What companies does Albertsons own? Albertsons Companies, Inc. is one of the largest food and drug retailers in the United States. Known for its wide range of grocery stores and supermarkets, Albertsons has built a diverse portfolio of brands and subsidiaries across the retail sector.

This article will explore Albertsons’ history, ownership, the companies it owns, its leadership, financials, and address common questions about the corporation.

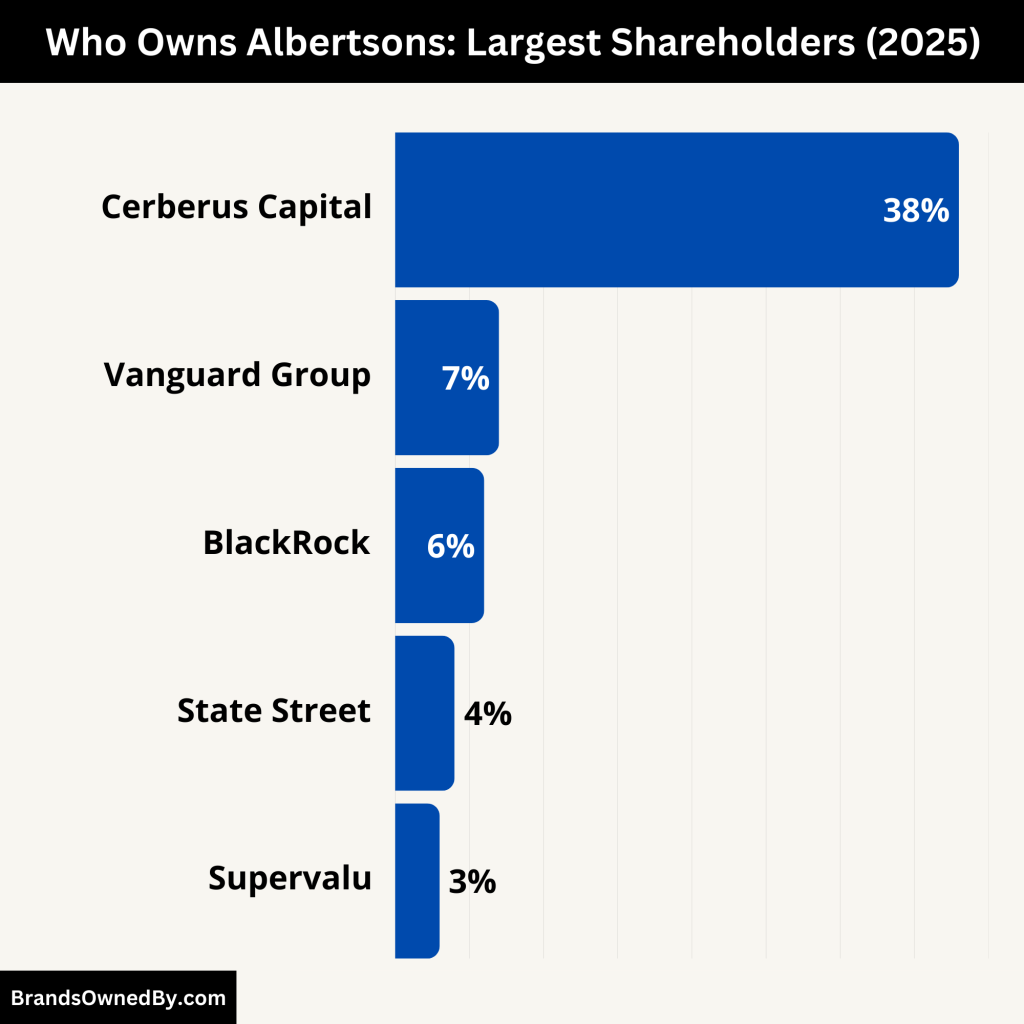

Who Owns Albertsons: Major Shareholders

Albertsons Companies, Inc. is a publicly traded company with a mix of institutional investors, private equity ownership, and public shareholders. While shares are available on the open market, a few key entities hold substantial portions, influencing its operations and strategy.

