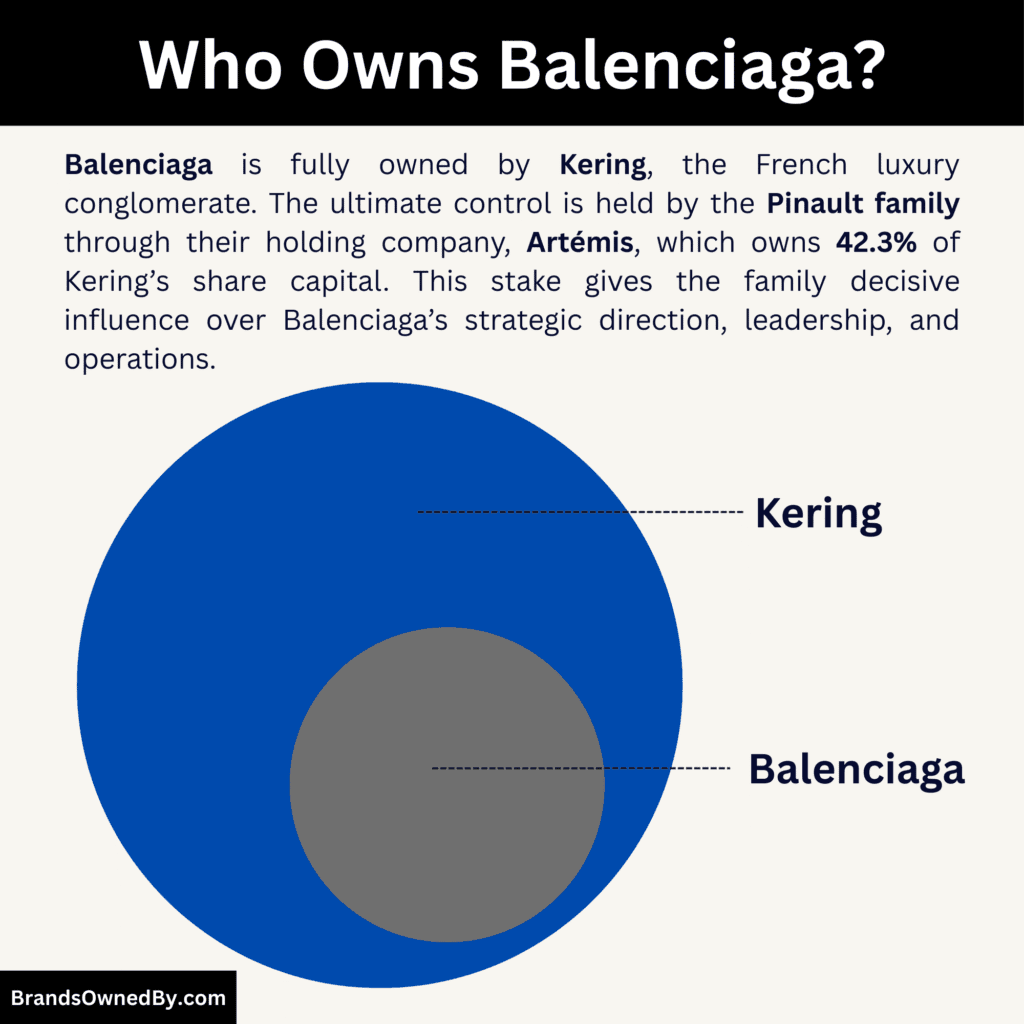

- Balenciaga is fully owned by Kering, meaning the brand has no public shareholders, no separate stock listing, and no minority ownership; all equity, voting rights, and strategic control flow through its parent company.

- Ultimate control of Balenciaga is exercised indirectly by the Pinault family, which controls Kering through its holding company Artémis, giving the family decisive influence over long-term strategy, leadership appointments, and capital allocation.

- Balenciaga operates as a wholly owned subsidiary with brand-level management and creative autonomy, but major financial, structural, and strategic decisions require approval at the Kering group level.

- Investors cannot buy shares in Balenciaga directly; exposure to the brand’s performance is only possible through ownership of Kering shares, where Balenciaga’s results are consolidated with those of other luxury houses.

Balenciaga is a luxury fashion house founded in 1917.

The brand was established by Spanish designer Cristóbal Balenciaga in San Sebastián, Spain. It later moved its operations to Paris, where it became one of the most influential couture houses of the 20th century.

Balenciaga earned a reputation for architectural silhouettes. It redefined women’s fashion in the 1950s and 1960s. The brand temporarily closed after Cristóbal Balenciaga retired. It was revived decades later and repositioned as a modern luxury label.

