Kodak is one of the most iconic names in photography and imaging. Known for its rich history in film and cameras, Kodak has transformed over the decades into a technology company focused on imaging, printing, and software solutions. Many people ask who owns Kodak today, especially after its major financial struggles and restructuring.

Kodak Company Profile

Eastman Kodak Company—commonly known as Kodak—is an American multinational technology company headquartered in Rochester, New York. It is publicly traded on the New York Stock Exchange under the ticker KODK.

Founded in the late 19th century, Kodak has long been recognized as a pioneer in photography and imaging. While its early fame came from cameras and film, the company has since transformed into a provider of technology-driven solutions. Today, Kodak’s core businesses include commercial printing systems, advanced materials and chemicals, motion picture film, and brand licensing.

The company maintains a global presence, with operations and customers across North America, Europe, Asia, and Latin America. Kodak continues to play a key role in industries ranging from publishing and packaging to entertainment and pharmaceuticals, while keeping its historic brand identity alive through select imaging and film products.

Kodak Founders

Kodak traces its origins to the late 19th century. The company began with George Eastman’s invention of a dry-plate coating machine in 1879. In 1881, Eastman and local businessman Henry A. Strong formed the Eastman Dry Plate Company, later becoming Eastman Kodak Company in 1892.

Eastman’s vision was simple: make photography as easy and accessible as using a pencil. This philosophy gave rise to the iconic slogan “You Press the Button, We Do the Rest”—a hallmark of Kodak’s innovation and mass appeal.

Major Milestones

- 1885–1888: Eastman patented the flexible film roll and launched the first Kodak camera in 1888, preloaded with film—ushering in modern photography.

- 1900: Introduction of the Brownie camera, an inexpensive box camera that revolutionized amateur photography.

- 1935: Kodachrome film debuted—a groundbreaking color film that became beloved by professionals and hobbyists alike.

- 1950s–60s: Kodak fueled the color revolution in publishing and imaging, further solidifying its leadership.

- 1975–1978: Kodak invented the first digital camera, and its engineers laid the foundations for electronic imaging technology.

- 1970s: At its commercial peak, Kodak controlled around 90 % of film sales and 85 % of camera sales in the U.S.

- 2000: Kodak posted one of its best years—roughly $14 billion in revenue and $1.4 billion in net income.

- 2012: Kodak filed for Chapter 11 bankruptcy due to mounting debt and a decline in film demand.

- 2013: Emerged from bankruptcy and refocused on B2B—commercial printing, advanced materials, and software solutions.

- 2020: Expanded into pharmaceutical manufacturing, producing active ingredients under a government-backed initiative.

- 2025: Faces renewed financial challenges, with warnings about debt obligations, potential pension freezes, and $500 million in near-term debt raising survival concerns.

