Brookfield Corporation stands as one of the largest and most diversified asset management companies globally. The list of companies owned by Brookfield Corporation is fairly long and interesting.

With a focus on long-term investment strategies, Brookfield has amassed a portfolio spanning real estate, renewable energy, infrastructure, and private equity.

This article explores the ownership structure of Brookfield Corporation, detailing its subsidiaries, history, leadership, financials, and workforce.

Brookfield Corporation History

Brookfield Corporation, established in 1899, is a leading global asset management company with a history of innovation, strategic growth, and diversification. Its roots trace back to a small Canadian-based hydroelectric company that initially focused on power generation, but over the years, Brookfield has evolved into a major player in real estate, infrastructure, renewable energy, and private equity. The company’s journey is one of continuous expansion, transforming itself into a multi-faceted global investment firm.

Early Beginnings: Powering Canada’s Growth

The origins of Brookfield Corporation lie in its first significant venture in 1899, when it was known as the Brookfield Power Corporation. The company initially focused on harnessing hydroelectric power in Canada, capitalizing on the growing demand for electricity during the Industrial Revolution. At the time, the Canadian economy was heavily reliant on natural resources, and Brookfield’s investment in hydroelectric plants marked the beginning of its role as an energy provider in the country.

By the early 20th century, the company had already begun expanding its energy operations, securing a reputation as a reliable provider of electricity. The growth of the industrial sector and increasing demand for power laid the foundation for the company’s future.

Diversification into Real Estate and Infrastructure

In the mid-20th century, Brookfield’s leadership began to explore new avenues beyond the energy sector. As the global economy changed, Brookfield shifted its focus toward infrastructure and real estate, setting the stage for its transformation into a diversified investment company. In the 1960s and 1970s, Brookfield began acquiring commercial properties and managing large-scale infrastructure projects. This included significant investments in North American real estate, where the company developed a strong portfolio of office buildings, shopping centers, and other commercial properties.

During this period, Brookfield also expanded its operations to include infrastructure assets like toll roads, bridges, and ports, marking its entry into global markets. The company’s investments were aimed at long-term growth and providing essential services to economies worldwide.

Rebranding and Global Expansion

In the 1990s, Brookfield underwent a rebranding, adopting the name Brookfield Asset Management, which more accurately reflected its diversified portfolio of real estate, infrastructure, and energy assets. During this time, Brookfield started to expand internationally, with key acquisitions in Europe, the United States, and Latin America.

Brookfield’s global expansion accelerated under the leadership of Bruce Flatt, who became CEO in 2002. Flatt’s leadership marked a new era for the company, characterized by significant growth and a strategic focus on sustainable investments in renewable energy, infrastructure, and long-term capital projects. Under his direction, Brookfield aggressively pursued acquisitions in key sectors, including energy, real estate, and infrastructure, solidifying its position as a top-tier asset management firm.

Evolution into Brookfield Corporation

In 2021, Brookfield made a strategic decision to rebrand once again, this time under the name Brookfield Corporation, to more effectively reflect its diversified business operations and its global reach. The new branding aligned with its expanded portfolio, which now included a strong focus on technology-driven infrastructure and the renewable energy sector.

As part of its evolution, Brookfield Corporation continued to diversify its holdings by making substantial investments in clean energy, particularly in solar, wind, and hydroelectric power generation. The company also developed a portfolio of private equity investments and alternative assets, expanding its capabilities in managing capital on behalf of institutional investors around the world.

Looking Ahead

Today, Brookfield Corporation operates across multiple sectors, including real estate, infrastructure, renewable energy, and private equity, with assets under management exceeding $800 billion. The company’s success is a testament to its ability to adapt to changing markets, innovate in its investment strategies, and grow its global presence.

Brookfield’s commitment to long-term value creation, sustainability, and global expansion continues to shape its future, making it one of the most influential asset managers in the world. Its history of strategic acquisitions, diversification, and environmental responsibility ensures that Brookfield Corporation remains a significant player in the global economy.

Who Owns Brookfield Corporation?

Brookfield Corporation is a publicly traded company listed on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX).

The corporation operates under a decentralized ownership structure, with institutional and retail investors holding shares. Its management team, led by seasoned professionals, steers its investment strategies and growth initiatives.

