Leicester City’s story is one of the most remarkable journeys in modern football. From near-administration to lifting the Premier League trophy, the club has moved through eras of struggle, hope, ambition, and global recognition. Fans across the world often ask who owns Leicester City today because the transformation feels almost unbelievable without understanding the people behind it. The club’s evolution has been shaped by long-term planning, community commitment, and a leadership model built on stability rather than impulsive decision-making.

Key Takeaways

- Leicester City is fully owned by the Srivaddhanaprabha family through King Power International, giving them complete control of the club’s strategic and financial decisions.

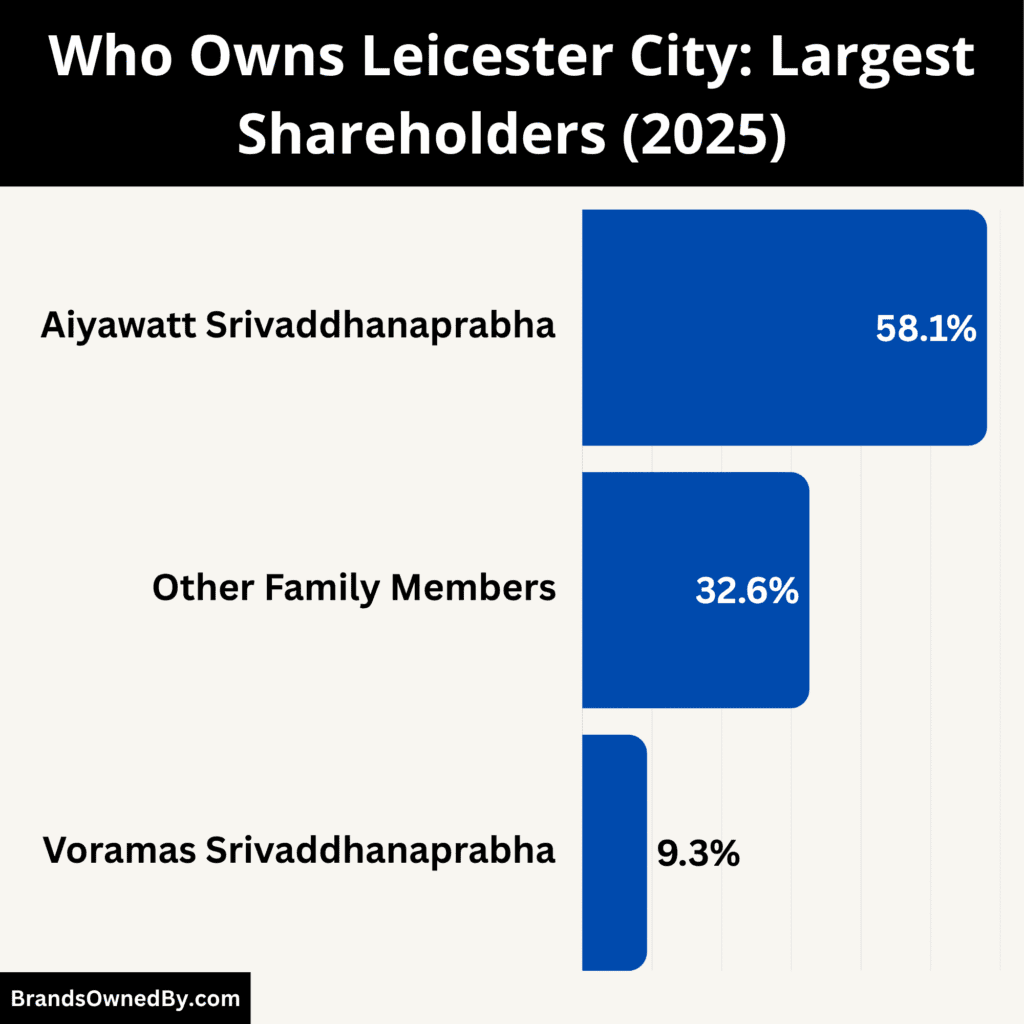

- Aiyawatt “Top” Srivaddhanaprabha is the majority beneficial owner with 58.1% ownership, making him the primary decision-maker and chairman of the club.

- Voramas Srivaddhanaprabha holds a 9.3% stake, while the remaining 32.6% is held collectively by other Srivaddhanaprabha family members and family-controlled entities.

- The consolidated 100% family ownership ensures long-term stability, unified leadership and consistent investment across Leicester City’s football operations, infrastructure and commercial growth.

