Aston Martin is one of the most iconic British luxury car manufacturers, known for its connection to James Bond and its elegant, high-performance sports cars. Over the decades, the question of who owns Aston Martin has changed multiple times as the brand went through restructurings, acquisitions, and new investments. As of 2025, Aston Martin is owned by a mix of institutional investors, luxury groups, and wealthy individuals, with significant influence from major shareholders like Lawrence Stroll and Geely.

Key Takeaways

- Aston Martin Lagonda Global Holdings plc is a publicly traded company listed on the London Stock Exchange (LSE) under the ticker AML.

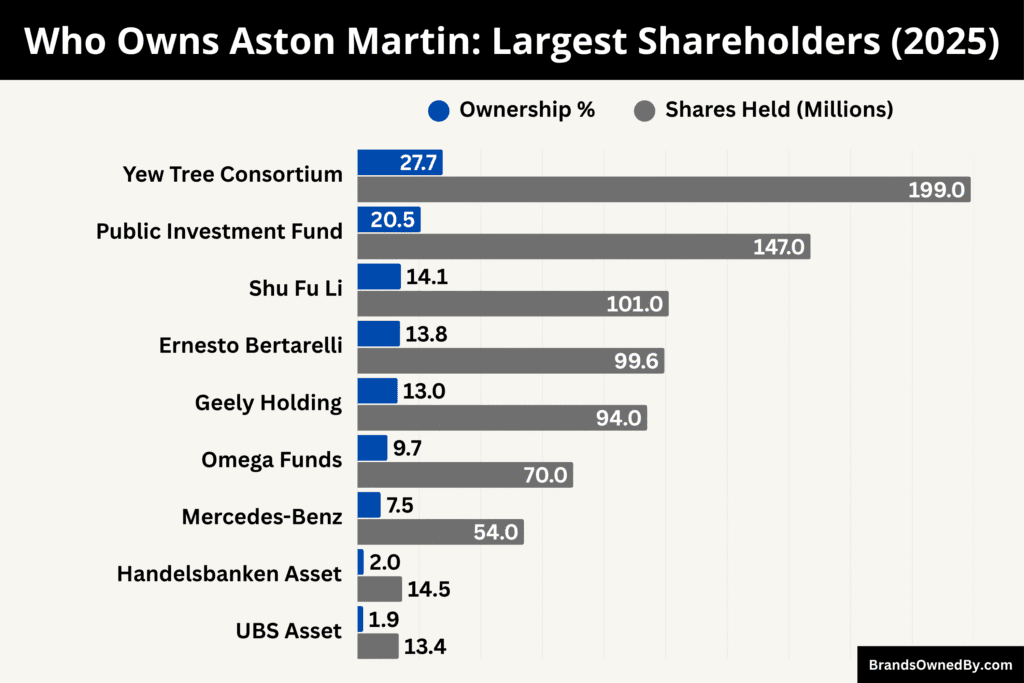

- The largest shareholder, as of October 2025, is the Yew Tree Consortium, led by Lawrence Stroll, holding approximately 27.7% and maintaining controlling influence over company strategy and board decisions.

- Other major investors include Saudi Arabia’s Public Investment Fund (PIF) with 16.7–20.5%, Geely Holding Group with 13–17%, and Mercedes-Benz with around 7.5–8%, providing capital, technology, and global market support.

- Smaller institutional and retail investors, including hedge funds and mutual funds, hold minor stakes of roughly 8–10% combined, contributing to market liquidity but limited strategic control.

Aston Martin Company Profile

Aston Martin Lagonda Global Holdings plc is a British ultra-luxury performance car manufacturer renowned for creating handcrafted grand tourers, sports cars, and SUVs that combine power, elegance, and craftsmanship. Headquartered in Gaydon, Warwickshire, England, the company produces vehicles that embody British sophistication and engineering precision.

The company operates in the luxury automotive and performance technology sectors. Its portfolio includes high-performance models like the DB12, Vantage, and DBX 707, each blending cutting-edge engineering with hand-built artistry. Aston Martin’s design philosophy centers on combining luxury with racing DNA, a heritage evident in its long-standing connection to motorsport, especially through its Aston Martin Aramco Formula One Team.

Aston Martin also develops advanced performance technologies through its subsidiary Aston Martin Performance Technologies (AMPT), providing engineering services, aerodynamics research, and innovation for automotive and motorsport clients.

Founders

Aston Martin was founded in 1913 by Lionel Martin and Robert Bamford.

