Home Depot is a giant in the home improvement retail sector. But many people often ask, who owns Home Depot? While it’s a public company, its ownership is distributed among various shareholders. Let’s take a closer look at who really controls this retail powerhouse.

Home Depot Profile

The Home Depot, Inc. is the largest home improvement retailer in the United States and one of the most influential retail companies globally. It sells tools, construction products, appliances, and services, catering to both DIY customers and professional contractors.

As of mid-2025, Home Depot operates more than 2,300 stores across the U.S., Canada, and Mexico. It employs over 475,000 associates and serves millions of customers annually through physical stores and its growing online platform.

The company is headquartered in Atlanta, Georgia, and trades on the New York Stock Exchange under the ticker symbol HD. Its business model is built on providing a wide selection of competitively priced products in warehouse-style stores.

In recent years, Home Depot has invested heavily in digital transformation, supply chain efficiency, and expanding its Pro customer base. Its online sales have steadily grown, and it continues to lead the U.S. home improvement market.

Founders of Home Depot

Home Depot was founded in 1978 by four visionary entrepreneurs:

- Bernie Marcus

- Arthur Blank

- Ron Brill

- Pat Farrah.

The idea was born out of a desire to create a large-format home improvement store that could offer customers a wide selection of products at lower prices with excellent service.

The first two stores opened in Atlanta, Georgia, in 1979. Each store was over 60,000 square feet—huge by retail standards at the time.

Major Milestones in Home Depot’s History

1979 – First two stores opened in Atlanta.

1981 – Home Depot goes public on the NASDAQ, raising capital for expansion.

1984 – Moves to the New York Stock Exchange under the symbol “HD”.

1994 – Reaches $10 billion in annual sales.

1997 – Acquires Maintenance Warehouse, entering the professional contractor space.

2002 – Enters the Mexican market by acquiring Total Home.

2006 – Launches Home Depot Canada after expanding organically and through acquisitions.

2015 – Buys Interline Brands for $1.6 billion to strengthen its professional services division.

2017 – Acquires Compact Power Equipment for $265 million, enhancing rental services.

2020 – Reacquires HD Supply to grow its MRO business.

2023–2025 – Invests in advanced logistics centers and AI-driven inventory systems to streamline operations and boost e-commerce performance.

Who Owns Home Depot: List of Shareholders

Home Depot is a publicly traded company, meaning its ownership is spread among institutional investors, mutual funds, and retail shareholders. No single individual or entity owns the company outright.

