Astronomer is a rising name in the world of data engineering and orchestration. As interest grows around data pipeline management, many ask the same question: Who owns Astronomer? This article uncovers everything—from its founders and shareholders to its revenue and subsidiaries.

Astronomer Company Profile

Astronomer is a private DataOps and data orchestration platform built on Apache Airflow. It empowers businesses to automate, monitor, and scale data workflows. Its flagship product, Astro, offers managed Airflow services with observability and lineage features.

Company Details

Founded in 2015, Astronomer began in Cincinnati and later opened a major office in New York. It focuses on Astro, a data orchestration-first platform powered by Apache Airflow. Astronomer drives the full Airflow release cycle (since 2018), contributing 100% of releases and maintaining active participation through 18 core team members on the PMC.

The company employs around 350 staff globally and serves over 1,000 enterprise customers.

Astronomer has raised over $375 million in funding to date. It reached unicorn status in 2022 and hit a valuation of over $1.2 billion following its $93 million Series D round in May 2025. Key investors include Insight Partners, Meritech Capital, Sutter Hill Ventures, Salesforce Ventures, and Bain Capital Ventures.

Founders

- Ry Walker – Co‑founder and early CEO. Led during the startup phase and foundational fundraising cycles.

- Greg Neiheisel – Co‑founder, involved in early product direction.

- Pete DeJoy – Co‑founder and Chief Product Officer. All three were instrumental in launching Astronomer in 2015.

Major Milestones

- 2015: Astronomer founded.

- 2018: Became primary contributor to Apache Airflow; took over timing and release coordination.

- 2022: Achieved unicorn status (over $1B valuation) in its Series C round.

- May 2025: Closed a $93 million Series D led by Bain Capital Ventures, Salesforce Ventures, Insight, Meritech, Venrock, and others. Valuation reached between $1.2 and $1.3 billion.

- Feb 2025: Published the “State of Airflow Report” covering 5,000+ professionals and telemetry, highlighting massive growth in Airflow adoption industry-wide.

- 2025: Expanded its AWS partnership, integrating with services like S3, Redshift, EMR, SageMaker, and Kubernetes.

