- Microsoft fully owns Activision, having acquired 100% of the company in an all-cash $68.7 billion deal, ending Activision’s status as a publicly traded company.

- There are no public or institutional shareholders anymore; all ownership, financial control, and strategic authority sit solely with Microsoft Corporation.

- Activision operates as a core publishing division within Microsoft Gaming, alongside Xbox, Blizzard, Bethesda, and King, while retaining its brand and studio structure.

- Ultimate decision-making power rests with Microsoft, with Activision’s leadership handling operations under Microsoft’s broader gaming strategy.

Activision is one of the world’s most influential video game publishers. It operates as a core publishing label within Activision Blizzard, which itself is part of Microsoft Gaming. The company focuses on developing and publishing interactive entertainment for consoles, PC, and online platforms.

Activision is best known for building long-running blockbuster franchises. Its portfolio includes Call of Duty, Crash Bandicoot, Tony Hawk’s Pro Skater, and Sekiro publishing partnerships. The company specializes in large-scale AAA development, live-service ecosystems, and multiplayer infrastructure.

The organization works through a network of internal studios. These include Infinity Ward, Treyarch, Sledgehammer Games, Raven Software, and others. Each studio contributes to core franchise development, especially the Call of Duty ecosystem, which operates as a yearly premium release combined with a persistent live-service platform.

As of 2026, Activision functions within Microsoft’s gaming structure alongside Xbox Game Studios, Bethesda, Blizzard, and King. The brand continues to focus on global publishing, franchise management, and live multiplayer operations.

Activision Founders

Activision was founded in 1979 by four former Atari game developers who wanted creative control, fair recognition, and better financial rewards for their work. At the time, game creators were not credited publicly, and publishers held complete control. These founders changed the structure of the gaming industry by creating the first successful independent third-party video game publisher.

David Crane

David Crane was the most technically influential founder. He was a highly skilled programmer and game designer at Atari before leaving to co-found Activision. Crane created Pitfall in 1982, one of the most successful and technically advanced games of its era.

The game introduced smooth side-scrolling mechanics and character animation that were groundbreaking at the time. His engineering mindset helped establish Activision’s early reputation for high-quality game design and technical innovation.

Larry Kaplan

Larry Kaplan played a major role in shaping Activision’s early development culture. At Atari, he was known for building complex game logic and pushing technical limits.

At Activision, Kaplan helped design early game architecture and development workflows outside the control of console manufacturers. Although he left the company relatively early, his contribution helped prove that independent developers could successfully publish games without relying on hardware companies.

Alan Miller

Alan Miller was central to Activision’s formation and long-term philosophy. He strongly believed that game creators deserved public credit and financial participation. Miller helped define Activision’s developer-first culture, which attracted talented programmers and designers.

He also contributed to early game production and strategic direction, ensuring the company maintained a balance between creativity and commercial success during its early growth phase.

Bob Whitehead

Bob Whitehead was one of the key technical engineers behind Activision’s first generation of games. Before Activision, he developed several successful Atari 2600 titles. At Activision, he focused on optimizing performance within severe hardware limits, helping the company deliver smooth and polished gameplay experiences.

His engineering discipline helped establish production standards that influenced early console game development.

Jim Levy

Jim Levy joined shortly after the company’s formation and became Activision’s first CEO. Unlike the other founders, Levy came from a media and business background rather than programming. He played a crucial role in transforming Activision into a structured entertainment company.

Levy introduced branding, marketing strategy, and the practice of crediting game developers publicly. He positioned Activision not just as a developer but as a professional publishing organization, which helped the company gain industry credibility and long-term stability.

Together, these founders reshaped the video game industry. They shifted power toward developers, introduced creator recognition, and proved that independent game publishing could succeed at a global scale. Their vision laid the foundation for the modern third-party gaming ecosystem that dominates the industry today.

Ownership History

Activision’s ownership has changed multiple times over the decades. The company moved from being an independent pioneer to becoming part of one of the world’s largest technology corporations. Below is a detailed breakdown of its ownership evolution.

Independent Founding Era (1979–1990)

Activision began as an independent company in 1979. It was founded by former Atari developers who wanted creative freedom and recognition. During this period, the company operated as a standalone game publisher. It focused on developing titles for the Atari 2600 and other early platforms.

In the early 1980s, Activision became one of the most recognized names in gaming. However, the 1984 video game industry crash affected the company heavily. The market collapse reduced console demand and forced Activision to restructure. Leadership changes followed, and the company struggled to maintain growth.

Despite the challenges, Activision survived while many early gaming companies disappeared. This survival laid the groundwork for its future transformation.

Bobby Kotick Acquisition and Corporate Rebuild (1991–2007)

A major ownership shift happened in 1991. Investor Bobby Kotick acquired a significant stake in Activision and took control of the company. At the time, Activision was financially weak and lacked direction. Kotick restructured operations and repositioned Activision as a major third-party publisher.

