You might have heard a lot about companies owned by BlackRock, but who owns BlackRock?

Let’s find out…

But first, a little about Blackrock.

BlackRock, Inc. is the world’s largest asset management firm overseeing trillions of dollars in investments across multiple asset classes. As a publicly traded company, its ownership is distributed among institutional and retail investors with major stakeholders influencing its governance and strategic direction.

BlackRock’s global presence is marked by its vast assets under management (AUM) and its influence on financial markets through advanced risk management and investment technologies. Its pioneering use of data analytics and innovative investment strategies has set industry benchmarks worldwide.

History of BlackRock

BlackRock was founded in 1988 by Larry Fink, Robert S. Kapito, Susan Wagner, and several others as a risk management and fixed-income institutional asset manager.

It expanded its offerings to include ETFs, active equity funds, and alternative investments. The firm went public in 1999 and has since grown through acquisitions such as the notable purchase of Barclays Global Investors in 2009 which brought the iShares ETF brand under its control.

BlackRock has continuously evolved by embracing technological advancements and expanding its global footprint.

Key milestones include the development of the Aladdin platform, a state-of-the-art risk management system, and strategic acquisitions such as eFront and Aperio that bolstered its capabilities in alternative investments and customized portfolio solutions.

This evolution highlights BlackRock’s commitment to innovation and responsiveness to market dynamics.

Who Owns BlackRock?

BlackRock is a publicly traded company listed on the New York Stock Exchange under the ticker symbol BLK. It is owned by a combination of institutional investors, mutual funds, and individual shareholders.

The largest shareholders are primarily institutional investors including some of BlackRock’s own clients.

The share structure is designed to ensure broad ownership, with no single entity holding a controlling interest. This distributed ownership model provides stability and encourages diverse perspectives in corporate governance.

