American Express is one of the most recognized names in the global financial services industry. When people ask, who owns American Express, they’re typically curious about the major shareholders, ownership structure, and the business empire behind the brand. This article explains all that and more.

American Express Profile

American Express, commonly known as Amex, is a leading global financial services company known for its credit cards, payment solutions, and travel-related services. It was founded in 1850 in Buffalo, New York, and has grown into one of the most valuable and trusted brands in the financial industry. The company operates in over 200 countries and territories, with a presence at more than 100 million merchant locations worldwide.

American Express is especially known for its premium card offerings, including the Green, Gold, Platinum, and Centurion (Black) Cards. Its business model stands out from competitors because it acts as both the issuer and the payment processor, allowing it to control the full customer experience.

Company Details

- Company Name: American Express Company

- Ticker Symbol: AXP (NYSE)

- Headquarters: New York City, New York, USA

- Founded: March 18, 1850

- Industry: Financial services

- Core Offerings: Credit and charge cards, savings and lending products, travel services, fraud protection, and expense management tools

- 2025 Revenue: $53.2 billion

- Total Cards Issued (2025): 118 million globally

- Global Transaction Volume (2025): $1.72 trillion.

Founders of American Express

American Express was founded by three prominent American businessmen:

- Henry Wells

- William G. Fargo

- John Butterfield.

These men initially launched American Express as a freight and express mail service. Later, Henry Wells and William Fargo went on to establish Wells Fargo, another major American financial institution. A fourth key figure, Benjamin Pierce Cheney, joined shortly after and played a crucial role in expanding the company’s logistics network.

Major Milestones

- 1850: American Express is founded in Buffalo, New York, as an express mail and freight forwarding service.

- 1868: Merged with Merchants Union Express Company to form American Merchants Union Express Company.

- 1873: Returned to the name American Express Company.

- 1891: Introduced the first traveler’s checks, revolutionizing secure international travel.

- 1958: Launched the first paper charge card for consumers.

- 1966: Introduced the American Express Gold Card.

- 1969: Released the Green Card, one of its most iconic products.

- 1984: Platinum Card was launched, offering luxury benefits and travel perks.

- 1999: Unveiled the exclusive Centurion Card (Black Card), available by invitation only.

- 2010s–2020s: Expanded into mobile payments, AI-based fraud prevention, and global partnerships with merchants and fintech companies.

- 2025: Reported $53.2 billion in revenue, processed $1.72 trillion in transactions, and issued 118 million cards globally. Ranked #1 in customer satisfaction for premium credit cards by J.D. Power.