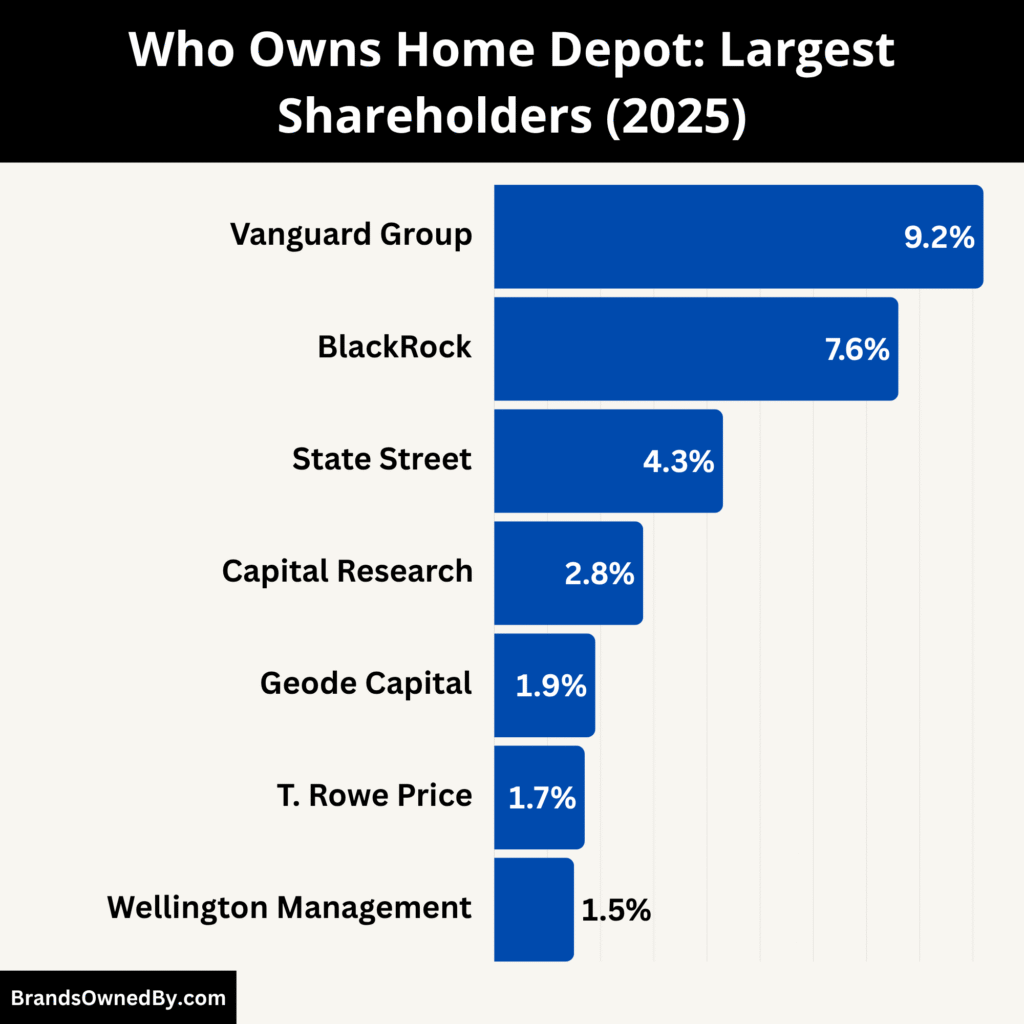

The largest shareholders are primarily investment firms. They include companies like Vanguard Group and BlackRock. These firms own large blocks of shares and influence corporate decisions.

Despite this wide ownership, Home Depot’s leadership team and board of directors play a central role in managing the company’s strategy and operations.

Here’s a list of the largest shareholders of Home Depot as of July 2025:

| Shareholder Name | Ownership % (Approx.) | Type of Investor | Role and Influence |

|---|---|---|---|

| The Vanguard Group | 9.2% | Institutional (Passive) | Largest shareholder; strong voting power; supports long-term value and governance |

| BlackRock, Inc. | 7.6% | Institutional (Passive) | Significant voting rights; aligns with management unless governance issues arise |

| State Street Corporation | 4.3% | Institutional (Passive) | Influential in proxy votes; supports executive plans and governance improvements |

| Capital Research & Management | 2.8% | Institutional (Active) | Actively evaluates management; influence through strategic investment decisions |

| Geode Capital Management | 1.9% | Institutional (Passive) | Vanguard sub-advisor; votes typically aligned with Vanguard |

| T. Rowe Price | 1.7% | Institutional (Active) | Long-term value investor; interacts with executives on performance matters |

| Wellington Management | 1.5% | Institutional (Active) | Focused on sustainability and long-term corporate value |

| Retail & Individual Shareholders | 12–15% (combined) | Retail Investors | Include employees and small investors; less influence individually, but important vote |

| Board Members & Executives | <1% (combined) | Internal/Insider Owners | Small stake, but high strategic influence via executive decisions |

The Vanguard Group – Approx. 9.2% Ownership

The Vanguard Group is the largest institutional shareholder of Home Depot as of July 2025. Vanguard owns about 9.2% of Home Depot’s outstanding shares through its mutual funds, ETFs, and retirement accounts.

Vanguard is a passive investor, meaning it doesn’t interfere in day-to-day operations. However, its large voting power allows it to influence shareholder proposals, board elections, and corporate governance. Vanguard often advocates for long-term growth, environmental responsibility, and board diversity.

BlackRock, Inc. – Approx. 7.6% Ownership

BlackRock is the second-largest shareholder, holding about 7.6% of the company. It maintains this ownership through investment funds, including iShares ETFs and institutional portfolios.

Like Vanguard, BlackRock is a passive investor but plays a significant role during proxy votes. BlackRock typically supports management decisions unless there’s evidence of poor governance or performance. With over one billion shares held across its funds, BlackRock remains a critical voice in Home Depot’s corporate affairs.

