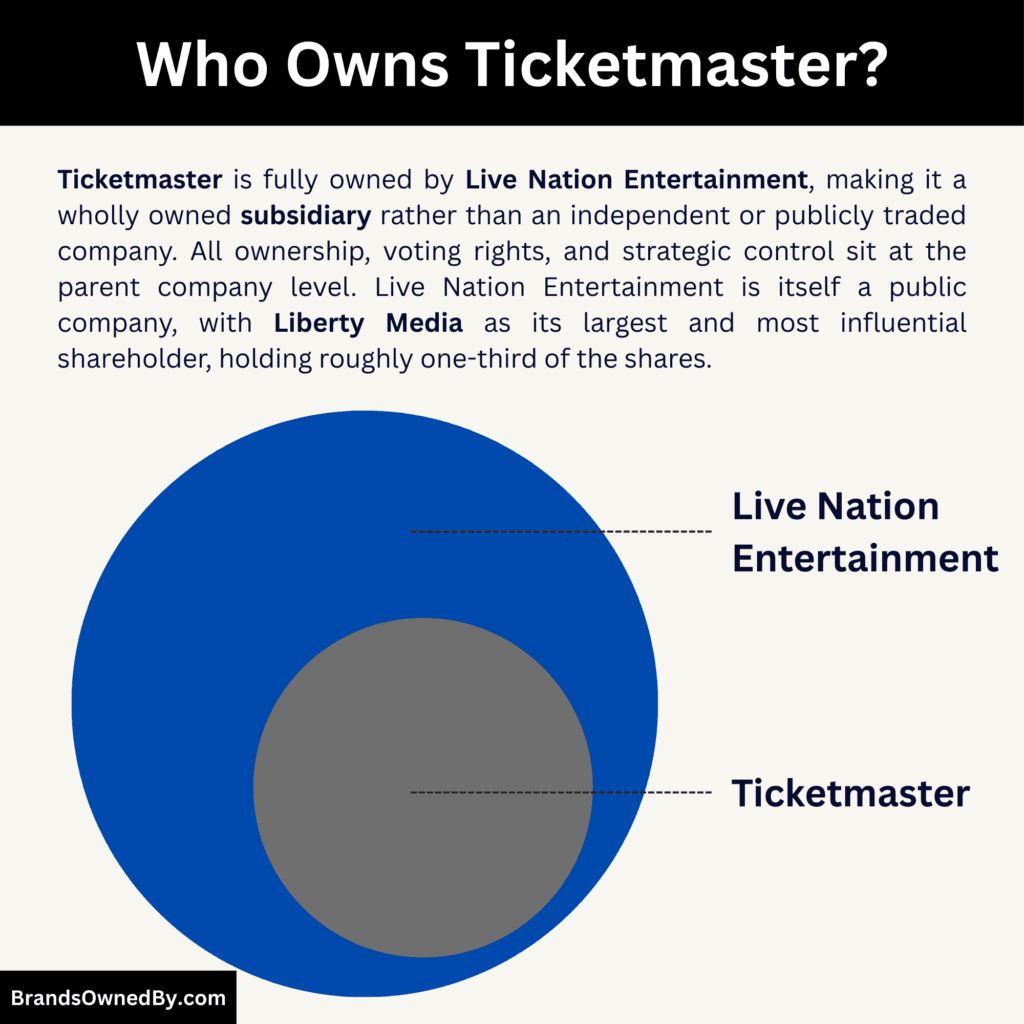

- Ticketmaster is 100% owned by Live Nation Entertainment, meaning it has no independent shareholders or public stock of its own.

- Live Nation Entertainment is a public company, so Ticketmaster’s indirect ownership flows through Live Nation’s shareholder base.

- Liberty Media is the largest and most influential shareholder at the parent-company level, holding roughly 30%–31% of Live Nation’s shares, giving it significant voting power.

- Strategic control over Ticketmaster sits with Live Nation’s board and executive leadership, while institutional investors hold minority, non-controlling stakes.

Ticketmaster is one of the world’s largest and most influential ticketing companies. It provides ticket sales, distribution, and event access technology for concerts, sports, theater, and other live entertainment events globally.

