CrowdStrike is a leader in cybersecurity, known for protecting businesses and governments worldwide. Many people wonder who owns CrowdStrike, how the company is structured, and who leads it.

This article provides a detailed overview of its history, ownership, major shareholders, leadership, revenue, and acquisitions.

History of CrowdStrike

CrowdStrike was founded in 2011 by George Kurtz, Dmitri Alperovitch, and Gregg Marston. The company launched with a mission to revolutionize endpoint security. Its cloud-native platform, Falcon, quickly gained attention for its ability to detect and prevent advanced threats.

In 2014, CrowdStrike made headlines after exposing North Korea’s role in the Sony Pictures cyberattack. This moved the company into the global spotlight. It continued to expand its services across multiple sectors.

In June 2019, CrowdStrike went public on the NASDAQ under the ticker CRWD. Since then, it has grown rapidly in revenue, customer base, and influence.

Who Owns CrowdStrike: Shareholder List

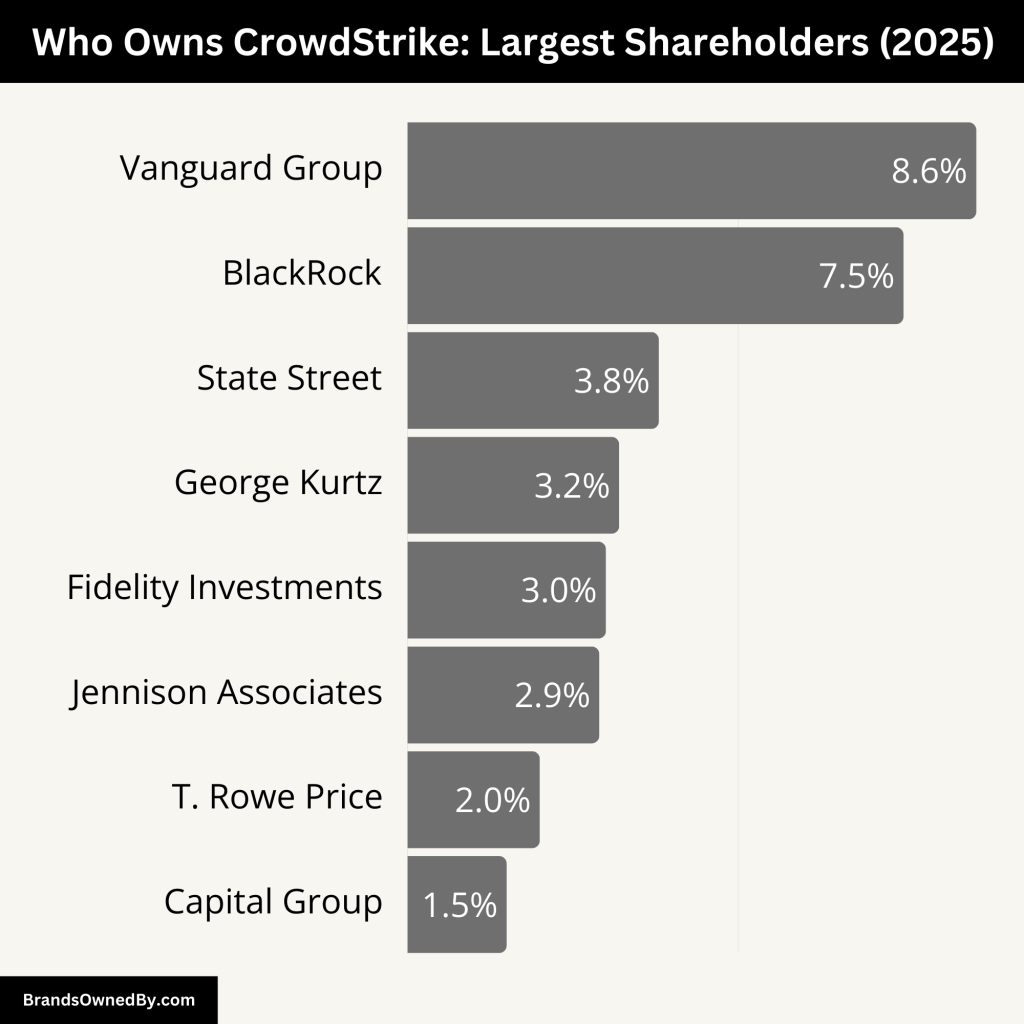

CrowdStrike Holdings Inc. (NASDAQ: CRWD) is a publicly traded cybersecurity company with a diverse ownership structure. As of April 2025, institutional investors hold approximately 71.16% of the company’s stock. The remaining shares are held by company insiders, including co-founder and CEO George Kurtz, and individual investors.

