Who owns Kraft Heinz is a question tied to one of the most recognized food companies in the world. The Kraft Heinz Company is behind everyday products found in kitchens across the globe. From ketchup bottles to cheese slices, it has built a legacy of trusted brands.

The company’s ownership story is just as fascinating as its products. It involves legendary investors, powerful institutions, and a public market presence. Knowing who owns Kraft Heinz helps explain its strategies, decisions, and global reach.

Kraft Heinz Company Profile

The Kraft Heinz Company is an American multinational. It was formed in 2015 through the merger of Kraft Foods Group and H. J. Heinz Company. The firm is co-headquartered in Chicago and Pittsburgh. It ranks as the third-largest food and beverage company in North America and the fifth-largest globally. In 2023, it generated about $27 billion in net sales.

Founders

The roots of the business stretch back to the 19th and early 20th centuries. Henry J. Heinz founded The H. J. Heinz Company in 1869, gaining fame with Heinz Tomato Ketchup and innovative canning methods.

James L. Kraft began his business in 1903, selling cheese door-to-door in Chicago. He later patented processed cheese, which extended shelf life and propelled growth.

Major Milestones

Over the decades, both companies grew through innovation and expansion. Kraft introduced processed cheese and broadened its product range. Heinz expanded globally and diversified into baby food and other ready-to-eat meals.

Key milestones for Kraft Heinz include:

- 2015 merger: Kraft Foods Group and H. J. Heinz merged under the aegis of 3G Capital and Berkshire Hathaway, forming one of North America’s largest food companies.

- 2017: The company made a bold, but ultimately withdrawn, $143 billion bid for Unilever, showing ambitious growth plans.

- 2019: A $15 billion write-down of legacy brands like Kraft and Oscar Mayer marked a wake-up call amid shifting consumer tastes.

- 2020–2021: Leadership changed with Miguel Patricio becoming CEO. Divestitures like the sale of the Planters nuts portfolio followed strategic refocusing.

- 2022: Kraft Heinz exited the Russian market amid geopolitical shifts.

- 2023 onward: Focus shifted to operational efficiency and cost optimization.

- 2025 developments: Consideration of a major $20 billion spin-off of Kraft grocery brands surfaced to streamline business around higher-performing condiments and sauces.

Who Owns Kraft Heinz: Largest Shareholders

The Kraft Heinz Company emerged in 2015 from the high-profile merger of Kraft Foods Group and H.J. Heinz Company. This alliance, backed by Berkshire Hathaway and 3G Capital, created the fifth-largest food and beverage company in the world, with revenues nearing $28 billion.

At that time, Heinz shareholders received 51 percent of the new company, Kraft shareholders received 49 percent, and Berkshire and 3G provided a combined $10 billion in fresh investment.

