What companies does Uber own is a common question asked by people who know the brand mainly for ride-hailing. Uber is no longer just about booking a ride.

Over the years, it has expanded into food delivery, logistics, and global partnerships that strengthen its reach. From Uber Eats to Uber Freight, the company owns and operates several businesses that make it more than a transport service.

Uber Company Profile

Uber Technologies Inc. is a global technology company based in San Francisco, California. It is best known for its ride-hailing app, but it also operates food delivery, freight logistics, and mobility services. Uber has grown into one of the world’s most recognized platforms, present in over 70 countries. Its core mission has been to simplify the way people move, deliver, and connect across cities.

Company Details

Uber was founded in 2009 and officially launched in 2010. Its headquarters is in San Francisco. The company trades on the New York Stock Exchange under the ticker UBER. Over the years, Uber has evolved from a simple black-car service into a multi-service platform.

Its main business lines now include mobility (ride-hailing), delivery (Uber Eats and Postmates), freight (Uber Freight), and regional operations (Careem in the Middle East).

Uber has made significant acquisitions to strengthen its global presence. It also divested some of its businesses, including autonomous driving unit ATG and operations in China, Russia, and Southeast Asia, in exchange for stakes in local competitors. This strategy helped it consolidate focus while maintaining global influence.

Founders

Uber was founded by Travis Kalanick and Garrett Camp.

- Garrett Camp, also a co-founder of StumbleUpon, came up with the idea of a mobile app that could request a ride with a tap.

- Travis Kalanick, an entrepreneur with a background in startups, joined Camp and helped turn the idea into a scalable business.

Together, they launched UberCab in 2010, which was later shortened to just Uber.

Major Milestones

- 2009: UberCab was founded in San Francisco.

- 2010: Official launch with a luxury black-car service.

- 2011: Uber expands internationally, starting in Paris.

- 2012: Launch of UberX, making rides more affordable and accessible.

- 2014–2016: Rapid global expansion, though facing regulatory challenges.

- 2016: Uber acquires Otto, a self-driving truck startup. It also sells its China operations to Didi Chuxing.

- 2017: Travis Kalanick resigns as CEO after controversies; Dara Khosrowshahi takes over.

- 2019: Uber goes public on the New York Stock Exchange.

- 2019: Uber acquires Careem in the Middle East.

- 2020: Uber acquires Postmates, expanding food and local delivery.

- 2021: Uber acquires Drizly and Car Next Door (later Uber Carshare).

- 2023–2024: Shuts down Drizly and Uber Carshare to focus on core business.

- 2025: Uber reaches strong profitability with record revenue and continues to dominate mobility and delivery markets.

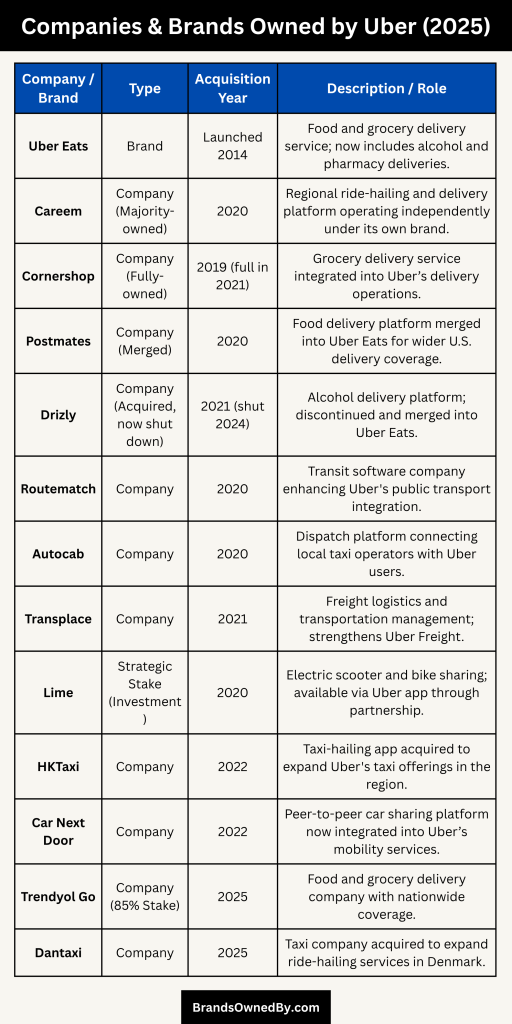

List of Companies Owned by Uber

Uber has expanded its portfolio through strategic acquisitions and investments in companies that align with its vision of seamless transportation and delivery.

