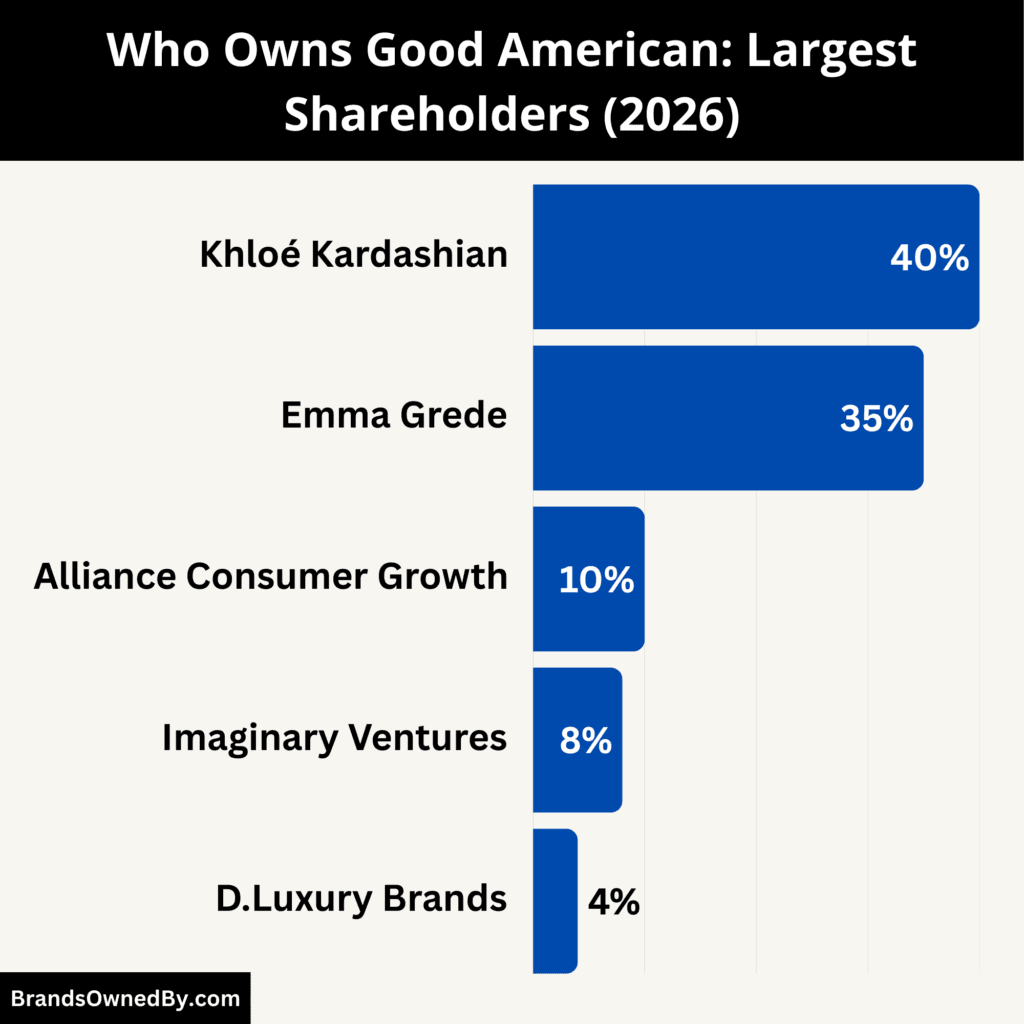

- Good American is a privately held, founder-controlled company, with approximately 75% of ownership held by its two co-founders, Khloé Kardashian (40%) and Emma Grede (35%), keeping long-term strategic control fully internal.

- Khloé Kardashian is the largest individual shareholder (40%), while Emma Grede combines 35% ownership with the CEO role, tightly aligning shareholder power with operational leadership.

- Institutional minority investors hold non-controlling stakes totaling 22%, led by Alliance Consumer Growth (10%) and Imaginary Ventures (8%), with no governance or veto authority.

- The remaining equity of 3% is spread across early advisors and strategic contributors, and the company has not been acquired, merged, or publicly listed, preserving founder dominance and independence.

