Kroger is one of the largest grocery retailers in the United States. Many shoppers recognize the name but often ask, who owns Kroger? Understanding its ownership, leadership, and associated brands offers a clear picture of how this massive retailer operates.

History of Kroger

Kroger was founded in 1883 by Bernard Kroger in Cincinnati, Ohio. His goal was to provide quality groceries at affordable prices. The company grew steadily through the early 20th century. It became one of the first grocery chains to operate its own bakery and sell private-label products.

By the mid-1900s, Kroger had expanded across many states. It introduced innovations like electronic scanners at checkout and loyalty programs. Over time, it acquired several regional chains, solidifying its place as a top supermarket operator in the country.

Today, Kroger operates thousands of stores across the U.S., serving millions of customers weekly.

Who Owns Kroger: Shareholder List

Kroger Co. (NYSE: KR) is a publicly traded company, meaning it is owned by shareholders who purchase its stock. These shareholders include institutional investors, company insiders, and retail investors.

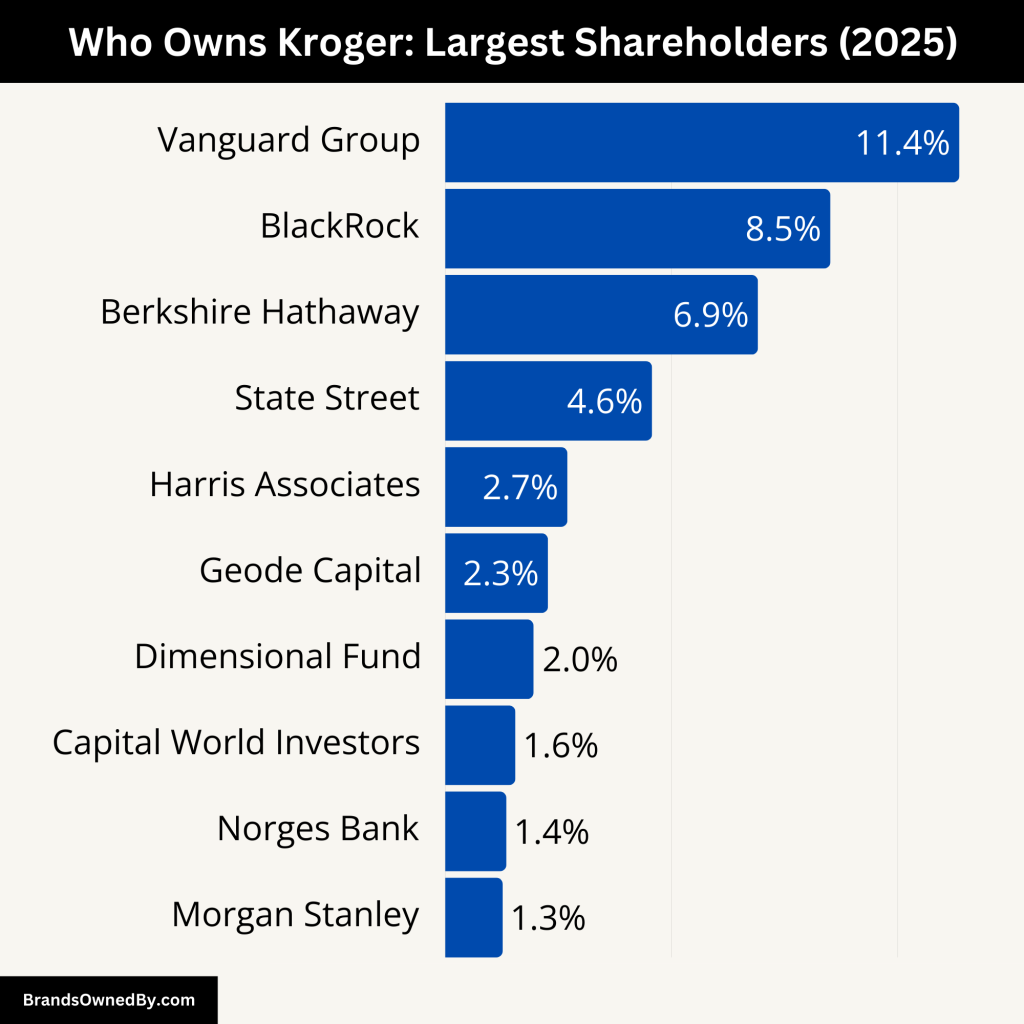

As of 2025, institutional investors hold approximately 80.66% of Kroger’s shares, insiders hold about 1.82%, and the remaining 17.51% is held by retail investors