The company’s platform enables event organizers and venues to sell tickets directly to fans, manage digital entry, and handle customer support for ticketed events. Ticketmaster operates in dozens of countries, servicing thousands of venues and millions of customers every year.

The company is structured as a subsidiary of Live Nation Entertainment. Since its merger with Live Nation in 2010, Ticketmaster has operated as the primary ticketing arm of the larger live entertainment group, integrated closely with tour promotion, venue operations, and artist services.

Ticketmaster’s technology and market reach have made it a dominant player in primary and secondary ticket distribution worldwide.

Ticketmaster Founders

Ticketmaster was founded in 1976 in Phoenix, Arizona. The founding team included three individuals with complementary skills who saw an opportunity in computerized ticket sales:

- Albert Leffler was a university staff member who became interested in computerized ticketing after researching existing solutions.

- Peter Gadwa, also a university staff member, brought technical expertise and programming capability to help build early ticketing systems.

- Gordon Gunn III was a businessman who provided entrepreneurial experience and operational direction during the company’s early stages.

Together, these three pioneers developed systems to license computer programs and sell ticketing hardware to venues, offering a new way to manage ticket sales efficiently.

The company’s first real ticketed event was for Electric Light Orchestra, marking its entry into live event ticket distribution. Early growth was driven by innovation in computerized ticketing technology and expanding partnerships with venues.

Ownership Snapshot

Ticketmaster is not an independent or publicly traded company. It operates as a wholly owned subsidiary of Live Nation Entertainment. All ownership, governance, and strategic oversight come from its parent company.

- Ticketmaster is not a standalone or publicly listed company.

- It is a wholly owned subsidiary of Live Nation Entertainment.

- All ownership and governance of Ticketmaster flow through Live Nation Entertainment.

- Live Nation Entertainment is a publicly traded company on the NYSE.

- The largest and most influential shareholder at the parent-company level is Liberty Media, through its Liberty Live structure.

- Liberty Media’s stake gives it significant voting influence over major decisions.

- Other ownership is held by large institutional investors such as asset managers and index funds.

- Day-to-day operations are managed by Live Nation’s executive leadership, not by individual shareholders.

Ownership History

Ticketmaster’s ownership history explains how a small, independent ticketing startup evolved into a core asset inside the world’s largest live entertainment company. Over five decades, ownership shifted multiple times in response to technology changes, industry consolidation, and strategic control over live events. Each phase reshaped how Ticketmaster operated and who ultimately held power over the platform.

| Period | Ownership Status | Key Owner / Controller | What Changed |

|---|---|---|---|

| 1976–early 1980s | Privately held | Founders and early stakeholders | Operated as an independent company focused on computerized ticketing systems for venues. |

| 1980s–mid 1990s | Privately held | Private investors and professional management | Founders’ influence declined as Ticketmaster expanded nationally and signed exclusive venue contracts. |

| Late 1990s–2007 | Majority-owned subsidiary | USA Networks → InterActiveCorp (IAC) | Ownership shifted to a media and internet conglomerate, accelerating online ticket sales and digital growth. |

| 2008–2009 | Public company | Public shareholders | Ticketmaster was spun off from IAC and briefly operated as an independent publicly traded company. |

| 2010 | Merger completed | Live Nation Entertainment | Ticketmaster merged with Live Nation, ending its standalone status. |

| 2010–present | Wholly owned subsidiary | Live Nation Entertainment | Ticketmaster operates as Live Nation’s ticketing division with no separate shareholders. |

| 2013–present (influence level) | Strategic shareholder influence | Liberty Media | Liberty Media became the most influential shareholder at the parent-company level through a large stake in Live Nation. |

Early Independent Years

Ticketmaster was founded in 1976 as a privately held company. In its earliest phase, ownership rested with the founders and a small group of early stakeholders. The business model was focused on licensing computerized ticketing systems to venues rather than acting as a centralized ticket marketplace.

During this period, Ticketmaster did not dominate ticket sales. Venues often retained control, and Ticketmaster functioned as a technology provider. Ownership was closely tied to operational leadership, with founders actively involved in decision-making. This phase laid the technological foundation but lacked the scale and market power Ticketmaster would later achieve.

Expansion and Private Ownership Changes

As Ticketmaster expanded during the 1980s and early 1990s, ownership gradually shifted away from the original founders. Professional executives and private investors gained greater influence as the company pursued aggressive growth. Ticketmaster began securing exclusive, long-term contracts with major venues and sports organizations.