The origin began as a firm called Bamford & Martin, selling and servicing Singer cars in London. Lionel Martin raced at Aston Hill (in Buckinghamshire), and that inspired the “Aston” in the name combined with his surname.

In practice, early production was limited, and the First World War disrupted progress. Over time, the founders’ names became a legacy rather than hands-on operators, as the company passed through multiple owners.

Major Milestones

- 1913 – Lionel Martin and Robert Bamford establish Bamford & Martin Ltd. in London.

- 1915 – The first Aston Martin car is built with a four-cylinder Coventry-Simplex engine.

- 1922 – Aston Martin competes in the French Grand Prix and sets endurance records at Brooklands.

- 1925 – The company faces bankruptcy but is revived under new ownership later that decade.

- 1932 – The famous Aston Martin wings logo is introduced, symbolizing speed and freedom.

- 1947 – Industrialist David Brown acquires Aston Martin and Lagonda, creating the DB series (his initials).

- 1950–1959 – The brand enters motorsport seriously, winning the 24 Hours of Le Mans in 1959 with the DBR1.

- 1963 – The DB5 debuts, becoming globally famous as James Bond’s car in Goldfinger (1964).

- 1972 – The company is sold to Company Developments Ltd. after David Brown’s ownership ends.

- 1975 – Aston Martin re-emerges from receivership under new investors, producing the V8 models.

- 1987 – Ford Motor Company acquires a 75% stake in Aston Martin, later increasing it to full control.

- 1994 – The DB7 launches, marking a design renaissance and commercial revival for the brand.

- 2003 – Aston Martin moves its headquarters to Gaydon, Warwickshire, and opens a state-of-the-art production facility.

- 2005 – Launch of the V8 Vantage, one of the company’s most successful modern models.

- 2007 – Ford sells a controlling stake to a consortium led by Prodrive’s David Richards and investment firms.

- 2012 – The Aston Martin Vanquish launches, showcasing next-generation design and technology.

- 2016 – Introduction of the DB11, built on an all-new aluminum platform and powered by a Mercedes-AMG engine.

- 2018 – Aston Martin goes public on the London Stock Exchange (LSE) under the symbol AML.

- 2019 – The company unveils its first SUV, the DBX, built at a new plant in St Athan, Wales.

- 2020 – Lawrence Stroll’s Yew Tree Consortium invests heavily, taking control amid financial turbulence.

- 2021 – The company joins Formula 1 as the Aston Martin Cognizant F1 Team, re-establishing its motorsport presence.

- 2022 – Former Ferrari executive Amedeo Felisa becomes CEO, signaling a focus on design, quality, and performance.

- 2023 – Geely Holding Group acquires a 17% stake, expanding Aston Martin’s access to EV and hybrid technologies.

- 2024 – Aston Martin unveils the DB12, marketed as the world’s first “Super Tourer,” emphasizing performance and luxury.

- 2025 – The company delays its first all-electric model to 2026, announces a 5% workforce reduction, and continues its global restructuring efforts.

Who Owns Aston Martin: Top Shareholders

Aston Martin Lagonda Global Holdings plc is a publicly traded luxury automotive company listed on the London Stock Exchange (LSE) under the ticker AML. The company remains public, but its ownership is heavily concentrated among a few major investors who control most of its voting power and strategic direction.

As of 2025, the Yew Tree Consortium, led by Canadian billionaire Lawrence Stroll, is the largest shareholder and the de facto controlling entity of Aston Martin. Alongside Yew Tree, other significant stakeholders include Saudi Arabia’s Public Investment Fund (PIF), China’s Geely Holding Group, Swiss investor Ernesto Bertarelli, and Mercedes-Benz Group AG.

Below is a list of the largest shareholders of Aston Martin as of October 2025:

| Shareholder / Investor | Ownership (Approx.) | Shares Held (Millions) | Investor Type | Role / Influence | Key Details (as of 2025) |

|---|---|---|---|---|---|

| Yew Tree Consortium (Lawrence Stroll) | 27.67% (expected to rise to ~33%) | ~199 million | Private consortium led by Lawrence Stroll (Canada) | Largest shareholder and de facto controller | Stroll serves as Executive Chairman; holds significant voting power; drives company strategy, Formula 1 presence, and capital structure. |

| Public Investment Fund (PIF) | 16.7–20.5% | ~130–147 million | Sovereign Wealth Fund (Saudi Arabia) | Major institutional investor and strategic partner | Provides financial strength and supports Aston Martin’s expansion into luxury and electric vehicle segments. |