Here’s a list of the major shareholders of CrowdStrike Holdings Inc.:

| Shareholder | Estimated Ownership | Type | Role/Influence |

|---|---|---|---|

| The Vanguard Group, Inc. | 8.6% | Institutional (Passive) | Largest shareholder; proxy voting power; governance influence |

| BlackRock, Inc. | 7.5% | Institutional (Passive) | Second-largest holder; ESG influence through voting |

| State Street Corporation | 3.8% | Institutional (Passive) | Index fund investor; active in proxy governance |

| Jennison Associates LLC | ~2.9% (5M+ shares) | Institutional (Active) | High-conviction investor; manages ~$1.4B stake |

| George Kurtz | 3.2% | Insider (Individual) | Co-founder & CEO; key decision-maker and visionary leader |

| Fidelity Investments | ~2–3% | Institutional (Active) | Long-term investor; large retirement fund exposure |

| T. Rowe Price | ~2% | Institutional (Active) | Focus on growth companies; potential board engagement |

| Capital Group | ~1.5–2% | Institutional (Active) | Long-term, conservative investor; major fund presence |

| Morgan Stanley | <1% | Institutional (Mixed) | Smaller stake; provides financial services; sometimes trades actively |

| Baillie Gifford & Co | <1% | Institutional (Active) | Growth-focused international investor |

| ARK Invest | <1% | Institutional (Active) | Tech innovation-focused; trades based on market trends |

| Geode Capital Management | <1% | Institutional (Passive) | Partnered with Fidelity; small but steady position |

The Vanguard Group, Inc.

The Vanguard Group is the largest shareholder in CrowdStrike as of April 2025. It owns approximately 8.6% of the total outstanding shares. Vanguard is a global investment management company with trillions of dollars in assets under management. Its stake in CrowdStrike is held across several mutual funds and ETFs, including the Vanguard Total Stock Market Index Fund and the Vanguard Institutional Index Fund.

Though Vanguard is a passive investor, its size gives it a major role in shaping shareholder outcomes. It participates in board elections, executive compensation votes, and governance issues. Despite not engaging in daily operations, Vanguard’s influence is significant due to its proxy voting power.

BlackRock, Inc.

BlackRock is the second-largest shareholder of CrowdStrike. It owns about 7.5% of the company’s shares through its various investment vehicles, such as iShares ETFs and mutual funds. BlackRock is one of the largest asset managers in the world, and like Vanguard, it is known for passive investments with active governance engagement.

BlackRock’s investment signals high confidence in CrowdStrike’s long-term prospects. It uses its voting rights to support environmental, social, and governance (ESG) practices and can influence major decisions indirectly through board voting.

State Street Corporation

State Street holds approximately 3.8% of CrowdStrike shares. It is one of the “Big Three” indexing giants alongside Vanguard and BlackRock. State Street manages assets via its SPDR ETFs and is a known supporter of corporate transparency and diversity.

Its stake gives it a role in critical governance matters. Like the other large institutional investors, State Street engages through proxy voting and shareholder resolutions but remains a passive investor in terms of management.

Jennison Associates LLC

Jennison Associates LLC is a large institutional investor that owns over 5 million shares of CrowdStrike, valued at more than $1.4 billion as of early 2025. This makes Jennison one of the top active shareholders. The firm is a subsidiary of PGIM, the global investment management business of Prudential Financial.

Jennison is known for investing in high-growth companies. Its increasing position in CrowdStrike reflects confidence in the company’s future earnings, competitive moat, and its role in the growing cybersecurity sector. Unlike index funds, Jennison’s stake is likely the result of targeted research and portfolio conviction.

George Kurtz

George Kurtz is the co-founder, CEO, and one of the top individual shareholders of CrowdStrike. As of 2025, he owns approximately 3.2% of the company. This ownership aligns his interests closely with shareholders and underscores his long-term commitment to the firm.

Kurtz’s equity includes common stock and unexercised options. His influence goes beyond his share percentage. As CEO and board member, he plays a key role in setting strategy, making executive decisions, and maintaining CrowdStrike’s innovative edge.