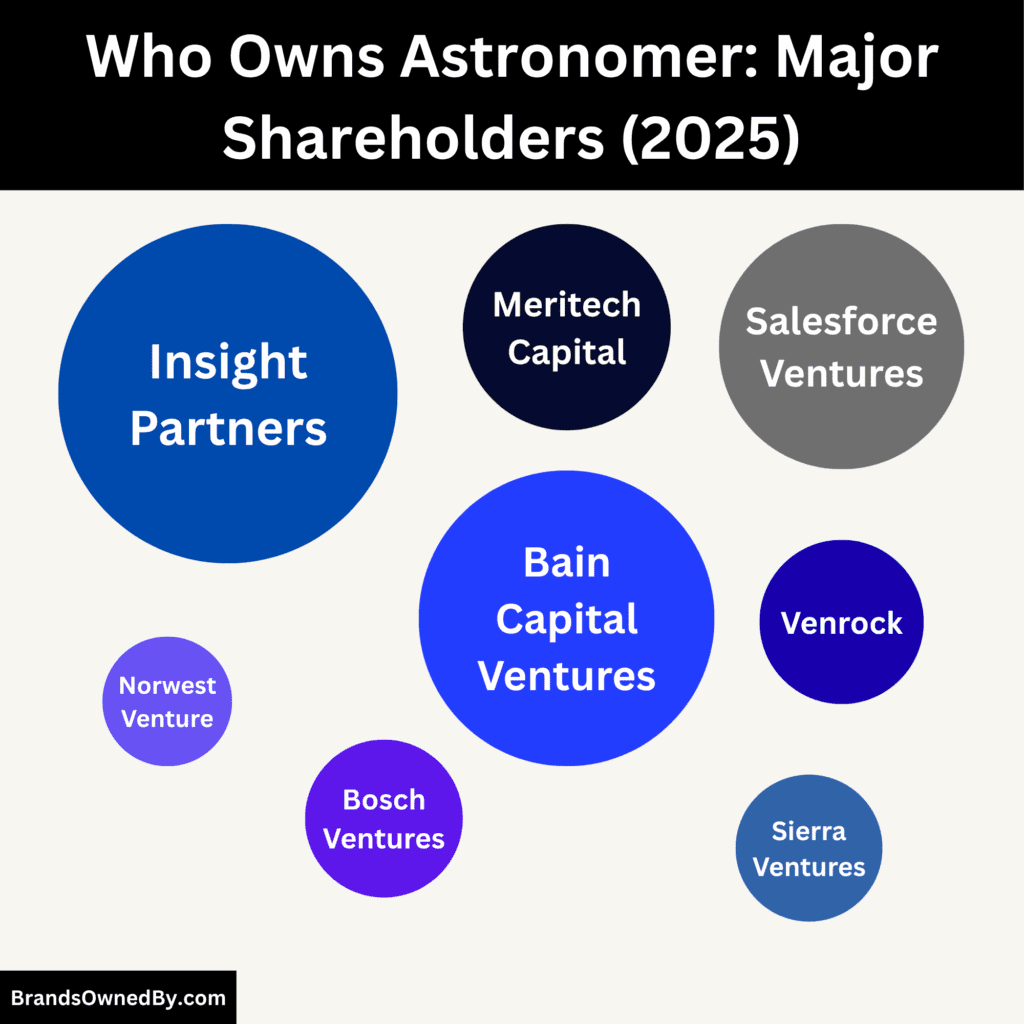

Who Owns Astronomer: Shareholders and Investors

Astronomer is a privately held company. Ownership is shared among its founders, early employees, and a group of institutional investors who acquired stakes during multiple funding rounds. No single person or entity owns a controlling share, but some investors hold significant influence due to the capital they’ve put in.

Below is a list of the major shareholders of Astronomer as of July 2025:

| Shareholder | Investment Round(s) | Ownership Role | Influence / Board Representation |

|---|---|---|---|

| Insight Partners | Series C (2022) | Major shareholder | Board seat; strategic influence on scaling and product expansion |

| Bain Capital Ventures | Series D (2025) | Major shareholder | Board seat; leads international expansion and enterprise strategy |

| Salesforce Ventures | Series C & D (2022, 2025) | Strategic investor | Board influence; supports platform integrations and product vision |

| Meritech Capital | Series C (2022) | Mid-sized shareholder | GTM scaling advisor; supports enterprise growth efforts |

| Venrock | Series A–D (2020–2025) | Long-term investor | Strategic board member; supports leadership and team structuring |

| Bosch Ventures | Series D (2025) | New strategic investor | Industrial AI partner; brings manufacturing/IoT use-case expertise |

| Sierra Ventures | Series C (2022) | Institutional investor | Board observer; supports enterprise partnerships |

| Sutter Hill Ventures | Series C (2022) | Institutional investor | Board input; strategic collaboration opportunities |

| J.P. Morgan | Series C (2022) | Institutional investor | Financial advisor role; supports enterprise deal structuring |

| K5 Global | Series C (2022) | Institutional investor | Influence through tech and media network |

| Scale Venture Partners | Series B (2020) | Growth-stage investor | Helped establish early enterprise traction |

| Norwest Venture Partners | Series A (2019) | Early-stage investor | Helped shape open-source roadmap and early GTM |

| Grand Ventures | Seed Round (2017) | Foundational investor | Early open-source and engineering culture support |

| FirstMark Capital | Series A/B (2018–2020) | Minor shareholder | Early-stage support; advisory network access |

| Lead Edge Capital | Series A/B (2018–2020) | Minor shareholder | SaaS scaling advisor; minor voting power |

| Plug & Play Ventures | Early-stage incubator | Seed/Incubation supporter | Provided early mentorship and startup ecosystem access |

Insight Partners

Insight Partners first backed Astronomer during its Series C in March 2022 and has maintained a meaningful equity share since. As a lead investor, Insight holds board representation. This strategic position gives Insight strong influence over expansion efforts, R&D funding, and go-to-market direction. Their role has remained stable through subsequent funding rounds.