| Shu Fu Li (Li Shufu) | 14.09% | ~101 million | Individual / Business magnate (China) | Independent influential investor | Founder of Geely; focuses on collaboration opportunities in technology and EV transition for Aston Martin. |

| Ernesto Bertarelli | 13.82% | ~99.6 million | Private investor (Switzerland) | Stable long-term investor | Swiss billionaire investor ensuring brand value preservation; passive but stabilizing influence. |

| Geely Holding Group | 13–17% | ~94–122 million | Automotive conglomerate (China) | Strategic partner and technology provider | Owns Volvo, Lotus, and Zeekr; provides EV and hybrid technology; holds board representation and strong influence on future product strategy. |

| Mercedes-Benz Group AG | 7.5–8% (≈7.547%) | ~54 million | Automotive manufacturer (Germany) | Technical and strategic partner | Supplies powertrains and hybrid systems; remains a long-term partner despite reduced ownership stake. |

| Omega Funds I Limited | 9.69% | ~70 million | Institutional / hedge fund | Financial investor | Focused on stock performance and capital returns; active in corporate voting. |

| Handelsbanken Asset Management | 2.01% | ~14.5 million | Institutional investor | Minority shareholder | Passive institutional investor maintaining a small, stable stake. |

| UBS Asset Management | 1.86% | ~13.4 million | Institutional investor | Passive investor | Small but consistent institutional holding; contributes to market liquidity. |

| Other Institutional & Retail Shareholders | ~8–10% (combined) | ~58–72 million | Public shareholders | Collective ownership group | Includes individual investors, funds, and pensions trading on the London Stock Exchange under ticker AML. |

Yew Tree Consortium / Lawrence Stroll

Lawrence Stroll, through his investment vehicle known as Yew Tree Consortium (also referred to as Yew Tree Overseas), is the largest single influence in Aston Martin’s shareholding. Over time, Stroll has increased both his stake and his voting power.

In 2025, Stroll holds around 27.67 % of the voting rights (through proxy agreements and pledged shares), giving him de facto control of board decisions and strategy direction.

In early 2025, the consortium proposed to purchase an additional 75 million new shares (for about £52.5 million) to increase its stake to roughly 33 %, pending regulatory waivers. Shareholders overwhelmingly backed that plan (94.4 % in favor at a general meeting). That move would push Stroll’s influence further toward a controlling block.

His position as Executive Chairman grants him direct sway over board appointments, capital raises, alliances, and high-level governance. Even though he does not legally own a majority of ordinary shares, the combination of voting rights, pledged shares, and strategic leadership gives his consortium dominant influence.

Public Investment Fund

The Public Investment Fund (PIF) of Saudi Arabia is among the most prominent institutional investors in Aston Martin. In 2025, PIF owns around 16.7 % of Aston Martin’s equity, making it a key stakeholder. This level of investment comes with board representation and strategic voice in major decisions, particularly relating to capital structure, international expansion (especially the Middle East), and sustainability initiatives.

PIF has also been active in recent capital raises, participating in funds that helped the company stabilize its balance sheet. Its stake has increased over time—from earlier figures around 16–17 % to reported aspirations of reaching 20.5 % via indirect holdings. This upward movement underscores PIF’s strategic interest in securing a stronger foothold in a luxury automotive brand.

Shu Fu Li

Chinese billionaire Shu Fu Li (also known as Li Shufu) holds a significant personal stake in Aston Martin — around 14.09 % as of 2025. He is an influential independent shareholder. His stake places him among the top three investors in the firm. While not directly involved in day-to-day operations, his financial weight and connections in the Chinese automotive and technology sectors give him potential leverage, especially in any strategic moves toward electrification and access to Chinese markets.

Ernesto Bertarelli

Swiss entrepreneur Ernesto Bertarelli is another large private investor in Aston Martin, holding close to 13.82 % of its shares. Bertarelli’s investment is long-term, and he typically acts as a stable anchor shareholder rather than seeking active control. His capital support contributes to financial stability, and his presence ensures a counterbalance to more activist or strategic investors.

Geely Holding Group

Geely Holding Group, a Chinese automotive conglomerate (owner of Volvo, Lotus, Zeekr, etc.), holds about 13–17 % in Aston Martin as of 2025. Earlier, Geely expanded its stake by investing £234 million to double it to 17 %.

This investment gave it a board seat and technical collaboration rights. Geely’s strength lies in its engineering, electrification capability, and access to Chinese markets. While Geely does not dominate board control, its technological resources and minority influence make it a strategic partner rather than just a silent investor.

