Cargill is one of the largest private companies in the world. When asking what companies does Cargill own, it’s important to look at its vast global footprint across agriculture, food, animal nutrition, and industrial sectors. Cargill’s reach extends to over 70 countries, with ownership and partnerships in dozens of companies that play a significant role in the global food supply chain.

Cargill Company Profile

Cargill is a global leader in food, agriculture, trading, and industrial products. It is one of the largest privately held corporations in the world. With operations in over 70 countries, Cargill plays a key role in the global supply chain, especially in food production and distribution. It serves businesses in farming, food service, pharmaceuticals, and energy industries.

Company Overview and Details

Cargill is headquartered in Minnetonka, Minnesota. It operates across four major sectors: agricultural supply chain, animal nutrition, food ingredients and bioindustrials, and protein and salt. The company is involved in grain trading, meat processing, edible oils, animal feed, cocoa and chocolate, and even financial services for commodities markets.

Cargill employs more than 160,000 people worldwide and serves customers in more than 125 countries. Despite its size, Cargill remains a private company, owned primarily by family shareholders, which allows it to make long-term strategic decisions without public shareholder pressure.

Founders

Cargill was founded in 1865 by William Wallace Cargill. He began the company with a single grain storage warehouse in Conover, Iowa. His goal was to help farmers store and transport crops more efficiently as railroads expanded across the U.S.

Later, his son-in-law John MacMillan Sr. joined the business, forming the foundation for two family dynasties—Cargill and MacMillan—that still control the company today.

Major Milestones

- 1865: William Wallace Cargill opens a grain warehouse, founding the company.

- 1875: Cargill begins expanding into the grain trading business.

- 1909: John MacMillan Sr. becomes president and expands into new markets.

- 1930s: Cargill enters the international grain trade, even during the Great Depression.

- 1960s: It begins global expansion, including Latin America, Europe, and Asia.

- 1970s: Enters meat processing, edible oils, and cocoa trading.

- 1990s: Rapid expansion through acquisitions in feed, chocolate, and financial services.

- 2000s: Forms strategic partnerships and joint ventures in Asia and Africa.

- 2011: Sells its 64% stake in The Mosaic Company, ending a major chapter in its fertilizer business.

- 2015: Acquires EWOS, a leader in aquaculture feed, to expand into fish farming.

- 2020–2025: Focuses on sustainability, carbon reduction, and food innovation, including investments in plant-based proteins and bioplastics.

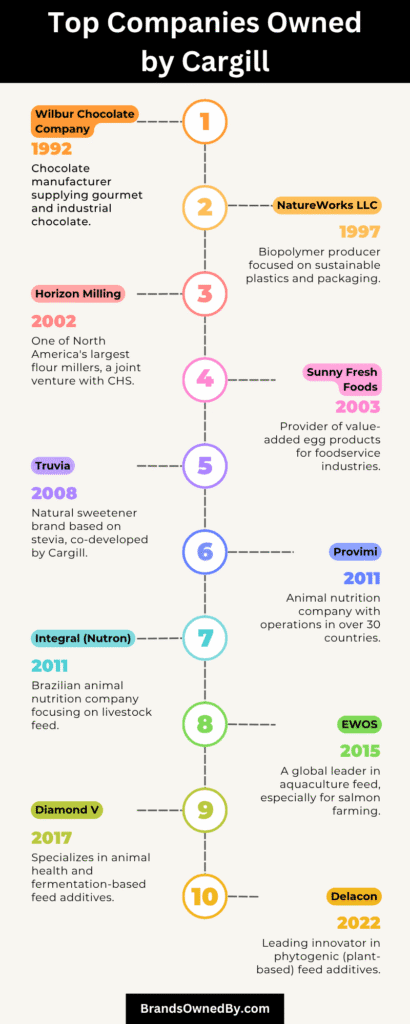

List of Companies Owned by Cargill

Here’s a list of the major brands, subsidiaries, entities, and companies owned by Cargill as of August 2025:

EWOS

EWOS is one of the world’s leading aquafeed companies, headquartered in Norway. Cargill acquired EWOS in 2015 for $1.5 billion to enter the aquaculture sector. Since the acquisition, EWOS has been fully integrated into Cargill Animal Nutrition & Health. The company specializes in feed for farmed salmon and trout and operates large production facilities in Norway, Chile, Canada, and Vietnam. EWOS plays a key role in Cargill’s strategy to support the growing demand for sustainable seafood.