Fidelity Investments

Fidelity is a significant institutional investor in CrowdStrike, although its exact percentage is not always public. Estimates suggest that Fidelity holds between 2% to 3% of shares through its mutual funds and retirement portfolios. Fidelity is known for long-term investment strategies, and its presence in CrowdStrike indicates strong investor confidence.

Fidelity often votes in line with management unless there is a clear concern. It tends to favor growth-oriented companies with strong fundamentals and market positioning.

T. Rowe Price

T. Rowe Price also holds a meaningful position in CrowdStrike, estimated at around 2% of the total shares. The firm manages actively traded mutual funds and retirement assets. Its interest in CrowdStrike highlights its support for innovation-driven tech companies.

T. Rowe Price’s analysts often influence investment decisions and may engage in behind-the-scenes discussions with company leadership. However, it does not play an operational role.

Capital Group

Capital Group, which manages the American Funds family, owns a stake in CrowdStrike estimated to be between 1.5% to 2%. The firm is known for its long-term, fundamental investment approach and typically supports companies with strong leadership and recurring revenue.

Its involvement strengthens CrowdStrike’s credibility in traditional institutional circles. Capital Group tends to invest for long durations, often across multiple funds and client segments.

Morgan Stanley

Morgan Stanley holds a smaller, yet still significant, stake in CrowdStrike. Its ownership is primarily through managed accounts and client investment products. While its shareholding may fluctuate, its continued presence indicates that major banks view CrowdStrike as a strategic investment in the cybersecurity space.

Morgan Stanley may also provide research coverage and investment banking services to CrowdStrike, further integrating it into the financial ecosystem of large-cap technology companies.

Other Noteworthy Holders

Several hedge funds, pension funds, and sovereign wealth funds also invest in CrowdStrike. While each may hold less than 1%, collectively these investors account for a large portion of the remaining institutional ownership. These include:

- Baillie Gifford & Co: A Scottish investment firm with a focus on high-growth global equities.

- ARK Invest: Known for investing in disruptive innovation, ARK has held and traded CrowdStrike in its technology-focused ETFs.

- Geode Capital Management: A partner firm to Fidelity, it holds a modest but consistent stake.

These investors participate in the broader financial oversight of the company and can impact its stock volatility, valuation, and public perception.

Who is the CEO of CrowdStrike?

As of 2025, George Kurtz continues to serve as the Chief Executive Officer (CEO) of CrowdStrike Holdings, Inc. His leadership has been instrumental in steering the company through significant growth and challenges in the cybersecurity landscape.

George Kurtz: CEO and Co-Founder

George Kurtz co-founded CrowdStrike in 2011 and has been at the helm since its inception. Under his guidance, the company has evolved into a leading provider of cloud-delivered protection of endpoints, cloud workloads, identity, and data. Kurtz’s vision and strategic direction have been pivotal in CrowdStrike’s development and success.

In 2024, Kurtz was recognized by Fortune magazine as one of the 100 Most Powerful People in Business, highlighting his influence in the tech industry.

Leadership and Decision-Making Structure

CrowdStrike’s executive leadership team comprises seasoned professionals who oversee various facets of the company’s operations. Key members include:

- Michael Sentonas, President

- Burt Podbere, Chief Financial Officer

- Shawn Henry, Chief Security Officer

- Daniel Bernard, Chief Business Officer

- Jennifer Johnson, Chief Marketing Officer

- Elia Zaitsev, Chief Technology Officer

- Raj Rajamani, Head of Products

- Karan Gupta, Head of Engineering

This team collaborates closely to drive CrowdStrike’s strategic initiatives, product development, and market expansion.

Board of Directors and Corporate Governance

CrowdStrike’s Board of Directors provides oversight and guidance to the company’s management. As of 2025, the board includes:

- Gerhard Watzinger, Chairman

- George Kurtz, CEO and Founder

- Roxanne Austin, President and CEO, Austin Investment Advisors

- Cary Davis, Managing Director, Warburg Pincus

- Johanna Flower, Director

- Sameer Gandhi, Partner, Accel

- Denis O’Leary, Private Investor

- Laura Schumacher, Former Chief Legal Officer of AbbVie

- Godfrey Sullivan, Former Member of the Board of Directors of Splunk Inc.

The board’s diverse expertise supports CrowdStrike’s mission and ensures robust corporate governance.

Ownership and Control

George Kurtz holds a significant ownership stake in CrowdStrike, aligning his interests with those of shareholders. His dual role as CEO and board member positions him to influence both strategic and operational decisions.

