- E-Trade is owned by Morgan Stanley, and it operates as the group’s primary digital brokerage and self-directed investing platform rather than an independent public company.

- Control flows through Morgan Stanley’s corporate leadership and board, while E-Trade manages day-to-day brokerage operations within that strategic framework.

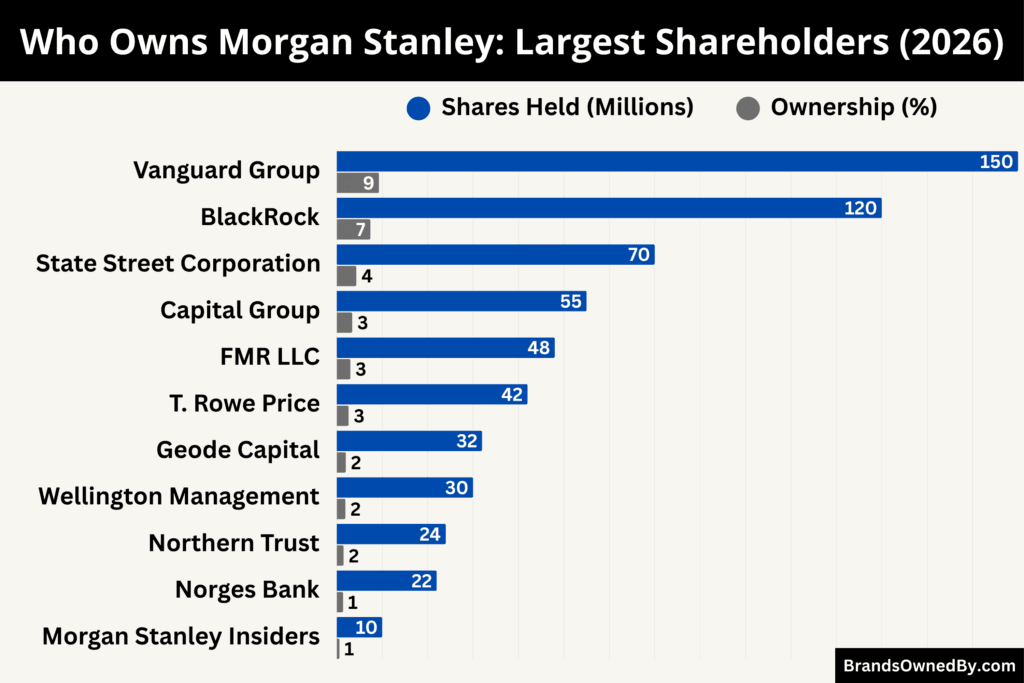

- E-Trade’s effective shareholders are Morgan Stanley’s shareholders, dominated by large institutional investors such as Vanguard, BlackRock, State Street, and Capital Group, with no single controlling shareholder.

- The ownership structure provides long-term stability, combining institutional backing, strong governance, and integration with a global wealth management ecosystem.

E-Trade, also written as E*Trade, is a leading digital brokerage and financial services platform. It focuses on self-directed investing, online trading, retirement solutions, and integrated banking.

It operates under Morgan Stanley but maintains its own brand identity. E-Trade serves retail investors, active traders, and corporate clients. Its platform combines trading tools, research, portfolio management, and cash management in one ecosystem. ETrade is widely known for pioneering online brokerage technology and making stock trading accessible to individual investors.

It remains one of the most recognized digital investing platforms in the United States, operating within Morgan Stanley’s wealth management division.

Founders of E-Trade

E-Trade was founded by William A. Porter and Bernard A. Newcomb in 1982. Both founders played a critical role in shaping the early online brokerage industry.

William A. Porter was a physicist and entrepreneur. He envisioned a system where individual investors could trade securities electronically without relying on traditional brokers. His idea focused on reducing trading costs and improving access to financial markets. Porter helped establish the early technological and strategic foundation of E-Trade. He believed computers would transform financial services, and his vision eventually became the blueprint for modern online investing.

Bernard A. Newcomb was a technology innovator and co-founder of TradePlus, the company that later evolved into E*Trade. He played a key role in developing the electronic trading infrastructure. Newcomb focused on building systems that allowed retail investors to place trades digitally. His technical expertise helped turn E-Trade into one of the first fully electronic brokerage platforms. Together, Porter and Newcomb created a company that changed how individuals invest and trade securities.