Provimi

Provimi was a Dutch-based animal nutrition firm acquired by Cargill in 2011 for €1.5 billion. It added a broad portfolio of premixes, feed additives, and nutritional services for swine, poultry, and ruminants. Today, Provimi operates across Europe, Latin America, and Asia, serving industrial-scale farms and feed mills. It remains a cornerstone of Cargill’s animal nutrition business, offering data-driven formulations and veterinary support. Provimi also supports Cargill’s push for precision feeding technologies.

NatureWorks LLC

NatureWorks is a Cargill majority-owned joint venture with PTT Global Chemical of Thailand. The company produces Ingeo™, a patented biopolymer made from renewable plant materials, primarily corn. These bioplastics are used in food packaging, compostable utensils, textiles, and hygiene products. In 2023, NatureWorks began building a second biopolymer facility in Thailand to meet global demand. It represents Cargill’s investment in circular economy and plant-based industrial materials.

Diamond V

Cargill acquired Diamond V in 2017 to strengthen its role in animal health and nutrition. Based in Iowa, Diamond V develops fermentation-based products that improve immunity, gut health, and nutrient absorption in livestock and poultry. It is a leader in postbiotic technologies and works closely with veterinarians and integrators worldwide. Diamond V retains its brand identity and continues to run R&D operations independently while benefiting from Cargill’s global distribution.

Delacon

Delacon is an Austrian company and pioneer in phytogenic feed additives. It was fully acquired by Cargill in 2022. The company formulates natural ingredients from herbs, spices, and plant extracts to enhance animal performance without antibiotics. Delacon has offices and partners in more than 80 countries and focuses on poultry, swine, and ruminant markets. Its research-based approach supports Cargill’s goal of developing sustainable and residue-free animal nutrition solutions.

Wilbur Chocolate

Wilbur Chocolate was a historic chocolate brand in Pennsylvania, acquired by Cargill in the early 2000s. While the Wilbur retail store was closed, the manufacturing operations were integrated into Cargill’s chocolate production network. Its legacy recipes and chocolate formats are still used in commercial baking and foodservice applications. The factory in Lititz remains a strategic site for Cargill Cocoa & Chocolate in the U.S.

Peter’s Chocolate

Peter’s Chocolate is one of the oldest American chocolate brands, originally founded in Switzerland. Cargill acquired it from Nestlé in 2002. The brand now operates under Cargill Cocoa & Chocolate and supplies high-quality chocolate coatings, blocks, and chips to confectioners and bakeries across North America. Peter’s remains a premium brand focused on artisanal and commercial chocolatiers.

Gerkens Cocoa

Gerkens is Cargill’s flagship cocoa powder brand. It offers a wide range of colors and flavor profiles for use in beverages, baked goods, and dairy. Originating in the Netherlands, Gerkens cocoa powder is processed in state-of-the-art plants in Europe and West Africa. It supports Cargill’s bean-to-bar traceability and sustainable cocoa sourcing efforts, especially through the Cocoa Promise program.

Honeysuckle White

Honeysuckle White is a vertically integrated turkey brand owned by Cargill and distributed widely across the United States. The brand emphasizes traceability and transparency. Consumers can even trace the farm where their turkey was raised through QR codes. Honeysuckle White turkeys are antibiotic-free and raised on family farms under strict animal welfare protocols. Cargill owns the hatcheries, feed mills, grow-out farms, and processing facilities that support the brand.