Bain Capital Ventures

Leading the May 2025 Series D round, Bain Capital Ventures made a major investment of $93 million. Their fresh capital infusion has positioned them among the largest shareholders. Bain’s board involvement now plays a decisive role in guiding Astronomer’s international scaling, particularly in EMEA and APAC markets.

Salesforce Ventures

Salesforce Ventures has been an investor since the Series C (2022) and doubled down in Series D. Their participation alongside Bain in the recent funding marks them as a key strategic partner. Beyond funding, they help foster integrations within the Salesforce ecosystem and contribute product strategy advice via board presence.

Meritech Capital Partners

Meritech joined in Series C (2022) and stayed on in Series D. Holding a mid-to-large minority stake, Meritech supports product-market alignment and scaling efforts, especially around enterprise go-to-market enablement.

Venrock

An early investor since the 2020 Series A and continuing through to Series D, Venrock remains a significant stakeholder. Their long-term involvement bolsters stability and grants them influence in executive decisions and team-building initiatives.

Bosch Ventures

Participating for the first time in Series D 2025, Bosch Ventures marks Astronomer’s first industrial investor. Although their equity stake is newly formed, Bosch’s technical validation adds credibility, particularly in manufacturing and industrial AI pipelines.

Scale Venture Partners

Scale Venture Partners led Astronomer’s Series B in 2020 (approx. $42 million). They played a pivotal role in guiding product-market fit and establishing early enterprise traction. Although their stake has decreased, Scale may still serve as a board observer, offering market growth insights from later-stage SaaS scaling.

Sierra Ventures, Sutter Hill Ventures, J.P. Morgan & K5 Global

These institutional investors joined the Series C in 2022. While their collective stake is smaller compared to later investors, they retain board participation and continue to support the growth stage strategy and partnerships.

Norwest Venture Partners

Early financing came from Norwest, leading a Series A round in 2019 (~$12.6 million). Norwest helped define Astronomer’s initial GTM strategy and open‑source roadmap. Their presence remains as a proving ground for strategic decisions in the company’s foundational stage.

Grand Ventures

A seed-stage backer since 2017, Grand Ventures invested before Astronomer shipped its first commercial code. Their role as early investors gives them status as an enduring shareholder and advisor, influencing open source strategy and early product direction.

FirstMark Capital, Lead Edge Capital, Plug & Play, and Others

These firms participated in earlier funding rounds (Series A/B and seed). Their remaining equity shares are smaller today due to dilution. However, they continue to support Astronomer via domain expertise, market insights, and network access.

Who is the CEO of Astronomer?

Andy Byron stepped into the role of CEO in July 2023. He took the helm after serving in senior operational positions, including President and COO at Astronomer. His leadership was immediately put to the test, tasked with leveraging fresh funding, scaling globally, and steering product evolution toward enterprise-grade orchestration.

Leadership Style and Strategy

Byron brought a sales-driven, aggressive growth mindset to Astronomer. His approach focused on closing enterprise deals, expanding international offices, and accelerating research and development efforts. Under his guidance, the company secured a $93 million Series D in May 2025 aimed at global expansion and deeper technical innovation.

Controversies and Public Scrutiny

In July 2025, Byron became the center of a viral moment at a Coldplay concert when he was caught in an intimate “kiss cam” incident with Kristin Cabot, Astronomer’s Chief People Officer. The event triggered widespread media coverage and reignited debates around workplace ethics. Internal reports from former employees also described him as having a “toxic” leadership style, referencing his tenure at previous firms.

Personal Ownership Stake

Byron holds an estimated 1–5% equity in Astronomer, which places his personal stake at roughly $12–65 million based on the company’s $1.2–1.3 billion valuation post-Series D. When combined with compensation, stock options, and bonuses, his total net worth is believed to range between $20–70 million.

