AT&T is one of the largest telecommunications companies in the world, with a history that stretches back more than a century. Known for providing wireless, broadband, and business communication services, it has played a central role in shaping modern connectivity. Understanding who owns AT&T today is important, as its shareholder structure is a mix of powerful institutional investors, everyday retail shareholders, and company insiders. This combination of owners influences the company’s strategies, investments, and the future of its services.

AT&T Company Profile

AT&T Inc. is a leading global telecommunications company. It is headquartered in Dallas, Texas. It specializes in wireless, broadband, and enterprise-level communications. It ranks as one of the largest telecom firms worldwide. It serves millions of customers across the U.S.

The company continues to invest in its 5G wireless network and fiber infrastructure. It expects to generate significant free cash flow—over $18 billion by 2027—from these expansions.

Company details

AT&T provides a range of services. These include wireless communications, broadband internet, business solutions, and network infrastructure. It once included media and entertainment but has recently divested those assets to refocus on connectivity.

The company employs nearly 140,000 people. Its market capitalization hovers around $200 billion in 2025.

AT&T Founders

AT&T’s origins trace back to the Bell Telephone Company. It was founded by Alexander Graham Bell, Thomas Watson, and Gardiner Greene Hubbard. This followed Bell’s invention of the telephone and patent in 1875.

The American Telephone and Telegraph Company—AT&T—was established in 1885 as a subsidiary. It became the parent company by 1899.

Major milestones

The company’s journey includes several key milestones:

1885 – Founding of AT&T

The American Telephone and Telegraph Company was created as a subsidiary of the Bell Telephone to manage long-distance communication. It quickly grows into the backbone of U.S. telephone infrastructure.

1899 – Becomes Parent Company

AT&T takes over Bell Telephone’s assets, becoming the nation’s primary telecommunications provider and setting the stage for decades of dominance.

1927 – First Transatlantic Telephone Service

AT&T launches the first commercial transatlantic telephone line between the United States and London, marking a new era in global communications.

1984 – Breakup of the Monopoly

Following antitrust rulings, AT&T divested its local exchange companies, leading to the creation of seven regional “Baby Bells” and ending its century-long monopoly.

2005 – SBC Acquisition and Rebranding

SBC Communications acquires AT&T Corp. for $16 billion, adopting the AT&T name and brand, which reestablishes AT&T as a major national telecom player.

2006 – BellSouth Merger

AT&T merges with BellSouth in an $86 billion deal, consolidating Cingular Wireless into AT&T Mobility and strengthening its wireless market position.

2015 – DirecTV Acquisition

AT&T acquires DirecTV for $48.5 billion, becoming the largest pay-TV provider in the U.S. and expanding its presence in the entertainment sector.

2018 – Time Warner Acquisition

AT&T completes its $85 billion purchase of Time Warner (later WarnerMedia), entering the content creation and media streaming market.

2022 – WarnerMedia-Discovery Merger

AT&T spins off WarnerMedia in a $43 billion deal, merging it with Discovery to form Warner Bros. Discovery, refocusing on core telecom services.

2023–2025 – 5G and Fiber Expansion

AT&T accelerates nationwide 5G coverage to over 300 million people, invests heavily in fiber broadband, and explores satellite and AI-driven network technologies to future-proof its services.

Recent strategic moves

Under CEO John Stankey, AT&T has shifted focus back to core telecom. He is leading major expansions in fiber and next-generation wireless. Wall Street has notably responded, with AT&T shares up significantly in 2025.

The company also outlined plans to return more than $40 billion to shareholders by 2026 through dividends and buybacks, while modernizing its network and preparing for future growth.

The planned sale of its 70% stake in DirecTV to TPG, valued at $7.6 billion, is expected to close by mid-2025.

Who Owns AT&T: Major Shareholders

AT&T does not have a single owner. It is a public company. Its shares trade on the stock exchange. The company is owned by many. Institutional investors hold a big portion. Retail shareholders also hold a sizable share. Company insiders own a small slice.

Institutional investors collectively own around 63.56% of AT&T’s shares. Retail investors account for roughly 36.13%, with insiders holding a minor 0.31%. These ownership dynamics underscore the scale and stability of AT&T’s shareholder base, driven by global investment firms, funds, and the public alike.