Ownership History

E-Trade has had three major ownership phases. It started as a privately owned fintech company founded by William A. Porter and Bernard A. Newcomb in 1982. It then became a publicly traded company in 1996 with ownership spread across institutional and retail investors. In 2020, Morgan Stanley acquired E*Trade in a major all-stock deal, making it a wholly owned subsidiary. Today, Morgan Stanley is the full and sole owner of E-Trade.

Early Independent Ownership (1982–1996)

E-Trade began as TradePlus in 1982. It was privately owned by its founders, William A. Porter and Bernard A. Newcomb, along with a small group of early investors. During this stage, the company focused on building an electronic trading infrastructure. Its core idea was simple but disruptive. Allow individual investors to trade securities electronically without relying on traditional brokers.

Ownership during this phase was concentrated. Founders and early backers controlled strategic direction. The company invested heavily in technology rather than expansion. This laid the foundation for what would become one of the first online brokerage platforms in the world.

By the early 1990s, E*Trade introduced one of the earliest online trading systems for retail investors. This innovation positioned the company for rapid growth and future public listing.

Public Company Era and Distributed Ownership (1996–2007)

E-Trade went public in 1996. This transformed its ownership structure completely. Shares became available on the open market. Institutional investors, mutual funds, hedge funds, and retail shareholders all gained ownership stakes.

Public ownership gave E*Trade access to capital. The company used this funding to expand aggressively. It entered online brokerage at scale. It also expanded into banking and digital financial services. During this period, no single shareholder controlled the company. Ownership was widely distributed across public investors.

E-Trade became one of the most recognized online brokerage brands in the United States. Its customer base grew rapidly. Its platform became a major gateway for retail investing during the internet boom.

Financial Crisis, Institutional Influence, and Restructuring (2008–2015)

The global financial crisis marked a turning point. E-Trade faced major financial pressure due to mortgage-related exposure within its banking division. The company did not change its ownership structure. It remained publicly traded. However, the composition of shareholders shifted.

Large institutional investors increased their influence. The company focused on survival and stabilization rather than growth. It restructured its banking operations. It reduced risky assets. It strengthened capital reserves. Leadership also shifted strategy toward core brokerage and digital services.

This phase was difficult but critical. E*Trade gradually restored profitability. It rebuilt investor confidence. It repositioned itself as a stable and focused digital brokerage firm.

Recovery, Growth, and Strategic Positioning (2016–2019)

After stabilization, E-Trade entered a strong recovery phase. The company focused on digital innovation, mobile trading, and wealth management tools. Ownership remained public. Institutional investors held significant stakes, but no single entity controlled the company.

E*Trade expanded its corporate stock plan services. It strengthened its position in self-directed investing. Its financial health improved. Its platform became attractive to large financial institutions seeking digital brokerage capabilities.

By this period, E-Trade had transformed from a crisis-affected brokerage into a modern, stable, and technology-driven investing platform. This made it a prime acquisition target.

Morgan Stanley Acquisition and Ownership Transition (2020)

The most significant ownership change happened in 2020. Morgan Stanley announced a full acquisition of E-Trade in an all-stock deal valued at about $13 billion. The strategic goal was clear. Combine Morgan Stanley’s wealth management leadership with E*Trade’s digital brokerage strength.

The deal officially closed in October 2020. E-Trade stopped being a publicly traded company. All outstanding shares were absorbed by Morgan Stanley. Ownership became fully consolidated under one parent company.

This acquisition reshaped the brokerage industry. It gave Morgan Stanley a powerful digital investing platform. It also expanded its reach into self-directed retail investors.

Full Integration Under Morgan Stanley (2021–Present)

Since 2021, E-Trade has operated as a wholly owned subsidiary of Morgan Stanley. It is no longer publicly owned. Morgan Stanley is the sole shareholder and decision-making authority.

E*Trade was integrated into Morgan Stanley’s wealth management division. The platform now serves as the bank’s primary digital brokerage channel. It supports millions of retail investors and corporate clients. Strategic decisions, product direction, and long-term growth are aligned with Morgan Stanley’s global financial strategy.

Despite full ownership, the E-Trade and E*Trade brand continues to operate independently in the market. It remains one of the most recognized digital brokerage platforms, now backed by one of the world’s largest financial institutions.