Notably, Bruce Flatt, the current CEO, has been instrumental in shaping Brookfield’s trajectory over the past two decades.

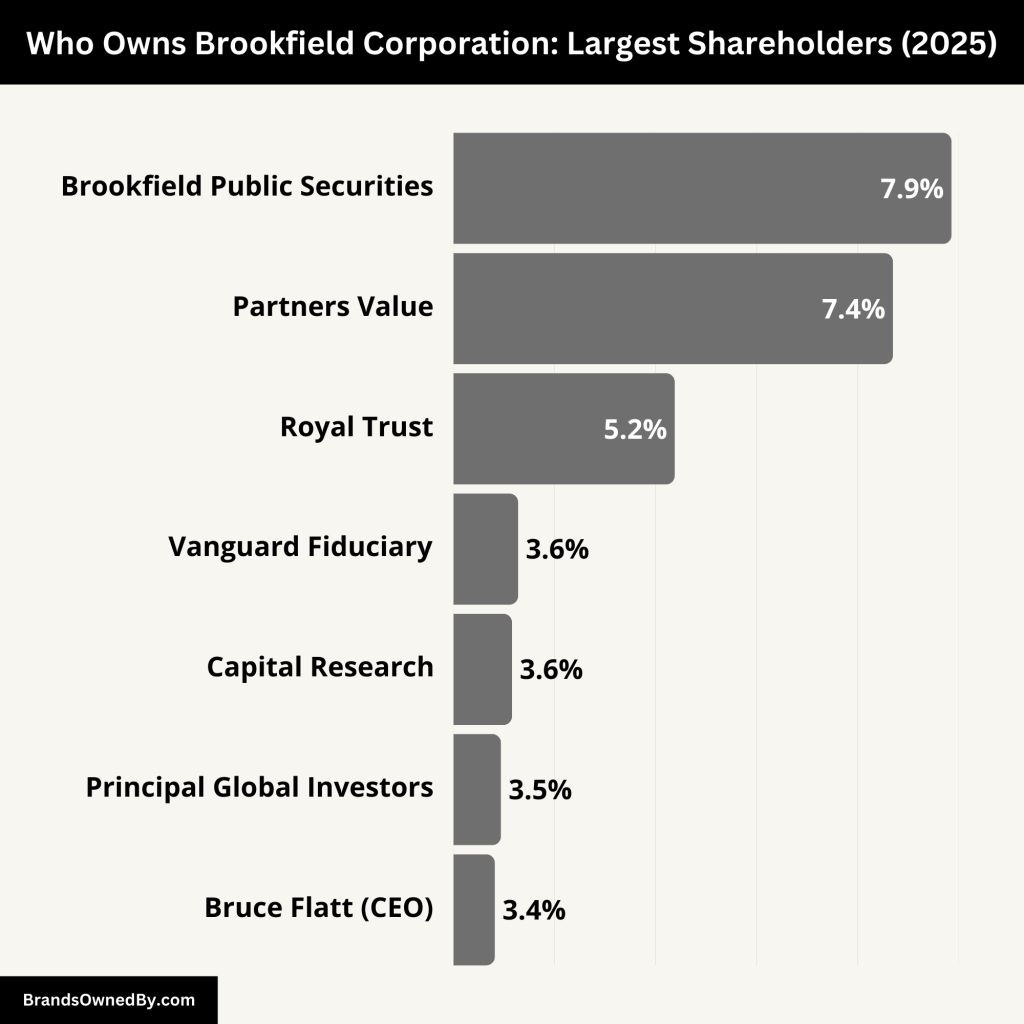

Here are the major shareholders who own Brookfield Corporation:

| Shareholder | Percentage of Shares | Shares Held (millions) |

|---|---|---|

| Partners Value Investments LP | 7.35% | 120.97 |

| Royal Trust Corporation of Canada | 5.19% | 85.44 |

| Vanguard Fiduciary Trust Company | 3.64% | 59.90 |

| Capital Research & Management Co. (World Investors) | 3.58% | 59.02 |

| Bruce Flatt (CEO) | 3.41% | 56.09 |

| Brookfield Public Securities Group LLC | 7.93% | 119.60 |

| Principal Global Investors, LLC | 3.47% | 52.40 |

| Total Institutional and Insider Ownership | 61.60% |

Partners Value Investments LP

Partners Value Investments LP is the largest shareholder of Brookfield Corporation, holding approximately 7.35% of the company’s shares, which translates to around 120.97 million shares valued at approximately $7.01 billion. This substantial stake highlights the strong relationship between Partners Value Investments LP and Brookfield, reflecting a strategic and influential investor role.