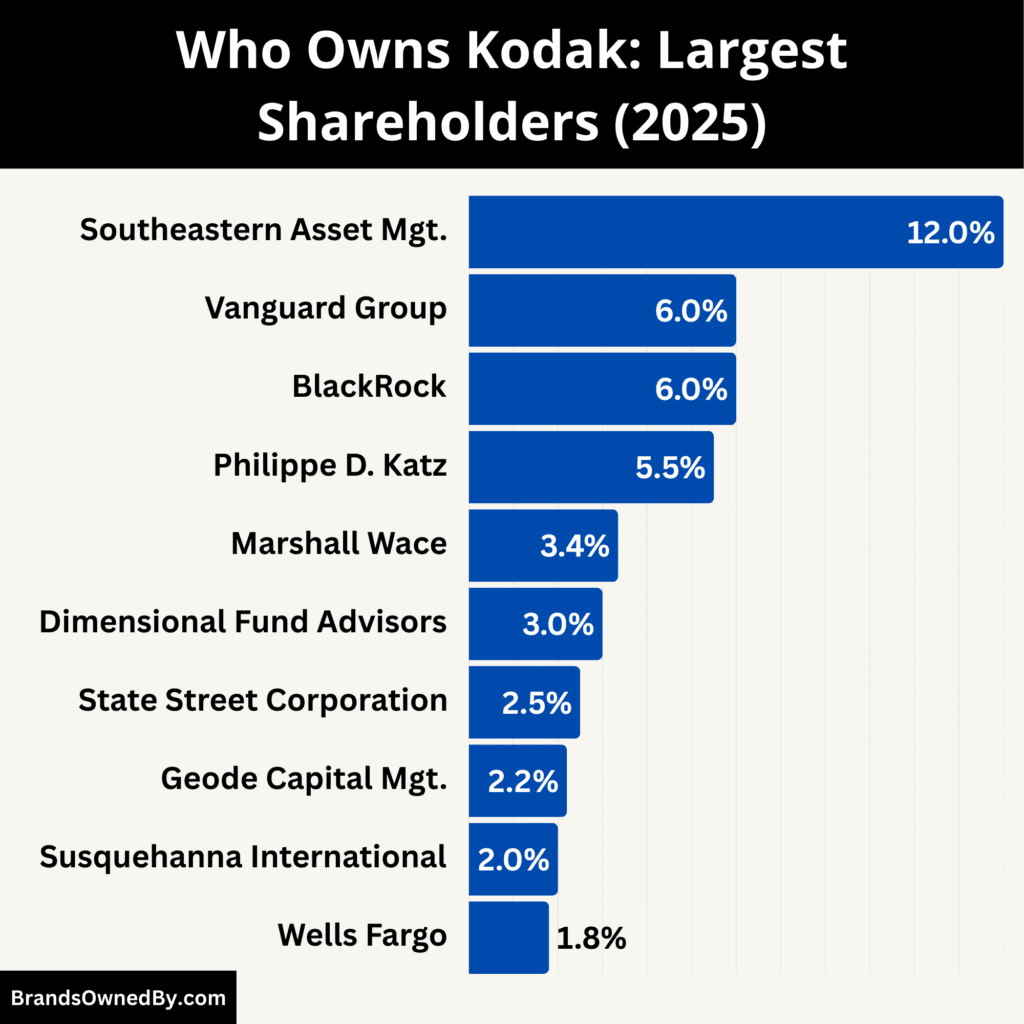

Who Owns Kodak: Top Shareholders

Kodak is a publicly traded company listed on the New York Stock Exchange under the ticker symbol KODK. Unlike privately held firms, Kodak does not have a single owner. Instead, it is owned by a mix of institutional investors, mutual funds, and individual shareholders. The largest shareholders are institutional investors who hold significant stakes and influence over the company’s direction.

Here’s a list of the top shareholders of Kodak as of August 2025:

| Shareholder | Ownership % | Type of Investor | Role & Influence |

|---|---|---|---|

| Southeastern Asset Management | ~12 % | Institutional (Asset Mgmt) | Largest single shareholder; significant influence on long-term planning and policies. |

| Vanguard Group, Inc. | ~6 % | Institutional (Index Fund) | Provides stable, long-term investment; supports broad governance practices. |

| BlackRock, Inc. | ~6 % | Institutional (Asset Mgmt) | Major global investor; pushes for efficiency, cost control, and responsible capital use. |

| Philippe D. Katz | ~5.5 % | Individual Investor | Largest individual shareholder; visible in governance discussions but not controlling. |

| Dimensional Fund Advisors LP | ~3 % | Institutional (Quant/Index) | Focuses on systematic, evidence-based investing; supports steady value creation. |

| Marshall Wace LLP | ~3.35 % | Institutional (Hedge Fund) | Actively monitors company performance; potential to influence board-level decisions. |

| State Street Corporation | ~2.5 % | Institutional (Asset Mgmt) | Steady institutional presence; emphasizes prudent governance. |

| Geode Capital Management, LLC | ~2.2 % | Institutional (Quant) | Quant-driven investor; generally supports consensus-driven decisions. |

| Susquehanna International Group | ~2 % | Institutional (Trading) | Active trading and market-making firm; influence tied to market positioning. |

| Wells Fargo & Company | ~1.8 % | Institutional (Bank/Finance) | Traditional financial institution; stable but modest influence. |

| Insiders (Executives & Board) | ~23 % | Insider Ownership | Strong alignment with shareholders; ensures leadership has a direct stake in success. |