Shady Brook Farms

Shady Brook Farms is Cargill’s turkey brand primarily marketed in the eastern U.S. It operates similarly to Honeysuckle White, focusing on family-farm-raised, antibiotic-free turkeys. It is USDA Process Verified and meets Cargill’s high animal welfare standards. Together with Honeysuckle White, it represents Cargill’s leading share in the U.S. turkey market.

Nutrena

Nutrena is a well-known brand under Cargill Animal Nutrition offering feed for horses, pets, poultry, and livestock. Its products are available through agricultural retailers and farm supply stores across the U.S. Nutrena focuses on balanced, high-performance feed formulas and also provides feeding guidance for small-scale farmers and hobbyists. It supports Cargill’s mission to nourish animals across all segments—from backyard chickens to performance horses.

Southern States Feed

Cargill manufactures and supplies feed products sold under the Southern States brand through licensing and production partnerships. These products are distributed through cooperatives and rural retailers across the southeastern U.S. Cargill produces customized rations for cattle, horses, goats, and swine under this brand and ensures consistent nutrition for regional livestock operations.

Diamond Crystal Salt (Cargill Salt Division)

Cargill acquired Diamond Crystal Salt Company in 1973. It is now part of Cargill’s Salt division and provides consumer, water softening, agricultural, and industrial salt. Its products are available in grocery stores and used in food processing, road de-icing, and water treatment. Diamond Crystal Kosher Salt is particularly popular with chefs for its texture and flavor.

Black River Asset Management

Black River was formed in 2003 as Cargill’s internal hedge fund arm. While some units were spun off in 2015, parts of Black River still operate under Cargill’s investment group, focusing on commodity markets and private equity. The firm helps Cargill manage risk and identify financial opportunities across its global supply chains.

Cargill Metals

Cargill Metals trades and distributes steel and iron ore. It provides raw materials to manufacturers, construction firms, and infrastructure developers worldwide. Cargill owns and operates supply chain networks in Asia, Europe, and the Americas for ferrous products. The division also helps customers manage price volatility through hedging tools.

Cargill Risk Management

Cargill Risk Management is a wholly owned subsidiary that helps businesses hedge against price fluctuations in agricultural commodities, energy, and interest rates. It serves farmers, cooperatives, and food processors with custom financial products. This arm supports clients in managing margins and planning for market uncertainty.

Cargill Bioindustrial

This division produces industrial-use chemicals derived from renewable plant materials, such as soy and corn. Products include adhesives, lubricants, paints, and construction materials. The bioindustrial team works closely with manufacturers seeking to reduce carbon footprints by replacing petrochemical ingredients.

Cargill Cocoa & Chocolate

Cargill Cocoa & Chocolate handles sourcing, processing, and manufacturing of chocolate and cocoa products. It owns factories in the U.S., Europe, and West Africa. The division supports major food brands with ingredients like cocoa liquor, butter, and powder. It also oversees sustainability programs to support cocoa farmers.

Cargill Protein – North America

This division is responsible for meat and egg operations. It includes beef processing plants in Kansas, Nebraska, and Colorado, turkey operations in Texas and Virginia, and egg production under contract. Cargill Protein provides meat products to restaurants, foodservice chains, and retail grocers. It is one of the top meat suppliers in the U.S.

Cargill Animal Nutrition and Health

This is a global division managing all animal feed, additives, and health-related products. It includes operations under brands like Provimi, Nutrena, Diamond V, and Delacon. The division serves poultry, dairy, aquaculture, and livestock producers in over 40 countries.

Cargill Agricultural Supply Chain

This core business unit handles sourcing, transporting, and marketing of grains, oilseeds, and pulses. Cargill operates silos, terminals, and ports globally. It moves agricultural commodities from farms to markets, mills, and food manufacturers. It’s also active in origination and market-making for futures and physical commodities.

Cargill Food Ingredients & Bioindustrial

This division produces sweeteners, starches, oils, lecithins, texturizers, and specialty food ingredients. It supplies large food and beverage manufacturers across North America, Europe, and Asia. Products include corn syrup, soybean oil, and functional ingredients used in bakery, dairy, and snacks.