Who Owns E-Trade?

E-Trade is owned by Morgan Stanley. The investment bank acquired E*Trade in 2020 through an all-stock deal valued at about $13 billion. Since then, E-Trade has operated within Morgan Stanley’s Wealth Management division as its primary digital brokerage platform. Strategic decisions, governance, and financial control are handled by Morgan Stanley, while E-Trade continues to operate under its established brand in online investing and brokerage services.

Parent Company: Morgan Stanley

Morgan Stanley is one of the world’s largest financial services firms, with operations in wealth management, investment banking, institutional securities, and asset management. Over the last decade, the firm has shifted its focus toward stable, recurring revenue through wealth and asset management. The addition of E-Trade accelerated this transformation by expanding Morgan Stanley’s reach into self-directed and mass affluent investors.

Ownership of Morgan Stanley is widely distributed among institutional and public shareholders. The largest shareholders include The Vanguard Group, BlackRock, State Street Corporation, and Capital Research and Management. These institutions hold significant stakes through index funds, ETFs, and actively managed portfolios.

While no single shareholder has majority control, institutional investors collectively hold a large portion of the company’s shares and influence governance through voting power and long-term capital allocation.

Control of Morgan Stanley rests with its executive leadership and board of directors. The company is led by CEO Ted Pick, who oversees strategic direction, capital allocation, and global operations.

The board provides governance oversight, while senior executives manage business divisions including Wealth Management, where E-Trade operates. Insider ownership by executives and board members aligns management interests with shareholder value, but operational control remains centralized within the corporate leadership structure rather than any single shareholder.

Acquisition Overview

Morgan Stanley announced the acquisition of E-Trade in February 2020. The transaction was structured as an all-stock merger, meaning E-Trade shareholders received Morgan Stanley shares instead of cash. The deal was valued at approximately $13 billion, making it one of the largest acquisitions in the online brokerage sector.

The transaction officially closed in October 2020 after regulatory approvals and shareholder consent. Following completion, E-Trade shares were delisted from public markets, and the company became part of Morgan Stanley’s corporate structure.

This acquisition was strategically important because it combined Morgan Stanley’s advisory and investment expertise with E-Trade’s technology-driven brokerage platform and large retail investor base.

Strategic Purpose of the Acquisition

The acquisition reshaped Morgan Stanley’s business model. Historically, the firm focused heavily on institutional clients and wealthy individuals. E-Trade enabled expansion into the self-directed retail investor market, one of the fastest-growing segments in financial services.

The deal created a complete wealth ecosystem. Investors can begin with self-directed trading, move into automated portfolio management, and eventually transition into full advisory services without leaving the Morgan Stanley platform.

E-Trade also strengthened Morgan Stanley’s funding structure. Brokerage cash balances increased the firm’s deposit base, providing stable and low-cost funding. The platform also generates recurring fee income through asset-based services, corporate stock plan administration, and advisory products.

Overall, the acquisition positioned Morgan Stanley as a full-spectrum competitor to major brokerage and wealth management firms.

Post-Acquisition Integration

Morgan Stanley followed a gradual integration strategy rather than fully rebranding E-Trade. The E-Trade name remained intact to preserve customer trust and brand recognition. However, core systems, advisory capabilities, and product offerings were aligned with Morgan Stanley’s infrastructure.

Corporate stock plan services were integrated with Morgan Stanley’s workplace and equity compensation platform. Banking and cash management services were aligned with Morgan Stanley’s lending and liquidity systems. Investment research, advisory tools, and wealth solutions were expanded across the combined platform.

This integration created a unified ecosystem where clients can seamlessly access trading, investing, banking, and advisory services within one financial network.

Governance and Control

Governance authority flows through Morgan Stanley’s executive leadership and board of directors. Strategic decisions affecting E-Trade, including capital deployment, risk management, and long-term growth strategy, are made at the parent company level.

E-Trade maintains its own operational leadership team responsible for platform operations, customer services, and digital product development. However, corporate governance, compliance, and regulatory oversight follow Morgan Stanley’s global framework.

This structure ensures centralized strategic control while preserving operational flexibility. It allows E-Trade to remain competitive in the fast-moving digital brokerage market while benefiting from the stability and resources of a major global financial institution.