Here’s an overview of the major shareholders of Albertsons:

| Shareholder | Ownership Percentage | Role/Notes |

|---|---|---|

| Cerberus Capital Management | ~38% | Largest shareholder; private equity firm with significant control over corporate strategy and board. |

| The Vanguard Group | ~7% | Major institutional investor; passive ownership with voting rights. |

| BlackRock, Inc. | ~6% | Large institutional investor; passive ownership with influence via votes. |

| State Street Corporation | ~4% | Institutional investor; participates in governance through voting. |

| Supervalu, Inc. | <5% | Former major shareholder; now a minor, non-controlling stake. |

| Public Shareholders | ~40% | Retail investors, employees, and other small shareholders; dispersed ownership. |

| Insiders (Executives & Board Members) | Minor % | Management and board share ownership aligning interests with shareholders. |

Cerberus Capital Management: The Largest Shareholder

Cerberus Capital Management is the dominant shareholder of Albertsons, holding roughly 38% of the company’s outstanding shares. Cerberus first became involved with Albertsons during the company’s 2015 merger with Safeway, which it helped orchestrate. As a private equity firm specializing in distressed and undervalued assets, Cerberus played a crucial role in the restructuring and expansion of Albertsons post-merger.

Cerberus’ large stake gives it significant influence over Albertsons’ board of directors and strategic decisions. Although Albertsons is public, Cerberus’ ownership allows it to effectively guide corporate policy, operational strategy, and major capital expenditures.

Institutional Investors: Key Minority Shareholders

Beyond Cerberus, several institutional investors hold important minority stakes. These include large asset management firms that invest on behalf of pension funds, mutual funds, and other clients. Some of the largest institutional shareholders as of 2025 include:

- The Vanguard Group: Approximately 7% ownership

- BlackRock, Inc.: Roughly 6% ownership

- State Street Corporation: Around 4% ownership

These institutional investors do not typically involve themselves in daily management but exercise voting rights during shareholder meetings and influence corporate governance through board elections and proposals.

Public Shareholders and Retail Investors

About 40% of Albertsons’ shares are held by public investors. This group includes retail investors, employees holding shares through stock purchase plans, and smaller investment funds. Because these shares are widely dispersed, public shareholders generally do not have direct control but influence the company indirectly via voting on key issues like executive compensation and board member elections.

Former Ownership by Supervalu, Inc.

Supervalu, Inc., a former major player in the grocery retail space, once owned a substantial stake in Albertsons. However, following corporate restructuring and sales, Supervalu has divested most of its holdings. As of now, Supervalu owns less than 5% of Albertsons and does not exert significant control.

Board of Directors and Insider Ownership

A portion of Albertsons’ shares is owned by its executives and board members. While this insider ownership is relatively small compared to Cerberus and institutional investors, it aligns management’s interests with shareholders. The board oversees corporate governance, with several members appointed or supported by Cerberus, reinforcing their influence.

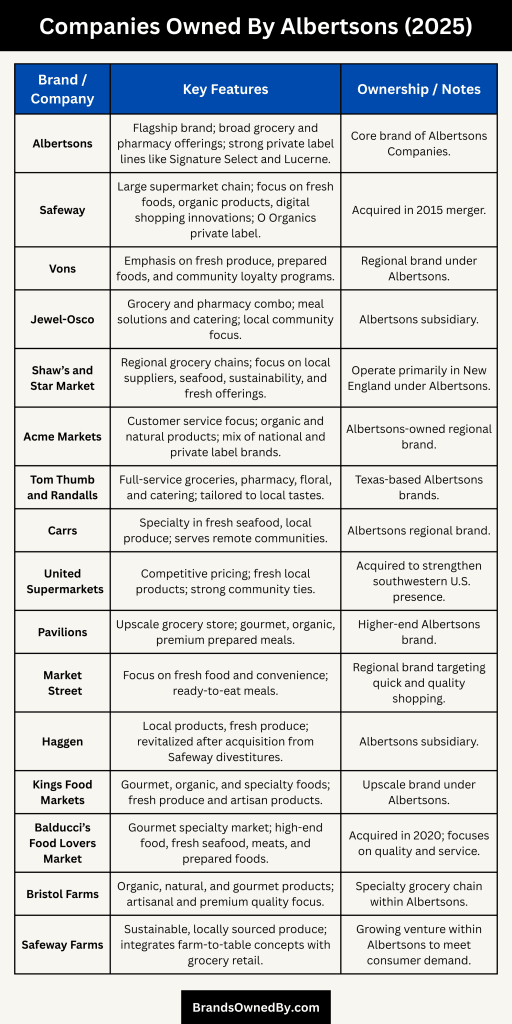

What Companies Does Albertsons Own?

Albertsons operates under a multi-brand strategy. It owns and manages several well-known grocery store brands across different regions, providing localized offerings and maintaining strong regional presences.