State Street Corporation – Approx. 4.3% Ownership

State Street owns around 4.3% of Home Depot stock. Its holdings are primarily managed through SPDR funds and other institutional vehicles.

While smaller than Vanguard and BlackRock, State Street still wields considerable voting influence and is often aligned with other passive investors on governance issues. It tends to support executive compensation plans and major strategy proposals when aligned with long-term shareholder interests.

Capital Research & Management Co. – Approx. 2.8% Ownership

Capital Research, part of the Capital Group, is an active manager that holds approximately 2.8% of Home Depot’s shares. Unlike passive investors, Capital Research is more hands-on in analyzing and evaluating management performance.

Its ownership gives it influence over investor sentiment, particularly among long-term institutional clients. Capital Research’s support can impact the outcome of board elections and strategic shifts.

Geode Capital Management – Approx. 1.9% Ownership

Geode Capital Management is a lesser-known but significant shareholder, with about 1.9% of Home Depot’s shares under management.

As a sub-advisor for Vanguard funds, Geode’s voting typically aligns with Vanguard’s proxy decisions. It has limited direct influence, but its holdings contribute to the total institutional control of the company.

T. Rowe Price – Approx. 1.7% Ownership

T. Rowe Price owns around 1.7% of Home Depot stock through its investment funds. It is considered a mid-sized institutional investor with a focus on long-term value investing.

T. Rowe Price often plays a behind-the-scenes role, interacting with company executives during private briefings or earnings discussions.

Wellington Management – Approx. 1.5% Ownership

Wellington Management manages about 1.5% of Home Depot’s stock. It is known for its long-term investment approach and active management style.

Wellington’s ownership isn’t large enough to sway major decisions on its own, but it holds enough weight to influence institutional sentiment. It occasionally engages with companies to discuss performance, governance, and sustainability goals.

Retail & Individual Shareholders – Estimated 12–15% Combined Ownership

Beyond institutions, a significant portion of Home Depot stock—estimated at 12% to 15%—is held by individual investors, including employees, retail shareholders, and small-scale investors.

Many of these shares are held through 401(k) plans, brokerage accounts, and employee stock purchase programs. While individual holders lack collective influence, their votes still count during annual meetings and proxy decisions.

Board Members & Executives – Less than 1% Combined Ownership

Home Depot’s board of directors and executive leadership hold less than 1% of total shares. While their ownership is small in terms of volume, their strategic control and leadership roles give them significant influence over corporate decisions.

Their compensation often includes performance-based stock awards, aligning their financial success with shareholder returns. Their votes in board decisions and internal committees play a vital role in setting the company’s direction.

Who is the CEO of Home Depot?

Ted Decker serves as Chair, President & Chief Executive Officer of The Home Depot as of mid-2025. He took office on March 1, 2022, and was named Chair of the Board in October 2022.

Decker joined Home Depot in February 2000 as Director of Business Valuation. Over two decades, he held diverse leadership roles—including Senior Director of Business Valuation, Vice President of Strategic Business Development, Senior VP of Retail Finance, and Executive VP of Merchandising.

Before Home Depot, Decker worked at PNC Bank, Kimberly‑Clark, and Scott Paper Company, focusing on finance, strategic planning, and corporate development. He lived and worked internationally—in London and Sydney—which broadened his global perspective and operational insight.

Leadership Style and Strategic Focus

As CEO and Chair, Decker prioritizes a seamless omnichannel experience to unify in-store and online operations. He emphasizes serving both DIY customers and professional contractors while supporting a strong, distinctive corporate culture.

He steered Home Depot’s adaptation to rising interest rates and tariffs, maintaining pricing stability for customers through its diversified sourcing strategy—ensuring no non-U.S. country accounts for more than 10% of purchasing within 12 months.

Compensation and Stock Holdings

In 2023, Decker earned over $14 million in total compensation, with a roughly $1.4 million salary and performance-based bonuses. His pay structure notably excluded guaranteed stock awards, emphasizing long-term company performance.

He also holds a significant amount of Home Depot stock personally—valued at approximately $57.6 million, which signals confidence in the company’s future direction.