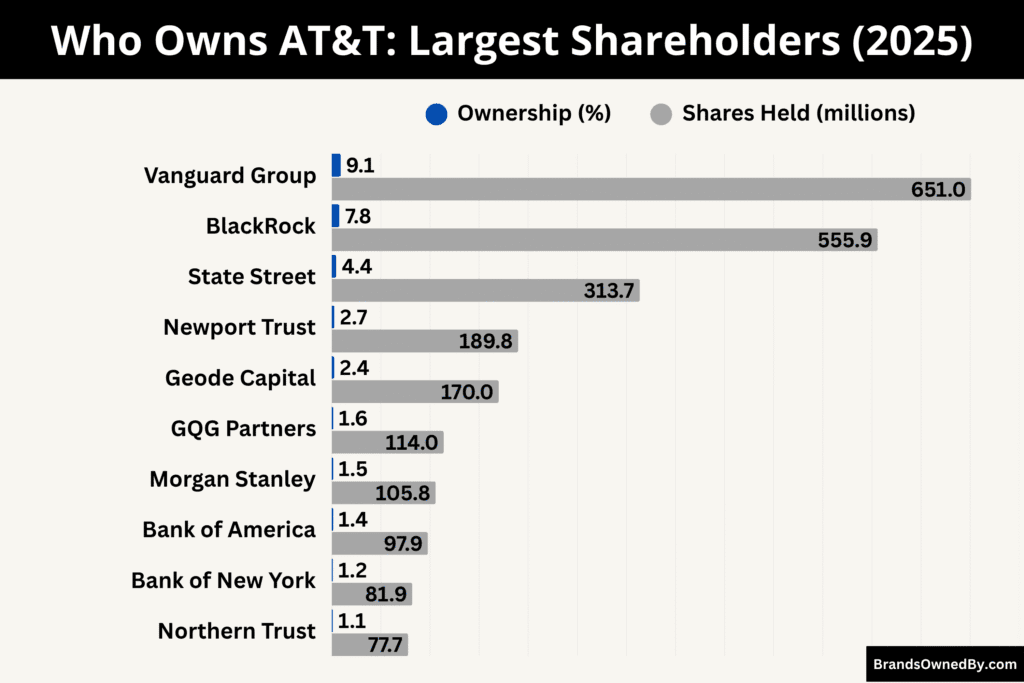

Here’s a breakdown of the largest shareholders of AT&T as of August 2025:

| Shareholder | Shares Held (approx.) | Ownership (% of outstanding) |

|---|---|---|

| Vanguard Group Inc. | 651,044,650 | 9.11% |

| BlackRock Inc. | 555,911,603 | 7.78% |

| State Street Corporation | 313,666,133 | 4.39% |

| Newport Trust Company, LLC | 189,762,992 | 2.66% |

| Geode Capital Management, LLC | 169,973,846 | 2.38% |

| GQG Partners LLC | 113,957,259 | 1.59% |

| Morgan Stanley | 105,782,513 | 1.48% |

| Bank of America Corporation | 97,864,796 | 1.37% |

| Bank of New York Mellon Corporation | 81,906,720 | 1.15% |

| Northern Trust Corporation | 77,727,741 | 1.09% |

Vanguard Group Inc. – 9.11% Ownership

Vanguard Group Inc. is the largest shareholder of AT&T, holding approximately 651 million shares as of August 2025.

Known for its low-cost index funds and ETFs, Vanguard’s holdings in AT&T are part of its passive investment strategy, where large-cap telecommunications companies like AT&T are included in broad market and sector-specific funds.

Vanguard’s position gives it significant influence in corporate governance through proxy voting, even though it does not actively manage AT&T’s daily operations. Its holding reflects long-term investor confidence in AT&T’s dividend yield and stable cash flows.

BlackRock Inc. – 7.78% Ownership

BlackRock, the world’s largest asset manager, owns roughly 556 million shares of AT&T. Like Vanguard, its stake is held largely through ETFs and mutual funds such as the iShares Core S&P 500 ETF. BlackRock’s substantial ownership makes it the second-largest institutional holder of AT&T stock.