Leicester City FC Overview

Leicester City Football Club stands as one of English football’s most compelling long-term success stories. The club developed from a local school-based team into a global name recognized for resilience, smart management, and historic achievements. Its journey includes financial struggles, relegations, iconic promotions, and a Premier League title that stunned the world.

As of 2025, Leicester City continues to grow as a modern football institution supported by world-class facilities, a strong fan culture, and a legacy that balances tradition with ambitious planning.

Founders and Early Background

Leicester City began life in 1884 when a group of former pupils from Wyggeston School formed a football team called Leicester Fosse. The founders were young local men who wanted to establish an organized club representing their community. Early matches were played on local grounds including Victoria Park and later the Belgrave Road Cycle and Cricket Ground.

The name “Fosse” came from the ancient Roman road, the Fosse Way, running through Leicester. The club joined the Football Association shortly after formation and spent its early years arranging friendly games and regional competitions. In 1891, the club moved to Filbert Street, which became its spiritual home for more than a century.

By 1894, Leicester Fosse gained enough recognition and financial stability to enter the Football League. This transition from amateur beginnings to a structured league team marked the start of its long journey through the English football pyramid.

Major Milestones

- 1884 – Leicester Fosse founded by former Wyggeston School pupils, laying the foundation for organized football in the city.

- 1887 – The club plays its first FA Cup match, signaling its early competitive ambitions.

- 1891 – Leicester Fosse begins playing at Filbert Street, which eventually becomes its long-term home for 111 years.

- 1894 – Leicester Fosse is elected to the Football League, beginning its first official league campaign.

- 1908 – The club achieves its first major league promotion, rising to the First Division.

- 1913 – Filbert Street undergoes expansion to accommodate growing crowds.

- 1919 – After financial difficulties, the club reforms as Leicester City, adopting the name that reflects its growing regional identity.

- 1928 – Leicester City finishes as First Division runners-up, one of the highest league finishes of its early history.

- 1949 – Leicester reaches the FA Cup Final for the first time, beginning a long tradition of memorable cup runs.

- 1964 – Leicester wins the League Cup, earning its first major competitive trophy.

- 1966 – Leicester City wins the League Cup again and continues to solidify its place as a competitive top-flight club.

- 1971 – The club earns promotion back to the First Division, supported by strong youth development.

- 1980 – Gary Lineker emerges as one of the club’s most successful academy products, later becoming an England star.

- 2002 – Leicester City moves from Filbert Street to the new Walkers Stadium (later renamed the King Power Stadium), modernizing the club’s infrastructure.

- 2008 – Leicester suffers the first relegation to League One in club history but immediately begins restructuring.

- 2009 – The club earns promotion back to the Championship at the first attempt, showing strong resilience.

- 2010 – King Power International acquires Leicester City, beginning a new era of investment and stability.

- 2014 – Leicester City is promoted to the Premier League after winning the Championship with a dominant season.

- 2015 – The “Great Escape” takes place as Leicester survives relegation despite being bottom for most of the season.

- 2016 – Leicester City wins the Premier League title in one of the greatest sporting upsets ever recorded.

- 2017 – The club reaches the Champions League quarterfinals, marking one of the highest points in its European history.

- 2018 – The tragic helicopter crash claims the life of Chairman Vichai Srivaddhanaprabha, leading to an emotional turning point in the club’s modern era.

- 2021 – Leicester City wins the FA Cup for the first time in its history, defeating Chelsea at Wembley.

- 2022 – The club wins the FA Community Shield, adding another trophy to its cabinet.

- 2023 – Leicester City is relegated from the Premier League after a difficult season marked by financial and squad challenges.

- 2024 – Leicester City wins the Championship and returns to the Premier League, demonstrating long-standing resilience.

- 2025 – The club continues strengthening its academy structure and investing in facilities, keeping long-term development at the center of its strategy.

Who Owns Leicester City FC: Top Shareholders

Leicester City’s ownership is concentrated under the Thai retail group King Power International Group and the Srivaddhanaprabha family. Over the past decade, the club has been steered by this ownership model which has combined long-term investment and family control. In recent years, however, the financial health of King Power and regulatory challenges have added complexity to the ownership story.

Parent Company: King Power International Group

King Power International Group is the parent company behind Leicester City and the legal entity that controls the club’s corporate structure. King Power is a Thai duty-free and retail giant with operations across Asia. Its acquisition of Leicester City in 2010 changed the trajectory of the club. Through King Power, the club gains access to long-term capital, corporate expertise, and a business philosophy centered on patience rather than short-term risk-taking.

Under King Power’s ownership, Leicester City invested heavily in infrastructure, including the King Power Stadium redevelopment and the construction of one of Europe’s most advanced training complexes.