This era marked a critical shift in ownership dynamics. Control moved from entrepreneurial founders to centralized management. Ticketmaster became less of a software vendor and more of a gatekeeper to live events. Although still privately held, ownership was increasingly structured to support scale, market consolidation, and operational dominance.

Acquisition by USA Networks and the IAC

A major ownership turning point came when USA Networks acquired a controlling interest in Ticketmaster in the late 1990s. USA Networks later became part of InterActiveCorp, commonly known as IAC. Under this ownership, Ticketmaster was absorbed into a broader media and internet-focused portfolio.

This phase accelerated Ticketmaster’s digital transformation. Online ticket sales became central to the business. Ownership under IAC brought access to capital, media assets, and digital expertise. Ticketmaster shifted from venue-centric systems to consumer-facing platforms, reinforcing its role as the primary interface between fans and events.

Separation from IAC and a Brief Public Company Phase

In the late 2000s, IAC spun off Ticketmaster as a standalone public company. For a short period, Ticketmaster had its own public shareholders and an independent market valuation. This separation was strategic rather than permanent.

The public listing allowed Ticketmaster to streamline its operations, clarify its financial structure, and position itself for a larger strategic transaction. While technically independent during this phase, the company was already preparing for a deeper integration with the live events ecosystem.

Merger with Live Nation

In 2010, Ticketmaster merged with Live Nation Entertainment in a landmark deal. This merger fundamentally changed Ticketmaster’s ownership. Ticketmaster shareholders exchanged their shares for Live Nation stock, and Ticketmaster ceased to exist as an independent company.

From this point onward, Ticketmaster became a wholly owned operating division within Live Nation Entertainment. Ownership was no longer about ticketing alone. It was now part of a vertically integrated structure that combined ticketing, concert promotion, artist management, and venue ownership under one corporate roof.

Post-Merger Ownership Stability

After the merger, Ticketmaster’s ownership structure stabilized. There have been no carve-outs, spin-offs, or separate equity offerings for Ticketmaster. All ownership changes since 2010 have occurred at the Live Nation level, not within Ticketmaster itself.

Ticketmaster’s strategic role expanded significantly during this period. It became the default ticketing platform for Live Nation venues and tours, deeply embedding it into the parent company’s operations. Ownership remained centralized, reinforcing long-term control and consistency.

Influence of Strategic Shareholders

While Ticketmaster is fully owned by Live Nation, major shareholders at the parent company level shape its ownership environment. The most influential of these has been Liberty Media, which holds a significant stake in Live Nation through its Liberty Live structure.

Liberty Media has never owned Ticketmaster directly. However, its large ownership position in Live Nation gives it substantial influence over board decisions, leadership continuity, and long-term strategy. As of 2026, this structure remains intact, with Ticketmaster firmly positioned as a core asset within Live Nation’s ownership framework.

Overall, Ticketmaster’s ownership history shows a clear progression from independence to consolidation. Each ownership transition reduced fragmentation, increased scale, and tightened control, ultimately resulting in the vertically integrated model that defines Ticketmaster today.

Who Owns Ticketmaster?

Ticketmaster is not an independent company. It is fully owned by Live Nation Entertainment. There are no separate Ticketmaster shareholders, no public stock, and no standalone ownership structure. All equity, voting rights, and legal control over Ticketmaster sit entirely with Live Nation Entertainment. Any change in Ticketmaster’s ownership can only happen through changes in Live Nation’s shareholder base.

Parent Company: Live Nation Entertainment

Live Nation Entertainment is the direct and sole owner of Ticketmaster. Ticketmaster operates as a wholly owned subsidiary and does not have its own equity, public float, or independent shareholder structure.