Role Within Morgan Stanley’s Long-Term Strategy

E-Trade plays a central role in Morgan Stanley’s long-term growth strategy. It acts as the primary entry point for millions of self-directed investors. Many clients begin with digital trading and gradually transition into higher-value advisory relationships within Morgan Stanley.

The platform strengthens recurring revenue through brokerage services, asset-based fees, and corporate stock plan administration. It also deepens relationships with corporations by managing employee equity programs, creating long-term client pipelines.

Through E-Trade, Morgan Stanley built one of the most comprehensive digital investing and wealth management ecosystems in the financial industry, combining scale, technology, and advisory expertise into a single integrated platform.

Competitor Ownership Comparison

E*Trade operates within the corporate structure of Morgan Stanley. This gives it the backing of a global investment bank. However, its main competitors follow different ownership models. Some are independent public companies. Some are privately owned. Others operate under diversified financial groups.

| Company | Ownership Type | Major Shareholders / Owners | Who Controls the Company | Key Ownership Insight |

|---|---|---|---|---|

| E-Trade (E*Trade) | Subsidiary of a public company | Owned within Morgan Stanley shareholder base including Vanguard, BlackRock, State Street, Capital Group | Morgan Stanley executive leadership and board | Bank-backed brokerage integrated with global wealth management and advisory ecosystem |

| Charles Schwab | Publicly traded | Institutional investors such as Vanguard, BlackRock, State Street, and public shareholders | CEO and Board of Charles Schwab | Independent brokerage-focused financial institution without a parent company |

| TD Ameritrade | Fully acquired and integrated into Charles Schwab | No independent shareholders after acquisition | Charles Schwab leadership | Former standalone brokerage now fully absorbed into Schwab platform |

| Fidelity Investments | Privately owned | Johnson family, insiders, and employees | Internal executive leadership and family control | Private ownership allows long-term strategy without public shareholder pressure |

| Robinhood Markets | Publicly traded | Institutional investors, founders, and public shareholders | CEO, executive leadership, and board | Independent technology-driven brokerage not owned by a traditional bank |

| Interactive Brokers | Publicly traded with strong insider ownership | Founder Thomas Peterffy and institutional investors | Founder influence and executive leadership | Founder-led structure with concentrated ownership and strong internal control |

Charles Schwab and TD Ameritrade

Charles Schwab is one of the largest competitors in the brokerage industry. It is a publicly traded company with ownership spread across institutional investors, mutual funds, and public shareholders. The largest shareholders include major asset managers such as Vanguard, BlackRock, and State Street. No single shareholder controls the company.

Charles Schwab acquired TD Ameritrade in a major industry consolidation. After the acquisition, TD Ameritrade was fully integrated into Schwab’s platform and no longer operates as an independent brokerage. Unlike E*Trade, which operates under a large investment bank, Schwab functions as an independent brokerage-focused financial institution. Its control rests with executive leadership and its board rather than a parent company.

Fidelity Investments

Fidelity Investments is structured differently from both E-Trade and Schwab. It is a privately held company. Ownership is primarily controlled by the Johnson family, along with company insiders and employees. Because Fidelity is private, it does not face public shareholder pressure and can operate with a long-term strategic focus.

Fidelity’s private ownership gives it flexibility in pricing, investment, and innovation. Unlike E*Trade, which operates under Morgan Stanley’s corporate framework, Fidelity operates independently with centralized control from its internal leadership. This ownership model allows it to reinvest heavily in technology, asset management, and brokerage services.

Robinhood Markets

Robinhood is another major competitor in the digital brokerage space. It is a publicly traded company with ownership distributed among institutional investors, founders, and retail shareholders. Major institutional investors include Vanguard, BlackRock, and other global asset managers.

Unlike E-Trade, Robinhood is not owned by a traditional financial institution. It operates as an independent technology-driven brokerage platform. Control is shared between its executive leadership, board of directors, and public shareholders. Robinhood focuses heavily on mobile-first trading, younger investors, and commission-free brokerage services, creating a different strategic approach compared to E*Trade’s bank-backed model.

Interactive Brokers

Interactive Brokers is a global brokerage firm known for serving professional traders and institutional investors. It is publicly traded, but its ownership is more concentrated compared to many competitors. Founder Thomas Peterffy holds a significant controlling stake through insider ownership, giving him strong influence over strategic decisions.