Major BlackRock Shareholders

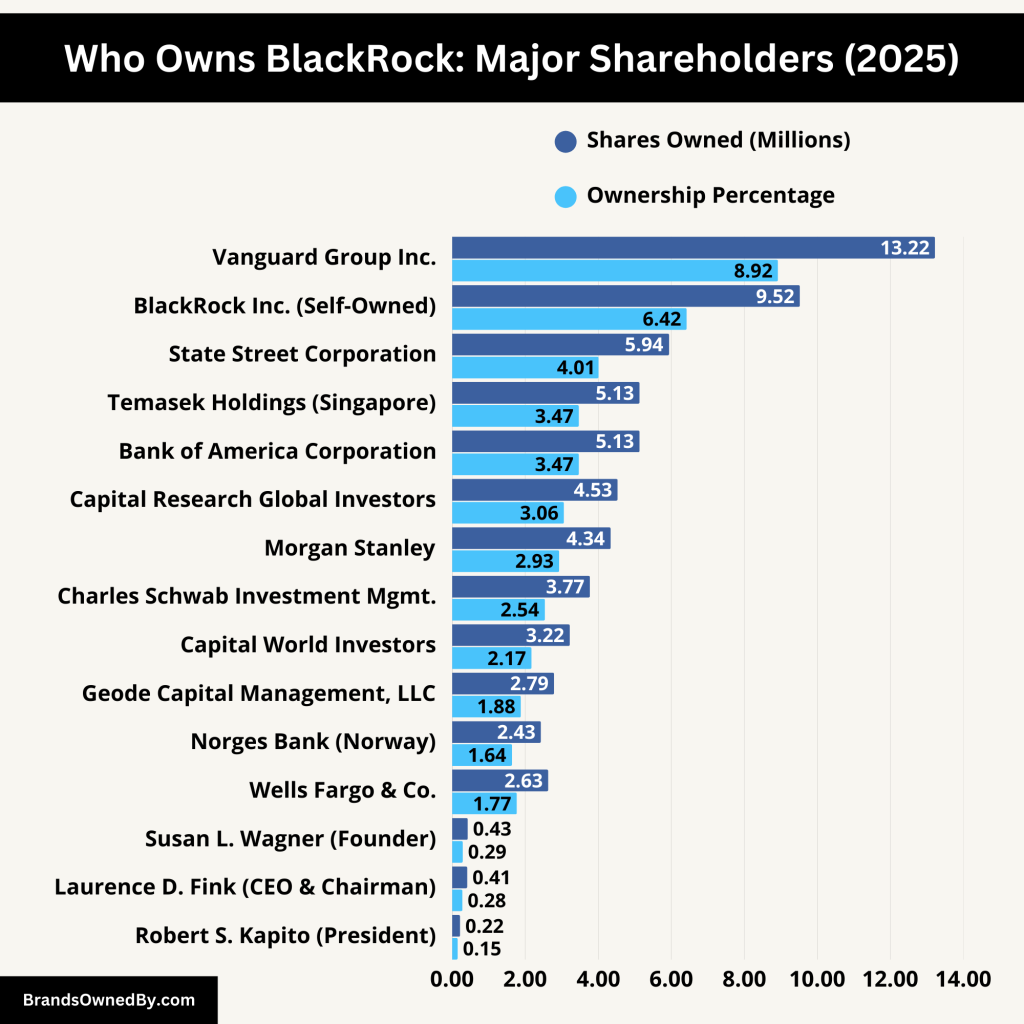

Below is a breakdown of BlackRock’s largest shareholders as of 2025:

| Shareholder | Shares Owned | Ownership Percentage | Estimated Value (USD) |

|---|

| Vanguard Group Inc. | 13.22M | 8.92% | $11.63B |

| BlackRock Inc. (Self-Owned) | 9.52M | 6.42% | $8.37B |

| State Street Corporation | 5.94M | 4.01% | $5.23B |

| Temasek Holdings (Singapore) | 5.13M | 3.47% | $4.52B |

| Bank of America Corporation | 5.13M | 3.47% | $4.52B |

| Capital Research Global Investors | 4.53M | 3.06% | $3.99B |

| Morgan Stanley | 4.34M | 2.93% | $3.82B |

| Charles Schwab Investment Mgmt. | 3.77M | 2.54% | $3.32B |

| Capital World Investors | 3.22M | 2.17% | $2.83B |

| Geode Capital Management, LLC | 2.79M | 1.88% | $2.45B |

| Norges Bank (Norway) | 2.43M | 1.64% | N/A |

| Wells Fargo & Co. | 2.63M | 1.77% | N/A |

| Susan L. Wagner (Founder) | 427K | 0.29% | N/A |

| Laurence D. Fink (CEO & Chairman) | 414K | 0.28% | N/A |

| Robert S. Kapito (President) | 217K | 0.15% | N/A |

Vanguard Group Inc.

Vanguard Group Inc. holds the largest stake in BlackRock, owning approximately 13.22 million shares, which represents 8.92% of the company. This investment is valued at around $11.63 billion. Vanguard’s substantial holding underscores its confidence in BlackRock’s long-term growth and stability.

BlackRock Inc.

Interestingly, BlackRock itself is the second-largest shareholder, possessing about 9.52 million shares, equating to a 6.42% ownership stake. This self-ownership, valued at approximately $8.37 billion, reflects the company’s commitment to its own stock and aligns its interests with those of its investors.

State Street Corporation

State Street Corporation holds roughly 5.94 million shares of BlackRock, accounting for 4.01% of the company. This stake is valued at about $5.23 billion. State Street’s investment highlights its role as a significant institutional investor in the financial sector.

Temasek Holdings (Private) Limited

Temasek Holdings, the investment arm of the Government of Singapore, owns approximately 5.13 million shares, representing a 3.47% stake in BlackRock. This investment is valued at around $4.52 billion. Temasek’s involvement signifies international confidence in BlackRock’s global asset management capabilities.

Bank of America Corporation

Bank of America Corporation also holds a 3.47% stake in BlackRock, equivalent to about 5.13 million shares valued at approximately $4.52 billion. This investment reflects the bank’s strategic interest in maintaining a significant position within the asset management industry.

Capital Research Global Investors

Capital Research Global Investors owns roughly 4.53 million shares of BlackRock, amounting to a 3.06% stake valued at about $3.99 billion. Their investment underscores a strong belief in BlackRock’s future performance and market position.

Morgan Stanley

Morgan Stanley holds approximately 4.34 million shares, representing a 2.93% ownership stake in BlackRock. This translates to an investment valued at around $3.82 billion, indicating Morgan Stanley’s substantial involvement in the asset management sector.

Charles Schwab Investment Management, Inc.

Charles Schwab Investment Management, Inc. owns about 3.77 million shares of BlackRock, equating to a 2.54% stake valued at approximately $3.32 billion. This holding reflects Charles Schwab’s strategic investment in a leading asset management firm.

Capital World Investors

Capital World Investors holds around 3.22 million shares, representing a 2.17% ownership stake in BlackRock, with an investment valued at about $2.83 billion. This demonstrates their confidence in BlackRock’s market leadership and growth prospects.

