JetBlue Airways has grown into one of the most recognized low-cost carriers in the United States. Many travelers often ask, who owns JetBlue, especially as the airline competes with giants like Delta and American. To understand its ownership and position in the aviation industry, it is important to look at its history, shareholders, leadership, and financial strength.

JetBlue Company Profile

JetBlue Airways Corporation is a prominent American airline known for its blend of low-cost fares and elevated service. Headquartered in Long Island City, New York, it operates across the U.S., the Caribbean, Latin America, Canada, and Europe.

The airline’s fleet comprises roughly 280 aircraft, including Airbus A320, A321, and A220 models, serving more than 100 destinations. JetBlue employs about 23,000 crewmembers.

Founding & Founders

JetBlue was founded in 1998 by Utah businessman David Neeleman, whose vision was to “bring humanity back to air travel”. The airline commenced service with its inaugural passenger flight on February 11, 2000, flying from New York’s JFK Airport to Fort Lauderdale—a flight that remains active today as JetBlue Flight #1.

David Barger, a co-founder, later joined the leadership. He served as CEO until February 2015.

Major Milestones

- Inaugural Flight (2000): JetBlue’s first-ever passenger flight marked the start of a new era in affordable, customer-centric air travel.

- 25th Anniversary (2025): The airline celebrated its 25th birthday with a dedicated aircraft livery honoring crewmembers and began a year-long series of events.

- Financial Resilience (2025): Amid economic uncertainties, JetBlue reported a Q1 GAAP net loss of $208 million but held $3.8 billion in liquidity, supporting its “JetForward” turnaround plan.

- A220 Fleet & Longest Route: JetBlue now operates around 50 Airbus A220 aircraft, recently launching its longest A220 route—Boston to Vancouver (~2,500 miles).

- European Expansion: The airline added direct service between Madrid and Boston, along with flights from Boston to Edinburgh, and resumed seasonal flights to London-Gatwick.

- United Airlines Partnership (“Blue Sky”): Starting fall 2025, JetBlue and United will enable reciprocal reward earning via their TrueBlue and MileagePlus programs, increasing connectivity in the Northeast U.S.

- Loyalty Campaigns: JetBlue launched the “25 for 25” TrueBlue promotion, offering up to 350,000 bonus points and 25 years of Mosaic 1 loyalty status for members traveling to multiple destinations by year-end 2025.

- Premium Service Enhancements: The JetBlue Premier World Elite Mastercard debuted with perks like lounge access and credits, signaling a shift toward premium offerings; a domestic first-class product is slated for 2026. Airport lounges planned for JFK and Boston will debut in late 2025.

- Ventures & Rebranding: JetBlue sold its venture capital arm, JetBlue Ventures, to SKY Leasing in May 2025. Meanwhile, JetBlue Travel Products was rebranded twice in 2025—first to Paisly (June), then to TrueBlue Travel (August), emphasizing loyalty integration.