Vanguard Group, Inc. (~6 %)

Vanguard commands one of the largest institutional positions in Kodak, owning around 6 % of shares. This level of ownership suggests a strong alignment of the firm’s long-term investment goals with Kodak’s strategic initiatives. As a major index fund manager, Vanguard’s involvement offers a stable and silent influence—favoring company-wide decisions that benefit diversified shareholders.

BlackRock, Inc. (~6 %)

BlackRock holds a similarly significant stake of approximately 6 % of Kodak’s stock. With its vast resources and global reputation, BlackRock brings considerable weight to governance decisions. It typically steers companies toward operational efficiency, cost discipline, and responsible capital allocation—principles that can support Kodak’s continued evolution.

Marshall Wace LLP (~3.35 %)

At close to 3.35 %, Marshall Wace maintains a notable investment in Kodak. As an active hedge fund manager, its stake implies alertness to Kodak’s performance trends and responsiveness to corporate strategy shifts. While not a controlling force, its position is large enough to voice opinions and potentially influence board-level considerations.

Southeastern Asset Management (~12 %)

Remarkably, Southeastern Asset Management is listed by some reports as holding an exceptionally large stake—around 12 %. This elevated ownership level marks it as arguably Kodak’s single most influential shareholder. Southeastern’s position likely affords considerable voice on policy, long-term planning, and structural decisions, though without majority control.

Dimensional Fund Advisors LP (~3 %)

Dimensional Fund Advisors controls about 3 %, extending Kodak’s institutional ownership base. Often committed to systematic, evidence-based investment, Dimensional’s stake signals confidence in Kodak’s fundamentals. Its posture tends to favor steady progress rather than aggressive corporate pivots.

State Street Corporation (~2.5 %)

State Street holds approximately 2.5 % of shares in Kodak. As another fund giant, its interests usually align with prudent governance and shareholder returns. While not a major disruptor, its participation rounds out the company’s institutional investor ecosystem.

Geode Capital Management (~2.2 %)

With roughly 2.2 % ownership, Geode adds to the diversity of Kodak’s institutional shareholders. Known for quantitative strategies and index-based investments, Geode would likely support consensus-driven governance and long-term value creation.

Susquehanna International Group (~2 %)

Susquehanna holds about 2 % of Kodak’s stock. As an active trading and market-making firm, its presence suggests a readiness to influence corporate momentum based on emerging trends, though it is not a control-level stakeholder.

Wells Fargo & Company (~1.8 %)

At nearly 1.8 %, Wells Fargo maintains a modest but meaningful slice of Kodak shares. Representing more traditional financial services interests, its position is steady and typically focused on preserving institutional value over time.

Philippe D. Katz (~5.5 %)

Philippe D. Katz is the largest individual shareholder, owning approximately 5.5 % of Kodak. His stake stands out among individual investors and reflects a deep personal commitment. While it’s non-controlling, it gives him a platform for meaningful engagement and consistent representation in shareholder discourse.

Insiders (~23 %)

Collectively, company insiders—including executives, board members, and key affiliated entities—hold an estimated 23 % of Kodak’s shares. This insider bulk signals substantial alignment between Kodak’s leadership and shareholder interests, bridging management with ownership in a pronounced way.

Who is the CEO of Kodak?

Kodak’s leadership is anchored by a singular vision under its Chief Executive Officer. This structure shapes strategy, culture, and the ongoing transformation of the historic company.

