Cava has grown from a small Mediterranean eatery into one of America’s most talked-about fast-casual chains. Known for its customizable bowls, fresh ingredients, and bold flavors, the company has built a loyal following across the United States. Many food lovers and investors now wonder about its background, leadership, and especially who owns Cava. Understanding its ownership structure reveals how this once local concept became a billion-dollar publicly traded brand.

CAVA Company Profile

Cava Group, Inc., known simply as Cava, is a publicly traded Mediterranean fast-casual restaurant company based in Washington, D.C. It was founded in 2006 and operates across the United States. The company features customizable bowls, salads, and pitas built with fresh proteins, vegetables, and signature dips. It also offers grocery products such as dips and spreads sold in stores like Whole Foods.

As of early 2025, Cava employs several thousand people and manages between roughly 380 to 400 restaurant locations nationwide.

CAVA Founders

Cava was established in 2006 by three childhood friends: Ted Xenohristos, Ike Grigoropoulos, and Dimitri Moshovitis. They launched the original full-service concept called Cava Mezze in Rockville, Maryland.

In 2009, Brett Schulman joined the team as co-founder and CEO of the fast-casual iteration. He played a key role in scaling the brand and later leading its public listing.

Major Milestones

- 2006: First full-service restaurant, Cava Mezze, opens in Rockville, MD.

- 2011: Launch of the fast-casual concept, originally called Cava Mezze Grill, later renamed Cava.

- 2018: Acquisition of a larger Mediterranean chain to accelerate expansion.

- June 2023: Cava goes public on the NYSE under the ticker CAVA.

- Q1 2025: Company surpasses $1 billion in trailing 12-month revenue. Same-store sales rose; the restaurant count reached around 382. Growth expanded into new states and high-profile markets.

- Q2 2025 (ending July 13): Revenue grew by 20.3% year-over-year to about $278 million. Same-restaurant sales increased, and the company reached nearly 400 locations. Profit margins remained strong.

- Mid-2025: Cava opened a major new restaurant in a landmark location, signaling continued expansion into prominent markets. The company has a clear goal of reaching at least 1,000 restaurants by 2032.

- July 2025: Cava released its first Impact Report, showcasing its values-led approach centered on community, wellness, and employee care.