This structure makes Interactive Brokers different from E-Trade, where control flows through Morgan Stanley’s corporate leadership rather than a founder. Interactive Brokers operates independently and focuses on advanced trading technology, global markets, and professional-grade tools.

Key Ownership Differences and Market Impact

The ownership structure of each brokerage influences its strategy and competitive positioning. E-Trade benefits from the financial strength, capital resources, and global infrastructure of Morgan Stanley. This allows it to combine digital brokerage with full-service wealth management and banking capabilities.

Independent public companies like Charles Schwab and Robinhood rely on market-driven shareholder structures and executive leadership. Privately owned firms like Fidelity operate with long-term strategic flexibility. Founder-influenced firms like Interactive Brokers maintain centralized decision-making tied to insider ownership.

These ownership differences shape how each company approaches pricing, innovation, client segments, and long-term growth. E-Trade’s integration within a global investment bank gives it stability, scale, and access to a broader wealth management ecosystem, distinguishing it from many standalone brokerage competitors.

Who Controls E-Trade?

Control of E*Trade sits inside Morgan Stanley’s Wealth Management division. The brokerage does not operate as an independent decision center. Strategic authority flows from Morgan Stanley’s CEO, executive committee, and board of directors. E-Trade runs day-to-day brokerage operations, but enterprise strategy, capital allocation, risk policy, and major technology direction are set at the parent level. This creates a top-down control model with operational autonomy at the platform layer.

Ultimate Authority: Morgan Stanley CEO and Executive Committee

The highest decision-making authority affecting E-Trade is Morgan Stanley’s CEO, Ted Pick, supported by the firm’s executive committee. This group defines enterprise priorities such as wealth management growth, digital platform expansion, capital deployment, and risk tolerance.

E-Trade’s product roadmap, integration with advisory services, and technology investments must align with these corporate priorities. Large initiatives such as platform modernization, brokerage pricing strategy, and integration with Morgan Stanley’s banking and lending ecosystem are approved at this level. This ensures E*Trade evolves in sync with Morgan Stanley’s long-term shift toward stable, fee-based wealth revenue rather than standalone brokerage growth.

Board-Level Oversight and Governance Control

Morgan Stanley’s board of directors exercises governance control over all divisions, including E-Trade. The board does not manage operations, but it approves strategic investments, monitors enterprise risk, and evaluates executive performance.

Key decisions such as major technology investments, platform expansion, regulatory positioning, and long-term integration of digital brokerage into the wealth ecosystem pass through board-level oversight. The board ensures E-Trade contributes to shareholder value, maintains regulatory compliance, and aligns with Morgan Stanley’s global financial strategy.

Divisional Control: Wealth Management Leadership

Within Morgan Stanley, E-Trade is controlled operationally through the Wealth Management division. Divisional leadership oversees how E-Trade connects with advisory services, managed portfolios, banking, and workplace solutions.

This level controls how clients move across the ecosystem. For example, self-directed investors using E*Trade can transition into advisory relationships or managed portfolios within Morgan Stanley. Decisions related to product bundling, cross-platform integration, and client lifecycle management are handled at this divisional level rather than at the standalone brokerage layer.

Platform-Level Leadership: E-Trade Management

E-Trade has its own executive management responsible for running the brokerage platform. This includes digital trading infrastructure, user experience, brokerage operations, customer service, and product development.

However, this leadership does not control corporate strategy or capital direction. Its authority is execution-focused. It ensures platform reliability, competitive features, and continuous innovation in areas such as mobile trading, derivatives tools, and self-directed investing. Strategic boundaries are defined by Morgan Stanley, but operational excellence is delivered by E-Trade’s internal leadership.

Influence of Past Leadership on Current Control

The control structure today reflects decisions made during earlier leadership eras. James Gorman, former CEO of Morgan Stanley, initiated the acquisition of E-Trade to transform the firm into a full-spectrum wealth platform. His strategy shifted Morgan Stanley away from market-driven revenue toward recurring wealth and advisory income.

Under Ted Pick, this strategy continues with deeper integration between digital brokerage, advisory, and banking. E-Trade is no longer treated as a standalone brokerage brand. It is a core component of Morgan Stanley’s client acquisition and wealth lifecycle strategy. Control today is therefore shaped by long-term structural integration rather than short-term brokerage management.