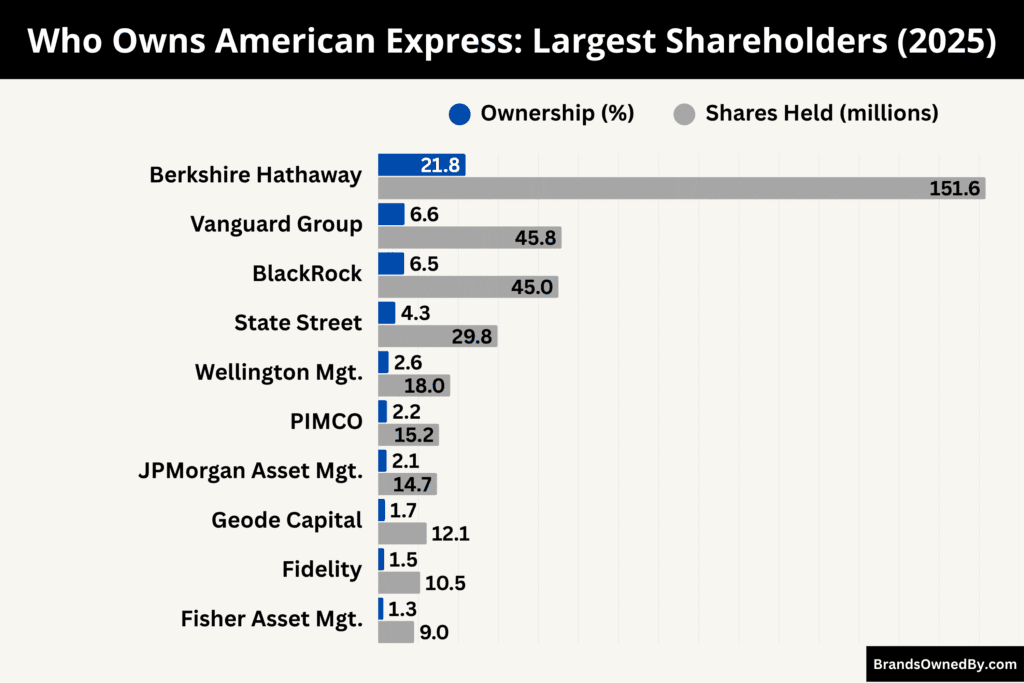

Who Owns American Express: Largest Shareholders

American Express is a publicly traded company listed on the New York Stock Exchange (NYSE) under the ticker symbol AXP. No single person or entity owns American Express outright. Instead, it is owned by thousands of institutional and individual shareholders who hold its publicly traded shares.

The largest shareholder is Berkshire Hathaway Inc., led by Warren Buffett. Buffett’s firm has been a long-term investor in American Express, holding a significant percentage of the company for decades. Other institutional investors also hold large portions of the company, including Vanguard Group and BlackRock.

Roughly 84% of American Express shares are held by institutions. The top 25 shareholders control over 63.8% of the shares. Public companies own 21.8%, while individual insiders account for 0.14%, and the general public holds about 9%.

Here’s a list of the top shareholders of American Express as of August 2025:

| Shareholder | Ownership (%) | Shares Held (millions) | Approx. Value (USD Bn) |

|---|---|---|---|

| Berkshire Hathaway Inc. | 21.8% | 151.6 | $45.0 billion |

| The Vanguard Group Inc. | 6.6% | 45.8 | $14.0 billion |

| BlackRock Inc. | 6.5% | 45.0 | $13.9 billion |

| State Street Corporation | 4.3% | 29.8 | $9.2 billion |

| Wellington Management Group LLP | 2.6% | 18.0 | $5.6 billion |

| PIMCO | 2.2% | 15.2 | $4.5 billion |

| JPMorgan Asset Management | 2.1% | 14.7 | $4.3 billion |

| Geode Capital Management, LLC | 1.7% | 12.1 | $3.6 billion |

| FMR LLC (Fidelity) | 1.5% | 10.5 | $3.2 billion |

| Fisher Asset Management | 1.3% | 9.0 | $2.8 billion |

| American Century Investment Mgmt | 1.6% | N/A | N/A |

| UBS Asset Management | 1.4% | N/A | N/A |

| Morgan Stanley | 1.9% | N/A | N/A |

| Massachusetts Financial Services | 1.1% | N/A | N/A |

| T. Rowe Price | 1.0% | N/A | N/A |

| Northern Trust | 1.0% | N/A | N/A |

| Norges Bank Investment Management | 0.9% | N/A | N/A |

Berkshire Hathaway Inc. (Approx. 21.8%)

Berkshire Hathaway remains the single largest shareholder of American Express, owning roughly 151.6 million shares, or 21.8% of the company by August 2025. Its stake is worth approximately $45 billion.

This position isn’t just financial—it’s historic. Warren Buffett’s firm first acquired Amex shares back in 1994, and the holding has been consistently maintained and occasionally expanded over the decades.

While Berkshire doesn’t involve itself in daily operations, its weight in shareholder meetings and votes grants it substantial strategic influence. Despite its size, this remains a non‑controlling but undeniably powerful passive stake.

The Vanguard Group Inc. (Approx. 6.6%)

As of August 2025, Vanguard holds around 45.8 million shares, translating to about 6.6% of Amex’s outstanding shares, with a valuation near $14 billion. Vanguard operates primarily through index and mutual funds.

Its influence stems from vote aggregation in board elections and policy matters. Though passive, Vanguard’s voting power is influential in reinforcing long-term shareholder interests and sustaining management continuity.

