Deere & Company stands as a global leader in agricultural, construction, and forestry machinery. Its name—John Deere—is instantly recognized by farmers and operators worldwide. If you are curious as to who owns John Deere, continue reading. This article uncovers John Deere’s ownership, major shareholders, its profile, leadership, finances, and brand network.

John Deere Company Profile

Deere & Company, widely known by its brand name John Deere, is a leading American manufacturer of agricultural, construction, and forestry equipment, along with diesel engines, drivetrains, and precision agriculture technologies. Established in 1837 by blacksmith John Deere in Grand Detour, Illinois, the company has grown into a global brand recognized by its signature green and yellow equipment.

Headquartered in Moline, Illinois, Deere operates manufacturing plants, engineering centers, and parts distribution facilities across North America, South America, Europe, and Asia. Its products range from tractors and harvesters to excavators, roadbuilding machinery, and turf care equipment. The company is also a pioneer in integrating technology into farming and construction, offering autonomous tractors, satellite-guided equipment, and advanced crop management tools.

Deere serves a diverse customer base, including farmers, contractors, government agencies, and landscaping professionals, and supports them through a vast dealer network in more than 100 countries. Its long-standing reputation for durability, innovation, and customer service has made John Deere one of the most trusted names in heavy machinery worldwide.

Founder of Deere & Company

John Deere, born in 1804 in Rutland, Vermont, was a skilled blacksmith with an innovative mind. In 1836, facing economic challenges, he moved to Grand Detour, Illinois. There, he encountered farmers struggling with sticky Midwestern soil that clogged traditional cast-iron plows.

In 1837, Deere crafted a polished steel plow with a moldboard design that easily cut through prairie soil. This innovation transformed farming efficiency and became the foundation of Deere & Company. John Deere served as the company’s president from its incorporation in 1868 until 1886. Even after stepping down, his legacy lived on in the company’s culture of innovation and quality.

Major Milestones

1837 – Invention of the steel plow

John Deere builds the first polished steel plow in Grand Detour, Illinois, solving a major agricultural problem in the American Midwest.

1848 – Relocation to Moline, Illinois

The company moves to Moline, a location with better transportation access via the Mississippi River, enabling faster growth.

1868 – Incorporation of Deere & Company

John Deere incorporates the business, formalizing its structure and setting the stage for expansion.

1918 – First tractor

Deere enters the tractor market with the Waterloo Boy, marking its transformation from a plow manufacturer to a full-scale agricultural machinery company.

1947 – Expansion into construction equipment

The company begins producing bulldozers, diversifying beyond agriculture.

1964 – Deere & Company World Headquarters

Designed by architect Eero Saarinen and completed by Kevin Roche, the Moline headquarters became an architectural landmark with its pioneering use of COR-TEN steel.

1970s – Global expansion

John Deere plants and operations spread across Europe, South America, and Asia, making it a global leader.

1990s – Technology integration

Deere launches its first GPS-guided farming equipment, paving the way for precision agriculture.

2017 – Acquisition of Wirtgen Group

This $5.2 billion deal expands Deere’s reach into roadbuilding equipment.

2017 – Acquisition of Blue River Technology

A major step in AI-driven precision farming, enabling See & Spray technology to detect and treat weeds individually.

2021 – Autonomous tractor launch

Deere unveils its first fully autonomous 8R tractor at CES, marking a leap in agricultural automation.

2025 – $20 billion U.S. investment plan

Deere announces its largest domestic investment ever, funding new factories (including an excavator plant in North Carolina), upgrading existing facilities like the East Moline Harvester Works ($150M for X9 combine production), and expanding the Des Moines See & Spray manufacturing line.

Who Owns John Deere (Deere & Company): List of Shareholders

John Deere, officially known as Deere & Company, is a publicly traded American corporation specializing in agricultural, construction, and forestry machinery. Founded in 1837, the company is listed on the New York Stock Exchange under the ticker symbol DE. It is not owned by a single individual or family but by a broad range of institutional and individual shareholders.