Cargill Starches, Sweeteners & Texturizers

A sub-division of food ingredients, this unit creates ingredient solutions for food processing and industrial use. Products include modified starches, glucose, polyols, and functional blends. It works with R&D teams at global food companies to enhance texture, shelf life, and flavor.

Cargill Ocean Transportation

This is one of the largest private ocean freight operators in the world. Cargill charters and operates over 500 dry bulk and tanker vessels each year. It ships grain, fertilizer, energy products, and metals across the globe. The division also works on decarbonizing shipping through fuel innovation and route optimization.

Two U.S. Feed Mills from Compana Pet Brands

In September 2024, Cargill acquired two feed mills from Compana Pet Brands—one in Denver, Colorado, and another in Kansas City, Kansas.

This acquisition enhances Cargill’s Animal Nutrition & Health division in the western and central U.S. The Denver facility employs over 35 staff and includes dedicated packing lines. Cargill plans to modernize it into a flagship feed mill.

The Kansas City mill sits adjacent to an existing Cargill site, boosting production capacity and customer reach in that region. Both facilities support growth across retail pet food, backyard farming and large-scale livestock feed.

Soybean Crusher Plant in Barreiras, Brazil

In June 2025, Cargill completed a corporate asset purchase of a soybean crushing plant in Barreiras, Brazil. This acquisition strengthens its soybean processing and oilseed capabilities in Brazil’s agricultural heartland. The move supports local sourcing and enhances the company’s ability to produce meal, oil, and related products for domestic and export markets.

SJC Bioenergia (Brazil)

In February 2025, Cargill agreed to acquire the remaining 50 % stake in SJC Bioenergia, a renewable energy and sugarcane processing firm in Goiás, Brazil. Founded in 2006, SJC processes sugarcane and corn to produce raw sugar, fuel-grade ethanol, corn oil, high-protein dried grains (DDGs), and electricity.

The deal, upon regulatory approval, gives Cargill 100 % ownership. It aligns with the company’s strategy to grow in renewable energy, biofuels and sustainable agriculture.

Teys Australia and Teys USA

In June 2025, Cargill moved to acquire 100 % ownership of Teys Australia and Teys USA, transitioning from a 50:50 joint venture to single ownership. Teys, founded in 1946, is among Australia’s largest beef processors with operations in Queensland, New South Wales, and South Australia; it also runs feedlots, value‑added processing, and distribution in the U.S.

The purchase honors a seventy-five-year family legacy. Pending approvals, Cargill will name a new CEO and integrate Teys fully into its global protein network.