These acquisitions not only diversify Uber’s offerings but also strengthen its foothold across industries like food delivery, freight, and advanced mobility solutions.

Below is a list of the major brands and companies owned by Uber as of 2025:

| Company/Brand | Type of Business | Year Acquired/Launched | Current Status (2025) | Key Details |

|---|---|---|---|---|

| Uber Eats | Food & grocery delivery | 2014 (launched) | Active | Operates in 6,000+ cities worldwide; integrated with Cornershop for grocery delivery. |

| Postmates | Delivery of food & goods | 2020 (acquired) | Integrated with Uber Eats | Strengthened Uber Eats in U.S. markets like LA and NYC. |

| Careem | Ride-hailing & delivery | 2019 (acquired) | Active (separate brand) | Operates across Middle East, North Africa, Pakistan; includes Careem Pay and food delivery. |

| Uber Freight | Logistics & freight broker | 2017 (launched) | Active | Connects shippers and carriers; scaled into U.S. and Europe with billions in annual revenue. |

| Drizly | Alcohol delivery platform | 2021 (acquired) | Closed in 2024 | Alcohol delivery service; integrated into Uber Eats before shutdown. |

| Uber Carshare (Car Next Door) | Peer-to-peer car sharing | 2022 (acquired) | Closed in 2024 | Allowed individuals to rent personal vehicles; shut down due to financial and operational challenges. |

| Otto | Self-driving trucks | 2016 (acquired) | Folded into ATG; later sold | Technology merged into Uber ATG; ATG sold to Aurora Innovation in 2020. |

| Jump Bikes | E-bike & scooter sharing | 2018 (acquired) | Divested to Lime (2020) | Users booked bikes/scooters through Uber app; Uber retained a stake in Lime. |

| Cornershop | Grocery delivery | 2019 (acquired) | Integrated into Uber Eats | Expanded Uber’s grocery delivery in Latin America and beyond. |

| Uber ATG (Advanced Technologies Group) | Autonomous driving research | 2015 (launched) | Sold in 2020 | Focused on self-driving cars; sold to Aurora Innovation. |

| Uber Elevate | Air mobility (flying taxis) | 2016 (launched) | Sold in 2020 | Later acquired by Joby Aviation; focused on urban air mobility. |

Uber Eats

Uber Eats is Uber’s global food delivery platform. Launched in 2014, it allows users to order food and beverages from restaurants and have them delivered by Uber drivers or cyclists.

Over the years, Uber Eats has become one of Uber’s largest revenue drivers. The service expanded through acquisitions, most notably Postmates in 2020, which was integrated into Uber Eats to strengthen its U.S. operations.

In some countries, Uber Eats also handles grocery and convenience store deliveries, making it a full-scale delivery marketplace.

Postmates

Uber acquired Postmates in December 2020 for $2.65 billion. Postmates was known for its “anything, anytime” delivery model. While much of Postmates’ operations merged into Uber Eats, the brand continued in some areas as a niche urban delivery service.

Postmates gave Uber greater reach in competitive U.S. cities like Los Angeles and New York, where Postmates had strong local loyalty.

Careem

Careem is a ride-hailing and delivery service based in Dubai. Uber acquired Careem in 2019 for $3.1 billion. Unlike other acquisitions, Careem was allowed to continue operating under its own brand.

This strategy preserved Careem’s strong identity in the Middle East, where it was deeply integrated into regional markets. Careem not only provides rides but also offers food delivery and digital wallet services, expanding Uber’s footprint in a region with unique needs.

