Brookfield Corporation is a major global investment company with interests in real estate, infrastructure, renewable energy, and private equity. In this article, we explore who owns Brookfield Corporation, its corporate structure, major shareholders, subsidiaries, leadership, and financial performance.

Brookfield Corporation Profile

Brookfield Corporation is a leading global investment firm. It focuses on real assets, insurance and wealth solutions, and asset management. It has over $1 trillion in total assets, including discretionary capital of $165 billion in early 2025.

Company Details

Headquartered in Toronto at Brookfield Place, Brookfield Corporation trades publicly under the symbol BN in both Toronto and New York. It was originally founded in 1899, evolving from a power company in Brazil. In 2022, it spun off Brookfield Asset Management to simplify its structure and drive value.

As of Q1 2025, it reported distributable earnings of $1.5 billion (up 27%) and had repurchased $850 million in shares. Discretionary capital reached a record $165 billion. It deploys capital across three main segments: Asset Management, Wealth Solutions, and Operating Businesses.

Founders

The origin traces back to São Paulo Tramway, Light and Power Co., founded in 1899 by William Mackenzie and Frederick Pearson. In 1912, it became a Toronto-listed utility under the Brazilian Traction & Light banner. The Bronfman brothers later shaped it via Brascan and Edper in the mid‑20th century.

Major Milestones

Brookfield’s history is defined by strategic phases:

• 1899–1960s: Power and utility development in Brazil; transition to Brazilian Light & Power, then Brascan.

• 1997: Merger of Edper and Brascan to form EdperBrascan Corporation.

• 2002: Bruce Flatt appointed CEO.

• 2005: Rebranded as Brookfield Asset Management.

• 2018: Acquired Westinghouse Electric Company to enter nuclear power.

• 2019: Gained control of Oaktree Capital for $4.7 billion.

• 2022: Corporate spin‑off of asset management into Brookfield Asset Management; Brookfield Corporation becomes the parent entity.

• 2024: BAM launches U.S. office; raises $2.4 billion for climate fund at COP28.

• 2025: Distributable earnings up 27%; deployable capital hit record $165 billion.