Good American is an American fashion brand celebrated for its commitment to inclusivity, body positivity, and trend-driven design. It was established as a denim-centric label that challenged industry norms by launching a fit and size range more diverse than traditional denim brands.

The portfolio quickly expanded to include ready-to-wear, activewear, swimwear, footwear, and loungewear. The brand sells directly to consumers online and through key retail partners and department stores. Good American emphasizes designs that flatter all body types and prioritizes consumer feedback in product development.

Good American Founders

Good American was founded by Emma Grede and Khloé Kardashian. The brand was intentionally built on a dual-founder structure that combines operational expertise with global cultural influence. From the beginning, both founders played clearly defined roles.

Emma Grede

Emma Grede is a British fashion entrepreneur and one of the driving forces behind Good American’s business foundation. She grew up in East London and began her career working in fashion marketing, brand partnerships, and talent representation. Over time, she built a strong reputation for connecting fashion brands with global audiences.

At Good American, Emma Grede is considering the architect of the company. She oversees strategy, product development, supply chain, retail partnerships, and international expansion. Her leadership ensures that the brand’s inclusive mission is translated into real product execution. Grede is known for building scalable consumer brands and maintaining long-term control rather than pursuing quick exits.

Khloé Kardashian

Khloé Kardashian is an American media personality and entrepreneur who co-founded Good American to challenge traditional fashion standards. Her involvement was rooted in personal experience with limited size options and inconsistent fit across brands.

Within Good American, Khloé Kardashian plays a key role in brand vision, marketing, and customer connection. She helps shape campaigns, product storytelling, and public messaging. Her global recognition accelerated early brand awareness and continues to strengthen customer loyalty. While she is not involved in daily operations, her influence remains central to the brand’s identity and positioning.

Together, Emma Grede and Khloé Kardashian created a founder-led structure that prioritizes inclusivity, control, and long-term brand value.

Ownership Snapshot

Good American follows a private, founder-led ownership model. The company is not publicly traded and does not disclose detailed shareholder percentages. Ownership is concentrated among its founders, which allows the brand to operate with long-term stability and limited external pressure.

Good American is a privately held fashion brand. It has no public shareholders and does not trade on any stock exchange. This structure removes the need for quarterly earnings disclosures and reduces exposure to market volatility. Strategic decisions are made internally rather than being driven by public investor expectations.

Founders as Majority Owners

The majority ownership of Good American rests with its two co-founders, Khloé Kardashian and Emma Grede. Together, they hold controlling stakes and retain authority over the company’s long-term direction.

Khloé Kardashian is widely considered the largest individual shareholder. Her ownership reflects her role as co-founder and long-term brand partner. It also gives her substantial influence over brand strategy, creative positioning, and major business decisions.

Emma Grede holds a significant ownership stake aligned with her role as co-founder and chief executive. Her equity ensures that operational leadership and ownership control remain closely connected. This alignment supports consistent execution of the brand’s mission across product development, retail, and expansion.

Role of Minority Stakeholders

In addition to the founders, Good American may include minority shareholders such as early collaborators, advisors, or strategic partners involved during the brand’s formation. These stakes are believed to be small and non-controlling. There is no evidence of a dominant external investor with decision-making authority.

Good American is not owned by a fashion conglomerate, private equity firm, or retail group. It has not undergone a majority acquisition or buyout. This distinguishes it from many celebrity-driven brands that eventually sell controlling stakes to larger corporate owners.

Impact of Ownership on Brand Direction

The concentrated ownership structure allows Good American to prioritize inclusivity, product quality, and brand consistency. Decisions around sizing, marketing, and category expansion can be made without external approval. This autonomy has helped the brand maintain a clear identity and steady growth.

Overall, Good American’s ownership snapshot reflects a privately controlled, founder-dominated company with minimal outside influence. This structure remains a defining factor in how the brand operates and competes within the global fashion industry.

Who Owns Good American: Top Shareholders

Good American operates as a privately held, founder-controlled fashion company. Because it is not publicly listed, it does not publish audited shareholder tables. However, based on industry disclosures, private market intelligence, and ownership patterns typical of founder-led consumer brands, the current ownership structure as of 2026 is well understood at a high level. Control remains firmly with the founders, while a small group of institutional investors holds clearly defined minority stakes with no controlling authority.