Through its proxy voting power, BlackRock plays a role in approving executive compensation, board appointments, and strategic corporate moves, but it does not directly run the company.

State Street Corporation – 4.39% Ownership

State Street holds approximately 314 million shares, making it AT&T’s third-largest shareholder. As one of the “Big Three” index fund managers alongside Vanguard and BlackRock, State Street manages its AT&T position through its SPDR ETFs and index fund offerings.

Its investment approach is primarily passive, yet its combined voting power with Vanguard and BlackRock often influences shareholder resolutions and governance issues.

Newport Trust Company, LLC – 2.66% Ownership

Newport Trust holds about 190 million shares of AT&T, mainly as a custodian for employee benefit and retirement plans. This includes shares owned indirectly by AT&T employees through company stock plans. Although Newport Trust’s role is administrative, it represents a significant voting bloc in shareholder decisions.

Geode Capital Management, LLC – 2.38% Ownership

Geode Capital, with roughly 170 million shares, is closely affiliated with Fidelity Investments and manages index fund assets, including those tied to the S&P 500. Its stake in AT&T reflects AT&T’s inclusion in major benchmarks and indicates the stock’s importance in diversified institutional portfolios.

GQG Partners LLC – 1.59% Ownership

GQG Partners holds around 114 million shares of AT&T. Unlike the large passive managers, GQG is an actively managed investment firm focusing on quality growth companies. Its position in AT&T reflects a belief in the telecom giant’s ability to maintain stable earnings, pay consistent dividends, and adapt to the evolving 5G and fiber markets.

Morgan Stanley – 1.48% Ownership

Morgan Stanley owns an estimated 106 million shares, partly through its wealth management and investment advisory arms. It invests in AT&T across multiple client portfolios and may also hold positions for trading purposes. While its stake is smaller than the top passive managers, Morgan Stanley’s research coverage and advisory services can indirectly influence market sentiment toward AT&T.

Bank of America Corporation – 1.37% Ownership

Bank of America, with 98 million shares, is both an institutional investor and a provider of banking and financing services to AT&T. Through Merrill Lynch, its investment arm, Bank of America offers AT&T exposure in client portfolios and retirement accounts. This dual relationship strengthens its overall influence in the company’s financial ecosystem.

Bank of New York Mellon Corporation – 1.15% Ownership

BNY Mellon holds about 82 million shares of AT&T. As one of the world’s largest custodian banks, BNY Mellon’s role is primarily to safeguard institutional and client assets, though it also participates in proxy voting. Its position represents the interests of a diverse set of institutional clients.

Northern Trust Corporation – 1.09% Ownership

Northern Trust owns roughly 78 million shares of AT&T. Primarily known for its wealth management and institutional asset management services, Northern Trust invests in AT&T on behalf of pension funds, endowments, and high-net-worth clients. Its investment reflects AT&T’s standing as a stable dividend payer in the U.S. equity market.

Who is the CEO of AT&T?

John T. Stankey has served as AT&T’s President and Chief Executive Officer since July 2020 and was unanimously elected Chairman of the Board in February 2025. He now holds both top executive and board leadership roles. His elevation to Chair underscores his central role in steering AT&T’s future strategy and corporate governance.

Professional Background and Career Path

Stankey joined AT&T in 1985. Over nearly four decades, he has held numerous leadership positions across the company. His roles have included Chief Strategy Officer, Chief Technology Officer, CEO of WarnerMedia, COO, and President before becoming CEO.

He also served as CEO of AT&T’s Entertainment Group and various operations-focused positions, giving him expansive insight across telecom, media, and corporate functions.

Strategic Vision and Transformation Efforts

Since taking the helm, Stankey has refocused AT&T on its core strengths—wireless, broadband, and fiber infrastructure. He has overseen the exit from media-heavy ventures and reoriented the company toward connectivity.

His strategy includes investing heavily in fiber deployment, expanding 5G, reducing reliance on outdated infrastructure, and executing disciplined capital allocation with a performance-driven approach.

These moves helped AT&T’s stock rise over 20–60% in 2025 and have begun to restore investor confidence.

