Costco Wholesale Corporation, commonly known as Costco, is a leading global retailer operating on a membership-only warehouse club model. Understanding who owns Costco involves examining its history, ownership structure, control mechanisms, financial performance, market position, and associated brands.

History of Costco

Costco’s journey began on September 15, 1983, when James Sinegal and Jeffrey Brotman opened the first warehouse in Seattle, Washington.

The company experienced rapid growth, leading to a merger with Price Club in 1993. This merger expanded its reach and resources, solidifying its position in the retail industry.

By 1997, the merged entity adopted the name Costco Wholesale Corporation, under which it continues to operate today.

Who Owns Costco?

Costco is a publicly traded company listed on the Nasdaq under the ticker symbol “COST.” Its ownership is distributed among institutional investors, individual shareholders, and company insiders. Institutional investors hold a significant portion of the company’s shares, reflecting their confidence in Costco’s business model and performance.

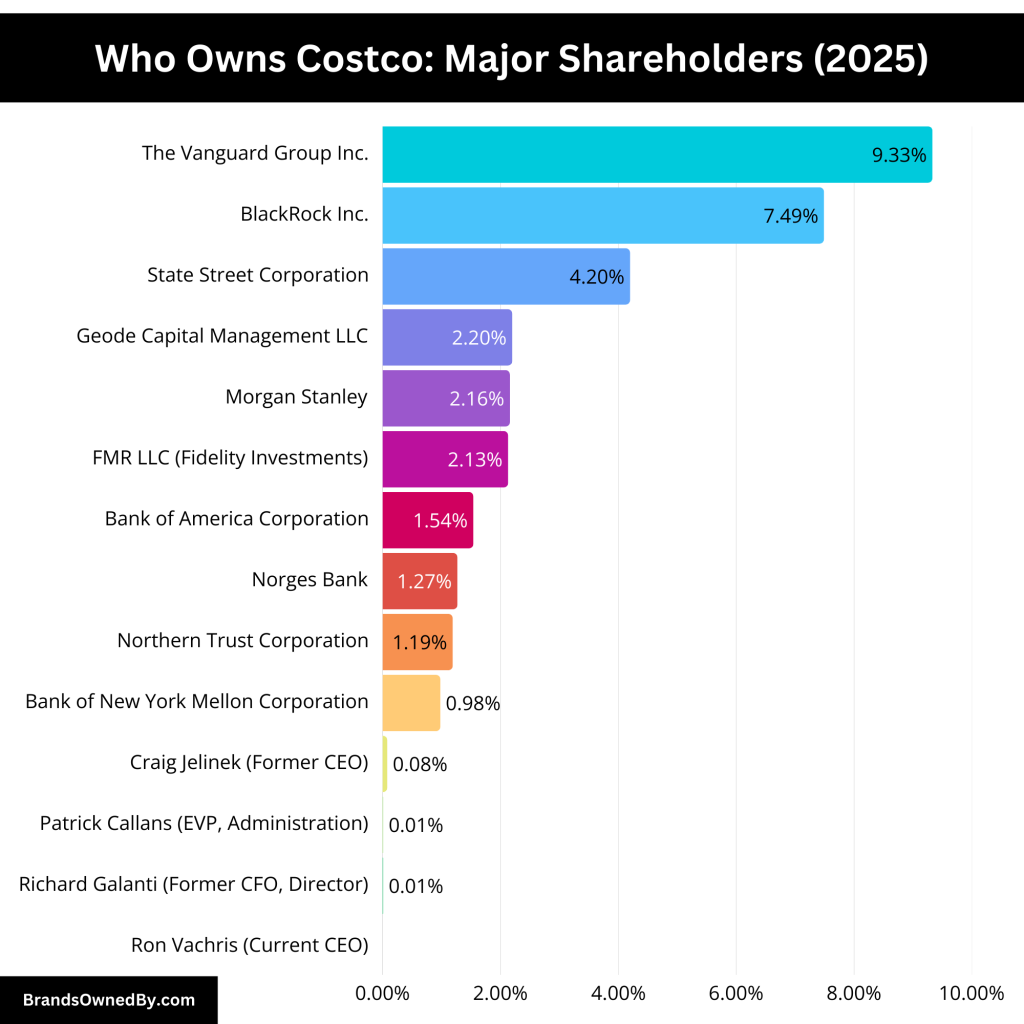

List of Major Costco Shareholders

Costco Wholesale Corporation, a leading global retailer, has a diverse ownership structure comprising institutional investors, company insiders, and retail shareholders. As of June 30, 2024, institutional investors own approximately 71.85% of Costco’s outstanding shares.