Royal Trust Corporation of Canada

Royal Trust Corporation of Canada owns around 5.19% of Brookfield Corporation’s shares, amounting to 85.44 million shares, valued at about $4.95 billion. This is a significant investment, showing the trust’s belief in the company’s long-term growth potential and stability in the market.

Vanguard Fiduciary Trust Company

Vanguard Fiduciary Trust Company holds about 3.64% of Brookfield Corporation’s shares, equating to approximately 59.9 million shares, valued at around $3.47 billion. Vanguard is one of the world’s largest asset management firms, and its investment reflects confidence in Brookfield’s strategic direction and its potential for sustained financial performance.

Capital Research & Management Co. (World Investors)

Capital Research & Management Co., operating under its World Investors division, holds about 3.58% of Brookfield Corporation’s shares, which is roughly 59.02 million shares valued at $3.42 billion. As a major institutional investor, this stake underscores the trust Capital Research places in Brookfield’s business model and its future growth.

Bruce Flatt

Bruce Flatt, the Chief Executive Officer of Brookfield Corporation, personally owns around 3.41% of the company’s shares, amounting to 56.09 million shares valued at approximately $3.25 billion. His personal stake aligns his interests with those of other shareholders, reinforcing his commitment to the company’s success and ensuring that he has a vested interest in its long-term performance.

Brookfield Public Securities Group LLC

Brookfield Public Securities Group LLC, a subsidiary of Brookfield Corporation, holds a significant 7.93% of the company’s shares, approximately 119.6 million shares valued at $6.9 billion. This is a strategic holding, and as part of the Brookfield family, it reinforces the company’s internal investment and governance structure.

Principal Global Investors, LLC

Principal Global Investors, LLC owns about 3.47% of Brookfield Corporation’s shares, translating to 52.4 million shares valued at approximately $3.0 billion. As a major institutional investor, Principal Global Investors’ stake reflects strong market confidence in Brookfield’s financial stability and future prospects.

Institutional and Insider Ownership

Institutional investors collectively hold around 61.60% of Brookfield Corporation’s stock, demonstrating robust institutional confidence in the company’s strategic direction.

Additionally, insiders, including executives and board members, own approximately 11.3% of the company’s shares, ensuring that Brookfield’s management has a significant personal interest in its success.

List of Companies Owned by Brookfield Corporation

Brookfield Corporation’s diverse portfolio includes some of the most prominent companies in various sectors. Here’s a detailed look at the various brands and companies owned by Brookfield Corporation:

| Company Name | Ownership Percentage (as of March 2025) | Role |

|---|---|---|

| Brookfield Asset Management Ltd. | 51% | Asset management services across real estate, infrastructure, renewable energy, and private equity. |

| Data Infrastructure Trust | 49.85% | Investment in data infrastructure assets. |

| Alstria Office REIT-AG | 95.39% | Ownership and management of office properties in Germany. |

| Brookfield India Real Estate Trust | 29.5% | Investment in commercial real estate properties in India. |

| Brookfield Renewable Partners L.P. | 2.82% | Ownership and operation of renewable power assets globally. |

| The British Land Company PLC | 2.77% | Development and management of commercial properties in the UK. |

| Brookfield Infrastructure Partners L.P. | 0.3% | Ownership and operation of infrastructure assets globally. |

| Nirlon Limited | 7.72% | Development of industrial and commercial real estate in India. |

| Plenti Group Limited | 1.06% | Financial services focusing on lending and investment platforms. |

| Seafarms Group Limited | 0.94% | Development of aquaculture projects in Australia. |

| Arc Infrastructure WA Pty Ltd | 100% | Rail transport services in Western Australia. |