BlackRock Inc. (Approx. 6.5%)

BlackRock holds approximately 45.0 million shares, or 6.5% of American Express’s stock, valued at nearly $13.9 billion. As the world’s largest asset manager, BlackRock shapes company policy through its stewardship initiatives and proxy voting, often aligning with sustainability and governance agendas that may impact corporate strategy.

State Street Corporation (Approx. 4.3%)

State Street controls around 29.8 million shares, about 4.3% of the company, worth approximately $9.2 billion. Its influence is channeled through its large ETFs and institutional fund vehicles. Though it remains passive, its proxy votes and voting guidelines make it a key voice in board composition and corporate accountability.

Wellington Management Group LLP (Approx. 2.6%)

Wellington owns 18.0 million shares, or 2.6% of Amex, valued at roughly $5.6 billion. Known for active management, Wellington may engage in deeper dialogue with corporate leadership on issues like executive compensation, risk strategy, or digital investment.

PIMCO (Pacific Investment Management Company LLC) (Approx. 2.2%)

PIMCO holds 15.2 million shares, around 2.2% of the company, worth near $4.5 billion. Though primarily a fixed-income specialist, PIMCO’s equity allocations carry significant influence in shaping board oversight and capital structure through their client-managed funds.

JPMorgan Asset Management (Approx. 2.1%)

JPMorgan manages 14.7 million shares, representing 2.1% ownership, valued at around $4.3 billion. As a global banking powerhouse, their holdings add a dimension of strategic corporate insight—especially in matters tying back to financial services.

Geode Capital Management, LLC (Approx. 1.7%)

Geode holds 12.1 million shares, or about 1.7%, worth around $3.6 billion. This affiliate of Fidelity often represents passive retail index positions, adding depth and stability to the shareholder base.

FMR LLC (Fidelity) (Approx. 1.5%)

FMR maintains 10.5 million shares, or 1.5% of the company, valued at $3.2 billion. Through its mutual funds, Fidelity contributes to governance decisions while generally supporting operational consistency and dividend policy.

Fisher Asset Management (Approx. 1.3%)

Fisher Asset holds 9.0 million shares, around 1.3%, with a value near $2.8 billion. Its investment posture often favors financially sound, lower-volatility firms like Amex, supporting long-term growth strategies.

Who is the CEO of American Express?

As of August 2025, the CEO of American Express is Stephen J. Squeri. He took over as CEO in 2018 after serving in various senior roles within the company, including Vice Chairman and Group President of Global Corporate Services.

Stephen J. Squeri – Chairman and CEO (2018–Present)

Stephen J. Squeri has served as both Chairman and Chief Executive Officer since 2018. He also leads the American Express National Bank (AENB). Over four decades with the company, he has held key leadership roles, including Vice Chairman, Group President of Global Corporate Services, Group President of Global Services, Executive VP, and Chief Information Officer. His deep institutional knowledge anchors the company’s strategic direction.

Squeri began at American Express in 1985, initially managing the Travelers Cheque Group. He climbed through the ranks—leading Establishment Services, Global Commercial Card, and later overseeing service, credit, fraud, technology, and M&A as CIO and Group President. He became Vice Chairman in 2015, paving the way for his CEO appointment in 2018.

Under Squeri’s stewardship, American Express has emphasized digital transformation, Membership-driven innovation, and global market expansion. He’s championed AI initiatives and customer-first strategies—creating new payment experiences, enhancing fraud prevention, and deepening partnerships across industries.

Recognition and Influence

Squeri’s leadership extends beyond American Express. In 2025, Time named him one of the 100 Most Influential People, lauding his growth‑with‑purpose model and commitment to customers, colleagues, and communities.

He also serves on influential boards and councils, including the Business Roundtable, The Business Council, and academic and philanthropic institutions—reinforcing his impact in corporate governance and social responsibility.

Compensation and Ownership Alignment

In 2023, Squeri’s total compensation reached approximately $35.8 million, spanning base salary, performance-based bonuses, and vested stock units—reflecting strong alignment between his incentives and the company’s long‑term performance.