Here’s a detailed breakdown of the largest shareholders of Kroger:

| Shareholder | Ownership (%) | Shares Owned | Estimated Value | Investment Role |

|---|---|---|---|---|

| The Vanguard Group, Inc. | 11.36% | 82,223,697 | $5.46 billion | Passive institutional investor; votes on key decisions |

| BlackRock, Inc. | 8.51% | 61,558,093 | $4.09 billion | Institutional investor focused on ESG and long-term value |

| Berkshire Hathaway Inc. | 6.91% | 50,000,000 | $3.32 billion | Long-term strategic investor; led by Warren Buffett |

| State Street Corporation | 4.57% | 33,064,848 | $2.20 billion | Passive index fund manager; supports governance reform |

| Harris Associates L.P. | 2.70% | 19,551,961 | $1.30 billion | Value investor; may engage with management |

| Geode Capital Management, LLC | 2.27% | 16,436,688 | $1.09 billion | Quantitative index investor; affiliated with Fidelity |

| Dimensional Fund Advisors LP | 1.95% | 14,113,596 | $937 million | Quantitative fund manager; academic investing strategies |

| Capital World Investors | 1.55% | 11,180,717 | $742.29 million | Long-term institutional investor; part of Capital Group |

| Norges Bank Investment Management | 1.35% | 9,785,603 | $649.67 million | Sovereign wealth fund; promotes ESG and ethical investing |

| Morgan Stanley | 1.27% | 9,156,530 | $607.90 million | Institutional investor and analyst; diversified exposure |

The Vanguard Group, Inc.

The Vanguard Group is the largest institutional shareholder of Kroger, owning approximately 11.36% of the company’s outstanding shares. This equals about 82.2 million shares, worth an estimated $5.46 billion based on 2025 stock prices.

Vanguard is known for managing mutual funds and ETFs, often focusing on long-term investments. Its shares in Kroger are held on behalf of millions of investors in its funds, including retirement accounts and index funds. While Vanguard doesn’t get involved in daily operations, it has significant voting power in shareholder meetings. It often votes on issues related to board appointments, executive compensation, and corporate governance policies.

Vanguard’s passive investment strategy means it doesn’t interfere directly but has a major influence over strategic direction through shareholder proposals and proxy votes.

BlackRock, Inc.

BlackRock is the second-largest shareholder, holding about 8.51% of Kroger’s stock. This equates to 61.5 million shares valued at approximately $4.09 billion.

As one of the largest asset managers in the world, BlackRock invests on behalf of pension funds, governments, institutions, and individual clients. It uses a mix of active and passive investment strategies. BlackRock’s voting power in Kroger gives it influence over important decisions such as mergers, environmental policies, and executive changes.

BlackRock is also known for its emphasis on environmental, social, and governance (ESG) factors. It often encourages companies to adopt sustainable practices and long-term financial responsibility.

Berkshire Hathaway Inc.

Berkshire Hathaway owns 6.91% of Kroger, which amounts to 50 million shares worth around $3.32 billion. Unlike other large investors, Berkshire Hathaway takes a more focused, long-term approach to its investments.

The company is led by Warren Buffett, who is known for investing in companies with strong cash flow and brand strength. Kroger fits this model, especially with its extensive national footprint and solid earnings. While Buffett does not sit on Kroger’s board, his firm’s stake is a strong vote of confidence in Kroger’s financial future.

Berkshire typically avoids activist tactics but monitors performance closely and holds onto high-performing investments for many years.

State Street Corporation

State Street holds 4.57% of Kroger shares, totaling 33.06 million shares worth about $2.20 billion.

State Street operates mainly through its investment management arm, State Street Global Advisors. It manages trillions of dollars in client assets and offers passive index funds and ETFs. Its role as a shareholder is largely passive, but it engages with companies on governance issues.

State Street regularly publishes stewardship reports and participates in proxy voting. It supports board diversity, financial transparency, and responsible leadership. Its investment in Kroger is part of a broader index and equity funds.

Harris Associates L.P.

