- Ben & Jerry’s is 100% owned by Unilever, making it a wholly owned subsidiary with no public shareholders or minority investors at the brand level. All equity ownership flows directly to the parent company.

- The brand operates under a unique governance model, where Unilever controls financial and strategic decisions, while an independent board is legally empowered to protect Ben & Jerry’s social mission and brand integrity.

- This ownership structure allows Ben & Jerry’s to scale globally using corporate resources while maintaining a level of mission-driven independence that is uncommon among multinational food brands.

Ben & Jerry’s is an American ice cream company known for luxury frozen desserts, unique flavors, and an outspoken social values mission. The business began in 1978 in Burlington, Vermont, as a single scoop shop selling handcrafted ice cream.

Over the decades, it expanded across the U.S. and internationally. Though now part of a larger corporate structure, Ben & Jerry’s maintains a brand identity tied to its founders’ values, community involvement, and activism. The headquarters is in South Burlington, Vermont, and the main manufacturing facility remains in nearby Waterbury, Vermont. Its products are sold in grocery stores, scoop shops, and restaurants around the world.

Founders of Ben & Jerry’s

Ben & Jerry’s was founded in 1978 in Burlington, Vermont, as a single scoop shop rooted in friendship and experimentation. Cohen drove creativity and values. Greenfield provided operational stability. Together, they built a brand defined by product innovation, social mission, and a founder-led identity that still shapes Ben & Jerry’s today.

Ben Cohen

Ben Cohen co-founded Ben & Jerry’s in 1978 in Burlington, Vermont. He was born in 1951 in Brooklyn, New York, and raised on Long Island. Cohen struggled academically due to dyslexia and later discovered he had anosmia, a limited sense of smell. This directly influenced the brand’s product identity. Because aroma mattered less to him, he focused on texture, leading to the large chunks and dense mix-ins that became a Ben & Jerry’s signature.

Before starting the company, Cohen worked a variety of nontraditional jobs and had no formal business education. He believed businesses should serve a broader purpose beyond profit. That philosophy shaped Ben & Jerry’s long-standing focus on social justice, community impact, and public advocacy. As of 2026, Cohen is no longer involved in operations but remains closely associated with the brand’s activist legacy.

Jerry Greenfield

Jerry Greenfield co-founded Ben & Jerry’s in 1978 in Burlington, Vermont alongside Cohen. Born in 1950 in Brooklyn, New York, he grew up on Long Island and met Cohen in junior high school. Greenfield was a National Merit Scholar and graduated from Oberlin College in 1973 on a pre-med track. After being rejected from medical school, he shifted direction and partnered with Cohen to start a business.

Greenfield brought structure and operational discipline to the company. He focused on production quality, process control, and early scaling. Both founders completed a correspondence course in ice cream making from Penn State University before opening their first scoop shop in a converted gas station in Burlington. As of 2026, Greenfield is no longer involved in governance but remains a vocal advocate for ethical, mission-driven business.

Ownership History

The ownership history of Ben & Jerry’s reflects its transformation from a founder-led local business into a globally owned brand. Over time, the company moved through private ownership, public markets, and finally full corporate acquisition. Each stage reshaped how the company was owned, governed, and scaled, while still attempting to preserve its original mission.

| Period | Ownership Structure | Key Owners | Ownership Details |

|---|---|---|---|

| 1978–1984 | Privately owned | Ben Cohen, Jerry Greenfield | Company founded and fully owned by its two founders. All decisions were founder-led and informal. |

| 1984–2000 | Publicly traded company | Public shareholders | Ben & Jerry’s listed on U.S. stock exchanges. Ownership spread among institutional and retail investors, while founders retained influence. |

| 2000 | Acquisition | Unilever | Unilever acquired 100% of Ben & Jerry’s and took the company private. All public shares were bought out. |

| 2000–present | Wholly owned subsidiary | Unilever | Ben & Jerry’s operates as a fully owned Unilever brand with an independent board to protect its social mission. |

Founding as a Privately Owned Company (1978–1984)

Ben & Jerry’s was founded in 1978 in Burlington, Vermont by Ben Cohen and Jerry Greenfield as a privately owned business. In its early years, the company was fully controlled by the two founders. Decisions were informal, founder-led, and closely tied to their personal values. Ownership and management were inseparable. The founders handled product development, operations, and brand identity directly.