As of early 2025, his net worth stands in the tens of millions, bolstered by his holdings in American Express shares and performance-linked equity.

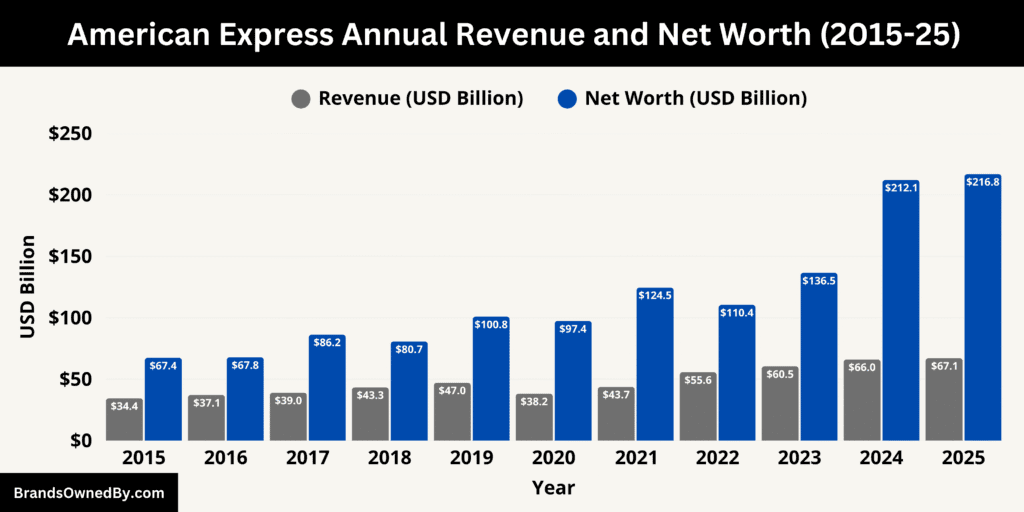

American Express Annual Revenue and Net Worth

American Express continued to build momentum through 2025, achieving record quarterly and year-to-date performance. In the second quarter (Q2), the company generated $17.9 billion in consolidated revenues net of interest expense, reflecting a 9% year-over-year increase. This was propelled by strong growth in card member spending, net interest income, and card fees.

Card member spending (billed business) reached a quarterly high of $416.3 billion, up 7% from the prior year, underlining engagement from premium customer segments.

Year-to-date revenues reached $34.8 billion, marking an 8% rise compared to the prior year. For full-year context, underlying fundamentals point to increased revenue leverage driven by new product launches—like refreshed consumer and business Platinum cards—and strategic partnerships, such as the introduction of the Coinbase One Card.

Earnings and Profitability Dynamics

While headline net income for Q2 dipped by 4% to $2.9 billion compared to the prior year, underlying profits remained resilient. Adjusted earnings per share rose 17%, when excluding the prior year’s one-time gain from the Accertify sale, underscoring the strength of core operations and profitability.

This divergence between GAAP and adjusted earnings reflects both strong demand traction and disciplined management of credit risk. Provisions for credit losses did increase by 11%, reaching $1.4 billion, driven by loan growth and macroeconomic assumptions—but net write-off and delinquency rates held at best-in-class levels, evidencing effective risk control.

American Express Net Worth

By early August 2025, American Express’s market capitalization stood at approximately $207.8 billion, marking nearly a 16% increase from its value one year earlier.

Other estimates place it around $206.4 billion, reinforcing its position among the largest financial services firms globally.

Taking mid-year values into account, American Express’s market cap registered between $212 billion and $215 billion in July—a testament to sustained investor confidence amid ongoing earnings strength.

Strategic Outlook: Maintaining Momentum

American Express’s 2025 performance reflects a strong alignment of premium brand appeal, customer loyalty, and disciplined execution. Quarterly revenue growth led by card fees, strategic innovation, and recurring engagement created a solid foundation for shareholder value. Even in a season of rising provisions and elevated expenses, the company maintained healthy capital returns and risk-adjusted profitability.