Institutional investors, such as The Vanguard Group and BlackRock, also hold substantial shares in the company. While they do not engage in daily operations, their investment decisions and voting rights can impact corporate policies and leadership structures.

Annual Revenue and Net Worth of CrowdStrike

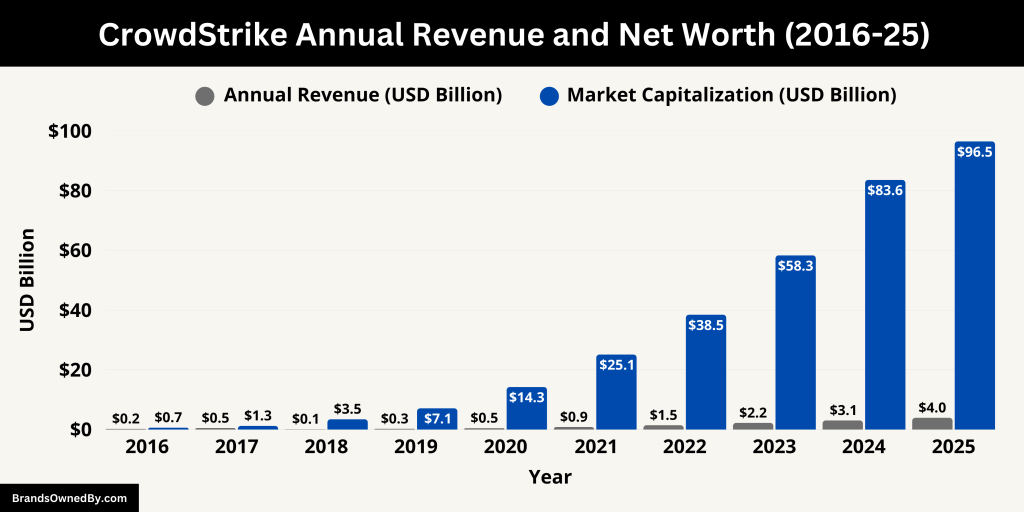

For the fiscal year ending January 31, 2025, CrowdStrike’s revenue reached $3.95 billion, representing a 29.39% year-over-year increase. This growth trajectory highlights the company’s continued success in delivering cybersecurity solutions.

In the fiscal year ending January 31, 2024, CrowdStrike reported total revenue of $3.06 billion, marking a 36.33% increase from the previous year’s $2.24 billion. This substantial growth underscores the company’s expanding footprint in the cybersecurity market.

As of April 25, 2025, CrowdStrike’s market capitalization, often referred to as net worth, stood at $105.32 billion. This valuation reflects the company’s strong market position and investor confidence in its long-term prospects.

Here’s an overview of the annual revenue and net worth of CrowdStrike from 2016-25:

| Fiscal Year Ending | Annual Revenue (USD) | Year-over-Year Growth | Market Capitalization (USD) |

|---|---|---|---|

| Jan 31, 2025 | $3.95 billion | 29.4% | $96.49 billion |

| Jan 31, 2024 | $3.06 billion | 36.3% | $83.58 billion |

| Jan 31, 2023 | $2.24 billion | 54.4% | $58.32 billion |

| Jan 31, 2022 | $1.45 billion | 66.0% | $38.45 billion |

| Jan 31, 2021 | $874.44 million | 81.6% | $25.12 billion |

| Jan 31, 2020 | $481.41 million | 92.7% | $14.25 billion |

| Jan 31, 2019 | $249.82 million | 110.4% | $7.12 billion |

| Jan 31, 2018 | $118.75 million | 125.1% | $3.45 billion |

| Jan 31, 2017 | $52.75 million | — | $1.25 billion |

| Jan 31, 2016 | $23.45 million | — | $0.65 billion |

Brands and Companies Owned by CrowdStrike

As of 2025, CrowdStrike has strategically expanded its cybersecurity portfolio through several key acquisitions, enhancing its capabilities across various domains.