| Linx Cargo Care Group Pty Ltd | 27% | Port operations and logistics services in Australia. |

| Ruby Pooling Hold Trust | 29% | Data center operations in Australia. |

| Nova Transportadora do Sudeste S.A. (NTS) | 31% | Energy infrastructure services in Brazil. |

| Enercare | 26% | Home and commercial energy services in Canada. |

| Inter Pipeline Ltd. | 56% | Energy infrastructure company in Canada. |

| NorthRiver Midstream Inc. | 29% | Energy infrastructure services in Canada. |

| Warwick Gas Storage L.P. | 25% | Gas storage services in Canada. |

| Vanti S.A. ESP | 21% | Energy infrastructure services in Colombia. |

| Thermondo GmbH | 11% | Residential energy infrastructure services in Germany. |

| Crest Digitel Private Ltd | 17% | Telecommunications infrastructure services in India. |

| Pipeline Infrastructure | 21% | Energy infrastructure services in India. |

| Rayalseema Expressway Private Limited | 29% | Toll road operations in India. |

| Simhapuri Expressway Ltd | 29% | Toll road operations in India. |

| Summit Digitel Infrastructure Private Ltd | 17% | Telecommunications infrastructure services in India. |

| Rutas de Lima S.A.C. | 17% | Toll road operations in Peru. |

| BIF India Holdings Pte Ltd | 40% | Toll road operations in Singapore. |

| BOXT Ltd | 15% | Residential infrastructure services in the UK. |

| Brookfield Port Acquisitions (UK) Ltd | 59% | Port operations in the UK. |

| BUUK Infrastructure No 1 Limited | 80% | Energy infrastructure services in the UK. |

Note: The ownership percentages and roles are based on available data (as of March 2025) and may be subject to change.

Brookfield Asset Management

Brookfield Asset Management ULC serves as the asset management arm of Brookfield Corporation, overseeing investments across real estate, infrastructure, renewable energy, and private equity.

As of December 31, 2023, Brookfield Corporation holds a 75% equity ownership interest in this subsidiary.

Brookfield Renewable Partners

This subsidiary focuses on renewable energy, owning and operating a portfolio of hydroelectric, wind, and solar power assets.

Brookfield Renewable Partners is a leader in the transition to green energy, managing over 23,000 megawatts of installed capacity worldwide.

Its investments align with global sustainability goals, showcasing Brookfield’s commitment to combating climate change.

As of December 31, 2023, Brookfield Corporation holds a 45% equity ownership interest in this subsidiary.

The company aims to generate stable and growing returns through its diversified portfolio of renewable energy assets.

Brookfield Infrastructure Partners L.P.

Brookfield Infrastructure Partners L.P. specializes in owning and operating infrastructure assets globally, including utilities, transport, energy, and data infrastructure. As of December 31, 2023, Brookfield Corporation holds a 26% equity ownership interest in this subsidiary.

The company has investments in transmission lines, toll roads, ports, and pipelines, aiming for long-term capital appreciation

Brookfield Property Partners

Renowned for its real estate ventures, Brookfield Property Partners owns and operates iconic commercial properties, including office towers, shopping centers, and multi-family residential units in key urban centers.

Its properties include some of the most recognizable landmarks, such as Brookfield Place in New York City, cementing its reputation in the real estate industry.

As of December 31, 2023, Brookfield Corporation holds a 100% equity ownership interest in this subsidiary.

The partnership’s portfolio encompasses properties in the United States, Canada, Australia, Europe, Brazil, and Asia, with a focus on high-quality assets in prime locations.

Brookfield Business Partners L.P.

Brookfield Business Partners L.P. is the primary public vehicle through which Brookfield Corporation owns and operates its business services and industrial operations within its private equity group.

Established in June 2016, it focuses on sectors such as business services, construction, energy, and industrial operations. Notable investments include the acquisition of Westinghouse Electric Company and a significant stake in BrandSafway.

Oaktree Capital Management

Acquired by Brookfield in 2019, Oaktree Capital Management specializes in distressed asset investment.

With expertise in credit strategies, Oaktree complements Brookfield’s portfolio diversification.

The collaboration has enabled Brookfield to expand its reach in alternative investment markets, offering a broader range of financial solutions.