The group also provides financial backing for recruitment, academy investment, and commercial expansion. Even during periods of financial pressure — which have affected the company since 2020 — King Power has continued to fund the club through share issues, capital injections, and debt restructuring.

Their position as the parent owner gives them overall authority over club assets, financial stability, and long-term strategic direction.

Aiyawatt Srivaddhanaprabha (58.1%)

Aiyawatt “Top” Srivaddhanaprabha is the primary decision-maker at Leicester City. With a beneficial ownership of 58.1%, he holds the largest individual stake and the authority that comes with it. His role is not symbolic; he is directly involved in defining the club’s philosophy, approving budgets, overseeing executive appointments, and shaping the club’s global expansion strategy.

Since taking over leadership after his father’s passing in 2018, Aiyawatt has focused heavily on sustainability. He has championed long-term investments rather than short-term spending sprees. His decisions led to the club’s training ground project, commercial brand expansions into Asia, and increased emphasis on youth development. Beyond business, he remains deeply connected to the emotional fabric of the club — his public relationship with fans and staff continues to influence the club’s atmosphere and identity.

His majority stake gives him full voting control, ensuring he can influence both footballing and corporate decisions without requiring external approval. As of 2025, he is the most influential figure in the entire ownership structure.

Voramas Srivaddhanaprabha (9.3%)

Voramas Srivaddhanaprabha holds a 9.3% beneficial stake, making him the second-largest individual shareholder. While not involved in daily operations, his role is important in maintaining the family’s consolidated control over the club. His share gives him influence in shareholder-level decisions and ensures that family alignment remains strong.

Voramas plays a background role in the King Power business empire, which indirectly contributes to Leicester City’s operational stability. His stake also reinforces the legal and financial power of the family within internal agreements, financial reorganizations, and regulatory filings. Having a second significant family stakeholder supports continuity, ensuring that decision-making power remains internal even in periods of corporate restructuring.

Other Srivaddhanaprabha Family Members (32.6%)

The remaining 32.6% of Leicester City is held by other members of the Srivaddhanaprabha family. These include siblings, senior family figures, and King Power–aligned holding companies that represent long-standing family trusts. While individual percentages within this group are not publicly broken down, the combined ownership is designed to maintain unity rather than distribute control.

These shareholders provide internal stability. Their presence ensures that the voting power stays within the family, protecting the club from external takeover attempts and maintaining a single, unified vision.

They also contribute to the governance structure by participating in oversight roles and family-level investment discussions. Although they do not influence football operations directly, they play a vital part in sustaining the ownership model that has shaped Leicester City’s identity.

Internal Ownership Mechanisms and Club-Controlled Instruments

Leicester City also operates through internal corporate structures that act as extensions of King Power and the Srivaddhanaprabha family. Share issues, debt-to-equity conversions, and subsidiary ownership vehicles are part of the club’s financial architecture. These instruments enhance liquidity, strengthen the balance sheet, and ensure that full ownership stays within the family network.

In recent years, the club used these mechanisms to convert large internal loans into equity. These conversions reduced the club’s debt load and increased the family’s overall holding percentage. This corporate approach allows Leicester City to function with minimal external debt, which is crucial under modern financial regulations. The internal ownership system ensures that all executive authority and strategic control remain within the same family-driven system.

Leicester City FC Ownership History

Leicester City’s ownership journey is one of the most dramatic in English football. Across more than 140 years, the club has moved from small local businessmen to consortiums, administrators, private investors, and finally to the Srivaddhanaprabha family. Each ownership era shaped the club’s finances, culture, ambitions, and long-term direction.

| Ownership Era / Owner | Years Active | Ownership Type | Key Contributions & Relevant Details |

|---|---|---|---|

| Local Businessmen & Wyggeston School Founders | 1884–1919 | Founders & early private investors | Formed Leicester Fosse in 1884. Ran the club through personal funds and small committees. Oversaw entry into the Football League. Financial struggles led to the 1919 restructuring and renaming to Leicester City. |

| Local Boards & Regional Business Investors | 1919–1960s | Multi-shareholder boards | Controlled by groups of local business leaders. Managed club operations through board votes. Limited financial resources but maintained stability during league campaigns and multiple FA Cup finals. |

| Modernizing Local Business Groups | 1970s–1980s | Regional business consortiums | A mix of traditional shareholders and new business figures. Faced rising costs due to football’s modernization. Kept the club afloat but struggled to compete with larger clubs’ financial backing. |