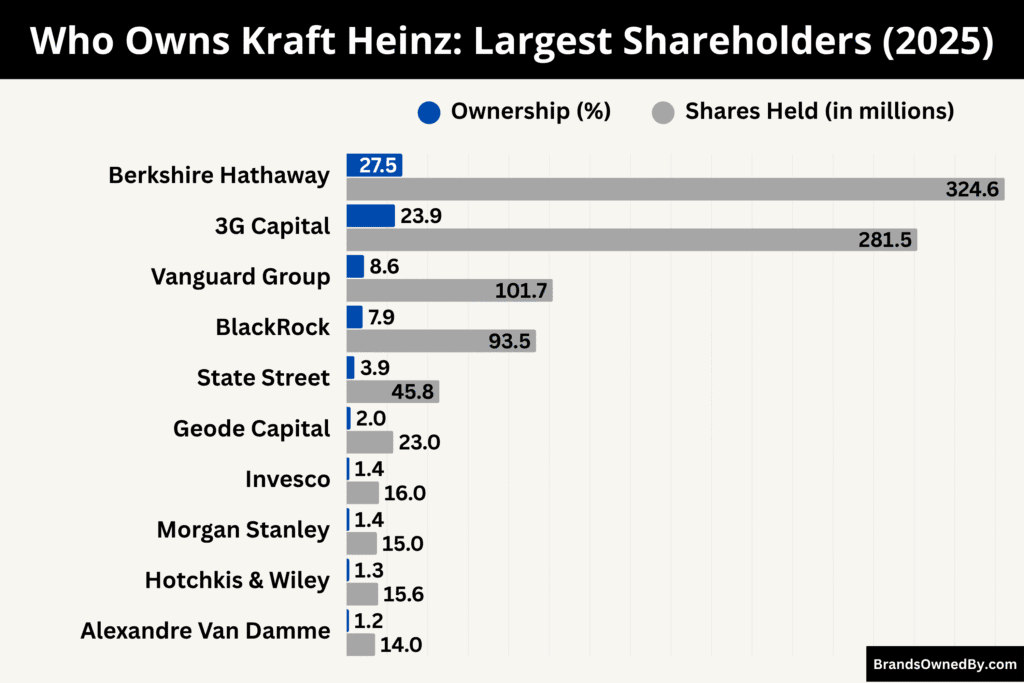

As of August 2025, ownership remains concentrated with a small group of dominant investors. Berkshire Hathaway stands as the largest shareholder, followed by 3G Capital. Vanguard, BlackRock, State Street, and a cadre of institutional investors make up the balance, while insider ownership is minimal.

Below is a detailed breakdown of key shareholders and their role in shaping the company’s trajectory:

Berkshire Hathaway

Berkshire Hathaway holds approximately 27.5 percent of Kraft Heinz shares—rightfully the largest individual holding. This equates to over 325 million shares, valued at roughly $10 billion at current market levels.

Recently, Berkshire took a significant $3.8 billion impairment on this stake, highlighting challenges in maintaining long-term value in shifting consumer markets.

In 2025, the firm removed its two board seats from Kraft Heinz, in line with its policy not to hold board positions in non-controlling investments.

While désormais lacking direct governance power, Berkshire’s sheer ownership still commands a powerful economic influence, making it a pivotal figure in any strategic decision or potential divestiture.

3G Global Food Holdings

3G Global Food Holdings controls around 23.9 percent of Kraft Heinz shares (282 million shares), making it the second-largest stakeholder.

As the architect behind the merger, 3G instituted cost-control strategies and zero-based budgeting, reshaping company operations. Although it no longer holds board positions, its substantial equity stake ensures that its legacy mindset—lean operations and efficiency—continues to influence corporate culture and long-term planning. This indirect influence remains critical during the current strategic review process.

Vanguard Group

Vanguard holds roughly 8.6 percent (around 102 million shares) of Kraft Heinz. As a passive but weighty institutional investor, Vanguard exerts significant sway through proxy voting and governance oversight. Its investment philosophy emphasizes long-term value and prudent corporate stewardship, often nudging management toward shareholder-focused objectives, such as strategic restructuring or share repurchases during downturns.

BlackRock, Inc.

BlackRock owns about 7.9 percent (roughly 94 million shares) of the company. Its influence stems not from overt activism but from voting power and governance practices. BlackRock’s approach typically leans toward advocating for transparency, board accountability, and sustainable returns. It plays a silent but significant role during pivotal corporate decisions—such as evaluations of mergers, asset sales, or structural changes.

State Street Global Advisors

State Street holds 3.9 percent (around 46 million shares). Despite being less dominant than Vanguard or BlackRock, its stature as a major institutional investor means its views on executive compensation, strategic direction, and shareholder returns still carry considerable weight.

Geode Capital Management

Geode Capital Management is a Boston-based investment firm that primarily manages index funds and serves as a sub-advisor for Fidelity Investments. With around 23 million shares representing nearly 2% ownership, Geode’s position gives it significant sway in shareholder votes and long-term governance matters.

Although not known for activist strategies, Geode’s large index-based holdings mean it prioritizes stable returns, corporate governance best practices, and sustainable business growth, often aligning its votes with institutional guidelines on ESG, risk oversight, and capital allocation.

Invesco Ltd.

Invesco Ltd., a global investment management firm headquartered in Atlanta, holds about 16 million shares, translating to roughly 1.39% ownership. This stake positions Invesco as an influential but steady shareholder, typically focused on portfolio diversification and value retention rather than aggressive intervention. Invesco’s investment committees often evaluate companies based on long-term cash flow potential and capital efficiency, meaning its continued ownership is a signal of institutional confidence in the company’s business fundamentals.