Harris Associates owns around 2.70% of Kroger, or 19.55 million shares, valued at approximately $1.30 billion.

Known for its value investing approach, Harris Associates focuses on companies it believes are undervalued relative to their intrinsic worth. Its stake in Kroger suggests confidence in the company’s earnings growth, operational efficiency, and market share stability.

Harris takes an active approach in some cases, engaging with management teams to improve shareholder value. However, in Kroger’s case, its role is more aligned with long-term value appreciation.

Geode Capital Management, LLC

Geode Capital Management holds about 2.27% of Kroger shares, which equals 16.43 million shares worth an estimated $1.09 billion.

Geode is a quantitative asset manager and manages index fund assets primarily for Fidelity Investments. Its investment in Kroger reflects Kroger’s inclusion in major stock indices like the S&P 500.

Geode typically follows passive investment strategies and does not actively engage in corporate decision-making. Its influence is primarily exercised through votes in shareholder meetings.

Dimensional Fund Advisors LP

Dimensional Fund Advisors owns approximately 1.95% of Kroger, which amounts to 14.11 million shares, valued at around $937 million.

This firm uses academic research and quantitative analysis to build its investment portfolios. Dimensional emphasizes diversification and long-term market exposure rather than stock picking.

Its stake in Kroger reflects its strategy to invest in large-cap companies with stable earnings. While it does not actively campaign for changes in corporate behavior, it exercises its voting rights on key governance issues.

Capital World Investors

Capital World Investors holds roughly 1.55% of Kroger shares. This totals 11.18 million shares, valued at $742.29 million.

Capital World is a division of Capital Group, one of the oldest and largest investment management firms. It tends to invest in companies with strong long-term prospects and capable leadership.

Capital World generally engages with companies on strategic performance and supports transparency and long-term planning. Its stake in Kroger reflects its belief in the grocery chain’s resilience in competitive markets.

Norges Bank Investment Management

Norges Bank owns around 1.35% of Kroger, which equals 9.78 million shares, valued at about $649.67 million.

This firm manages Norway’s Government Pension Fund Global, one of the largest sovereign wealth funds in the world. It invests globally to ensure financial returns for future generations of Norwegians.

Norges Bank has been vocal about ESG issues, promoting ethical investments. It has a robust voting record and often supports shareholder proposals related to environmental responsibility and fair labor practices.

Morgan Stanley

Morgan Stanley holds approximately 1.27% of Kroger, totaling 9.15 million shares valued at $607.90 million.

The company invests through various fund vehicles, including wealth management and asset management divisions. Its investment in Kroger likely reflects a belief in its defensive value and steady earnings.

While Morgan Stanley doesn’t engage in direct corporate activism for most holdings, it contributes to market sentiment through analysis, recommendations, and participation in annual meetings.

Who is the CEO of Kroger?

As of March 2025, Ron Sargent serves as the interim CEO and Chairman of the Board at Kroger. He stepped into this role following the resignation of Rodney McMullen, who departed after an internal investigation into personal conduct that violated the company’s ethics policy.

Sargent brings extensive experience in retail leadership. He began his career at Kroger, working in various roles across stores, sales, marketing, manufacturing, and strategy. Later, he joined Staples Inc., where he served as Chairman and CEO from 2002 to 2016. Sargent has been a member of Kroger’s board since 2006 and served as the lead director since 2017.

In his interim role, Sargent is committed to maintaining stability and executing Kroger’s strategic initiatives. He stated, “Kroger has been a special place throughout my retail career… My decades here have given me a full appreciation of what makes Kroger unique”.

Former CEO: Rodney McMullen

Rodney McMullen served as Kroger’s CEO from January 2014 until his resignation in March 2025. His career at Kroger spanned over four decades, starting as a part-time stock clerk in 1978. Under his leadership, Kroger expanded through acquisitions, including Harris Teeter and Roundy’s, and invested in technology partnerships like the one with Ocado for automated fulfillment centers.

McMullen’s tenure ended following a board-led investigation into personal conduct that was inconsistent with Kroger’s business ethics policy. The conduct was unrelated to the company’s financial performance or operations.

Leadership Structure and Control

Kroger’s leadership is overseen by its Board of Directors, which includes both internal executives and independent members. The board is responsible for major decisions, including the appointment of the CEO and oversight of company strategy.