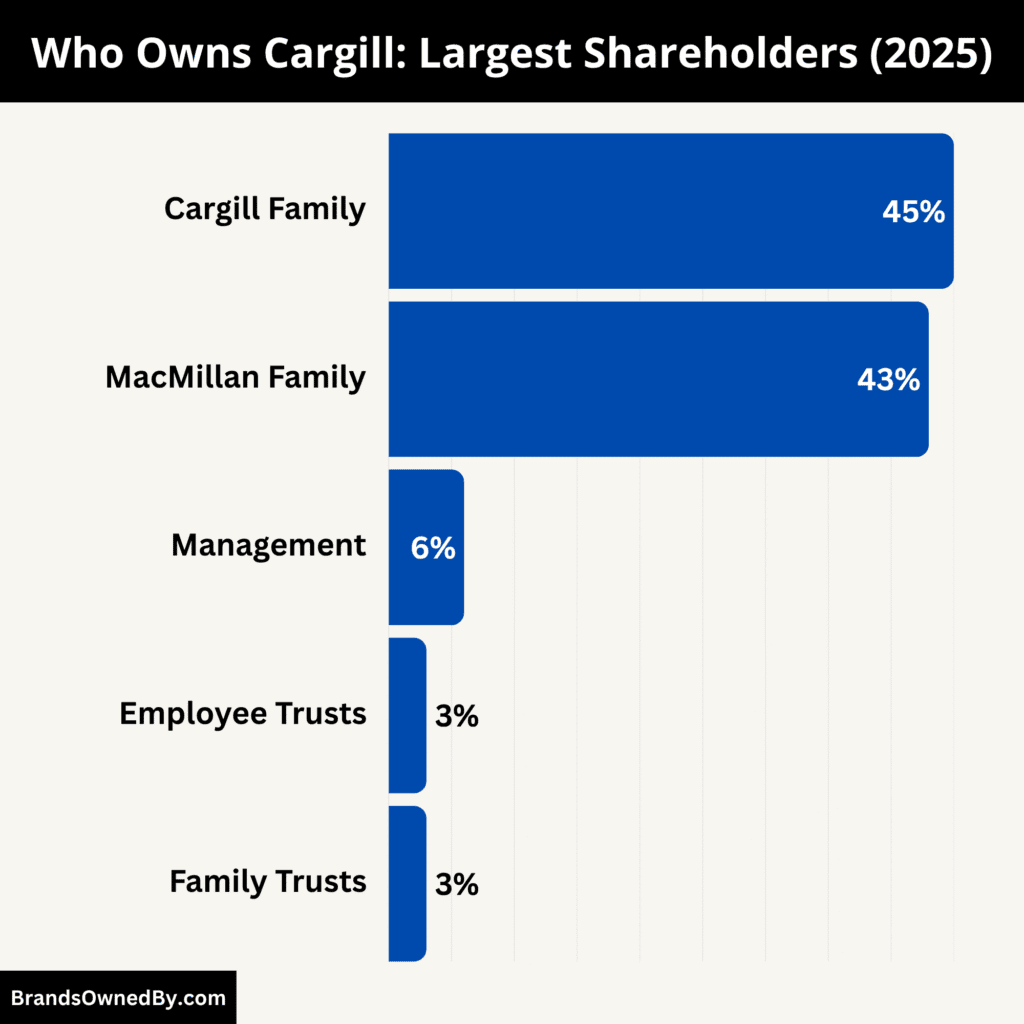

Who Owns Cargill?

Cargill remains a privately held company, owned almost entirely by members of the Cargill and MacMillan families. These descendants collectively hold approximately 88%–90% of the company’s equity.

The company does not issue public stock and maintains control through private family governance and internal ownership arrangements.

Approximately 100 family members hold shares, though historically, around 23 key individuals made up the core holding group. Ownership is managed through family trusts and internal share transfers, enabling long‑term strategic control without exposure to public markets.

Here’s a list of the major shareholders of Cargill:

Pauline MacMillan Keinath

One of the wealthiest individual holders, Pauline MacMillan Keinath, reportedly owns around 9%–13% of Cargill. As a great‑granddaughter of founder W.W. Cargill, she has been listed among the richest Americans, reflecting her large stake in the company.

Marianne Cargill Liebmann

Marianne Liebmann, another great‑granddaughter of William Cargill, holds a significant share of Cargill as part of the extended family equity pool. Her wealth and holdings similarly place her among the billionaire heirs of the family.

James R. Cargill II and Austen S. Cargill II

James R. Cargill II and Austen S. Cargill II are additional direct descendants and shareholders. They each hold multi‑percent stakes and are included in the ranks of the Cargill‑MacMillan family billionaires. Their ownership is part of the roughly 88% total held by the family group.

Employee Ownership & Minority Holders

Cargill also operates an Employee Stock Ownership Plan (ESOP) and internal share systems. While small in proportion, these holdings create alignment with employee interests. Employees hold a minor stake (historically less than 5%) and are not significant decision‑makers.

Family Governance & Board Representation

The Cargill‑MacMillan family participates in oversight through a Family Council and board representation. Historically, around six family members have sat on Cargill’s board, ensuring family perspectives influence strategic decisions. Day‑to‑day management is handled by professional executives.