Today, Balenciaga focuses on ready-to-wear, footwear, handbags, accessories, and haute couture. The brand operates globally through boutiques and digital channels. Paris remains its creative and operational center.

Ownership Snapshot

Balenciaga is owned 100% by Kering.

This means Kering has complete control over Balenciaga’s financial planning, leadership appointments, brand strategy, and long-term positioning. Balenciaga operates as a standalone luxury label, but within Kering’s centralized governance framework.

Kering itself is a publicly traded company. However, it is controlled by the Pinault family through their private holding company, Artémis.

As a result, Balenciaga is indirectly controlled by the Pinault family. Strategic decisions that affect the brand at a high level ultimately trace back to Kering’s board and its controlling shareholders.

Balenciaga is a private brand within a public group.

Investors cannot buy shares in Balenciaga directly. Exposure to the brand is only possible through ownership of Kering shares. This structure protects Balenciaga from short-term market pressure while still benefiting from public-market capital at the group level.

Kering holds full voting and economic rights over Balenciaga.

Creative direction is managed internally by Balenciaga’s leadership team. Major investments, acquisitions, executive changes, and risk decisions require approval at the Kering group level.

This ownership snapshot explains why Balenciaga has strong creative autonomy but limited financial disclosure. Its performance is consolidated into Kering’s financial reporting rather than disclosed independently.

Ownership History and Structural Background

Balenciaga’s ownership has changed several times over the past century. The brand evolved from an independent couture house into a fully integrated luxury subsidiary. Each ownership phase shaped its creative freedom, financial stability, and global reach.

| Time Period | Ownership / Structure | Key Stakeholders | Structural Impact on the Brand |

|---|---|---|---|

| 1917–1972 | Independent couture house | Cristóbal Balenciaga | Founder had full creative and business control. Focus on haute couture and craftsmanship. |

| 1972–1986 | Dormant brand | None (operations closed) | Brand ceased operations after founder’s retirement. No commercial activity. |

| 1986–2001 | Private ownership | Groupe Jacques Bogart and other private entities | Brand revival. Shift toward ready-to-wear. Early restructuring and market re-entry. |

| 2001–2005 | Majority stake acquired | Gucci Group (under PPR) | Entry into a global luxury group. Access to capital, retail network, and management systems. |

| 2005–2013 | Fully integrated subsidiary | PPR (Pinault-Printemps-Redoute) | Stronger corporate governance. Brand repositioning under high-profile creative leadership. |

| 2013–Present (2026) | Wholly owned subsidiary | Kering | Full ownership and strategic control. Centralized financial oversight with brand-level autonomy. |

| Ultimate Control (2026) | Indirect family control | Pinault family via Artémis | Long-term investment philosophy. Stability over short-term market pressure. |

Early Foundation and Independent Beginnings

Balenciaga began as an independent fashion house. It was founded in 1917 by Spanish couturier Cristóbal Balenciaga in San Sebastián, Spain. Cristóbal built a reputation for architectural precision and bold silhouette innovation. He later moved the fashion house to Paris.

His work made Balenciaga one of the most influential couture brands of the mid-20th century. The original house closed in 1972 after his retirement. It remained dormant for more than a decade.

Revival and Early Ownership Transitions

Balenciaga was revived in 1986 under new private ownership. During this period, the label operated under the stewardship of entities such as Groupe Jacques Bogart. Creative directors were appointed to rebuild the brand’s relevance in ready-to-wear fashion.

Designers such as Michel Goma, Josephus Thimister, and later Nicolas Ghesquière contributed to its resurgence.

Acquisition by PPR/Gucci Group

A major turning point in Balenciaga’s ownership came in July 2001. The Gucci Group, then part of the larger French conglomerate PPR (Pinault-Printemps-Redoute), acquired a controlling stake in Balenciaga.

This marked the beginning of integration into a larger luxury portfolio. At that time, the acquisition helped reposition Balenciaga into global markets.

Integration into the Kering Luxury Empire

In subsequent years, PPR transformed into a dedicated luxury group and rebranded itself as Kering. Once Kering was established, the fashion house became a core part of its portfolio.

Balenciaga was consolidated alongside other historic houses such as Gucci, Saint Laurent, and Bottega Veneta. The group’s luxurious ecosystem allowed Balenciaga to leverage shared infrastructure, global distribution channels, and strategic investment.

Structural Background Under Kering

Since the acquisition, Balenciaga’s corporate structure has been that of a wholly owned subsidiary. It is fully consolidated within Kering’s broader financial and governance framework.

Strategic decision-making and capital allocation are determined at the group level, while Balenciaga retains brand-specific management teams.

By 2026, the CEO of Balenciaga is Gianfranco Gianangeli, who works alongside the creative director to drive the label’s vision.