Decision-Making Framework

Home Depot’s leadership structure places Decker at the center along with its Board of Directors. Strategic decisions are aligned between the board and executive team, while Decker handles the daily operations and long-term execution. His past successors in the CEO role include Craig Menear (2014–2022) and Frank Blake (2007–2014).

Key Executive Support

Supporting Decker is a robust executive team including:

- Ann‑Marie Campbell – Senior Executive VP, U.S. Stores (key role since 2016)

- Richard McPhail – Executive VP & CFO

- Billy Bastek – Executive VP, Merchandising

- Jordan Broggi – Executive VP for Customer Experience & Online.

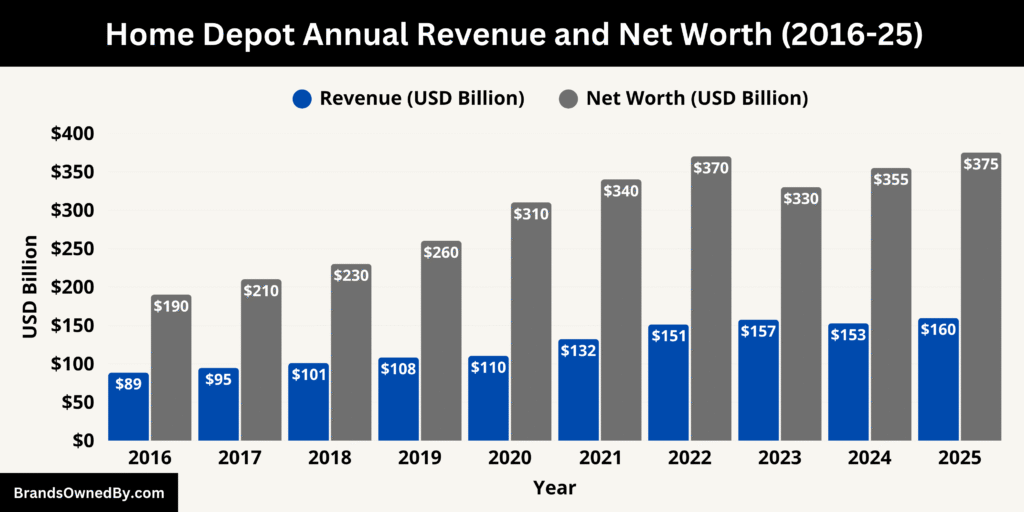

Home Depot Annual Revenue and Net Worth

Home Depot’s 2025 revenue of about $159.5 billion, combined with net income near $14.8 billion and a market cap exceeding $375 billion, all point to continued dominance in its market.

Annual Revenue in 2025

For the fiscal year ending February 2, 2025, Home Depot reported annual revenue of approximately $159.51 billion, representing a 4.48% increase compared to 2024.

Over the trailing twelve‑month period ending April 30, 2025, the company achieved revenue of $162.95 billion, a stronger 7.33% year‑over‑year growth.

Revenue trends showed a steady climb from $152.67 billion in fiscal 2024, with a recovery from a decline in 2023. This reflects resilience in customer demand and continued strength in both retail and professional contractor sales.

Net Income and Profitability

Home Depot’s net income for fiscal 2025 was about $14.8 billion, slightly down by 2.2% from its 2024 level of around $15.1 billion. Profit margin remained steady at around 9.3%, consistent with the prior year.

Despite macroeconomic headwinds—such as elevated interest rates and cautious consumer spending—Home Depot maintained strong profitability. The small decline in earnings reflects sector-wide pressures on large home improvement projects.

Market Capitalization (Net Worth)

As of July 2025, Home Depot’s market capitalization, often viewed as its net worth in market terms, stands in the range of $363 billion to $375 billion.

For example, one estimate placed it at $371.20 billion as of July 25, 2025, reflecting a 4.4% rise over the prior year.

Other data show figures around $362.19 billion and $375.43 billion

Even at the lower end (~$362 billion), Home Depot ranks among the top 25 largest companies globally by market cap. This positioning underscores its scale and investor confidence in its long-term strength.