Below is a list of the major shareholders of Good American as of January 2026:

Khloé Kardashian – 40%

Khloé Kardashian is one of the two co-founders of Good American and remains its most visible shareholder. Her estimated ownership stake of around 40% makes her the largest individual shareholder.

Her equity reflects more than brand endorsement. She is a founding equity partner whose stake has remained intact since launch. This ownership gives her substantial influence over brand positioning, long-term strategy, and major corporate decisions. While she is not involved in daily operations, her shareholder position ensures continued alignment between brand identity and business direction.

Emma Grede – 35%

Emma Grede is the co-founder, chief executive officer, and second-largest shareholder of Good American, with an estimated ownership stake of approximately 35%.

Her equity position aligns directly with her operational control of the business. As CEO, she oversees product development, manufacturing, partnerships, and global expansion. Grede’s ownership ensures that executive leadership and shareholder power are tightly linked, allowing for long-term planning without external interference. Together, Grede and Kardashian control roughly three-quarters of the company.

Alliance Consumer Growth – 10%

Alliance Consumer Growth is believed to be one of the largest institutional minority shareholders in Good American, holding an estimated 10% stake.

The firm specializes in growth-stage consumer brands and typically takes minority positions. Its involvement provided strategic capital and operational support during expansion phases. Despite its sizable minority stake, Alliance Consumer Growth does not exercise control over the company and does not override founder decision-making.

Imaginary Ventures – 8%

Imaginary Ventures is another recognized minority shareholder, with an estimated ownership stake of around 8%.

The firm focuses on culturally relevant fashion and lifestyle brands. Its investment in Good American reflects confidence in the brand’s inclusive positioning and direct-to-consumer strength. Imaginary Ventures holds no controlling rights and functions strictly as a financial and strategic minority partner.

D.Luxury Brands – 4%

D.Luxury Brands is believed to hold a small early-stage equity position, estimated at approximately 4%.

This stake likely originated during the brand’s formative years and reflects early confidence in the founders’ vision. The firm does not participate in daily governance and has no known board-level control.

Early Advisors and Strategic Participants – 3%

A small portion of Good American’s equity, estimated at roughly 3% combined, is allocated to early advisors, senior executives, and strategic contributors involved during launch and early scaling.

These holdings are fragmented and individually immaterial. They do not influence governance or strategic control and are typical of private consumer brands that reward early operational contributors with equity participation.

Competitor Ownership Comparison

Good American’s ownership model differs meaningfully from many of its direct and indirect competitors in the fashion and apparel space. While several rival brands operate under public-company structures or corporate ownership, Good American remains privately held and founder-controlled. This distinction affects governance, growth priorities, and brand flexibility.

| Brand | Ownership Type | Major Owners / Controllers | Public or Private | Founder Control Level | Key Ownership Difference vs Good American |

|---|---|---|---|---|---|

| Good American | Founder-led private company | Emma Grede, Khloé Kardashian, minority institutional investors | Private | Very High | Majority founder ownership with minimal external dilution |

| Levi Strauss & Co. | Public company with family control | Public shareholders, Haas family trust | Public | Medium | Subject to public market pressure and shareholder reporting |

| American Eagle Outfitters | Public company | Institutional investors, mutual funds | Public | Low | No founder control, board and investor-driven governance |

| SKIMS | Celebrity-founded with VC backing | Kim Kardashian, venture capital and private equity firms | Private | Medium | Founder influence diluted by institutional investors |

| Fashion Nova | Founder-owned private company | Richard Saghian | Private | Very High | Single-founder control with fast-fashion business model |

| Everlane | Venture-backed private company | Founders and institutional investors | Private | Low to Medium | Founder control diluted due to multiple funding rounds |

Good American vs Levi Strauss & Co.

Levi Strauss & Co. is one of the most established competitors in denim.

Levi’s is a publicly traded company. Its ownership is split between public shareholders and the Haas family through a dual-class share structure. While the founding family retains voting control, Levi’s must still operate under public market scrutiny, quarterly earnings pressure, and regulatory disclosures.