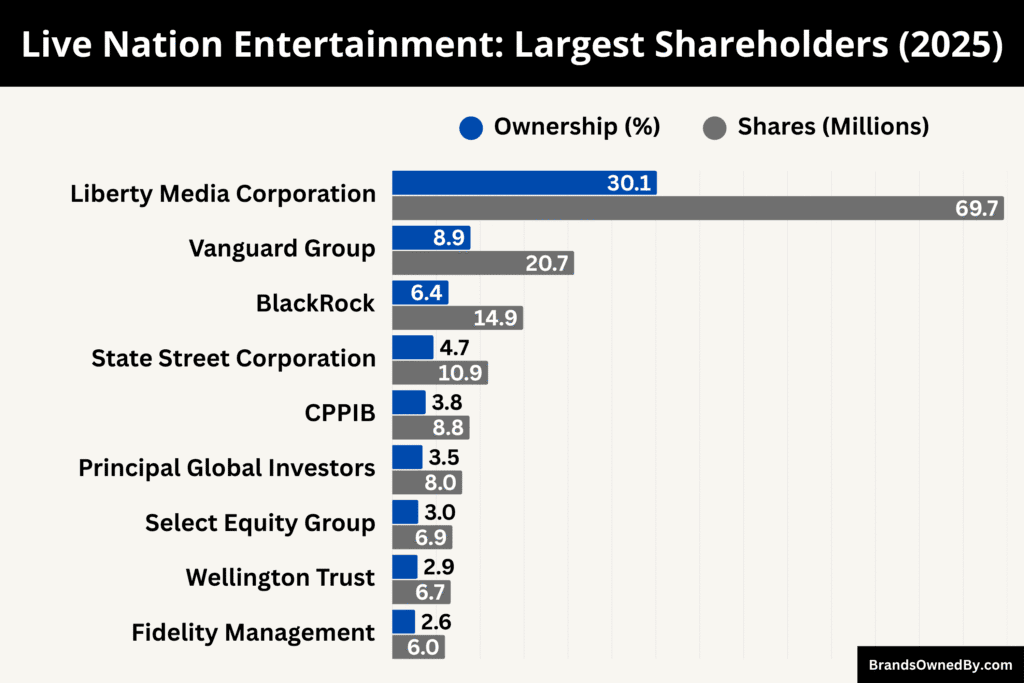

Live Nation Entertainment is a publicly traded company listed on the New York Stock Exchange under the ticker LYV. As of 2026, ownership of Live Nation is concentrated among a mix of strategic and institutional shareholders:

- Liberty Media controls roughly 30%–31% of Live Nation’s outstanding shares through its Liberty Live tracking and holding structure, making it the largest and most influential shareholder.

- Institutional investors such as Vanguard, BlackRock, and State Street collectively hold a significant portion of the remaining shares, each generally owning mid-to-high single-digit percentage stakes.

- Executive and insider ownership, including CEO Michael Rapino, represents a low single-digit percentage but carries outsized influence due to management control and board alignment.

Because Ticketmaster is 100% owned by Live Nation, this shareholder mix effectively represents Ticketmaster’s indirect ownership. Liberty Media’s roughly one-third stake gives it substantial voting power, influence over board composition, and long-term strategic direction, even though it does not manage daily operations.

Acquisition and Merger

Ticketmaster’s current ownership structure was created through a merger rather than a traditional acquisition.

In 2010, Ticketmaster merged with Live Nation in an all-stock transaction valued at approximately $2.5 billion at the time of announcement. The deal combined Ticketmaster, then the world’s largest ticketing company, with Live Nation, the world’s largest concert promoter.

Key factual elements of the merger include:

- Ticketmaster was a publicly traded company prior to the deal.

- Live Nation shareholders and Ticketmaster shareholders received shares in the newly formed Live Nation Entertainment.

- Ticketmaster shareholders exchanged their existing shares for Live Nation Entertainment stock at a fixed conversion ratio agreed upon in the merger terms.

- No cash buyout occurred. Ownership shifted entirely through equity exchange rather than a leveraged purchase.

Following the merger, Ticketmaster ceased to exist as a standalone public company. It became an operating division within Live Nation Entertainment, with no separate valuation, balance sheet, or shareholder reporting.

The merger was approved subject to regulatory conditions, including behavioral remedies designed to prevent anti-competitive conduct. These conditions shaped how Ticketmaster contracts with venues and competitors, but did not alter ownership or equity control.

Since 2010, there have been no further acquisitions, divestitures, or partial sales involving Ticketmaster itself. All ownership changes since then have occurred only at the Live Nation shareholder level, not within Ticketmaster as a business unit.