Under Kotick’s leadership, Activision expanded aggressively. It acquired smaller studios and focused on building strong franchises. The company transitioned from a struggling publisher into a global gaming force. During this period, Activision remained publicly traded, meaning ownership was spread across institutional investors and public shareholders, while Kotick maintained strong executive influence.

This era set the stage for Activision’s rise into the top tier of the gaming industry.

Merger with Blizzard – Formation of Activision Blizzard (2008)

One of the most important ownership milestones occurred in 2008. Activision merged with Blizzard Entertainment, the creator of Warcraft, StarCraft, and Diablo. This merger formed Activision Blizzard, one of the largest video game companies in the world.

The merger was structured through Activision combining with Vivendi Games, Blizzard’s parent division. After the deal, Vivendi became the largest shareholder in Activision Blizzard. However, the company remained publicly traded, and shares were widely held by institutional investors.

This merger diversified the company across console, PC, and online gaming. Blizzard’s strong PC ecosystem and Activision’s console dominance created a powerful global publisher.

Buyback from Vivendi and Return to Independent Public Structure (2013)

In 2013, Activision Blizzard executed a major ownership restructuring. The company bought back a large portion of shares from Vivendi. This reduced Vivendi’s controlling stake and returned Activision Blizzard to a more independent public ownership model.

After this transaction, ownership became widely distributed among institutional investors, including major asset management firms. Bobby Kotick remained CEO and continued leading the company’s strategy.

This phase marked Activision Blizzard’s peak as an independent global gaming powerhouse.

Expansion Through King Digital Acquisition (2016)

In 2016, Activision Blizzard acquired King Digital, the company behind Candy Crush. This move significantly expanded the company into mobile gaming. While this acquisition did not change overall ownership structure, it strengthened the company’s strategic position.

Activision Blizzard now operated across three major segments:

- Activision (console and premium games)

- Blizzard (PC and online gaming)

- King (mobile gaming).

Ownership still remained public, with institutional shareholders holding most shares.

Microsoft Acquisition Announcement (2022)

In January 2022, Microsoft announced its intention to acquire Activision Blizzard. This marked the beginning of one of the largest acquisitions in technology and gaming history. The deal aimed to bring Activision under Microsoft’s gaming ecosystem alongside Xbox and Bethesda.

The acquisition required global regulatory approvals due to its size and potential impact on competition. Regulators in the US, UK, and EU reviewed the deal closely. The approval process lasted more than a year.

During this time, Activision Blizzard remained publicly traded but operated under acquisition planning.

Microsoft Completes Full Acquisition (October 2023)

In October 2023, Microsoft officially completed the acquisition of Activision Blizzard. Microsoft purchased 100% of the company’s shares, making it a wholly owned subsidiary. Activision Blizzard was delisted from the public stock market after the transaction.

This marked the end of Activision as an independent public company. Ownership shifted completely to Microsoft. Previous institutional shareholders no longer held direct ownership.

Activision became part of Microsoft Gaming, joining Xbox Game Studios, Bethesda, and other first-party developers.

Ownership Structure As of 2026

As of 2026, Activision is fully owned by Microsoft Corporation. It operates as a core publishing label within Microsoft Gaming. Strategic direction, financial control, and long-term planning come from Microsoft’s executive leadership.

While Activision continues to operate under its brand name, it no longer has independent shareholders. Its studios, franchises, and publishing operations are fully integrated into Microsoft’s broader gaming and technology ecosystem.

This transformation reflects Activision’s journey from a small independent developer group in 1979 to a key component of one of the world’s largest technology companies.

Who Owns Activision?

Activision is fully owned by Microsoft Corporation. Microsoft holds 100% of Activision Blizzard after completing its acquisition in October 2023. This means Activision is no longer a publicly traded company and has no independent shareholders.

Before the acquisition, Activision Blizzard was listed on the NASDAQ stock exchange. Ownership was spread across institutional investors, public shareholders, and executives. After Microsoft purchased all outstanding shares, the company was delisted and became a wholly owned subsidiary.

As of 2026, Activision operates under Microsoft Gaming but continues to function using its own brand identity and publishing structure.

Parent Company: Microsoft Corporation

Microsoft is one of the largest technology companies in the world. It operates across software, cloud computing, artificial intelligence, and gaming. Activision is now part of Microsoft’s gaming division, which includes:

- Xbox Game Studios

- Bethesda (ZeniMax Media)

- Blizzard Entertainment

- King Digital.

Within Microsoft, Activision primarily focuses on AAA console and PC publishing. Its flagship franchise, Call of Duty, plays a major role in Microsoft’s gaming ecosystem, including Game Pass, cloud gaming, and cross-platform strategy.

Microsoft provides financial backing, infrastructure, and long-term strategic direction. However, Activision still manages its internal studios and franchise operations.