Uber Freight

Uber Freight is the logistics arm of Uber, launched in 2017. It connects shippers with truck drivers, working as a digital freight broker. Uber Freight gives trucking companies the ability to book loads through an app in real time, similar to how passengers book rides.

Uber Freight acquired smaller logistics firms and scaled globally. It is now a key part of Uber’s long-term growth, contributing billions in annual revenue.

Drizly

Uber purchased Drizly, an alcohol delivery platform, in 2021 for $1.1 billion. The service allowed customers to order alcohol from local liquor stores and have it delivered.

However, Uber shut down Drizly in 2024 due to regulatory challenges and market overlaps with Uber Eats. Despite its closure, the acquisition helped Uber expand temporarily into the alcohol delivery business and informed its broader delivery strategies.

Uber Carshare

Uber acquired Car Next Door, an Australian peer-to-peer car-sharing company, in early 2022. It was rebranded as Uber Carshare. The platform allowed individuals to rent out their personal vehicles when not in use.

This aligned with Uber’s vision of flexible mobility options. However, the service was discontinued in September 2024 after financial and operational challenges.

Otto

Otto was a self-driving truck startup acquired by Uber in 2016. Its technology was integrated into Uber’s autonomous vehicle research. Otto was an early step in Uber’s push toward self-driving technology.

However, the project faced lawsuits and later merged into Uber’s Advanced Technologies Group (ATG). Uber eventually sold ATG to Aurora Innovation in 2020, but retained Otto’s legacy as part of its self-driving efforts.

Jump Bikes

Uber purchased Jump Bikes in 2018, a dockless e-bike and scooter rental company. Jump was integrated into the Uber app, allowing users to book rides or bikes seamlessly.

In 2020, Uber transferred Jump to Lime as part of a strategic partnership but retained a stake in Lime. Although Uber no longer owns Jump directly, this move positioned Uber within the micromobility sector through its Lime investment.

Cornershop

Uber acquired a majority stake in Cornershop, a Latin American grocery delivery company, in 2019 and later took full ownership in 2020. Cornershop was integrated into Uber Eats, which now offers grocery delivery in multiple regions.

This acquisition helped Uber build a stronger foothold in Latin America and in the growing grocery delivery market.

Other Entities and Ventures

Uber has invested in and operated several other ventures over the years:

- Uber Advanced Technologies Group (ATG): Focused on self-driving cars, sold to Aurora in 2020.

- Uber Elevate: An air mobility division working on flying taxis, later sold to Joby Aviation in 2020.

- Geospecific partnerships: Uber has also formed regional alliances by selling operations to local competitors like Didi in China, Yandex in Russia, and Grab in Southeast Asia, while maintaining equity stakes in these companies.