Its market value, exceeding $200 billion, reinforces Amex’s durable positioning and resilience. Investors continue to reward its sustained performance, while management’s focus on innovation and credit quality offers a springboard for future growth.

Companies Owned by American Express

American Express operates a number of subsidiaries and acquired brands that support its business ecosystem. Here’s a list of the brands and companies owned by American Express as of 2025:

| Company/Brand | Type | Year Acquired/Founded | Function/Role |

|---|---|---|---|

| American Express Travel Related Services (TRS) | Core Operations / Service Infrastructure | 1950s (Internal Division) | Manages global card issuance, merchant relationships, and cardmember services |

| American Express National Bank | Banking / Financial Services | 1980s (Consolidated) | Offers savings accounts, CDs, and issues Amex credit cards |

| Accertify, Inc. | Fraud Prevention / SaaS | 2010 (Acquired) | Provides fraud detection, prevention, and chargeback management tools |

| AMEX Assurance Company | Insurance / Risk Management | 1980s (Internal Division) | Underwrites travel and purchase protection benefits for Amex cardholders |

| Kabbage (now American Express Business Blueprint) | Fintech / SME Lending | 2020 (Acquired) | Offers credit lines, checking, and payment tools to small businesses |

| LoungeBuddy | Travel / Airport Lounge Access | 2019 (Acquired) | Allows users to discover, access, and book airport lounges globally |

| Resy | Dining / Restaurant Reservations | 2019 (Acquired) | Provides restaurant reservation tech and exclusive dining experiences |

| Tock | Dining / Hospitality Management | 2024 (Acquired) | Manages restaurant, winery, and event reservations for premium merchants |

| Center | Expense Management Software | 2025 (Acquired) | Offers automated expense reporting tools for businesses using Amex |

| Various International Subsidiaries | Global Operations | Various | Manages card services, regulatory compliance, and localized services worldwide |

American Express Travel Related Services (TRS)

American Express Travel Related Services, commonly referred to as TRS, serves as the operational backbone for much of Amex’s global services. It provides critical infrastructure, including personnel, systems, and facilities, to support card issuance, travel logistics, and merchant partnerships. TRS channels revenue via merchant discount fees, card fees, and commissions from travel bookings, enabling seamless coordination across American Express’s various brands and geographies.

American Express National Bank

American Express National Bank is the company’s insured banking arm, offering online savings accounts, certificates of deposit, and personal lending products, alongside its credit and charge card functions. It originated in the late 1980s as a different entity and was rebranded following the consolidation of several legacy banks. Today, it handles both consumer deposits and card issuance, reinforcing the integrated financial model of Amex’s services.

Accertify, Inc.

Accertify is Amex’s global fraud prevention platform. Operating as a wholly owned subsidiary, it offers merchants software-driven fraud detection, chargeback management, and payment analytics. Its SaaS-based solutions, along with managed services, empower e-commerce businesses to guard against card-not-present fraud. Accertify enhances Amex’s risk management capabilities and positions the company as a technology-forward service provider.

AMEX Assurance Company

Operating as the internal underwriter, AMEX Assurance provides insurance coverage tied to American Express products. It offers protections such as extended warranties, purchase protection, travel accident insurance, and rental car loss coverage. Structured under the broader company umbrella, it allows Amex to deliver value-added benefits directly to its cardholders.

Kabbage (now American Express Business Blueprint)

Once an independent fintech lender, Kabbage was acquired by American Express in 2020. Integrated into Amex’s small business offerings, it rebranded as the “American Express Business Blueprint.” The platform delivers automated underwriting, quick access to credit lines, and small business checking solutions. It streamlines financial access for entrepreneurs and enriches Amex’s business customer portfolio.

LoungeBuddy

LoungeBuddy is a travel tech platform Amex acquired in 2019. It enables users to discover, book, and gain airport lounge access via a mobile app. This acquisition deepened Amex’s travel ecosystem, enhancing perks for premium cardholders and aligning with the company’s emphasis on exclusive travel experiences.

Resy

Amex acquired Resy, a digital restaurant reservation service, in 2019 to bolster its dining portfolio. Resy grants cardholders access to exclusive dining reservations, early booking windows, and curated culinary experiences. It reinforces Amex’s positioning as a lifestyle brand offering more than just financial services.