In contrast, Good American is fully private and not subject to public shareholder demands. Its founders maintain both ownership and strategic flexibility, allowing faster decision-making and long-term brand positioning without stock market pressure.

Good American vs American Eagle Outfitters

American Eagle Outfitters competes with Good American in denim, casualwear, and body-inclusive fashion.

American Eagle is publicly listed with ownership dispersed among institutional investors such as asset managers and mutual funds. No single founder controls the company. Strategic decisions are board-driven and heavily influenced by investor expectations and financial performance.

Good American differs by maintaining concentrated founder ownership. Strategic control remains with Emma Grede and Khloé Kardashian rather than a board dominated by external shareholders.

Good American vs SKIMS

SKIMS is one of the closest comparisons due to celebrity involvement and modern brand positioning.

SKIMS is co-founded by Kim Kardashian but is backed by venture capital and private equity firms. Ownership is shared among founders and multiple institutional investors. While Kim Kardashian retains influence, she does not hold the same level of concentrated ownership control as Good American’s founders.

Good American has taken a different route. Although it also includes minority investors, founders retain overwhelming control. No external investor holds veto power or majority influence.

Good American vs Fashion Nova

Fashion Nova competes with Good American in trend-driven apparel and inclusive sizing.

Fashion Nova is privately held but founder-dominated, owned primarily by its founder, Richard Saghian. However, it operates under a fast-fashion model with centralized founder control and limited transparency.

While both companies are private, Good American differs in governance style. It combines founder ownership with structured executive leadership, broader category expansion, and long-term brand equity rather than rapid trend turnover.

Good American vs Everlane

Everlane operates in a similar direct-to-consumer fashion segment.

Everlane has raised venture capital and institutional funding. Its ownership includes founders and external investors, and its leadership has changed over time. This has diluted founder control and shifted brand direction periodically.

Good American has avoided this dilution. Its ownership stability has supported consistent messaging around inclusivity and fit since launch.

Who Controls Good American?

Control of Good American is closely tied to its ownership and leadership structure. Because the company is privately held and founder-led, decision-making authority remains concentrated among a small group of individuals rather than being spread across public shareholders or external institutions. This structure allows the brand to operate with clarity, speed, and long-term focus.

Founder-Led Control Structure

Good American is controlled by its co-founders, Emma Grede and Khloé Kardashian. Together, they hold majority ownership and retain ultimate authority over the company’s strategic direction.

Unlike publicly traded apparel companies, Good American does not answer to outside shareholders or activist investors. This means control is exercised internally, with founders setting priorities around brand identity, inclusivity standards, and expansion plans.

Role of the Chief Executive Officer

Emma Grede serves as the chief executive officer of Good American and holds the highest level of operational control. She is responsible for executing the company’s strategy across all functions, including product design, manufacturing, supply chain, retail partnerships, and international growth.

As both CEO and major shareholder, Grede’s leadership combines executive authority with ownership accountability. This alignment ensures that long-term brand value takes precedence over short-term gains.

Brand and Strategic Influence of Khloé Kardashian

Khloé Kardashian plays a central role in shaping Good American’s brand and public identity. While she does not manage daily operations, her influence extends to marketing strategy, creative direction, and consumer engagement.

Her control is exercised through ownership rights and strategic input rather than executive management. Major brand campaigns, positioning decisions, and long-term messaging are developed with her involvement, reinforcing consistency between the brand’s values and its public image.

Decision-Making and Governance Model

Good American operates with a streamlined governance model. Strategic decisions are typically made at the founder level, with input from senior executives and trusted advisors. There is no publicly disclosed board dominated by external investors with voting control.

Minority investors do not have veto rights or governing authority. Their role is advisory rather than directive. This keeps final decision-making power with the founders and executive leadership.

Past and Ongoing Leadership Continuity

Since its launch in 2016, Good American has not experienced frequent leadership changes. Emma Grede has served as CEO since inception, providing stability and consistent execution. There is no history of founder replacement or externally appointed executives taking control.

This continuity is uncommon among fashion brands that scale quickly. It has allowed Good American to grow while maintaining its core principles around fit, representation, and product quality.