Here’s a quick summary of Kodak’s CEO as of 2025:

- Role: James V. Continenza is both Executive Chairman and CEO.

- Tenure: In place since early 2019, providing long-term strategic stability.

- Leadership Approach: Focused on B2B transformation, advanced materials, and U.S.-based manufacturing.

- Governance: Dual leadership role ensures strong alignment between board-level policy and operational execution.

- Corporate Transition: Builds on past CEOs’ efforts to pivot Kodak from consumer film to industrial services and licensing.

James V. Continenza – Executive Chairman and CEO

At the helm is James V. Continenza, who serves as both Executive Chairman and Chief Executive Officer. He has held this dual leadership role since early 2019, marking over six years of guidance through Kodak’s pivotal reinvention. His extended tenure underscores stability at the top during a period of strategic reorientation.

Continenza’s leadership is defined by pragmatism and resilience. He has steered Kodak away from its legacy as a consumer-film giant toward a tougher, business-to-business (B2B) focus.

Under his direction, Kodak has deepened its capabilities in advanced materials, chemicals, and pharmaceutical-grade production. His approach is centered around leveraging Kodak’s manufacturing heritage—particularly in the U.S.—to serve specialized markets where quality and control matter most.

Governance and Continuity

Holding both the CEO and Executive Chairman titles grants Continenza significant influence. He plays a central role in aligning the board’s strategy with operational execution.

This structure reinforces continuity, allowing decisive and cohesive leadership—especially critical as Kodak navigates financial headwinds and restructures for long-term viability.

Past CEOs

- Antonio M. Pérez (2005–2014)

- Former HP executive who became Kodak’s CEO in 2005.

- Oversaw Kodak’s pivot from traditional film to digital imaging.

- Championed the expansion into inkjet printers and digital services.

- Led Kodak through its 2012 bankruptcy filing and restructuring efforts.

- His tenure reflected both the challenges of a shrinking film market and Kodak’s attempts at reinvention.

- Jeff Clarke (2014–2019)

- Took over as CEO after Kodak’s emergence from bankruptcy.

- Focused on stabilizing the company financially and simplifying operations.

- Shifted Kodak more deeply into commercial printing and licensing businesses.

- Oversaw restructuring that reduced Kodak’s consumer footprint while strengthening its industrial and B2B operations.

- His leadership prepared the company for the next stage of transformation.

- James V. Continenza (2019–Present)

- Became CEO in 2019 and continues to serve as Executive Chairman and CEO in 2025.

- Built on the groundwork of his predecessors by accelerating Kodak’s shift toward advanced materials, specialty chemicals, and pharmaceuticals.

- Positioned Kodak as a key supplier in motion picture film production and as a partner in industrial manufacturing.

- Advocates for Kodak’s “U.S.-based manufacturing first” philosophy to strengthen reliability and supply chains.

- His leadership emphasizes diversification and resilience, steering Kodak through modern challenges.

Engagement with Kodak’s Transition

Under Continenza’s leadership, Kodak has undertaken concrete investments in new facilities and manufacturing lines. These include FDA-registered cGMP chemical plants for pharmaceutical ingredients and the continued expansion of motion picture film production. He emphasizes in-country manufacturing, aiming to reinforce reliability, quality control, and environmental responsibility.