Westinghouse Electric Company

Brookfield acquired Westinghouse Electric Company, a leader in nuclear energy technology, showcasing its commitment to diverse and sustainable energy solutions.

Westinghouse’s innovative nuclear technologies have positioned it as a key player in the global energy transition.

GGP Inc. (General Growth Properties)

Formerly a standalone entity, GGP was integrated into Brookfield Property Partners to enhance its retail property offerings, making it a significant player in commercial real estate.

The acquisition bolstered Brookfield’s ability to own and operate premier shopping destinations in top-tier locations.

Howard Hughes Corporation

Brookfield has investments in Howard Hughes Corporation, a real estate development company focusing on master-planned communities and mixed-use properties.

This partnership underscores Brookfield’s strategy to invest in innovative developments that integrate residential, commercial, and recreational spaces.

Brookfield Residential Properties Inc.

Brookfield Residential Properties Inc. is a leading North American land developer and homebuilder, specializing in master-planned residential communities.

Headquartered in Calgary, Alberta, the company operates in strategic markets across Canada and the United States, focusing on delivering innovative and sustainable housing solutions.

Multiplex Global Ltd.

Multiplex Global Ltd. is an international construction contractor known for delivering landmark property and infrastructure assets. With operations in regions like Europe, Australia, the Middle East, and Canada, Multiplex specializes in high-rise buildings, stadia, and other complex structures, emphasizing innovation and quality.

Clarios Global LP

Clarios Global LP is a global leader in advanced energy storage solutions, producing automotive batteries for various applications, including conventional, start-stop, hybrid, and electric vehicles.

The company serves a diverse customer base, contributing to energy efficiency and sustainability in the automotive industry.

Sagen Mortgage Insurance Company Canada

Sagen Mortgage Insurance Company Canada, formerly known as Genworth Financial Mortgage Insurance Company Canada, is a leading private-sector supplier of mortgage default insurance in Canada. The company provides tailored mortgage insurance solutions, facilitating homeownership for Canadians by mitigating lender risk.

Brookfield White Pine Hydro LLC

Brookfield White Pine Hydro LLC operates hydroelectric power stations, contributing to renewable energy generation. Based in Hallowell, Maine, the company plays a significant role in providing sustainable energy solutions in the region.

Caithness Shepherds Flat LLC

Caithness Shepherds Flat LLC owns and operates one of the world’s largest wind farms, located in Oregon, USA. The facility contributes substantially to renewable energy production, supporting the transition to sustainable energy sources.

Who Controls Brookfield Corporation?

Brookfield Corporation is controlled by a combination of its executive management team, led by the CEO, and its board of directors. While institutional investors own a significant portion of the company’s shares, control over day-to-day decisions and strategic direction rests with the management team, primarily the CEO and other key executives, along with the approval and oversight of the board.

Role of the CEO in Controlling Brookfield Corporation

The CEO plays a central role in the control of Brookfield Corporation. Bruce Flatt, the CEO, has been with the company for many years and holds significant influence over its direction. He also owns around 3.41% of the company’s shares, aligning his interests with those of the other shareholders. As the company’s leader, Flatt is responsible for setting the strategic vision, making critical decisions on acquisitions, investments, and partnerships, and overseeing the company’s operations on a global scale.

Flatt’s deep experience and personal stake in the company make him one of the most influential figures within Brookfield. His leadership is vital in steering the company through the challenges of the global financial landscape, and his strategic decisions are key to Brookfield’s success.

Role of the Board of Directors

Brookfield Corporation’s board of directors plays an essential role in overseeing the company’s activities and providing governance. The board is responsible for approving major decisions, such as mergers and acquisitions, large capital expenditures, and executive compensation. The board is composed of experienced individuals with diverse backgrounds, many of whom have longstanding relationships with Brookfield.

The board’s role in controlling the company is to ensure that the decisions made by the management team, particularly the CEO, align with the interests of shareholders and other stakeholders. While the CEO is responsible for day-to-day management, the board serves as a check on executive actions and approves key strategic initiatives.

