 2023 | ~$130 million | ~$700 million | Expanded into flavored sparkling water; DTC growth |

| 2024 | ~$195 million | ~$950 million | Series D round; international expansion begins |

| 2025 | ~$263 million | ~$1.4 billion | Series E funding; unicorn status achieved |

Brands Owned by Liquid Death

As of 2025, Liquid Death Mountain Water, Inc. remains an independent company. It is primarily known for its aluminum-canned water, and it has strategically expanded its brand ecosystem. The company has developed and operates several distinct product lines and sub-brands under its edgy, counter-culture identity. Each extension contributes to its revenue while staying aligned with its environmental and cultural mission.

Below is a list of the major brands and companies owned by Liquid Death in 2025:

| Brand / Entity Name | Type | Launch Year | Description | Key Contributions |

|---|---|---|---|---|

| Liquid Death Mountain Water | Core Product Line | 2019 | Still mountain water in recyclable aluminum cans | Flagship product; high-volume retail and DTC sales |

| Liquid Death Sparkling Water | Product Line | 2021 | Flavored sparkling water with bold branding and natural ingredients | Represents over 35% of total revenue; drives repeat purchases and shelf space |

| Rest in Peach (Iced Tea Series) | Product Line | 2024 | Low-calorie flavored iced teas with functional benefits | Expands into functional beverage market; appeals to wellness-conscious consumers |

| Limited Edition Drops | Merchandise Line | 2020 | Apparel, collectible cans, collabs with artists, musicians, and athletes | Generates brand hype, DTC revenue, and cultural presence beyond beverages |

| Death to Plastic | Nonprofit Initiative | 2020 | Sustainability campaign and ocean cleanup fund | Reinforces ESG mission; supports plastic waste reduction through community programs |

| Murder Your Thirst Studio | In-house Creative Agency | 2024 | Produces viral content, animated shorts, influencer campaigns, and brand videos | Controls brand storytelling; fuels growth through unconventional marketing |

Liquid Death Mountain Water

This is the core flagship product. It features still, non-carbonated mountain water sourced from the Austrian Alps and packaged in recyclable aluminum tallboy cans. The brand’s death-metal inspired packaging, anti-plastic mission, and irreverent humor have made it a cult favorite among Gen Z and millennial consumers.

- Sold in single cans, 12-packs, and variety boxes

- Distributed across the U.S., Canada, UK, and select EU markets

- Also available via a DTC subscription model

Liquid Death Sparkling Water

Launched after the success of its still water, this sparkling water line includes multiple natural flavor options and has become a best-selling alternative to traditional sodas and flavored waters.

Flavors in 2025 include:

- Severed Lime

- Mango Chainsaw

- Berry It Alive

- Convicted Melon

- Chainsaw Orange (2025 launch)

Each flavor is marketed with a dark-humor twist, and the cans often feature limited-edition artwork, music collaborations, or collectible themes. Sparkling water now represents over 35% of the brand’s total revenue.

Liquid Death Iced Tea (Rest in Peach Line)

In 2024, the company launched its Rest in Peach series — a line of lightly sweetened, flavored iced teas with functional benefits. Unlike conventional tea brands, Liquid Death’s version offers punk-themed packaging and unique names like:

- Grim Leafer (Green Tea)

- Dead Billionaire (Lemonade + Black Tea)

- Armless Palmer (Half tea, half lemonade)

- Rest in Peach (Peach Iced Tea)

This sub-brand positions Liquid Death as a functional beverage player, attracting health-conscious consumers looking for low-sugar energy or hydration alternatives.

Liquid Death Limited Edition Drops

Liquid Death also operates a limited-edition merchandise and collectibles division. This includes apparel, skateboards, collectible cans, and rare collabs with musicians, tattoo artists, and influencers.

Notable collaborations in 2023–2025:

- Tony Hawk’s “blood-infused” skateboard series

- Exclusive merch lines with Slayer, Ghost, and Steve Aoki

- Comic-style artist editions of their cans

- Death Metal Holiday Advent Boxes

These drops drive DTC sales and brand engagement while generating additional revenue outside the beverage sector.

Death to Plastic Campaign (Nonprofit Entity)

Although not a revenue-generating brand, Death to Plastic is a company-operated initiative and registered nonprofit that supports Liquid Death’s environmental mission. It funds ocean cleanup, plastic reduction campaigns, and circular economy efforts.

Liquid Death donates a portion of proceeds from each can sold and encourages fan participation through events and social pledges.

- Partnered with local beach cleanups

- Runs environmental awareness campaigns on social media

- Engages schools and colleges for youth participation

Murder Your Thirst Studio

This is Liquid Death’s in-house content and creative agency formed in 2024. It produces viral campaigns, digital ads, animated shorts, and experimental marketing content. The studio gives the company full control over brand storytelling and is also rumored to be developing longer-form content like a horror-comedy short series based on the Liquid Death universe.

This unit:

- Creates all in-house commercials and social media films

- Produces content for influencer partnerships

- Handles branding for all new product launches

It gives Liquid Death the autonomy to maintain its provocative voice without relying on traditional agencies.