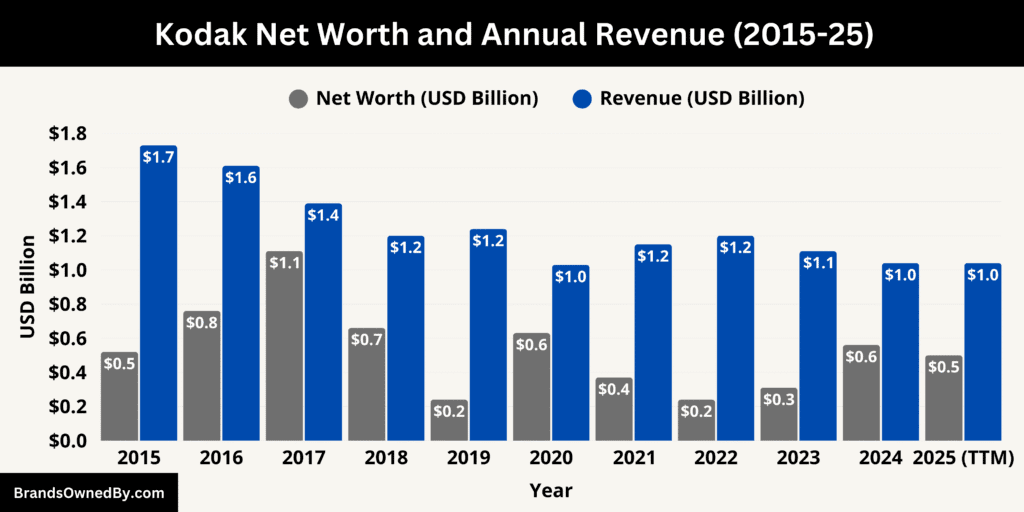

Kodak Annual Revenue and Net Worth

Here’s a quick overview of Kodak’s financial standing as of August 2025:

- Trailing 12-month revenue (2025): $1.04 billion

- Q1 2025 revenue: ~$247 million

- Q2 2025 revenue: ~$263 million

- Net worth (August 2025): ~$500 – 600 million.

Annual Revenue (2025)

Kodak’s annual revenue—calculated on a trailing 12-month basis—stands at approximately $1.04 billion as of mid-2025. This figure reflects a modest decline from around the same level in 2024, indicating relative stability in annual sales after years of contraction.

On a quarterly basis, Kodak reported $247 million in revenue in Q1 and $263 million in Q2 of 2025. The Q2 result represents a slight 1 percent drop compared to Q2 of 2024, while on a sequential quarter-to-quarter basis, Q2 showed a modest uptick after Q1.

Despite the challenges in consumer-facing markets, the company continues to sustain its revenue through diversified segments such as commercial printing, advanced materials, chemicals, and licensing.

Here’s an overview of Kodak’s net worth and revenue from 2015-25:

| Year | Revenue (USD billions) | Market Cap / Net Worth (USD billions) |

|---|---|---|

| 2015 | 1.73 | 0.52 |

| 2016 | 1.61 | 0.76 |

| 2017 | 1.39 | 1.11 |

| 2018 | 1.20 | 0.66 |

| 2019 | 1.24 | 0.24 |

| 2020 | 1.03 | 0.63 |

| 2021 | 1.15 | 0.37 |

| 2022 | 1.20 | 0.24 |

| 2023 | 1.11 | 0.31 |

| 2024 | 1.04 | 0.56 |

| 2025 (TTM)¹ | 1.04 | 0.50 |

Net Worth 2025

As of August 2025, Kodak’s market capitalization, which serves as a proxy for its net worth as a public company, falls in the range of $500 million to $600 million. Different reputable sources offer slightly varied estimates—with figures quoted around $581 million, $574 million, and $599 million.

These differences reflect minor timing or methodological variations, but collectively they suggest the company remains a small-cap entity. This valuation marks a considerable decline from Kodak’s historical peak when its value reached into the tens of billions, illustrating the long arc of its transformation and contraction.

Context and Trends

Over time, Kodak’s annual revenue has been on a downward slope, shrinking significantly from the $14 billion–plus heights of the early 2000s.

By 2024–25, that revenue has contracted to approximately $1 billion, indicating a more focused and scaled business model. Meanwhile, its market capitalization reflects this shift—hovering around half a billion dollars—underscoring the company’s much narrower scope in today’s economy.