Influence of Major Shareholders

Major shareholders, including institutional investors and insiders, also exert significant control over the company. These shareholders typically have voting power at annual shareholder meetings, where they approve decisions such as board members and executive compensation. While the CEO and management control the company’s operations, large institutional investors like Partners Value Investments LP and Vanguard have significant sway over corporate governance due to their substantial shareholding. Their votes can influence decisions on matters such as strategic direction, mergers, and executive leadership.

Bruce Flatt’s Leadership and Influence

Bruce Flatt, the CEO of Brookfield Corporation, has been with the company for over two decades and is one of the key figures in its control. He holds around 3.41% of the company’s shares, a personal investment that demonstrates his alignment with the interests of Brookfield’s shareholders. Under his leadership, the company has grown into a global powerhouse in asset management, real estate, and infrastructure, with billions in assets under management.

Flatt’s leadership is characterized by a long-term vision, which has helped the company navigate various economic cycles and expand into new markets. His role as CEO places him at the center of Brookfield’s decision-making process, and his influence extends beyond the company’s operations, as he plays a vital role in shaping the investment strategies that Brookfield employs across its different sectors.

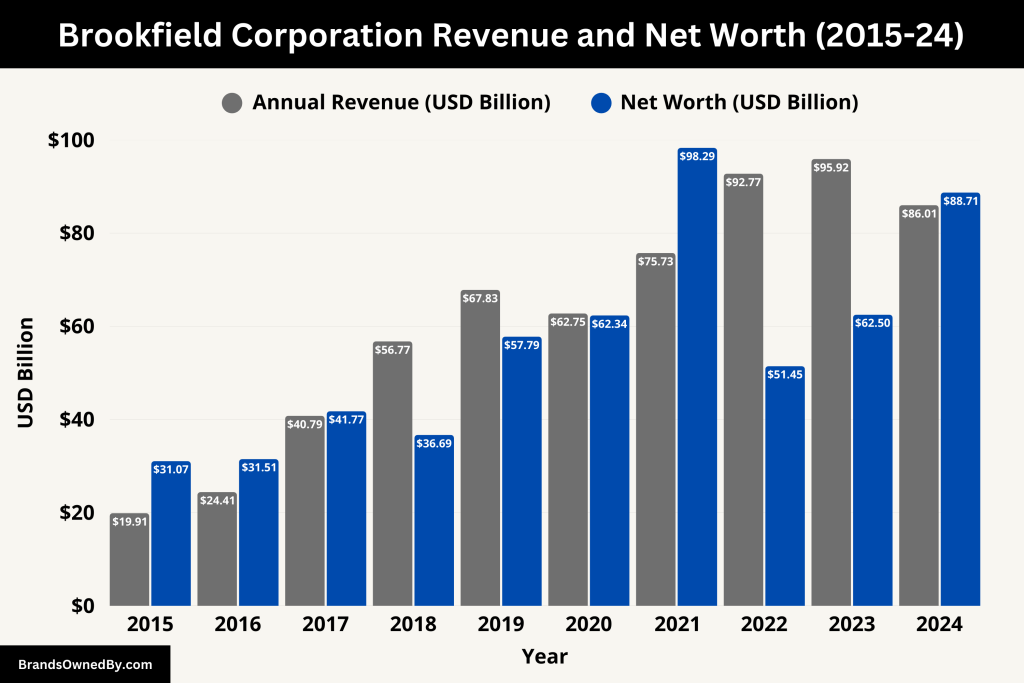

Brookfield Corporation Annual Revenue and Net Worth

In 2024, Brookfield Corporation reported a total revenue of $88.74 billion, marking a 9.45% decrease from the previous year’s revenue of $95.92 billion.

As of April 2025, Brookfield Corporation’s market capitalization, a common indicator of a company’s net worth, stood at approximately $88.57 billion.

Here’s an overview of the historical revenue and net worth of Brookfield Corporation:

| Year | Annual Revenue (USD) | Market Capitalization (USD) |

|---|---|---|

| 2024 | $86.01 billion | $88.71 billion |

| 2023 | $95.92 billion | $62.50 billion |

| 2022 | $92.77 billion | $51.45 billion |

| 2021 | $75.73 billion | $98.29 billion |

| 2020 | $62.75 billion | $62.34 billion |

| 2019 | $67.83 billion | $57.79 billion |

| 2018 | $56.77 billion | $36.69 billion |

| 2017 | $40.79 billion | $41.77 billion |

| 2016 | $24.41 billion | $31.51 billion |

| 2015 | $19.91 billion | $31.07 billion |

Final Words

Brookfield Corporation’s ownership of an extensive portfolio of companies underscores its position as a global leader in asset management. With a history spanning over a century, a strategic leadership team, and a commitment to sustainable investment, Brookfield continues to shape industries and drive innovation.