Dividend Policy & Capital Management

Cargill is known to retain about 80% of its net income for reinvestment each year. The remaining roughly 18% is paid out as dividends to family shareholders. In late 2024, the company distributed around $500 million in a special dividend and repurchased $1.5 billion in shares, benefitting largely family owners during a workforce restructuring phase.

Who is the CEO of Cargill?

Brian Sikes has served as Chief Executive Officer of Cargill since January 1, 2023. He was elected Chair of the Board in January 2024, combining the roles of Board Chair and CEO. He is the 10th CEO in the company’s history, spanning over 160 years.

Sikes joined Cargill in 1991, right after graduating from Texas Tech University with a degree in agricultural economics.

Over three decades, he has led major business units across the company. He has held leadership roles in beef plants, protein, salt, foodservice, and global operations across the U.S., Canada, and Europe.

He rose to the executive team in 2019, serving as Chief Operating Officer prior to his appointment as CEO. As COO, he co-developed Cargill’s long-term strategy and oversaw the company’s Protein & Salt enterprise globally.

Leadership Style and Priorities

Sikes is widely recognized for his focus on people and culture, mentoring leadership at all levels. He has emphasized customer-driven growth, operational rigor, and building a robust talent bench, often championing employees from non-traditional career paths.

In 2024, under his leadership, Cargill announced a $40 million workforce housing project in Fort Morgan, Colorado, demonstrating his commitment to employee welfare and community development.

Strategic Vision for 2025

Sikes continues to navigate trade disruptions, global agricultural volatility, and climate risks. At a 2025 Economic Club of Minnesota event, he addressed issues such as U.S. tariffs, water scarcity, and the company’s role in long-term food security. He reaffirmed Cargill’s presence in challenging markets, including Ukraine, where local operations remain active despite conflict.

He is also overseeing a corporate restructuring, consolidating the business from five units into three core divisions—food enterprise, agriculture & trading, and specialized portfolio—as part of Cargill’s 2030 strategy.

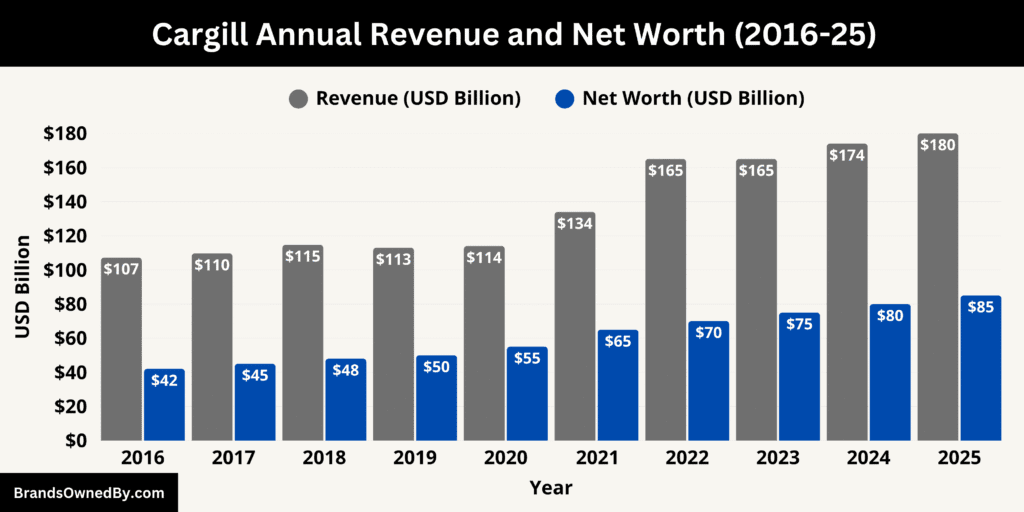

Cargill Annual Revenue and Net Worth

In 2025, Cargill achieved approximately $180 billion in total revenue. This reflected diverse performance across its core segments.

- Agricultural Supply Chain (grains, oilseeds, pulses) remains the largest contributor, responsible for around 45% of total revenue.