Microsoft Acquisition of Activision Blizzard

Microsoft announced its plan to acquire Activision Blizzard in January 2022. The deal was valued at approximately $68.7 billion, making it the largest acquisition in gaming history and one of the biggest in the technology sector.

The acquisition aimed to strengthen Microsoft’s position in:

- Console gaming

- PC gaming

- Mobile gaming

- Cloud gaming and subscription services.

Because of its size, the deal faced global regulatory scrutiny. Authorities in the United States, United Kingdom, and European Union examined its impact on competition, especially regarding the Call of Duty franchise and cloud gaming.

After a lengthy review process, Microsoft received approval with certain commitments related to cloud gaming distribution and licensing agreements.

The acquisition officially closed on October 13, 2023.

What Microsoft Gained From the Acquisition

The acquisition gave Microsoft control over some of the most valuable gaming intellectual properties in the world. These include:

- Call of Duty

- World of Warcraft

- Diablo

- Overwatch

- Candy Crush

- Crash Bandicoot

- StarCraft.

It also added major development studios and mobile gaming capabilities through King Digital. This significantly strengthened Microsoft’s long-term gaming strategy, especially in subscription services and global player reach.

Activision became a core pillar of Microsoft Gaming, contributing to both revenue and content ecosystem expansion.

Post-Acquisition Corporate Structure

After the acquisition, Activision Blizzard was reorganized under Microsoft Gaming. The company is not independent but operates as an internal publishing label. Microsoft controls:

- Financial decisions

- Long-term strategy

- Major investments

- Corporate governance.

Operational leadership remains within Activision’s publishing and studio structure. However, all major strategic direction ultimately comes from Microsoft’s executive leadership.

Leadership Changes After the Acquisition

The acquisition led to significant leadership transitions. Bobby Kotick, who served as CEO of Activision Blizzard for over three decades, stepped down at the end of 2023 after the deal closed.

Microsoft integrated Activision leadership into its broader gaming management structure. Phil Spencer, CEO of Microsoft Gaming, now oversees Activision alongside Xbox and Bethesda.

Studio heads and publishing leaders within Activision continue to manage day-to-day game development and franchise operations.

Ownership Status As of 2026

As of February 2026, Activision is fully owned by Microsoft and operates as a core division within Microsoft Gaming. It no longer has public shareholders and is not independently traded on the stock market.

The company retains its brand identity and continues to publish major franchises globally. However, Microsoft holds complete financial and strategic control, making it the sole owner and ultimate decision-maker behind Activision’s future.

Competitor Ownership Comparison

Ownership structure plays a major role in how gaming companies operate, expand, and compete globally. Unlike Activision, which is fully owned by Microsoft, many of its top competitors follow different ownership models.

| Company | Ownership Type | Parent Company | Largest/Key Owners | Control Structure | Key Strategic Advantage |

|---|---|---|---|---|---|

| Activision | Wholly owned subsidiary | Microsoft Corporation | Microsoft (100%) | Controlled by Microsoft Gaming leadership | Strong ecosystem integration across Xbox, cloud gaming, and subscription services |

| Electronic Arts (EA) | Publicly traded | None | Institutional investors (Vanguard, BlackRock, others) | Board of directors and executive leadership | Independent publishing and strong live-service franchises |

| Take-Two Interactive | Publicly traded | None | Institutional investors and public shareholders | Executive leadership and board control | Powerful AAA franchises like GTA and Red Dead |

| Ubisoft | Publicly traded with strategic investors | None | Guillemot family, Tencent (minority stake), institutional investors | Shared influence between founders, investors, and management | Global studio network and strong open-world franchises |

| Sony Interactive Entertainment | Internal division | Sony Group Corporation | Sony Group (100%) | Controlled by Sony corporate leadership | Strong console ecosystem and exclusive first-party titles |

| Tencent (Gaming Investments) | Investment-based ownership | Tencent Holdings | Minority stakes in multiple gaming companies | Financial influence rather than full operational control | Massive global investment reach and mobile gaming dominance |

Electronic Arts (EA) Ownership Structure

Electronic Arts operates as an independent publicly traded company. It is listed on the NASDAQ stock exchange and does not have a single parent company. Ownership is widely distributed among institutional investors such as large asset management firms, mutual funds, and pension funds.

No single entity controls EA. Instead, decision-making power comes from its board of directors and executive leadership. The company maintains independence in strategy, acquisitions, and publishing decisions. This structure allows EA to operate freely but without the financial backing of a major technology parent like Microsoft.

Compared to Activision, EA lacks vertical integration across hardware, cloud infrastructure, and subscription ecosystems. Activision benefits from Microsoft’s resources, while EA relies solely on its own publishing and live-service model.