Morgan Stanley

Morgan Stanley, one of the world’s leading financial services firms, maintains an almost identical stake to Invesco, with approximately 15 million shares. While Morgan Stanley’s investment arm is more active in providing market analysis and influencing investor sentiment, it generally supports management when corporate performance aligns with market expectations. However, its research division and strategic advisory capabilities make it an important voice in shaping investor narratives around the company.

Hotchkis & Wiley Capital Management

Hotchkis & Wiley Capital Management, based in Los Angeles, is known for its value-investing approach, targeting companies trading below intrinsic value with strong fundamentals. Holding about 1.32% of shares, this firm’s investment signals a belief that the company has long-term growth potential, perhaps trading below its market worth. Its portfolio managers are known for advocating efficient capital use, shareholder-friendly policies, and disciplined strategic expansion.

Damme Alexandre Van

Alexandre Van Damme is a Belgian billionaire businessman and a key figure linked to the Anheuser-Busch InBev founding families. Holding about 14 million shares, his stake is unique because it blends personal wealth management with a long-standing legacy of influence in global business circles. Van Damme’s personal and professional network often grants him behind-the-scenes influence, making his support or opposition to strategic moves noteworthy for the company’s leadership.

Insider Ownership

Kraft Heinz insiders—including executives, board members, and founding affiliates like 3G—collectively hold around 26.1 percent of shares.

However, much of this overlaps with the 3G stake, meaning top-level executives have limited additional equity. The practical implication is that actual control lies more with institutional ownership than with internal management.

Institutional vs. Insider Balance

Institutional investors collectively own approximately 81.9 percent of Kraft Heinz stock, while insiders hold about 26.1 percent. The overlap underscores that while executives may have insider stakes, it’s the external institutions—particularly Berkshire, 3G, Vanguard, BlackRock, and State Street—who wield real strategic influence and drive corporate governance

Who is the CEO of Kraft Heinz?

Carlos Abrams-Rivera became Chief Executive Officer in January 2024 after leading North American operations. He joined the Kraft Heinz board at the same time, marking a smooth leadership transition.

Abrams-Rivera brings decades of CPG experience. He worked at Mondelēz International and Campbell before returning to Kraft Heinz in early 2020. His background spans brand-building, emerging markets, and strategic growth. He holds a BS in Economics from Carnegie Mellon and an MBA from Michigan Ross.

Since taking the helm, he has emphasized innovation and efficiency. He introduced “Agile@Scale” pods, AI tools in manufacturing, and the Heinz Remix machine to streamline operations and boost cost savings across plants.

Driving Innovation

Abrams-Rivera shifted the company’s approach to focus on lasting innovation rather than short-term gimmicks. He steered the launch of impactful new products like Heinz Pickle Ketchup and introduced improved Oscar Mayer packaging that cuts plastic by 30% while maintaining quality.

He also outlined three “Accelerate” platforms for growth: taste elevation, easy-ready meals, and substantial snacking—with examples like Lunchables Spicy Nachos and Super Mario–themed Mac & Cheese shapes.

Strategy and Shareholder Value

Facing market pressure and declining sales, Abrams-Rivera declared that Kraft Heinz is evaluating strategic options, including a potential $20 billion spin-off of its grocery division to unlock value.

In Q2 2025, the company took a $9.3 billion impairment, resulting in a net loss of $7.82 billion. Abrams-Rivera cited resilience in core earnings and reaffirmed adjusted earnings guidance amid extreme headwinds.

He also highlighted ongoing strategic review discussions aimed at breaking up the company into focused segments—such as dividing condiments from grocery brands—to improve performance and recapture investor confidence.

A Health-Conscious Executive in a Processed-Food World

Interestingly, Abrams-Rivera follows a very healthy lifestyle—Mediterranean diet, regular intermittent fasting, and daily exercise. He acknowledges the irony of leading a processed-food empire but uses it to drive healthier product innovation within the company.