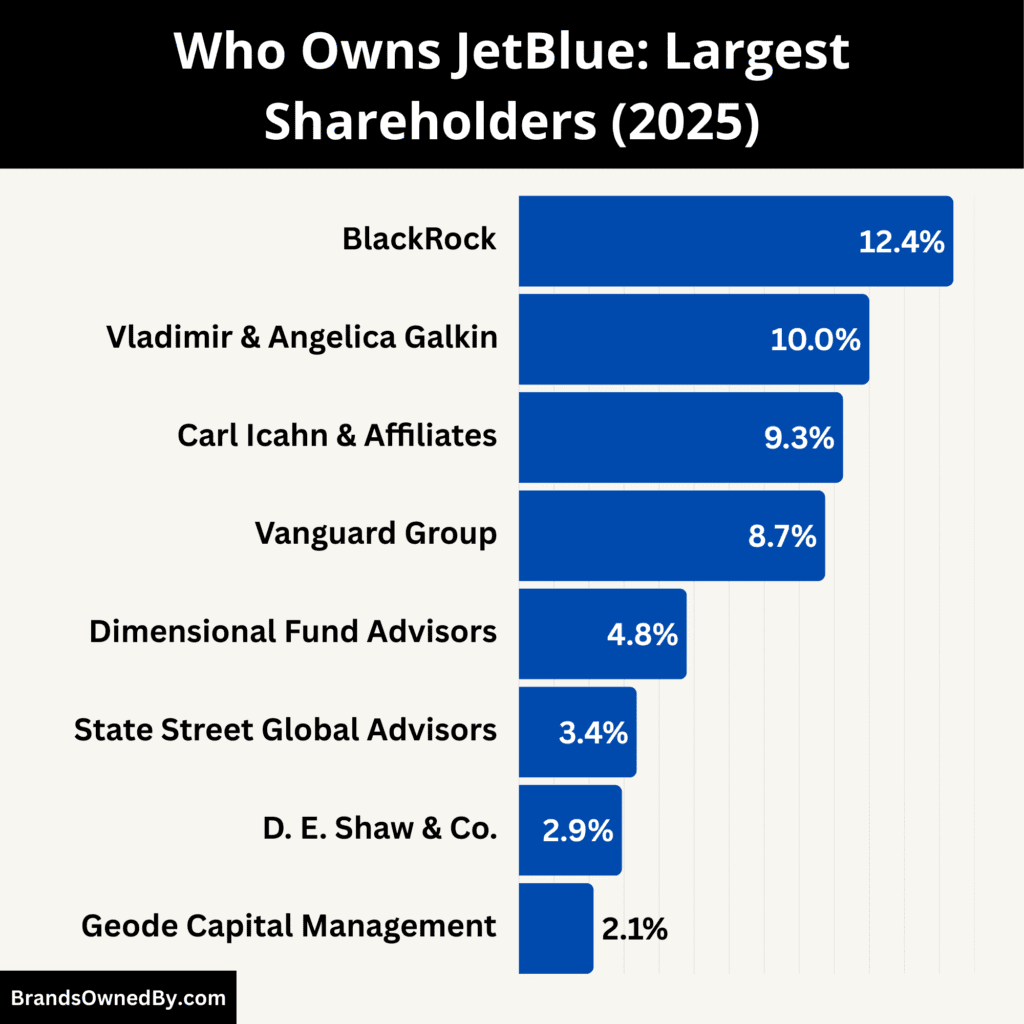

Who Owns JetBlue: Largest Shareholders

JetBlue is a publicly traded company listed on the NASDAQ under the ticker symbol JBLU. This means it is not owned by one individual or a single company but by a mix of institutional investors, mutual funds, and individual shareholders. Institutional investors hold a substantial 83.71% of JetBlue’s shares. These include mutual funds, asset managers, and various institutional vehicles.

Here’s a list of the top shareholders of JetBlue as of August 2025:

| Shareholder | Ownership % / Shares | Role & Influence |

|---|---|---|

| BlackRock, Inc. | ~12.4% (~45M shares) | Largest institutional shareholder; influences governance, sustainability, and executive pay through ETFs and mutual funds. |

| Carl Icahn & Affiliates | ~9.25% | Activist investor; pushes for cost-cutting, efficiency, and board representation. Major force in shaping JetBlue’s strategy. |

| Vladimir & Angelica Galkin | ~10% | Second-largest individual shareholders; long-term investors seeking operational improvements; growing influence in strategic direction. |

| The Vanguard Group | ~8.74% | Passive index fund investor; impacts governance and long-term shareholder value. Provides exposure through S&P 500 and aviation funds. |

| Dimensional Fund Advisors | ~4.79% | Academic-driven investor; ensures stability and long-term value without short-term speculation. |

| State Street Global Advisors | ~3.36% | Part of “Big Three” asset managers; focuses on governance, transparency, and diversity initiatives. |

| D. E. Shaw & Co. | ~2.94% | Quant-driven hedge fund; influences share price through active trading but not board involvement. |

| Geode Capital Management | ~2.13% (~7M shares) | Manages Fidelity index funds; provides institutional support and diversification. |

| Citadel Advisors | ~9M shares | Hedge fund led by Ken Griffin; active trader with confidence in JetBlue’s restructuring and expansion. |

| Susquehanna International Group | ~8.1M shares | Trading and investment firm; adds liquidity through options trading and arbitrage. |

| Insider Shareholders | ~28.4% | Includes executives, directors, and employees (notably CEO Joanna Geraghty and former CEO Robin Hayes). Aligns management with shareholder interests. |

| Retail Investors | ~27.7% | Broad base of small shareholders via trading platforms and index funds; increasingly active in proxy voting. |