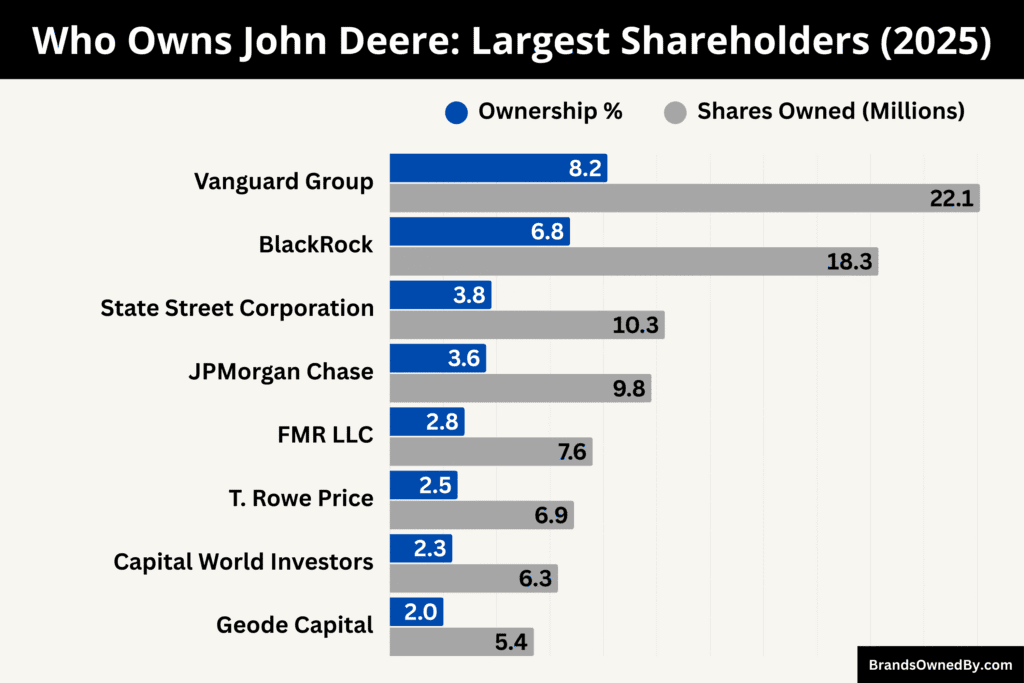

As of August 2025, the largest stakeholders are major asset management firms such as Vanguard Group and BlackRock, which together hold a significant portion of the company’s shares. This diversified ownership structure ensures that John Deere’s control is exercised collectively through shareholder voting and a board of directors.

Below is a list of the largest shareholders of John Deere as of 2025:

| Shareholder | Shares Owned (Millions) | Ownership % | Relevant Details |

|---|---|---|---|

| Vanguard Group, Inc. | 22.1 | 8.15% | Largest institutional investor in John Deere, known for passive index fund holdings and significant influence in corporate governance through proxy voting. |

| BlackRock, Inc. | 18.3 | 6.75% | Major global asset manager with substantial voting power, often influencing ESG and sustainability policies in portfolio companies. |

| State Street Corporation | 10.3 | 3.81% | Investment management giant and ETF provider, part of the “Big Three” index fund managers shaping shareholder decisions. |

| JPMorgan Chase & Co. | 9.8 | 3.61% | Diversified financial services firm holding John Deere shares through asset management and private wealth portfolios. |

| FMR LLC (Fidelity Investments) | 7.6 | 2.80% | Privately owned investment management company with a mix of mutual fund and institutional holdings in John Deere. |

| T. Rowe Price Associates, Inc. | 6.9 | 2.54% | Investment management firm focusing on active management strategies, often engaging in governance discussions. |

| Capital World Investors | 6.3 | 2.34% | Part of Capital Group, known for long-term equity investments and active shareholder involvement. |

| Geode Capital Management, LLC | 5.4 | 2.01% | Investment advisor to Fidelity index funds, holding John Deere shares as part of diversified passive strategies. |

| Other Institutional Shareholders | N/A | Part of ~69% total | Includes pension funds, insurance companies, and smaller asset managers with aggregated significant influence. |

| Individual Shareholders and Insiders | N/A | Small percentage | Consists of John Deere executives, board members, and employees holding stock directly or through compensation plans. |

Vanguard Group, Inc.

Vanguard Group is the largest single shareholder of Deere & Company. It owns roughly 22.1 million shares, representing about 8.15% of the company’s outstanding stock.

As one of the world’s largest asset managers, Vanguard holds its stake on behalf of its index and mutual fund investors. This gives it significant voting power in corporate matters, including board elections and major policy approvals. Vanguard’s influence is indirect but substantial, as it typically supports governance policies that align with long-term shareholder value.