Risk, Compliance, and Regulatory Control

Risk management and regulatory oversight for E-Trade are governed centrally by Morgan Stanley. This includes capital controls, cybersecurity policy, brokerage compliance, and regulatory reporting. E-Trade follows Morgan Stanley’s enterprise-wide risk framework rather than maintaining an independent system.

This centralized control ensures consistent compliance across global operations and protects the brokerage platform from systemic financial and regulatory risks. It also aligns E-Trade with Morgan Stanley’s institutional-grade governance standards.

How Real Control Works in Practice

In practical terms, control of E-Trade operates in layers. Corporate strategy, capital, and risk are controlled by Morgan Stanley leadership. Divisional integration is controlled by Wealth Management executives. Platform execution is handled by E-Trade management.

This layered structure allows E-Trade to remain fast-moving in digital brokerage while benefiting from the capital strength, governance discipline, and strategic direction of a global financial institution. Real control is not concentrated in a single executive or shareholder. It is embedded in Morgan Stanley’s centralized corporate and divisional leadership system.

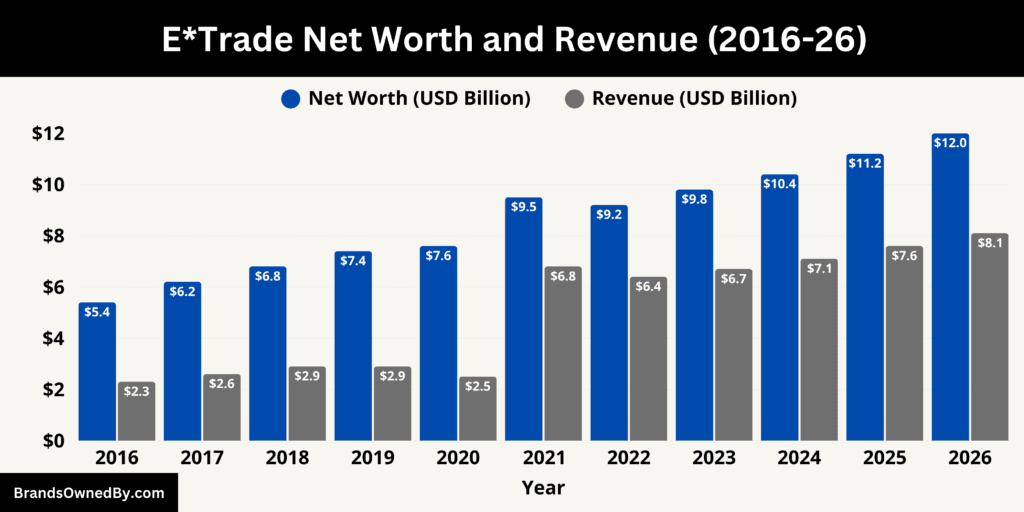

E-Trade Annual Revenue and Net Worth

As of February 2026, E*Trade generates an estimated annual revenue of about $8.1 billion and has an estimated net worth of roughly $12.0 billion. It reflects the scale of the E-Trade platform operating inside Morgan Stanley’s Wealth Management division. The platform supports millions of brokerage accounts, hundreds of billions in client assets, and a large corporate stock plan network, all of which contribute to its financial strength and recurring revenue base.

Revenue Composition and Core Income Streams

E-Trade’s estimated $8.1 billion revenue comes from multiple diversified business segments. The largest contributor is net interest income, which generates approximately $3.4 to $3.6 billion annually. This income is produced from margin lending, brokerage-linked banking, and interest earned on uninvested client cash balances. The scale of client deposits and margin activity makes this the most stable and predictable revenue stream.

Trading and brokerage-related revenue contributes around $2.1 to $2.3 billion. This includes options trading, derivatives, payment for order flow, and advanced trading services. Although direct stock trading commissions have largely disappeared, high options volume and active trading continue to support high transaction-related income.

Asset-based and advisory revenue generates approximately $1.3 to $1.5 billion annually. This segment includes managed portfolios, robo-advisory services, and integration with Morgan Stanley’s advisory platform. Growth in this area reflects the transition of many self-directed investors into advisory and managed investment relationships.