Tock

In 2024, American Express completed the acquisition of Tock, a platform serving high-end restaurants, wineries, and hospitality venues. Tock’s reservation management system allows partners to access Amex’s affluent customer base. This acquisition expanded Amex’s influence in the premium dining and hospitality market.

Center

In April 2025, American Express completed the acquisition of Center, a modern expense management software company that serves small and mid-sized businesses. Center’s platform automates policy setup, spending visibility, and accounting workflows. The integration of Center into Amex’s commercial card offerings enhances value for enterprise and SME clients through streamlined expense control.

Other International and Operational Entities

American Express also owns and operates an expansive roster of regional subsidiaries and legal entities, ranging from card issuance in markets like Mexico, India, Malaysia, and the Netherlands, to operational and service units in Europe, Asia, and Australia. These include regional subsidiaries such as American Express (India) Private Limited, American Express Australia Limited, and American Express de España. These entities localize Amex’s offerings—ranging from card services to concierge and corporate solutions—cementing its global presence.

Conclusion

American Express is a major player in the global financial landscape, known for its brand prestige and customer service. If you’re wondering who owns American Express, the answer is a diverse group of shareholders, with Berkshire Hathaway being the most significant among them.

The company has evolved from a mail business to a powerful financial institution with investments in banking, travel, technology, and risk management. It continues to thrive under seasoned leadership and a forward-looking strategy.

FAQs

Who owns American Express company?

American Express is a publicly traded company listed on the New York Stock Exchange (NYSE: AXP). It is owned by a mix of institutional investors, mutual funds, retail shareholders, and large investment firms. No single entity owns it entirely, though some firms hold significant shares.

Who owns American Express bank?

American Express National Bank is a wholly owned subsidiary of American Express Company. It is fully controlled and operated by the parent company to offer consumer banking products such as savings accounts, CDs, and credit cards.

Where was American Express founded?

American Express was founded in Buffalo, New York, in 1850. It began as an express mail business before evolving into financial services.

Where is American Express headquartered?

The global headquarters of American Express is located at 200 Vesey Street, New York, NY 10285, in Lower Manhattan, part of the Brookfield Place complex.

Is American Express a listed company?

Yes, American Express is a public company listed on the New York Stock Exchange under the ticker symbol AXP. It is a component of both the Dow Jones Industrial Average and the S&P 500 Index.

Who is the major shareholder of American Express?

As of August 2025, the largest shareholder of American Express is Berkshire Hathaway Inc., which owns around 20.1% of the company. Warren Buffett’s firm has maintained a large stake for decades and holds significant influence.

Who bought out American Express?

No company has bought out American Express. It remains an independent, publicly traded entity. There have been no acquisitions or mergers resulting in a buyout of the firm.

Does Standard Chartered own Amex?

No, Standard Chartered does not own American Express. They are separate financial institutions headquartered in different countries. However, they may have limited co-branded card partnerships in select markets, but there is no ownership involved.

Does Warren Buffett own American Express?

Yes, Warren Buffett, through his investment firm Berkshire Hathaway, owns a significant stake in American Express. It is one of Buffett’s longest-held investments and a core part of Berkshire’s portfolio.

Is American Express a bank?

Yes, American Express is also a bank. It operates under the name American Express National Bank and is regulated by the Office of the Comptroller of the Currency (OCC). While it is not a traditional bank with branch networks, it offers online banking services such as high-yield savings, CDs, and credit cards.

Who founded American Express?

American Express was co-founded in 1850 by Henry Wells, William G. Fargo, and John Butterfield. All three were pioneers in the express transportation and finance industries.

Is American Express owned by Warren Buffett?

Warren Buffett does not fully own American Express, but his firm, Berkshire Hathaway, is its largest shareholder, owning over 20% of the company. This gives him significant influence, though not full control.

Is American Express a Fortune 500 company?

Yes, American Express is a Fortune 500 company. As of 2025, it ranks among the top financial services companies in the United States based on revenue and market value.