Cultural and Operational Overhaul

Stankey has led a sweeping cultural transformation within AT&T. He moved away from the traditional paternalistic culture and introduced a market-based, performance-focused model.

His return-to-office policy reinforces this shift. Internal memos emphasize the importance of capability, commitment, and contribution over tenure. His approach, while controversial, reflects his intention to create a leaner and more agile workforce aligned with competitive demands.

Financial Stewardship and Investor Engagement

Under Stankey’s leadership, AT&T outlined a three-year strategic and capital allocation plan focused on generating over $50 billion in financial capacity. The plan supports multibillion-dollar capital returns and aggressive network expansion.

At investor conferences, he reiterated AT&T’s targets: sustaining dividends, executing substantial share buybacks, reinvesting in network infrastructure, and maintaining financial discipline—all while aiming to become the top communications provider in the U.S.

AT&T Annual Revenue and Net Worth

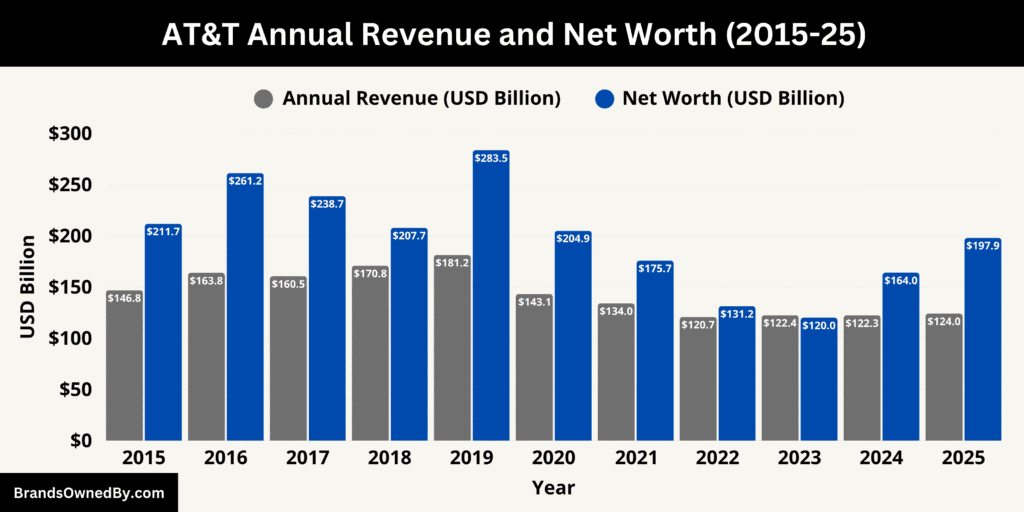

In the twelve months ending June 30, 2025, AT&T generated $123.98 billion in revenue. This figure marks a modest 1.5% increase compared to the same period a year earlier, reflecting consistent demand for its core services.

Its second quarter alone delivered $30.85 billion, a 3.5% year-over-year rise driven by strong growth in both fiber and mobility services. These gains underscore the effectiveness of AT&T’s refocused strategy around high-value connectivity offerings.

For context, AT&T’s full-year revenue for 2024 hovered just below these levels at $122.34 billion, reflecting a slight decline of 0.1% from 2023. That year still performed close to 2022’s $120.74 billion, indicating relatively stable demand amid market shifts.

AT&T Net Worth

AT&T’s market capitalization—a key proxy for its net worth—has shown significant growth. As of August 2025, its market value stood at approximately $197.9 billion, placing the company among the top 80 most valuable globally.

Earlier estimates reported similar valuation levels—$195.99 billion by the end of July and $198.42 billion as of early August.

Here’s an overview of AT&T’s annual revenue and market capitalization (“net worth”) over the past ten years:

| Year | Annual Revenue (USD billions) | Market Capitalization (USD billions) |

|---|---|---|

| 2015 | 146.8 | 211.7 |

| 2016 | 163.8 | 261.2 |

| 2017 | 160.5 | 238.7 |

| 2018 | 170.8 | 207.7 |

| 2019 | 181.2 | 283.5 |

| 2020 | 143.1 | 204.9 |

| 2021 | 134.0 | 175.7 |

| 2022 | 120.7 | 131.2 |

| 2023 | 122.4 | 120.0 |

| 2024 | 122.3 | 164.0 |

| 2025 | 124.0 (TTM through mid-2025) | 197.9 |

Value Appreciation and Investor Outlook

AT&T’s market cap has surged since the beginning of 2024. Today, it stands roughly 20% higher than its 2024 close of around $164 billion, signaling renewed investor confidence in AT&T’s refocused telecom strategy. Its valuation recovery highlights a market appreciation for growth in fiber, mobile connectivity, and disciplined capital deployment.