Despite these constraints, Kodak maintains a foundation of operations serving niche markets where its heritage, quality, and industrial capabilities still carry weight. Its enduring presence in sectors like motion picture film, advanced materials, and chemicals allows it to pursue revenue streams even as overall scale has diminished.

Brands and Companies Owned by Kodak

Kodak owns and operates a diverse portfolio of businesses that span printing, advanced materials, chemicals, and motion picture film. As of 2025, it continues to manage these entities directly under its core structure, each contributing to its position as a technology-driven imaging and print solutions leader.

Here’s a list of the major companies and brands owned by Kodak as of 2025:

| Company / Brand | Category / Division | Description | Key Features / Offerings |

|---|---|---|---|

| KODAK PRINERGY On Demand | Print Software & Workflow | Cloud-based workflow automation platform for print service providers. | Job management, automation, ERP/MIS integration, security features. |

| KODAK PRINERGY Access | Print Software & Workflow | Cloud-delivered workflow for uploading, preflighting, and approving print jobs. | Digital collaboration, faster turnaround, no IT infrastructure needed. |

| KODAK PROSPER Presses | Digital Printing | High-speed inkjet presses (PROSPER 7000 Turbo, ULTRA 520) for industrial printing. | Offset-level quality, variable data, direct mail, books, catalogs. |

| KODAK PROSPER Imprinting Systems | Digital Printing | Inkjet heads integrated with offset/finishing lines for variable data printing. | Barcodes, serial numbers, personalization at high speeds. |

| KODAK SONORA Plates | Prepress / Plates | Process-free thermal plates for eco-friendly and cost-saving printing. | No chemical processing, compatible with MAGNUS & TRENDSETTER. |

| KODAK MAGNUS Platesetters | Prepress Equipment | Large-format, high-performance CTP devices. | Automation, speed, precision for large publishers/packaging printers. |

| KODAK TRENDSETTER Platesetters | Prepress Equipment | Affordable thermal imaging platesetters for SMEs. | SONORA-compatible, streamlined workflow integration. |

| KODAK NEXFINITY Press | Digital Printing (Legacy) | Supported sheetfed EP press, discontinued in 2022. | Parts, service, consumables, dry-ink innovations. |

| KODAK NEXPRESS Press | Digital Printing (Legacy) | Legacy EP digital press, still supported by Kodak. | Consumables, service, extended machine lifespan. |

| KODAK VISION3 Motion Picture Films | Motion Picture Film | Kodak’s flagship film stock portfolio used in Hollywood and TV. | Color negative, intermediate, B&W options. |

| Kodak Film Labs | Motion Picture Film Processing | Film processing and scanning labs in London, New York, Atlanta. | ECN-2 processing, 4K/8K scanning, archival services. |

| Kodak Advanced Materials & Chemicals | Specialty Chemicals & Films | Division producing industrial films, chemicals, coatings, and biotech inputs. | Electronics, life sciences, pharma intermediates, specialty coatings. |

| KODAK TRACELESS Solutions | Brand Protection & Security | Ultraviolet and covert markers, inks, and varnishes for supply chain security. | Authentication, anti-counterfeiting, supply chain tracking. |

| Kodak Brand Licensing | Licensing & Consumer Products | Manages the KODAK and KODAK MOMENTS brands. | Consumer electronics, instant cameras, retail photo solutions. |

| Kodak Joint Ventures | Partnerships | Regional and strategic ventures expanding service reach. | Localized support for high-volume customers. |

KODAK PRINERGY On Demand

KODAK PRINERGY On Demand is Kodak’s cloud-based workflow automation platform. It replaces traditional on-premise servers and gives print service providers a secure, scalable backbone to manage jobs.

The solution integrates estimating, order intake, scheduling, and production tracking. It also provides rules-based automation and seamless connections with MIS/ERP and e-commerce platforms.

Kodak continuously updates PRINERGY On Demand with security features, new modules, and enhanced integrations, making it a flagship in its workflow portfolio.