Influence of the Pinault Family

Kering itself is publicly listed but heavily influenced by the Pinault family’s holding company, Artémis. This means that although Balenciaga sits within a global public company’s portfolio, ultimate control stems from a long-term, family-oriented investment philosophy.

This governance model has shaped Balenciaga’s strategy, balancing artistic innovation with financial discipline.

Evolution Through Creative Leadership

Balenciaga’s ownership history also intersects with its creative leadership. Designers and artistic directors often influence the brand’s market perception. Notable figures such as Nicolas Ghesquière and Demna (Demna Gvasalia) played pivotal roles in revitalizing Balenciaga’s global presence under Kering’s ownership.

More recently, Pierpaolo Piccioli has taken on the role of creative director, starting in mid-2025, further shaping the brand’s evolution.

Who Owns Balenciaga?

Balenciaga is fully owned by Kering.

Balenciaga is not an independent or publicly traded company. All ownership rights and equity are held by its parent company, Kering. There are no direct public shareholders in Balenciaga’s structure.

As a wholly owned subsidiary, Balenciaga’s performance and financials are consolidated into Kering’s reported results. This structure allows the brand to focus on creative innovation while benefiting from the stability of a large luxury group.

Balenciaga’s leadership team manages operations, but key strategic decisions require approval from Kering’s executive and governance bodies.

Parent Company: Kering

Kering is a French multinational luxury group that specialises in high-end fashion, leather goods, jewelry, and accessories. It owns several of the world’s most recognisable luxury brands, including Gucci, Saint Laurent, Bottega Veneta, and Alexander McQueen. Kering’s business model is centred on long-term brand development, investment in design talent, and global market expansion.

Kering’s governance combines public shareholders with significant influence from the Pinault family through their holding company, Artémis. This long-term ownership approach prioritises sustainable growth and brand heritage over short-term market pressures.

As Balenciaga’s parent, Kering provides access to shared resources such as global supply chain networks, financial planning expertise, retail platforms, and marketing capabilities.

Balenciaga Acquisition Insights

Balenciaga’s integration into Kering’s portfolio was the result of a significant acquisition in 2001.

At that time, Kering’s predecessor, Pinault-Printemps-Redoute (PPR), was actively building a luxury segment and expanding its global footprint. Through PPR’s ownership of Gucci and related entities, the group acquired a majority stake of approximately 90–91% in Balenciaga in July 2001.

This acquisition marked Balenciaga’s transition from smaller private ownership to being part of a global luxury conglomerate.

The specific financial terms of the 2001 acquisition were not officially disclosed by the parties. However, reports from industry sources at the time indicated that Gucci (under PPR’s control) acquired Balenciaga’s capital in a transaction that provided immediate access to international distribution channels and management support.

Over subsequent years, Kering consolidated its ownership, bringing Balenciaga fully under its corporate umbrella.

The acquisition was strategic. Kering sought to diversify beyond its flagship brand, Gucci. Balenciaga’s history of avant-garde fashion, couture legacy, and growing ready-to-wear appeal made it a valuable asset. Integration enabled Balenciaga to scale its operations, invest in design talent, and expand its retail presence globally.

Structural and Strategic Integration

Following the acquisition, Balenciaga retained its brand identity and design ethos, but its corporate functions were realigned to fit within Kering’s operational systems. Financial planning, legal oversight, and global supply chain coordination are managed within Kering’s central infrastructure.

Creative leadership and brand vision remain largely at the Balenciaga level, guided by executive appointments and creative directors.

Balenciaga’s CEO reports to Kering’s senior leadership. The brand participates in group-wide strategic planning processes, ensuring that initiatives align with broader corporate goals.

This balanced model allows the brand to maintain a distinctive voice while benefiting from the scale and governance of a multinational organisation.

Long-Term Ownership Influence

Although Balenciaga is part of a public company, ultimate influence is shaped by the Pinault family through their control of Kering’s voting rights. This governance structure provides stability and encourages long-term planning. It also mitigates exposure to short-term market fluctuations that can affect standalone luxury companies.

The relationship between Balenciaga and Kering continues to evolve. In 2025, Kering entered into a strategic deal to sell its beauty division, including licensing agreements for fragrance and cosmetic products for Balenciaga and sister brands, under long-term arrangements with L’Oréal.

This move reflects Kering’s efforts to refine its focus on core fashion and luxury segments while still leveraging global partnerships.

Competitor Ownership Comparison

Luxury fashion brands often compete in the same consumer segments while operating under very different ownership structures. These structures directly influence decision-making speed, risk tolerance, creative freedom, capital allocation, and long-term strategy.