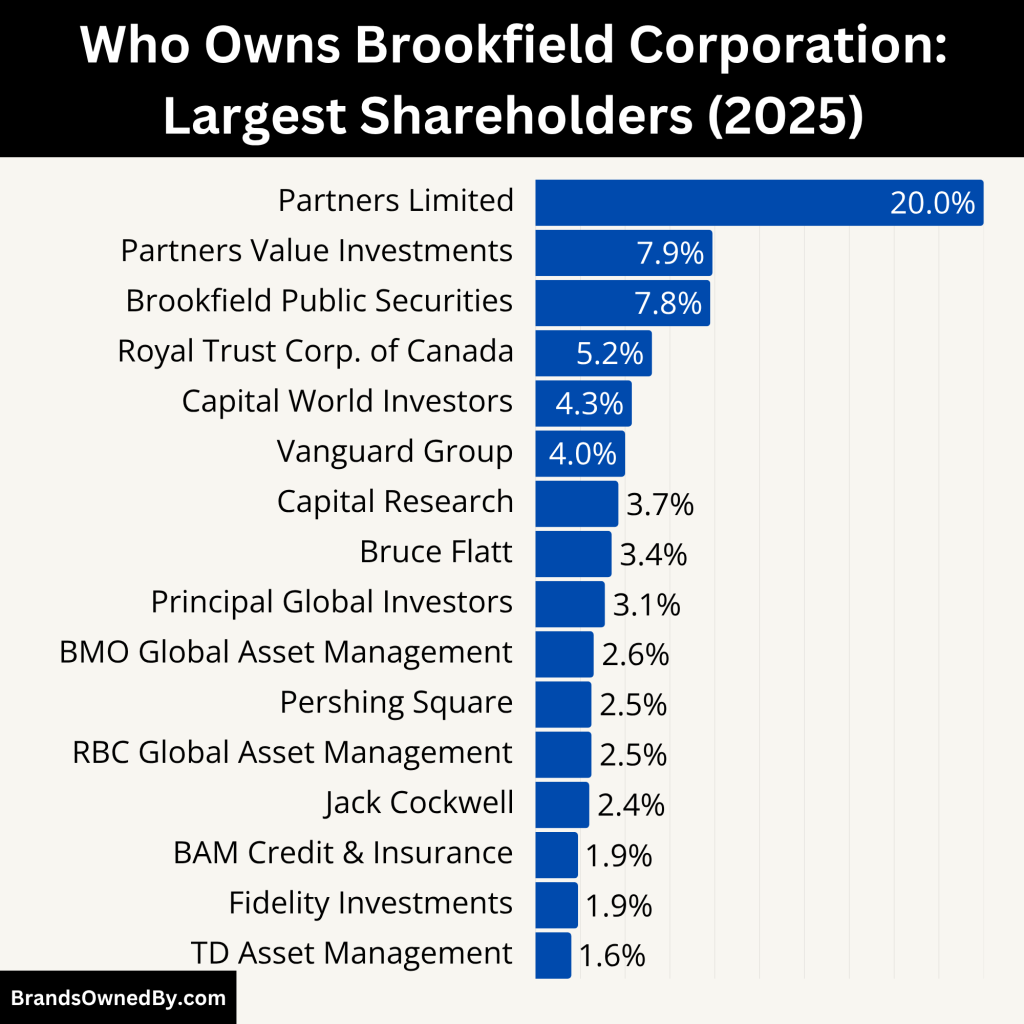

Who Owns Brookfield Corporation: Major Shareholders

Brookfield Corporation is publicly traded on the Toronto and New York Stock Exchanges under the ticker symbol BN. It is majority-held by institutional investors and controlled by its senior leadership through private holdings and voting shares. The largest shareholder is the CEO himself, Bruce Flatt, who holds both direct and indirect interests.

Here’s a list of the largest shareholders of Brookfield Corporation as of July 2025:

| Shareholder | Ownership (%) | Estimated Shares Held | Role/Control Details |

|---|---|---|---|

| Bruce Flatt (CEO) | 3.4% | ~56 million | CEO and major insider; also influences board appointments via Bermuda trust |

| Partners Limited | 20% | Strategic block | Insider partnership of senior executives; maintains control and long-term governance |

| Partners Value Investments LP | 7.9% | ~121 million | Aligned investment vehicle supporting insider-led ownership |

| Brookfield Public Securities Group LLC | 7.8% | ~120 million | Internal affiliate aligning public investment funds with Brookfield strategy |

| Capital World Investors | 4.3% | ~66 million | Large U.S. mutual fund investor; passive long-term holder |

| Capital Research & Management | 3.7% | ~60 million | Related to Capital Group; provides stability and long-term investment |

| Vanguard Group | 4.0% | ~61 million | Passive index investor; contributes liquidity and market presence |

| Pershing Square (Bill Ackman) | 2.5% | ~40 million | Active investor; increased stake in 2024; vocal supporter of Brookfield strategy |

| BMO Global Asset Management | 2.6% | ~42 million | Major Canadian institutional investor; supports domestic shareholder base |

| RBC Global Asset Management | 2.5% | ~40 million | Canadian institutional investor; involved in corporate governance and finance |

| Jack Cockwell (Former CEO) | 2.4% | ~38 million | Former executive; influential legacy shareholder |

| Royal Trust Corp. of Canada | 5.2% | ~85 million | Trust-based holder; manages estate/fiduciary assets |

| BAM Credit & Insurance Solutions LLC | 1.9% | ~31 million | Subsidiary aligned with Brookfield’s credit and insurance business |

| Principal Global Investors | 3.1% | ~50 million | U.S. institutional investor; active in shareholder matters |

| Fidelity Investments | 1.9% | ~30 million | Institutional investor; supports asset-based value strategy |

| TD Asset Management | 1.6% | ~25 million | Canadian institutional investor; passive long-term holding |

| 1832 Asset Management | ~1.2% | ~19 million | Long-term Canadian fund manager |

| Mackenzie Financial | ~1.0% | ~16 million | Mid-sized institutional stakeholder |

| CIBC Asset Management | ~0.9% | ~14 million | Part of Canadian Imperial Bank group |

| Jarislowsky Fraser Ltd. | ~0.8% | ~13 million | Long-term Canadian investment firm |

Bruce Flatt – CEO, Founder Partner & Insider Leader

Bruce Flatt has been at Brookfield’s helm since 2002. As of 2025, he holds approximately 3.4% of outstanding shares (around 56 million), valued at over $3.2 billion.

He also leads Partners Limited, the private ownership group that controls 20% of the company.