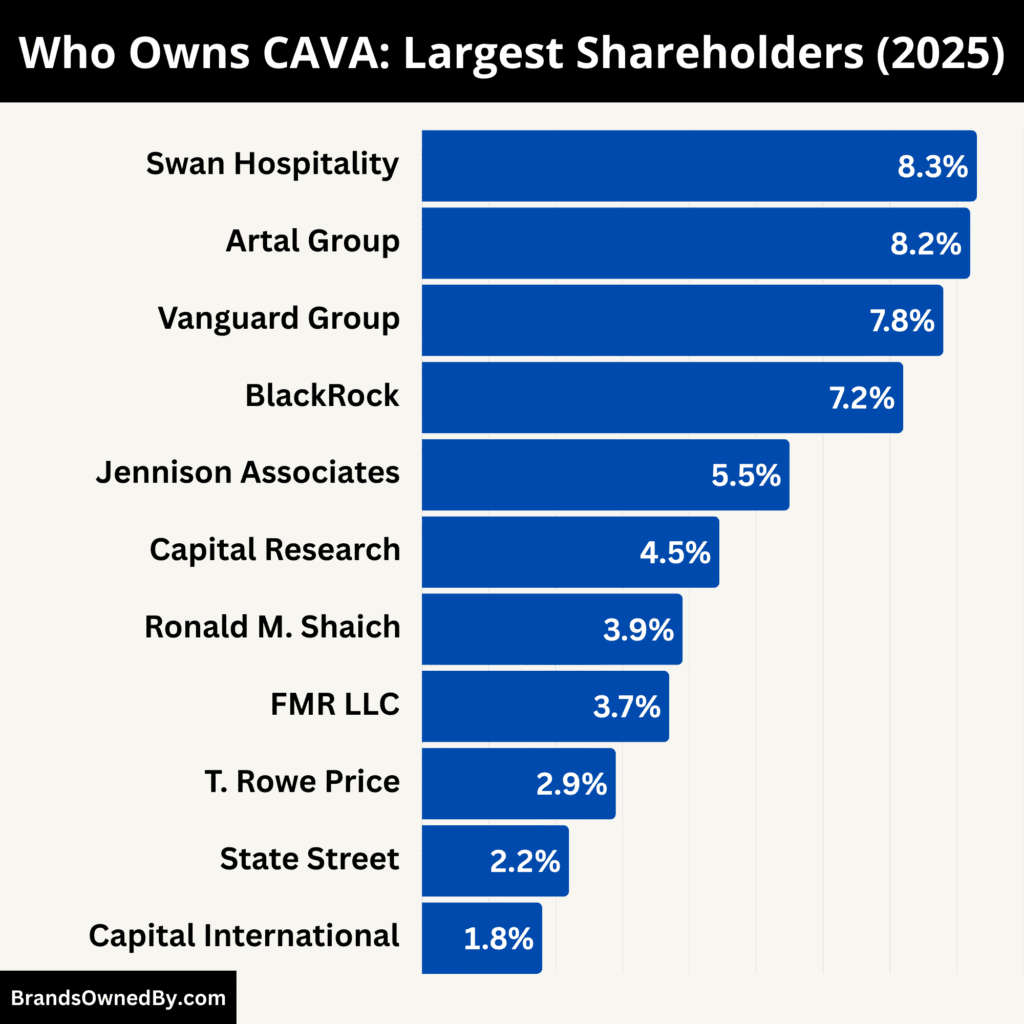

Who Owns CAVA: Top Shareholders

CAVA’s ownership structure reflects a balance between institutional investors, insiders, and retail shareholders. The company has attracted some of the world’s largest asset managers, private investment firms, and long-term strategic backers. While institutional investors hold the majority of shares, insiders such as founders and executives maintain a meaningful stake, ensuring that leadership’s interests remain aligned with growth and brand development.

The ownership breakdown is as follows as of 2025:

- Institutional Investors: ~73–82%

- Insiders: ~14–15%

- Retail/Public Investors: ~14–18%.

Below is a list of the major shareholders of CAVA as of August 2025:

| Shareholder / Group | Ownership % (Approx.) | Role & Influence |

|---|---|---|

| Swan Hospitality LLC | 8.3% | Largest individual holder; insider-led entity with strong governance influence. |

| Artal Group S.A. | 8.2% | Long-term institutional backer; strategic oversight in growth planning. |

| The Vanguard Group Inc. | 7.8% | Major index fund investor; passive but powerful governance influence. |

| BlackRock, Inc. | 7.2% | Global asset manager; passive stake but significant proxy voting power. |

| Jennison Associates LLC | 5.5% | Active manager; supports aggressive growth strategies. |

| Capital Research Global Investors | 4.45% | Long-term institutional investor; steady governance role. |

| Ronald M. Shaich / Act III Holdings | 3.9–4.0% | Chairman and strategic leader; blends ownership with board influence. |

| FMR LLC (Fidelity) | 3.7–3.8% | Focus on consumer-facing companies; adds retail credibility. |

| T. Rowe Price Associates | 2.9% | Reputable institutional investor; growth-focused outlook. |

| State Street Corporation (SSgA) | 2.2% | Index-based investor; passive but key for ETF exposure. |

| Capital International Investors | 1.8% | Diversified global investor; adds international weight. |

| Smallcap World Fund | 3.9% | Mutual fund exposure diversifies the retail investor base. |

| Vanguard Total Stock Market ETF | 2.7% | Broad index ETF; passive holding across U.S. equities. |

| iShares Core S&P Mid-Cap ETF | 2.3% | Mutual fund exposure diversifies retail investor base. |

| Vanguard Small-Cap ETF | 2.1% | Index ETF targeting small-cap companies; supports retail exposure. |

| Insiders (Executives & Founders) | 14–15% combined | Includes Ronald Shaich (~3.9%) and CEO Brett Schulman (~1.3%); aligns leadership with investors. |

| Retail / Public Investors | 14–18% combined | Provides liquidity and balances institutional dominance. |

Artal Group S.A.