Here’s a breakdown of the major shareholders of Costco:

| Shareholder | Percentage of Shares Owned | Role in Costco |

|---|

| The Vanguard Group Inc. | 9.33% | Largest institutional shareholder, passive investor |

| BlackRock Inc. | 7.49% | Second-largest institutional shareholder, passive investor |

| State Street Corporation | 4.20% | Third-largest institutional shareholder, passive investor |

| Geode Capital Management LLC | 2.20% | Institutional investor, manages index funds |

| Morgan Stanley | 2.16% | Institutional investor, investment banking & wealth management |

| FMR LLC (Fidelity Investments) | 2.13% | Institutional investor, mutual fund manager |

| Bank of America Corporation | 1.54% | Institutional investor, banking and asset management |

| Norges Bank | 1.27% | Institutional investor, manages Norway’s sovereign wealth fund |

| Northern Trust Corporation | 1.19% | Institutional investor, wealth management services |

| Bank of New York Mellon Corporation | 0.98% | Institutional investor, investment services provider |

| Craig Jelinek (Former CEO) | 0.08% | Former CEO, advisor, and board member |

| Patrick Callans (EVP, Administration) | 0.014% | Executive Vice President, Administration |

| Richard Galanti (Former CFO, Director) | 0.007% | Former CFO, current board member |

| Ron Vachris (Current CEO) | Undisclosed | President and CEO, oversees Costco’s operations |

The Vanguard Group Inc.

The Vanguard Group Inc. is Costco’s largest institutional shareholder, owning approximately 41.37 million shares, which represents about 9.33% of the total shares outstanding as of June 30, 2024.

Vanguard is a prominent mutual fund and ETF management company with approximately $8.6 trillion in global assets under management (AUM) as of 2024. One of its largest ETFs, the Vanguard S&P 500 ETF (VOO), includes Costco, with the retailer comprising 0.79% of VOO’s holdings as of July 31, 2024.

BlackRock Inc.

BlackRock Inc. holds about 33.19 million shares of Costco, accounting for 7.49% of the total shares outstanding as of June 30, 2024.

BlackRock is a global investment management corporation with approximately $10.47 trillion in AUM as of 2024. Its iShares Core S&P 500 ETF (IVV), one of BlackRock’s largest ETFs with around $511 billion in AUM, includes Costco, which represents 0.85% of IVV’s holdings as of September 4, 2024.

State Street Corporation

State Street Corporation owns approximately 18.63 million shares of Costco, representing about 4.20% of the total shares outstanding as of June 30, 2024.

State Street manages mutual funds, ETFs, and other assets, with approximately $4.37 trillion in AUM. The SPDR S&P 500 ETF Trust (SPY), one of State Street’s largest ETFs with around $553.6 billion in AUM, includes Costco, which constitutes 0.85% of SPY’s holdings.

Geode Capital Management LLC

Geode Capital Management LLC holds approximately 9.74 million shares of Costco, accounting for about 2.20% of the total shares outstanding.

Geode specializes in investment management and serves as the sub-advisor for various index funds, including those in the Fidelity family.

Morgan Stanley

Morgan Stanley owns approximately 9.57 million shares of Costco, representing about 2.16% of the total shares outstanding.

As a leading global financial services firm, Morgan Stanley provides investment banking, securities, wealth management, and investment management services.

FMR LLC (Fidelity Management and Research)

FMR LLC, commonly known as Fidelity Investments, holds about 9.46 million shares of Costco, accounting for approximately 2.13% of the total shares outstanding.

Fidelity is a multinational financial services corporation managing a large portfolio of mutual funds and providing investment services.