Below is a clear explanation of how Balenciaga’s ownership compares with its major competitors and why those differences matter.

| Brand / Group | Ownership Type | Ultimate Controller(s) | Strategic implications |

|---|---|---|---|

| Balenciaga (Kering) | Wholly owned subsidiary of public group | Kering (influenced by Pinault family) | Group capital & services; brand autonomy but consolidated reporting. |

| Gucci, Saint Laurent (Kering) | Same as above | Kering | Shared group strategy; internal allocation of resources. |

| Louis Vuitton (LVMH) | Public conglomerate with family control | Christian Dior SE / Arnault family | Very large scale; decisive family control; diversified risk. |

| Chanel | Private, family-owned | Wertheimer family | Total independence; long-term focus; no public reporting. |

| Hermès | Public with family majority | Hermès family | Crafts-led, conservative growth; public reporting + family protection. |

| Prada | Public with family holding majority | Prada Holding / Prada family | Market access plus family control; hybrid governance. |

| Burberry | Public, institutional investors | Institutional & retail shareholders | Market discipline; potential for activist involvement. |

Balenciaga vs Gucci and Saint Laurent (Same Parent Structure)

Balenciaga, Gucci, and Saint Laurent all operate under the same parent company, Kering.

From an ownership perspective, they are not true corporate competitors. They are sister brands. Strategic capital allocation, executive appointments, and long-term positioning are decided at the Kering group level. While each brand has creative independence, financial priorities are coordinated to optimize group performance.

This structure reduces financial risk for individual brands. It also limits absolute autonomy. A brand’s expansion pace or investment level depends on group-wide priorities rather than brand-only performance.

Balenciaga vs Louis Vuitton (LVMH Model)

Louis Vuitton operates under LVMH.

Both Kering and LVMH follow a public conglomerate model, but LVMH is significantly larger and more diversified. LVMH is also tightly controlled by the Arnault family through voting power, similar to how the Pinault family influences Kering.

For Balenciaga, this means competing with brands that often have larger marketing budgets, broader retail networks, and stronger vertical integration. However, Balenciaga benefits from Kering’s more focused portfolio, which allows comparatively closer strategic attention per brand.

Balenciaga vs Chanel (Private Family Ownership)

Chanel is privately owned and controlled by the Wertheimer family.

This is a fundamentally different ownership model. Chanel does not face public-market pressure, quarterly reporting cycles, or external shareholder scrutiny. This allows it to prioritize long-term brand equity, control distribution tightly, and limit overexposure.

Compared to Balenciaga, Chanel enjoys more absolute independence. However, Balenciaga benefits from Kering’s scale, shared resources, and financial resilience, which Chanel must generate entirely on its own.

Balenciaga vs Hermès (Family-Controlled Public Company)

Hermès represents a hybrid ownership structure.

Hermès is publicly listed, but the founding family retains decisive control. This model blends transparency and capital-market access with strong protection against hostile takeovers or activist investors.

Compared to Balenciaga, Hermès operates with greater ownership stability and slower, more conservative growth. Balenciaga, by contrast, can pursue more aggressive repositioning and trend-driven strategies due to Kering’s portfolio-level risk management.

Balenciaga vs Prada and Burberry (Public with Concentrated or Dispersed Ownership)

Prada is publicly listed with majority family control. Burberry is publicly listed with largely institutional ownership.

Prada’s structure allows family-led vision with market discipline. Burberry’s model exposes it to greater short-term investor pressure and potential activist influence.

Balenciaga avoids both extremes. It is shielded from direct market pressure because it is not listed, yet it benefits from Kering’s public-market access at the group level.

Key Ownership Takeaways

Balenciaga’s ownership model sits between full independence and full market exposure.

Being owned by Kering gives Balenciaga financial stability, access to capital, and global infrastructure. It also reduces vulnerability to market downturns. At the same time, it limits complete autonomy compared to privately owned brands like Chanel.

Compared to family-controlled public brands such as Hermès, Balenciaga can move faster and take creative risks with lower existential risk. Compared to brands like Burberry, it avoids short-term shareholder pressure and activist intervention.

The key strategic advantage for Balenciaga is risk sharing. Kering absorbs volatility across its portfolio. This allows Balenciaga to experiment creatively while remaining financially protected. The trade-off is that ultimate control does not rest with the brand itself, but with the parent group’s long-term strategy.

Who Controls Balenciaga?

Balenciaga is a major luxury fashion house known worldwide for its creativity, influence, and commercial success. Control of Balenciaga is exercised through a layered corporate and governance structure that ultimately ties back to the largest shareholders and strategic decision-makers of its parent company.

The brand itself does not operate independently in public markets. Instead, it fits into the structure of a global luxury conglomerate where control is shared between corporate leaders and family stakeholders.