BlackRock, Inc.

BlackRock is the second-largest shareholder, holding around 18.3 million shares, or approximately 6.75% ownership. Like Vanguard, BlackRock’s shares are held across various exchange-traded funds and investment products. It has a strong voice in Deere’s corporate governance, often advocating for sustainability, risk management, and transparent reporting practices.

State Street Corporation

State Street owns about 10.3 million shares, giving it roughly 3.81% of Deere & Company. The firm manages investments for institutional clients and index funds, meaning its ownership is spread across a diverse investor base. Its voting influence plays a role in supporting or challenging management decisions during annual meetings.

JPMorgan Chase & Co.

JPMorgan holds nearly 9.8 million shares, which amounts to about 3.61% ownership. While smaller than the top two institutional holders, JPMorgan remains a key player with meaningful voting rights. Its investment arm evaluates Deere’s performance and strategic direction as part of its broader portfolio management.

FMR LLC (Fidelity Investments)

FMR LLC controls about 7.6 million shares, representing roughly 2.80% of the company. Fidelity has shown growing interest in Deere, increasing its holdings significantly in recent quarters. This signals strong confidence in the company’s long-term prospects, particularly in technology-driven agriculture.

T. Rowe Price Associates, Inc.

T. Rowe Price owns approximately 6.9 million shares, or 2.54% ownership. The firm focuses on active portfolio management and invests in Deere for its innovation track record and market leadership in agricultural machinery.

Capital World Investors

Capital World Investors holds about 6.3 million shares, giving it around 2.34% ownership. The firm tends to take a long-term investment approach, aligning with Deere’s steady innovation and global market expansion.

Geode Capital Management, LLC

Geode Capital owns roughly 5.4 million shares, or about 2.01% of Deere’s total shares. As a sub-advisor for certain Vanguard funds, Geode’s stake indirectly reinforces Vanguard’s overall influence on the company.

Other Institutional Shareholders

Apart from the top holders, other institutions and asset managers collectively own a significant portion of Deere’s stock. Combined, institutional investors control close to 69% of the company, giving them considerable sway over corporate decisions.

Individual Shareholders and Insiders

Individual investors and company insiders own a much smaller percentage of Deere’s stock. These include current executives, board members, and in some cases, descendants of the founder. While their shareholdings are modest, their influence is more pronounced through leadership positions and direct involvement in decision-making.

Who Builds John Deere Engines?

John Deere engines are primarily designed and built by John Deere Power Systems (JDPS), a dedicated division of the company specializing in powertrain technology. JDPS produces a wide range of diesel and natural gas engines used in John Deere’s agricultural, construction, forestry, and turf equipment, as well as for marine and industrial applications. These engines are engineered for durability, fuel efficiency, and compliance with the latest global emissions regulations.

Manufacturing Locations

John Deere engines are manufactured at multiple facilities worldwide:

- Waterloo, Iowa, USA – The largest John Deere engine plant, producing large displacement diesel engines for agricultural and construction machinery.

- Torreón, Mexico – Manufactures mid-sized engines for tractors, loaders, and other equipment.

- Saran, France – Specializes in smaller and mid-sized engines for agricultural, turf, and industrial uses.

- Ribeirão Preto, Brazil – Supplies engines for equipment serving the Latin American market.

- Pune, India – Produces smaller displacement engines for compact tractors and emerging markets.

OEM and External Supply

In addition to powering John Deere equipment, JDPS engines are also supplied to original equipment manufacturers (OEMs) in industries like marine, industrial machinery, and specialty vehicles. This diversification ensures John Deere engines are found far beyond their own green-and-yellow machines.

John Deere Power Systems also develops and integrates advanced technologies into its engines, such as:

- Turbocharging systems for improved power and efficiency.

- High-pressure common rail fuel injection for precise fuel delivery.

- Exhaust aftertreatment systems for emissions control.

- Hybrid and electrification-ready designs, especially after investments like the Kreisel Electric acquisition for battery systems.

While most John Deere engines are made in-house, certain smaller utility equipment or specialty models may use engines from trusted partners like Yanmar or Cummins, particularly in niche or regional markets. These collaborations ensure that John Deere can meet diverse customer needs without compromising on performance or quality.