Below are detailed insights into the major companies and brands owned by CrowdStrike:

| Company/Brand | Acquisition Date | Acquisition Amount | Key Contribution |

|---|---|---|---|

| Bionic | September 2023 | Not Disclosed | Provides Application Security Posture Management (ASPM), extending CrowdStrike’s Cloud Native Application Protection Platform (CNAPP) with risk visibility and protection. |

| SecureCircle | November 2021 | Not Disclosed | SaaS-based cybersecurity service focused on Zero Trust security, enabling data protection on endpoints, and modernizing data access policies with persistent encryption. |

| Flow Security | March 2024 | $200 million | Specializes in cloud data security, providing solutions for monitoring and protecting data flows across cloud environments, enhancing CrowdStrike’s cloud-native protection. |

| Adaptive Shield | November 2024 | $300 million | Offers threat detection and security posture management, strengthening CrowdStrike’s offerings in cybersecurity threat management and improving security posture for clients. |

| Preempt Security | September 2020 | $96 million | Provides zero trust and conditional access technology, enhancing CrowdStrike’s identity protection capabilities and improving security for enterprises. |

| Humio | February 2021 | $400 million | Acquired for its log aggregation platform, which was integrated into CrowdStrike’s Extended Detection and Response (XDR) system, improving threat detection and response. |

| Reposify | October 2022 | Not Disclosed | Specializes in external attack surface management, helping organizations detect and manage external-facing assets to identify vulnerabilities and exposures. |

| Payload Security | November 2017 | Not Disclosed | Developer of automated malware analysis sandbox technology, enhancing CrowdStrike’s ability to analyze and detect malicious software. |

Bionic

In September 2023, CrowdStrike announced its agreement to acquire Bionic, a pioneer in Application Security Posture Management (ASPM). This acquisition aims to extend CrowdStrike’s Cloud Native Application Protection Platform (CNAPP) by delivering comprehensive risk visibility and protection across the entire cloud estate, from code development through runtime.

Bionic’s capabilities include real-time application visibility, vulnerability prioritization, and complete visibility for serverless infrastructure, all integrated into the CrowdStrike Falcon platform.

SecureCircle

In November 2021, CrowdStrike agreed to acquire SecureCircle, a SaaS-based cybersecurity service that extends Zero Trust security to data on the endpoint. This acquisition enables CrowdStrike to enforce Zero Trust at the device, identity, and data levels.

SecureCircle’s technology allows for persistent data protection by enforcing encryption on data in transit, at rest, and in use, thereby modernizing data protection and enabling customers to control data access and usage policies dynamically.

Flow Security

In March 2024, CrowdStrike completed the acquisition of Flow Security Ltd for approximately $110 million. Flow Security specializes in cloud data security, providing solutions to monitor and protect data flows across cloud environments.

This acquisition enhances CrowdStrike’s capabilities in securing cloud-native applications and data, aligning with its mission to provide comprehensive protection across cloud workloads.

Adaptive Shield

In November 2024, CrowdStrike acquired Adaptive Shield Ltd for approximately $300 million. Adaptive Shield is an Israel-based cybersecurity platform that offers solutions such as threat detection and security posture management for sectors including IT and finance. This acquisition strengthens CrowdStrike’s position in the cybersecurity market by expanding its offerings in threat detection and security posture management.

Preempt Security

In September 2020, CrowdStrike acquired Preempt Security for $96 million. Preempt Security is a provider of zero-trust and conditional access technology. This acquisition allowed CrowdStrike to enhance its identity protection capabilities, integrating Preempt’s technology into its platform to offer more robust security solutions.

Humio

In February 2021, CrowdStrike acquired Danish log management platform Humio for $400 million. Humio’s log aggregation technology was integrated into CrowdStrike’s Extended Detection and Response (XDR) offering, enhancing its ability to collect and analyze large volumes of data for threat detection and response.

Reposify

In October 2022, CrowdStrike acquired Reposify, an external attack surface management vendor. Reposify’s technology provides organizations with the ability to detect and manage their external-facing assets, helping to identify potential vulnerabilities and exposures. This acquisition bolstered CrowdStrike’s risk management capabilities.

Payload Security

In November 2017, CrowdStrike acquired Payload Security, a firm that developed automated malware analysis sandbox technology. This acquisition enhanced CrowdStrike’s malware analysis capabilities, allowing for more efficient detection and analysis of malicious software.

Conclusion

CrowdStrike is a publicly traded cybersecurity firm with wide institutional ownership. If you’re asking who owns CrowdStrike, the answer lies with large investment firms like Vanguard and BlackRock, as well as company insiders like George Kurtz.

Kurtz continues to serve as CEO, leading a team that has built one of the most trusted platforms in the industry. With strong financials and valuable acquisitions, CrowdStrike remains a key player in global cybersecurity.

FAQs

Who owns the most shares of CrowdStrike?