Companies Owned by AT&T

Here’s a list of the top brands, subsidiaries, and companies owned by AT&T as of 2025:

| Company/Brand/Entity | Year Acquired/Founded | Type | Description |

|---|---|---|---|

| AT&T Mobility | Founded 2004 | Wireless Services | The wireless arm of AT&T providing mobile phone services across the U.S., serving millions of subscribers. |

| Cricket Wireless | Acquired 2014 | Prepaid Wireless | A prepaid wireless service provider targeting budget-conscious customers, operating nationwide. |

| AT&T Business | Established 1983 (as SBC Business, rebranded) | Business Solutions | Provides enterprise-level voice, data, cloud, and networking services to corporations and governments. |

| AT&T Fiber | Launched 2016 | Broadband Internet | High-speed fiber-optic internet service available in select U.S. cities, offering gigabit speeds. |

| DirecTV (70% stake) | Acquired 2015 (partial divestiture 2021) | Satellite TV | Satellite television service provider, serving both residential and commercial customers. |

| AT&T Internet | Founded 1995 (as AT&T Worldnet) | Internet Service | Offers DSL and fixed wireless internet to residential and business customers. |

| AT&T Mexico | Acquired 2015 | Wireless Carrier | Mobile telecommunications provider in Mexico, operating under AT&T’s brand. |

| AT&T Latin America | Established 2012 | Regional Division | Provides pay-TV and broadband services in several Latin American countries. |

| AT&T AdWorks (now Xandr, sold in 2022) | Founded 2011 | Advertising Technology | AT&T’s advertising platform; Xandr was sold to Microsoft in 2022 but its tech is still partially integrated in AT&T’s operations. |

| AT&T Cybersecurity | Acquired 2019 | Cybersecurity Solutions | Offers security services, threat detection, and compliance solutions for businesses. |

| Wayport | Acquired 2008 | Wi-Fi Services | Public Wi-Fi hotspot provider, integrated into AT&T’s network. |

| Alltel Wireless Assets | Acquired 2013 | Wireless Spectrum | Acquisition of spectrum and subscribers from Alltel to boost AT&T’s coverage. |

| Centennial Communications | Acquired 2009 | Wireless Carrier | Regional mobile network operator merged into AT&T’s operations. |

| BellSouth | Acquired 2006 | Telecommunications | Major telecom provider in the southeastern U.S., integrated into AT&T’s core network. |

| Pacific Bell & Nevada Bell | Acquired 1997 (via SBC) | Regional Telecom | Former regional Bell companies providing local service in California and Nevada. |

| Ameritech | Acquired 1999 (via SBC) | Regional Telecom | Provided services in the Midwest; fully integrated into AT&T. |

| Time Warner (WarnerMedia, divested 2022) | Acquired 2018 | Media & Entertainment | Owner of HBO, Warner Bros., and Turner networks before being merged with Discovery, Inc. in 2022. |

| Leap Wireless | Acquired 2014 | Wireless Services | Parent company of Cricket Wireless, merged into AT&T Mobility. |

| Nextel Mexico | Acquired 2015 | Wireless Carrier | Mobile service provider in Mexico, integrated into AT&T Mexico. |

| Cingular Wireless | Founded 2000 (SBC & BellSouth JV, merged into AT&T 2007) | Wireless Carrier | Predecessor to AT&T Mobility, became the largest U.S. wireless provider at the time. |

AT&T Mobility (AT&T Wireless)

AT&T Mobility is the company’s primary wireless arm and the core consumer-facing brand for mobile voice and data services in the United States. It operates AT&T’s nationwide 4G LTE and 5G networks, sells postpaid and prepaid plans, and bundles mobile services with home internet offers.