Control Compared to Industry Norms

In the broader fashion industry, control often shifts away from founders after acquisitions, public offerings, or private equity investments. Good American has deliberately avoided these paths.

As a result, control remains centralized, founder-driven, and mission-focused. This structure enables the company to adapt to market trends without compromising its identity.

In summary, Good American is controlled by its founders through a combination of majority ownership and executive leadership. Emma Grede exercises operational control as CEO, while Khloé Kardashian exerts strategic and brand influence. Together, they define the company’s direction and maintain full control over its future.

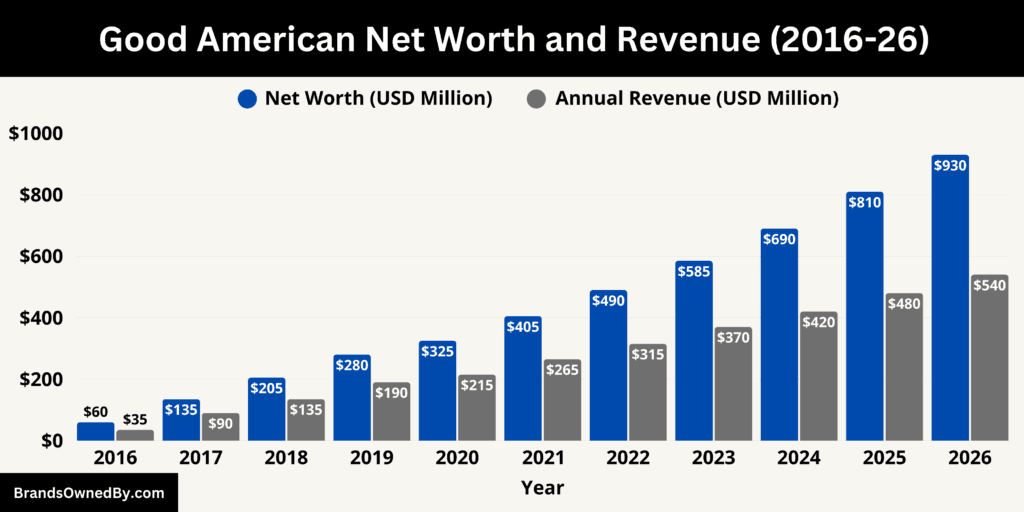

Good American Annual Revenue and Net Worth

As of 2026, Good American continues to show strong financial momentum as a privately held, founder-controlled fashion company. The brand’s estimated annual revenue in 2026 stands at $540 million, while its estimated net worth is approximately $930 million as of January 2026.

Revenue Breakdown by Sales Channel

Good American’s revenue in 2026 is primarily driven by its direct-to-consumer business, which accounts for approximately 62% of total revenue, or about $335 million. This channel includes sales through the brand’s official website and proprietary digital platforms. High repeat purchase rates and strong customer lifetime value continue to support this segment.

Wholesale and retail partnerships contribute roughly 38% of total revenue, equal to around $205 million. This includes department stores, global fashion retailers, and curated physical retail locations. Wholesale growth has been intentionally controlled to protect brand equity and pricing integrity rather than maximize short-term volume.

Revenue Contribution by Product Category

Denim remains the core revenue driver for Good American. In 2026, denim accounts for approximately 45% of total revenue, or about $243 million. This category continues to benefit from strong brand association with fit, size inclusivity, and product durability.

Ready-to-wear apparel, including tops, dresses, and outerwear, contributes an estimated 25%, or $135 million. Activewear and loungewear collectively generate around 18%, or $97 million, supported by repeat customers expanding beyond denim purchases.

Swimwear and footwear together make up the remaining 12%, equivalent to roughly $65 million. While smaller in share, these categories show faster year-over-year growth than denim, indicating long-term diversification potential.

2026 Net Worth

Good American’s estimated net worth of $930 million represents enterprise value rather than cash holdings. Approximately 60% of this valuation, or about $560 million, is attributed to brand equity, intellectual property, and customer loyalty. This includes trademark strength, digital reach, and long-term brand recognition.