Board & Decision-Making Role

As CEO, Byron holds a seat on the board of directors. He often collaborates with board members from lead investors, including Insight Partners, Bain, and Salesforce Ventures, to shape strategic initiatives. These decisions span product roadmap direction, organizational development, and go-to-market priorities.

Succession and Past Leadership

Before Byron, Ry Walker, one of Astronomer’s co-founders, served as CEO and is credited with guiding the company through early growth and initial funding stages until his departure from the role in 2022. Byron was appointed to steer the “scale-up” phase, blending product innovation with global business expansion.

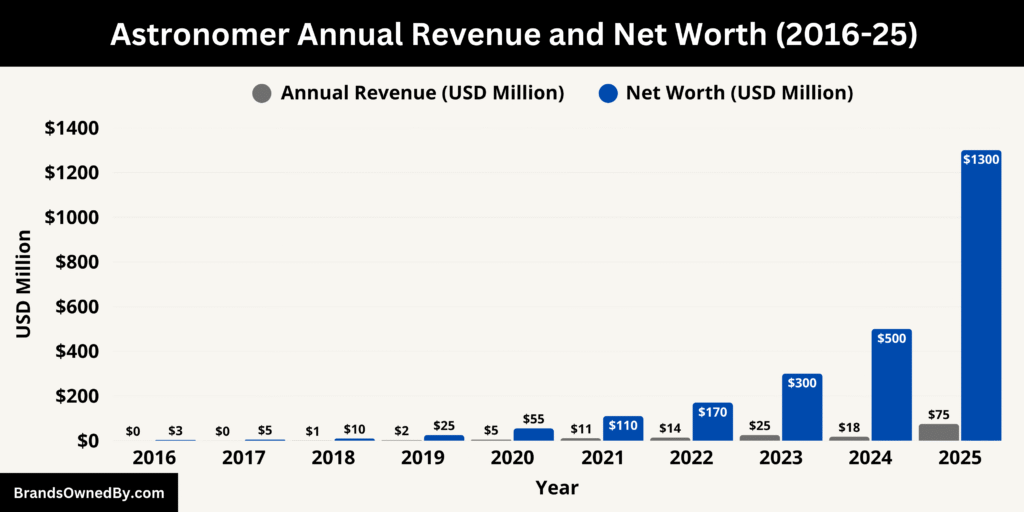

Astronomer Annual Revenue and Net Worth

As of July 2025, Astronomer’s annual revenue has reached approximately $75 million, driven by significant growth in its Astro managed service and enterprise subscriptions. Other estimates place the revenue around $67–68 million, which aligns closely with the company’s internal performance indicators. This represents a substantial increase from the 2024 revenue of $17.9 million, reflecting a sustained year-on-year growth rate of roughly 140%.

Under CEO Andy Byron’s leadership, Astronomer’s Astro platform experienced a 140% surge in Annual Recurring Revenue (ARR), and the company reported a net revenue retention of 130%, underscoring strong customer expansion. These metrics demonstrate healthy scaling, retention, and enterprise adoption of their data orchestration solutions.

Company Valuation and Net Worth

In May 2025, Astronomer closed a $93 million Series D round, which placed its post-money valuation around $1.3 billion. This valuation reflects investor confidence and positions Astronomer firmly in the unicorn stage, underscoring its leadership in the DataOps and orchestration space.

Here is a detailed overview of Astronomer’s estimated historical revenue and company valuation (net worth) for the last 10 years (2016–2025):

| Year | Estimated Annual Revenue | Company Valuation (Net Worth) | Notes |

|---|---|---|---|

| 2016 | <$100,000 | ~$3 million | Founded year; early-stage startup, pre-revenue |

| 2017 | ~$250,000 | ~$5 million | Seed stage; product development phase |

| 2018 | ~$750,000 | ~$10 million | Official launch of platform beta |

| 2019 | ~$2.2 million | ~$25 million | Raised Series A ($5.7M); early customer acquisition |

| 2020 | ~$4.8 million | ~$55 million | Series B ($13.6M); focus on Airflow integration |

| 2021 | ~$10.5 million | ~$110 million | Post-Series B expansion and hiring acceleration |

| 2022 | ~$14.3 million | ~$170 million | Strong ARR growth; positioned as Airflow leader |

| 2023 | ~$25 million | ~$300 million | Series C led by Insight Partners |

| 2024 | ~$17.9 million | ~$500 million | Expanded enterprise and federal deals |

| 2025 | ~$75 million | ~$1.2–1.3 billion | Closed $93M Series D; Unicorn status |