Artal Group S.A. holds around 8.2% of CAVA. As one of the earliest and largest institutional backers, Artal has had a long-term role in shaping the company’s growth strategy. Its consistent stake reflects confidence in CAVA’s scalability and brand strength.

The group’s influence lies more in strategic oversight than in daily management, but its voice in shareholder meetings carries weight.

Swan Hospitality LLC

Swan Hospitality LLC owns approximately 8.3%, making it the single largest individual holder. This insider-led entity has been deeply involved in CAVA’s expansion and governance.

Its stake ensures that company leadership stays closely aligned with long-term brand building rather than only short-term financial goals. Swan Hospitality has one of the strongest voting influences among shareholders.

The Vanguard Group Inc.

The Vanguard Group controls about 7.8% of shares. As one of the largest asset managers globally, Vanguard primarily invests through its index funds and ETFs. Its ownership is passive but powerful, as its sheer stake provides substantial voting influence in corporate governance matters. Vanguard’s presence helps attract additional institutional investors due to its reputation.

BlackRock, Inc.

BlackRock holds roughly 7.2% of CAVA. Like Vanguard, BlackRock invests mainly through ETFs and mutual funds. Despite being a passive investor, its scale gives it significant say in proxy voting and governance. BlackRock’s involvement signals that CAVA is viewed as a strong growth company suitable for inclusion in major index funds.

Jennison Associates LLC

Jennison Associates controls about 5.5% of shares. Known for its active management approach, Jennison’s investment represents a more growth-focused bet on CAVA. Unlike passive investors, Jennison tends to influence companies more directly by supporting expansion strategies that align with its portfolio vision.

Capital Research Global Investors

With ownership of around 4.45%, Capital Research Global Investors adds to the pool of long-term, stable institutional backers. Its presence reinforces institutional confidence in CAVA’s brand growth and operational execution. Capital Research typically plays a quiet but steady role in governance.

FMR LLC (Fidelity)

FMR LLC, commonly known as Fidelity, owns close to 3.7–3.8%. Fidelity’s funds often target companies with strong retail and consumer appeal. This stake provides balance to CAVA’s shareholder structure by blending both retail investor trust and institutional confidence.

Ronald M. Shaich / Act III Holdings

Ron Shaich, CAVA’s chairman and the founder of Panera Bread, along with Act III Holdings, collectively controls about 3.9–4%. Shaich’s ownership is strategic rather than purely financial. His influence combines board leadership with long-term vision for CAVA’s growth. He is one of the most important figures in decision-making, bridging the gap between management and investors.

T. Rowe Price Associates

T. Rowe Price owns approximately 2.9%. As an established institutional investor, T. Rowe brings additional credibility to CAVA’s investor pool. It supports growth-driven companies with a focus on consumer sectors.

State Street Corporation (SSgA)

State Street Corporation controls around 2.2%. Its investment is largely index-based, making it another passive but crucial institutional shareholder. State Street also acts as a custodian for many ETFs that indirectly hold CAVA.

Capital International Investors

Capital International Investors holds about 1.8%. Their participation adds to the depth of global investment in CAVA and diversifies the shareholder base further.

Mutual Fund and ETF Holders

Several pooled investment funds contribute to CAVA’s broad shareholder base.

- Smallcap World Fund: ~3.9%

- Vanguard Total Stock Market ETF: ~2.7%

- iShares Core S&P Mid-Cap ETF: ~2.3%

- Vanguard Small-Cap ETF: ~2.1%.

These funds bring retail investors indirect access to CAVA through diversified holdings.

Insider Ownership

Executives and insiders collectively control around 14–15%. This group includes:

- Ronald Shaich (Chairman): ~3.9%

- Brett Schulman (CEO): ~1.3%.

Insider ownership ensures management interests are aligned with shareholder goals. It also reflects leadership’s confidence in CAVA’s long-term potential.

Who is the CEO of CAVA?

The current CEO of Cava Group is Brett Schulman. He helped lead early growth and remains in the decision-making leadership. The company’s structure includes a board of directors, chaired by Ron Shaich, founder of Act III Holdings.

Brett Schulman co-founded CAVA in 2010 and has served as its Chief Executive Officer, President, and Director ever since.