In 2025, AT&T Mobility continued to be a major growth engine, adding hundreds of thousands of postpaid phone subscribers each quarter; by mid-2025, the company reported roughly 73–74 million postpaid phone subscribers, with total wireless subscribers (including connected devices and prepaid) far higher.

Mobility drives a substantial portion of AT&T’s service revenue and is central to the company’s bundle strategy that pairs 5G phone service with fiber broadband to raise customer lifetime value. AT&T Mobility also manages device distribution, channel partnerships with retailers, and a large enterprise mobility business for business customers.

Cricket Wireless

Cricket Wireless is AT&T’s nationwide prepaid wireless brand. It was acquired through the Leap Wireless purchase and has since been operated as AT&T’s value/prepaid channel. Cricket serves multi-million prepaid subscribers (historically reported around 12–13 million; the brand remains a material prepaid footprint in 2025) and targets price-sensitive and no-contract customers.

Cricket provides 5G access on select plans, simplified rate tiers, and a broad retail presence through dedicated stores and third-party outlets. Strategically, Cricket lets AT&T compete across the full consumer price spectrum without diluting the main AT&T postpaid brand.

Cricket also leverages AT&T’s network wholesale relationships and supports seasonal and regional promotions to capture churn from other prepaid carriers.

AT&T Fiber

AT&T Fiber is AT&T’s fiber-to-the-premises broadband service and a central pillar of the company’s growth thesis in 2023–2025. AT&T has been aggressively expanding its fiber footprint and by mid-2025 reported millions of fiber locations passed and net fiber customer additions measured in the hundreds of thousands per quarter (quarterly net adds in 2025 were often in the low hundreds of thousands).

Fiber customers generate higher average revenue per user (ARPU) than legacy copper or fixed wireless subscribers, and AT&T bundles fiber with Mobility services to reduce churn. AT&T Fiber’s strategy emphasizes both customer acquisitions in dense urban/suburban markets and a gradual move to retire older copper infrastructure. The business also includes wholesale fiber agreements with other carriers and ISPs in some markets.

AT&T Internet & Fixed Wireless Access (FWA / AT&T Internet Air)

AT&T markets consumer broadband under AT&T Internet and AT&T Internet Air (its branded fixed wireless access product). The Internet business comprises legacy DSL/copper customers transitioning to fiber, fixed wireless customers in areas where fiber is not yet available, and broadband bundles sold with TV or mobile services.

In 2025, AT&T Internet Air (FWA) became an important complement to fiber expansion, adding customers in suburban and rural areas quickly while fiber buildouts continue. The combined consumer wireline segment (fiber + FWA + legacy services) has delivered consistent net additions in 2024–2025 and contributed materially to broadband revenue growth.

AT&T Business (Business Wireline, Managed Services, and Enterprise)

AT&T Business is the company’s enterprise and wholesale unit. It sells networking, cloud, security, managed services, private 5G, IoT solutions, and global connectivity to corporations, public sector organizations, and other carriers. The business unit includes advanced ethernet services, MPLS/IP VPN, dedicated fiber/enterprise broadband, and professional services for network transformation.

In 2025, AT&T Business emphasized hybrid cloud connectivity, edge computing for enterprise use-cases, private 5G deployments for industrial clients, and cybersecurity offerings that pair AT&T network capabilities with managed security services. It also operates a suite of solutions for small and medium businesses, with sales channels tailored to national accounts and local markets.

AT&T Communications (Corporate Operating Division)

AT&T Communications is the corporate division that groups together mobility, consumer wireline, business services, and underlying network operations. It is the operational umbrella for the company’s customer-facing brands (Mobility, Fiber, Internet) and owns much of AT&T’s network assets, spectrum licenses, and central engineering teams. This division is where network engineering, spectrum strategy, capital allocation for towers/fiber/5G, and large-scale commercial deals are executed.

In 2025, AT&T Communications continued to be the engine of the company as it reallocated capital toward fiber and 5G and away from non-core media businesses.

AT&T Mexico (AT&T Latin America)

AT&T Mexico (operating as AT&T Mexico / AT&T Latin America) has been the company’s regional mobile operator in Mexico since the acquisition of Iusacell and Nextel Mexico. It operates a national mobile network, sells prepaid and postpaid plans, and serves tens of millions of subscribers in Mexico.