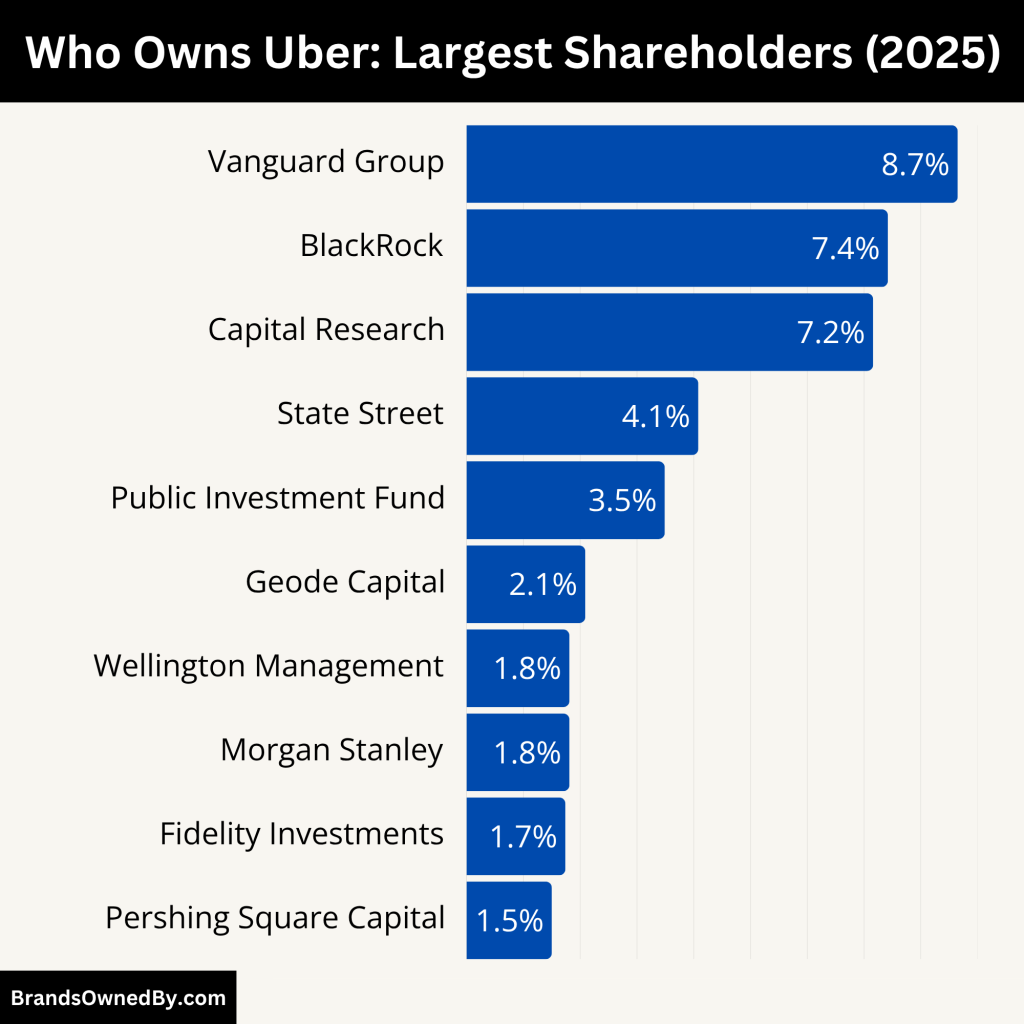

Who Owns Uber?

Uber is a publicly traded company listed on the New York Stock Exchange under the ticker UBER. Because it is publicly listed, no single person or entity has full control. Instead, its ownership is spread across institutional investors, sovereign wealth funds, hedge funds, and a small pool of insiders and retail investors.

Most of Uber’s shares are concentrated in large institutional investors. As of 2025:

- Institutional investors hold about 80–82% of Uber’s stock. This is typical of a large-cap U.S. technology company and reflects trust in Uber’s long-term growth.

- Insider ownership is small, sitting around 1.7–1.8%. While not large, this ensures executives and board members have direct financial alignment with shareholders.

- Retail investors hold less than 1%, as most shares are traded in large blocks by funds and institutions.

This mix means Uber’s strategic direction is heavily influenced by the biggest global investment managers, while its executives hold symbolic but impactful stakes.

Below is an overview of the major shareholders of Uber as of August 2025:

| Shareholder / Investor | Type of Investor | Ownership % (2025) | Approx. Shares Held | Key Details |

|---|---|---|---|---|

| The Vanguard Group | Institutional (Asset Manager) | ~8.7% | ~178M shares | Largest shareholder; manages index funds and ETFs; exerts strong governance influence. |

| BlackRock, Inc. | Institutional (Asset Manager) | ~7.4% | ~151M shares | Second largest; focuses on governance and sustainability in portfolio companies. |

| Capital Research & Management (Global Investors) | Institutional (Active Fund) | ~7.2% | ~147M shares | Active investment firm with influence on Uber’s long-term growth strategy. |

| State Street Global Advisors | Institutional (Asset Manager) | ~4.1% | ~84M shares | One of the “Big Three” index fund managers; governance-focused role. |