Before establishing the company, he worked as Partner and COO at Snikiddy Snacks and previously held financial leadership positions at FBR Securities and Alex. Brown Deutsche Bank. He earned a B.A. in Behavioral and Social Sciences from the University of Maryland.

Here’s an overview of his achievements:

| Key Aspect | Details |

|---|---|

| Background | Former COO at Snikiddy Snacks; finance roles; BA from University of Maryland |

| Leadership Role | Co-founder; CEO, President, and Board Director since 2010 |

| Company Growth | ~400 locations by mid-2025; rapid revenue and profit growth |

| Strategy and Vision | Dual restaurant and packaged goods focus; innovation-driven expansion |

| Recognition | Named 2023 CEO of the Year |

| Compensation & Net Worth | ~792K shares; ~$54M net worth; ~$1.97M annual compensation |

| Forward Outlook | Co-founder, CEO, President, and Board Director since 2010 |

Operational Leadership and Strategic Vision

Schulman has been the driving force behind CAVA’s expansion, overseeing its growth from a single concept into a nationwide Mediterranean fast-casual chain. He played a central role in launching the company’s packaged goods line and guided CAVA through its successful IPO on the NYSE in 2023.

His leadership emphasizes innovation, hospitality, and operational efficiency, balancing restaurant growth with a consumer packaged goods strategy.

Company Growth under His Tenure

Under his leadership, CAVA has grown to nearly 400 restaurant locations across the United States by mid-2025. Revenue in the first quarter of 2025 climbed 28% to more than $328 million, while same-store sales rose 10.8% and net income increased 83.7%.

By the second quarter of 2025, the company reported revenue of $278.2 million, marking 20.3% growth, and celebrated the milestone of opening its 400th restaurant. CAVA also raised its long-term target to 1,000 locations by 2032.

Recognition and Leadership Style

Brett Schulman was named CEO of the Year by the Washington Business Journal in 2023. His leadership style is known for balancing data-driven decision-making with openness to experimentation.

For example, he has openly discussed learning from past mistakes, such as an underperforming 2012 store, and using those experiences to refine CAVA’s growth strategy. He fosters a culture that views challenges as opportunities for innovation.

As of 2025, Schulman owns more than 792,000 shares of CAVA, giving him an estimated net worth of at least $54 million. His annual compensation is approximately $1.97 million, reflecting his dual role as CEO and co-founder.

Future Outlook and Vision

Schulman continues to push CAVA toward sustainable long-term growth. His priorities include expanding the restaurant footprint, enhancing digital customer experiences, and implementing AI-enabled kitchen innovations.

He also emphasizes building a strong community-focused brand rooted in health and hospitality. Despite broader economic uncertainties, Schulman maintains CAVA’s trajectory toward nationwide expansion and innovation leadership.

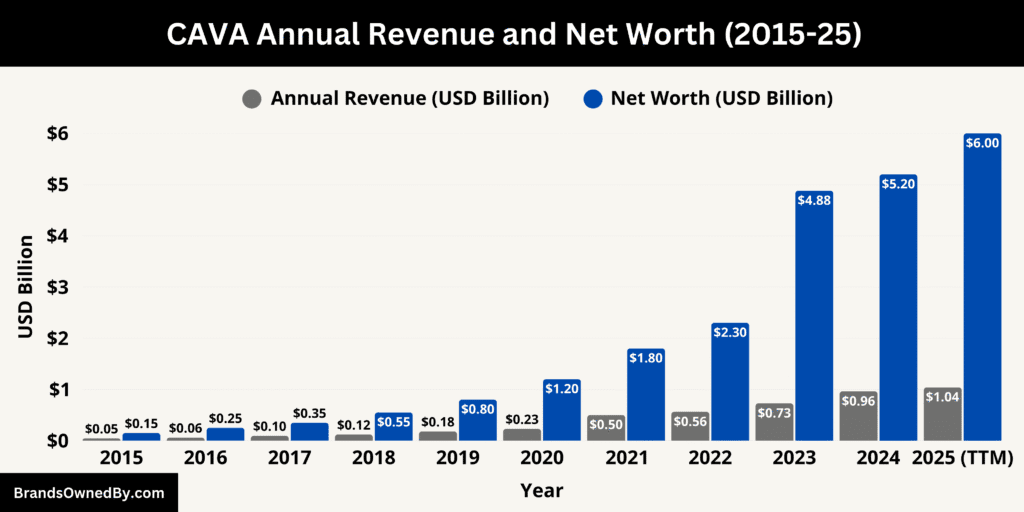

CAVA Annual Revenue and Net Worth

CAVA’s financial performance in 2025 underscores its rapid rise in the fast-casual dining industry. It reported quarterly revenue of $328 million in early 2025 and continues to deliver strong same-store sales growth.