Below is an overview of the major brands and companies owned by Albertsons:

| Brand/Company | Primary Region(s) | Key Features | Ownership/Notes |

|---|---|---|---|

| Albertsons | Nationwide | Flagship brand; broad grocery and pharmacy offerings; strong private label lines like Signature Select and Lucerne. | Core brand of Albertsons Companies. |

| Safeway | West Coast, Rocky Mountain, Mid-Atlantic | Large supermarket chain; focus on fresh foods, organic products, digital shopping innovations; O Organics private label. | Acquired in 2015 merger. |

| Vons | Southern California, Nevada | Emphasis on fresh produce, prepared foods, and community loyalty programs. | Regional brand under Albertsons. |

| Jewel-Osco | Chicago Metro, Midwest | Grocery and pharmacy combo; meal solutions and catering; local community focus. | Albertsons subsidiary. |

| Shaw’s and Star Market | New England | Regional grocery chains; focus on local suppliers, seafood, sustainability, and fresh offerings. | Operate primarily in New England under Albertsons. |

| Acme Markets | Mid-Atlantic | Customer service focus; organic and natural products; mix of national and private label brands. | Albertsons-owned regional brand. |

| Tom Thumb and Randalls | Texas | Full-service groceries, pharmacy, floral, and catering; tailored to local tastes. | Texas-based Albertsons brands. |

| Carrs | Alaska | Specialty in fresh seafood, local produce; serves remote communities. | Albertsons regional brand. |

| United Supermarkets | Texas, New Mexico | Competitive pricing; fresh local products; strong community ties. | Acquired to strengthen southwestern U.S. presence. |

| Pavilions | Southern California | Upscale grocery store; gourmet, organic, premium prepared meals. | Higher-end Albertsons brand. |

| Market Street | Texas, New Mexico | Focus on fresh food and convenience; ready-to-eat meals. | Regional brand targeting quick and quality shopping. |

| Haggen | Pacific Northwest | Local products, fresh produce; revitalized after acquisition from Safeway divestitures. | Albertsons subsidiary. |

| Kings Food Markets | New Jersey, Northeast | Gourmet, organic, and specialty foods; fresh produce and artisan products. | Upscale brand under Albertsons. |

| Balducci’s Food Lovers Market | Northeast | Gourmet specialty market; high-end food, fresh seafood, meats, and prepared foods. | Acquired in 2020; focuses on quality and service. |

| Bristol Farms | Southern California | Organic, natural, and gourmet products; artisanal and premium quality focus. | Specialty grocery chain within Albertsons. |

| Safeway Farms | Various | Sustainable, locally sourced produce; integrates farm-to-table concepts with grocery retail. | Growing venture within Albertsons to meet consumer demand. |

1. Acme Markets

Located mainly in the Mid-Atlantic region, Acme Markets has a strong focus on customer service, quality fresh foods, and a range of organic and natural products.

Acme stores blend national brand offerings with Albertsons’ private labels to provide value and variety. The brand supports local farmers and suppliers, which is a key part of its marketing and customer engagement strategy.

2. Safeway

Safeway became part of Albertsons through the significant 2015 merger. It is one of the largest supermarket chains in the country, with a strong footprint especially on the West Coast, Rocky Mountain states, and parts of the Mid-Atlantic. Safeway stores are recognized for their extensive fresh food departments, organic selections, and pharmacy services.

The brand’s private labels, such as O Organics and Signature Select, contribute substantially to its revenue. Safeway continues to focus on digital innovations, including online grocery ordering and curbside pickup, meeting growing consumer demand.

3. Jewel-Osco

Serving the Chicago metropolitan area and parts of the Midwest, Jewel-Osco combines grocery retail with a full-service pharmacy. The brand is known for its customer-centric approach, including meal solutions and catering services.

Jewel-Osco stores offer a broad selection of both national brands and Albertsons’ private label products, maintaining strong ties to local communities through fundraising and health initiatives.

4. Shaw’s and Star Market

Shaw’s and Star Market operate primarily in New England, with Shaw’s serving states like Maine, New Hampshire, and Vermont, while Star Market has a significant presence in Massachusetts.

Both brands emphasize regional products and local supplier partnerships. They are known for fresh seafood, bakery, and deli offerings, with ongoing investments in sustainability and healthy food options.

5. Vons

Primarily operating in Southern California and Nevada, Vons is a key regional brand under the Albertsons umbrella. It serves diverse urban and suburban populations with an emphasis on fresh produce, prepared foods, and bakery products.