Through direct shareholdings and trust vehicles, he appoints nearly a third of the board via a Bermuda trust. His influence extends across corporate strategy, governance, and major transactions.

Partners Limited (Partners Group)

This private partnership is composed of senior Brookfield executives, including Bruce Flatt. It holds approximately 20% of Brookfield Corporation’s shares, mostly through direct and indirect ownership in affiliated vehicles. Partners Limited’s structure allows Brookfield to maintain strategic continuity and insider-led governance while still being publicly traded.

Partners Value Investments LP

This internal investment arm holds around 7.35–8.0% (~121 million shares), valued at roughly $7 billion.

It acts as a long-term holder focused on capital alignment, reinforcing insider control and stability. Structurally, it holds voting power equal to its equity percentage, making it the largest non-insider single holder.

Brookfield Public Securities Group LLC

This publicly registered Brookfield vehicle owns 7.8% (~120 million shares).

Its purpose is to align capital market dynamics with Brookfield’s investment outlook. It helps bridge public investor expectations with internal strategy execution.

Brookfield Asset Management Ltd.

Brookfield Corporation owns approximately 2.03–2.45% (~31 million shares) of BAM, its spun-off asset-management arm.

BAM itself is a major operating subsidiary and a key revenue engine. Its equity stake ensures aligned decision-making and secure access to fee income streams.

Principal Global Investors

An institutional investor owning 3.07–3.31% (about 50 million shares, ~$3 billion).

They support Brookfield’s diversified real asset strategy and participate consistently in shareholder meetings.

BMO Asset Management / Bank of Montreal

This Canadian institutional investor holds between 2.68–3.07% (~44–47 million shares, ~$2.6–2.9 billion). It brings strong Canadian investor participation and helps maintain compliance with domestic regulations.

RBC Global Asset Management

Holding around 2.6–2.7% (~39–40 million shares, ~$2.3–2.5 billion). It’s an active institutional stakeholder with a seat at important governance and financial discussions.

Capital World Investors and Capital Research

Collectively, these mutual fund groups hold ~3.98% (Capital World ~3.97%; Capital Research ~4.29%) and 3.9% respectively (~66 million; ~60 million shares) valued at ~$3.9–4.1 billion. They are long-term passive holders backing Brookfield’s diversified strategy.

The Vanguard Group

Holding approximately 3.7–4.0% (~60–61 million shares; ~$3.6–3.8 billion). Primarily a passive index investor, Vanguard ensures liquidity and continuity without direct governance involvement.

Pershing Square (Bill Ackman)

As of late 2024, Ackman’s fund owns 2.12–2.68%, around 35–41 million shares (~$2–2.6 billion). This stake quadrupled in 2024. His vocal advocacy emphasizes Brookfield’s value and supports the narrowing of valuation discounts.

Jack Cockwell – Former CEO & Director

Still holds 2.43–2.45%, about 37–40 million shares (~$2.2–2.4 billion). Although no longer running day-to-day operations, he remains a board member and continues to influence major strategic decisions.

BAM Credit & Insurance Solutions Advisor LLC

This affiliate holds ~1.88% (~31 million shares; ~$1.8 billion). It tightly integrates Brookfield’s credit and insurance operations, ensuring these affiliates complement corporate strategy and cash flow.

Royal Trust Corp. of Canada

Holds about 5.19–5.66% (~85 million shares; ~$5 billion). This trust and estate manager likely holds shares in fiduciary capacity, reflecting deep ties to Canadian financial and corporate structures.

Additional Institutional Stakeholders

Other notable holders include:

- Fidelity International (~1.9–1.15%, ~32 million shares)

- TD Asset Management (~1.6–1.49%, ~25–30 million shares)

- 1832 Asset Management, Mackenzie Financial, Jarislowsky Fraser, FMR, Viking Global, and CIBC AM – each hold between ~0.85–1.5%.

Who is the CEO of Brookfield Corporation?

The current CEO of Brookfield Corporation is Bruce Flatt. He has led the company since 2002 and is often referred to as “Canada’s Warren Buffett” for his value-oriented approach. Under his leadership, Brookfield has expanded into a global powerhouse with diversified investments.

Background & Early Career

Bruce Flatt, born June 10, 1965, in Winnipeg, Manitoba, is a Canadian business leader. He earned a Bachelor of Commerce degree from the University of Manitoba. He began his career as a chartered accountant at Clarkson Gordon (now part of Ernst & Young) before joining Brascan (now Brookfield) in 1990.