With a net worth of over $6 billion as of August 2025, CAVA’s revenue and net worth demonstrate both its financial strength and its growing influence in the restaurant sector.

Here’s an overview of CAVA’s net worth and annual revenue from 2015 to 2025:

| Year | Annual Revenue (Millions USD) | Market Cap / Net Worth (Billions USD) |

|---|---|---|

| 2015 | ~45 | ~0.15 (private valuation) |

| 2016 | ~60 | ~0.25 |

| 2017 | ~95 | ~0.35 |

| 2018 | ~120 | ~0.55 |

| 2019 | ~180 | ~0.80 |

| 2020 | ~230 | ~1.20 |

| 2021 | 500.1 | ~1.80–2.00 |

| 2022 | 564.1 | ~2.30–2.50 |

| 2023 | 728.7 | 4.88 (IPO debut) |

| 2024 | 963.7 | 5 |

| 2025 | ≈ 1,040 (TTM) | 6 |

CAVA Revenue in 2025

CAVA’s revenue trajectory in 2025 has continued its upward momentum, reflecting both strong consumer demand and strategic expansion. In the first quarter of 2025, the company generated over $328 million in revenue, marking a 28% increase compared to the same period in the previous year.

This growth was fueled by new restaurant openings, higher guest traffic, and increased digital ordering. By the second quarter of 2025, CAVA reported revenue of $278.2 million, which represented a year-over-year growth of 20.3%. Despite seasonal variations, the company’s performance highlighted its ability to sustain double-digit growth in a competitive restaurant industry.

Beyond overall revenue, CAVA’s same-store sales demonstrated remarkable strength in 2025. Comparable sales climbed by 10.8% in the first quarter alone, showcasing the brand’s resonance with customers and its ability to generate repeat business. Profitability also improved significantly.

Net income soared by 83.7% year-over-year in early 2025, underscoring the company’s progress in managing costs while scaling operations. These results have positioned CAVA as one of the fastest-growing brands in the U.S. fast-casual dining sector.

CAVA Net Worth

As of August 2025, CAVA’s market capitalization has exceeded $6 billion, placing it among the leading publicly traded restaurant chains in terms of valuation. This net worth reflects not only strong revenue and profitability but also investor confidence in the brand’s long-term growth prospects.

The company’s steady financial performance and ambitious expansion targets have helped maintain a healthy stock performance since its IPO in 2023.

Looking ahead, CAVA has reaffirmed its goal of reaching 1,000 restaurant locations nationwide by 2032. Achieving this target is expected to push annual revenue well into the billions, solidifying its standing as a household name in fast-casual dining.

With a combination of strategic growth, customer loyalty, and operational efficiency, CAVA’s financial outlook for the rest of 2025 and beyond remains robust.

Companies Owned by CAVA

CAVA has steadily built a diverse portfolio of operations that extend beyond its restaurants. The company not only runs a fast-growing chain of Mediterranean-inspired eateries but also manages digital platforms, catering services, grocery products, and in-house production facilities. Through acquisitions, brand integration, and centralized systems, CAVA has created a network of owned entities that strengthen its growth, enhance consistency, and expand its reach in multiple consumer markets.