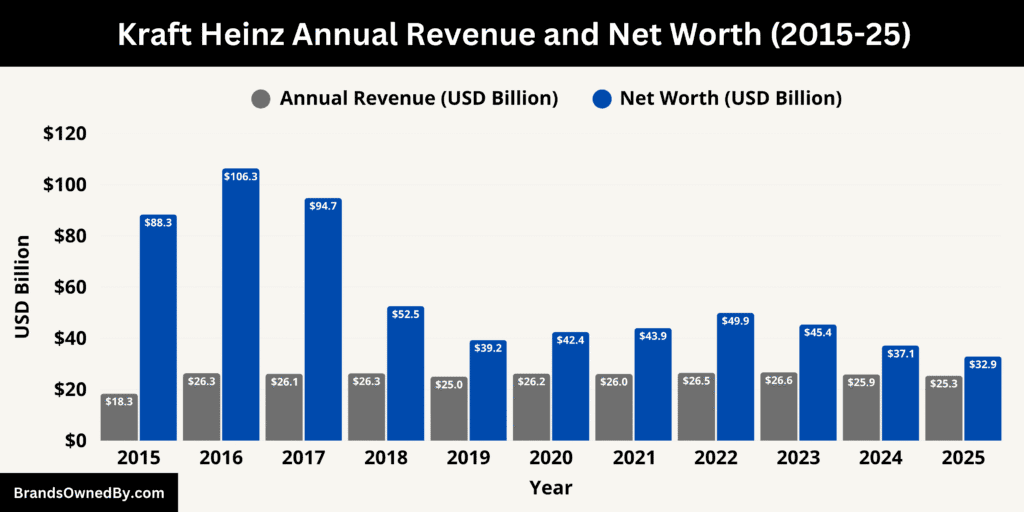

Kraft Heinz Annual Revenue and Net Worth

Kraft Heinz finished the full year 2024 with net sales of approximately $25.85 billion, reflecting a nearly 3 percent drop from 2023. This decline was driven by softness in demand and challenging consumer trends.

As of mid-2025, the trailing twelve-month revenue stands around $25.31 billion, down roughly 3.8 percent year-over-year. The most recent quarter (Q2 2025) generated about $6.35 billion in sales, a small decline of under 2 percent. These figures point to persistent headwinds and a gradual contraction in top-line performance.

Q2 2025 Performance Highlights

In Q2 2025, Kraft Heinz’s net sales came in at $6.35 billion, down around 1.9 percent. Organic sales declined slightly more, at 2 percent, showing pressure across key product categories like cold cuts and coffee.

Despite this, operational efficiency improved. The company reported strong free cash flow of $1.5 billion, up 28 percent year-to-date, and returned $1.4 billion in capital to shareholders.

Kraft Heinz Net Worth

As of August 8, 2025, Kraft Heinz’s market capitalization is approximately $32.86 billion—a nearly 23% decline year-over-year. This figure represents the total market value of all its outstanding shares and reflects how investors currently value the company.

Over the past 52 weeks, the average market cap has stood near $36.7 billion, with the lowest point around $30.3 billion. These fluctuations underscore the impact of market sentiment, broader economic shifts, and internal performance on investor valuation.

In mid-June 2025, the market cap slipped to about $30.5 billion, reflecting ongoing investor caution in light of slowing sales and strategic uncertainty. Since then, the valuation has rebounded modestly, pushing it back above $32 billion.

A decade ago, in 2015, Kraft Heinz was valued at roughly $95.6 billion. Over time, the company has lost around two-thirds of its peak value, amounting to an annualized decline of roughly 10%.

A Snapshot of the Financial Picture

Kraft Heinz remains a large player in the global food sector, but its shrinking revenue and impairment charges highlight ongoing challenges. Still, its strong free cash flow and ability to return capital suggest disciplined operations.

Meanwhile, its market value near $33 billion indicates that, while diminished from its peak, it retains considerable investor attention—especially as the company explores strategic options like spin-offs or recalibrated growth strategies.

Companies Owned by Kraft Heinz

As of August 2025, Kraft Heinz’s operating portfolio contains a mix of powerhouse staples and growth-oriented, acquired brands. The company is actively evaluating portfolio choices—potentially spinning off slower-growing Kraft grocery assets while retaining and accelerating Heinz and higher-margin condiments.

Manufacturing investments and targeted innovation (health-forward, reduced-ingredient formulations, and sustainability improvements) reflect the company’s plan to stabilize revenue, improve margins, and respond to investor pressure.

Below is a list of the companies and brands owned by Kraft Heinz as of 2025:

Heinz

Heinz is the company’s flagship condiment and sauce business. It is best known for Heinz Tomato Ketchup, a global market leader that anchors the condiments portfolio. The Heinz business also includes mustards, vinegars, barbecue sauces, and ready-to-use cooking sauces that sell across retail, foodservice, and international markets.