Following McMullen’s resignation, the board appointed Ron Sargent as interim CEO and Mark Sutton, former Chairman and CEO of International Paper, as the lead independent director. The board has initiated a search for a permanent CEO, engaging a nationally recognized firm to assist in the process

Annual Revenue and Net Worth of Kroger

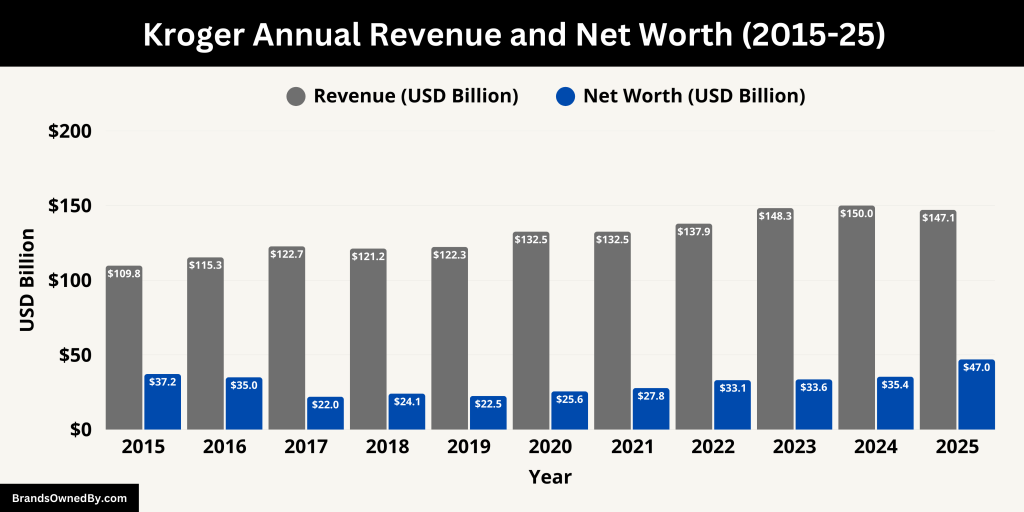

In fiscal year 2024, Kroger reported total sales of $147.1 billion, reflecting a slight decrease from the previous year’s $150.0 billion. This decline was primarily attributed to the absence of a 53rd week in 2024, which had contributed approximately $2.7 billion in sales in 2023. Excluding fuel, Kroger Specialty Pharmacy, and the 53rd week, sales increased by 1.8% compared to the same period last year.

The company’s operating profit for 2024 was $3.8 billion, with an adjusted FIFO operating profit of $4.7 billion. Earnings per share (EPS) stood at $3.67, while adjusted EPS was $4.47.

As of April 2025, Kroger’s market capitalization, which serves as a proxy for its net worth, was approximately $46.95 billion. This valuation reflects investor confidence in Kroger’s business model and its ability to navigate the competitive retail landscape.

In terms of profitability, Kroger’s net income for the twelve months ending January 31, 2025, was $2.665 billion, marking a 23.15% increase from the previous year. This growth underscores the company’s operational efficiency and strategic initiatives aimed at enhancing shareholder value.

Below is an overview of the annual revenue and net worth of Kroger for the last 10 years from 2015 to 2025:

| Year | Revenue (USD) | Net Worth / Market Cap (USD) |

|---|---|---|

| 2025 | $147.1 billion (2024 fiscal) | $46.95 billion (Mar 2025) |

| 2024 | $150.0 billion | $35.4 billion |

| 2023 | $148.3 billion | $33.6 billion |

| 2022 | $137.9 billion | $33.1 billion |

| 2021 | $132.5 billion | $27.8 billion |

| 2020 | $132.5 billion | $25.6 billion |

| 2019 | $122.3 billion | $22.5 billion |

| 2018 | $121.2 billion | $24.1 billion |

| 2017 | $122.7 billion | $22.0 billion |

| 2016 | $115.3 billion | $35.0 billion |

| 2015 | $109.8 billion | $37.2 billion |

Companies Owned by Kroger

As of 2025, Kroger operates a diverse portfolio of subsidiaries, regional supermarket chains, and private-label brands across the United States. These entities enable Kroger to cater to various customer preferences and regional markets.