KODAK PRINERGY Access

PRINERGY Access is a lighter, cloud-delivered version of the PRINERGY platform. It enables printers to upload, preflight, approve, and track jobs in a fully digital environment.

This service helps printers collaborate more efficiently with clients, reduces turnaround time, and removes the need for heavy IT infrastructure.

KODAK PROSPER Presses

The PROSPER inkjet press line is Kodak’s high-speed, continuous inkjet technology. The family includes the PROSPER 7000 Turbo and the PROSPER ULTRA 520, which deliver offset-level quality at industrial speeds.

These presses are widely used for direct mail, books, catalogs, and certain packaging applications. Their ULTRASTREAM technology allows sharp images, variable data, and efficient ink use.

KODAK PROSPER Imprinting Systems

Kodak also manufactures PROSPER imprinting components. These systems integrate with offset presses or finishing lines to add variable data at production speeds.

This makes it possible to print customized content—like barcodes, serial numbers, or personalized messages—on otherwise conventional offset runs.

KODAK SONORA Plates

SONORA is Kodak’s leading portfolio of process-free plates. These thermal plates eliminate chemical processing, reducing costs and environmental impact.

SONORA plates are widely adopted by commercial, newspaper, and packaging printers for their durability and ease of use. They integrate with Kodak’s platesetters and PRINERGY workflows for a streamlined prepress chain.

KODAK MAGNUS Platesetters

MAGNUS platesetters are Kodak’s high-performance CTP devices. They are designed for large-format and high-volume commercial printers.

These devices offer automation options, speed, and precision, making them suitable for large publishing houses and packaging printers.

KODAK TRENDSETTER Platesetters

TRENDSETTER platesetters are designed for small to medium-sized printers. They balance affordability with Kodak’s thermal imaging quality.

Like MAGNUS, they work seamlessly with SONORA plates and PRINERGY workflows, providing a complete Kodak prepress solution.

KODAK NEXFINITY Press

Kodak continues to support the installed base of its NEXFINITY digital presses, even though new production ceased in 2022.

The company provides parts, service, and consumables, extending the lifespan of these sheetfed electrophotographic machines. Customers still benefit from Kodak’s ongoing software updates and dry-ink innovations.

KODAK NEXPRESS Press

Like NEXFINITY, the legacy NEXPRESS digital presses remain supported by Kodak. The company supplies consumables, service, and technical support to users worldwide.

This commitment ensures that earlier adopters of Kodak’s EP technology can continue to run profitable operations.

KODAK VISION3 Motion Picture Films

KODAK VISION3 is Kodak’s flagship motion picture film stock portfolio. It includes color negative, intermediate, and black-and-white film.

These films remain in high demand for Hollywood productions, episodic TV, commercials, and music videos. Kodak’s ongoing production secures its central role in the entertainment industry.

Kodak Film Labs

Kodak owns and operates film labs that process and scan motion picture film. Locations include London, New York, and Atlanta.

The labs provide ECN-2 processing, high-resolution scanning, and archival services. In the UK, Kodak has also expanded large-format processing capacity to support major productions.

Kodak Advanced Materials & Chemicals

Kodak’s Advanced Materials & Chemicals division manufactures industrial films, specialty chemicals, and coatings.

The company uses its expertise in deposition and chemical synthesis to produce products for printing, electronics, and life sciences. In Rochester, Kodak has expanded regulated manufacturing, producing inputs for pharmaceuticals and biotech industries.

KODAK TRACELESS Solutions

KODAK TRACELESS is Kodak’s brand protection technology. It includes ultracovert markers, inks, and varnishes that can be embedded into packaging or labels.

These markers are invisible but detectable with Kodak’s proprietary readers, providing secure authentication for supply chains.

Kodak Brand Licensing

Kodak’s Brand division manages its trademarks, including the famous KODAK and KODAK MOMENTS names.