While AT&T Mexico remained part of AT&T’s international footprint through 2024 and into 2025, in 2025 the company publicly explored options for the Mexican operation and engaged advisers to evaluate potential sales or other strategic alternatives.

The Mexican business has been a long-term strategic investment that has struggled to overtake the dominant incumbent in that market; any sale process or restructuring would be executed with regulatory approvals and efforts to protect subscriber continuity.

AT&T Labs (Research & Development)

AT&T Labs is AT&T’s central research and development organization. It focuses on network innovation, broadband and 5G technologies, optical and transport systems, network automation, AI-enabled operations, and standards contributions. Labs supports product engineering for the company’s consumer, business, and wholesale product sets and often pilots new technologies (for example, advanced edge compute nodes, AI-assisted network orchestration, and new fixed wireless hardware).

In 2025, AT&T Labs remained a vital in-house capability to reduce vendor dependency and accelerate the deployment of operational efficiencies across AT&T’s large network footprint.

AT&T Cybersecurity & Managed Security Services

AT&T operates cybersecurity and managed security services within its business unit, offering threat detection, incident response, managed firewalls, secure access services, and consulting to enterprise and public sector clients.

These services are integrated with AT&T’s network intelligence and managed services portfolio and have been positioned in 2025 as value-add plays that complement connectivity offerings. The security unit supports cross-sell into large enterprise contracts and recurring revenue models.

AT&T Wholesale / Carrier Services

AT&T Wholesale provides network connectivity, IP transit, international capacity, and wholesale voice services to other carriers, MVNOs, and large wholesale customers.

The division manages carrier-to-carrier relationships, spectrum leasing, and network access packages. It also supports AT&T’s MVNO partners and wholesale arrangements that help monetize surplus capacity and network assets in markets where AT&T wants to scale more efficiently.

DirecTV

DirecTV was historically owned by AT&T following the 2015 acquisition, and then partially carved out in a joint venture with private equity.

By 2024, AT&T agreed to sell its remaining majority stake to a private-equity buyer, and the transaction process was active in 2025 with staged payments and transition agreements.

As of 2025, AT&T no longer treats DirecTV as a growth asset in its core telecom portfolio; the sale is part of management’s strategic effort to exit legacy pay-TV and redeploy capital toward fiber and wireless.

During the transition, there are contractual arrangements to maintain service continuity and certain commercial partnerships while ownership transfers to the buyer.

AT&T Retail and Distribution (Channels & Stores)

AT&T directly owns and operates an extensive retail and distribution network. This includes company-owned branded stores, online sales channels, direct business sales teams, and relationships with national retailers and third-party dealers. The retail network is a strategic asset for device sales, postpaid conversions, bundling fiber and mobility, and customer service.

In 2025, AT&T continued to refine its retail footprint for efficiency while investing in digital sales and self-service to reduce cost to serve.

AT&T Connected Vehicle and IoT Units

AT&T operates business lines focused on connected vehicles, telematics, and Internet of Things services. These units sell SIM connectivity, IoT platforms, device management, and industry solutions for fleet management, utilities, healthcare, and retail. AT&T’s IoT and connected vehicle business leverages nationwide coverage and enterprise sales channels to build recurring machine-to-machine revenue.

Centennial Communications

AT&T acquired Centennial Communications in 2009 for approximately $944 million. This deal expanded AT&T’s mobile network into rural U.S. markets, particularly in Puerto Rico, Louisiana, and Mississippi. The acquisition helped stitch together a broader network reach beyond the urban and suburban core.

Wayport

In 2008, AT&T bought Wayport, a Wi-Fi hotspot provider, giving it control over thousands of public Wi-Fi locations. This acquisition enabled AT&T to enhance its connectivity offerings by integrating Wi-Fi with cellular service, supporting seamless access in venues like airports, hotels, and cafes.

Dobson Communications (Cellular One)

Around 2007, AT&T acquired Dobson Communications (which operated under the Cellular One brand) for about $2.8 billion. This added extensive rural and semi-urban coverage, particularly in smaller markets where AT&T had limited presence. The network and subscriber base from this acquisition helped improve national coverage consistency.