Here’s a list of the major companies and brands owned by CAVA as of 2025:

| Company/Brand/Entity | Type | Description | Role within CAVA |

|---|---|---|---|

| CAVA Restaurants | Fast-Casual Dining Chain | Mediterranean-inspired restaurants serving customizable bowls, pitas, and salads across the U.S. | Core business and primary revenue driver |

| Zoës Kitchen (converted stores) | Former Restaurant Chain (Acquired 2018) | Over 250 Zoës Kitchen locations acquired and many converted into CAVA restaurants. | Expanded CAVA’s footprint nationwide |

| CAVA Digital Platform | Technology & Mobile App | Online ordering, loyalty program, delivery integration, and customer data analytics. | Enhances digital engagement and revenue growth |

| CAVA Catering | Catering Services | Large-scale catering solutions for corporate and private events. | Extends brand reach beyond in-store dining |

| CAVA Grocery Products | Packaged Goods | Dips, spreads, and sauces sold in grocery stores nationwide. | Builds brand awareness and revenue outside restaurants |

| CAVA Commissary Kitchens | Production Facilities | Centralized kitchens producing dips, sauces, and spreads. | Ensures consistency and supports both restaurants and retail products |

| CAVA Supply Chain Network | Logistics & Distribution | Oversees procurement, ingredient sourcing, and supply chain logistics. | Strengthens efficiency and quality control |

CAVA Restaurants

CAVA operates a nationwide fast-casual restaurant brand focused on customizable Mediterranean bowls, pitas, and salads. Stores follow a standardized operating model with line-service assembly, digital pick-up shelves, and streamlined kitchens for speed. New units are typically infill or cluster builds in target markets to improve brand awareness and logistics. Restaurants are supported by centralized training, playbooks, and unit-level analytics to optimize throughput, labor, and food costs.

CAVA Digital and Rewards

CAVA’s owned mobile app and web ordering platform power digital pickup, scheduled orders, and delivery through integrated partners. The in-house loyalty program rewards frequency, captures first-party data, and enables personalized offers. Digital channels also reduce order friction at peak times and provide operational signals (like prep pacing) back to kitchens. Marketing, menu tests, and LTOs are increasingly orchestrated through this owned digital stack.

CAVA Catering

CAVA Catering serves groups with build-your-own bars, curated bundles, and boxed meals. It is operated by the company as a distinct service line using restaurant kitchens and a centralized ordering workflow. Catering leverages off-peak kitchen capacity, improves fixed-cost absorption, and deepens community relationships with offices, schools, events, and healthcare clients.

CAVA Grocery (Dips, Spreads, and Dressings)

CAVA produces and sells branded refrigerated dips, spreads, and dressings in grocery channels. These products extend brand presence beyond the four walls and create a second consumer occasion at home. The CPG line also acts as a marketing flywheel, introducing new guests to the restaurant brand and providing R&D feedback on flavors that may migrate onto the menu.

CAVA Foods

CAVA Foods is the company’s owned production arm for select prepared items and retail products. It focuses on consistency, food safety, and cost control for high-volume SKUs such as hummus, tzatziki, and dressings. The group houses culinary R&D, sensory testing, and packaging development, enabling faster iteration on flavors and portion formats while maintaining quality standards at scale.

Zoës Kitchen

CAVA acquired Zoës Kitchen and subsequently converted or closed legacy units. While the Zoës consumer brand no longer operates as a separate concept, the acquisition contributed leases, trade areas, real estate intelligence, talent, and supply relationships that CAVA retained and integrated. The conversion program accelerated CAVA’s national footprint and informed a repeatable playbook for future market entries.

Centralized Supply Chain and Commissary Operations

CAVA manages key elements of procurement, distribution, and limited-prep commissary work to stabilize quality and unit-level efficiency. The company negotiates core ingredients and packaging, sets specifications with co-manufacturers, and uses regional DCs to balance freshness with availability. Commissary processes are focused on items where centralization improves consistency or labor productivity at the restaurant.

Training, Operations, and Leadership Development

CAVA operates internal training curricula, field certification programs, and a leadership pipeline for GMs and multi-unit operators. This internal “academy” approach is an owned capability that supports rapid new-unit openings, maintains hospitality standards, and lifts retention. Instructional content, SOPs, and checklists are developed centrally and pushed through digital tools for field execution.

Menu Innovation and Test Kitchen

CAVA runs an internal culinary program responsible for menu R&D, seasonal innovation, and limited-time offers. The company maintains a test kitchen environment to trial prep methods, new proteins, plant-forward items, and regional flavors. Insights from pilots flow into national rollouts only after operational validation on speed, hold quality, and cost.