BlackRock, Inc. (~12.4%)

BlackRock is JetBlue’s largest shareholder, holding roughly 12.4% of the company’s stock, which equals over 45 million shares. As the world’s biggest asset management firm, BlackRock influences JetBlue primarily through its exchange-traded funds (ETFs) and mutual funds.

Its stake ensures that it plays a critical role in governance matters, executive pay structures, and sustainability policies. BlackRock’s involvement is long-term, meaning its support adds stability to JetBlue’s shareholder base.

Carl Icahn and Affiliates (~9.25%)

Activist investor Carl Icahn and his investment vehicles, including Icahn Capital LP and Icahn Partners, own around 9.25% of JetBlue. Icahn is known for pushing companies toward cost-cutting and operational efficiency.

His involvement signals potential changes in JetBlue’s strategic direction, especially as he has historically sought board representation in companies where he builds significant stakes. His investment is closely watched by the market since Icahn is regarded as one of the most influential activist investors in aviation and beyond.

Vladimir and Angelica Galkin (~10%)

Florida-based investors Vladimir and Angelica Galkin, through the Angelica Galkin Revocable Trust and personal holdings, collectively control about 10% of JetBlue. Once little-known, the couple has become highly visible after significantly expanding their stake in the airline.

They are now the second-largest individual shareholders after Icahn. The Galkins’ strategy is long-term value growth, and they have publicly expressed interest in operational improvements. Their rising influence makes them a crucial voice in JetBlue’s future.

The Vanguard Group (~8.74%)

Vanguard holds around 8.74% of JetBlue’s stock, making it one of the largest institutional investors. Known for its passive index fund strategies, Vanguard’s influence is less activist but still impactful.

It uses its voting rights to support governance, financial reporting transparency, and long-term shareholder value. Vanguard’s presence ensures broad retail investor exposure to JetBlue through index funds like the S&P 500 and aviation-focused funds.

Dimensional Fund Advisors (~4.79%)

Dimensional Fund Advisors owns approximately 4.8% of JetBlue’s shares. As a firm focused on academic-driven investing, Dimensional avoids short-term speculation and instead emphasizes broad diversification.

Its presence is important for stability, ensuring that JetBlue benefits from investors who are less likely to sell during turbulent market conditions.

State Street Global Advisors (~3.36%)

State Street, with a stake of about 3.36%, is one of the “Big Three” asset managers alongside BlackRock and Vanguard. Its ownership comes through index funds, ETFs, and institutional portfolios.

While not an activist investor, State Street frequently engages with companies to improve corporate governance and diversity initiatives. Its holdings ensure JetBlue has the backing of long-term institutional investors.

D. E. Shaw & Co. (~2.94%)

Quant-driven hedge fund D. E. Shaw & Co. controls nearly 2.94% of JetBlue’s shares. Unlike passive investors, D. E. Shaw is more active in trading, seeking opportunities based on algorithms and market inefficiencies. While it does not typically push for board representation, its influence comes from actively trading large volumes, which can affect JetBlue’s share price performance.

Geode Capital Management (~2.13%)

Geode Capital Management owns about 2.13% of JetBlue, representing over 7 million shares. Geode manages index funds on behalf of Fidelity Investments, giving it a strong presence across U.S. equities. Its JetBlue stake, while smaller than Vanguard or BlackRock, provides consistent institutional support and helps balance ownership concentration.

Citadel Advisors (~9 million shares)

Citadel Advisors, a hedge fund founded by Ken Griffin, has significantly increased its JetBlue holdings in 2025, now owning close to 9 million shares. Citadel is known for active trading and market-making strategies. Its ownership suggests confidence in JetBlue’s turnaround efforts, especially as the airline pushes its JetForward restructuring and international expansion.