As the brand gained popularity beyond Vermont, the need for capital and structured growth increased. This set the stage for the first major ownership shift.

Transition to a Public Company (1984–2000)

In 1984, Ben & Jerry’s went public. The company was listed on U.S. stock exchanges, allowing public investors to buy shares. This marked a major change in ownership structure.

While Ben Cohen and Jerry Greenfield remained influential figures, ownership became dispersed among public shareholders. Institutional investors and retail investors began to hold stakes. Despite this, the founders took deliberate steps to protect the company’s culture. They introduced policies designed to prevent hostile takeovers and to maintain employee and community-focused practices.

During this period, Ben & Jerry’s balanced shareholder expectations with its social mission. However, increased competition in the global ice cream market and pressure from larger food conglomerates made long-term independence increasingly difficult.

Acquisition by Unilever (2000)

In 2000, Ben & Jerry’s was acquired by Unilever in a deal valued at approximately $326 million. This transaction ended Ben & Jerry’s status as a publicly traded company.

Under the acquisition, Unilever became the 100% owner of Ben & Jerry’s. All shares were bought out, and the company was delisted from public markets. Ownership shifted from thousands of shareholders to a single corporate parent.

What made this acquisition unique was the legally binding agreement attached to it. Ben & Jerry’s was granted an independent board of directors with authority to protect the brand’s social mission, values, and product integrity. This structure was unusual for a multinational acquisition and remains a defining feature of the brand’s ownership model.

Operating as a Wholly Owned Subsidiary (2000–Present)

Since 2000, Ben & Jerry’s has operated as a wholly owned subsidiary of Unilever. It does not have its own shareholders, stock ticker, or separate equity structure. All financial ownership flows directly to Unilever.

Unilever controls major financial, legal, and strategic decisions. This includes manufacturing scale, global distribution, and corporate compliance. However, the independent board retains influence over brand positioning, public statements, and mission-driven initiatives.

This dual structure has at times created tension between Ben & Jerry’s leadership and its parent company, especially around political advocacy and market decisions. Despite these conflicts, ownership has not changed.

Who Owns Ben & Jerry’s?

Ben & Jerry’s is fully owned by Unilever, which acquired the company in 2000 through a complete buyout. Since then, Ben & Jerry’s has operated as a wholly owned subsidiary with a unique governance structure that protects its social mission while remaining financially and legally controlled by its parent company.

Parent Company: Unilever

Ben & Jerry’s is a 100% owned subsidiary of Unilever, one of the world’s largest consumer goods companies.

Unilever is a publicly traded multinational with dual roots in the UK and the Netherlands. It operates hundreds of brands across food, beverages, personal care, and household products. Ice cream is one of Unilever’s core global categories, and Ben & Jerry’s sits within this division alongside brands such as Magnum and Breyers.

As the parent company, Unilever holds full legal and economic ownership of Ben & Jerry’s. This includes control over assets, trademarks, manufacturing infrastructure, global distribution rights, and financial reporting. Ben & Jerry’s does not issue shares, does not have minority owners, and does not operate as a separate legal holding company.

Strategic decisions related to capital investment, international expansion, supply chain integration, and compliance ultimately fall under Unilever’s authority. Ben & Jerry’s management team reports into Unilever’s ice cream leadership structure, making Unilever the final decision-maker on corporate matters.

Acquisition Insights

Unilever acquired Ben & Jerry’s in 2000 in a transaction valued at approximately $326 million. At the time of the deal, Ben & Jerry’s was a publicly traded U.S. company with thousands of shareholders.

The acquisition was executed as a full buyout. All outstanding shares were purchased, and Ben & Jerry’s was taken private. This ended its status as an independent public company and transferred 100% ownership to Unilever.