Time Warner (WarnerMedia)

In 2018, AT&T acquired Time Warner for approximately $85 billion, bringing content assets like HBO, Warner Bros., and Turner under AT&T’s umbrella. The strategy was to build a media+distribution powerhouse. This unit was spun off in 2022 into Warner Bros. Discovery, and is no longer under AT&T’s control by 2025.

AlienVault & AppNexus (Xandr)

In 2018, AT&T acquired cybersecurity firm AlienVault, deepening its managed security capabilities, which eventually became part of AT&T Cybersecurity. In the same timeframe, it acquired AppNexus (later branded Xandr) to build out its advertising and analytics division.

By 2025, AT&T has largely divested or restructured those ad-tech operations outside of core telecom.

Lumen’s Consumer Fiber Business

In 2025, AT&T agreed to acquire Lumen Technologies’ residential fiber-to-the-home operations for $5.75 billion. This deal includes nearly one million customers and expands fiber reach to about four million locations across multiple U.S. metros. The acquired assets will be housed within a new AT&T subsidiary and will accelerate fiber footprint expansion toward AT&T’s 2030 target of 60 million locations.

Final Thoughts

AT&T’s ownership reflects a classic example of a modern public corporation where institutional investors dominate. With firms like Vanguard, BlackRock, and State Street at the top, the company’s strategic direction is shaped by shareholders who prioritize stability, long-term returns, and governance accountability. AT&T’s position as a telecom leader continues to depend on both its leadership and the confidence of these investors.

FAQs

Who owns AT&T Corporation?

AT&T Inc. is a publicly traded company listed on the New York Stock Exchange under the ticker symbol T. It is owned by a wide range of institutional investors, mutual funds, and individual shareholders. No single person or entity fully owns AT&T.

Who is the largest shareholder of AT&T?

The largest shareholders are institutional investors. As of 2025, The Vanguard Group is the biggest shareholder, followed by BlackRock and State Street Corporation, each holding significant percentages of the company’s stock.

Is AT&T still owned by its founders?

No. AT&T was founded in 1885 as part of the Bell System, but it has gone through multiple mergers, breakups, and reorganizations over more than a century. The company is no longer owned or directly controlled by the original founders’ families.

Did AT&T buy Verizon?

No. AT&T has never bought Verizon. Verizon is a separate telecommunications company and one of AT&T’s biggest competitors in wireless, internet, and TV services.

Who is bigger, AT&T or Verizon?

In terms of wireless subscribers, Verizon often leads slightly, but AT&T has been larger in overall revenue when considering its broadband, wireless, business, and media operations combined. The two companies frequently trade places depending on the metric used.

Is Verizon partnered with AT&T?

No, Verizon and AT&T are direct competitors. However, they sometimes work together in industry-wide infrastructure projects or during emergency network restoration efforts.

Who bought AT&T Cellular?

AT&T Cellular was merged into Cingular Wireless in 2004 after Cingular (then a joint venture of SBC Communications and BellSouth) purchased AT&T Wireless Services. Cingular was later rebranded as AT&T Mobility in 2007 after SBC acquired AT&T Corp.

Does AT&T own Cricket?

Yes. AT&T acquired Cricket Wireless in 2014 through its purchase of Leap Wireless. Cricket now operates as AT&T’s prepaid wireless brand.

Who owns AT&T Stadium?

AT&T Stadium, located in Arlington, Texas, is owned by the City of Arlington and is the home of the NFL’s Dallas Cowboys. AT&T holds the naming rights through a sponsorship deal but does not own the stadium itself.

Does AT&T still own T-Mobile?

No. AT&T never actually owned T-Mobile. In 2011, AT&T attempted to acquire T-Mobile USA from Deutsche Telekom for $39 billion, but the deal was blocked by U.S. regulators.

How many companies does AT&T own?

As of 2025, AT&T owns or operates over 20 major companies, brands, and subsidiaries, including AT&T Mobility, AT&T Business, AT&T Fiber, Cricket Wireless, AT&T Mexico, and several regional telecom entities. It also has investments in cybersecurity, broadband, and advertising technology.