| 1990s Business Consortiums (incl. Martin George era) | 1990s–2007 | Consortium ownership | Oversaw Premier League-era growth and early top-flight success. Faced financial strains from stadium expansion, player wages, and relegations. Led to administration in 2002 before a Lineker-assisted rescue. |

| Post-Administration Rescue Group (incl. Gary Lineker involvement) | 2002–2007 | Local-business-led recovery ownership | Rescued the club from administration. Stabilized finances. Supported move to King Power Stadium. Restored credibility but lacked long-term capital for sustained Premier League growth. |

| Milan Mandarić | 2007–2010 | Single majority private owner | First modern sole-owner era. Invested aggressively. Rebuilt sporting structure. Achieved promotion and avoided financial collapse. Prepared club for sale to a more ambitious long-term owner. |

| King Power International Group (Vichai Srivaddhanaprabha) | 2010–2018 | Corporate ownership under single family | Cleared debts, invested in infrastructure, and modernized the club. Funded recruitment and long-term growth. Delivered promotion in 2014 and the historic Premier League title in 2016. Cultivated strong fan connection and community investment. |

| Aiyawatt “Top” Srivaddhanaprabha & Srivaddhanaprabha Family | 2018–Present | Family-controlled ownership (100%) | Aiyawatt becomes Chairman after Vichai’s passing. Oversees training complex completion, FA Cup win (2021), and Premier League return (2024). Responsible for club restructuring, youth investments, global expansion, and financial oversight. Holds majority beneficial stake. |

Early Ownership: The Local Businessmen Era (1884–1919)

Leicester City began as Leicester Fosse in 1884, founded by former Wyggeston School pupils and supported by small local businessmen. Ownership during these early years was modest and informal. Investors held responsibilities for equipment, playing facilities, and early wages, often using their personal money to keep the club running.

By the late 1800s, as the club entered the Football League, ownership shifted toward a more structured model. Local business owners purchased shares and sat on committees that managed match operations and finances. The club remained community-driven, financially vulnerable, and dependent on gate receipts.

Financial trouble in 1919 pushed the club into liquidation. After restructuring, the newly formed Leicester City Football Club emerged with fresh local investors and a clean slate.

Growth and Stability: Local Boards and Regional Investors (1919–1960s)

For the next several decades, Leicester City remained under the control of regional businessmen who formed the club’s board of directors. This era brought steady leadership but limited financial resources. Ownership was spread across many small shareholders.

The club grew slowly, relying on ticket sales, bonuses from strong league finishes, and occasional player sales.

Major decisions required consensus among board members, and the club’s ambitions reflected the modest financial backing of these community investors. While stability improved, there was no single wealthy benefactor to accelerate growth.

Football League Modernization and New Business Interests (1970s–1980s)

As English football modernized, Leicester City attracted wealthier regional investors who began consolidating shares. The board evolved into a mix of traditional local stakeholders and newer business figures from Leicester’s commercial community.

This period saw increasing financial pressures. Stadium upgrades, rising player wages, and escalating transfer fees demanded greater investment. While the club avoided collapse during this time, it struggled to keep pace with larger English teams that began attracting corporate owners.

The Modern Ownership Shift: Business Consortia and Financial Instability (1990s–2000s)

The 1990s marked Leicester City’s transition into the corporate era of football. Ownership shifted toward consortiums made up of businessmen seeking to modernize the club. The most notable was the Martin George–led group, which played a major role during the Premier League’s early expansion years.

Despite moments of sporting success, financial challenges persisted. In 2002, after relegation and the costly move to the new stadium, Leicester City entered administration. This was one of the most difficult periods in the club’s history.

A consortium supported by local figure Gary Lineker helped rescue the club, stabilizing ownership in the early 2000s. Yet the financial structure remained fragile, limiting long-term competitiveness.

The Turning Point: The Mandaric Era (2007–2010)

Serbian-American businessman Milan Mandarić purchased Leicester City in 2007. This marked the club’s first era under a single wealthy owner rather than a group of local businessmen.

Mandarić brought:

- personal investment

- modernized leadership

- higher aspirations for promotion

- willingness to change managers to find the right formula.

Although the club experienced both relegation and promotion under his leadership, the Mandarić era laid the foundation for the stability that would follow. His biggest legacy was preparing Leicester City for a more ambitious owner.

The Golden Era Begins: King Power Takeover (2010)

In 2010, King Power International Group, led by Vichai Srivaddhanaprabha, purchased Leicester City. This became the most transformative ownership change in the club’s history.