Geode Capital Management, LLC

Geode Capital Management, LLC owns approximately 2.79 million shares of BlackRock, accounting for a 1.88% stake valued at around $2.45 billion. Geode’s investment signifies its role as a notable institutional shareholder in the company.

Norges Bank

Norges Bank, the central bank of Norway, holds approximately 2.43 million shares of BlackRock, representing a 1.64% ownership stake. This investment underscores Norway’s sovereign wealth fund’s confidence in BlackRock’s performance and strategic direction.

Wells Fargo & Company/MN

Wells Fargo & Company/MN owns about 2.63 million shares, accounting for a 1.77% stake in BlackRock. This holding reflects Wells Fargo’s strategic investment in one of the leading firms in the asset management industry.

Capital Research Global Investors

Capital Research Global Investors holds approximately 4.53 million shares, equating to a 3.06% ownership stake in BlackRock. This investment highlights their confidence in BlackRock’s market position and future growth prospects.

Individual Shareholders

Beyond institutional investors, key individuals associated with BlackRock also hold significant shares:

- Susan L. Wagner: One of BlackRock’s original founders, Wagner held 427,887 shares as of February 22, 2024, making her the largest individual shareholder.

- Laurence D. Fink: As CEO and Chairman, Fink owned 414,146 shares as of February 28, 2024, underscoring his substantial personal investment in the company.

- Robert S. Kapito: Serving as President and a director, Kapito held 217,127 shares as of January 31, 2023, reflecting his long-term commitment to BlackRock.

Who Controls BlackRock?

BlackRock, the world’s largest asset management firm, is controlled by a combination of key executives, the board of directors, and major institutional shareholders. While no single entity or person has absolute control, decision-making power is primarily in the hands of leadership figures and influential investors.

1. Laurence D. Fink – The Architect of BlackRock’s Success

Laurence “Larry” Fink is the Chairman and CEO of BlackRock, making him the most influential figure in the company. As a co-founder of BlackRock in 1988, Fink has shaped the firm’s strategies, guiding its transformation into a financial powerhouse managing over $9 trillion in assets.

How Much Control Does Larry Fink Have?

- He owns 414,146 shares of BlackRock, showing his financial stake in the company.

- As CEO, he directs major investment strategies and influences corporate policies.

- He has been a key proponent of ESG (Environmental, Social, and Governance) investing, driving BlackRock’s sustainability initiatives.

Fink’s leadership and vision make him the face of BlackRock, giving him unparalleled control over the firm’s direction.

2. The Board of Directors – Governance and Oversight

BlackRock’s Board of Directors plays a crucial role in overseeing corporate decisions and ensuring the company follows its mission and regulatory obligations. The board consists of experienced financial executives, policymakers, and business leaders.

Key Responsibilities of the Board

- Approving major investment decisions and corporate policies.

- Supervising the CEO and executive leadership to ensure accountability.

- Maintaining corporate governance standards to protect shareholder interests.

Among its members, Susan Wagner, a BlackRock co-founder, and Robert S. Kapito, the company’s President, hold significant influence.

3. Institutional Investors – The Hidden Power Players

Although BlackRock manages trillions in assets for clients, its own ownership is dominated by institutional investors such as:

- Vanguard Group Inc. – 8.92% ownership

- State Street Corporation – 4.01% ownership

- Bank of America Corporation – 3.47% ownership

These institutional investors hold large stakes in BlackRock and can influence voting decisions at shareholder meetings, indirectly impacting the company’s governance.

4. Key Executives – The Strategists Behind BlackRock’s Success

Apart from Larry Fink, several other executives play key roles in shaping BlackRock’s operations and strategy.

- Robert S. Kapito (President) – Oversees global investment strategies and client relationships.

- Gary Shedlin (Chief Financial Officer) – Manages BlackRock’s financial planning and growth strategy.

- Rachel Lord (Head of International Business) – Expands BlackRock’s presence in global markets.

These executives ensure BlackRock remains a leader in asset management by implementing new investment strategies and adapting to market shifts.

BlackRock’s Annual Revenue and Net Worth

BlackRock generated approximately $19.3 billion in revenue in 2024 reflecting an 8.4% year-over-year (YoY) growth from $17.8 billion in 2023. The company’s net income for 2024 stood at $6.1 billion, an increase from $5.5 billion in the previous year.