Mercedes-Benz Group AG

Mercedes-Benz (Daimler / Mercedes Group) holds a 7.5–8 % (≈ 7.547 %) stake in Aston Martin. Their role is largely technological and strategic, supplying proprietary powertrains, hybrid systems, and software solutions.

Through this partnership, Mercedes obtains a voice in engineering direction while Aston Martin accesses key systems vital for modern performance and electrification. Mercedes does not act as a controlling force, but rather as a partner with mutual interest in success.

Omega Funds I Limited

Among institutional holders, Omega Funds I Limited holds about 9.69 % of Aston Martin as of mid-2025. As a hedge fund or investment vehicle, Omega is primarily financial in interest. Its influence is exercised through shareholder voting and oversight of performance, rather than in operations or governance. It is a significant block within the institutional investor base.

Other Institutional and Retail Shareholders

Beyond the major names above, the remainder of Aston Martin’s shares are held by a mix of institutional investors, mutual funds, asset managers, and retail shareholders. These include funds such as HSBC, UBS, Vanguard, and smaller specialized portfolio managers.

Collectively, they control a meaningful share of equity, and their votes in corporate affairs (capital raises, board elections, major strategy changes) can be decisive when mobilized.

For instance, public filings show that Handelsbanken Asset Management holds around 2.01 %, and UBS Asset Management about 1.86 %. Retail shareholders also form a significant floating share pool.

Although none of these minority holders individually can steer the company, in aggregate, they provide market discipline and demand accountability from the dominant shareholders and board.

Who is the CEO of Aston Martin?

As of 2025, Adrian Hallmark serves as Chief Executive Officer of Aston Martin Lagonda. He formally took over the role on 1 September 2024, succeeding Amedeo Felisa. Hallmark was recruited from Bentley, where he had been Chairman & CEO. His appointment is seen as a move to bring renewed stability and luxury-brand leadership to Aston Martin.

Hallmark is now responsible for setting strategic priorities, overseeing global operations, leading the electrification push, managing cost controls, and restoring the company toward profitability. He reports to the Executive Chairman (Lawrence Stroll) and works closely with the Board.

Transition from Amedeo Felisa

Before Hallmark, Amedeo Felisa was CEO from May 2022 until September 2024. He stepped down formally on 1 September 2024 and remained available to assist during the transition period through the end of 2024.

During his tenure, Felisa oversaw the rollout of key models such as the DB12 and helped reposition Aston Martin’s product roadmap. His responsibilities included guiding new front-engine sports car launches and supervising engineering alignment with brand goals. Though his era was ambitious, the company also faced financial strain, and his departure was planned to align with the next phase under Hallmark.

Past CEOs & Leadership Continuity

- Tobias Moers (August 2020 – May 2022): He joined from Mercedes-AMG and sought to revamp Aston Martin’s performance credentials. Moers left abruptly in 2022 and stayed on as a consultant until July.

- Andy Palmer (until May 2020): He led the company through its IPO phase and attempted product diversification, but was replaced following financial challenges.

Hallmark is the third CEO in as many years under the current ownership era, showing how the role has seen frequent turnover as the company reorients itself. His success will depend on steady execution, cost discipline, and the ability to balance the brand’s heritage with the demands of electrification and global markets.

Strategic Priorities under Hallmark

- Operational Discipline & Cost Reduction: Hallmark has emphasized the importance of reducing overheads, tightening control over spending, and making Aston Martin’s operations more efficient. For example, under his leadership, the company cut about 5% of its global workforce, saving approximately £25 million annually.

- Shift from Volume to Profitability: Rather than aggressive volume targets, Hallmark has moved the focus to margin, cash flow, and profitable growth. A previously stated delivery goal of 10,000 units per year is under review, and more importance is now being placed on pricing, options, and the mix of models rather than sheer output.

- Model Variants and Personalization: Hallmark is pushing for more variations of existing models, expanded customization, and differentiation beyond simple cosmetic tweaks. He has also shown interest in bringing back manual transmission variants and purist driving experiences for some models. This fits with a luxury strategy where customers expect uniqueness.

- Electric & Hybrid Transition (with Caution): While Aston Martin continues on the path toward electrification, Hallmark has delayed the launch of its first full battery electric vehicle (BEV) to prioritize hybrids and plug-in hybrids first. He believes the pace must match demand and cost constraints.

- Quality Control & Manufacturing Efficiency: Improving build quality and increasing “right first time” metrics have been part of his agenda. He observed that when he took over, Aston Martin’s production had been experiencing significant rework and inefficiency. Under his leadership, these have improved.