Below is an overview of major brands and companies owned by Kroger:

| Company/Brand | Key Features/Services |

|---|---|

| Harris Teeter | Operates 262 stores across seven states and Washington, D.C., with an emphasis on upscale offerings, fresh produce, and a robust loyalty program. Known for community impact through food donations and local sourcing. |

| Roundy’s Supermarkets | Includes Pick ‘n Save, Metro Market, and Mariano’s Fresh Market. Focuses on fresh produce, local products, and in-store dining experiences. Mariano’s stores feature micro-restaurants and chef demonstrations. |

| Dillons | Operates in Kansas, Nebraska, and Missouri with a strong presence in the community. Offers in-store pharmacies and fresh food selections. Launched Scan, Bag, Go technology for faster checkouts. |

| Food 4 Less and Foods Co | Discount grocery chains in California and the Midwest, offering low-cost products. Focused on self-bagging and bulk goods, they have in-store fuel centers offering rewards for purchases. |

| Home Chef | A leading meal kit and food delivery service, now available in-store and online. Offers a customizable platform for customers to adjust their meal choices and meal plans. Home Chef expanded to provide oven-ready meal trays. |

| Kroger Health | Over 1,300 pharmacies and 200 healthcare clinics providing vaccinations, consultations, and health screenings. Its telehealth services and virtual care platform serve millions of members across the U.S. |

| Kroger Personal Finance | Provides financial services like prepaid cards, money transfers, and bill payment kiosks. Its services offer easy access to banking solutions within Kroger stores, improving convenience for customers. |

| Kroger Technology | Focuses on IT solutions and innovations, including AI-driven demand forecasting and customer-facing mobile apps. Kroger’s advanced analytics improve inventory management and help enhance customer experience. |

| Kroger Manufacturing | Operates 35 plants producing bakery, dairy, meat, and snack products. Responsible for producing Kroger’s private-label goods, ensuring quality and freshness across its 13,000+ SKU range. |

| Kroger Logistics | Manages Kroger’s distribution network, with over 3,500 trucks and 40 distribution centers. Its cutting-edge logistics system includes real-time tracking and automated fulfillment to ensure timely delivery. |

| Private Label – Our Brands | Kroger’s extensive portfolio of over 13,000 private-label products, including Simple Truth, Private Selection, and Smart Way. These brands help drive $30 billion in annual sales, focusing on organic, budget, and premium lines. |

| Simple Truth | Kroger’s organic and natural brand, offering a wide range of products, including dairy, meats, and pantry staples. Simple Truth is a leading brand in the organic space, growing by 30% in 2024. |

| Private Selection | A premium, gourmet private-label brand offering over 1,200 products, including seasonal and chef-curated collections. It competes with top-tier food brands and appeals to customers looking for high-end grocery items. |

| Smart Way | A value-focused private label providing essential grocery products at budget-friendly prices, aimed at helping customers save money while maintaining quality. Smart Way continues to expand in Kroger’s key markets. |

| Mercado | Kroger’s private-label line catering to Hispanic customers. It includes a wide range of authentic Hispanic food products such as tortillas, salsas, and tamales, helping Kroger target the growing Latino demographic. |

| Field & Vine | Offers locally sourced produce, particularly fresh berries, and is part of Kroger’s sustainability efforts. The brand also launched a direct-to-consumer berry subscription service, enhancing its e-commerce presence. |

Harris Teeter

Harris Teeter operates 262 stores across seven states plus Washington, D.C. Each store features an extensive deli, bakery, and seafood department. The chain’s loyalty program, VIC, offers personalized digital coupons and fuel rewards. Harris Teeter partners with local farmers and artisans to stock regionally sourced produce and specialty cheeses. Its Community Impact program donates unsold but edible food to local shelters, contributing over 10 million meals annually. The chain also pilots curbside pickup and same-day delivery in select markets under the Express Lane banner.

Roundy’s Supermarkets

Roundy’s, acquired in 2015, includes Pick ’n Save (130 stores), Metro Market (25 stores), and Mariano’s Fresh Market (45 stores). Mariano’s is known for its in-store micro-restaurants and chef demonstrations. Roundy’s loyalty program, Plenti (now merged into Kroger’s One), helped integrate digital savings and fuel points. The banners emphasize local sourcing through “Market District” sections, and in 2024, they launched a zero-waste initiative that has diverted over 5,000 tons of packaging from landfills.