Rise Through the Ranks

Flatt was appointed CEO of Brookfield Properties in 2000. In 2002, he took the helm of the entire Brookfield organization. Under his lead, the company expanded from a regional firm to a global alternative asset manager present in over 30 countries.

CEO and Chair

In 2025, Flatt assumed the Chair of Brookfield Asset Management in January. This dual role (as CEO and Chair) enables him to align the firm’s strategy across operating businesses, asset management, and investment capital.

Leadership Style & Philosophy

Flatt is often called “Canada’s Warren Buffett.” He follows a value-oriented investment style focused on long-term ownership of high-quality, cash-generating businesses. He is known for his calm demeanor. Even amid geopolitical tensions, he sees turbulence as an opportunity.

Strategic Vision

Under his leadership, Brookfield scaled its managed assets to over $1 trillion by 2024–25 and aims to reach $2 trillion within five years. He champions expansion into areas like energy transition, data centers, credit, and insurance—supporting diversified future growth.

Track Record & Recognitions

Flatt has overseen some of Brookfield’s most significant deals:

- The 2019 acquisition of Oaktree Capital.

- The 2018 purchase of Westinghouse Electric.

- Office assets like Canary Wharf and General Growth Properties.

He has received multiple accolades: CEO of the Year by The Globe and Mail (2017), ranked among Harvard Business Review’s top CEOs (2018), and recognized by Bloomberg as one of the 50 most influential businesspeople in 2019.

Flatt is known for his low-profile personal life. He lives between Toronto, New York, and London. He is married to Lonti Ebers, a prominent art collector and philanthropist.

Decision-Making & Governance

Brookfield operates a decentralized structure with CEOs heading each business unit (e.g., Renewable, Infrastructure, Private Equity). However, Flatt centrally shapes overarching strategy, capital allocation, acquisitions, and major transactions. His recent elevation as Chair consolidates his influence over both corporate policy and asset management.

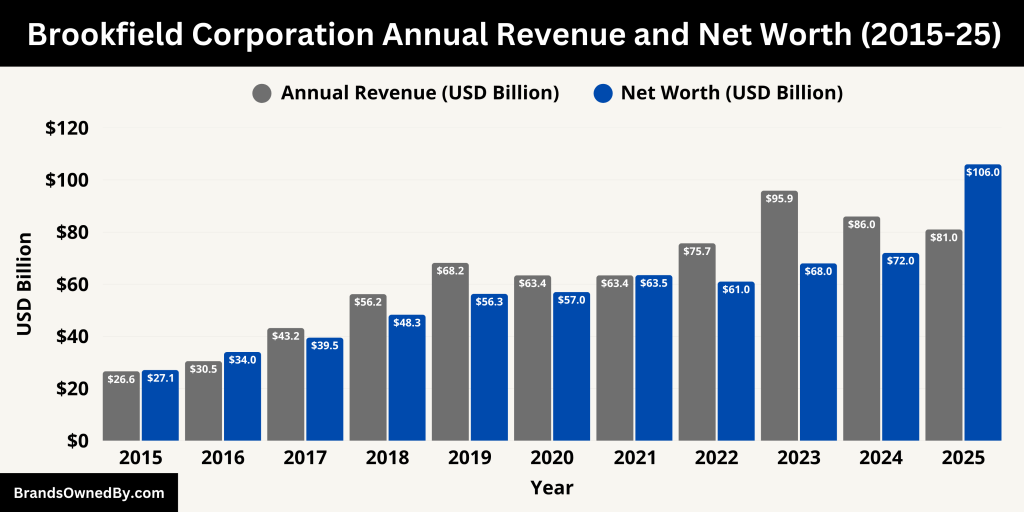

Brookfield Corporation Annual Revenue and Net Worth

In 2025, Brookfield Corporation reported declining revenue—$81 billion trailing twelve months—though its net worth remained strong, anchored by a market cap approaching $100 billion as of July 2025.

Brookfield Corporation Revenue in 2025

As of March 31, 2025, Brookfield Corporation generated approximately $17.9 billion in revenue during Q1, reflecting a modest decline of about 7.6% compared to the prior quarter. The total revenue for the trailing twelve months stood at $81.04 billion, which marks a year-over-year decrease of roughly 15% from the previous period.