In 2025, Heinz remains the highest-margin, fastest-growing part of the company in many regions. Management has leaned on Heinz to drive premiumization, launching new limited-edition flavors and smaller-pack “on-the-go” SKUs. Heinz is central to the corporate strategy being considered in 2025, where condiments and sauces are the core assets that could remain in a focused “Heinz” parent if a split occurs.

Kraft

Kraft refers to a family of grocery staples that includes Kraft Mac & Cheese, Kraft Singles, Kraft Mayo, and dressings. These products are deeply embedded in North American pantry culture and represent stable, high-volume sales. Under the Kraft banner, there are legacy SKUs that enjoy strong brand recognition but face margin pressure from private-label competition.

By 2025, Kraft grocery lines are the ones most often named as candidates for a potential spin-off. Management and investors view the Kraft portfolio as “balanced” but slower-growing, and the company has signaled it may separate these grocery assets to allow both the Heinz condiment business and the Kraft grocery business to pursue different growth paths.

Oscar Mayer

Oscar Mayer is Kraft Heinz’s meat and cold-cuts brand with a long U.S. heritage. The business covers lunch meats, hot dogs, processed meats, and refrigerated protein snacks. Oscar Mayer has been a steady cash generator but faces margin and volume pressure from deli counters and private label.

In recent years, Kraft Heinz invested in packaging upgrades and smaller-format innovation to defend Oscar Mayer’s shelf presence. The brand’s fate is a bellwether for the company’s North America refrigerated portfolio and figures prominently in discussions about reorganizing the business to better isolate grocery versus condiment performance.

Philadelphia

Philadelphia is Kraft Heinz’s flagship cream cheese and spread business. It supplies cream cheese for both retail and foodservice customers and has cultivated premium line extensions such as whipped, flavored, and plant-based alternatives. Philadelphia often serves as a higher-margin dairy anchor within Kraft Heinz’s U.S. dairy offerings.

By 2025, Philadelphia continues to be positioned for incremental innovation around convenience and health—reformulations that reduce saturated fat, new culinary collaborations, and ready-to-spread formats that target on-the-go consumers.

Maxwell House and Gevalia

Maxwell House and Gevalia form the backbone of Kraft Heinz’s branded coffee business. Maxwell House sits as a traditional, broad-market roast with deep penetration in grocery and foodservice. Gevalia is positioned as a premium, specialty-oriented coffee brand in select markets.

In 2025, the company focuses on managing pricing and shelf mix in coffee amid commodity swings. Maxwell House remains a volume play that drives consistent revenue, while Gevalia is used to capture higher margins and test premium coffee innovations, single-serve formats, and retail partnerships.

Velveeta

Velveeta is a processed cheese brand used heavily in prepared meals, boxed kits, and snacking applications. Its key value derives from convenience and iconic recipes that lean into comfort food trends. Velveeta is marketed for melting performance and shelf stability, making it a staple in both home cooking and quick-serve concepts.

In 2025, the company has pushed Velveeta into cross-category innovation—mac & cheese hybrids, microwaveable single-serve cups, and limited-time co-branded items aimed at younger consumers seeking indulgent convenience.

Jell-O and Gel Desserts

Jell-O is Kraft Heinz’s long-standing gelatin dessert brand and includes puddings and desserts in powdered and ready-to-eat formats. The brand has nostalgic appeal and a stable base among families and institutional buyers.

Kraft Heinz continues to rely on Jell-O in seasonal promotions and school-focused marketing.

Facing changing consumer preferences, the company has nudged the Jell-O line toward cleaner labels and reduced sugar options. In 2025, Jell-O acts as a midline performer in the portfolio that funds innovation elsewhere.

Kool-Aid and Beverage Mixes

Kool-Aid is Kraft Heinz’s flavored drink mix brand with a strong affinity among value-seeking consumers and families. It occupies an important price-sensitive niche and benefits from low production costs and a long shelf life. Kool-Aid, Crystal Light, and MiO are grouped across beverage mixes to cover mass, low-calorie, and liquid concentrate segments.

In 2025, management pushes Kool-Aid toward limited-edition flavors and co-branding activations to keep youth appeal, while Crystal Light and MiO are leveraged for low-calorie and portion-control trends.