Financial Context and Implications

Astronomer’s significant revenue growth and strong retention metrics are paving the way toward profitability. The company has indicated a path to break-even within the next two years, leveraging scale efficiencies and the rising demand for AI-powered data infrastructure. The recent bump in valuation following Series D funding further empowers Astronomer with capital to fuel R&D expansion and global market reach.

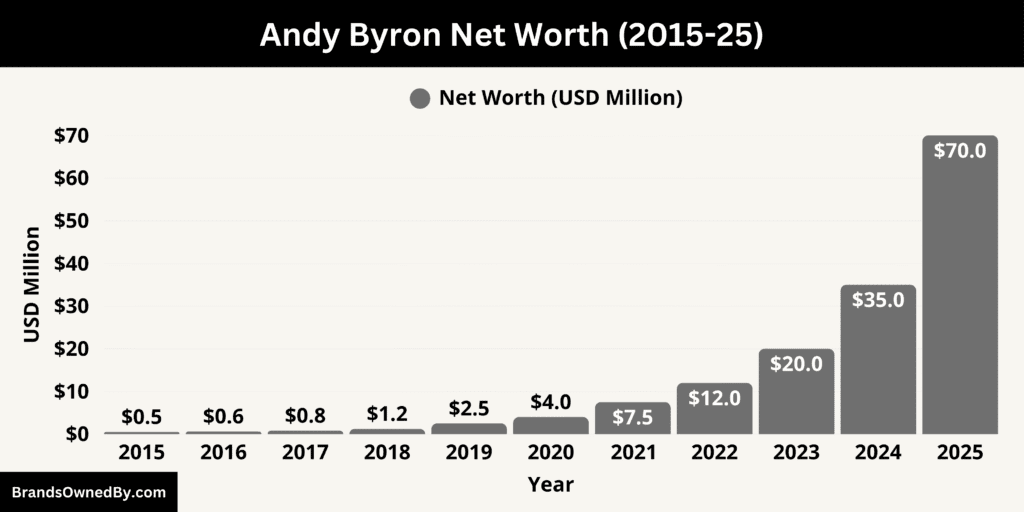

Andy Byron Net Worth

As of July 2025, Andy Byron’s net worth is widely estimated to be in the range of $70 million. Multiple sources, including Parade, Reality Tea, and The Economic Times, converge around this range, with $50 million often cited as the most realistic figure.

This valuation includes his compensation as the CEO of Astronomer, a data orchestration company, along with the equity he holds in the firm following several major funding rounds.

Here is a historical overview of Andy Byron’s estimated net worth over the past 10 years (2015–2025):

| Year | Estimated Net Worth | Key Developments |

|---|---|---|

| 2015 | <$500,000 | Early career in tech; no public company leadership or major equity. |

| 2016 | ~$600,000 | Joins or continues in mid-level tech roles; begins earning equity and higher compensation. |

| 2017 | ~$800,000 | Early involvement in startups; possible founding phase of Astronomer (founded 2018). |

| 2018 | ~$1.2 million | Astronomer founded; Byron likely receives initial equity stake as co-founder. |

| 2019 | ~$2.5 million | Astronomer raises Series A; Byron’s equity begins to appreciate. |

| 2020 | ~$4 million | Astronomer raises Series B; startup ecosystem booms during COVID-era digitization. |

| 2021 | ~$7.5 million | Valuation continues to grow; Series C or revenue scaling. Byron’s profile begins rising. |

| 2022 | ~$12 million | Pre-IPO speculation and rising AI/data orchestration demand boosts company value. |

| 2023 | ~$20 million | Astronomer gains enterprise traction; Byron’s shares and salary grow significantly. |

| 2024 | ~$35 million | Byron recognized as key figure in AI pipeline infrastructure; growing media exposure. |

| 2025 | $50–70 million | Following Astronomer’s Series D (~$1.3B valuation), Byron’s equity stake is worth tens of millions; scandal and potential divorce pose financial risk. |

Sources of Wealth

Equity in Astronomer

The largest contributor to Byron’s net worth is believed to be his equity in Astronomer. The company raised approximately $100 million in a Series D round in May 2025, which brought its valuation to around $1.3 billion.