Susquehanna International (~8.1 million shares)

Susquehanna International Group, a global trading and investment firm, holds about 8.1 million shares of JetBlue. The firm is known for options trading and arbitrage strategies, so its presence highlights the airline’s attractiveness to both long-term and short-term investors. While not a controlling shareholder, Susquehanna’s activity adds liquidity to JetBlue’s stock.

Insider Shareholders (~28.4%)

Executives, directors, and employees together own about 28.4% of JetBlue. This includes CEO Joanna Geraghty, former CEO Robin Hayes, and other key leaders. Insider ownership aligns management with shareholders, ensuring that decision-makers have a vested interest in JetBlue’s success.

Among insiders, Vladimir Galkin stands out with his 10% ownership, making him one of the most influential individuals connected to the airline.

Retail Investors (~27.7%)

Retail investors hold nearly 27.7% of JetBlue’s stock, reflecting the airline’s popularity among individual shareholders. Many small investors gained exposure through trading platforms and index funds. Their collective voice is significant, particularly in proxy votes where retail investors are becoming more active. This dispersed base provides balance against concentrated institutional influence.

Who is the CEO of JetBlue?

Joanna Geraghty has served as JetBlue’s CEO since February 12, 2024, succeeding Robin Hayes. She made history as the first woman to lead a major U.S. airline, a milestone widely recognized in the industry. Her appointment reflects JetBlue’s commitment to leadership diversity.

Tenure and Career Path

Geraghty joined JetBlue in 2005, starting in the legal and regulatory division before moving into operational and customer-focused leadership roles. She became Chief People Officer between 2010 and 2014, where she redefined JetBlue’s approach to workplace culture and employee relations.

From there, she moved into customer experience leadership, overseeing airports, customer support, and in-flight services, helping JetBlue strengthen its reputation as a customer-friendly airline.

In 2018, she was named President and Chief Operating Officer, managing the airline’s daily operations and strategic planning until her promotion to CEO. This long journey through different departments gave her a deep understanding of both JetBlue’s people and its business model.

Strategic Vision and Leadership Priorities

As CEO, Geraghty has introduced JetBlue’s JetForward turnaround strategy, which focuses on restoring profitability after several challenging years. The plan includes reducing operating costs, streamlining routes, and focusing more on profitable markets.

She has also emphasized JetBlue’s push into premium services, such as airport lounges in New York and Boston, and the introduction of first-class seating beginning in 2026.

While JetBlue’s long-term growth remains important, Geraghty has made it clear that stabilizing financial performance is the top priority. She has also addressed industry rumors by confirming that, despite JetBlue’s new loyalty program partnership with United Airlines, the company has no plans to merge and intends to remain an independent airline.

Operational and Cultural Leadership

Geraghty’s leadership style blends operational discipline with JetBlue’s trademark culture of customer-first service. She has worked to balance employee satisfaction with efficiency and profitability.

Under her guidance, JetBlue continues to invest in sustainability initiatives, aiming to reduce emissions and modernize its fleet with more fuel-efficient aircraft. Her cultural focus ensures that the airline retains its identity as a customer-centric brand, even while pursuing necessary cost controls.

JetBlue has also gained recognition for its ESG leadership, particularly in gender diversity, governance, and sustainability practices.

Industry Recognition and Board Roles

Geraghty’s role as the first woman to head a major U.S. airline has drawn widespread recognition across the aviation industry. She is seen as a role model for inclusive leadership and has been honored for her contributions to corporate responsibility and sustainability.

In addition to her role at JetBlue, she serves on several boards, including the JetBlue Foundation, Airlines for America (A4A), and L3Harris Technologies. She also chairs the board of Concern Worldwide, reflecting her commitment to humanitarian and global development causes.

These roles strengthen her influence both inside and outside the aviation industry, positioning her as one of the most impactful leaders in the sector.