| Morgan Stanley | Institutional (Investment Bank & Asset Manager) | ~3.9% | ~80M shares | Was a lead underwriter of Uber’s IPO; maintains a significant equity position. |

| Public Investment Fund (Saudi Arabia) | Sovereign Wealth Fund | ~3.5% | ~73M shares | Invested pre-IPO; has board representation (Turqi Alnowaiser); strengthens Uber’s Middle East ties. |

| Pershing Square Capital (Bill Ackman) | Hedge Fund / Activist | ~1.0% | ~30M shares | Took a $2B stake in 2025; known activist investor with potential to push for strategic shifts. |

| Dara Khosrowshahi (CEO) | Insider / Executive | <0.1% | ~2.3M shares | CEO since 2017; significant individual shareholder aligning his compensation with Uber’s stock. |

| Turqi Alnowaiser (PIF Board Member) | Insider (via PIF stake) | ~3.5% (indirect) | ~73M shares | Represents PIF’s interest on Uber’s board; strategic voice from Middle East. |

| Other Insiders (Board & Executives) | Insiders | ~1% combined | ~20M shares (est.) | Includes Ronald Sugar (Chairman), Tony West (CLO), Nikki Krishnamurthy (CPO), and others. |

| Retail Investors | Individual Shareholders | <1% | Small float | Limited retail participation compared to institutional investors. |

The Vanguard Group

The Vanguard Group is Uber’s single largest shareholder, owning around 8.6–8.7% of the company. Vanguard is a passive investor, managing index funds and ETFs. While it does not actively interfere in Uber’s management, its large position gives it strong voting power in shareholder meetings. Vanguard typically votes on governance issues and pushes for long-term shareholder value.

BlackRock, Inc.

BlackRock holds about 7.4% of Uber’s equity. Similar to Vanguard, it manages index and active funds. BlackRock has a reputation for supporting sustainability and governance reforms. At Uber, it plays a quiet but powerful role by shaping board and executive decisions through voting influence.

Capital Research & Management (Global Investors)

Capital Research holds roughly 7.2% of Uber’s shares. Unlike passive funds, Capital Research is more active in how it manages holdings. This makes it an influential shareholder that can shape Uber’s financial and operational strategy, especially as Uber expands into freight and delivery.

State Street Global Advisors

State Street owns about 4.1% of Uber. As one of the “Big Three” asset managers alongside Vanguard and BlackRock, it plays a stabilizing role. State Street’s influence is more governance-focused, ensuring Uber meets global standards for board accountability and shareholder reporting.

Morgan Stanley

Morgan Stanley controls about 3.9% of Uber’s shares. Beyond being an investor, Morgan Stanley was also a lead underwriter during Uber’s 2019 IPO. This dual role makes it both a financial advisor and shareholder, with a vested interest in Uber’s long-term success.

Public Investment Fund (Saudi Arabia)

Saudi Arabia’s Public Investment Fund (PIF) owns approximately 3.5% of Uber. This investment was made years before Uber’s IPO and reflects Saudi Arabia’s strategy to diversify its economy beyond oil. PIF’s presence on Uber’s board ensures that Uber has strong ties to Middle Eastern markets, particularly through its Careem subsidiary.

Turqi Alnowaiser (PIF Board Member)

Turqi Alnowaiser represents the Saudi Public Investment Fund on Uber’s board. Through PIF’s stake, he indirectly holds about 3.5% of Uber, equivalent to more than 70 million shares. His role bridges Uber with Middle Eastern business opportunities, especially as Uber strengthens its partnerships in the region.

Dara Khosrowshahi (CEO)

Uber’s CEO, Dara Khosrowshahi, personally owns about 2.3 million shares of Uber. While this is less than 1% of the company, it still makes him one of the largest individual shareholders. His ownership stake ensures alignment with Uber’s performance, as much of his compensation is tied to stock-based incentives.

Other Executives and Board Members

Several other Uber insiders own smaller stakes, including Nikki Krishnamurthy (Chief People Officer), Tony West (Chief Legal Officer), and Ronald Sugar (Chairman of the Board). While their stakes are relatively minor, they help align management with shareholder interests. Collectively, insiders hold under 2% of the company.