Here’s a quick overview of who controls Balenciaga as of January 2026:

- Balenciaga is controlled through its parent company, Kering, which owns 100% of the brand.

- Kering’s board and executive team set strategic direction and corporate oversight affecting Balenciaga.

- Groupe Artémis and the Pinault family represent the ultimate controlling influence by virtue of their significant shareholding and voting rights in Kering.

- Brand leadership at Balenciaga handles operational and creative execution within the governance framework established by Kering and its controlling shareholders.

This control architecture combines the stability of long-term family influence with the resources and governance rigour of a publicly listed luxury group. Balenciaga thus operates at the intersection of brand autonomy and corporate strategy.

Corporate Control: Parent Company Authority

Balenciaga is wholly owned by the French luxury group Kering. Balenciaga does not have standalone public shareholders or its own stock listing. All shares, voting rights, and economic claims are held by Kering, which consolidates the brand’s results into its financial reporting.

This means control begins at the group level, where decisions impacting Balenciaga’s strategy, investments, leadership appointments, and major initiatives are made.

Because Kering is a publicly listed company, it is subject to corporate governance practices and shareholder oversight typical of large European firms. However, Balenciaga’s management team reports into Kering’s executive and board structure rather than to an independent board of its own.

This model places Balenciaga under the operational and strategic direction of Kering’s senior leadership, allowing the fashion house to benefit from group-wide infrastructure, financial resources, and global networks while maintaining brand-level creative execution.

Leadership Influence: Group Management and Board

Kering’s executive leadership and board of directors play a critical role in controlling Balenciaga’s trajectory. Decisions about corporate priorities, resource allocation, and long-term strategy are made at this level. Key roles include:

- Chief Executive Officer (CEO) of Kering – The CEO sets the broad strategic direction for the group and oversees all houses, including Balenciaga.

- Board of Directors – The board approves major investments, corporate policies, executive compensation frameworks, and risk management principles that shape how Balenciaga operates.

In late 2025, Luca de Meo took over as CEO of Kering, with a mandate to revitalize the group after a period of financial challenges. His appointment reflects the influence Kering’s board and controlling shareholders exert over corporate leadership — even on decisions affecting brands like Balenciaga.

Ultimate Control: The Pinault Family and Artémis

While Kering owns Balenciaga, control over Kering itself rests largely with the Pinault family through its investment holding company, Groupe Artémis. As of 2026, Artémis holds approximately 42.3% of Kering’s share capital and a higher proportion of voting rights due to double-voting structures.

This gives the family significant influence over strategic decisions, leadership appointments, and corporate direction — and by extension, over Balenciaga’s governance and long-term orientation.

This level of control means that even though Kering is publicly traded and has institutional and retail shareholders, the Pinault family’s voice carries substantial weight. Their influence shapes Kering’s policies on brand portfolio management, capital deployment, global expansion, sustainability commitments, and risk strategy.

For Balenciaga, this translates into a balance between creative freedom and parent company oversight rooted in long-term value creation rather than short-term market performance.

Operational Control: Brand Leadership and Creative Direction

Operationally, Balenciaga is led by its own CEO and creative director. As of January 2026:

- Gianfranco Gianangeli is the CEO responsible for running Balenciaga’s day-to-day business, including retail operations, marketing, commercial planning, and financial results.

- Pierpaolo Piccioli is the creative director shaping the brand’s artistic vision, design ethos, and runway collections.

These leaders direct Balenciaga’s internal teams, collaborate with global markets, and translate broader corporate strategy into actionable plans.

However, their decisions occur within the framework established by Kering’s leadership. Strategic initiatives requiring major investment, structural changes, or global expansion mandates must align with Kering’s broader priorities.

Control Dynamics in Practice

The control model for Balenciaga blends corporate governance with brand-level autonomy:

- Strategic oversight and financial responsibilities reside with Kering’s board and executive team.

- Operational autonomy and creative leadership are delegated to Balenciaga’s senior management, guided by brand heritage and market demands.

- Ultimate influence on major direction and governance stems from the Pinault family via Groupe Artémis’s voting control over Kering.

This layered control structure ensures that Balenciaga benefits from the scale and resilience of a major luxury group while preserving its distinctive creative identity and operational flexibility.