Take-Two Interactive Ownership Structure

Take-Two Interactive is also a publicly traded company with no parent corporation. Its ownership is spread across institutional investors and public shareholders. The company remains independent and focuses on premium AAA franchises such as Grand Theft Auto, Red Dead Redemption, and NBA 2K.

Because Take-Two is independent, strategic control lies with its executive leadership and board. It does not have direct backing from a major technology company. However, its strong intellectual property portfolio allows it to remain competitive globally.

In contrast, Activision operates within Microsoft’s ecosystem. This gives Activision advantages in cloud gaming, platform distribution, and long-term investment capacity.

Ubisoft Ownership Structure

Ubisoft has a mixed ownership model. It is publicly traded but still influenced by its founding family, the Guillemot family. The family holds a significant ownership stake and maintains strong influence over corporate decisions.

Chinese technology company Tencent also owns a notable minority stake in Ubisoft. However, Tencent does not fully control the company. Ubisoft continues to operate independently with shared influence between institutional investors, the founding family, and strategic partners.

Compared to Activision, Ubisoft remains independent but lacks full financial backing from a single global tech giant. Activision’s integration into Microsoft provides stronger ecosystem synergy and infrastructure support.

Sony Interactive Entertainment and PlayStation Studios

Sony Interactive Entertainment operates differently from independent publishers. It is not publicly traded as a separate company. Instead, it is a division of Sony Group Corporation. Sony fully owns PlayStation Studios and its internal development teams.

This structure is somewhat similar to Activision’s position under Microsoft. Both companies operate as gaming divisions within larger technology and entertainment corporations. However, Sony focuses heavily on exclusive console ecosystems, while Microsoft emphasizes cross-platform and cloud gaming expansion.

Activision’s integration into Microsoft strengthens Xbox Game Pass, cloud streaming, and multiplatform distribution. Sony maintains control through its PlayStation hardware and exclusive game strategy.

Tencent’s Role in the Gaming Industry

Tencent is one of the most influential gaming investors globally. Unlike Microsoft, Tencent usually does not fully acquire major publishers. Instead, it invests in minority stakes across multiple companies, including Epic Games, Ubisoft, and others.

Tencent’s strategy focuses on financial influence rather than full ownership. This differs from Microsoft’s complete acquisition of Activision. Microsoft fully controls Activision’s strategy, while Tencent typically allows companies to operate independently.

Key Difference Between Activision and Competitors

The biggest difference lies in ownership concentration. Activision is fully owned by Microsoft, giving it strong financial backing, technology infrastructure, and ecosystem integration. Most competitors, including EA and Take-Two, remain independent and publicly traded.

Ubisoft operates under shared influence, while Sony’s gaming division is internally owned like Activision. However, Microsoft’s global cloud and software ecosystem gives Activision broader strategic advantages compared to most competitors.

This ownership structure positions Activision as a key pillar within Microsoft’s long-term gaming strategy rather than an independent publisher competing alone.

Who Controls Activision?

Control of Activision is layered. Microsoft holds full ownership, but operational leadership exists within the Activision publishing structure. Below is a detailed breakdown of who controls strategy, management, and day-to-day operations.

Ultimate Control: Microsoft Gaming Leadership

Microsoft has full strategic and financial control over Activision. The company operates under Microsoft Gaming, which oversees Xbox, Bethesda, Blizzard, King, and Activision. Major decisions such as long-term strategy, capital allocation, acquisitions, and platform integration are made at the Microsoft level.

Phil Spencer leads Microsoft Gaming and serves as the top executive overseeing Activision. He reports to Microsoft’s senior corporate leadership. Under this structure, Activision is not an independent decision-making entity. Instead, it functions as a core publishing division aligned with Microsoft’s global gaming strategy, including Game Pass, cloud gaming, and cross-platform distribution.

Operational Control: Activision Publishing Leadership

While Microsoft controls overall strategy, operational management remains within Activision’s internal leadership. Day-to-day publishing, franchise planning, and studio coordination are handled by Activision executives.

Rob Kostich serves as President of Activision Publishing. He oversees major franchises such as Call of Duty and manages relationships between internal development studios. His role focuses on game production, release planning, and live-service operations.

Studio heads at Infinity Ward, Treyarch, Sledgehammer Games, and Raven Software manage development cycles, technology implementation, and gameplay innovation. These teams operate within Microsoft’s broader strategic framework but retain operational autonomy in game creation.

Corporate Governance and Decision-Making Structure

Activision no longer has an independent board of directors because it is fully owned by Microsoft. Governance flows through Microsoft’s corporate structure. Major corporate decisions are influenced by:

- Microsoft executive leadership

- Microsoft Gaming division

- Corporate strategy and platform teams.

This structure ensures alignment between Activision’s publishing activities and Microsoft’s long-term ecosystem goals, including subscription growth, cloud gaming expansion, and cross-platform engagement.