In 2024, the company recorded annual revenue of $86 billion, a modest decline of 10.3% from 2023, while its top line had reached nearly $95.9 billion in 2023. These figures highlight a moderate pullback from peak levels, yet Brookfield continues to generate tens of billions in annual revenue.

Brookfield’s revenue streams are driven by its diverse global portfolio—spanning real estate, infrastructure, renewable energy, credit, insurance, and asset management. Q1 2025 saw strong fee-related earnings and performance inflows, signaling resilience in underlying operations even as macro headwinds weighed on overall revenue.

Brookfield Corporation Net Worth and Market Capitalization

In mid-2025, Brookfield’s market capitalization (a proxy for net worth in public markets) ranged between $96 billion and $106 billion, depending on the reporting source and date.

As of early July, estimates sit around $98–99 billion, with some platforms citing a peak of $105.97 billion on July 4, and a figure of $101.96 billion at the end of June. This marks a substantial 49–58% increase over the prior year, indicating strong investor confidence and market valuation.

Here is a 10-year historical overview of Brookfield Corporation’s revenue and net worth (market capitalization) from 2015 to 2025:

| Year | Annual Revenue (USD Billion) | Net Worth / Market Cap (USD Billion) |

|---|---|---|

| 2025 | 81.0 (TTM as of Q1) | 98.0–106.0 |

| 2024 | 86.0 | 66.5–72.0 |

| 2023 | 95.9 | 64.0–68.0 |

| 2022 | 75.7 | 58.0–61.0 |

| 2021 | 63.4 | 59.8–63.5 |

| 2020 | 63.4 | 52.1–57.0 (COVID impact year) |

| 2019 | 68.2 | 54.6–56.3 |

| 2018 | 56.2 | 44.1–48.3 |

| 2017 | 43.2 | 37.2–39.5 |

| 2016 | 30.5 | 32.5–34.0 |

| 2015 | 26.6 | 25.8–27.1 |

Underlying Earnings and Deployable Capital

Brookfield reported distributable earnings of $1.5 billion in Q1 2025, representing a robust 27% year-over-year increase. Adjusted figures before realizations stood at $1.3 billion, up 30% year-over-year, accumulating to $5.2 billion for the trailing twelve months.

The net income for the same quarter reached $215 million, a 30% increase from the year prior, though it remained below distributable earnings—reflecting recognition differences. At quarter-end, Brookfield also held a record $165 billion in deployable capital, including $69 billion in cash and undrawn credit lines, underscoring substantial dry powder for future investments.

Interpretation and Strategic Implications

Despite flat-to-declining revenues, Brookfield’s rise in distributable earnings and market value highlights its operational strength and investor trust. The discrepancy between accounting net income and distributable earnings suggests strong cash generation capacity, driven by long-term contracts, asset management fees, and recurring cash from operating businesses. The sizeable deployable capital provides flexibility to acquire and expand across sectors.

Brookfield’s market value is near $100 billion, combined with its aggressive redeployment of capital, positions it well for future growth. The divergence between top-line and investor returns underscores a business model that prioritizes long-term cash flow generation over short-term revenue spikes.

Companies Owned by Brookfield Corporation

By 2025, Brookfield Corporation directly owns and operates a diversified portfolio of companies spanning real assets, credit, insurance, and nuclear technology. Each entity is strategically designed to deliver long-lasting cash flows, thematic growth, and alignment with the parent company’s global investment objectives.

Here is a list of the major companies and brands owned by Brookfield Corporation as of July 2025:

| Company/Entity | Business Focus | Ownership Type | Operational Scope |

|---|---|---|---|

| Brookfield Asset Management | Global asset management (real estate, infra, credit, etc.) | Majority-controlled affiliate | 30+ countries; raises and manages capital |

| Brookfield Renewable Partners | Clean energy: hydro, wind, solar, storage | Public partnership (BN controls) | Americas, Europe, Asia |

| Brookfield Infrastructure Partners | Transport, utilities, data infrastructure, energy | Public partnership (BN controls) | North & South America, Europe, Australia |

| Brookfield Business Partners | Private equity in industrials, services, health | Public partnership (BN controls) | Global operations, asset-heavy businesses |

| Brookfield Properties | Commercial real estate: office, retail, logistics | Wholly owned subsidiary | North America, Europe, Asia |

| Oaktree Capital Management | Alternative investment: distressed debt, credit | Majority-owned (non-wholly) | Independent platform under BN |

| Westinghouse Electric Company | Nuclear power tech and services | Majority-owned entity | Nuclear utilities globally |

| Brookfield Reinsurance | Life, annuity, and P&C reinsurance | Wholly owned division | U.S., Bermuda, and international markets |

| Brookfield Infrastructure Credit | Infrastructure debt and project finance | Internal investment platform | U.S., Europe, and emerging markets |

| Brookfield Real & Private Capital | Private capital vehicles: real estate, infra, ESG | Internal asset platform | Thematic and strategic co-investment globally |