Operational assets, including inventory, supply chain relationships, and technology infrastructure, represent around 25%, or $233 million, of total net worth. The remaining 15%, approximately $137 million, reflects growth premium tied to consistent revenue expansion, category scalability, and low ownership dilution.

Profitability and Margin Structure

While exact profit figures are private, Good American is estimated to operate at a gross margin of approximately 65% in 2026. After marketing, logistics, and operating expenses, estimated operating margins fall in the 18% to 20% range, translating to an estimated operating profit of $95 million to $108 million for the year.

This margin structure is considered strong for an apparel brand operating at scale, particularly one that avoids heavy discounting and maintains inclusive sizing standards, which can increase production complexity.

Future Revenue Outlook (2027–2030)

Looking ahead, Good American is projected to grow revenue at an average annual rate of 11% to 13% over the next four years. Based on current trajectories, estimated revenue is expected to reach:

- 2027: $600 million

- 2028: $670 million

- 2029: $750 million

- 2030: $840 million.

By 2030, direct-to-consumer revenue is projected to rise to 68% of total sales, driven by improved personalization, international e-commerce expansion, and stronger customer retention. Wholesale revenue is expected to stabilize at around 32%, focusing on premium retail partners rather than mass distribution.

Future Net Worth and Valuation Outlook

Good American’s net worth is expected to grow faster than revenue due to operating leverage and brand maturity. Based on projected performance, the enterprise value is estimated to reach approximately:

- $1.05 billion in 2027

- $1.25 billion in 2028

- $1.5 billion in 2029

- $1.75 billion to $1.9 billion by 2030.

This valuation growth assumes continued founder control, no major equity dilution, and stable margins. A potential public offering or strategic acquisition is not factored into these estimates. Any such event would materially change valuation dynamics.

Long-Term Financial Positioning

Good American’s financial trajectory reflects a brand transitioning from high-growth to high-stability. Denim will continue to anchor revenue, but non-denim categories are projected to surpass 55% of total revenue by 2030, reducing category concentration risk.

With strong margins, diversified revenue streams, and disciplined ownership, Good American is positioned to cross the $1 billion revenue threshold in the early 2030s while maintaining private control. Its financial outlook suggests long-term durability rather than short-term volatility, reinforcing its position as one of the strongest founder-led fashion brands of its generation.

Brands Owned by Good American

As of 2026, Good American operates as a single-brand fashion company rather than a diversified holding group. It has not pursued mergers or acquisitions of external companies. Instead, it has expanded internally by building multiple product-focused brands and entities under the Good American umbrella.

All brands listed below are owned, developed, and operated directly by Good American:

| Brand / Entity Name | Entity Type | Core Product Focus | Strategic Role Within the Company | Revenue Importance |

|---|---|---|---|---|

| Good American Denim | Core Brand Line | Premium inclusive denim | Foundational business unit and brand identity anchor | Highest |

| Good American Ready-to-Wear | Brand Line | Tops, dresses, bodysuits, outerwear | Expands brand beyond denim into full lifestyle apparel | High |

| Good American Activewear | Brand Line | Leggings, sports bras, athleisure | Drives repeat purchases and fast-growing category expansion | High |

| Good American Swim | Brand Line | Swimwear, resortwear, cover-ups | Seasonal and international growth driver | Medium |

| Good American Shoes | Brand Line | Heels, boots, sandals, footwear | Completes lifestyle offering and increases order value | Medium |

| Good American Essentials & Basics | Product Division | Bodysuits, tanks, everyday staples | Stabilizes revenue and supports frequent repeat buying | Medium |

| Good American Direct-to-Consumer Operations | Internal Operating Entity | E-commerce, CRM, digital marketing | Controls pricing, data ownership, margins, and customer experience | Critical (Non-revenue-facing) |

Good American Denim

Good American Denim is the foundation of the company and remains its most recognizable and strategically important business unit. It was the brand’s first product line and continues to define its market positioning.

The denim line is built around inclusive sizing, consistent fit standards, and premium fabric construction. It covers women’s jeans across a wide size range and multiple silhouettes. Denim remains the single largest revenue contributor and serves as the entry point for many first-time customers. Product development and fit innovation within denim continue to influence all other categories.