The deal followed months of evaluation by Ben & Jerry’s board, which faced pressure from investors to accept a premium offer. Unilever’s bid was ultimately selected because it included legally binding commitments that went beyond price.

A key component of the acquisition was the creation of an independent board of directors for Ben & Jerry’s. This board was granted formal authority to protect the company’s social mission, brand identity, and core values. These protections were written into the acquisition agreement and remain in effect as of February 2026.

Post-Acquisition Ownership and Governance Model

After the acquisition, Ben & Jerry’s became financially integrated into Unilever but retained a distinct governance layer. The independent board operates separately from Unilever’s corporate board and focuses specifically on mission alignment and brand integrity.

Unilever controls financial performance, executive appointments, and long-term strategy. Ben & Jerry’s leadership controls product development, marketing tone, and public advocacy, subject to the oversight of its independent board.

This structure is highly unusual in large corporate acquisitions. It allows Unilever to own the brand outright while limiting direct control over certain non-financial decisions.

Competitor Ownership Comparison

Most major ice cream brands are owned by large corporations that exercise direct and comprehensive control over their subsidiaries. These brands are designed to align closely with shareholder returns and corporate strategy.

Ben & Jerry’s differs in a meaningful way. While it is fully owned by a multinational parent, it operates under legally protected mission oversight. This makes Ben & Jerry’s a rare case of a brand that is both corporately owned and structurally insulated from complete top-down control. In an industry dominated by conventional ownership models, Ben & Jerry’s remains a notable exception.

| Brand | Parent Company | Ownership Type | Governance & Control Model | Key Ownership Characteristics |

|---|---|---|---|---|

| Ben & Jerry’s | Unilever | Wholly owned subsidiary | Hybrid model with independent board | Unilever owns 100% of equity and controls finances and strategy. An independent board legally protects social mission, brand values, and public advocacy. |

| Häagen-Dazs | General Mills | Corporate brand within public company | Fully centralized corporate control | Ownership aligned entirely with shareholder interests. No independent governance or mission protections. Decisions driven by earnings and market performance. |

| Magnum | Unilever | Fully integrated global brand | Standard top-down corporate control | Operates entirely under Unilever’s ice cream division. No autonomy or independent oversight beyond corporate management. |

| Breyers | Unilever | Mass-market subsidiary | Centralized corporate management | Focuses on scale and efficiency. Ownership is purely commercial with no mission-driven governance structure. |

| Dairy Queen | Berkshire Hathaway | Conglomerate-owned franchise brand | Central ownership with franchise operations | Berkshire Hathaway controls brand and strategy. Franchisees manage daily operations. No independent board or social mission protections. |

Ben & Jerry’s: Mission-Protected Corporate Ownership

Ben & Jerry’s is owned outright by Unilever, making it financially and legally controlled by one of the world’s largest consumer goods companies. Unlike most corporate brands, Ben & Jerry’s operates under a binding governance agreement created during its acquisition. This agreement established an independent board responsible for protecting the brand’s social mission, public advocacy, and values-based positioning.

While Unilever controls capital allocation, global expansion, and executive oversight, Ben & Jerry’s retains a higher degree of autonomy over messaging, activism, and brand voice. This hybrid structure is rare in the food industry and has no direct equivalent among its largest competitors.

Häagen-Dazs: Traditional Public Company Control

Häagen-Dazs is owned by General Mills, a publicly traded U.S. food company. The brand operates as a standard subsidiary within General Mills’ portfolio. Ownership is fully aligned with shareholder interests, and strategic decisions are driven by earnings performance, market share, and margin growth.

There are no special governance protections for brand values or independence. Product innovation, pricing, and marketing strategies are tightly integrated into General Mills’ broader corporate objectives. Compared to Ben & Jerry’s, Häagen-Dazs reflects a conventional ownership model focused primarily on financial performance.

Magnum: Fully Integrated Unilever Brand

Magnum is also owned by Unilever, but its ownership model is entirely centralized. Magnum functions as a global premium brand designed for scale, consistency, and mass appeal. All major decisions flow directly through Unilever’s ice cream division.