Who is the CEO of John Deere?

As of August 2025, John C. May is the Chairman, President, and Chief Executive Officer of Deere & Company. He has led the company since 2019, guiding it through significant technological advancements and global expansion. With decades of experience within Deere and a strong background in both operations and strategic leadership, May plays a central role in shaping the company’s vision, innovation efforts, and market position.

John C. May: Roles and Titles

John C. May serves as the Chairman, President, Chief Executive Officer (CEO), and Chief Operating Officer (COO) of Deere & Company. He also holds senior leadership roles in several key Deere subsidiaries and affiliate entities, including chairing roles at John Deere Capital Corp. and John Deere Ltd (Australia). His broad responsibilities reflect his central role in steering both corporate strategy and day-to-day operations.

Career Background and Education

Before becoming CEO in late 2019, John May held several strategic roles across Deere’s global operations. His past appointments include Managing Director at John Deere (Tianjin) Co. Ltd., Vice President for global platforms at Dubuque Works, and Director of vehicle marketing at Deere’s Health Care business. He holds a bachelor’s degree from the University of New Hampshire and an MBA from the University of Maine.

Leadership Focus and Milestones

Since assuming the CEO role, May has pushed the company into the forefront of agricultural technology and innovation. Under his leadership, Deere introduced its first fully autonomous tractor—the John Deere 8R—in 2021, a notable leap into autonomous farming solutions. He also prioritized sustainable practices, including electric and biofuel-powered machinery, highlighting a shift toward greener operations.

Strategic Commitment to U.S. Growth

In 2025, John May announced a landmark $20 billion investment in U.S. manufacturing operations over the next decade. This includes new construction plants (like an excavator facility in North Carolina), substantial upgrades to existing factories (such as the East Moline harvester works), and expansions in remanufacturing and assembly lines across multiple states. The commitment underlines his focus on domestic manufacturing growth, workforce development, and advanced production capabilities.

Governance and Board Participation

In addition to his executive roles within Deere, John May holds a seat on the board of directors at Ford Motor Company and is a member of influential industry groups such as The Business Roundtable and the Council on Competitiveness. These positions extend his influence beyond Deere and reflect his engagement in broader strategic discussions across manufacturing and policy spheres.

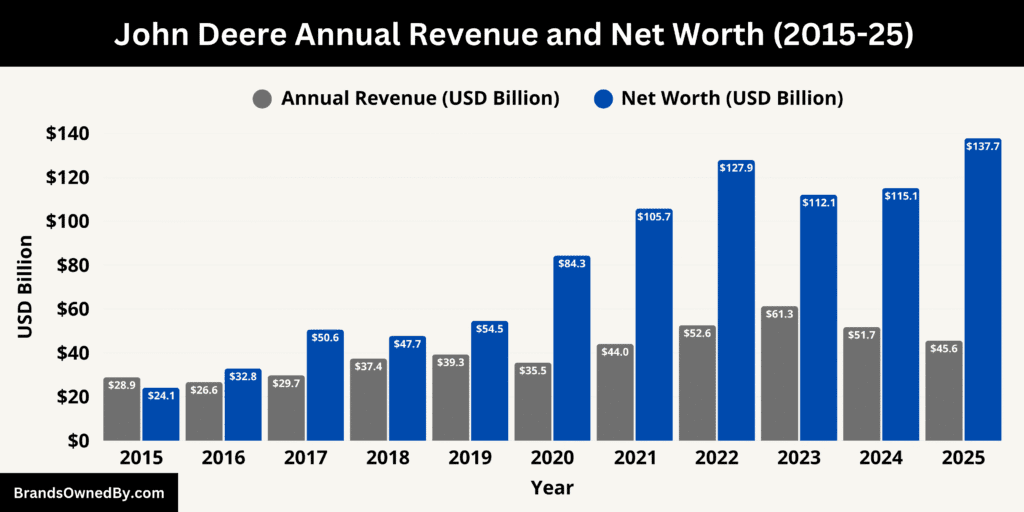

John Deere Annual Revenue and Net Worth

In 2025, Deere & Company generated approximately $45 billion in trailing twelve-month revenue. By August 2025, the company’s net worth—measured by market capitalization—stood near $138 billion, reflecting its strong brand value and investor confidence amid challenging industry conditions.