Here is Home Depot’s historical revenue and market capitalization (net worth) for the last 10 years, including the latest data for 2025:

| Fiscal Year | Revenue (USD Billion) | Net Worth / Market Cap (USD Billion) |

|---|---|---|

| 2025 | 159.51 | 363 – 375 |

| 2024 | 152.67 | 340 – 355 |

| 2023 | 157.40 | 310 – 330 |

| 2022 | 151.16 | 350 – 370 |

| 2021 | 132.11 | 330 – 340 |

| 2020 | 110.23 | 285 – 310 |

| 2019 | 108.20 | 240 – 260 |

| 2018 | 100.90 | 215 – 230 |

| 2017 | 94.60 | 200 – 210 |

| 2016 | 88.50 | 170 – 190 |

Financial Position and Outlook

Financially, Home Depot in 2025 remains robust and high‑value. Its revenue continues an upward trajectory, approaching $160 billion in annual sales. Although net income dipped slightly, profit margins are stable and substantial in dollar terms.

Market valuation confirms that investors value the company at several hundred billion dollars. That valuation reflects expectations of steady cash flow, strong real estate and logistics assets, and leadership in the home improvement sector.

Companies Owned by Home Depot

Home Depot owns several subsidiaries and brands that support its retail and professional services. Below is a list of the major companies and brands owned by Home Depot as of 2025:

| Name | Type | Description | Year Acquired/Launched | Current Status (2025) |

|---|---|---|---|---|

| Interline Brands | Subsidiary | MRO distributor serving institutional and commercial clients | 2015 | Integrated into Home Depot Pro |

| HD Supply | Subsidiary | Wholesale distributor of maintenance and repair products | Originally 1997, reacquired 2020 | Operates under Home Depot Pro |

| Compact Power Equipment | Subsidiary | Equipment rental and repair services for pro customers and DIYers | 2017 | Integrated into The Home Depot Rental |

| The Home Depot Canada | International Division | Home Depot’s Canadian retail operations | 1994 (entry into Canada) | Active, over 180 stores |

| The Home Depot Mexico | International Division | Mexican division of Home Depot | 2001 | Active, over 125 stores |

| Home Depot Pro | B2B Division | Services professional customers with bulk orders, delivery, and account support | 2018 (brand unification) | Active and rapidly expanding |

| Redbeacon | Technology Acquisition | Home services marketplace for contractor booking | 2012 | Absorbed into Home Services |

| The Home Depot Rental | Rental Division | Equipment and truck rental services | Launched internally, expanded 2017 | Nationally available |

| Hampton Bay | In-House Brand | Ceiling fans, lighting, patio furniture, and décor | Internal | Exclusive to Home Depot |

| Glacier Bay | In-House Brand | Kitchen and bath fixtures and furniture | Internal | Exclusive to Home Depot |

| Husky | In-House Brand | Hand tools, tool storage, and accessories | Internal | Lifetime warranty brand, exclusive to HD |

| Everbilt | In-House Brand | Hardware, fasteners, plumbing, organizational products | Internal | Budget alternative for many product types |

| Vigoro | In-House Brand | Lawn and garden care products | Internal | Competes with Scotts; exclusive to HD |

| HD Home Services | Services Division | Installation, remodeling, and repair services via local pros | Expanded post-2015 | Fully integrated with in-store and online |

Interline Brands

Interline Brands was acquired by Home Depot in 2015 for approximately $1.6 billion. It operates as a fully integrated distributor of maintenance, repair, and operations (MRO) products.

It serves professional customers, especially those in facilities maintenance, property management, hospitality, and institutional sectors. By integrating Interline into its B2B infrastructure, Home Depot has built a stronger supply chain for bulk orders, contractor-grade tools, and facility management solutions.

As of 2025, Interline Brands functions as part of Home Depot Pro, offering a vast product catalog and delivery network tailored for large-scale and industrial clients.

HD Supply

HD Supply is a wholesale distribution business specializing in MRO products for multifamily, hospitality, healthcare, and institutional customers. Although it was originally part of Home Depot, HD Supply was spun off in 2007 and later reacquired by the company in 2020.