Grey Poupon and Premium Condiments

Grey Poupon is Kraft Heinz’s premium mustard and upscale condiment offering. It targets consumers looking for gourmet and deli-style flavors and is sold in smaller, higher-margin formats. Grey Poupon plays an important strategic role because it enables premium price points within the condiments category.

In 2025, the brand is used in targeted premiumization strategies—limited regional variants, culinary partnerships, and foodservice agreements—helping lift average category margins.

Primal Kitchen

Primal Kitchen is a natural and better-for-you brand that Kraft Heinz acquired to expand into fast-growing, health-oriented condiments and dressings. It offers avocado oil-based dressings, mayonnaise alternatives, and clean-label sauces that appeal to health-forward consumers. Primal Kitchen operates semi-autonomously and is a key part of Kraft Heinz’s “innovation-first” playbook.

By 2025, Primal Kitchen is a strategic growth vehicle that lets Kraft Heinz test higher-growth, premiumized, and natural product formats without disrupting legacy brand equity. The brand helps the company engage consumers who otherwise avoid conventional processed brands.

Just Spices and Regional Seasonings

Just Spices is a European seasoning business where Kraft Heinz holds a majority stake; it expands the company’s reach into seasoning blends and meal-prep categories popular in Europe. The company uses Just Spices to capture home-cook trends and the premiumization of pantry items.

In 2025, Just Spices remains an example of Kraft Heinz’s efforts to broaden its international specialty portfolio through bolt-on acquisitions and to scale small brands with strong digital followings.

Lunchables and Kids’ Convenience Meals

Lunchables is a CPR (convenience prepared) brand targeted to families and school-aged children. It blends portability, convenience, and brand play—offering ready-to-eat combinations with strong licensing tie-ins and limited-edition releases. The brand drives weekday snack and lunch occasions and has a loyal base.

Lunchables faces scrutiny over nutrition trends in 2025, but remains a reliable revenue contributor in the snacking and convenience segment. The company has reformulated certain SKUs to improve nutritional profiles to meet evolving school and parental preferences.

Ore-Ida and Frozen Sides

Ore-Ida anchors Kraft Heinz’s frozen potato and sides business. Products such as tater tots, hash browns, and frozen potato specialties are central to the frozen aisle, where Ore-Ida competes on convenience and consistent quality.

It is a key brand for capturing quick-prep meal occasions and for co-marketing with protein brands; Kraft Heinz emphasizes supply chain investments to secure potato supply and optimize frozen distribution.

Classico and Cooking Sauces / Pasta Sauces

Classico represents Kraft Heinz’s pasta and cooking-sauce range. It captures both everyday cooking occasions and premium tastes with regional flavor variants. Classico is an important part of the company’s center-of-plate sauce strategy.

Through 2025, Classico continues to receive modest innovation dollars for flavor extensions and packaging sustainability improvements. It helps the company maintain a presence in the Italian-style cooking category.

Claussen and Pickles

Claussen is a refrigerated pickle brand that sits in the premium, crisp-pickle subcategory. It benefits from fresh refrigeration positioning and an upscale image relative to shelf-stable rivals. Claussen’s shelf differentiation helps Kraft Heinz cover both shelf-stable and refrigerated condiment markets.

It remains a small but meaningful contributor to category mix, used to defend share in deli and sandwich occasions.

A.1., Lea & Perrins and Other Sauces

A.1. steak sauce and Lea & Perrins Worcestershire are examples of Kraft Heinz’s savory and cooking-sauce portfolio beyond ketchup. These brands serve food-prep and finishing-sauce roles, and they target flavor-savvy consumers.

These sauces are steady performers, often bundled into value packs or promotional sets to drive trial and shelf penetration.

Convenience Niche Brands

Brands such as Boca (meat alternatives), Smart Ones (portion-controlled frozen meals), and Bagel Bites serve niche but strategic roles—covering plant-based, portion control, and snackable frozen meal categories. These brands allow Kraft Heinz to play in diversified meal occasions and to test new product ideas with limited risk.

In 2025, these smaller brands are managed through targeted marketing and channel strategies—digital-first launches and retailer promotions—to extract incremental growth without high overhead.