Pershing Square Capital Management

In early 2025, billionaire investor Bill Ackman revealed a major stake in Uber through his hedge fund Pershing Square Capital Management.

The fund purchased about 30.3 million shares, equivalent to roughly 1% of Uber’s market value, worth more than $2 billion.

This move sparked a surge in Uber’s stock price, as markets saw Ackman’s entry as a vote of confidence in Uber’s long-term potential.

Ackman is known for being an activist investor, which means he could push Uber toward new strategic moves, such as accelerating profitability in Uber Eats or exploring spin-offs.

Other Hedge Funds and Value Investors

- Robert Karr (Joho Capital): Allocated about 12.5% of his portfolio to Uber, signaling strong conviction.

- David Tepper (Appaloosa Management): Holds Uber among his technology and mobility bets.

- Other value-driven funds also hold Uber, reflecting a belief in its freight and delivery growth.

These hedge fund stakes are smaller compared to passive giants like Vanguard and BlackRock, but they often create momentum in Uber’s stock performance, especially when activist voices like Ackman’s are added to the mix.

Who is The CEO of Uber?

As of 2025, Uber is led by Dara Khosrowshahi, who has served as CEO since 2017. He was appointed after the resignation of Uber’s controversial founder, Travis Kalanick. Dara is widely credited with steering the company away from its turbulent early years and reshaping it into a more stable, profitable, and globally respected business.

Background and Early Career

Dara Khosrowshahi was born in Tehran, Iran, in 1969, and emigrated to the United States during his childhood. He studied electrical engineering at Brown University. His career began in finance with Allen & Company, where he gained valuable experience in mergers and acquisitions.

Later, he joined IAC (InterActiveCorp), where he quickly rose to senior leadership positions. In 2005, he became CEO of Expedia, turning the online travel agency into a global powerhouse through strategic acquisitions and global expansion. His long tenure at Expedia prepared him for the complex challenges of leading a company like Uber.

Leadership Style at Uber

Dara is known for a calm, measured leadership style that contrasts sharply with Uber’s earlier, aggressive culture. He emphasizes transparency, compliance, and long-term sustainability. Under his leadership, Uber focused on three core pillars: ride-hailing, delivery (Uber Eats and acquisitions like Postmates), and freight logistics.

He also pushed Uber toward operational discipline, leading to significant cost cuts, divestitures of non-core businesses, and focusing resources on profitable areas. His approach helped Uber achieve profitability on an adjusted EBITDA basis for the first time in 2021.

Achievements as CEO

- Stabilized Uber’s culture after years of scandals under Travis Kalanick.

- Expanded Uber Eats into one of the largest food and grocery delivery platforms in the world.

- Scaled Uber Freight, turning it into a billion-dollar logistics platform.

- Divested non-core businesses like Uber Elevate (air taxis) and ATG (self-driving cars), while maintaining strategic partnerships.

- Pushed for profitability, transforming Uber from a growth-first startup to a financially disciplined tech giant.

- Strengthened Uber’s global footprint, especially through Careem in the Middle East and Latin America expansion.

Compensation and Shareholding

In 2025, Dara Khosrowshahi’s compensation is heavily tied to Uber’s stock performance. He holds approximately 2.3 million shares, aligning his incentives with investors. His pay package includes base salary, stock awards, and performance-based bonuses linked to revenue growth, profitability, and market share expansion.

Role in Uber’s Future

Dara’s strategy for Uber in 2025 is focused on:

- Expanding Uber Eats into retail and convenience delivery.

- Strengthening Uber Freight through AI-driven logistics.

- Enhancing sustainability with electric vehicles and partnerships.

- Deepening Uber’s presence in emerging markets through Careem and other subsidiaries.