John Deere Revenue

Deere & Company remains one of the world’s foremost agricultural and heavy equipment manufacturers. The company generated approximately $45 billion in trailing twelve-month revenue through mid-2025, reflecting a notable year-over-year decline of around 20%.

This contraction underscores headwinds faced by the broader farming and construction sectors. Despite this downward move, Deere continues to lead its markets, leveraging advanced machinery and innovative services to maintain global reach.

Quarterly Performance Trends

The company’s quarterly revenue figures further illustrate this trend. In the first quarter of 2025, revenue plunged nearly 30%, down to just over $8.5 billion, compared to the prior year. By the second quarter, sales improved to approximately $12.76 billion, though this still marked a 16% drop from 2024.

For the third quarter, revenue held relatively steady at around $12 billion, reflecting an 8–9% year-over-year decline. These fluctuations mirror agricultural market cycles and macroeconomic pressures facing the industry.

Net Income and Earnings

Profitability has been impacted, though still resilient. In Q1 2025, net income halved to roughly $869 million, before rebounding somewhat to $1.8 billion in Q2. The third quarter produced $1.29 billion in net income—about 25–26% lower than the same period in 2024. These results highlight Deere’s focus on margin preservation and operational discipline amid tough market conditions.

John Deere Net Worth 2025

Deere & Company’s net worth, as shown through its market capitalization, reached approximately $138 billion by early August 2025.

This valuation reflects investor expectations not just for immediate performance but also for the company’s sustained leadership in agriculture and innovation. Over the past year, Deere’s market cap has surged by over 30%, signaling renewed investor optimism around its long-term strategic direction.

Several factors contribute to Deere’s robust valuation:

- Technology Leadership: Deere continues to lead in precision agriculture, autonomous machinery, and intelligent farming solutions—areas attracting favorable investor sentiment.

- Recurring Revenue Potential: Analysts see growth potential in recurring software and service revenue, with Deere targeting 10% of sales from recurring sources by the end of the decade. This strategic shift adds resilience and value perception.

- Strategic Investments: Deere’s commitment to a $20 billion investment in U.S. operations underscores its long-term vision and reinforces confidence in manufacturing scale and workforce expansion.

Market Fluctuations and Catalysts

While Deere’s market cap has rebounded significantly, recent challenges have weighed on sentiment:

- Persistent inventory oversupply, elevated interest rates, and trade policy uncertainties have pressured margins, particularly in large turf and agricultural machinery segments.

- Despite these headwinds, Deere consistently beats quarterly estimates, helping maintain investor trust in its management and recovery strategy.

Valuation Trends and Outlook

The rise in Deere’s market cap to nearly $138 billion represents a strong recovery from cyclical lows and aligns with broader improvements in sector outlook. Market analysts anticipate continued upward momentum, supported by Deere’s technological edge and strategic U.S. investments.

Companies Owned by John Deere

Deere & Company operates a wide portfolio of businesses, brands, and specialized entities that go far beyond tractors and combines. As of 2025, its operations span agriculture, construction, forestry, electrification, precision technology, financing, and global aftermarket services. Each division plays a strategic role in delivering equipment, software, and solutions that keep the company at the forefront of off-highway innovation.

Here’s a list of the top companies, subsidiaries, and brands owned by John Deere as of 2025:

| Company/Brand/Entity | Primary Focus | Key Products/Services | Geographic Presence | Notable Details |

|---|---|---|---|---|

| John Deere Agriculture & Turf | Farming & turf equipment | Tractors, combines, sprayers, planters, hay tools, turf care | Global | Largest segment, integrates precision agriculture tech via Operations Center |

| John Deere Construction & Forestry | Heavy construction & forestry machinery | Loaders, dozers, graders, dump trucks, skidders, harvesters | Global | Expanded in-house design after excavator partnership changes |

| John Deere Financial | Equipment financing | Retail & wholesale financing, leasing, insurance | North America, Latin America, Europe, Asia-Pacific | Supports sales with tailored credit products |

| John Deere Power Systems | Engine manufacturing | Diesel/natural gas engines, drivetrain, power electronics | Global | Develops hybridization strategies for efficiency & low emissions |

| John Deere Electronic Solutions | Electronic hardware for machinery | Controllers, displays, telematics, power electronics | Global | Formerly Phoenix International, supports autonomy & automation |