Vichai brought significant financial investment, immediate debt clearing, and a long-term plan to rebuild the club structurally. Under his leadership, Leicester City moved from Championship uncertainty to Premier League promotion in 2014. His ownership approach emphasized loyalty, stability, and investment in infrastructure — values that shaped the club culture deeply.

The Emotional Transition: From Vichai to Aiyawatt (2018–present)

Following Vichai’s tragic passing in 2018, his son Aiyawatt “Top” Srivaddhanaprabha became Chairman. The family retained full control of the club, and Aiyawatt took on a more active leadership role.

Under his guidance, the club:

- completed a world-class training facility

- expanded global commercial operations

- continued investing in youth development

- rebuilt the squad after key departures

- strengthened internal financial structures.

Aiyawatt’s leadership resulted in Leicester City winning the FA Cup for the first time in 2021 and returning to the Premier League in 2024 after a brief relegation.

By 2025, the Srivaddhanaprabha family remains the 100% beneficial owner of Leicester City, with Aiyawatt holding the controlling majority stake. Their long-term, emotionally invested approach continues to define the club’s identity and direction.

Aiyawatt Srivaddhanaprabha & Family Net Worth

As of November 2025, the net worth of Aiyawatt Srivaddhanaprabha and his family is estimated at $3.5 billion. This wealth underpins Leicester City’s financial stability and reflects decades of expansion in duty-free retail, real estate, hospitality, aviation commerce and diversified global investments.

The Srivaddhanaprabha family’s net worth is rooted in King Power International Group, one of Thailand’s most influential retail and travel corporations. The family controls the company through a combination of direct ownership, leadership roles and interconnected private entities.

Their wealth has grown alongside King Power’s expansion into airport concessions, luxury retail, global partnerships and large-scale commercial projects.

In addition, the family maintains diversified assets across property, sports, hospitality, logistics, and aviation services.

King Power International Group – Core Source of Wealth

King Power International Group is the crown jewel of the family empire. Founded by Vichai Srivaddhanaprabha in 1989, it grew from a modest duty-free outlet into Thailand’s largest travel retail company.

Below are real businesses and assets owned or controlled by King Power:

- King Power Duty Free (Thailand Duty-Free Co., Ltd.)

Operates duty-free stores in Suvarnabhumi Airport, Don Mueang Airport, Chiang Mai Airport, and Phuket Airport. - King Power Downtown Complexes

Flagship luxury shopping centers located at:- King Power Rangnam (Bangkok)

- King Power Srivaree (Samut Prakan)

- King Power Pattaya

- King Power Online

A major e-commerce platform offering luxury products, perfumes, cosmetics and travel-exclusive items. - International Luxury Distribution Partnerships

Exclusive Thai retail agreements with brands such as Burberry, Gucci, Cartier, Chanel, Dior, Estée Lauder, and Moët Hennessy.

Key Value Drivers

- monopoly-style airport concessions

- high-spending tourist markets

- luxury retail dominance

- international brand exclusivity agreements.

This section of the empire still represents the majority of the family’s wealth.

Real Estate & Urban Development Ventures

The family owns and invests in high-value real estate projects across Thailand, especially in Bangkok.

Major Properties & Projects

- King Power Mahanakhon (formerly MahaNakhon Tower)

Thailand’s most iconic skyscraper. Includes:- Mahanakhon SkyWalk observation deck

- Luxury retail zones

- Mahanakhon Cube

- Hospitality and F&B clusters

- Srivaddhanaprabha Family Property Holdings

A portfolio of luxury properties used for commercial leasing, retail outlets and corporate facilities. - King Power Headquarters Complex

A large business estate in Bangkok housing offices, hospitality facilities and logistics operations.

Aviation & Travel-Related Commercial Assets

The family generates substantial revenue from aviation commerce beyond duty-free stores.

- World Duty Free (Thailand operations) — controlled after strategic shifts in Thai concession allocation

- King Power Traveler Co., Ltd. — travel retail distribution for airline partners

- Airport Lounge & Passenger Services — premium lounges and travel-experience businesses in Thai airports

- Logistics & Distribution Centers — supply-chain hubs supporting airport retail operations.

These ventures give the family control over airport retail pipelines — one of the most profitable business environments in Asia.

Hospitality, Hotels & Entertainment

The family has strong interests in high-end hospitality and lifestyle ventures.

Notable Assets

- Pullman Bangkok King Power Hotel

A flagship 5-star hotel located next to the King Power Rangnam complex. - King Power Mahanakhon Hospitality Cluster

High-end dining, luxury entertainment venues and event spaces inside the skyscraper. - International Tourism Partnerships

Collaborations with travel brands, luxury chauffeur services and curated tourism experience companies.