Brookfield Asset Management

Brookfield Asset Management remains the core asset‑management arm, though publicly listed, Brookfield Corporation retains a significant equity stake. It oversees the firm’s global investment platforms across real estate, infrastructure, renewable energy, private equity, credit, and insurance. BAM raises capital from institutional and retail investors, structures funds, and earns management fees. Its autonomy allows it to create specialized investment pools while following the parent company’s long-term strategic direction and access to deployable capital.

Brookfield Renewable Partners

Brookfield Renewable is one of the world’s largest publicly traded clean‑energy companies owned by Brookfield Corporation. It operates across hydroelectric, wind, solar, and energy storage assets globally. Its portfolio spans North and South America, Europe, and Asia. By 2025, the company has scaled to over 22 GW of installed capacity and consistently wins long-term power contracts, insulating it from short-term commodity price shifts. It contributes recurring cash flows and supports Brookfield’s energy transition strategy.

Brookfield Infrastructure Partners

This major arm owns and operates critical infrastructure assets such as toll roads, rail terminals, midstream energy pipelines, and data infrastructure across North America, South America, Europe, and Australia. Assets are often invested with inflation‑linked revenue models and long‑term contracts. This unit provides both stable income and financing flexibility and complements Brookfield’s broader asset diversification effort.

Brookfield Business Partners

Brookfield Business Partners focuses on vertically integrated private operating businesses across manufacturing, industrial services, governments, and healthcare. It aims for transformational growth via operational improvements, bolt-on acquisitions, and long-term investment horizons. Its platform includes companies across North America, Europe, and Australia, making it a key pipeline for Brookfield’s broader industrial exposure.

Brookfield Properties

Brookfield Properties is the real estate operating division, with a diverse portfolio of office, retail, multifamily, logistics, life-science, and mixed‑use developments. Major holdings include flagship office towers in New York and Toronto, high‑end retail destinations, and logistics hubs near major trade corridors. Properties focuses on active asset management, including property redevelopment, lease reopenings, and sustainability retrofits.

Oaktree Capital Management

In 2019, Brookfield Corporation completed a controlling‑interest acquisition of Oaktree Capital Management. Oaktree operates as a distinct global alternative‑asset manager specializing in distressed‑debt, credit, real‑estate, and private‑equity investments. Oaktree serves as a key platform to access opportunistic, value‑oriented credit strategies. This acquisition broadened Brookfield’s reach into credit markets and added complementary fee and carry potential to its asset‑management ecosystem.

Westinghouse Electric Company

Brookfield Corporation owns Westinghouse, a leader in nuclear technology and fuel services. Westinghouse designs and supplies reactor systems, nuclear fuel, services, and power modernization solutions globally. As a nuclear‑technology specialist, Westinghouse integrates into Brookfield’s clean‑energy platform and contributes to major utility and reactor‑infrastructure investments.

Brookfield Reinsurance

This insurance and reinsurance entity operates under Brookfield’s credit & insurance arm. It provides property & casualty reinsurance and specialty insurance solutions. Its underwriting business leverages Brookfield’s asset management and capital‑markets access. It supports Brookfield’s financial-sector diversification and offers stable revenue streams from premiums and underwriting profits.

Brookfield Infrastructure Credit

Operating under Brookfield’s credit platform, Brookfield Infrastructure Credit invests in infrastructure‑related debt—such as project finance loans, equipment leases, and credit financing tied to data centers, utilities, and transport. It bridges infrastructure asset ownership and credit risk, offering diversified cash flows through interest income aligned with infrastructure growth.

Brookfield Real & Private Capital

This internal investment vehicle structures private pools targeting real estate, infrastructure or specialized sectors like data, life-sciences real estate, and energy transition solutions. These strategies allow Brookfield to attract co‑investors and align with dedicated mandates while leveraging Brookfield’s deal‑sourcing capabilities and operational platforms.