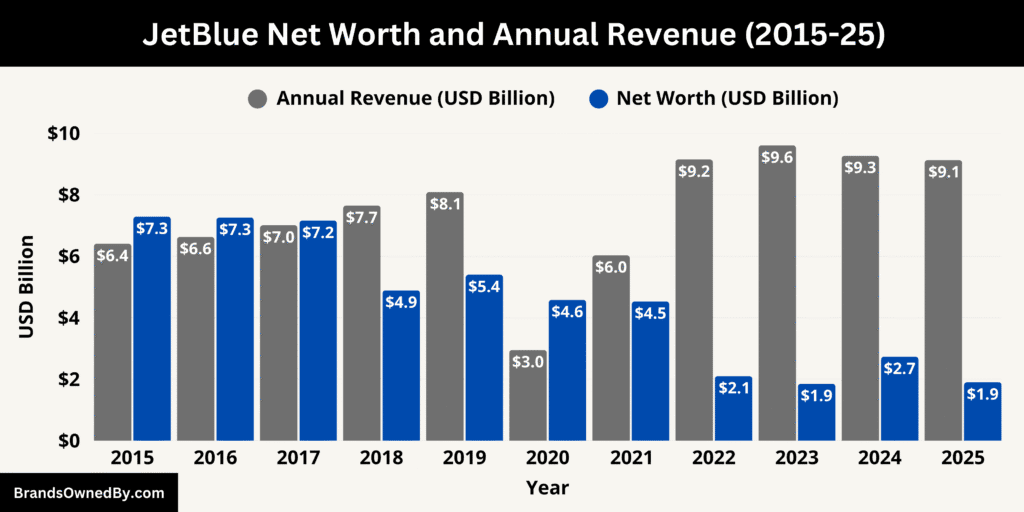

JetBlue Annual Revenue and Net Worth

In 2025, JetBlue continues to generate strong top-line performance, with annual revenue surpassing $9 billion. However, its market capitalization remains relatively constrained, over $1.9 billion as of August 2025.

JetBlue 2025 Revenue

As of mid-2025, JetBlue’s trailing twelve-month revenue stands at approximately $9.13 billion, reflecting a slight decline from $9.28 billion recorded in the full fiscal year of 2024. The drop in revenue highlights the airline’s ongoing efforts to rebound from industry-wide pressures and pandemic-related turbulence while continuing to invest in its turnaround strategy.

Quarter-by-quarter, the airline generated about $2.36 billion in revenue during Q2 2025, marking a modest decline compared to the same quarter in the prior year.

JetBlue’s revenue levels around $9 billion over recent years, represent a recovery toward pre-pandemic volumes, although growth remains modest. In 2023, the company achieved about $9.61 billion, followed by a dip in 2024. The downward trend of roughly 1.5% year-over-year into 2025 underscores the challenging environment of fuel prices, labor costs, and still-recovering demand.

Despite these pressures, revenue initiatives tied to JetBlue’s JetForward strategy helped lift operational performance through late 2024, setting the stage for stabilized styling in 2025.

Below is an overview of the historical revenue and net worth of JetBlue:

| Year | Annual Revenue (USD billions) | Market Capitalization (USD billions) |

|---|---|---|

| 2015 | 6.41 | 7.29 |

| 2016 | 6.63 | 7.26 |

| 2017 | 7.01 | 7.16 |

| 2018 | 7.65 | 4.89 |

| 2019 | 8.09 | 5.40 |

| 2020 | 2.95 (pandemic drop) | 4.58 |

| 2021 | 6.03 | 4.53 |

| 2022 | 9.15 | 2.10 |

| 2023 | 9.61 | 1.85 |

| 2024 | 9.27 | 2.73 |

| 2025 (TTM) | ≈9.13 | ≈1.84 –1.90 |

JetBlue 2025 Net Worth

JetBlue’s net worth, as measured by market capitalization, hovers around $1.9 billion in mid-August 2025. This valuation places JetBlue in the small-cap tier among publicly traded airlines, signaling modest investor expectations and reflecting ongoing recovery challenges.

Market cap has ranged from $1.84 billion to $1.93 billion depending on the data source and date, but generally remains under $2 billion.

With trailing-12-month revenues just over $9 billion and a market value under $2 billion, JetBlue trades at a low price-to-sales ratio compared to larger legacy carriers. This valuation reflects investor caution, as the airline seeks to regain profitability amid restructuring and cost pressures.