Corporate stock plan and workplace services contribute roughly $750 to $900 million annually. E-Trade manages equity compensation programs for thousands of corporations and millions of employees. This business provides stable long-term fee income and also acts as a pipeline for new wealth management clients entering the Morgan Stanley ecosystem.

Net Worth and Financial Strength

E-Trade’s estimated net worth of around $12 billion, as of February 2026, reflects strong retained earnings, large client asset balances, and stable profitability. The platform supports hundreds of billions of dollars in customer assets, which strengthens its financial position and recurring income capability.

Net worth growth has been driven by expansion in margin lending, steady advisory income, and increasing corporate stock plan assets. Integration with Morgan Stanley also enhances financial stability through institutional capital support, advanced risk management systems, and stronger liquidity. Compared to its pre-2020 standalone structure, E-Trade now operates with significantly greater capital backing and financial resilience.

Revenue and Net Worth Growth Over Time

Over the last decade, E-Trade has evolved from a mid-sized digital brokerage generating under $3 billion annually into a major wealth-integrated platform generating over $8 billion in estimated revenue. Growth accelerated after the Morgan Stanley acquisition due to cross-selling into advisory services, deeper banking integration, and expansion of digital investing.

The revenue model shifted from transaction-heavy income toward recurring streams such as interest income, advisory fees, and workplace equity administration. This shift improved earnings stability and supported consistent growth in net worth. The platform’s financial expansion closely tracks the growth in client assets, digital brokerage adoption, and wealth management integration.

In 2026, E-Trade ranks among the largest digital brokerage platforms globally by estimated revenue contribution. Its diversified structure across brokerage, banking, advisory, and workplace services provides financial stability and long-term growth potential. The platform continues to play a major role in Morgan Stanley’s Wealth Management division, particularly in digital client acquisition, margin lending growth, and advisory conversion.

Revenue Forecast Through 2030

Based on current growth trends, expanding client assets, and deeper integration with Morgan Stanley’s wealth ecosystem, E-Trade’s revenue and net worth are expected to continue rising steadily.

- 2027: Estimated revenue $8.6 billion | Estimated net worth $12.8 billion

- 2028: Estimated revenue $9.2 billion | Estimated net worth $13.7 billion

- 2029: Estimated revenue $9.8 billion | Estimated net worth $14.6 billion

- 2030: Estimated revenue $10.5 billion | Estimated net worth $15.8 billion.

Future growth is expected to be driven by increasing digital brokerage participation, expansion of advisory and managed portfolios, growth in margin lending, and continued dominance in corporate stock plan administration. The integration with Morgan Stanley’s broader wealth platform is likely to remain the primary catalyst for long-term financial expansion.

Brands Owned by E-Trade

E-Trade’s structure is concentrated around brokerage, banking, trading technology, and workplace equity services built under the E-Trade name. Below are the core companies, brands, platforms, and acquired technologies directly operated by E-Trade as of 2026.

E*Trade Financial

E*Trade Financial is the main brokerage brand used by millions of retail investors. It provides trading across stocks, ETFs, bonds, mutual funds, options, and futures. The platform supports both beginner and advanced traders through real-time market data, charting systems, screeners, and risk analytics. It also includes portfolio tracking, tax-optimized investing tools, and multi-device trading access.

The brokerage platform handles a large share of client activity including order execution, margin trading, and derivatives transactions. Its technology infrastructure supports high daily trading volume and advanced order routing. This brand represents the primary customer-facing identity of E-Trade in the retail investing market.

E*Trade Bank

E*Trade Bank is the platform’s banking brand integrated with brokerage accounts. It offers high-yield savings, checking, cash management, and brokerage-linked liquidity services. Investors can move funds instantly between cash and investment accounts, enabling seamless trading and liquidity management.

The bank also supports margin lending, secured credit, and interest income generation from uninvested cash balances. This brand plays a central role in the financial structure of E-Trade by supporting funding, liquidity, and stable interest-based revenue streams tied to brokerage activity.

E*Trade Securities

E*Trade Securities operates as the regulated broker-dealer responsible for trade execution, clearing coordination, and regulatory compliance. It manages order routing, derivatives execution, and trading settlement processes. This entity ensures trading activity complies with financial regulations and market standards.