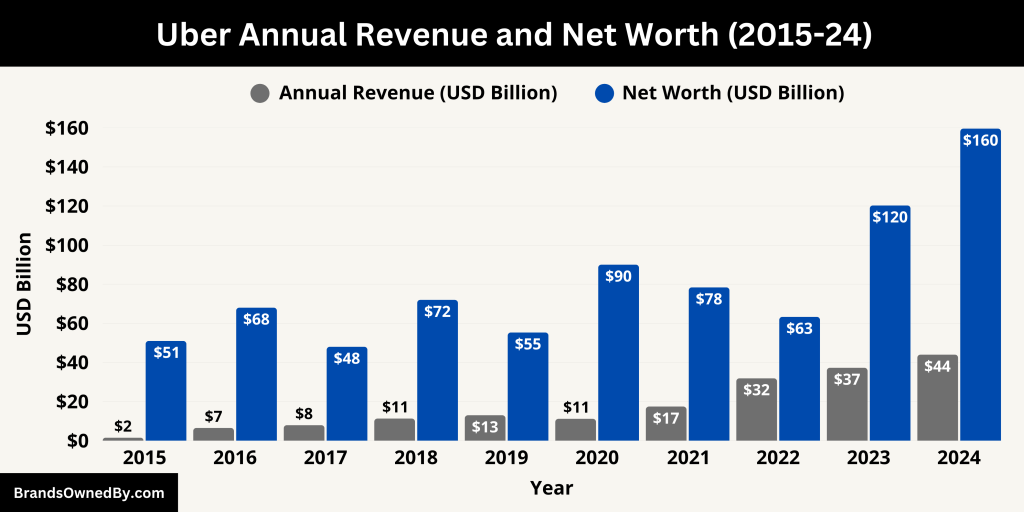

Uber Annual Revenue and Net Worth

As of 2025, Uber has continued its steady growth across its three main business segments: mobility (ride-hailing), delivery (Uber Eats), and logistics (Uber Freight). The company generated an estimated $46.8 billion in annual revenue in 2025.

This growth reflects increasing demand in ride-hailing after global travel fully recovered, as well as expansion in Uber Eats beyond food into groceries, convenience items, and retail delivery. Uber Freight also became a strong contributor with consistent double-digit revenue growth, benefiting from AI-driven logistics and an expanding European footprint.

Revenue Breakdown by Business Segment

- Mobility (Ride-Hailing): Uber’s core ride-hailing service remains its largest revenue driver, contributing around 55% of total revenue in 2025. The growth was supported by strong demand in North America, Europe, and Latin America.

- Delivery (Uber Eats & Postmates): Uber Eats accounted for about 33% of total revenue, making it a key driver of diversification. Grocery delivery, enabled by the integration of Cornershop, added new revenue streams.

- Freight (Uber Freight): Logistics generated nearly 12% of Uber’s revenue in 2025. This segment grew significantly due to partnerships with large shipping companies and the adoption of automated logistics platforms.

Uber Net Worth in 2025

Uber’s net worth in 2025 is estimated at $150 billion, based on its market capitalization and asset valuation. The company’s stock has seen strong performance, largely due to sustained profitability and long-term investor confidence.

The net worth is also supported by Uber’s equity stakes in international ride-hailing giants such as Grab, Didi, Yandex.Taxi, and Lime, which continue to add value to its balance sheet.

Profitability and Margins

Uber became sustainably profitable in the early 2020s, and by 2025, it has improved its operating margins to 10%. This profitability is a sharp contrast to the early years when the company struggled with high operating losses. Strategic cost-cutting, divestments of non-core businesses, and increased efficiency in operations allowed Uber to strengthen its financial standing.

Growth Outlook Beyond 2025

Looking ahead, Uber plans to continue scaling in three key areas:

- Mobility electrification with a global shift to electric vehicles by 2030.

- Expansion of Uber Eats into retail, medicine, and package delivery.

- Further growth of Uber Freight through AI-powered supply chain solutions.

Uber’s revenue and net worth position it as one of the most influential companies in the global transportation and logistics industry in 2025.