Its subsidiaries across real estate, renewable energy, infrastructure, and private equity offer a testament to its diversification and resilience, making it a cornerstone of modern investment strategies.

FAQs

Who is the biggest shareholder in Brookfield?

The largest shareholder in Brookfield Corporation (BN) is BAM Partners, a private partnership controlled by Bruce Flatt, the CEO. Through BAM Partners and other affiliated entities, Flatt and senior management retain significant voting power in Brookfield.

Institutional shareholders also hold large stakes. As of 2025:

- Royal Bank of Canada (RBC), Vanguard Group, BlackRock, and T. Rowe Price are among the top institutional investors.

Who owns Brookfield business?

Brookfield Corporation (formerly Brookfield Asset Management Inc.) is a publicly traded Canadian multinational conglomerate, majority-owned by institutional investors and company insiders.

It is run by Bruce Flatt, who has been instrumental in shaping Brookfield into a global alternative asset manager. While it is publicly owned, Brookfield operates under a tight leadership group that retains long-term control through internal partnerships like BAM Partners.

Who is the CEO of Brookfield stock?

As of 2025:

- Bruce Flatt is the CEO of Brookfield Corporation (BN).

- Bruce Flatt was also the long-time CEO of Brookfield Asset Management (BAM) before it was spun off in 2022. Now, Connor Teskey is the CEO of Brookfield Asset Management, which is a separately traded entity managing the investment funds.

Does Brookfield own Nuclear?

Yes, Brookfield owns nuclear energy assets through Brookfield Renewable Partners (BEP) and Brookfield Business Partners (BBU).

Most notably:

- In 2018, Brookfield acquired Westinghouse Electric Company, a major global provider of nuclear power technology and services.

- In 2023, Brookfield Renewable and Cameco jointly acquired Westinghouse, further emphasizing Brookfield’s strong footprint in nuclear energy.

What is the parent company of Brookfield?

The parent company is Brookfield Corporation (BN). It oversees a group of publicly listed partnerships and funds, including:

- Brookfield Asset Management (BAM)

- Brookfield Renewable Partners (BEP)

- Brookfield Infrastructure Partners (BIP)

- Brookfield Business Partners (BBU)

- Brookfield Real Estate Income Trust

These are all part of the broader Brookfield ecosystem managed and governed by the parent company.

What is the full name of Brookfield?

The full legal name is Brookfield Corporation.

Previously, it was called Brookfield Asset Management Inc., but in 2022, the asset management division was spun off as a separate publicly traded company (BAM), and the parent entity was renamed Brookfield Corporation (BN).

Who owns Brookfield Engineering?

If you’re referring to Brookfield Engineering Laboratories, a U.S.-based company known for its viscometers and rheometers, it is not related to Brookfield Corporation.

Brookfield Engineering is owned by Ametek, Inc., a global manufacturer of electronic instruments and electromechanical devices. Ametek acquired Brookfield Engineering in 2016.

Is Brookfield bigger than Blackstone?

In market capitalization, Blackstone is larger than Brookfield Asset Management (BAM), but Brookfield Corporation (BN) has broader global operations and higher assets under management (AUM) when combined across all its entities.

As of 2025:

- Blackstone AUM: ~$1.2 trillion

- Brookfield total AUM (across all entities): ~$900+ billion

- However, Brookfield has deeper involvement in infrastructure, renewables, and real assets, whereas Blackstone focuses more on private equity and real estate.

So, while Blackstone may be bigger in valuation and pure private equity, Brookfield has a larger global operational footprint across asset classes.

What does Brookfield Corporation do?

Brookfield Corporation is a global asset management company specializing in alternative investments. It manages assets across various sectors, including real estate, infrastructure, renewable energy, and private equity. The company focuses on long-term value creation through sustainable and strategic investments in essential assets and industries.