Dillons

Dillons serves Kansas, Nebraska, and western Missouri with 190 stores under the Dillons, Baker’s, and Gerbes names. Each location features in-store pharmacies and the Fresh Marketplace concept—expanded produce, sushi bars, and wine shops. Dillons rolled out Kroger’s Scan, Bag, Go handheld device program in 2023, speeding checkout times by 30%. The chain’s “Community Cash” grants over $2 million yearly to local schools and nonprofits, funded by customer round-ups at the register.

Food 4 Less and Foods Co

Food 4 Less (65 stores) and Foods Co (30 stores) operate on a membership-free, low-cost model. Customers bag their own groceries, and stores offer fuel centers with discounted gas tied to receipts. These banners focus on high-volume staples and bulk goods. In 2024, they introduced “Fresh Savings Nights”—late-week markdown events reducing waste and boosting off-peak traffic. The banners also partner with local food banks, donating surplus items within 24 hours.

Home Chef

Home Chef grew to serve over 2 million meals per week as of 2025. Its kits are stocked in 1,800 Kroger pickup locations, blending direct-to-consumer delivery with in-store convenience. Home Chef’s customization platform lets customers swap proteins, adjust portions, or add smoothies. In 2024, it launched a line of oven-ready meal trays under the Home Chef brand exclusively at Kroger stores. This expansion increased private-label meal kit sales by 40%.

Kroger Health

Kroger Health now operates 1,300 pharmacies and 200 primary-care clinics across 35 states. The division generated $10 billion in revenue in 2024, driven by prescription fulfillment, immunizations, and telehealth services. Its “Plume by Kroger” virtual care platform offers chronic disease management and mental health counseling. Kroger Health’s partnerships with Blue Cross Blue Shield plans have expanded in-store clinic access to over 2 million insured members.

Kroger Personal Finance

Kroger Personal Finance manages over 1 million active prepaid Mastercard accounts. Services include fee-free money transfers, bill pay kiosks in 90% of stores, and a branded credit card offering 2% back in fuel rewards. In 2024, the division rolled out a financial literacy app for teens, funded through a grant from the Kroger Zero Hunger | Zero Waste Foundation. Revenues reached $120 million, up 15% year-over-year.

Kroger Technology

Kroger Technology operates innovation centers in Cincinnati and Bellevue, WA, employing 1,500 developers and data scientists. Key initiatives include the enhanced Kroger mobile app (5 million active users), AI-driven demand forecasting that reduced stockouts by 25%, and the expansion of automated fulfillment centers in partnership with Ocado. In 2024, Kroger Technology launched KR Labs, an incubator that funds in-house startups focused on robotics and sustainable packaging.

Kroger Manufacturing

Kroger Manufacturing runs 35 facilities producing bakery, dairy, meat, and snack items for both private-label and national brands. It supplies over 13,000 Our Brands SKUs. In 2024, the division invested $200 million in plant modernization, adding robotics to its poultry processing line, which increased throughput by 20%. It also achieved LEED certification at three plants, lowering water use by 30%.

Kroger Logistics

Kroger Logistics oversees 40 distribution centers, including 12 temperature-controlled sites. It operates a fleet of 3,500 trucks and uses real-time routing software to optimize delivery. In 2024, Kroger Logistics piloted electric delivery vans in California and expanded its last-mile cold chain network, cutting refrigerated product transit times by 15%. The division’s supply-chain control tower monitors inventory flow, reducing spoilage by 18%.

Private Label Brands

Kroger’s Our Brands portfolio exceeds 13,000 SKUs and brought in $30 billion in sales in 2024—20% higher than 2023. Key lines include:

- Private Selection: Over 1,200 premium items, including charcuterie boards and artisanal sauces. Grew 25% in sales after launching chef-curated seasonal collections.

- Simple Truth: Now 4,000 organic and natural products, with a 30% higher growth rate than the category average. New plant-based protein line drove a 50% uplift in Q4.

- Smart Way: Expanded to 1,800 SKUs, focusing on under-$3 essentials. Helped Kroger win “Best Value” in consumer surveys for three consecutive years.

- Mercado: Features 500 Hispanic-inspired items. In 2024, added ready-to-eat tamales and fresh tortillas made in-store. Sales jumped 40% in Texas and California.

- Field & Vine: Sourced from over 200 regional farms. Introduced “Berry Share” subscription in 2024, delivering mixed berries to subscribers monthly, boosting direct-to-consumer revenue by 35%.