These ventures complement the duty-free empire and serve as feeder channels for tourist spending.

Retail Brands, Luxury Partnerships & Exclusive Rights

King Power holds exclusive import, retail, or airport distribution rights for a vast range of global brands.

These are real, long-standing brand relationships:

- Gucci

- Louis Vuitton

- Burberry

- Prada

- Chanel

- Dior

- Rolex (selected airport and downtown channels)

- Estée Lauder Companies (MAC, Clinique, La Mer)

- Moët Hennessy (Hennessy, Dom Pérignon, Moët & Chandon).

These exclusive and semi-exclusive contracts significantly increase the family’s luxury-retail valuation.

Sports & Entertainment Investments

Leicester City is not the family’s only sports interest.

- Leicester City Football Club

Full ownership through family-controlled entities. - OH Leuven (Belgium)

The family also owns the Belgian club Oud-Heverlee Leuven, acquired as part of a multi-club strategy.

These assets expand their global influence in the sports sector.

Private Investment Vehicles & Diversified Assets

Aiyawatt and his siblings operate a network of holding companies, trusts, and private investment arms.

- Aiyawatt Srivaddhanaprabha Holdings (private)

- Srivaddhanaprabha Family Trusts

- King Power Group subsidiaries in Hong Kong, Singapore and Luxembourg

- Equity interests in Thai logistics, packaging and food distribution firms.

These holdings diversify risk and add multi-sector value to the overall net worth.

Long-Term Wealth Growth & Strategy

From 2010 to 2025, the family’s net worth expanded through:

- major airport concession renewals

- new downtown luxury complexes

- real estate appreciation (especially Mahanakhon)

- global brand licensing agreements

- expansion of online luxury retail during travel slowdowns

- sports branding and international partnerships.

The family’s wealth strategy focuses on monopoly-strength concessions, luxury goods, prime urban real estate, and sports-driven global branding.

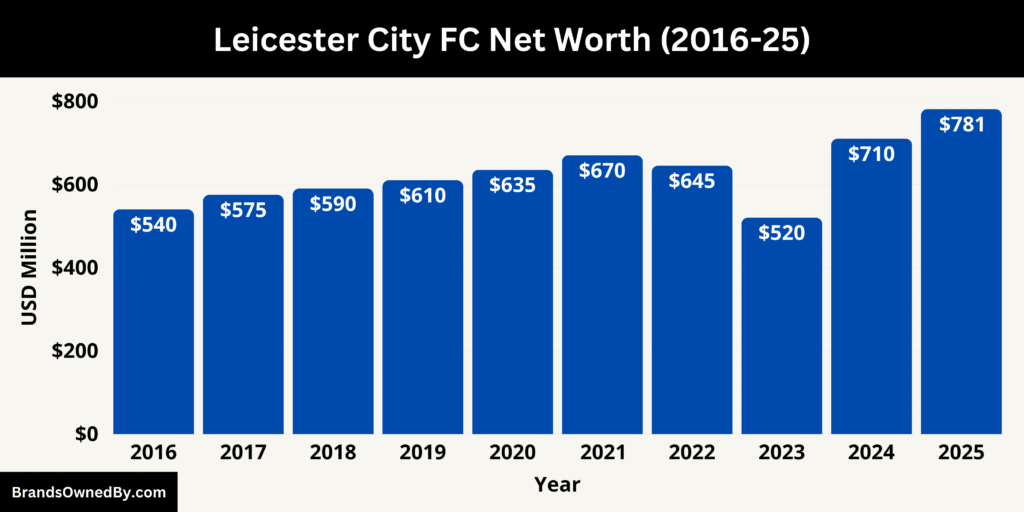

Leicester City FC Net Worth

As of November 2025, Leicester City has an estimated net worth of $781 million. This valuation reflects the club’s current Premier League status, its infrastructural growth, global brand appeal, sporting assets and long-term financial support from the Srivaddhanaprabha family.

Leicester City’s valuation as a football franchise incorporates its stadium, training facilities, sporting operations, commercial contracts and player assets. The club’s return to the Premier League in 2024 significantly boosted its market value. Promotion increased broadcasting revenue, sponsorship appeal and overall brand exposure.

The club remains one of the most efficiently run mid-tier Premier League teams, with strong infrastructure and a well-established global identity shaped by the 2016 Premier League title and 2021 FA Cup victory.

Revenue Drivers

Leicester City’s net worth is anchored in several major revenue streams that directly increase its financial value.