Conclusion

Brookfield Corporation is a global investment powerhouse with deep roots and a long-term approach. It is publicly owned but remains tightly controlled by its CEO and executive leadership. With a diversified portfolio spanning renewable energy, infrastructure, real estate, and private equity, the company plays a vital role in global asset management. Understanding who owns Brookfield Corporation reveals how insider control and institutional backing shape one of the world’s most influential investment firms.

FAQs

Who are the major shareholders of Brookfield?

Major shareholders of Brookfield Corporation include both institutional and insider investors. Key shareholders are Partners Limited (a group of senior executives), Bruce Flatt (CEO), Partners Value Investments LP, Brookfield Public Securities Group, Capital Group (via Capital World and Capital Research), Vanguard Group, Pershing Square (Bill Ackman), Royal Trust Corporation of Canada, and Canadian institutions such as BMO, RBC, and TD Asset Management. Together, insiders and affiliates control approximately 30% of the company, with the rest held by institutional and public investors.

Who is the parent company of Brookfield?

Brookfield Corporation is the ultimate parent company. It is a publicly traded global investment firm and holding company listed on the Toronto Stock Exchange (TSX: BN) and the New York Stock Exchange (NYSE: BN). There is no parent company above it.

Who runs Brookfield?

Brookfield Corporation is led by Bruce Flatt, who serves as both Chief Executive Officer (CEO) and Chairman (since 2025). Flatt has been with Brookfield since the 1990s and became CEO in 2002. He leads overall strategy and capital deployment across the corporation and its subsidiaries.

Who is the owner of Brookfield Place?

Brookfield Properties, a wholly owned subsidiary of Brookfield Corporation, owns and manages Brookfield Place properties in cities like New York, Toronto, Perth, Calgary, and Brisbane. These iconic commercial real estate complexes are part of Brookfield’s global office and retail property portfolio.

Who is the largest shareholder of Brookfield Infrastructure Partners?

The largest shareholder of Brookfield Infrastructure Partners (BIP) is Brookfield Corporation itself. It holds a significant ownership interest through both direct equity and special units, maintaining control over BIP’s management and board decisions.

Who are the shareholders of Brookfield Renewables?

Brookfield Corporation is the controlling shareholder of Brookfield Renewable Partners (BEP). Other shareholders include institutional investors, mutual funds, and retail shareholders. However, strategic and operational control remains with Brookfield Corporation through its general partner interest and board representation.

Does Mark Carney own Brookfield?

No, Mark Carney does not own Brookfield Corporation. He is a Vice Chair and Head of Transition Investing at Brookfield Asset Management, playing a key leadership role in the firm’s climate and sustainability initiatives. He is not a shareholder of significant size and does not control the company.

What are the major Brookfield Corporation subsidiaries?

Major subsidiaries of Brookfield Corporation include:

- Brookfield Asset Management (BAM)

- Brookfield Renewable Partners

- Brookfield Infrastructure Partners

- Brookfield Business Partners

- Brookfield Properties

- Brookfield Reinsurance

- Oaktree Capital Management

- Westinghouse Electric Company

- Brookfield Infrastructure Credit

These subsidiaries operate across energy, real estate, infrastructure, private equity, insurance, and investment management.

Is Brookfield Asset Management still a company?

Yes, Brookfield Asset Management (BAM) is still a company. It operates as a distinct, publicly listed entity that manages assets on behalf of Brookfield Corporation and third-party investors. Although spun off from Brookfield Corporation, the parent retains significant ownership and maintains strategic oversight over BAM.

Who owns Brookfield business?

Brookfield Corporation is publicly traded, but controlled by its executive leadership and BAM Partners Trust.

Who is the CEO of Brookfield stock?

Bruce Flatt is the CEO of Brookfield Corporation, the parent of all Brookfield-listed stocks.

Does Brookfield own Nuclear?

Yes, Brookfield owns Westinghouse Electric Company, a leading name in nuclear power technology.

What is the parent company of Brookfield?

Brookfield Corporation is the parent company. It owns Brookfield Asset Management and other subsidiaries.

What is the full name of Brookfield?

The full name is Brookfield Corporation. It was previously known as Brookfield Asset Management.

Who owns Brookfield Engineering?

Brookfield Engineering was a separate company acquired by other firms and is not directly related to Brookfield Corporation.

Is Brookfield bigger than Blackstone?

In terms of assets under management, Blackstone is larger. However, Brookfield leads in real asset ownership and infrastructure.