The broker-dealer infrastructure is critical for maintaining execution efficiency, risk control, and platform reliability. It supports millions of client trades and forms the operational backbone behind the visible brokerage platform.

E*Trade Advisor Services

E*Trade Advisor Services provides managed portfolios, automated investing, and hybrid advisory solutions. It supports both robo-advisory portfolios and professionally managed investment accounts. The platform uses algorithm-driven asset allocation combined with human advisory oversight for diversified portfolio management.

This brand helps transition self-directed traders into long-term managed investors. It generates recurring asset-based fees and strengthens the shift toward stable advisory revenue rather than transaction-only income.

E*Trade Corporate Services

E*Trade Corporate Services is one of the most strategically important business platforms. It manages employee equity compensation programs including stock options, restricted stock units, employee stock purchase plans, and executive equity structures. The platform serves thousands of corporations and millions of employees globally.

Corporate Services provides stable, long-term fee revenue and acts as a major client pipeline. Many employees who receive equity through this platform later become brokerage or advisory clients, strengthening long-term asset growth and platform expansion.

Power E*Trade

Power E*Trade is the advanced trading interface designed for active traders and derivatives-focused investors. It provides professional-grade charting, options analytics, strategy builders, probability modeling, and multi-leg options execution tools. The platform also includes advanced order types, volatility analysis, and risk modeling features.

This brand originated from the OptionsHouse acquisition and now represents E-Trade’s primary platform for high-frequency and advanced trading users. It significantly strengthened E-Trade’s competitive position in options and derivatives trading.

OptionsHouse

OptionsHouse was acquired in 2016 and integrated into E-Trade’s trading system. It was widely known for its options trading technology, low-cost structure, and advanced derivatives analytics. After the acquisition, its technology became the foundation for Power E*Trade and advanced options infrastructure.

Although the OptionsHouse brand is no longer marketed separately, its execution technology, pricing model, and analytics engine continue to power E-Trade’s derivatives and active trading ecosystem.

E*Trade Futures

E*Trade Futures is the platform supporting futures and leveraged derivatives trading. It provides access to index futures, commodity futures, and advanced trading strategies used by experienced traders. The platform includes margin-based trading tools, advanced risk monitoring, and derivatives analytics.

This business expands E-Trade’s reach beyond traditional brokerage into leveraged and professional-level trading markets, supporting higher-value and more active clients.

E*Trade Cash Management

E*Trade Cash Management integrates brokerage and banking into a unified liquidity system. It provides debit card access, automated cash sweeps, and spending functionality linked directly to investment accounts. Investors can manage daily cash flow without leaving the brokerage ecosystem.

This brand strengthens client retention and increases cash balances within the platform, supporting both liquidity and interest-based income.

Conclusion

E*Trade has evolved from an early online brokerage pioneer into a core digital investing platform within a larger financial ecosystem. Understanding who owns E-Trade clarifies how the platform operates, how decisions are made, and why its services continue to expand. The brand remains focused on self-directed investing, advanced trading, and workplace equity solutions. Its strength lies in combining technology, brokerage, and long-term client growth within a unified structure. For investors and users, E-Trade continues to represent a stable and widely recognized gateway into modern digital investing.

FAQs

Who Owns E*TRADE Now?

E*TRADE is owned by Morgan Stanley. It operates within Morgan Stanley’s Wealth Management division as the company’s primary digital brokerage and self-directed investing platform. While E*TRADE maintains its own brand and platform, all strategic direction, governance, and financial control come from Morgan Stanley’s corporate leadership and board of directors.

When Did Morgan Stanley Buy E*TRADE?

Morgan Stanley completed the acquisition of E*TRADE in October 2020. The transaction was an all-stock deal valued at about $13 billion. After the deal closed, E*TRADE was delisted from public markets and fully integrated into Morgan Stanley’s operations, combining digital brokerage with the firm’s global wealth management and advisory services.

Is E-Trade the Same as Charles Schwab?

No, E-Trade and Charles Schwab are separate companies with different ownership structures. E-Trade operates under Morgan Stanley as its digital brokerage platform, while Charles Schwab is an independent publicly traded financial services company. Schwab also acquired and integrated TD Ameritrade, making it one of the largest standalone brokerage firms, whereas E-Trade is part of a larger investment banking and wealth management ecosystem.