Challenges & Risks

- Macroeconomic Headwinds: Issues like trade tariffs (especially US tariffs), weakening demand in key markets like China, supply chain disruptions, rising input costs, inflation — all pose risks. Hallmark has had to manage these alongside internal change.

- Profit Warnings & Financial Performance: Under Hallmark, Aston Martin has issued profit warnings. Forecasted losses continue; the company anticipates that adjusted losses before interest and tax will exceed £110 million in certain periods. Cash flow has not yet turned positive as hoped.

- Delays in Electric Initiatives: The first full BEV has been delayed multiple times. Hallmark decided to delay it further to focus resources on more immediate hybrids and plug-in hybrids. This could expose Aston Martin to criticism for lagging rivals in the EV transition.

- Debt and Capital Requirements: Aston Martin carries high levels of debt. Several fundraising rounds have been required to maintain liquidity. The interest burden is significant. Hallmark must balance new investment with cost controls and avoid over-dilution of existing shareholders.

Early Results and Progress

- Hallmark has pushed for improved quality control; the percentage of vehicles meeting first-time quality standards has risen (from much lower) toward levels more acceptable in luxury cars.

- Savings from workforce reductions and cost containment have contributed to trimming losses. The company announced it saved around £25 million from earlier cuts.

- Some model sales (core models like DBX, Vantage) remain strong, while high-margin “specials” (limited edition hypercars) have underperformed or seen delays. The order book stays extended for certain core models.

- Hallmark has also clarified that the strategy is to make Aston Martin “stable, secure, and boring” in terms of structural consistency, rather than rapid, risky expansion. He wants steady progress.

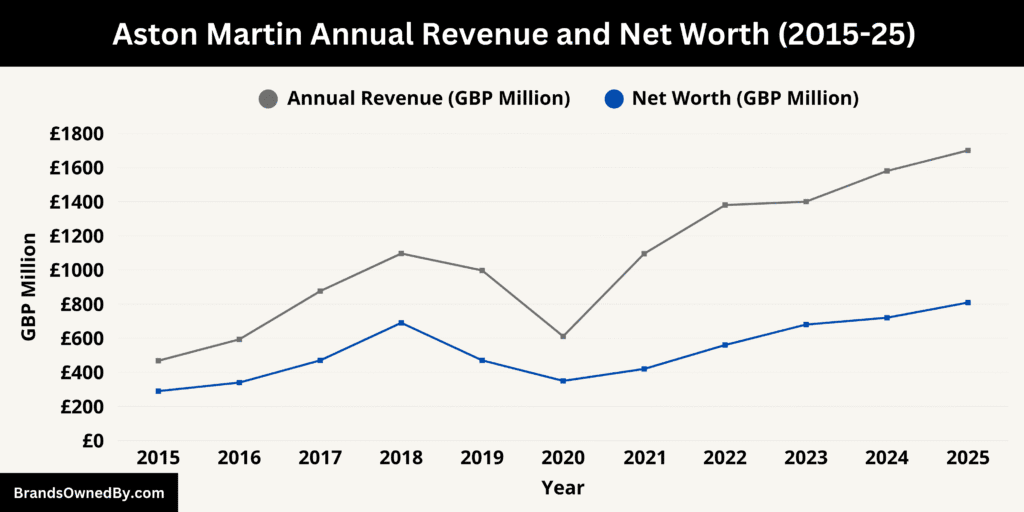

Aston Martin Annual Revenue and Net Worth

As of October 2025, Aston Martin Lagonda Global Holdings plc reports a net worth of approximately £809 million and continues to generate over £1.6 billion in annual revenue despite facing significant financial challenges. While the company remains a public luxury automaker listed on the London Stock Exchange, it is still navigating through restructuring, market headwinds, and the costly transition toward hybrid and electric models.

Here’s a 10-year historical financial overview of Aston Martin Lagonda Global Holdings plc (2015–2025) showing annual revenue and net worth:

| Year | Annual Revenue (£ millions) | Net Worth / Shareholder Equity (£ millions) | Key Financial or Strategic Notes |

|---|---|---|---|

| 2025 | 1,612 – 1,700 | 809 | Revenue softened early in year; cost reductions under CEO Adrian Hallmark; ongoing electrification push. |

| 2024 | 1,580 | 720 | Slight improvement in sales due to DB12 launch; heavy investment in hybrid transition; moderate net losses. |

| 2023 | 1,400 | 680 | Geely acquired 17% stake; PIF increased shareholding; liquidity improved; losses narrowed. |