There is no independent board or mission-focused oversight. Branding and messaging are aligned strictly with corporate marketing strategies. This contrast within Unilever’s own portfolio underscores how exceptional Ben & Jerry’s governance structure is.

Breyers: Mass-Market Corporate Ownership

Breyers, another Unilever-owned brand, operates at the opposite end of the premium spectrum. It targets mass-market consumers and competes primarily on price, distribution reach, and brand familiarity. Ownership is purely commercial, with no structural separation between brand leadership and corporate control.

Breyers’ strategy is shaped by efficiency, supply chain optimization, and market penetration. Unlike Ben & Jerry’s, Breyers does not engage in political or social advocacy and follows a traditional top-down ownership and management approach.

Dairy Queen: Conglomerate and Franchise Ownership

Dairy Queen is owned by Berkshire Hathaway, a diversified multinational conglomerate. Ownership is centralized at the holding company level, but operations rely heavily on a franchise model. Individual franchisees manage daily operations, while Berkshire Hathaway controls brand standards, long-term strategy, and capital structure.

Although Dairy Queen has operational flexibility at the store level, it lacks any formal mechanism to protect social or political independence. Its ownership model prioritizes stability, cash flow, and long-term brand durability rather than mission-driven differentiation.

Who Controls Ben & Jerry’s?

Control of Ben & Jerry’s is shared across multiple layers rather than concentrated in a single authority. While the company is fully owned by Unilever, its governance model blends corporate oversight with legally protected independence.

This structure determines who makes financial decisions, who sets operational direction, and who safeguards the brand’s social mission.

Ultimate Control: Unilever as Parent Company

At the highest level, Ben & Jerry’s is controlled by Unilever, which owns 100% of the brand. This ownership gives Unilever complete legal authority over Ben & Jerry’s assets, trademarks, manufacturing facilities, and global distribution rights.

Unilever sets the financial framework under which Ben & Jerry’s operates. This includes annual budgets, investment levels, profitability expectations, and long-term growth targets. Strategic decisions such as entering or exiting markets, expanding production capacity, or restructuring operations require Unilever approval. From a corporate governance perspective, Unilever is the final authority on all matters that affect financial performance and legal compliance.

Operational Oversight and Management Control

Day-to-day control is exercised through Unilever’s ice cream division. Ben & Jerry’s executive leadership team operates within this structure and reports upward into Unilever’s global management hierarchy.

Unilever oversees operational standards, supply chain integration, quality control, and risk management. This ensures Ben & Jerry’s complies with global regulations and aligns with Unilever’s corporate policies. Performance metrics, internal audits, and operational reviews are all managed within this framework, reinforcing Unilever’s operational control without directly managing daily brand activities.

Role of the CEO and Executive Leadership

Ben & Jerry’s is led by a Chief Executive Officer who manages daily operations, brand strategy, product development, and internal culture. The CEO plays a central role in translating the company’s mission into actionable business strategies while meeting corporate performance expectations.

Despite having significant autonomy in running the brand, the CEO is not independent. Executive leadership appointments, compensation structures, and long-term performance objectives require Unilever approval. This ensures that leadership remains accountable to the parent company while focusing on brand-specific goals.

Independent Board and Mission Governance

A defining element of Ben & Jerry’s control structure is its independent board of directors. This board was created as part of the 2000 acquisition agreement and continues to function as of February 2026.

The independent board’s mandate is limited but powerful. It does not oversee finances or operations. Instead, it protects the company’s social mission, values, and brand integrity. The board has authority over public advocacy positions, ethical sourcing commitments, and initiatives related to social justice and environmental responsibility.

When conflicts arise between corporate priorities and mission values, the board can formally challenge management and escalate concerns. This governance layer acts as a structural check on Unilever’s control, something rarely seen in multinational brand ownership.

Founders’ Role in Control

Founders Ben Cohen and Jerry Greenfield no longer hold ownership stakes or management roles within the company. They do not participate in corporate governance or operational decision-making.