Role of Former CEO Bobby Kotick

Bobby Kotick was the most influential leader in Activision’s modern history. He served as CEO of Activision Blizzard from 1991 until the Microsoft acquisition closed in 2023. Under his leadership, Activision transformed into one of the world’s largest gaming publishers.

Kotick played a major role in expanding Call of Duty, merging with Blizzard, and acquiring King Digital. After Microsoft completed the acquisition, Kotick stepped down from his CEO position. His departure marked the end of Activision operating as an independent public company.

Key Leaders in Activision’s Leadership History

Activision has had several influential leaders who shaped its direction over time:

- Bobby Kotick: Kotick rebuilt Activision in the early 1990s and led it through global expansion, major acquisitions, and franchise dominance. He served as CEO for more than three decades.

- Brian Kelly: Brian Kelly was a co-founder of the investor group that acquired Activision in 1991 alongside Kotick. He played a major role in financial restructuring and corporate rebuilding.

- Jim Levy: Jim Levy was Activision’s first CEO in the early years. He helped establish the company’s publishing identity and introduced developer recognition in the gaming industry.

Current Control Structure as of 2026

As of 2026, Activision is fully controlled by Microsoft through its gaming division. Microsoft sets strategic direction, manages financial oversight, and determines long-term investments. Activision leadership manages publishing execution, franchise development, and studio operations within that framework.

This dual-layer control model allows Microsoft to guide global strategy while Activision focuses on building and maintaining some of the most successful gaming franchises in the world.

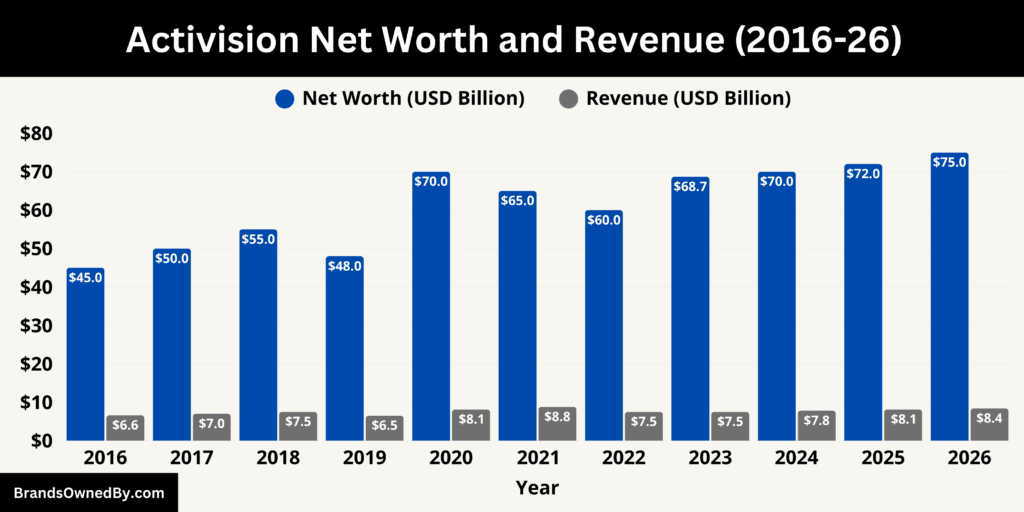

Activision Annual Revenue and Net Worth

As of February 2026, Activision generates an estimated $8.42 billion in annual revenue and carries an implied standalone valuation of approximately $74.8 billion. This valuation is derived from the $68.7 billion Microsoft acquisition baseline (2023), adjusted for revenue growth, franchise expansion, and stable recurring digital income.

2026 Revenue Breakdown

In 2026, Activision’s $8.42 billion revenue comes from three primary segments.

Console and PC gaming generate $4.23 billion, representing 50.2% of total revenue. The Call of Duty ecosystem alone contributes about $3.18 billion. Warzone generates roughly $1.05 billion, while premium game sales, downloadable content, and seasonal monetization produce approximately $2.13 billion combined.

Mobile gaming through King Digital contributes $3.09 billion, accounting for 36.7% of total revenue. The Candy Crush franchise generates about $2.64 billion, while other King titles add around $450 million.

Blizzard-related publishing, licensing, and catalog digital sales contribute $1.10 billion, representing 13.1% of total revenue. This includes digital expansions, legacy franchise income, and licensing streams.

Digital revenue dominates the business model. In 2026, digital sales generate $7.23 billion, or 85.9% of total revenue, while physical retail contributes $1.19 billion, or 14.1%.

Net Worth

Activision’s implied $74.8 billion valuation is supported by measurable franchise economics. The Call of Duty franchise generates approximately $3.18 billion annually and has produced more than $31 billion in lifetime revenue. Candy Crush contributes about $2.64 billion annually with lifetime franchise revenue exceeding $20 billion. Blizzard-linked digital ecosystems add approximately $1.10 billion per year through expansions, licensing, and catalog monetization.