Specialty and International Brands

Kraft Heinz operates many region-specific brands—Hemmer and Quero in Latin America, Wattie’s in New Zealand, Greenseas and Golden Circle in parts of Asia-Pacific, and other local condiments and canned seafood brands. These businesses are critical to Kraft Heinz’s international footprint and often outperform in their local markets where they are household names.

The company emphasizes tailoring product formulations, packaging sizes, and price points to local consumer needs while using global scale to improve procurement and manufacturing efficiency across these regional brands.

Final Thoughts

Understanding who owns Kraft Heinz is more than a financial fact. It reveals the balance of influence that shapes the company’s direction. Berkshire Hathaway’s large stake keeps a long-term, value-driven investor in the picture. Institutional investors add stability and voting power.

Public ownership opens the door to market forces and shareholder voices. Combined, these elements create a company that must balance tradition with innovation. The Kraft Heinz Company remains a major force in global food, and its ownership will continue to play a key role in its future.

FAQs

Who owns Kraft Heinz company?

The Kraft Heinz Company is publicly traded and owned by a mix of institutional and individual shareholders. The largest shareholders include Berkshire Hathaway and 3G Capital, which together hold a significant portion of the company’s shares and exert substantial influence.

Who founded Kraft Heinz?

Kraft Heinz’s origins trace back to two separate companies: Kraft Foods was founded by James L. Kraft in 1903, and Heinz was founded by Henry J. Heinz in 1869. The current company was formed in 2015 through the merger of Kraft Foods Group and H.J. Heinz Company.

Does the Heinz family still own the company?

No, the Heinz family no longer owns the company. Ownership and control have shifted primarily to institutional investors and large stakeholders like Berkshire Hathaway and 3G Capital.

Do the Heinz family still own Heinz?

No, the Heinz family no longer owns Heinz. The brand is now part of the Kraft Heinz Company, which is controlled by its major shareholders rather than the founding family.

Who is the owner of Kraft?

Kraft is owned by The Kraft Heinz Company, a publicly traded corporation with no single owner. Its ownership is shared among many shareholders, including institutional investors.

Does Warren Buffett own Heinz?

Warren Buffett’s investment company, Berkshire Hathaway, owns a substantial stake in Kraft Heinz, including Heinz. Berkshire Hathaway is one of the largest shareholders and a key influencer in company decisions.

Who originally owned Kraft?

Kraft Foods was originally owned by its founder James L. Kraft and his family before becoming a publicly traded company. Over time, ownership has passed to institutional shareholders and investors.

Does Philip Morris own Kraft?

No, Philip Morris does not own Kraft. However, Kraft Foods was once part of Philip Morris Companies after several acquisitions, but it became an independent entity before merging with Heinz in 2015.

Who is the original owner of Heinz?

Heinz was originally founded and owned by Henry J. Heinz in 1869. The company grew as a family-owned business before transitioning to public ownership.

When did Nestlé buy Kraft?

Nestlé has never bought Kraft. Kraft Heinz remains an independent publicly traded company. However, Nestlé owns some related brands, but it has no ownership stake in Kraft Heinz.

Who is the majority shareholder of Heinz?

There is no single majority shareholder of Heinz. The largest shareholders of Kraft Heinz overall are Berkshire Hathaway and 3G Capital, who collectively hold a controlling interest in the company.

Which are major Kraft Heinz owned brands?

Major brands owned by Kraft Heinz include Heinz, Kraft, Oscar Mayer, Philadelphia, Maxwell House, Velveeta, Jell-O, Kool-Aid, Grey Poupon, Primal Kitchen, Lunchables, Ore-Ida, and many more.

Who owns Kraft company?

Kraft company is owned by The Kraft Heinz Company, a publicly traded firm with ownership distributed among institutional investors and shareholders.

What companies does Kraft own?

Kraft Heinz owns and operates numerous brands primarily in food and beverages, including Heinz, Kraft grocery products, Oscar Mayer, Philadelphia, Maxwell House, Velveeta, Jell-O, and others.

Why did Kraft and Heinz merge?

Kraft and Heinz merged in 2015 to combine their complementary food portfolios, achieve cost synergies, expand global reach, and strengthen their market position in the competitive packaged foods industry.

Who are the top shareholders of Kraft Heinz?

The top shareholders of Kraft Heinz are Berkshire Hathaway, 3G Capital, The Vanguard Group, BlackRock, State Street Corporation, and other institutional investors who collectively own the majority of shares.