However, their legacy continues to influence the brand’s direction. Public statements made by the founders often attract media attention and shape public expectations of Ben & Jerry’s stance on social issues. While this influence is informal, it adds an external layer of pressure that affects how decisions are perceived and communicated.

In practice, control of Ben & Jerry’s operates through a dual authority system.

Unilever controls ownership, finances, legal matters, and long-term corporate strategy.

Ben & Jerry’s executive leadership manages daily operations and brand execution.

The independent board safeguards the social mission and brand values.

This layered control model makes Ben & Jerry’s a rare example of a globally owned brand that balances corporate authority with institutionalized mission protection.

Ben & Jerry’s Annual Revenue and Net Worth

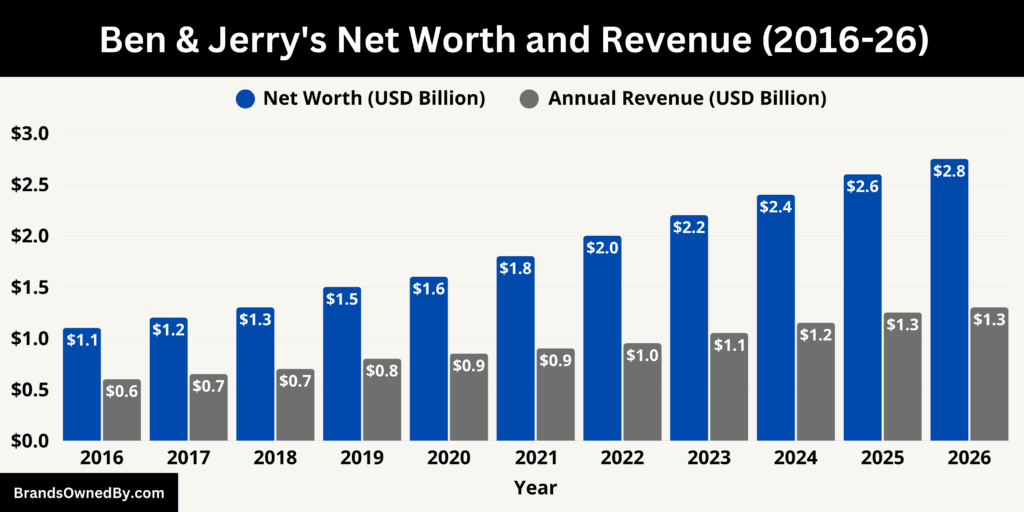

As of February 2026, Ben & Jerry’s generates an estimated $1.30 billion in annual revenue and holds an estimated brand net worth of $2.75 billion. These figures highlight Ben & Jerry’s status as one of the most valuable premium ice cream brands globally, operating under the ownership of Unilever while maintaining strong standalone brand equity.

2026 Annual Revenue

Ben & Jerry’s estimated $1.30 billion revenue in 2026 is the result of steady global demand, premium pricing, and diversified sales channels.

The United States remains the single largest market. It contributes approximately 45% of total revenue, equal to around $0.58 billion. U.S. revenue is driven primarily by grocery and retail pint sales, supported by high brand loyalty, frequent limited-edition releases, and strong placement in premium freezer aisles.

International markets account for the remaining 55%, or roughly $0.72 billion. Europe represents the largest share outside the U.S., followed by Asia-Pacific and select Middle Eastern and Latin American markets. International growth benefits heavily from Unilever’s established distribution networks, localized flavor development, and expanded freezer penetration in premium retail chains.

From a sales channel perspective, packaged retail products dominate revenue generation. Grocery and retail sales contribute an estimated 80% of total revenue, or about $1.04 billion. Scoop shops and foodservice locations generate the remaining 20%, or roughly $0.26 billion. While scoop shops contribute less financially, they play a critical role in brand storytelling, innovation testing, and consumer engagement.

Revenue Growth Over the Last Decade

Ben & Jerry’s revenue growth over the past ten years reflects consistency rather than volatility. In 2016, estimated revenue stood at $0.60 billion. In 2026, it has more than doubled to $1.30 billion.