Final Thoughts

Liquid Death is more than just a canned water brand—it’s a cultural statement. The company remains privately owned, with Mike Cessario holding the reins both creatively and strategically. Backed by a unique group of investors, from venture firms to celebrities, Liquid Death is charting a new course in the bottled water industry.

Its rapid rise, bold branding, and sustainability message have set it apart. Whether or not it ever sells to a larger corporation remains to be seen, but for now, it remains fiercely independent and unconventional.

FAQs

Who are the part owners of Liquid Death?

Liquid Death has several part owners due to multiple funding rounds involving celebrities, venture capital firms, and institutional investors. Notable part owners include CEO and founder Mike Cessario, alongside celebrity investors like Tony Hawk, Wiz Khalifa, Steve Aoki, and Fat Mike. Additionally, major investment firms such as Live Nation, Science Inc., Velos Partners, General Catalyst, and BlackRock Ventures also hold equity stakes.

Does Wiz Khalifa own Liquid Death?

Yes, Wiz Khalifa is a part-owner of Liquid Death. He invested in the company during a later-stage funding round and actively supports the brand through endorsements and collaborations.

Does Tony Hawk own Liquid Death?

Yes, Tony Hawk is both an investor and collaborator. He is a part-owner and has worked with Liquid Death on exclusive merchandise drops — including a limited-edition skateboard series. His long-standing support has contributed to the brand’s appeal in skate culture.

What celebrities invested in Liquid Death?

Several celebrities have invested in Liquid Death over its multiple funding rounds. These include:

- Tony Hawk (professional skateboarder)

- Wiz Khalifa (rapper)

- Steve Aoki (DJ and producer)

- Fat Mike (from punk band NOFX)

- Machine Gun Kelly (musician)

- DJ Zedd

- Joe Manganiello (actor)

- Tom Segura and Bert Kreischer (comedians).

Their investments helped increase brand exposure among younger audiences.

Is Liquid Death made by Steve-O?

No, Steve-O did not create Liquid Death. While his edgy comedic brand aligns with the product’s image, he is not the founder nor a confirmed investor. The brand is often mistaken for being made by comedians due to its humor-based marketing, but Steve-O has no ownership stake.

Who made up Liquid Death?

Liquid Death was created by Mike Cessario, a former creative director and advertising professional. He came up with the idea in 2016, blending punk-metal aesthetics with a mission to reduce plastic waste. The brand officially launched in 2019.

What is Mike Cessario’s net worth?

As of June 2025, Mike Cessario’s estimated net worth is around $80–100 million. His wealth comes primarily from his majority stake in Liquid Death, which was valued at $1.4 billion in 2025. He also earns income from his executive role and brand-related deals.

What is the Liquid Death controversy?

Liquid Death has faced criticism for its dark branding and aggressive marketing tactics, which some argue make fun of death and mental health. Others have accused the brand of being “style over substance” — marketing water as an extreme product. There was also controversy over its collaboration with Tony Hawk where skateboards were allegedly printed with his blood. Despite this, the brand has retained a loyal fanbase and defended its message as satire mixed with environmental activism.

Who manufactures Liquid Death?

Liquid Death’s water is sourced from the Austrian Alps and bottled in Austria. The company partners with third-party bottling facilities for manufacturing but oversees branding, design, and distribution internally. It does not own its own bottling plants.

Who makes Liquid Death water?

The water is made by Liquid Death Mountain Water, Inc. It is a U.S.-based company that sources spring and mineral water from Austria, which is then canned and distributed through various retail and online channels.

Why is it called Liquid Death?

The name “Liquid Death” was chosen to mock extreme energy drink branding while promoting a simple, healthy product: water. The idea was to make water cool, rebellious, and fun — turning it into something as edgy as a rock band or energy drink. The name also supports the brand’s “death to plastic” environmental mission.

Who invented Liquid Death water?

Mike Cessario invented Liquid Death in 2016. Inspired by his work in advertising and punk culture, he wanted to create a water brand that used humor, aggression, and counterculture to break into the boring bottled water industry.

Who founded Liquid Death?

Mike Cessario is the founder and current CEO of Liquid Death. He launched the company officially in 2017 and took it public in retail and online channels by 2019. His leadership has shaped its voice, brand, and cult-like consumer following.

Who is the majority owner of Liquid Death?

The majority owner is Mike Cessario, the founder and CEO of Liquid Death.

Is Liquid Death owned by Coca-Cola?

No, Liquid Death is not owned by Coca-Cola. It remains an independent brand.

Who are the investors in Liquid Death?

Investors include Science Ventures, Live Nation, Tony Hawk, Steve Aoki, and PowerPlant Partners.

Is Liquid Death a private or public company?

Liquid Death is a privately held company and has not gone public as of 2025.

How much is Liquid Death worth?

Liquid Death was valued at approximately $1.4 billion in 2025 in its last funding round.

What company owns Liquid Death?

Liquid Death is owned by its founder and a group of private investors. It is not a subsidiary of any larger company.

Where is Liquid Death headquartered?

The company is headquartered in Los Angeles, California.