The historical revenue of BlackRock over the past years has been as follows:

- 2024: $19.3 billion (+8.4% YoY)

- 2023: $17.8 billion (+2.3% YoY)

- 2022: $17.4 billion (-7.6% YoY)

- 2021: $18.8 billion (+20.3% YoY)

- 2020: $15.6 billion (+11.4% YoY)

BlackRock’s total assets under management (AUM) exceeded $11.8 trillion in 2024 reinforcing its position as the world’s largest asset manager.

Further analysis reveals that revenue growth has been driven by a combination of increased fee income from higher AUM and the expansion of technology-driven platforms like Aladdin.

The company’s diverse revenue streams, ranging from advisory fees to performance-based incentives, contribute to its robust financial performance in an ever-evolving market.

Market Share and Competitors

BlackRock dominates the asset management industry with a significant share in ETFs, mutual funds, and institutional asset management.

However, it faces competition from several major firms that also command vast sums in AUM and have distinct market strategies.

The Vanguard Group

Vanguard is the second-largest asset manager, known for its low-cost index funds and ETFs. It has approximately $8.6 trillion in AUM and competes directly with BlackRock’s iShares ETF segment.

Vanguard’s commitment to low fees and passive management continues to challenge BlackRock in attracting cost-conscious investors.

State Street Global Advisors

State Street manages over $4 trillion in assets and is a key competitor in institutional asset management and ETFs particularly through its SPDR product line. Its focus on innovation in ETF products and strategic partnerships in various markets helps maintain its competitive edge.

Fidelity Investments

Fidelity has over $4.5 trillion in AUM and competes in actively managed funds, retirement solutions, and brokerage services. Fidelity’s strong research capabilities and customer-centric investment strategies provide a robust counterbalance to BlackRock’s market share.

J.P. Morgan Asset Management

J.P. Morgan oversees approximately $3.2 trillion in AUM, providing investment solutions across asset classes, including alternative investments. Its global presence and diversified product offerings make it a formidable competitor in the asset management space.