Conclusion

Uber has transformed from a simple ride-hailing startup into a global powerhouse that spans transportation, food delivery, and logistics. Its acquisitions, partnerships, and strategic focus have allowed it to remain a leader in multiple industries.

With strong revenue growth, rising net worth, and steady leadership under Dara Khosrowshahi, Uber is positioned for long-term success. Understanding what companies does Uber own gives a clear picture of how the business has expanded its ecosystem far beyond rides.

In 2025, Uber is not only shaping how people move but also how they eat, shop, and ship goods worldwide.

FAQs

Who own Uber?

Uber is a publicly traded company listed on the New York Stock Exchange under the ticker symbol UBER. It does not have a single owner. Instead, it is owned by millions of institutional investors, mutual funds, and individual shareholders. The largest shareholders include Vanguard Group, Morgan Stanley, and BlackRock, along with company executives and board members.

Who owns Uber Freight?

Uber Freight is a division fully owned and operated by Uber Technologies Inc. It was launched in 2017 as Uber’s logistics and trucking platform. Although Uber Freight has its own management team, the business is an integrated segment of Uber’s overall operations.

What companies does Uber own in the world?

Uber owns several companies across different regions and industries. Major ones include Uber Eats, Postmates, Cornershop, Drizly, and Uber Freight. The company also holds investments in international ride-hailing services like Grab (Southeast Asia), Yandex.Taxi (Russia), and Didi (China).

Which companies are owned by Uber?

Uber owns Uber Eats, Postmates, Cornershop, Drizly, Careem (majority stake), and Uber Freight. These brands represent its global reach in ride-hailing, delivery, and logistics.

What company did Uber buy out?

Uber has acquired multiple companies over the years. Its most notable buyouts include Postmates (2020) to expand food delivery, Cornershop (2019-2020) to enter grocery delivery, and Careem (2019) to strengthen its position in the Middle East.

What companies does Uber partner with?

Uber has strategic partnerships with a wide range of companies. These include Spotify (in-car music streaming), Marriott (loyalty program integration), Toyota (electric vehicle development), and several airlines, such as United Airlines and Emirates for smoother airport travel experiences.

Does Uber own Careem?

Yes, Uber acquired a majority stake in Careem in 2019 for $3.1 billion. Careem continues to operate as a separate brand in the Middle East, but it is part of Uber’s global business structure.

Did Uber buy Lyft?

No, Uber never bought Lyft. Lyft remains a separate American ride-hailing company and is Uber’s main competitor in the United States.

Does Uber own Postmates?

Yes, Uber acquired Postmates in 2020 for $2.65 billion. Postmates was merged into Uber Eats, but its brand and app continue to operate in certain U.S. cities.

Did Uber buy Foodpanda?

No, Uber never bought Foodpanda. Foodpanda is owned by Delivery Hero, a German food delivery company. Uber competes with Foodpanda in several international markets.

Has Jeff Bezos invested in Uber?

Jeff Bezos personally invested in Uber during its early fundraising rounds in 2011. His investment was relatively small compared to institutional investors but added prestige to Uber’s growth story.

Which airline partners with Uber?

Uber has partnerships with several airlines worldwide. For example, United Airlines in the U.S. and Emirates in Dubai offer seamless ride-booking through their apps or loyalty programs. These partnerships make airport transfers more convenient for passengers.

Did Google invest in Uber?

Yes, Google’s parent company, Alphabet, invested in Uber through its venture capital arm, GV (formerly Google Ventures), in 2013. However, Alphabet later shifted some of its focus to its own autonomous vehicle project, Waymo.

Did Apple invest in Uber?

Apple did not directly invest in Uber. However, Apple CEO Tim Cook has publicly supported Uber’s innovations. Apple has also integrated Uber into its ecosystem through Siri and Apple Maps ride-booking features.

Who is the parent company of Uber?

Uber does not have a parent company. It is an independent, publicly traded company known as Uber Technologies Inc.

Does Google own Uber?

No, Google does not own Uber. While Alphabet (Google’s parent company) was an early investor, Uber operates independently and is controlled by its public shareholders.