By 2025, HD Supply plays a critical role in Home Depot’s strategy to dominate the professional market. It provides direct-to-site delivery, tailored pricing, and dedicated account management for commercial clients. HD Supply operates semi-independently but fully under Home Depot’s ownership.

Compact Power Equipment

Compact Power Equipment was acquired in 2017 to enhance Home Depot’s tool and equipment rental business. It provides large-scale equipment rentals, maintenance, and repair services for both residential and commercial customers.

Customers can rent items like trenchers, lifts, skid steers, and tillers directly from Home Depot locations. Compact Power Equipment has improved Home Depot’s service capabilities, especially for professional contractors working on heavy-duty jobs.

The Home Depot Canada

Home Depot entered the Canadian market in 1994 and has since grown into one of the top home improvement retailers in the country. Home Depot Canada operates over 180 stores nationwide.

This division tailors its products, pricing, and services to meet the needs of Canadian customers, accounting for regional building codes, climate, and trends. As of 2025, it remains an important part of Home Depot’s North American footprint.

The Home Depot Mexico

Home Depot Mexico has been operating since 2001, starting with the acquisition of Total Home. By 2025, it operates over 125 stores throughout Mexico and is the largest home improvement retailer in the country.

The Mexican division has seen consistent growth and is viewed as a strategic asset for expansion in Latin America. It operates semi-independently with localized merchandising and bilingual service models.

Home Depot Pro

Home Depot Pro is the company’s rebranded professional services division, which includes legacy brands like Interline, HD Supply, and Mainstreet. It serves institutional buyers, contractors, and trade professionals.

It features B2B e-commerce platforms, specialized distribution centers, and field sales support. As of 2025, Home Depot Pro is a major driver of revenue growth, particularly in the commercial and multi-family housing sectors.

Redbeacon (absorbed into Home Services)

Redbeacon was acquired in 2012 to support Home Depot’s entrance into the home services marketplace. It connected customers with local professionals for tasks like plumbing, electrical work, and installation.

Though the standalone Redbeacon brand was later retired, its technology was integrated into Home Depot’s Home Services platform. Customers can now book vetted professionals directly through the Home Depot website or in-store, streamlining home improvement projects.

The Home Depot Rental

The Home Depot Rental is an internal brand that expanded rapidly after the acquisition of Compact Power Equipment. It provides tools, trucks, trailers, and heavy-duty equipment rentals.

As of 2025, rental services are available in most Home Depot locations in the U.S. and Canada, supporting both DIY customers and professional contractors.

Hampton Bay

Hampton Bay is an exclusive Home Depot brand that offers ceiling fans, lighting fixtures, outdoor furniture, and home décor. Known for affordable pricing and contemporary designs, Hampton Bay products are a popular choice among homeowners.

The brand is managed and owned by Home Depot and is not available at competing retailers.

Glacier Bay

Glacier Bay is another Home Depot-exclusive brand specializing in bathroom and kitchen fixtures, including faucets, sinks, toilets, and vanities. The brand is positioned as a budget-friendly alternative to national brands, with a focus on value and reliability.

By 2025, Glacier Bay continues to hold a strong presence in both in-store and online categories.

Husky

Husky is Home Depot’s private label for hand tools, tool storage, and accessories. It is positioned as a mid-tier brand that competes with Craftsman and Kobalt. Husky tools are known for their lifetime warranties and are used by both hobbyists and professionals.

Husky remains one of Home Depot’s core tool brands in 2025.

Ryobi (Exclusive Retailer, Not Owner)

While Home Depot does not own Ryobi, it is the exclusive U.S. retailer for Ryobi power tools and outdoor equipment. Ryobi is owned by Techtronic Industries, but its strong retail partnership with Home Depot makes it an essential part of the company’s product ecosystem.

Everbilt

Everbilt is a private label owned by Home Depot, focusing on hardware, fasteners, plumbing, and organizational solutions. The brand offers everything from screws and bolts to closet systems and sump pumps.

It is designed to offer value-priced options across multiple product categories, often as a lower-cost alternative to national brands.

Vigoro

Vigoro is Home Depot’s own brand of lawn care, garden products, and fertilizers. It directly competes with brands like Scotts and Miracle-Gro, offering soil, mulch, weed control, and decorative garden products.