The company licenses these brands to third parties for use in consumer electronics, instant cameras, and retail printing solutions. Licensing brings Kodak royalty revenue while allowing it to focus on core industrial and film businesses.

Kodak Joint Ventures

Kodak also participates in regional joint ventures to expand its service reach. These partnerships are often focused on supporting high-volume customers with local facilities and technical support.

An important note: Kodak no longer owns its former flexographic packaging division. That unit was sold in 2019 and now operates as Miraclon.

Final Words

Kodak’s story is one of innovation, transformation, and resilience. From revolutionizing photography in the 19th century to adapting its business around printing, materials, and imaging technologies in the modern era, it has remained a recognizable global brand. While its role in consumer cameras has diminished, the company continues to evolve and find relevance in specialized industries.

Kodak’s legacy as a pioneer in making photography accessible to the world ensures its place in history, while its ongoing focus on technology and imaging keeps the brand meaningful for future generations.

FAQs

Who owns Kodak company?

Kodak is a publicly traded company listed on the New York Stock Exchange under the ticker symbol KODK. It does not have a single owner. Instead, ownership is distributed among institutional investors, mutual funds, and individual shareholders. As of August 2025, the largest shareholders include The Vanguard Group, BlackRock, Dimensional Fund Advisors, and State Street Corporation.

Which company owns Kodak?

No other company owns Kodak. It operates independently as Eastman Kodak Company. The business is run under its own corporate structure, with oversight from its board of directors and executive leadership team.

Who bought Kodak?

Kodak has not been bought out by another corporation. Although the company faced bankruptcy in 2012, it restructured and emerged in 2013 as an independent business focused on printing technology, film, specialty chemicals, and licensing.

Who founded Kodak company?

Kodak was founded by George Eastman and Henry A. Strong in 1888 in Rochester, New York. George Eastman pioneered affordable photography for the masses with his roll-film innovations, while Henry Strong helped in financing and managing the company.

Where was George Eastman found dead?

George Eastman was found dead in his home in Rochester, New York, in 1932. He took his own life due to declining health, leaving behind a note that read, “To my friends, my work is done. Why wait?”

Who invented film roll?

The roll film, which revolutionized photography, was invented by George Eastman in the late 19th century. His invention made photography accessible to the public by replacing bulky glass plates with portable film rolls.

Is Kodak in China?

Yes, Kodak has operations and licensing agreements in China. It manufactures and sells printing equipment, films, and licensed consumer products in the region. Kodak has also partnered with local companies for brand licensing and technology distribution in Asia.

What was the previous name of the Kodak company?

Before adopting the Kodak name, the business was originally called the Eastman Dry Plate Company (founded in 1881). In 1892, it was renamed to Eastman Kodak Company, which remains its official name today.

Who makes Kodak batteries?

Kodak batteries are not manufactured directly by Kodak. They are produced under brand licensing agreements with authorized third-party manufacturers, primarily in Asia. Kodak licenses its name to companies that produce consumer electronics and accessories.

Did Kodak invent the digital camera?

Yes, Kodak engineer Steven Sasson invented the first digital camera prototype in 1975 while working at Kodak. However, Kodak failed to capitalize on this groundbreaking innovation, as it continued focusing on film-based products instead of fully investing in digital.

Is Kodak still in business?

Yes, Kodak is still in business in 2025. While no longer a dominant player in consumer photography, the company has transformed into a leader in commercial printing, advanced materials, specialty chemicals, brand licensing, and motion picture film. It remains headquartered in Rochester, New York.

Is Kodak a private or public company?

Kodak is a public company listed on the New York Stock Exchange under the ticker KODK.

Does Kodak still make film?

Yes, Kodak continues to manufacture motion picture film and specialty photography film for professionals and enthusiasts.

What is Kodak’s main business now?

Kodak focuses on commercial printing, advanced materials, imaging solutions, and pharmaceutical manufacturing.