- Protein & Meat—including beef, turkey, and egg products under its Protein – North America division—contributed about 25%.

- Animal Nutrition & Health, which includes brands like Nutrena, Provimi, Diamond V, EWOS, and Delacon, generated roughly 15% through global feed, additives, and aquaculture products.

- Food Ingredients & Bioindustrial, covering sweeteners, starches, oils, lecithins, and bioindustrial solutions, represented about 10%.

- Cocoa & Chocolate operations (Peter’s, Gerkens, legacy Wilbur facilities) accounted for the remaining 5%.

These revenue streams are bolstered by Cargill Risk Management, Cargill Metals, and Cargill Ocean Transportation, which strengthen margins and support supply‑chain logistics.

Revenue Trend

Revenue for Cargill rose steadily from around $160 billion in 2023 to $168 billion in 2024, before settling at $180 billion in 2025. Growth was driven by strategic acquisitions—across feed mills in the U.S., soybean processing in Brazil, and full integration of Teys operations.

Incremental gains came from higher volumes in beef and poultry processing, expanded soy crushing capacity in South America, and stronger performance in bioindustrial and feed additives markets.

Cargill Net Worth

Cargill’s estimated enterprise value in 2025 stands at around $85 billion. This figure reflects the value of assets across global operations, factories, feed mills, shipping assets, and long-term contracts.

It does not account for the wealth of individual shareholders, which—collectively—is estimated at over $50 billion, held by the Cargill and MacMillan families.

Here’s a breakdown of its assets:

- Fixed assets: Processing plants, feed mills, cocoa factories, ocean transport vessels, and real estate, valued at several tens of billions.

- Working capital and inventory: Grain and commodity inventories, cash, and receivables.

- Intellectual property: Proprietary brands (Nutrena, Provimi, Gerkens), fermentation technologies (Diamond V), and biopolymers (Ingeo).

- Financial assets and investments: Holdings via Black River Asset Management and treasury portfolios contribute stable returns.

Profitability and Capital Allocation

Cargill retains approximately 80% of annual income for reinvestment in innovation, M&A, facilities, and sustainability. The remaining ~18–20% is distributed to owners as dividends or share repurchases.

Major dividends in 2024 and 2025 supported capital returns to family shareholders without compromising operations, even during global supply-chain volatility.

Financial Resilience

Privately held structure allows Cargill to maintain conservative debt levels, invest in long-term infrastructure, and avoid quarterly earnings pressure.

Years of reinvesting profits and strategic acquisitions have preserved strong liquidity, enabling the company to act on opportunities in renewable energy, vertical integration, and emerging markets.

Final Thoughts

Understanding what companies Cargill owns gives insight into one of the world’s most influential food corporations. From animal nutrition to chocolate to bioplastics, Cargill’s reach is vast and deep. Though privately held, it operates on a global scale comparable to multinational public giants. Its strategic acquisitions and family-held structure help maintain long-term stability and market leadership across several industries.

FAQs

What top companies are owned by Cargill?

Cargill owns several top-tier companies across agriculture, food processing, animal nutrition, and industrial markets. Some of the most prominent include:

- NatureWorks LLC (bioplastics)

- EWOS (aquaculture feed)

- Provimi (animal nutrition)

- Diamond V (animal health)

- Delacon (phytogenic feed additives)

- Horizon Milling (flour milling)

- The Wilbur Chocolate Company (chocolate products)

- Sunny Fresh Foods (egg products)

- Integral Animal Nutrition (Brazil-based feed producer).

These are part of Cargill’s global expansion strategy, spanning food, nutrition, and sustainability.

What major brands are owned by Cargill?

Cargill owns a wide range of brands including:

- Truvia (natural sweeteners)

- Diamond Crystal Salt

- Nutrena (animal feed)

- Loyall (pet food)

- Rumba Meats (Hispanic meat brand)

- Black Gold (livestock nutrition)

- NatureFresh (vegetable oils).