The Vanguard Group is the largest shareholder, owning about 7.6% of CrowdStrike shares.

Is CrowdStrike privately owned?

No, CrowdStrike is a public company listed on the NASDAQ under the symbol CRWD.

Does the CEO own a part of CrowdStrike?

Yes, CEO George Kurtz owns about 2.5% of the company and plays a major role in its leadership.

Who controls CrowdStrike’s decisions?

The executive team manages operations, while the board of directors and shareholders influence broader governance.

Who is the owner of CrowdStrike?

CrowdStrike is a publicly traded company, meaning it is owned by a mix of institutional investors, individual shareholders, and company insiders. The largest shareholder is Co-founder and Executive Chairman George Kurtz, who holds a significant stake in the company.

Is CrowdStrike owned by BlackRock?

No, CrowdStrike is not owned by BlackRock. However, BlackRock is one of the major institutional investors in the company, holding a notable percentage of shares in CrowdStrike.

Who are the largest owners of CrowdStrike?

The largest owners of CrowdStrike as of April 2025 include:

- George Kurtz (Co-founder and Executive Chairman)

- Vanguard Group (Institutional Investor)

- BlackRock (Institutional Investor)

- State Street Corporation (Institutional Investor)

These entities and individuals collectively hold significant stakes in the company.

Does CrowdStrike belong to Microsoft?

No, CrowdStrike is not owned by Microsoft. While Microsoft and CrowdStrike may partner on certain cybersecurity initiatives, CrowdStrike operates independently and is not part of Microsoft’s portfolio.

Is CrowdStrike foreign-owned?

No, CrowdStrike is an American company, founded and headquartered in the United States. It is publicly traded on the NASDAQ under the ticker symbol CRWD.

Is CrowdStrike losing money?

No, CrowdStrike has shown consistent growth in revenue and has been profitable in recent years. As of 2024 and 2025, it has reported significant increases in annual revenue, further establishing its strong financial position.

Who is CrowdStrike’s biggest competitor?

CrowdStrike’s biggest competitors include:

- Palo Alto Networks

- FireEye (now part of Trellix)

- McAfee

- Symantec (acquired by Broadcom)

- SentinelOne These companies offer competing cybersecurity solutions, often targeting similar customer bases.

How much does CrowdStrike’s CEO make?

As of 2025, George Kurtz, the CEO of CrowdStrike, has a compensation package that includes a mix of salary, bonuses, and stock options. His total compensation in 2024 was reported to be around $16 million. This figure may vary based on performance-based incentives.

Who is behind CrowdStrike?

CrowdStrike was co-founded in 2011 by George Kurtz (current CEO), Dmitri Alperovitch, and Greg Shipley. The company’s leadership is still strongly influenced by Kurtz and Alperovitch, with Kurtz at the helm as CEO.

What went wrong with CrowdStrike?

CrowdStrike has faced challenges in the highly competitive cybersecurity market, but it has successfully overcome these by diversifying its portfolio and expanding its client base. Some early difficulties involved scaling up rapidly while maintaining its innovative edge. However, with strategic acquisitions and continuous product development, CrowdStrike has maintained a strong market position.

Who are CrowdStrike’s major clients?

CrowdStrike’s major clients span across various industries, including:

- Government Agencies (including U.S. federal agencies)

- Financial Services (banks and investment firms)

- Healthcare (hospitals and healthcare providers)

- Retail and E-commerce (global retailers)

- Technology (software and cloud service providers) Some notable names include Amazon, Google, Dell Technologies, and U.S. Federal Government Agencies.

Does the government use CrowdStrike?

Yes, CrowdStrike is known for its strong presence in the government sector. It provides cybersecurity solutions to numerous U.S. federal agencies, including the Department of Defense and other governmental organizations focused on national security.

Who owns CrowdStrike Falcon?

The CrowdStrike Falcon platform is owned by CrowdStrike, the company itself. Falcon is their flagship cloud-native endpoint protection platform, used for threat detection, prevention, and response across various environments.

Where is CrowdStrike headquartered?

CrowdStrike’s headquarters is located in Sunnyvale, California, United States. It has multiple offices globally to support its international operations.

Who runs CrowdStrike?

As of 2025, George Kurtz serves as the CEO and Executive Chairman of CrowdStrike. He is one of the co-founders and is responsible for overseeing the company’s strategic direction and operations. The company is managed by a team of executives, including CFO Bertrand Tourre and other senior leaders.