Recurring digital income totals $5.82 billion in 2026, representing about 69% of total revenue. This recurring structure significantly stabilizes long-term valuation and reduces dependence on single-release cycles.

Profitability Structure

Activision maintains strong profitability due to digital distribution and live-service monetization. In 2026, the estimated operating margin is approximately 31%, producing operating profit of around $2.61 billion.

Mobile gaming delivers the highest margin at roughly 38% due to low distribution costs and recurring microtransactions. Console and PC gaming operate at about 29% margin, while licensing and other digital streams operate near 24%. High digital penetration continues to support stable long-term profitability.

Future Revenue Forecast (2027–2030)

- 2027: Revenue projected $8.86 billion, valuation approx $78.2 billion driven by live-service expansion and subscription integration

- 2028: Revenue projected $9.21 billion, valuation approx $82.4 billion supported by cloud distribution growth and franchise cycle strength

- 2029: Revenue projected $9.67 billion, valuation approx $87.6 billion as recurring digital income exceeds 72% of total revenue

- 2030: Revenue projected $10.18 billion, valuation approx $93.5 billion driven by mobile scale, subscription monetization, and long-term franchise stability

Activision’s financial trajectory shows steady expansion supported by recurring digital income, dominant IP economics, and integration into Microsoft’s global gaming infrastructure.

Games Owned by Activision

Activision’s game portfolio spans multiple genres including first-person shooters, platformers, action-adventure, multiplayer online games, and mobile ecosystems. The company’s strongest revenue drivers are Call of Duty and mobile gaming through King Digital, while legacy franchises provide long-term brand and licensing value.

Below is a detailed breakdown of the major game franchises owned or controlled by Activision as of February 2026:

| Franchise / Game | Primary Genre | Ownership Type | Key Titles / Components | Strategic Importance |

|---|---|---|---|---|

| Call of Duty | First-person shooter | Fully owned | Modern Warfare, Black Ops, Vanguard, Warzone | Largest franchise, major revenue driver, global FPS market leader |

| Call of Duty Warzone | Battle royale / Live service | Fully owned | Warzone, seasonal content, cross-platform ecosystem | Recurring digital revenue, long-term player retention |

| Crash Bandicoot | Platformer / Action | Fully owned | N. Sane Trilogy, Crash 4, Crash Team Racing | Strong nostalgic IP, family-friendly portfolio |

| Spyro the Dragon | Platformer | Fully owned | Reignited Trilogy, classic Spyro series | Legacy brand value and catalog sales |

| Tony Hawk’s Pro Skater | Sports / Skateboarding | Fully owned | THPS Remasters, classic Tony Hawk titles | High nostalgic demand, strong digital performance |

| Guitar Hero | Rhythm / Music | Fully owned | Guitar Hero series, Live | Strong legacy IP, licensing and revival potential |

| Skylanders | Action / Toys-to-life | Fully owned | Spyro’s Adventure, Giants, Imaginators | Physical-digital hybrid success, licensing value |

| Prototype | Open-world action | Fully owned | Prototype 1 & 2 | Cult franchise, catalog revenue |

| Sekiro: Shadows Die Twice | Action / Adventure | Published by Activision | Sekiro | Critically acclaimed, major publishing success |

| Diablo | Action RPG | Part of Blizzard ecosystem | Diablo I–IV, expansions | Strong recurring revenue, major RPG franchise |

| World of Warcraft | MMORPG | Part of Blizzard ecosystem | WoW, expansions, subscription model | Long-running live-service revenue |

| Overwatch | Multiplayer shooter | Part of Blizzard ecosystem | Overwatch 1 & 2 | Esports and live-service ecosystem |

| StarCraft | Real-time strategy | Part of Blizzard ecosystem | StarCraft I & II | Legacy RTS dominance and esports history |

Call of Duty

Call of Duty is Activision’s largest and most important franchise. It launched in 2003 and has grown into one of the highest-selling entertainment franchises in history. The series includes multiple sub-franchises such as Modern Warfare, Black Ops, and Warzone.

The franchise operates on a dual model. Premium titles release regularly, while Warzone functions as a continuous live-service platform. Revenue comes from full game sales, downloadable content, seasonal battle passes, in-game purchases, and cosmetics. The franchise has sold more than 425 million copies globally and continues to dominate first-person shooter markets.

Call of Duty Warzone

Warzone is the free-to-play battle royale ecosystem within Call of Duty. It generates strong recurring revenue through microtransactions, battle passes, and seasonal content. Warzone operates as a persistent platform rather than a one-time game, allowing continuous monetization across the year.

Warzone also supports cross-platform play and integration with premium Call of Duty releases, strengthening player retention and long-term engagement.

Crash Bandicoot

Crash Bandicoot is one of Activision’s most recognizable platform franchises. Originally created in the 1990s, Activision revived the brand through remastered trilogies and new releases. The franchise appeals to both nostalgic players and new audiences.