The gap between robust revenue figures and relatively low market cap underscores volatility in the sector and the need for sustained improvements in margins and investor confidence.

Companies Owned by JetBlue

Below is a list of the major companies and brands owned by JetBlue as of 2025:

| Company / Brand | Year Established / Acquired | Ownership (2025) | Role & Operations | Current Status |

|---|---|---|---|---|

| Paisly (formerly JetBlue Travel Products) | 2018 (as JetBlue Travel Products), rebranded 2025 | 100% wholly owned | Provides non-air travel services including hotels, car rentals, cruises, and loyalty-linked travel offers; operates tech platform with 24/7 customer support. | Active subsidiary |

| JetBlue Ventures | 2016 | Sold in 2025 to SKY Leasing; JetBlue retains strategic ties | Corporate venture capital arm investing in 55+ travel, hospitality, and transportation startups; brand continues under licensing. | Operates under SKY Leasing with JetBlue as strategic partner |

| JSX (formerly JetSuiteX) | JetBlue invested in 2016 | Minority stake (~10%) | Premium hop-on jet service offering regional flights with private jet–like experience; JetBlue has board representation. | Active; JetBlue retains equity interest |

| LiveTV | Acquired early 2000s, sold 2014 | No longer owned | Developed in-flight seatback entertainment, satellite TV, and wireless services for JetBlue and other airlines. | Sold to Thales in 2014 for ~$400M |

| TWA Hotel (JFK Airport) | Investment around 2019 | Minority stake (5–10%) | Landmark adaptive reuse of the TWA Flight Center into a luxury hotel; located at JetBlue’s JFK hub. | Active; JetBlue remains a minority investor |

Paisly

Paisly is a wholly-owned subsidiary of JetBlue that operates as a tech-enabled, managed travel services company. It evolved from JetBlue Travel Products and rebranded in 2025 to emphasize a human-first, technology-driven experience. Paisly handles every aspect of non-air travel offerings—from hotel contracting and marketing to customer care—using a proprietary platform tailored for the airline industry.

A hallmark of the brand is its 24/7 “Helpful Humans” team, delivering personalized, high-touch support combined with real-time offers and loyalty integrations. Paisly is expanding its reach beyond flights to cruises as well, having recently added partners like Holland America Line, Cunard, Virgin Voyages, and Oceania Cruises.

Through Paisly, JetBlue deepens its loyalty-linked offerings while maintaining full control over customer experience, supplier relationships, and brand consistency.

JetBlue Ventures

JetBlue Ventures began in 2016 as JetBlue’s corporate venture capital arm, focused on investing in early-stage startups working across travel, hospitality, and transportation technologies.

Over nearly a decade, it backed more than 55 startups, made over 40 follow-on investments, and supported eight exits through acquisitions or public listings.

In May 2025, JetBlue sold this subsidiary to SKY Leasing, an aviation investment manager, though JetBlue retained strategic ties. Under a licensing agreement, the JetBlue Ventures brand continues, with JetBlue serving as a strategic partner and maintaining its investment stakes in existing portfolio companies.

The team, led by Amy Burr, continues to operate under SKY Leasing’s ownership. This move allowed JetBlue to refocus on its core airline operations while maintaining access to innovation and emerging technologies.

JSX

JetBlue holds a minority equity investment in JSX, formerly known as JetSuiteX. In 2016, JetBlue invested in JSX as part of its strategy to pursue innovative, regional, and differentiated travel services, particularly on the West Coast.

This stake included a seat on the board. By 2018, JetBlue’s ownership remained around 10%. JSX provides a premium, hop-on jet service distinct from traditional commercial flights.

Although not a fully owned subsidiary, this strategic investment strengthens JetBlue’s connection to evolving customer segments and service models.

LiveTV

LiveTV was a JetBlue-owned subsidiary acquired in the early 2000s to deliver seat-back entertainment, satellite TV, and radio services for its aircraft and those of other airlines.

It was a significant value-add for in-flight experience enhancement at the time. In 2014, JetBlue sold LiveTV to Thales in a cash transaction worth approximately $400 million.

While LiveTV is no longer under JetBlue ownership, it represented an early venture into diversified in-flight services.