Real Estate and New Unit Development

CAVA’s development function sources, negotiates, and builds new restaurants using a standardized design system that balances brand look-and-feel with local flexibility. The company controls the full opening sequence from site selection and permitting through training and launch. Post-opening reviews and traffic studies inform subsequent market clustering and remodel cycles.

Corporate Functions and Shared Services

CAVA owns its core shared services across finance, legal, HR, IT, analytics, and ESG/impact. These teams support public-company reporting, internal controls, workforce management, and data platforms used by operations. The ESG and impact teams manage goals around sourcing, packaging, food waste reduction, and community engagement, aligning brand purpose with growth.

Brand Marketing and Community Partnerships

CAVA manages its creative, social, and local-store marketing programs centrally. The brand operates owned channels for storytelling, product education, and guest engagement, while community partnerships and openings are executed through field marketing. In-house brand stewardship ensures coherence across restaurants, grocery packaging, and digital touchpoints.

Safety, Quality Assurance, and Compliance

CAVA’s owned QA function sets product specifications, audits suppliers, and oversees food safety protocols from manufacturing to restaurant service. The company runs training and verification programs for HACCP, temperature control, allergen management, and sanitation, integrating these standards into daily operations and vendor scorecards.

Final Thoughts

Cava’s journey shows how a simple idea can grow into a nationally recognized brand. The question of who owns Cava highlights its evolution from a founder-led vision to a company supported by a wide range of shareholders. Its growth reflects changing consumer preferences and the rising demand for fresh, accessible dining. As it continues to expand, Cava stands as an example of how modern restaurant concepts can balance tradition with innovation while capturing the attention of both customers and investors.

FAQs

Who owns CAVA restaurant?

CAVA restaurants are owned and operated by CAVA Group, Inc., a U.S.-based public company listed on the New York Stock Exchange under the ticker CAVA. Ownership is shared among institutional investors, company insiders, and retail shareholders.

Is CAVA Israeli owned?

No, CAVA is not Israeli-owned. It is an American company, founded and headquartered in Washington, D.C. While the cuisine is Mediterranean-inspired, the ownership and operations are based in the United States.

Who founded CAVA?

CAVA was founded in 2006 by Ted Xenohristos, Ike Grigoropoulos, and Dimitri Moshovitis, three friends of Greek heritage who wanted to bring modern Mediterranean flavors to the U.S. dining scene.

Who owns CAVA restaurant chain?

The CAVA restaurant chain is owned by CAVA Group, Inc., which oversees its restaurant operations, grocery products, catering services, and commissary kitchens. Its shareholders include institutional investors like Vanguard, BlackRock, and others.

Is CAVA a public company?

Yes, CAVA is a publicly traded company. It went public in June 2023, with one of the most successful restaurant IPOs in recent years.

Who owns CAVA Group?

CAVA Group, Inc. is owned collectively by its shareholders, which include large institutional investors, mutual funds, private equity firms, insiders, and retail investors.

Who is the largest shareholder of CAVA?

As of 2025, the largest shareholder of CAVA is The Vanguard Group, a global investment management company that holds a significant stake through its index funds and ETFs.

Who invested in CAVA?

Before its IPO, CAVA received funding from Revolution Growth, T. Rowe Price, and other venture capital and private equity investors. Post-IPO, major institutional investors like Vanguard, BlackRock, Fidelity, and State Street are key investors.

Does BlackRock own CAVA?

Yes, BlackRock owns a notable percentage of CAVA shares through its index funds and ETFs. It is one of the top institutional investors but not the single largest shareholder.

Is CAVA owned by private equity?

CAVA was previously backed by private equity firms before going public. However, as of 2025, it is a public company. Private equity no longer directly owns CAVA, although some investment firms may still hold shares through public markets.

Who founded Cava?

Cava was founded by Ted Xenohristos, Ike Grigoropoulos, and Dimitri Moshovitis. Brett Schulman later joined as co-founder and CEO.

Did Cava own Zoës Kitchen?

Yes, Cava Group acquired Zoës Kitchen in 2018 and eventually rebranded or closed all locations by 2023.

Is Cava a public company?

Yes. Cava Group, Inc. went public in June 2023 and trades under the ticker CAVA.