Broadcasting Revenue

Premier League broadcasting payments are the club’s single largest income source. This includes:

- Equal-share payments distributed to all PL clubs.

- Merit payments based on league position.

- Facility fees for televised matches.

- International broadcasting distributions which have grown significantly due to global demand.

After promotion, Leicester regained access to a revenue pool that can exceed $150 million per season, depending on league finish and TV appearances. This broadcasting stability is a major component of the club’s valuation.

Matchday & Stadium Income

The King Power Stadium is one of Leicester’s strongest revenue-generating assets. Matchday income includes:

- season ticket revenue

- match-by-match ticket sales

- premium hospitality, including the Champions Club and executive boxes

- catering, merchandise kiosks, and in-stadium retail

- conference and events usage on non-matchdays.

Stadium ownership also increases Leicester’s valuation because the land and physical structure carry long-term marketable value. Planned expansion discussions add potential future upside to the club’s valuation.

Commercial & Sponsorship Income

Leicester City benefits from a commercial portfolio that includes:

- shirt sponsorship agreements

- training kit sponsorship

- global and regional brand partners

- licensing deals across Asia, Europe, and North America

- merchandise and online retail

- pre-season commercial tours.

The club’s strongest region commercially is Thailand, due to the ownership connection, followed by Southeast Asia and the UK domestic market. Brand value is enhanced by the club’s 2016 Premier League title and 2021 FA Cup win—moments that permanently lifted Leicester into global recognition.

Infrastructure & Facility Value

The club’s physical assets add significant weight to the $781 million valuation.

King Power Stadium

The stadium is a core property asset that contributes to the club’s net worth through:

- land value and real estate value

- matchday operational income

- corporate hospitality

- commercial retail outlets

- long-term expansion potential.

Few mid-tier English clubs own a modern stadium outright, which gives Leicester a competitive financial advantage.

Seagrave Training Complex

Opened recently, Seagrave is one of the most advanced training facilities in Europe. Its value includes:

- replacement cost (hundreds of millions of dollars)

- elite pitches and sports science laboratories

- integrated academy complex

- medical and rehabilitation facilities

- residential accommodation for youth players

- on-site administrative and analytical hubs.

The facility increases the club’s appeal for players, strengthens talent development and significantly enhances overall valuation.

Player Asset Value

The squad’s market value forms a large portion of the club’s total net worth. Squad value includes:

- first-team market valuations

- contract lengths and renewal status

- academy graduates with resale potential

- high-value assets under long-term deals.

Leicester has a strong track record of selling players at premium prices — examples include Riyad Mahrez, Wesley Fofana, Harry Maguire, Ben Chilwell and N’Golo Kanté. This reputation for developing and exporting talent boosts the club’s asset profile and future financial projections.

Brand Value & Global Recognition

Leicester City’s brand value is far higher than its pre-2016 status due to:

- the historic Premier League title

- global media coverage

- increased social media footprint

- strong appeal across Asia

- partnerships tied to the Srivaddhanaprabha family’s business network.

The club’s emotional connection with global audiences, particularly after the tragic loss of Vichai Srivaddhanaprabha, significantly increases its commercial attractiveness and intangible brand worth.

Ownership Investment & Financial Stability

The Srivaddhanaprabha family’s continuous capital injections, debt restructuring and operational support significantly strengthen the club’s financial position. Their backing provides stability, reduces borrowing risk and improves long-term planning. This ownership model directly increases the club’s valuation because it lowers the financial uncertainty often associated with football franchises.

Leicester City’s long-term valuation trajectory remains upward. Strong facilities, Premier League exposure, commercial growth, player development, global brand appeal and stable ownership suggest that the franchise remains financially healthy. Continued Premier League stability and strategic investment could drive the valuation above $900 million within several years.

Leicester City FC Leadership

Leicester City’s leadership in 2025 reflects a blend of long-term family ownership, professional executive management and a highly structured sporting department. The club operates through a modern governance and operations framework that connects the boardroom, commercial operations, football management and player development into a unified system.

Chairman & Strategic Owner: Aiyawatt Srivaddhanaprabha

As Chairman, Aiyawatt Srivaddhanaprabha sits at the apex of Leicester City’s leadership. He is the club’s primary decision-maker and oversees all major strategic initiatives such as stadium development, structural investment, brand expansion and senior appointments.

Under his stewardship, the club’s sporting philosophy, commercial strategy and long-term infrastructure plan are aligned with the family’s broader vision. He ensures that budgeting, finance and governance reflect a sustainable growth model, rather than a high-risk, short-term spending approach.