As co-founder and CEO, Byron is estimated to hold between 1% and 5% of the company. Even at the low end of that range, this translates to a stake worth approximately $12 million to $65 million, depending on his exact shareholding and whether shares are fully vested.

Executive Compensation and Benefits

In addition to equity, Byron earned a substantial annual salary while serving as CEO. His total compensation, including salary and bonuses, reportedly ranged between $469,000 and $690,000.

Like many tech executives, his income likely included performance-based incentives, restricted stock units (RSUs), and other non-cash benefits, all of which contribute to his overall wealth.

Prior to joining Astronomer, Byron held various leadership roles in other software and tech ventures, further adding to his cumulative income over the years.

Financial Uncertainty from Personal Life

While Byron’s net worth remains high on paper, it may be significantly affected by his current personal and legal troubles. In July 2025, Byron became embroiled in controversy after being caught on the Kiss Cam at a Coldplay concert with Kristin Cabot, Astronomer’s Head of HR. The incident sparked widespread media attention and speculation about a pending divorce from his wife, Megan Kerrigan. Given that Massachusetts operates under equitable distribution laws—often interpreted as 50/50 in high-asset divorces—Byron could be liable to forfeit as much as half of his assets if divorce proceedings go forward.

Experts suggest this could amount to a potential financial loss of $20 million to $35 million, depending on court rulings and how assets are divided.

Brands Owned by Astronomer

Astronomer doesn’t own many traditional companies or consumer-facing brands. Its structure is focused on developing and enhancing Apache Airflow and its surrounding ecosystem.

Below is a list of the major offers and brands owned by Astronomer as of July 2025:

| Name | Type | Description | Role in Ecosystem |

|---|---|---|---|

| Astro Cloud Platform | Managed SaaS Platform | Enterprise-grade managed Apache Airflow service with autoscaling, security, and orchestration tools | Core product for deploying and managing Airflow pipelines |

| Astro Runtime | Custom Runtime Package | Performance-optimized, secure Airflow distribution with bundled dependencies | Ensures reliability and supportability for production environments |

| Astronomer Studio | Development Interface | Visual interface to edit, test, and deploy DAGs in a team environment | Streamlines developer workflow and version control |

| Lineage by Astronomer | Data Lineage Tool | Tracks movement and transformation of data within pipelines, supports impact analysis | Ensures observability, compliance, and auditing of data pipelines |

| Astronomer CLI | Developer Tooling | Command-line interface for local dev, DAG deployment, and configuration | Bridges local and production development environments |

| Astronomer Scheduler | Scheduling Engine | Scalable, reliable task scheduler built on top of Airflow | Handles high-load environments and ensures pipeline resilience |

| Astronomer Orchestrator API | API Platform | API suite enabling automation, dynamic workflows, and CI/CD integration | Supports extensibility, GitOps, and automation |

| Airflow Support Services | Professional Services | Enterprise-grade support, training, and optimization consulting for Airflow and Astro | Accelerates customer adoption, resolves incidents, and drives success |

Astro Cloud Platform

The flagship managed service from Astronomer, Astro serves as an enterprise-grade deployment of Apache Airflow. It includes built-in access control, monitoring dashboards, logging, and scalable infrastructure managed entirely by Astronomer. Astro allows customers to focus on workflow logic while the tool handles scaling, upgrades, and security.

Astro Runtime

Astro Runtime is Astronomer’s custom distribution of Apache Airflow optimized for production use. It bundles curated packages, performance tuning, security patches, and managed dependency handling. Enterprises using Astro Runtime benefit from streamlined upgrades, pre-tested modules, and an officially supported runtime environment.