Balenciaga Annual Revenue and Net Worth

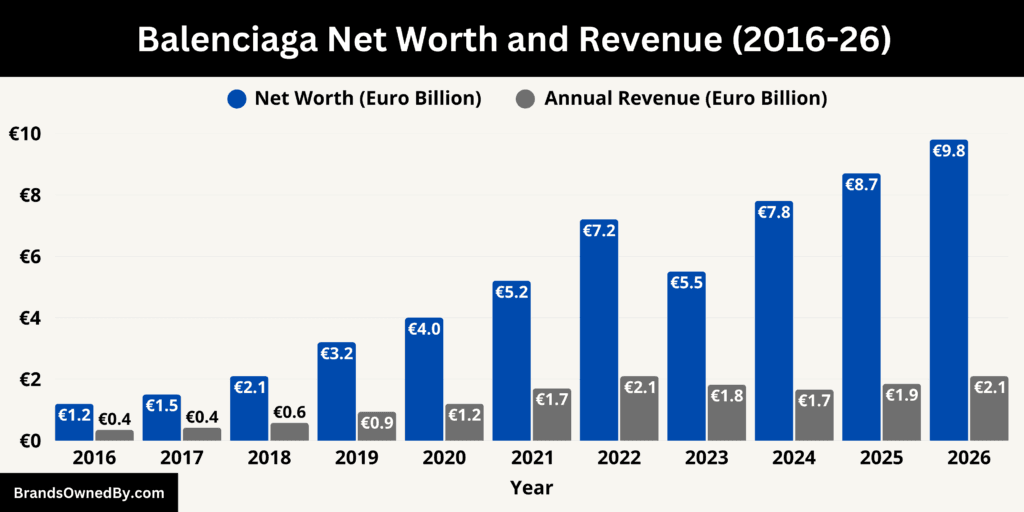

Balenciaga continues to strengthen its commercial position within the global luxury sector. In 2026, the brand is estimated to have generated approximately €2.10 billion in annual revenue, marking a continuation of its recovery and growth trajectory after a period of market adjustment. Alongside this revenue performance, Balenciaga’s estimated brand net worth reached around €9.8 billion as of January 2026, reflecting growing consumer demand, sustained cultural relevance, and improved financial performance.

Historical Revenue Growth and 2026 Performance

Over the past decade, Balenciaga’s annual revenue has evolved from modest beginnings into the multi-billion-euro range.

In 2016, revenue was estimated at €0.35 billion, reflecting the brand’s early resurgence under strategic direction following decades of dormancy and revitalisation.

Through the late 2010s, revenue continued to rise as Balenciaga expanded its product offerings, strengthened its retail footprint, and attracted new customers across key markets.

By 2019, annual revenue approached €0.94 billion, evidencing substantial commercial momentum.

The early 2020s saw further acceleration. Balenciaga’s revenue crossed the €1 billion threshold and continued to grow, reaching a peak estimated at €2.10 billion in 2022. This period corresponded with strong demand for its signature ready-to-wear lines, accessories, and footwear.

Despite encountering a headwind in 2023, when revenue dipped to approximately €1.82 billion amid broader industry pressures and brand restructuring, Balenciaga’s performance stabilised thereafter, posting an estimated €1.66 billion in 2024 and rebounding to around €1.85 billion in 2025.

In 2026, Balenciaga’s revenue growth regained strength, returning to approximately €2.10 billion, on par with its previous peak. This resurgence reflects strategic adjustments across product categories, particularly in high-demand segments such as premium footwear and accessories.

Geographic expansion and improved operational efficiency also contributed to stronger sales, with notable gains in key markets including North America, Europe, and parts of Asia.

The 2026 performance underscores Balenciaga’s ability to navigate market fluctuations and capitalise on evolving luxury consumption patterns.

Brand Net Worth Evolution and 2026 Valuation

Brand net worth, or the estimated market value of Balenciaga as a luxury fashion entity, has likewise shown a robust upward trend over the past decade. As of January 2016, Balenciaga’s estimated brand net worth was around €1.2 billion, a figure that reflected its rebuilding phase following decades of reinvigoration. As the brand achieved higher visibility and stronger commercial traction, its net worth increased steadily, reaching approximately €3.2 billion by 2019 and further expanding to around €7.2 billion in 2022.

This growth in brand value was propelled by successful marketing strategies, iconic product launches, and heightened recognition on the global luxury stage.

The dip in revenue in 2023 also translated into a temporary softening of net worth estimates, which declined to about €5.5 billion as market sentiment adjusted. However, Balenciaga regained momentum in subsequent years, with its brand net worth estimated at €7.8 billion in 2024 and further rising to €8.7 billion in 2025.

These figures reflected renewed confidence in the brand’s creative direction, improved financial results, and stronger alignment with luxury consumer trends.

For 2026, Balenciaga’s estimated brand net worth reached approximately €9.8 billion. This valuation underscores the brand’s enduring cultural impact, consistent market relevance, and strategic positioning within the luxury ecosystem.

The 2026 net worth assessment took into account not only revenue performance but also brand desirability, global market penetration, and intangible value drivers such as design influence and consumer loyalty. Achieving a near-€10 billion valuation signals Balenciaga’s transition from a rising label to a firmly established premium luxury powerhouse.