| 2022 | 1,380 | 560 | Yew Tree Consortium boosted ownership; restructuring and new capital raised; reduced Mercedes stake. |

| 2021 | 1,095 | 420 | Global recovery post-pandemic; strong DBX SUV sales; still operating at a net loss. |

| 2020 | 611 | 350 | Pandemic and production halts; sales fell nearly 40%; heavy reliance on investor funding. |

| 2019 | 997 | 470 | Year after IPO; weak demand; stock fell sharply; major financial pressure and high debt load. |

| 2018 | 1,096 | 690 | Peak IPO year; listed on LSE; strong early investor confidence before downturn. |

| 2017 | 876 | 470 | Pre-IPO momentum; DB11 boosted sales; strong global demand. |

| 2016 | 593 | 340 | Growth stage under Andy Palmer; pre-IPO funding rounds; preparation for DB11 launch. |

| 2015 | 468 | 290 | Early turnaround efforts; lower production volumes; high R&D spend on next-gen models. |

2025 Revenue Performance

For 2025, Aston Martin’s annual revenue is projected to reach between £1.61 billion and £1.7 billion, reflecting modest growth in its core sports car lineup but ongoing weakness in limited-edition “Specials.” The first half of the year saw softer deliveries in high-margin models, including the Valkyrie and Valor, though the DB12 and DBX SUV maintained stable demand.

Revenue dipped by around 13% year-on-year in the early part of 2025 due to weaker luxury spending in Asia and slower U.S. imports following new trade tariffs. However, price increases, higher customization options, and stronger average selling prices across the model range partially offset the decline.

In dollar terms, Aston Martin’s trailing twelve-month revenue stood near $1.54 billion. Analysts continue to forecast a gradual improvement in sales volume and margins from late 2025 into 2026 as production efficiency improves under new CEO Adrian Hallmark.

Net Worth and Market Valuation

As of October 2025, Aston Martin’s net worth stands at £809 million, marking a slight improvement compared to mid-year figures. The figure reflects its market capitalization, tangible assets, and shareholder equity, following several months of restructuring, capital injections, and debt realignment.

The company’s market capitalization currently hovers around £650 million, while total assets are estimated at over £4.1 billion, including manufacturing facilities, R&D centers, inventory, and its premium brand value. After accounting for debt obligations and liabilities, the company’s equity value places its net worth at roughly £809 million, up from earlier lows in 2024.

While Aston Martin remains unprofitable, it continues to narrow its losses. Estimated net losses for 2025 are around £134–140 million, reflecting progress in cost control and production efficiency. Operating losses (EBIT) have also declined year-over-year, and the company expects to approach break-even by 2026.

Financial Health and Strategic Context

The improvement in Aston Martin’s net worth has been aided by fresh capital infusions from its leading shareholders — including Lawrence Stroll’s Yew Tree Consortium, Saudi Arabia’s Public Investment Fund, and Geely Holding Group. Together, these investors have provided crucial funding to support model development and the electrification roadmap.

In 2025, the automaker also raised £125 million through equity and asset sales, including a partial stake adjustment in its Formula 1 team. These moves strengthened its liquidity position and allowed Aston Martin to maintain operations without taking on additional heavy debt.

Despite ongoing challenges, Aston Martin’s brand equity remains exceptionally strong in the luxury automotive segment. Its historical prestige, Formula 1 visibility, and renewed focus on profitability have supported a gradual recovery in investor confidence.

Outlook for 2026

Looking ahead, Aston Martin expects to stabilize its revenue base through expanded hybrid offerings, new luxury variants, and selective cost optimization. If demand for its DB12 and upcoming Valhalla supercar holds steady, the company could see revenues rebound above £1.8 billion by 2026.

Companies Owned by Aston Martin

Aston Martin owns and operates a range of brands, subsidiaries, and specialized divisions that extend beyond its core luxury cars. These entities cover high-performance racing, heritage restoration, electric vehicle development, bespoke limited editions, and lifestyle ventures, reflecting the company’s focus on innovation, exclusivity, and luxury experiences.