| John Deere Intelligent Solutions Group (ISG) | Precision agriculture & autonomy | Software, data analytics, Operations Center | Global | Orchestrates connectivity between machines & stakeholders |

| Blue River Technology | AI & computer vision for ag | See & Spray selective application tech | Primarily North America | Reduces herbicide use through plant-level recognition |

| Bear Flag Robotics | Tractor autonomy | Retrofit autonomy stacks | North America | Enables supervised autonomy in mixed fleets |

| Kreisel Electric | Battery technology | High-density battery modules, immersion cooling | Europe & global | Majority-owned Austrian firm advancing Deere electrification |

| Wirtgen Group | Roadbuilding equipment | Cold milling, paving, compaction, crushing/screening | Global | Includes brands Wirtgen, Vögele, Hamm, Kleemann, Benninghoven |

| Monosem | Precision seeding | Row-crop planters | Europe | Integrates with Deere’s guidance & data platforms |

| Mazzotti | Sprayers for specialty markets | Self-propelled compact sprayers | Europe | Retains brand identity for tight-row markets |

| Hagie | High-clearance sprayers | Front-boom sprayers | North America | Optimized for late-season applications |

| PLA | Ag equipment for Latin America | Sprayers, seeders, planters | Latin America | Designed for regional agronomy conditions |

| King Agro | Carbon fiber components | Sprayer booms, structures | Global | Lightweight, corrosion-resistant, enhances durability |

| Waratah Forestry Attachments | Forestry harvesting tools | Processing heads, control systems | Global | Integrates with Deere forestry carriers and third-party machines |

| NavCom Technology | Positioning technology | GNSS receivers, corrections services | Global | Provides high-accuracy guidance solutions |

| John Deere Reman | Component remanufacturing | Engines, transmissions, hydraulics | Global | Supports sustainability via material recovery |

| John Deere Parts and Distribution | Parts logistics | Dealer distribution network | Global | Ensures fast part availability for uptime |

| John Deere MachineFinder | Pre-owned equipment marketplace | Dealer-inspected used machinery | Primarily North America | Increases resale confidence & lifecycle value |

| John Deere Golf | Turf care for golf & sports | Mowers, aerators, utility vehicles | Global | Works with superintendents for course quality |

| John Deere WorkSight & Jobsite Technology | Construction site tech | Telematics, grade control, remote diagnostics | Global | Improves safety & productivity on job sites |

| John Deere Agriculture Technology Stack | Integrated ag tech | Autonomy, See & Spray, variable-rate control | Global | Modular design for cross-platform deployment |

| John Deere Engines & Drivetrain OEM Programs | OEM supply | Engines, axles, transmissions, e-drive | Global | Supports marine, industrial, and specialty uses |

| John Deere Dealer & Customer Support Operations | Dealer network support | Training, diagnostics, logistics | Global | Enables over-the-air updates & remote service |

John Deere Agriculture & Turf

This is the company’s largest operating segment. It designs and manufactures tractors, combines, sprayers, planters, hay tools, and turf equipment for farms, ranches, municipalities, and grounds care. The unit also delivers precision-ag features like autonomy, guidance, variable-rate tech, and connected support through the Operations Center.

John Deere Construction & Forestry

This segment builds loaders, dozers, graders, articulated dump trucks, skidders, feller bunchers, and forestry harvesters. After restructuring its excavator relationship in the Americas, Deere expanded in-house design, manufacturing, and distribution for earthmoving and forestry product lines. The business serves contractors, roadbuilders, loggers, and rental fleets.

John Deere Financial

John Deere Financial provides retail and wholesale financing, leasing, and insurance services to customers and dealers. It operates captive finance programs across North America, Latin America, Europe, and Asia-Pacific. The unit deepens customer loyalty and supports equipment sales with seasonal and multi-year credit products tailored to agriculture and construction cycles.

John Deere Power Systems

This subsidiary designs and manufactures diesel and natural gas engines, drivetrain components, and power electronics. It supplies OEMs and internal equipment lines with Stage V and Tier 4 solutions. The group also develops hybridization strategies that pair engines with batteries and power electronics for lower emissions and improved efficiency.