Conclusion

So, who owns Kroger?

It’s owned by thousands of shareholders, with large stakes held by investment firms like Vanguard and BlackRock. Rodney McMullen leads the company, which continues to grow through strong financial performance and strategic acquisitions. Kroger’s success lies in its diverse brands, dedicated leadership, and broad customer reach.

FAQs

Who is the parent company of Kroger?

Kroger is an independent company and does not have a parent company. It is a publicly traded company listed on the New York Stock Exchange under the ticker symbol KR.

Who owns most of Kroger?

The largest shareholders of Kroger include institutional investors such as The Vanguard Group and BlackRock, which hold significant stakes in the company. These investment firms manage billions of dollars in assets and control a substantial portion of Kroger’s outstanding shares.

Who is Kroger being bought out by?

As of 2025, there are no confirmed reports of Kroger being bought out. Kroger remains an independent publicly traded company, although it has previously made significant acquisitions, including Harris Teeter, Roundy’s Supermarkets, and Home Chef.

How much is the owner of Kroger worth?

Kroger’s owner, as a publicly traded company, is owned by its shareholders. The net worth of these institutional investors (such as The Vanguard Group, BlackRock) and individuals like Kroger’s CEO, Rodney McMullen, depends on the shares they hold. As of 2025, Kroger’s market capitalization is approximately $350 billion.

Is Kroger bigger than Amazon?

In terms of revenue, Amazon surpasses Kroger. Amazon had a revenue of approximately $510 billion in 2024, while Kroger’s revenue was around $137 billion in the same year. However, Kroger is the largest supermarket chain in the U.S., while Amazon operates across a much broader range of industries.

How many CEOs has Kroger had?

Kroger has had 11 CEOs since its founding in 1883. The current CEO is Rodney McMullen, who has been with the company since 1978 and became CEO in 2014.

Who is bigger, Kroger or Albertsons?

Kroger is the larger of the two, both in terms of revenue and store count. As of 2025, Kroger operates over 2,700 stores and generated approximately $137 billion in revenue in 2024, whereas Albertsons operates around 2,200 stores and reported about $74 billion in revenue.

Is Kroger owned by Walmart?

No, Kroger is not owned by Walmart. Kroger is an independent company, whereas Walmart is its own multinational corporation, primarily focused on large-scale retail and discount stores.

What brands are owned by Kroger?

Kroger owns several brands, including Harris Teeter, Roundy’s Supermarkets, Dillons, Home Chef, and its private-label lines such as Simple Truth, Private Selection, and Smart Way. These brands span a range of products, from meal kits to fresh produce and organic foods.

Does Kroger own Albertsons?

No, Kroger does not own Albertsons. The two are separate companies. However, there have been discussions about mergers or acquisitions between the two in the past, but as of 2025, Kroger and Albertsons remain independent.

Is Kroger Jewish?

No, Kroger is not a Jewish-owned company. It was founded by Bernard Kroger in 1883 in Cincinnati, Ohio, and is currently a publicly traded company owned by its shareholders.

Who founded Kroger?

Kroger was founded by Bernard Kroger in 1883. He opened the first Kroger store in Cincinnati, Ohio, with a commitment to providing customers with high-quality food at lower prices.

Is Vons owned by Kroger?

No, Vons is not owned by Kroger. Vons is a supermarket chain that is owned by Albertsons Companies, Inc. It operates primarily in Southern California and Nevada.

Is Kroger a private company?

No, Kroger is not a private company. It is a publicly traded corporation listed on the New York Stock Exchange under the ticker symbol KR.

Is Albertsons owned by Kroger?

No, Albertsons is not owned by Kroger. While there were discussions about a potential merger between Kroger and Albertsons, the two companies remain separate as of 2025.

What type of company is Kroger?

Kroger is a publicly traded retail company specializing in grocery stores and supermarkets. It operates under several different regional brands across the U.S.

Is Kroger privately owned?

No, Kroger is not privately owned. It is a public company listed on the NYSE and owned by institutional and retail shareholders.

Does Kroger own other grocery stores?

Yes, Kroger owns several grocery chains like Ralphs, Harris Teeter, King Soopers, and Fred Meyer.

Where is Kroger headquartered?

Kroger is headquartered in Cincinnati, Ohio.