These brands serve both retail consumers and businesses worldwide.

What companies does Cargill own in USA?

In the United States, Cargill owns:

- Horizon Milling

- Sunny Fresh Foods

- Truvia

- Diamond Crystal Salt

- Nutrena

- Wilbur Chocolate

- Cargill Protein (formerly Excel)

- EWOS USA

- Provimi North America.

It also operates one of the largest beef processing plants in the U.S.

What companies does Cargill own worldwide?

Globally, Cargill owns and operates:

- EWOS (Norway/Chile/Canada/Scotland)

- Provimi (Netherlands, Brazil, India)

- Delacon (Austria)

- Integral (Brazil)

- LNB International Feed (Vietnam)

- NatureWorks (USA with global partnerships)

- Seara’s former feed business (Latin America).

These support its animal nutrition, feed, and sustainability businesses worldwide.

Who is Cargill owned by?

Cargill is owned by the Cargill and MacMillan families. These families have maintained control for over 150 years. The company is not publicly traded and remains one of the largest family-owned businesses in the world.

Is Cargill a public company?

No, Cargill is a private company. It is not listed on any stock exchange and does not release financials publicly in the way public companies do. It is currently the largest privately held company in the United States by revenue.

What is Cargill known for?

Cargill is known for:

- Agricultural supply chains

- Grain trading

- Meat processing

- Animal nutrition

- Food ingredients like sweeteners, oils, cocoa

- Bioindustrials and sustainability efforts.

It plays a crucial role in global food production, supply chains, and commodity markets.

Who owns Cargill company?

The company is primarily owned by the Cargill and MacMillan families, with more than 90 heirs sharing ownership stakes. It is controlled through private equity structures.

Is Cargill a private company?

Yes, Cargill is a private company. It is owned by family members and key management. Its private status allows for long-term investment strategies and less external scrutiny.

What does the Cargill family own?

The Cargill family owns the largest portion of the company and is involved in agriculture, commodity trading, and food production through Cargill, Inc. Their wealth comes entirely from the company’s ownership, and they have equity interests in the full range of Cargill businesses.

Who is the largest shareholder of Cargill?

The MacMillan family holds the largest single ownership stake. Combined with the Cargill family, they own nearly 88% of the company. The remaining is held by employees and management through private shares.

What is the largest plant in Cargill?

One of Cargill’s largest plants is its protein processing facility in Dodge City, Kansas, which processes thousands of cattle per day. It’s among the largest beef production sites in the U.S.

Is Cargill owned by Monsanto?

No, Cargill is not owned by Monsanto. They are separate companies. However, both operate in agriculture and sometimes collaborate, especially in areas like biotech crops.

Is Cargill a meat company?

Cargill is not just a meat company, but its protein division is a major part of the business. It is one of the largest beef producers in North America and also processes poultry, pork, and value-added meat products.

Is Purina owned by Cargill?

No, Purina is not owned by Cargill. Purina Animal Nutrition is owned by Land O’Lakes, a different agricultural cooperative. Cargill competes in similar segments through its own animal nutrition brands like Nutrena and Provimi.

Does Cargill own Excel?

Yes. Excel Corporation was a major meatpacking company acquired by Cargill in 1979. It has since been rebranded as Cargill Protein, which is now one of the largest meat businesses in the world.

Who owns the majority of Cargill?

The Cargill and MacMillan families own over 88% of the company through family trusts and shares.

What does Cargill manufacture?

Cargill manufactures food ingredients, chocolate, animal feed, bioindustrial products, and protein products such as meat and poultry.

Is Cargill bigger than Nestlé?

Cargill is larger than Nestlé in terms of revenue, but Nestlé is publicly traded and focuses more on consumer-facing products, while Cargill focuses on supply chains.

Where is Cargill headquartered?

Cargill’s headquarters is in Minnetonka, Minnesota, USA.

Who is the richest family in America?

The Cargill-MacMillan family ranks among the richest families in America, with an estimated collective fortune of over $50 billion.