John Deere Electronic Solutions

Formerly Phoenix International, this entity designs rugged controllers, displays, telematics modules, and power electronics for off-highway equipment. It enables the software-defined machine strategy and integrates embedded computing with the company’s cloud platform. Its hardware underpins autonomy, automation, and precision control features across vehicle platforms.

John Deere Intelligent Solutions Group (ISG)

ISG leads precision agriculture software, data science, autonomy stacks, and the John Deere Operations Center. The group orchestrates connectivity between machines, dealers, agronomists, and partners. It converts sensor data into actionable prescriptions, helping customers cut inputs, raise yields, and coordinate fleets.

Blue River Technology

Acquired to accelerate computer vision and machine learning on equipment, Blue River is the origin of See & Spray selective application. Its perception and actuation system identifies plants in real time and targets input placement. The tech reduces herbicide use and supports new autonomy and robotics features.

Bear Flag Robotics

This team develops retrofit autonomy for tractors and other platforms. Its stack handles path planning, obstacle detection, and remote supervision for supervised autonomy. Bear Flag’s technology helps scale autonomy across mixed fleets and multiple machine sizes.

Kreisel Electric

Deere holds a majority stake in this Austrian battery specialist. Kreisel designs high-density battery modules, immersion-cooled packs, and fast-charging solutions for off-highway use. It anchors Deere’s electrification roadmap for compact machines, turf, and select on-road support vehicles.

Wirtgen Group

A major acquisition in roadbuilding, Wirtgen Group broadens Deere’s construction portfolio. The group includes Wirtgen (cold milling and recycling), Vögele (pavers), Hamm (rollers), Kleemann (crushing and screening), and Benninghoven (asphalt mixing). It gives Deere an end-to-end road construction ecosystem and global parts/service coverage.

Monosem

Monosem builds row-crop planters and precision seeding systems. The brand strengthens Deere’s footprint in European and specialty crops. Its mechanical and vacuum planters integrate with Deere guidance and data platforms for accurate seed placement.

Mazzotti

This Italian manufacturer produces self-propelled sprayers known for compact dimensions and high clearance. Deere retains the Mazzotti brand in Europe while integrating shared components and precision features. The line complements Deere sprayers in specialty and tight-row markets.

Hagie

Hagie is focused on high-clearance front-boom sprayers used for late-season applications. Deere positions Hagie as a complementary brand where unique agronomic timing is critical. Integration brings shared parts, dealer support, and precision tech while preserving Hagie’s application advantages.

PLA

Based in Argentina, PLA expands Deere’s South American sprayer and seeding presence. The portfolio includes self-propelled sprayers, seeders, and planters designed for local agronomy and field conditions. It supports regional manufacturing and tailored specs for Latin American producers.

King Agro

King Agro makes carbon fiber booms and structural components for sprayers. Its lightweight, corrosion-resistant booms allow wider widths with lower weight and improved durability. Integration with Deere sprayers improves productivity and reduces compaction.

Waratah Forestry Attachments

Waratah designs harvesting and processing heads for cut-to-length forestry. The brand complements John Deere Forestry carriers and also serves third-party machines. Its control systems, feed rollers, and measuring accuracy are tuned for productivity and wood quality.

NavCom Technology

NavCom provides GNSS receivers, corrections services, and positioning solutions for high-accuracy guidance. Its technology supports auto-steer, section control, and machine positioning across ag and construction. Integration with Deere’s software platform enables reliable pass-to-pass accuracy in diverse conditions.

John Deere Reman

This global remanufacturing operation restores engines, fuel systems, transmissions, hydraulics, and electronics to like-new condition. Reman reduces downtime and total cost of ownership while extending component life. It also supports the company’s sustainability goals through material recovery and energy savings.

John Deere Parts and Distribution

Deere runs a worldwide parts network with regional distribution centers and dealer depots. The organization ensures rapid availability of critical components for uptime. It also supports proactive maintenance programs and connected diagnostics.

John Deere MachineFinder

MachineFinder is the company’s official marketplace for pre-owned equipment. It gives dealers a platform to list inspected machines with service records. The channel increases resale confidence and lifecycle value for customers.

John Deere Golf

This business focuses on mowers, aerators, utility vehicles, and course maintenance tools for golf and sports turf. It integrates precision controls for consistent cut quality and surface performance. Dedicated support teams work with superintendents on agronomic standards and uptime.