Bank of America Corporation

Bank of America Corporation owns around 6.82 million shares of Costco, representing about 1.54% of the total shares outstanding.

As one of the world’s largest financial institutions, Bank of America offers a wide range of banking, investing, asset management, and other financial and risk management products and services.

Norges Bank

Norges Bank holds approximately 5.65 million shares of Costco, accounting for about 1.27% of the total shares outstanding.

Norges Bank manages Norway’s sovereign wealth fund, known as the Government Pension Fund Global, investing in a diversified portfolio globally.

Northern Trust Corporation

Northern Trust Corporation owns about 5.25 million shares of Costco, representing approximately 1.19% of the total shares outstanding.

Northern Trust is a financial services company specializing in wealth management, asset servicing, asset management, and banking.

Bank of New York Mellon Corporation

The Bank of New York Mellon Corporation holds around 4.33 million shares of Costco, accounting for about 0.98% of the total shares outstanding.

BNY Mellon is a global investment company providing investment management and investment services.

Craig Jelinek

As of July 19, 2024, Craig Jelinek owned 356,106 shares of Costco, representing approximately 0.08% of all outstanding shares.

Jelinek served as Costco’s CEO from 2012 until stepping down in January 2024, after which he continued in an advisory role until the spring. During his tenure, Jelinek oversaw significant growth, including expanding operations into China.

Patrick Callans

Patrick Callans owned 62,895 shares of Costco as of March 11, 2024, roughly 0.014% of all outstanding shares.

Callans serves as Executive Vice President of Administration for Costco, a position he has held since January 2019. He previously served as Senior Vice President of Human Resources and Risk Management and joined Costco as corporate counsel in 1994.

Richard Galanti

Richard Galanti owned 30,626 shares of Costco as of August 15, 2024, approximately 0.007% of the total shares outstanding.

Galanti has been a director of Costco since 1995 and served as Chief Financial Officer from 1997 until March 15, 2024. He played a crucial role in Costco’s financial strategy, guiding the company through significant expansions and economic shifts.

Ron Vachris

Ron Vachris, Costco’s current CEO as of January 2024, holds an undisclosed number of shares, but as the new leader of the company, he plays a pivotal role in shaping its future. Vachris has been with Costco for over 40 years, previously serving as Chief Operating Officer. His leadership focuses on maintaining the company’s core values while driving innovation and global expansion.

Who Controls Costco?

Costco’s control is divided between its Board of Directors, executive leadership, and major institutional shareholders. While institutional investors own the majority of shares, day-to-day decisions are managed by the company’s leadership team.

Board of Directors: The Governing Body

Costco’s Board of Directors is responsible for overseeing the company’s overall strategy, corporate governance, and major business decisions. The board consists of independent directors, company executives, and key industry professionals. They ensure Costco adheres to its long-term goals while maintaining shareholder interests.

Some key members of the Board include:

- Hamilton E. James – Chairman of the Board, former Executive Vice Chairman of Blackstone Group

- Ron Vachris – CEO and President of Costco, Board Member

- Susan Decker – Former Yahoo! CFO, Independent Director

- W. Craig Jelinek – Former CEO, Board Member

- Richard Galanti – Former CFO, Board Member

The Board of Directors also establishes corporate policies, executive compensation, and financial strategies, ensuring Costco remains competitive in the retail industry.

Executive Leadership: Day-to-Day Decision Makers

While the Board sets policies, the executive leadership team is responsible for implementing them. These top executives manage Costco’s daily operations, expansion, and financial performance.

Ron Vachris – President and CEO

Ron Vachris took over as CEO in January 2024, succeeding Craig Jelinek. With over 40 years at Costco, Vachris plays a critical role in leading the company’s global expansion and maintaining its cost-efficient business model. He oversees all business operations and works closely with the board to set long-term goals.

Gary Millerchip – Chief Financial Officer (CFO)

Gary Millerchip, appointed CFO in 2024, is responsible for managing Costco’s financial health. His role includes budgeting, financial planning, and investor relations.