Below is a list of the major companies and brands owned by Aston Martin as of October 2025:

| Company / Brand / Entity | Type | Focus / Function | Key Details (2025) |

|---|---|---|---|

| Aston Martin Lagonda | Core automotive brand | Luxury cars, grand tourers, sports cars | Produces DB12, Vantage, DBX 707, and upcoming Valhalla; Lagonda revived for ultra-luxury and EV models; bespoke customization and high-end performance. |

| Aston Martin Cognizant Formula One Team | Motorsport | Formula 1 racing | Operates Aston Martin’s F1 team; develops aerodynamics, hybrid tech, and performance systems; high global brand visibility; technology transfers to production vehicles. |

| Aston Martin Works | Heritage & restoration | Classic car restoration, certification, and continuation models | Restores and maintains historic Aston Martin cars; produces limited-edition continuation models like DB4 GT; strengthens brand heritage and collector engagement. |

| Aston Martin Racing (AMR) | Motorsport | GT racing, endurance championships | Develops GT race cars for FIA WEC and Le Mans; builds lightweight chassis, engines, and hybrid tech; licenses tech to private racing teams. |

| Aston Martin Residences | Lifestyle & real estate | Luxury residential development | Designs high-end properties with automotive-inspired interiors and amenities; extends Aston Martin brand into luxury lifestyle. |

| Aston Martin Performance Technologies (AMPT) | Engineering & R&D | Technical consultancy, internal vehicle engineering | Provides R&D in aerodynamics, hybrid systems, lightweight materials; supports internal development and external contracts with other automakers. |

| Lagonda Electric Vehicle Division | Automotive / EV | Development of electric and plug-in hybrid vehicles | Focused on Lagonda’s electrified lineup; oversees battery integration, electric powertrain development, and advanced connectivity; aligns with sustainability goals. |

| Aston Martin Financial Services & Residual Value | Finance | Customer financing, leasing, warranty services | Offers financing solutions and residual value management to support sales; ensures high resale value for customers. |

| Aston Martin Special Projects & Limited Editions | Bespoke / Limited Edition | One-off vehicles, collaborations, hypercars | Produces limited edition models, one-off hypercars, and collaborative luxury projects; drives exclusivity and high-margin revenue streams. |

Aston Martin Lagonda

Aston Martin Lagonda is the core brand of the company, producing handcrafted luxury cars, grand tourers, and high-performance sports cars. This includes models such as the DB12, Vantage, DBX 707, and the upcoming Valhalla. The Lagonda nameplate was revived in 2020 for ultra-luxury, electric-oriented vehicles, and the brand now operates as a distinct high-end line within Aston Martin. Lagonda vehicles emphasize advanced technology, sustainability features, and bespoke customization, highlighting Aston Martin’s commitment to luxury innovation.

Aston Martin Cognizant Formula One Team

Aston Martin owns and operates the Aston Martin Cognizant Formula One Team, its official Formula 1 racing team. Launched in 2021 (rebranding the former Racing Point F1 team), it serves both as a high-profile marketing arm and a technology incubator for the company.

Through this team, Aston Martin develops aerodynamics, materials, and hybrid performance systems that often transfer into production vehicles. The F1 team also strengthens brand visibility globally, linking Aston Martin’s heritage with cutting-edge motorsport.

Aston Martin Works

Aston Martin Works is the in-house heritage and restoration division. It handles classic Aston Martin restorations, certification, and maintenance services. The entity also produces limited-edition collector cars and continuation models such as the DB4 GT Continuation, allowing the company to monetize its heritage and maintain close engagement with collectors. Works supports brand value by ensuring older vehicles retain authenticity and high performance.

Aston Martin Racing

Aston Martin Racing (AMR) is the company’s motorsport arm beyond Formula 1. While primarily focused on GT racing, AMR designs, builds, and campaigns Aston Martin GT cars for international endurance championships, including the FIA World Endurance Championship and 24 Hours of Le Mans. AMR develops lightweight chassis, performance engines, and hybrid technology, feeding innovation back into consumer vehicles. The entity also licenses technology and expertise to private racing teams.

Aston Martin Residences

Aston Martin Residences is a lifestyle real estate brand owned and operated by Aston Martin. The entity develops luxury residential properties under the Aston Martin branding, combining automotive-inspired design, bespoke interiors, and high-end amenities. This initiative positions Aston Martin not only as a carmaker but as a luxury lifestyle brand, leveraging its design DNA to expand into real estate and experiences.

Aston Martin Performance Technologies (AMPT)

Aston Martin Performance Technologies is the company’s engineering services and R&D division. AMPT provides consultancy, research, and technical expertise in aerodynamics, lightweight materials, hybrid systems, and performance optimization. It works internally to enhance Aston Martin vehicles and also engages in external contracts with other automakers and technology partners. AMPT strengthens Aston Martin’s technical capabilities and supports advanced engineering for both production and motorsport applications.