Interpretation of 2026 Revenue and Net Worth

The estimated revenue and net worth figures for 2026 reflect a year of solid performance and strategic reinforcement. Balenciaga’s ability to return to and exceed previous revenue peaks demonstrates commercial resilience and adaptability.

Its net worth estimate nearing €9.8 billion highlights the brand’s strong equity in the luxury marketplace, a testament to effective leadership, creative innovation, and robust consumer engagement.

The combination of rising revenue and increasing brand value also suggests a favourable long-term outlook. Balenciaga’s performance in 2026 signals confidence among stakeholders and continued relevance among luxury consumers.

As the brand continues to evolve its collections, expand its global footprint, and invest in strategic initiatives, its revenue and net worth trajectory position it well among the leading luxury fashion houses in the world.

Brands Owned by Balenciaga

Balenciaga does not, as of January 2026, own multiple independent consumer brands or separate luxury houses. Instead, it owns and operates the integrated components of the Balenciaga business: the legal operating company, product divisions (ready-to-wear, couture, footwear, accessories), retail and e-commerce platforms, manufacturing relationships, licensing programmes, intellectual property, and creative/content teams. Fragrance and beauty activities are executed via licensing agreements rather than direct ownership of beauty companies.

Below is a list of the brands owned by Balenciaga as of January 2026:

Balenciaga S.A.S.

Balenciaga S.A.S. is the legal entity that holds and operates the Balenciaga business. This company registers the brand, signs commercial contracts, employs corporate staff, and consolidates operating units such as design, production oversight, wholesale, retail, and e-commerce activities.

It is Balenciaga S.A.S. that invoices wholesale partners, hires store managers, and manages the brand’s payroll and corporate governance at the brand level. While the entity is wholly owned by its parent group, Balenciaga S.A.S. is the operational centre through which the house runs its global business.

Balenciaga Ready-to-Wear Division

The ready-to-wear division produces seasonal men’s and women’s collections that are sold through Balenciaga’s own stores, e-commerce channels, and selected wholesale partners. This division includes design teams, product development, line planning, and merchandising functions.

It is the main revenue driver for the house and the public face of Balenciaga’s fashion calendar, responsible for runway shows, pre-collection drops, and the day-to-day product assortment that sustains retail sales and wholesale relationships.

Balenciaga Haute Couture and Atelier operations

Balenciaga maintains a couture and high-craft segment that oversees made-to-measure, special commissions, and select couture presentations. This entity is less about scale and more about brand heritage, technical skill, and prestige.

The atelier teams and couture workshops operate under the brand’s umbrella, preserving artisanal know-how and enabling Balenciaga to stage high-impact shows and custom projects that elevate the house’s reputation and command strategic attention from collectors and press.

Balenciaga Footwear and Accessories Division

Footwear, leather goods and accessories are organised as a dedicated commercial division within Balenciaga. This division manages product categories such as sneakers, boots, handbags, small leather goods, belts and sunglasses (where applicable).

It coordinates design, sourcing, quality control and global product launches. Accessories are a high-margin segment and an important lever for broadening brand reach; as such this division works closely with retail and marketing to maximise sell-through and seasonal relevance.

Balenciaga Retail and E-commerce

Balenciaga directly owns and operates a global retail network of flagship stores, mono-brand boutiques and concession spaces in department stores, plus its direct-to-consumer e-commerce platform.

The retail and e-commerce entity handles store leases, visual merchandising standards, omnichannel fulfilment, customer service and local market operations. Ownership of these channels gives Balenciaga control over pricing, presentation and customer experience, allowing rapid commercial execution of product drops and strategic retail formats.

Balenciaga Manufacturing, Supply-Chain, and Atelier Partnerships

Balenciaga operates a mixed manufacturing model. The house maintains in-house ateliers and workshops for high-value and couture production while relying on contracted specialist manufacturers for volume categories such as footwear and leather goods.

The manufacturing and supply-chain team is part of Balenciaga’s operating structure and is responsible for supplier selection, quality assurance, compliance, and the operational logistics that ensure collections and stock flows reach stores and distribution centres worldwide.

Balenciaga Licensing and Fragrance

Balenciaga itself does not typically own standalone fragrance or beauty companies. Instead, the house licenses its name and trademarks for fragrance and cosmetic products under long-term commercial agreements.

These licensing arrangements permit third parties to develop, manufacture, distribute and market Balenciaga-branded beauty and fragrance products in exchange for royalties and brand oversight. As a business model, licensing allows Balenciaga to extend its brand into beauty categories without owning or operating manufacturing or distribution infrastructure for those products directly, while retaining control of brand guidelines and product approval rights.