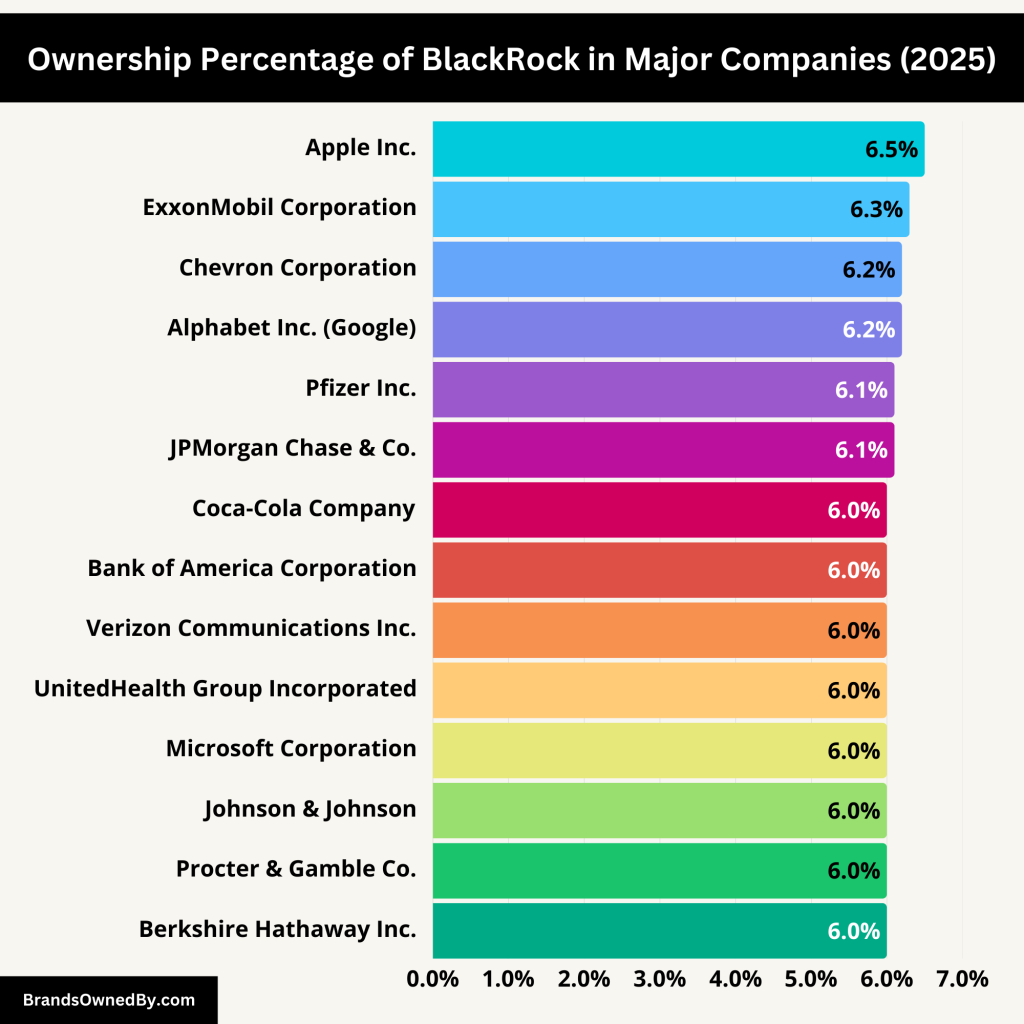

Companies Owned by BlackRock

BlackRock operates several investment brands and subsidiaries across different financial sectors. Below is a detailed breakdown of its major brands, BlackRock’s ownership percentage in each, and its role in managing these entities:

iShares (100% owned by BlackRock)

The world’s largest provider of Exchange-Traded Funds (ETFs), offering investment products to retail and institutional investors globally. BlackRock acquired iShares in 2009 through its purchase of Barclays Global Investors. iShares is renowned for its innovative ETF products that cater to diverse market segments, and it continuously expands its product lineup to meet evolving investor needs.

BlackRock Solutions (100% owned)

A risk management and investment analytics platform that serves financial institutions, government entities, and corporations. It offers sophisticated tools for risk assessment, portfolio construction, and scenario analysis. BlackRock Solutions is pivotal in helping clients navigate complex market conditions.

Aladdin (100% owned)

A comprehensive portfolio management system used by asset managers, banks, and institutional investors. Aladdin integrates risk analytics, trading, and operational tools to optimize investment decisions, acting as the central operating system for both BlackRock and its clients. Its data-driven approach is a cornerstone of modern asset management.

FutureAdvisor (100% owned)

A digital investment advisory platform offering automated portfolio management solutions. Through advanced algorithms, FutureAdvisor provides personalized investment strategies at a low cost, making sophisticated portfolio management accessible to a broader audience.

eFront (100% owned)

A software provider for alternative investments, specializing in private equity and real estate solutions. Acquired in 2019, eFront enhances BlackRock’s capabilities in managing alternative assets by offering robust data analytics and operational tools designed for complex investment structures.

Final Words

It isn’t surprising to say that BlackRock owns itself.

BlackRock, as the world’s largest asset manager, is owned primarily by institutional investors such as Vanguard and State Street. The company maintains its dominance through strategic acquisitions, cutting-edge technology, and a vast portfolio of investment brands. Despite competition from firms like Vanguard and Fidelity, BlackRock continues to expand its global influence, managing trillions of assets across diverse markets.

FAQs

Who is the largest shareholder of BlackRock?

The largest shareholder of BlackRock is Vanguard Group Inc., which owns approximately 8.92% of the company.

Does Larry Fink own BlackRock?

No, Larry Fink does not own BlackRock, but as the Chairman and CEO, he holds significant influence. He owns 414,146 shares, giving him a financial stake in the company.

Who makes the key decisions at BlackRock?

Key decisions at BlackRock are made by its executive leadership team and the Board of Directors, with Larry Fink playing the most influential role. Institutional investors also have a say through voting rights at shareholder meetings.

Can institutional investors control BlackRock’s decisions?

Institutional investors, such as Vanguard, State Street, and Bank of America, hold large stakes in BlackRock and can influence decisions through shareholder voting power. However, they do not directly control daily operations.

Is BlackRock controlled by the U.S. government?

No, BlackRock is a publicly traded company and is not controlled by the U.S. government. However, it frequently collaborates with government agencies on financial and economic matters.

Does BlackRock own the companies it invests in?

BlackRock does not “own” companies in the traditional sense. It manages investments on behalf of clients and holds large stakes in many corporations, but it does not exercise direct control over them.

Who regulates BlackRock?

BlackRock is regulated by multiple financial authorities, including the U.S. Securities and Exchange Commission (SEC) and other global regulatory bodies, depending on the markets it operates in.

What role does BlackRock’s board play in its control?

BlackRock’s Board of Directors oversees governance, approves major policies, and supervises executive leadership to ensure corporate accountability and strategic direction.

Why is BlackRock considered so powerful?

BlackRock is powerful because it manages over $9 trillion in assets, making it the largest asset manager in the world. Its influence extends across financial markets, corporate governance, and economic policy.