Patrick Callans – Executive Vice President, Administration

Patrick Callans manages Costco’s human resources, risk management, and internal operations. His leadership ensures the company maintains its strong corporate culture.

Bob Nelson – Executive Vice President, Finance and Investor Relations

Bob Nelson plays a key role in handling Costco’s financial operations and reporting to institutional shareholders.

Institutional Investors: Indirect Influence

While Costco’s executives and board control daily operations, institutional investors, such as The Vanguard Group, BlackRock, and State Street Corporation, have significant influence. These major shareholders control over 71% of Costco’s stock, giving them voting power in board elections and key corporate decisions.

Even though they do not manage Costco’s day-to-day operations, institutional investors vote on executive appointments, mergers, and financial strategies. Their investment decisions impact Costco’s stock price and long-term growth strategies.

Annual Revenue and Net Worth of Costco

Costco has demonstrated robust financial performance in recent years. In the fiscal year ending August 2024, the company reported revenue of $253.7 billion and an operating income of $9 billion.

As of March 2025, Costco’s market capitalization exceeded $401 billion, reflecting its strong market position and investor confidence.

Below is a detailed overview of Costco’s annual revenues from 2015 to 2024:

| Fiscal Year | Annual Revenue (USD) | Year-over-Year Growth (%) |

|---|---|---|

| 2015 | $116.20 billion | 1.80% |

| 2016 | $118.72 billion | 2.61% |

| 2017 | $129.03 billion | 8.68% |

| 2018 | $141.58 billion | 9.70% |

| 2019 | $152.70 billion | 7.85% |

| 2020 | $166.76 billion | 9.21% |

| 2021 | $195.93 billion | 17.48% |

| 2022 | $226.95 billion | 15.83% |

| 2023 | $242.29 billion | 6.76% |

| 2024 | $254.45 billion | 5.02% |

Market Share and Competitors

Costco operates within a highly competitive retail landscape, contending with several major players in the U.S. supermarket industry. As of 2024, Costco holds a market share of approximately 5%, positioning it among the top retailers in the sector.

Here’s a list of the top competitors of Costco:

Walmart: 22% Market Share

Walmart leads the U.S. supermarket industry with a substantial 22% market share. In 2024, Walmart’s grocery segment generated revenues of $420 billion, accounting for over half of its total revenue. The company’s extensive store network and competitive pricing strategies have solidified its dominant position.

Kroger: 10% Market Share

Kroger holds a significant 10% market share in the U.S. supermarket sector. In 2024, Kroger reported grocery revenues of $130 billion. The company’s focus on customer loyalty programs and private label brands has been instrumental in attracting and retaining a broad customer base.

Amazon: 8% Market Share

Amazon, through its acquisition of Whole Foods Market and expansion of its grocery delivery services, commands an 8% market share in the U.S. supermarket industry. In 2024, Amazon’s grocery segment reported revenues of $70 billion. The company’s emphasis on convenience and speed has resonated with consumers seeking efficient shopping solutions.

Albertsons: 6% Market Share

Albertsons maintains a 6% market share in the U.S. supermarket landscape. In 2024, the company reported grocery revenues of $60 billion. Albertsons’ diverse product offerings and commitment to customer service have contributed to its strong market presence.

Publix: 4% Market Share

Publix holds a 4% market share, with 2024 grocery revenues totaling $40 billion. The company’s reputation for exceptional customer service and fresh produce offerings has fostered a loyal customer base, particularly in the Southeastern United States.

Ahold Delhaize: 3% Market Share

Operating under various banners such as Food Lion and Stop & Shop, Ahold Delhaize commands a 3% market share in the U.S. supermarket industry. In 2024, the company’s U.S. grocery operations generated revenues of $30 billion. Ahold Delhaize’s diverse brand portfolio and loyalty programs have been key to its market position.

H-E-B: 2% Market Share

H-E-B, a regional chain based in Texas, holds a 2% market share in the U.S. supermarket industry. In 2024, H-E-B reported grocery revenues of $20 billion. The company’s focus on localized offerings and community engagement has strengthened its market position in the regions it serves.