Balenciaga Collaborations, Special Projects, and Co-brands

Balenciaga runs a formal structure for collaborations and limited-edition projects that partners the house with other designers, artists, cultural institutions and select commercial partners. These projects are executed as short-term commercial ventures under Balenciaga’s management, not as acquisitions of other brands.

Collaborations are used strategically to reach new audiences, produce cultural moments and create collectible product runs. The projects are administered by Balenciaga’s commercial partnerships team and executed through the brand’s retail and marketing channels.

Balenciaga Intellectual Property and Brand Asset Management

Balenciaga directly owns the core intellectual property (trademarks, designs, logos and trade dress) associated with the house. The brand asset management function sits inside the company and enforces trademark use, approves third-party licensing, and manages legal defence of design rights.

This unit also controls archives, heritage trademarks and the commercial exploitation of Balenciaga’s historical assets, ensuring consistency across product lines and markets.

Balenciaga Digital, Creative Studios, and Content Entities

Balenciaga operates internal creative and digital teams that produce campaigns, film content, social media assets, and e-commerce creative. These studios are organised as operating units within the company and are responsible for brand storytelling, photography, film production and the digital customer experience.

Ownership of these capabilities allows Balenciaga to execute high-control, fast-moving campaigns and to retain IP over its creative outputs.

Conclusion

Understanding who owns Balenciaga helps explain how the brand operates today.

Balenciaga is fully owned by Kering, one of the world’s most powerful luxury groups. This ownership gives the brand financial stability, global reach, and long-term strategic backing. While Balenciaga maintains creative independence, ultimate control rests with Kering and its leadership.

FAQs

Who owns Balenciaga 2026?

Balenciaga is fully owned by Kering. Balenciaga is not a publicly traded company. It operates as a wholly owned subsidiary, meaning all ownership, voting rights, and strategic control sit with Kering. Ultimate influence is exercised by the Pinault family through their controlling stake in Kering.

When was Balenciaga founded?

Balenciaga was founded in 1917 by Spanish designer Cristóbal Balenciaga. The original fashion house began operations in San Sebastián, Spain, before later relocating to Paris.

What is the net worth of Balenciaga?

As of 2026, Balenciaga’s estimated brand net worth is approximately €9.8 billion. This figure represents brand value rather than cash or assets on a balance sheet. It reflects revenue performance, global recognition, consumer demand, and long-term market positioning within the luxury sector.

What is the story behind Balenciaga?

Balenciaga was created by Cristóbal Balenciaga, a designer widely regarded as a master of couture construction. The house became famous in mid-20th-century Paris for revolutionary silhouettes and technical innovation. After Cristóbal Balenciaga retired, the brand closed in the 1970s. It was later revived, modernised, and eventually repositioned as a global luxury brand under corporate ownership, blending heritage craftsmanship with contemporary fashion.

What are Balenciaga’s scandals?

Balenciaga has faced several public controversies, most notably in 2022, when advertising campaigns sparked backlash due to inappropriate imagery and themes. The brand issued public apologies, removed the campaigns, and undertook internal reviews. These incidents temporarily impacted brand perception and sales but did not change ownership or long-term corporate control.

Where did Balenciaga originate?

Balenciaga originated in San Sebastián, Spain. Although the brand later became closely associated with Parisian haute couture, its roots are Spanish, reflecting Cristóbal Balenciaga’s heritage and early career.

Who is the CEO of Balenciaga?

As of 2026, the CEO of Balenciaga is Gianfranco Gianangeli. He oversees global operations, commercial strategy, retail expansion, and financial performance, while working within the governance framework set by Kering.

Did Gucci buy Balenciaga?

No, Gucci did not buy Balenciaga as an independent company. However, in 2001, the Gucci Group, which was part of what later became Kering, acquired a controlling stake in Balenciaga. Today, both Gucci and Balenciaga are sister brands owned by Kering.

Is Balenciaga related to Islam?

No, Balenciaga is not related to Islam as a religion or institution. Any claims linking the brand directly to Islam are incorrect. The brand is a commercial fashion house with no religious affiliation.

Is Kim Kardashian still associated with Balenciaga?

Kim Kardashian significantly reduced her association with Balenciaga following the 2022 controversy. While she was previously a high-profile ambassador and frequent collaborator, her public involvement has been limited since then, and she no longer plays a central promotional role for the brand.

What did Coco Chanel say about Balenciaga?

Coco Chanel famously praised Cristóbal Balenciaga, stating that he was “the only true couturier,” while others were merely fashion designers. This remark highlights the deep respect Balenciaga commanded among his peers and reinforces the house’s historical importance in haute couture.