John Deere WorkSight and Jobsite Technology

For construction and quarry sites, Deere provides telematics, payload management, grade control, and remote diagnostics. The suite connects machines, operators, and managers to improve productivity and safety. It aligns with rental and contractor workflows.

John Deere Agriculture Technology Stack

This internal ecosystem combines perception hardware, on-machine compute, connectivity, and cloud analytics. Features include autonomy, See & Spray, variable-rate control, and prescription maps. The stack is designed to be modular, enabling rapid deployment across platforms and regions.

John Deere Engines and Drivetrain OEM Programs

Beyond internal machines, Deere supplies engines, axles, transmissions, and e-drive components to external OEMs. These programs extend the brand into marine, industrial, and specialty applications. Support includes calibration, certification, and lifecycle service.

John Deere Dealer and Customer Support Operations

Deere operates factory-backed training, diagnostics, and parts logistics that serve its independent dealer network. While dealers are independently owned, Deere’s support infrastructure is a core operating entity. It enables remote service, over-the-air updates, and field campaigns across regions.

Final Thoughts

Understanding who owns John Deere means seeing a complex picture. It is not privately held but owned by a diverse mix of institutional and individual investors. The company thrives under the leadership of John C. May and a forward-looking board. Its financial strength supports innovation, from autonomous tractors to precision farming. Deere & Company’s network of brands and subsidiaries underscores its commitment to technology, customer service, and market leadership.

FAQs

Who bought John Deere?

No company has bought John Deere. Deere & Company remains an independent, publicly traded corporation listed on the New York Stock Exchange under the ticker symbol DE. Its ownership is spread across institutional investors, mutual funds, and individual shareholders.

Who owns John Deere tractors?

John Deere tractors are manufactured and sold by Deere & Company, which is owned by its shareholders. No single person or family fully owns the company, but large institutional investors like The Vanguard Group and BlackRock hold significant stakes.

Who owns John Deere?

John Deere is owned by public shareholders, with the largest stakes held by institutional investors such as The Vanguard Group, BlackRock, and State Street. The company operates as an independent, American-based manufacturer.

Is John Deere family owned?

No, John Deere is not family owned. While the company was originally founded by blacksmith John Deere in 1837, ownership has transitioned entirely to public shareholders over the decades.

Does the Deere family still own John Deere?

The Deere family no longer owns a controlling interest in the company. While descendants may still hold small personal shares, they do not play a major role in its ownership or decision-making.

Who owns John Deere stock?

John Deere stock is owned by a mix of institutional investors, mutual funds, and individual investors. Large institutions like The Vanguard Group, BlackRock, and State Street are among the biggest shareholders.

Where was John Deere founded?

John Deere was founded in 1837 in Grand Detour, Illinois, USA.

What is the origin of the John Deere company?

John Deere began when blacksmith John Deere invented a self-scouring steel plow in 1837. This innovation helped farmers work more efficiently and marked the start of the company’s agricultural equipment business.

What are the major companies owned by John Deere?

John Deere owns multiple subsidiaries and brands, including John Deere Financial, Wirtgen Group, Hagie, Blue River Technology, and others focused on agriculture, construction, forestry, and precision agriculture technology.

What’s John Deere’s company net worth?

As of August 2025, John Deere’s market capitalization is estimated at around $118 billion.

Is John Deere owned by Bill Gates?

No, Bill Gates does not own John Deere. However, some investment funds that hold Deere & Company shares may have Gates Foundation Trust investments indirectly linked to them.

Who is John Deere’s largest shareholder?

The Vanguard Group is the largest shareholder of John Deere, holding a significant percentage of the company’s stock.

Which country owns John Deere?

John Deere is an American company headquartered in Moline, Illinois, USA.

Does Warren Buffett own John Deere?

Warren Buffett’s company, Berkshire Hathaway, previously owned shares in Deere & Company but does not currently hold a notable stake as of 2025.

How many brands does John Deere own?

John Deere owns over a dozen brands, including Wirtgen, Hagie, and Blue River Technology, along with several others in the agricultural, construction, and forestry sectors.

Is John Deere German or American?

John Deere is an American company, though it operates manufacturing plants and subsidiaries in many countries, including Germany.

Where is John Deere made now?

John Deere manufactures equipment in multiple locations worldwide, including the United States, Germany, India, Brazil, and China, with production facilities tailored to regional markets.