This growth has not been driven by aggressive discounting or mass-market expansion. Instead, Ben & Jerry’s has relied on premium positioning, strong flavor innovation, ethical sourcing narratives, and cultural relevance. Even during periods of global economic disruption, the brand maintained pricing power and shelf demand, allowing revenue to grow steadily rather than spike unpredictably.

Brand Net Worth and Valuation in 2026

Ben & Jerry’s estimated net worth of $2.75 billion as of February 2026 represents brand value rather than corporate equity. As a wholly owned subsidiary, Ben & Jerry’s does not publish a standalone balance sheet. Its net worth is therefore assessed through brand valuation models.

These valuations account for consumer awareness, emotional loyalty, pricing premiums, repeat purchase behavior, and long-term earnings potential. The brand’s net worth has increased from approximately $1.10 billion in 2016 to $2.75 billion in 2026, reflecting sustained cultural relevance and strong global recognition.

Unlike many food brands, Ben & Jerry’s brand value is amplified by its distinct identity and outspoken positioning. While this approach can create controversy, it has also strengthened differentiation and reinforced consumer loyalty, which directly supports long-term valuation.

Relationship Between Revenue and Net Worth

Ben & Jerry’s brand net worth consistently exceeds its annual revenue. This gap illustrates the strength of its intangible assets. Strong margins, premium pricing, and high repeat purchase rates allow the brand to generate value beyond simple sales volume.

The combination of global reach, loyal customer base, and cultural visibility supports a valuation multiple that is higher than many mass-market competitors. Within Unilever’s portfolio, Ben & Jerry’s is viewed as a high-equity brand rather than a pure volume-driven business.

Future Revenue Forecast

Based on current performance trends, international expansion, and premium category growth, Ben & Jerry’s future revenue outlook remains positive.

- 2027: Annual revenue is projected to reach approximately $1.35 billion, driven by incremental growth in European retail channels and expanded freezer penetration in Asia-Pacific markets. Brand net worth is expected to rise to around $2.85 billion, supported by strong pricing power and repeat consumer demand.

- 2028: Revenue is forecast to increase to roughly $1.40–$1.45 billion, as premium product extensions and limited-edition launches sustain consumer interest. Brand net worth is projected to cross $3.00 billion, reflecting long-term brand equity rather than short-term sales volume.

- 2029: Annual revenue is expected to approach $1.50 billion, with international markets accounting for a larger share of total sales than the United States. Net worth is forecast at approximately $3.15 billion, driven by higher international margins and improved supply chain efficiencies.

- 2030: Revenue is projected to reach between $1.55 and $1.60 billion, assuming steady global economic conditions and continued premium demand. Brand net worth is expected to range between $3.30 and $3.40 billion, positioning Ben & Jerry’s among the most valuable ice cream brands worldwide.

By 2030, international markets are expected to contribute close to 60% of total revenue, reducing reliance on the U.S. market and strengthening global brand resilience. Growth will be driven less by store count expansion and more by pricing strategy, brand extensions, and consumer loyalty.

Overall, Ben & Jerry’s is forecast to remain a high-equity, premium-led brand with predictable growth and increasing long-term value. Its financial trajectory reflects brand strength and differentiation rather than aggressive scale, aligning with Unilever’s strategy of prioritizing value creation over volume alone.

Brands Owned by Ben & Jerry’s

Ben & Jerry’s operates a focused ownership model. It owns its core operating company, its foundation, its scoop shop network, and all brand-related intellectual property. It does not own unrelated food brands or external companies.

Below is a list of the entities and brands owned and operated by Ben & Jerry’s as of February 2026:

Ben & Jerry’s Homemade, Inc.

Ben & Jerry’s Homemade, Inc. is the primary operating entity under which all core business activities are conducted. This entity manages product development, brand strategy, marketing, and coordination with manufacturing and distribution partners.

It is responsible for flavor innovation, packaging design, brand voice, and global consistency. While manufacturing and large-scale logistics are integrated within Unilever’s systems, Ben & Jerry’s Homemade, Inc. remains the central brand-operating company that defines what Ben & Jerry’s stands for in the market.