Astronomer Studio

This is a visual IDE-like workspace built into the Astro platform. Studio provides data engineers with a GUI to edit, test, and deploy DAGs (Directed Acyclic Graphs) in a collaborative environment. It supports version control, role-based permissions, testing pipelines, and seamless deployment to production.

Lineage by Astronomer

Following their acquisition of the Datakin codebase and lineage tools, Astronomer now offers a data lineage module. This tool automatically tracks how data moves and transforms across pipelines. It enables lineage visualizations, downstream impact analysis, drift detection, and auditing—all integrated with Astro.

Astronomer CLI

A developer tool that interfaces directly with Astronomer’s cloud environment. It facilitates local simulation of DAGs, deployment from the command line, environment configuration, and version control integration. The CLI ensures consistency between local development and production behavior.

Astronomer Scheduler

An enterprise scheduler service that builds on the standard Airflow scheduler. It offers increased reliability under heavy enterprise loads, with features like heartbeat scaling, dynamic scaling of worker pools, and resilience mechanisms against task queue failures.

Astronomer Orchestrator API

A programmatic interface that allows integration of custom tools, event triggers, and CI/CD pipelines. The Orchestrator API enables automation of deployment workflows, dynamic DAG generation, and policy enforcement across workflow pipelines, supporting GitOps and policy-as-code methodologies.

Airflow Support Services

Astronomer also offers enterprise support and professional services built around Airflow and Astro. These include managed upgrades, performance tuning, incident response, engineering best practices, training workshops, and consulting engagements to help large organizations adopt DataOps culture.

Final Thoughts

Astronomer remains a leader in orchestrating modern data workflows. Its influence on the Apache Airflow project and the orchestration landscape is undeniable. Ownership is shared among institutional investors and founders, with Insight Partners holding the largest known stake. The company’s path has been marked by smart leadership, significant funding, and a sharp focus on data infrastructure innovation.

FAQs

Is Astronomer public or private?

Astronomer remains a privately held company. It has not completed an IPO, and ownership is shared among founders, early employees, and institutional investors across multiple venture funding rounds.

Who is Andy Byron?

Andy Byron has been serving as CEO of Astronomer since July 2023. He previously held senior roles in enterprise software firms such as Lacework and Cybereason. Under his leadership, Astronomer grew rapidly, including securing a $93 million Series D led by Bain Capital Ventures and achieving significant ARR growth and high net dollar retention in 2025.

He became a focal figure in public discussion when he and Kristin Cabot, Astronomer’s Chief People Officer, were caught in an apparently intimate moment during a Coldplay concert’s “kiss cam” segment, triggering widespread media coverage and speculation.

Who is the wife of the Astronomer’s CEO?

Andy Byron is married to Megan Kerrigan Byron, an educator and associate director in admissions at the Bancroft School in Massachusetts. She largely stayed out of the public spotlight until the Coldplay concert incident. In the aftermath, she reportedly removed “Byron” from her social media name and deactivated her accounts, prompting speculation about marital strain.

Has Astronomer acquired Datakin?

Yes. In March 2022, Astronomer acquired Datakin, an operational data lineage tool from the creators of the OpenLineage and Marquez open‑source projects. The acquisition was enabled by a $213 million Series C funding round and integrated Datakin’s real‑time lineage capabilities into Astronomer’s workflow platform as a native observability feature.

Who is the owner of Astronomer?

Astronomer is owned by a mix of institutional investors, founders, and early employees. No single entity holds a majority stake.

Who founded Astronomer?

Astronomer was founded by Ry Walker, Tim Brunk, and Benji Lampel in 2015.

What does Astronomer company do?

Astronomer provides managed Apache Airflow services for building, running, and scaling data pipelines in the cloud or on-premises.

Who is the CEO of Astronomer?

Andy Byron is the current CEO of Astronomer.

How much is Astronomer worth?

Astronomer’s estimated valuation is over $1.3 billion as of July 2025.