Crash Bandicoot titles generate revenue through premium game sales, remasters, and spin-off multiplayer titles. The franchise remains an important part of Activision’s family-friendly gaming portfolio.

Spyro the Dragon

Spyro is another classic platform franchise under Activision. The series was revived through the Spyro Reignited Trilogy, which introduced modern graphics and gameplay enhancements. Spyro contributes through premium sales and catalog monetization.

Although Spyro releases are less frequent than Call of Duty, the franchise holds strong brand recognition and long-term licensing value.

Tony Hawk’s Pro Skater

Tony Hawk’s Pro Skater is one of the most successful skateboarding game franchises ever created. Activision revitalized the series with remastered editions that performed strongly in digital sales. The franchise generates revenue through premium titles and nostalgic player engagement.

The brand also holds licensing and cross-media value, maintaining relevance even with fewer new releases.

Sekiro: Shadows Die Twice (Publishing Rights)

Activision served as the global publisher for Sekiro: Shadows Die Twice, developed by FromSoftware. The game became a major critical and commercial success, winning Game of the Year awards and selling millions of copies.

Although Sekiro is not an internally created franchise, Activision retains publishing significance and historical association with the title.

Guitar Hero

Guitar Hero was once one of Activision’s biggest franchises. It defined the rhythm game genre and generated massive revenue during its peak years. While new releases have slowed, the franchise still holds strong intellectual property value and potential for revival.

The brand continues to generate licensing and catalog revenue through digital distribution and legacy sales.

Prototype

Prototype is an open-world action franchise developed under Activision. While not as large as Call of Duty, the series maintains a loyal fan base and contributes to catalog revenue. The franchise remains part of Activision’s intellectual property portfolio.

Skylanders

Skylanders introduced the toys-to-life gaming model, combining physical figures with digital gameplay. The franchise was highly successful during its peak and generated strong revenue through both game sales and physical collectibles.

Although active releases have slowed, Skylanders remains a valuable intellectual property with licensing potential.

Diablo (Publishing Role within Activision Blizzard)

Diablo operates under Blizzard but remains part of the broader Activision Blizzard ecosystem owned by Microsoft. The franchise generates revenue through premium releases, expansions, and digital monetization. Diablo contributes to the overall gaming portfolio value associated with Activision’s ecosystem.

World of Warcraft (Publishing Ecosystem)

World of Warcraft is one of the longest-running subscription-based online games in history. While developed by Blizzard, it forms part of the same corporate portfolio under Microsoft Gaming. The franchise generates recurring revenue through subscriptions, expansions, and digital purchases.

Overwatch and StarCraft (Blizzard Portfolio Association)

These franchises also belong to the broader Activision Blizzard portfolio. Overwatch operates as a live-service multiplayer ecosystem, while StarCraft holds strong legacy value in real-time strategy gaming and esports history.

Conclusion

The answer to who owns Activision is clear. Microsoft is the sole owner, and Activision now operates within a larger global gaming ecosystem. This structure gives the company strong technological support, long-term stability, and wider platform reach.

Despite the ownership shift, Activision continues to stand out through its powerful franchises, global player base, and consistent game development pipeline. Its influence across console, PC, and mobile gaming remains significant. With strong intellectual property and deep integration into Microsoft Gaming, Activision continues to play a major role in shaping the modern video game industry.

FAQs

Who owns Activision Blizzard?

Microsoft owns Activision Blizzard. The company became a wholly owned subsidiary after Microsoft completed its acquisition on October 13, 2023. This means Microsoft purchased all outstanding shares and now holds full financial and strategic control. Activision Blizzard no longer operates as a publicly traded company and is fully integrated into Microsoft Gaming alongside Xbox, Blizzard, Bethesda, and King.

Who owns Activision now?

Activision is fully owned by Microsoft Corporation. After the 2023 acquisition, Activision stopped being an independent public company and became a core publishing division within Microsoft Gaming. While Activision still operates under its own brand and manages its studios and franchises, all ownership and ultimate decision-making authority belong to Microsoft.

Does Microsoft own Activision?

Yes, Microsoft owns Activision completely. Microsoft holds 100% ownership after acquiring Activision Blizzard in an all-cash transaction. This gives Microsoft full control over Activision’s intellectual property, studios, financial operations, and long-term strategic direction. Activision now operates within Microsoft’s broader gaming ecosystem.

Did Microsoft buy Activision?

Yes, Microsoft bought Activision Blizzard in a landmark deal worth $68.7 billion. The acquisition was officially completed on October 13, 2023, after global regulatory approvals. This became the largest acquisition in gaming history and significantly strengthened Microsoft’s position in console, PC, mobile, and cloud gaming.

Who founded Activision?