Vons is popular for its loyalty programs and community-oriented promotions. It maintains a competitive position by blending local preferences with national grocery trends.

6. United Supermarkets

United Supermarkets operates mainly in Texas and New Mexico, focusing on customer service and fresh, local products. It has a reputation for competitive pricing and strong community ties, including support for local farmers and charities.

United Supermarkets was acquired as part of Albertsons’ strategy to strengthen its presence in the southwestern U.S.

7. Tom Thumb Food & Pharmacy

Tom Thumb Food & Pharmacy is an American supermarket chain owned by Albertsons.

Founded in 1960, Tom Thumb operates over 200 stores across Texas and southern Oklahoma.

8. Randalls

Randalls is an American supermarket chain owned by Albertsons.

Founded in 1966, Randalls currently operates over 70 stores across Texas and Louisiana.

The company is committed to providing customers with a superior shopping experience and offers a variety of services including online ordering, catering, and home delivery.

9. Pavilions

Pavilions is a higher-end grocery store brand operating mostly in Southern California. It targets customers seeking specialty, gourmet, and organic foods along with premium prepared meals. The stores provide a boutique shopping experience within the Albertsons portfolio.

10. Osco Drug

Osco Drug is an American drugstore chain owned by Albertsons.

Founded in 1891, Osco currently operates over 100 stores across the United States.

The company provides customers with a wide selection of pharmaceuticals and over-the-counter medications as well as health and beauty products.

11. Sav-on Drugs

Sav-on Drugs is an American drugstore chain owned by Albertsons.

Founded in 1927, Sav-on currently operates over 80 stores across the United States.

The company provides customers with a wide selection of pharmaceuticals and over-the-counter medications as well as health and beauty products.

12. Shoppers Drug Mart

Shoppers Drug Mart is an American drugstore chain owned by Albertsons.

Founded in 1962, Shoppers currently operates over 1,000 stores across Canada and the United States.

The company provides customers with a wide selection of pharmaceuticals and over-the-counter medications as well as health and beauty products.

13. Market Street

Market Street stores focus on fresh food and convenience, often located in Texas and New Mexico. This brand targets shoppers looking for quality ready-to-eat meals and fresh ingredients, blending traditional grocery with quick shopping solutions.

14. Haggen

Haggen operates primarily in the Pacific Northwest. After acquiring stores from Safeway’s divestitures, Albertsons revitalized the Haggen brand with an emphasis on local products, fresh produce, and community engagement.

15. Kings Food Markets

Operating in New Jersey and parts of the Northeast, Kings Food Markets offers gourmet, organic, and specialty foods with an emphasis on fresh produce, prepared meals, and artisan products. It caters to upscale consumers looking for quality and variety.

16. Balducci’s Food Lovers Market

Acquired in 2020, Balducci’s is a specialty gourmet grocery store focused on high-end food products, fresh seafood, meats, and prepared foods. It primarily serves customers in the Northeast and is known for exceptional quality and service.

17. Bristol Farms

Bristol Farms operates in Southern California and caters to customers seeking organic, natural, and gourmet products. The brand emphasizes premium quality, artisanal products, and an elevated shopping experience.

18. Safeway Farms

A smaller but growing venture, Safeway Farms focuses on sustainable and locally sourced produce, integrating community-supported agriculture with grocery retail to meet the rising demand for farm-to-table products.

Who is the CEO of Albertsons?

As of May 1, 2025, Susan Morris has assumed the role of Chief Executive Officer (CEO) of Albertsons Companies, Inc. She succeeded Vivek Sankaran, who retired after six years in the position. Morris brings nearly four decades of experience in the retail grocery industry to the role.

She has held various leadership positions within Albertsons, including Executive Vice President and Chief Operations Officer since 2018. Morris began her career at an Albertsons store in Denver, Colorado, and has progressively taken on roles of increasing responsibility, overseeing retail operations across more than 2,200 stores in 34 states.

Leadership Transition and Strategic Vision

Morris’s appointment marks a significant leadership transition as Albertsons navigates a competitive retail environment. She is expected to continue the company’s “Customers for Life” strategy, focusing on enhancing customer loyalty, expanding digital capabilities, and modernizing supply chain operations.

Under her leadership, Albertsons aims to drive growth through investments in e-commerce, private label products, and store renovations. Morris’s extensive experience and deep knowledge of the business position her to lead Albertsons into its next phase of growth.