JSX, LiveTV, and TWA Hotel Involvement

Although not wholly controlled entities today, JetBlue has had strategic involvement with other brands. JSX, as noted, remains a minority stakeholder. LiveTV was once an in-flight technology subsidiary but is now sold.

JetBlue also holds a minority ownership stake (5–10%) in the TWA Hotel at JFK—an adaptive reuse of the historic TWA Flight Center turned into a luxury hotel. While not a core airline brand, this investment aligns JetBlue with a high-profile landmark adjacent to its hub terminal.

Conclusion

JetBlue is a unique airline that blends affordability with comfort. Since its founding, it has grown into one of the most influential low-cost carriers in the U.S. JetBlue is not owned by one entity but by a mix of institutional and individual investors. With Joanna Geraghty as CEO and major shareholders like Vanguard and BlackRock, the company’s future remains strong. Understanding who owns JetBlue gives insight into how decisions are made and how the airline continues to compete in a challenging industry.

FAQs

Who owns JetBlue Airways?

JetBlue Airways is a publicly traded company listed on the NASDAQ under the ticker JBLU. It is not owned by a single entity but by a mix of institutional investors, mutual funds, and individual shareholders. Major investors include Vanguard Group, BlackRock, and other financial institutions.

Which company owns JetBlue?

No single company owns JetBlue. It is an independent, publicly traded airline. The largest stakes are held by investment firms such as The Vanguard Group and BlackRock.

Is JetBlue owned by Delta?

No, JetBlue is not owned by Delta Air Lines. Delta is one of JetBlue’s competitors in the U.S. airline industry.

Is JetBlue owned by American Airlines?

No, JetBlue is not owned by American Airlines. The two airlines had a Northeast Alliance (NEA) partnership, but this alliance was terminated in 2023 after a court ruling.

Who is the largest shareholder of JetBlue?

As of 2025, the largest shareholder of JetBlue is The Vanguard Group, which holds around 11–12% of the company’s shares.

Did United buy JetBlue?

No, United Airlines did not buy JetBlue. JetBlue remains independent and has not been acquired by any U.S. legacy airline.

Who was the original owner of JetBlue?

JetBlue was founded in 1998 by David Neeleman, a Brazilian-American entrepreneur. He was the original visionary and owner behind the creation of the airline.

Who is the new partner of JetBlue?

As of 2025, JetBlue has expanded codeshare and interline agreements with several global airlines. Recent partnerships include Emirates, Qatar Airways, and others. The airline continues building alliances to enhance international connectivity after the NEA with American Airlines ended.

Is JetBlue made by Boeing?

No, JetBlue aircraft are not made by Boeing. The airline primarily operates a fleet of Airbus aircraft.

How many planes does JetBlue have?

As of 2025, JetBlue operates a fleet of around 290 aircraft, primarily consisting of Airbus A320, A321, A220 models, and Embraer 190 jets.

Are JetBlue and Emirates partners?

Yes, JetBlue and Emirates are partners. Their codeshare agreement allows JetBlue passengers to connect seamlessly to Emirates’ global network through New York (JFK) and Boston (BOS).

Is Qatar Airways a JetBlue partner?

Yes, JetBlue and Qatar Airways have a strong codeshare and interline partnership. This provides JetBlue customers access to Qatar’s extensive Middle Eastern, Asian, and African routes.

Is JetBlue a Boeing or Airbus?

JetBlue is primarily an Airbus airline. It operates A320s, A321neos, and A220s. It does not fly Boeing aircraft.

What’s David Neeleman’s net worth?

As of 2025, David Neeleman’s net worth is estimated at around $400–500 million. He earned much of his wealth through founding JetBlue, Azul Brazilian Airlines, and other aviation ventures.

Who is the founder of JetBlue?

David Neeleman founded JetBlue in 1998. He later went on to create other airlines, including Azul Brazilian Airlines and Breeze Airways.

Does JetBlue have a parent company?

No, JetBlue does not have a parent company. It operates independently as a publicly traded corporation.

Where is JetBlue headquartered?

JetBlue is headquartered in Long Island City, New York, near John F. Kennedy International Airport.