Chief Executive: Susan Whelan

Susan Whelan serves as Chief Executive and is responsible for the day-to-day operational running of the club. Her remit covers finance, commercial partnerships, matchday operations, global brand development and administrative leadership.

She translates the Chairman’s strategic vision into executable business plans, coordinates the senior executive team, manages relationships with commercial sponsors, oversees the club’s financial reporting and ensures that non-football operations support the club’s athletic ambitions.

Sporting Director & Head of Football Operations: Jon Rudkin

Jon Rudkin holds dual responsibility as Sporting Director and Head of Football Operations. His role encompasses recruitment strategy, scouting networks, contract negotiations, youth development alignment and first-team oversight.

He manages the interface between the academy and the senior squad, works closely with the first-team manager to identify playing-profile needs, and ensures that Leicester City maintains its model of smart recruitment and player development. His leadership is key to sustaining the club’s competitive edge and commercial value in the transfer market.

First-Team Manager: Martí Cifuentes

Martí Cifuentes, appointed in July 2025, is the First-Team Manager charged with delivering on-field results. He is responsible for training, matchday tactics, squad selection, player development and alignment with the club’s long-term footballing philosophy.

Cifuentes works under the Sporting Director’s remit but has autonomy in coaching staff appointments, tactical framework and player-performance metrics. His impact on the club’s sporting success is a major driver of Leicester City’s value—best performance means better broadcasting income, higher brand visibility and improved commercial opportunities.

Director of Venue Commercial Development: Dan Schofield

Dan Schofield heads the commercial and venue operations at the King Power Stadium. His responsibilities include matchday hospitality, corporate suites, retail operations, non-matchday event hosting (such as concerts or conferences), retail leasing within the stadium complex and optimizing stadium-linked revenue. The venue-commercial leadership he provides is critical to maximizing the stadium asset’s contribution to the club’s net worth.

Communications & Global Partnerships Director: Anthony Herlihy

Anthony Herlihy manages global communications, digital strategy, brand licensing, social-media engagement and international partnership development. He oversees how Leicester City communicates its identity worldwide, drives merchandise sales, enters new international markets and engages fans across platforms. His department plays a vital role in growing the club’s global footprint, which in turn enhances brand value and commercial sponsorship ability.

Governance & Compliance Oversight: Finance Director Kevin Davies

Kevin Davies, the Finance Director, oversees financial controls, audits, regulatory compliance (including Premier League profit-and-sustainability rules), risk assessments and internal governance. His role involves producing financial statements, managing club debt, working with auditors and ensuring that the club’s financial operations meet best-practice standards. The governance leadership he provides helps protect the club from financial mismanagement and supports the club’s valuation by maintaining transparency and regulatory alignment.

Final Thoughts

Understanding who owns Leicester City and how the club is structured behind the scenes reveals why it has remained one of the most resilient and well-run teams in English football. The Srivaddhanaprabha family’s long-term investment, modern leadership framework, strong infrastructure and global brand strategy continue to shape the club’s identity and financial strength. Leicester City’s journey from underdog champions to a stable Premier League franchise shows how the right ownership, management team and vision can transform a club’s destiny, ensuring that Leicester City remains competitive, ambitious and firmly rooted in sustainable success.

FAQs

Who are Leicester City owners?

Leicester City is owned by the Srivaddhanaprabha family through King Power International Group. The controlling figure is Aiyawatt “Top” Srivaddhanaprabha, who holds the majority stake and serves as Chairman.

Who is the new owner of Leicester City?

There is no new owner. Aiyawatt Srivaddhanaprabha has remained the club’s controlling owner since taking over leadership of the family’s interests in 2018.

How rich are Leicester City owners?

As of November 2025, the Srivaddhanaprabha family has an estimated net worth of around $3.5 billion, built through their duty-free empire, real estate holdings, hospitality ventures, aviation commerce and global investments.

Is Leicester City owned by Thai?

Yes. Leicester City is owned by a Thai family. The Srivaddhanaprabhas are one of Thailand’s most prominent business families, and they own the club through King Power International Group.

Who owns King Power now?

King Power International Group is still owned and controlled by the Srivaddhanaprabha family, with Aiyawatt “Top” Srivaddhanaprabha serving as its leader.

Who owns King Power Stadium?

King Power Stadium is owned by a King Power–controlled entity linked directly to the Srivaddhanaprabha family, making them the ultimate owners of both the club and its stadium asset.

Who is the new CEO of Leicester City?

As of 2025, Susan Whelan continues to serve as the Chief Executive of Leicester City, overseeing the club’s business operations, commercial strategy and executive management.