Target: 2% Market Share

Target maintains a 2% market share in the U.S. supermarket sector, with 2024 grocery revenues amounting to $15 billion. The company’s strategy of integrating grocery offerings with its general merchandise has attracted a diverse customer base seeking convenience.

Meijer: 1% Market Share

Meijer, operating primarily in the Midwest, holds a 1% market share in the U.S. supermarket industry. In 2024, Meijer’s grocery operations generated revenues of $10 billion. The company’s commitment to value and variety has cultivated a loyal customer base in its operating regions.

Brands Owned by Costco

Costco Wholesale Corporation, renowned for its membership-based warehouse clubs, has strategically developed and acquired several subsidiaries to enhance its operations and member offerings. Below is an overview of these key subsidiaries:

Innovel Solutions

In March 2020, Costco acquired Innovel Solutions, a logistics company specializing in the “final mile” delivery of large and bulky items such as appliances, furniture, and fitness equipment. This acquisition, valued at $1 billion, included Innovel’s 1,500 employees and approximately 15 million square feet of warehouse space across the United States.

By integrating Innovel’s capabilities, Costco aimed to streamline its delivery services, ensuring efficient and reliable transportation of oversized products from warehouses to customers’ homes.

Kirkland Signature

Kirkland Signature is Costco’s private-label brand, offering a wide array of products ranging from groceries and packaged foods to clothing and household goods. By producing its own brand, Costco can control product designs, costs, and pricing, allowing the company to sell these products at a higher profit margin compared to third-party vendors.

In recent years, Costco has focused on co-branding Kirkland Signature with other familiar names, introducing new products like Cole Haan shoes and Brown Jordan patio furniture.

Costco Wholesale Canada Ltd.

Costco Wholesale Canada Ltd. operates as the Canadian arm of Costco, managing over 100 warehouses across Canada. This subsidiary ensures that Canadian members have access to Costco’s extensive range of high-quality merchandise and services, tailored to meet the preferences and needs of the Canadian market.

NW Re Limited

NW Re Limited is a subsidiary responsible for certain aspects of Costco’s risk management operations. While it does not directly contribute to Costco’s consumer-facing business, NW Re Limited plays a critical role behind the scenes in managing corporate risk and insurance matters, thereby supporting the overall stability and sustainability of Costco’s operations.

Costco Food Services Inc.

Costco Food Services Inc. oversees all food service operations within U.S. warehouses, including the popular food courts known for items like hot dogs and pizza slices. This subsidiary ensures consistency, quality, and efficiency in the food offerings available to members, enhancing the overall shopping experience.

Costco Insurance Agency Inc.

Costco Insurance Agency Inc. provides insurance services to Costco members, offering a range of insurance products tailored to meet their needs. This subsidiary exemplifies Costco’s commitment to delivering value-added services beyond traditional retail offerings.

CWC Gift Card Co.

CWC Gift Card Co. manages Costco’s gift card operations, ensuring seamless transactions and a variety of gift card options for members. This subsidiary contributes to enhancing member convenience and satisfaction.

El Camino Real Bakery Inc.

El Camino Real Bakery Inc. is involved in producing bakery items for Costco warehouses, maintaining the quality and freshness of baked goods available to members. This subsidiary supports Costco’s commitment to offering high-quality in-house products.

Conclusion

Costco’s ownership is characterized by a diverse mix of institutional investors, individual shareholders, and company insiders. This diversified ownership structure ensures balanced control and strategic direction. Under the leadership of its Board and executive team, Costco continues to thrive financially, maintain a strong market position, and offer value to its members through brands like Kirkland Signature.

FAQs

Who is the largest shareholder of Costco?

The Vanguard Group Inc. is the largest shareholder, holding approximately 9.51% of Costco’s shares.

How much of Costco is owned by institutional investors?

Institutional investors collectively own about 68.48% of Costco’s shares.

Does Costco have any private-label brands?

Yes, Costco’s private label brand is Kirkland Signature, offering a wide range of products known for quality and value.

Who is the CEO of Costco?

W. Craig Jelinek has been the CEO of Costco since 2012.

When was Costco founded?

Costco was founded on September 15, 1983, in Seattle, Washington.