Who Controls Albertsons?

Albertsons is a publicly traded company with a complex ownership structure. While shares are available on the open market, several key entities hold significant stakes in the company, influencing its strategic direction.

Cerberus Capital Management: The Largest Shareholder

Cerberus Capital Management is the largest shareholder of Albertsons, holding approximately 38% of the company’s outstanding shares. As a private equity firm specializing in distressed and undervalued assets, Cerberus has played a pivotal role in Albertsons’ growth and strategic decisions. The firm has significant influence over the company’s operations and governance.

Institutional Investors

In addition to Cerberus, several institutional investors hold substantial stakes in Albertsons:

- The Vanguard Group: Approximately 7% ownership

- BlackRock, Inc.: Around 6% ownership

- State Street Corporation: About 4% ownership

These institutional investors hold significant voting power and can influence corporate governance and strategic decisions.

Public Shareholders and Retail Investors

The remaining shares of Albertsons are held by public shareholders, including retail investors and employees. This dispersed ownership means that individual shareholders have limited influence over the company’s strategic direction but can participate in shareholder meetings and vote on key issues.

Board of Directors and Governance

The Board of Directors oversees the management of Albertsons and is responsible for making major decisions, including executive appointments and strategic initiatives. The board includes representatives from Cerberus Capital Management, reflecting the firm’s significant ownership stake. In October 2024, Stephen Feinberg, co-CEO of Cerberus, was appointed to the board, underscoring the firm’s influence within the company’s governance structure.

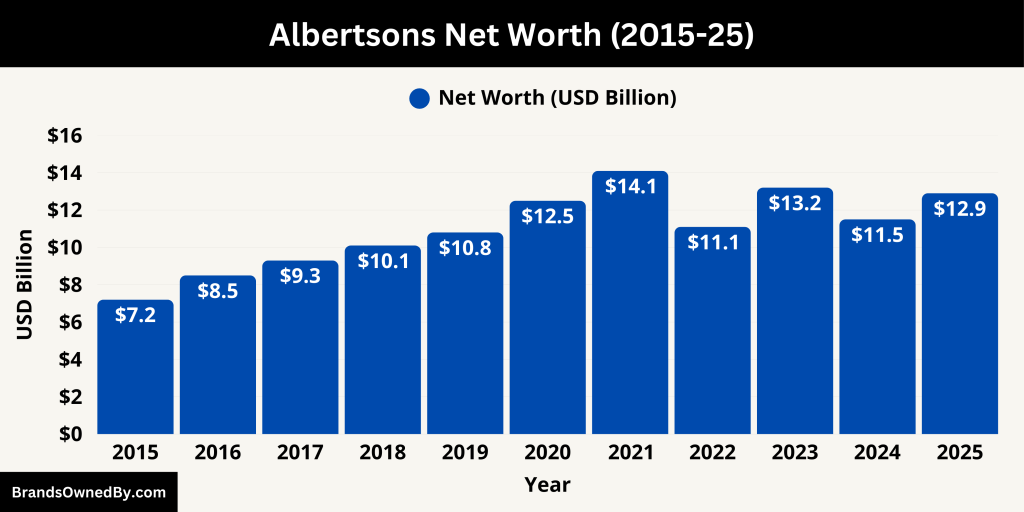

Albertsons Net Worth

As of May 2025, Albertsons Companies Inc. (NYSE: ACI) holds a market capitalization of approximately $12.93 billion, reflecting the total market value of its outstanding shares. This valuation places Albertsons among the mid-cap companies in the U.S. retail sector.

Albertsons’ Enterprise Value (EV), which considers both equity and debt, stands at approximately $18.0 billion as of early 2025. Key financial metrics include:

- Revenue (TTM): $80.39 billion

- EBITDA (TTM): $3.75 billion

- Net Income (TTM): $957.3 million

- Total Debt: $7.45 billion

- Cash Reserves: $360.9 million

Dividend Policy and Shareholder Returns

Albertsons maintains a quarterly dividend of $0.15 per share, reflecting a commitment to returning value to shareholders. The company’s Dividend Yield is approximately 2.74%, aligning with industry standards for retail companies.

In response to market dynamics and regulatory challenges, Albertsons has initiated a $2 billion share repurchase program, aiming to enhance shareholder value and optimize its capital structure. Additionally, the company is focusing on expanding its digital capabilities and modernizing its supply chain to remain competitive in the evolving retail landscape.