Good American Ready-to-Wear

Good American Ready-to-Wear represents the brand’s expansion beyond denim into everyday fashion. This entity includes tops, dresses, bodysuits, skirts, and outerwear designed with the same size-inclusive philosophy.

The ready-to-wear line allows Good American to function as a full lifestyle brand rather than a single-category label. It plays a key role in increasing average order value and customer lifetime value. Designs focus on versatility, comfort, and body-flattering construction rather than trend-only fashion.

Good American Activewear

Good American Activewear operates as a dedicated performance and lifestyle category within the company. It includes leggings, sports bras, compression pieces, and casual athleisure styles.

This entity was developed internally to capture demand from customers seeking inclusive sizing in functional apparel. The activewear line emphasizes stretch, durability, and support while maintaining the brand’s signature aesthetic. It has become one of the fastest-growing categories and a major driver of repeat purchases.

Good American Swim

Good American Swim is the brand’s swimwear-focused entity. It includes bikinis, one-piece swimsuits, cover-ups, and resortwear-inspired designs.

The swim line applies the company’s core fit and size standards to a category traditionally criticized for limited inclusivity. Adjustable designs, supportive construction, and consistent sizing are central to this segment. Swimwear has also helped Good American expand seasonally and internationally.

Good American Shoes

Good American Shoes is the footwear division of the company. It includes heels, boots, sandals, and casual footwear designed to complement the brand’s apparel collections.

Footwear was developed as an extension of the Good American lifestyle concept rather than as a standalone shoe company. Fit, comfort, and proportion are emphasized to align with the body-inclusive positioning of the apparel lines. Shoes contribute to category diversification and brand completeness.

Good American Essentials and Basics

This entity covers foundational wardrobe pieces such as bodysuits, tanks, leggings, and everyday staples. These products are designed for frequent repeat purchases and year-round demand.

Essentials play a strategic role in stabilizing revenue and reducing seasonality. They also serve as cross-sell products that support higher conversion rates across the broader product portfolio.

Good American Direct-to-Consumer Operations

Good American operates its own direct-to-consumer infrastructure, including e-commerce platforms, digital marketing operations, and customer data systems. While not consumer-facing as a brand, this internal entity is central to the company’s control over pricing, customer experience, and data ownership.

DTC operations enable rapid product testing, personalized marketing, and stronger margins compared to wholesale-only models. This internal capability is a key competitive advantage.

Final Thoughts

Understanding who owns Good American reveals why the brand stands apart in the fashion industry. It is not controlled by a conglomerate or public shareholders. Instead, it remains founder-owned and founder-led.

This structure gives Good American the freedom to stay inclusive, innovative, and customer-focused. It also explains its steady growth and strong brand loyalty in a crowded market.

FAQs

Is Good American owned by Khloé?

Khloé Kardashian is a co-founder and the largest individual shareholder of Good American, owning an estimated ~40% stake. However, she does not own the company outright. Ownership is shared with other shareholders, primarily her co-founder.

Who is the majority owner of Good American?

There is no single majority owner holding more than 50%. Control is shared between the two founders. Together, Khloé Kardashian (~40%) and Emma Grede (~35%) hold approximately 75% of the company, giving them joint majority control.

Is Good American Black owned?

Good American is co-founded and co-owned by Emma Grede, who is Black. While the company is not 100% Black-owned, it is partially Black-owned at a significant ownership and leadership level, with Grede also serving as CEO.

Who owns Good American jeans?

Good American jeans are owned by Good American, the fashion brand itself. The brand is privately owned and controlled by its founders, Khloé Kardashian and Emma Grede, along with a small group of minority investors.

Who are Good American founders?

Good American was founded in 2016 by Khloé Kardashian and Emma Grede. Khloé Kardashian helped shape the brand’s identity and visibility, while Emma Grede built and continues to run the business as chief executive.

Who owns the Good American brand?

The Good American brand is owned by its founders and shareholders. Khloé Kardashian (~40%) and Emma Grede (~35%) are the primary owners, while minority stakes are held by institutional investors and early contributors. The company remains privately held and founder-controlled as of 2026.