Activision was founded in 1979 by David Crane, Larry Kaplan, Alan Miller, and Bob Whitehead, all of whom were former Atari game developers. They created Activision to gain creative control and recognition for developers, something that was uncommon at the time. Jim Levy later joined as the company’s first CEO and helped build Activision into a structured game publishing organization.

Does Microsoft own 100% of Activision?

Yes, Microsoft owns 100% of Activision. The company purchased all publicly traded shares and fully absorbed Activision Blizzard into its corporate structure. There are no remaining public or institutional shareholders. Microsoft is the sole owner and ultimate controlling authority over Activision.

Who is the CEO of Activision?

Activision does not operate with a separate corporate CEO after the Microsoft acquisition. Phil Spencer, CEO of Microsoft Gaming, oversees Activision along with Xbox and Bethesda. Within Activision, Rob Kostich serves as President of Activision Publishing and manages day-to-day franchise and studio operations.

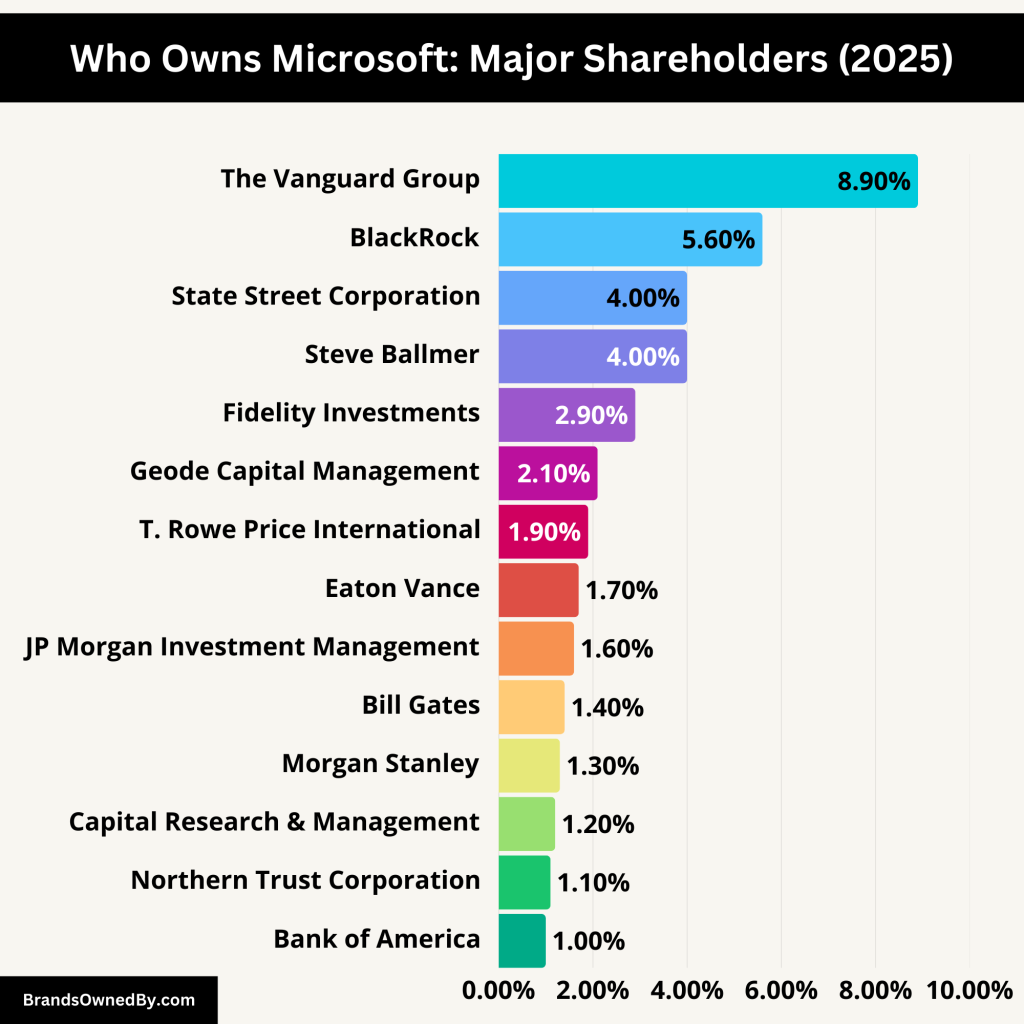

Who owned Activision before Microsoft?

Before Microsoft, Activision Blizzard was a publicly traded company owned by institutional investors, mutual funds, and public shareholders. Major asset managers such as Vanguard and BlackRock held significant stakes. Bobby Kotick served as CEO and played a central role in building Activision into one of the world’s largest gaming publishers before Microsoft acquired the company.

When did Microsoft buy Activision?

Microsoft completed the acquisition of Activision Blizzard on October 13, 2023. After this date, Activision officially became a wholly owned subsidiary of Microsoft, ending its status as an independent publicly traded company and integrating it into Microsoft Gaming.