Here’s an overview of the last 10 years of the net worth of Albertsons:

| Year | Estimated Market Capitalization (USD Billions) |

|---|---|

| 2015 | 7.2 |

| 2016 | 8.5 |

| 2017 | 9.3 |

| 2018 | 10.1 |

| 2019 | 10.8 |

| 2020 | 12.5 |

| 2021 | 14.1 |

| 2022 | 11.1 |

| 2023 | 13.2 |

| 2024 | 11.5 |

| 2025 | 12.9 |

Where is the Headquarters of Albertsons?

Albertsons’ headquarters is located in Boise, Idaho.

The headquarters of Albertsons is nestled in the heart of the Gem State.

Known for its bustling downtown area and breathtaking views of the Rocky Mountains, Boise provides a great backdrop for the corporate office of such a successful and well-known company.

So the next time you shop at an Albertsons store, know that its headquarters is located in one of the most beautiful parts of the country.

Final Thoughts

From humble beginnings in 1939 to becoming one of the biggest and most successful supermarket corporations in the United States, Albertsons has certainly made a lasting impact on the retail industry.

Owned by Cerberus Capital Management, Albertsons is now part of a grocery conglomerate that owns several popular retail chains such as Vons, Safeway, Shaw’s, Tom Thumb, Jewel-Osco, and Acme Markets.

With its headquarters based in Boise, Idaho, and 2093 stores located throughout the United States, the company serves over 34 million customers a week.

All in all, Albertsons is leading customer service by consistently providing quality products at an affordable cost for those who come to their store doors every day.

FAQs

How many brands does Albertsons own?

Albertsons owns over a dozen major supermarket brands across the U.S., including Albertsons itself, Safeway, Vons, Jewel-Osco, Shaw’s, Star Market, Acme Markets, Tom Thumb, Randalls, Carrs, United Supermarkets, Pavilions, Market Street, Haggen, Kings Food Markets, Balducci’s, and Bristol Farms. Altogether, this multi-brand portfolio covers a wide geographic area and diverse customer bases.

Who is bigger, Kroger or Albertsons?

Kroger is larger than Albertsons in terms of revenue, store count, and market share. Kroger is the largest supermarket chain in the U.S., while Albertsons ranks second. Kroger’s annual revenue surpasses $150 billion, compared to Albertsons’ approximately $80 billion.

What company did Albertsons buy?

Albertsons has acquired several companies over the years, including Safeway in 2015, United Supermarkets in 2018, and Balducci’s Food Lovers Market in 2020. These acquisitions expanded Albertsons’ footprint and diversified its brand portfolio.

Is Albertsons owned by the Mormons?

No, Albertsons is not owned by the Mormon Church. While Cerberus Capital Management is the largest shareholder, the company is publicly traded, with shares held by various institutional and retail investors.

Who is the largest shareholder of Albertsons?

Cerberus Capital Management is the largest shareholder, owning about 38% of Albertsons’ outstanding shares, giving it significant influence over company decisions.

Did Albertsons buy United Supermarkets?

Yes, Albertsons acquired United Supermarkets in 2018 to strengthen its presence in Texas and the southwestern United States.

Why did Albertsons sue Kroger?

Albertsons sued Kroger in 2023 over alleged anti-competitive practices related to Kroger’s attempts to acquire Albertsons, claiming violations of antitrust laws and unfair business tactics that could harm competition and consumers.

Does Kroger own Albertsons?

No, Kroger does not own Albertsons. They are separate companies and competitors in the grocery retail market.

Who owns Albertsons and Safeway?

Albertsons Companies, Inc. owns both Albertsons and Safeway. After acquiring Safeway in 2015, Albertsons incorporated it as one of its major brands.

Does Albertsons own Safeway?

Yes, Albertsons owns Safeway as a key brand within its multi-brand portfolio.

What supermarkets does Albertsons own?

Albertsons owns several supermarket brands including Albertsons, Safeway, Vons, Jewel-Osco, Shaw’s, Star Market, Acme Markets, Tom Thumb, Randalls, Carrs, United Supermarkets, Pavilions, Market Street, Haggen, Kings Food Markets, Balducci’s Food Lovers Market, and Bristol Farms.

Is Vons owned by Albertsons?

Yes, Vons is owned by Albertsons and operates primarily in Southern California and Nevada.

Who owns Albertsons supermarkets?

Albertsons supermarkets are owned by Albertsons Companies, Inc., a publicly traded company with major ownership by Cerberus Capital Management and other institutional shareholders.