Ben & Jerry’s Scoop Shops

Ben & Jerry’s Scoop Shops are owned and operated through a mix of company-operated and franchised locations. These scoop shops are a core brand asset rather than a standalone subsidiary.

Scoop shops serve as experiential brand hubs. They are often used to test new flavors, launch limited editions, and reinforce the company’s community-driven identity. While they contribute a smaller share of revenue compared to retail pints, they play an outsized role in marketing, storytelling, and customer engagement.

As of 2026, Ben & Jerry’s operates scoop shops across the United States and internationally, with localized menus and community-focused initiatives.

Ben & Jerry’s Foundation

Ben & Jerry’s Foundation is a wholly owned and independently governed entity created to advance the company’s social mission. The foundation is funded annually through a portion of Ben & Jerry’s profits.

It operates separately from commercial decision-making and focuses on grassroots organizing, economic justice, environmental sustainability, and human rights initiatives. The foundation distributes grants to nonprofit organizations and community groups, primarily in the United States.

This foundation is a key reason Ben & Jerry’s is often described as a mission-led company rather than a conventional consumer brand.

Flavor Portfolio and Product Lines

Ben & Jerry’s owns and manages all of its proprietary flavor lines and product concepts internally. These are not separate companies but are treated as strategic brand assets.

Core product categories include classic pint flavors, non-dairy alternatives, limited-batch releases, and region-specific exclusives. Flavor concepts such as large mix-ins, named flavors tied to pop culture, and socially themed releases are fully owned intellectual property of Ben & Jerry’s.

These product lines are central to the brand’s differentiation and are developed entirely under Ben & Jerry’s internal teams.

Licensing and Co-Branded Product Programs

Ben & Jerry’s operates selective co-branded and licensed product initiatives, which are owned and controlled by the company itself. These include partnerships for themed flavors, seasonal collaborations, and cause-driven releases.

While partners may contribute branding or visibility, Ben & Jerry’s retains ownership of product formulation, naming, and brand usage. These arrangements are structured as licensing or collaboration agreements rather than acquisitions or mergers.

Manufacturing and Operational Entities

Ben & Jerry’s does not own separate manufacturing subsidiaries under its own name. Production is carried out through integrated facilities aligned with its parent company’s infrastructure. However, Ben & Jerry’s maintains operational control over recipes, ingredient standards, and quality specifications.

Operational teams within Ben & Jerry’s oversee compliance with sourcing policies, sustainability standards, and flavor integrity across all manufacturing locations.

Final Thoughts

Ben & Jerry’s stands apart in the global ice cream industry, not because of its size, but because of how it operates under corporate ownership. Asking who owns Ben & Jerry’s reveals more than a parent company. It explains why the brand can scale globally while still maintaining a distinct voice and purpose. That balance between ownership, control, and values continues to shape how Ben & Jerry’s evolves and why it remains relevant well beyond its products.

FAQs

How much was Ben and Jerry’s sold for?

Ben & Jerry’s was sold to Unilever in 2000 for approximately $326 million. The deal was structured as a full buyout, meaning all outstanding shares were purchased and the company was taken private.

Who owns Ben and Jerry’s ice cream company?

Ben & Jerry’s ice cream company is 100% owned by Unilever. Ben & Jerry’s does not have its own shareholders and is not publicly traded. All ownership is held at the parent company level.

Why did Ben and Jerry’s sell to Unilever?

Ben and Jerry sold the company due to increasing pressure from shareholders and growing competition from large multinational food companies. As a publicly traded company at the time, Ben & Jerry’s board was legally required to consider acquisition offers that maximized shareholder value. Unilever’s offer was selected because it included legally binding protections for the brand’s social mission, something other bidders did not provide.

Are Ben and Jerry still alive?

Yes. Ben Cohen and Jerry Greenfield are both alive as of 2026. While they no longer own or manage the company, both founders remain publicly active and are still closely associated with the brand’s legacy and values.