Lagonda Electric Vehicle Division

The Lagonda EV Division is a dedicated unit for developing fully electric and plug-in hybrid vehicles under the Lagonda brand. With the first fully electric model expected in 2026, this division oversees battery technology, electric powertrain integration, and next-generation connectivity features. It represents Aston Martin’s commitment to sustainability and aligns with global automotive electrification trends.

Aston Martin Residual Value & Financial Services

Aston Martin also operates an internal Financial Services and Residual Value division, managing customer financing, leasing programs, and warranty services. While not a standalone consumer-facing brand, this entity is critical in supporting sales and maintaining vehicle value retention, ensuring buyers can access flexible financing and that Aston Martin vehicles retain high resale and residual value in the market.

Aston Martin Special Projects & Limited Editions

This division focuses on bespoke, limited-edition vehicles and special projects, including collaborations with watchmakers, luxury goods brands, and artist commissions. Examples include one-off hypercars, limited edition DBX variants, and anniversary models. This entity drives exclusivity, strengthens brand allure, and generates high-margin revenue streams from ultra-luxury buyers.

Final Words

Aston Martin’s ownership today is a mix of global investors combining heritage with innovation. From the Yew Tree consortium’s strategic vision to Geely’s technological strength and Mercedes-Benz’s engineering input, the company stands at a transformative moment. The brand’s commitment to electrification and performance ensures that Aston Martin will continue to balance luxury with cutting-edge design in the years ahead.

FAQs

Who owns Aston Martin car company?

Aston Martin Lagonda Global Holdings plc is a publicly traded company listed on the London Stock Exchange (LSE: AML). The largest shareholder is the Yew Tree Consortium, led by Lawrence Stroll, holding approximately 27.7%. Other major investors include Saudi Arabia’s Public Investment Fund (16.7–20.5%), Geely Holding Group (13–17%), and Mercedes-Benz (7.5–8%).

Who owns Aston Martin F1 team?

The Aston Martin Cognizant Formula One Team is fully owned by Aston Martin Lagonda, with Lawrence Stroll’s consortium providing major funding and strategic oversight. The team operates as a subsidiary and marketing arm of the company.

Where is Aston Martin based?

Aston Martin is headquartered in Gaydon, Warwickshire, England, with additional facilities for production, R&D, and heritage operations in the UK.

Who owns Aston Martin Lagonda?

Aston Martin Lagonda is the flagship automotive brand of the company and is fully owned by Aston Martin Lagonda Global Holdings plc.

Does Ford own Aston Martin?

No, Ford no longer owns Aston Martin. Ford sold its controlling stake in 2007, and today the company is publicly traded with a mix of private and institutional shareholders.

Where was Aston Martin founded?

Aston Martin was founded in 1913 by Lionel Martin and Robert Bamford in London, England.

Who owns Aston Martin Racing?

Aston Martin Racing (AMR) is owned and operated by Aston Martin Lagonda. It manages GT and endurance racing programs, including customer racing initiatives.

Is Aston Martin owned by Mercedes?

No, Mercedes-Benz Group AG owns a minority stake of around 7.5–8% and acts as a technical and strategic partner, supplying engines, hybrid systems, and electronics, but it does not control the company.

Is Aston Martin under Volkswagen?

No, Aston Martin is independent of Volkswagen. Geely, a Chinese automotive group, holds a minority stake, but Volkswagen has no ownership.

Do the Chinese own Aston Martin?

Partially. Geely Holding Group, a Chinese automotive company, owns approximately 13–17% of Aston Martin and provides technology and strategic support, but it is not the controlling owner.

Is Aston Martin British or German?

Aston Martin is a British company, headquartered in England, with a century-long heritage as a UK luxury automaker.

Do Aston Martin use Mercedes engines?

Yes, Aston Martin uses Mercedes-Benz-sourced engines and hybrid systems in several models, including the DBX, Vantage, and upcoming models under the partnership agreement.

Is Aston Martin Mercedes F1?

No, Aston Martin’s F1 team is independent of Mercedes, though Mercedes supplies technology and engines in some collaborations. Aston Martin runs its own team, the Aston Martin Cognizant F1 Team, fully owned by the company.

Will Mercedes buy Aston Martin?

There are currently no plans for Mercedes-Benz to acquire Aston Martin. Mercedes is a minority investor and technical partner only.

Is Aston Martin still British-owned?

Yes, Aston Martin remains primarily British-owned, with its largest shareholder, Lawrence Stroll, and headquarters based in the UK.

Is Aston Martin owned by Tata?

No, Aston Martin is not owned by Tata Motors. Tata owns Jaguar Land Rover, a separate British automotive group.