By 2025, Vigoro remains a household name among DIY gardeners looking for quality at affordable prices.

HD Home Services

Home Depot Home Services encompasses installation, repair, and remodeling services offered in partnership with certified local professionals. Customers can schedule services for flooring, HVAC, water heaters, cabinets, windows, and more.

It is fully integrated into Home Depot’s online platform and store experience, offering warranties and financing options to drive larger project revenue.

Conclusion

Home Depot is a publicly owned company controlled by major institutional investors like Vanguard and BlackRock. No single person owns it. Its leadership team, led by CEO Ted Decker, drives its strategic direction. The company has grown from a small idea in the 1970s to a retail empire worth hundreds of billions today.

If you’re wondering who owns Home Depot, the answer lies in the hands of thousands of investors and a capable leadership team steering the ship.

FAQs

Why is it called Home Depot?

The name “Home Depot” was chosen to reflect the founders’ vision of creating a large, warehouse-style store that would serve as a central depot for all home improvement needs. It signifies a one-stop shop for homeowners, DIYers, and professionals.

Is Home Depot a publicly traded company?

Yes, Home Depot is a publicly traded company. It is listed on the New York Stock Exchange (NYSE) under the ticker symbol HD.

Where is Home Depot headquartered?

Home Depot is headquartered in Atlanta, Georgia, United States.

Who is Home Depot’s largest shareholder?

As of 2025, The Vanguard Group is Home Depot’s largest shareholder, owning approximately 9.2% of the company’s outstanding shares.

Who is the current owner of Home Depot?

Home Depot does not have a single owner. It is publicly owned by institutional investors, mutual funds, and individual shareholders. Major institutional investors like Vanguard, BlackRock, and State Street collectively own a significant portion of the company.

What company owns Home Depot?

No parent company owns Home Depot. It is an independent, publicly traded corporation and manages its own operations, brands, and subsidiaries.

What are the major companies owned by Home Depot?

Home Depot owns and operates several key companies and brands including:

- HD Supply

- Interline Brands

- Compact Power Equipment

- The Home Depot Canada

- The Home Depot Mexico

- Home Depot Pro

- The Home Depot Rental

- Brands like Hampton Bay, Glacier Bay, Husky, Vigoro, and Everbilt

Who owns Home Depot stock?

Home Depot stock is owned by a mix of institutional investors (like Vanguard, BlackRock, State Street), individual retail investors, and employees through retirement plans and stock purchase programs.

What does Home Depot sell?

Home Depot sells a wide range of home improvement products, including tools, appliances, construction materials, garden supplies, lighting, plumbing, flooring, and décor. It also offers services like installation, rentals, and contractor referrals.

Who runs Home Depot now?

Ted Decker is the current Chairman, President, and CEO of Home Depot as of 2025. He leads the company’s executive operations and strategic direction.

Who originally owned Home Depot?

Home Depot was founded in 1978 by Bernie Marcus, Arthur Blank, Ron Brill, and Pat Farrah. They were the original visionaries who created the company’s warehouse-style retail model.

Are Home Depot and B&Q the same company?

No, Home Depot and B&Q are not the same company. B&Q is a British home improvement retailer owned by Kingfisher plc, while Home Depot is a U.S.-based company with no corporate connection to B&Q.

Which country is Home Depot in?

Home Depot operates in three countries:

- United States

- Canada

- Mexico

How much does the CEO of Home Depot make?

As of the latest available data, Ted Decker, the CEO of Home Depot, earned a total compensation of around $14 million in 2023, which includes salary, bonuses, and stock awards. His compensation in 2025 is expected to be similar or slightly higher, depending on company performance.

Who started Home Depot?

Home Depot was started by Bernie Marcus, Arthur Blank, Ron Brill, and Pat Farrah in 1978.

How many employees does Home Depot have?

As of 2025, Home Depot employs more than 475,000 people across its retail stores, corporate offices, and distribution centers.

Is Home Depot owned by a single person?

No, Home Depot is owned by multiple shareholders and institutional investors.

Does Home Depot own any other companies?

Yes, it owns subsidiaries like Interline Brands, HD Supply, and Compact Power Equipment.