How big is Brookfield Corporation?

Brookfield Corporation is one of the largest asset managers globally, with over $850 billion in assets under management (AUM) as of recent reports. It operates in more than 30 countries and employs approximately 180,000 people, demonstrating its vast scale and global influence across multiple industries.

Is Brookfield Corporation the same as Brookfield Asset Management?

No, Brookfield Corporation and Brookfield Asset Management (BAM) are related but distinct entities. In December 2022, Brookfield Asset Management underwent a corporate reorganization, spinning off its asset management business into a separate publicly traded entity called Brookfield Asset Management (BAM), while the parent company was renamed Brookfield Corporation. Brookfield Corporation now focuses on owning and operating assets, while BAM manages investments on behalf of clients.

Does Brookfield Corporation own renewable energy companies?

Yes, Brookfield Corporation owns and operates renewable energy companies through its subsidiary, Brookfield Renewable Partners. This entity is one of the world’s largest publicly traded renewable power platforms, with a portfolio that includes hydroelectric, wind, solar, and storage facilities across North America, South America, Europe, and Asia.

What real estate properties does Brookfield Corporation own?

Brookfield Corporation owns a vast portfolio of real estate properties globally. Some of its most notable holdings include Canary Wharf in London, Brookfield Place in New York City, Manhattan West, and numerous office towers, retail spaces, and multifamily residential properties. It also invests in large-scale development projects and logistics facilities.

Does Brookfield Corporation invest in infrastructure?

Yes, Brookfield Corporation has significant investments in infrastructure through its subsidiary, Brookfield Infrastructure Partners. This includes transportation networks (toll roads, railways, ports), utilities (electricity and natural gas distribution), and data infrastructure (fiber networks, data centers).

Is Brookfield Corporation involved in private equity?

Yes, Brookfield Corporation is involved in private equity through its Brookfield Private Equity Group. This division focuses on acquiring and operating high-quality businesses across various industries, including industrials, healthcare, technology, and business services.

How does Brookfield Corporation generate revenue?

Brookfield Corporation generates revenue through its ownership and operation of assets across real estate, infrastructure, renewable energy, and private equity. It earns income from property rentals, utility operations, energy production, and returns on private equity investments. Additionally, its subsidiary, Brookfield Asset Management, earns fees for managing third-party capital.

Is Brookfield Corporation a publicly traded company?

Yes, Brookfield Corporation is a publicly traded company listed on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the ticker symbol “BN.”

What is Brookfield Corporation’s approach to sustainability?

Brookfield Corporation is committed to sustainability and has integrated environmental, social, and governance (ESG) principles into its operations. Through Brookfield Renewable Partners, it is a global leader in renewable energy. The company also focuses on reducing carbon emissions, enhancing energy efficiency, and promoting sustainable development across its real estate and infrastructure portfolios.

Does Brookfield Corporation operate globally?

Yes, Brookfield Corporation operates on a global scale, with investments and operations in over 30 countries across North and South America, Europe, Asia, and Australia. Its diversified portfolio spans multiple sectors and geographies, making it one of the largest alternative asset managers and operators in the world.

How does Brookfield Corporation support its communities?

Brookfield Corporation supports communities through various initiatives, including charitable donations, community development projects, and sustainability programs. It focuses on creating long-term value by investing in infrastructure, renewable energy, and real estate projects that benefit local economies and improve quality of life.

Can individuals invest in Brookfield Corporation?

Yes, individuals can invest in Brookfield Corporation by purchasing its publicly traded shares on the New York Stock Exchange (NYSE) or the Toronto Stock Exchange (TSX) under the ticker symbol “BN.” Additionally, investors can gain exposure to specific sectors through its publicly traded subsidiaries, such as Brookfield Renewable Partners (BEP) and Brookfield Infrastructure Partners (BIP).

What is the relationship between Brookfield Corporation and Brookfield Asset Management Ltd.?

In December 2022, Brookfield Corporation spun off its asset management business into a separate publicly traded entity named Brookfield Asset Management Ltd. The parent company retained the name Brookfield Corporation, while the spun-off asset management business adopted the former name.