In practical terms, Ticketmaster was not “bought” outright. It was absorbed into Live Nation through a $2.5 billion stock-based merger that permanently tied its ownership, governance, and future to the world’s largest live entertainment company.

Competitor Ownership Comparison

Ticketmaster’s competitive position is shaped primarily by its ownership structure. Unlike most rivals, Ticketmaster is not just a ticketing platform. It is embedded inside a global live entertainment conglomerate. Comparing ownership models across major competitors highlights why Ticketmaster holds a structurally stronger position in the industry.

| Company | Ownership Type | Parent Company / Owners | Level of Vertical Integration | Key Ownership Advantage or Limitation |

|---|---|---|---|---|

| Ticketmaster | Wholly owned subsidiary | Live Nation Entertainment | Very high | Integrated with concert promotion, venue ownership, and artist services under one company. |

| SeatGeek | Private, venture-backed | Founders and venture capital investors | Low | Strong technology focus but no ownership of venues or tour promotion assets. |

| AXS | Subsidiary | AEG (private entertainment group) | Medium | Some vertical integration through AEG venues, but smaller global scale than Live Nation. |

| StubHub | Privately owned | Private investment groups | None (secondary market only) | Focused on resale; no control over primary ticket supply or venues. |

| Eventbrite | Public company | Public shareholders | Very low | Platform-neutral model serving small and mid-sized events, not major tours or arenas. |

Ticketmaster: Vertically Integrated Ownership Model

Ticketmaster is wholly owned by Live Nation Entertainment. Live Nation controls the full live entertainment value chain, including tour promotion, venue ownership, artist services, sponsorships, and ticketing.

This ownership structure allows Ticketmaster to operate as part of a closed ecosystem. Live Nation-promoted tours and Live Nation-owned venues often rely on Ticketmaster as the primary ticketing partner. As of 2026, Live Nation owns or operates hundreds of venues worldwide and promotes tens of thousands of events annually. This scale reinforces Ticketmaster’s market access and long-term contracts.

Ownership influence is further concentrated through Liberty Media, which holds roughly 30%–31% of Live Nation’s shares. This creates long-term strategic stability and discourages divestment or structural separation of Ticketmaster.

SeatGeek: Venture-Backed Private Ownership

SeatGeek is a privately held company backed by venture capital firms and strategic investors. Ownership is distributed among founders, early investors, and private equity stakeholders.

SeatGeek’s ownership model emphasizes product design, data-driven pricing tools, and partnerships with sports teams and leagues. While it has secured notable contracts with professional sports franchises, it does not own venues or promote concerts at scale. This limits its leverage when competing for exclusive, long-term ticketing deals with major arenas and tours.

SeatGeek remains dependent on partnerships rather than ownership-driven integration, which places structural limits on its expansion compared to Ticketmaster.

AXS: Entertainment Group Subsidiary Ownership

AXS is owned by AEG, a privately held global entertainment company. Like Live Nation, AEG owns venues and promotes tours, giving AXS a degree of vertical integration.

However, AEG operates at a smaller global scale than Live Nation. AXS has strong presence in select markets and venues, particularly in North America and parts of Europe, but it lacks the same global reach and volume of exclusive venue agreements. Ownership under AEG allows AXS to compete for major events, but it does not provide the same level of systemic dominance.

StubHub: Private Secondary Marketplace Ownership

StubHub operates primarily in the secondary ticket market. It is privately owned and functions as a resale platform rather than a primary ticket issuer.

StubHub’s ownership model is transaction-focused. It depends on resale volume, market demand, and liquidity. It does not control primary ticket supply, venue contracts, or artist relationships. This makes its ownership structure fundamentally different from Ticketmaster, as it cannot influence initial ticket distribution or pricing mechanisms.

Eventbrite: Public, Platform-Neutral Ownership

Eventbrite is a publicly traded company with ownership spread across institutional and retail investors. Its platform is designed for self-service ticketing, primarily serving independent creators, small venues, and community events.

Eventbrite does not own venues, promote tours, or negotiate exclusive ticketing contracts for large-scale events. Its ownership structure prioritizes platform neutrality and accessibility rather than control. This places Eventbrite in a different market segment with minimal direct overlap with Ticketmaster’s core business.

What Ownership Differences Mean in Practice

Ownership structure directly affects bargaining power, market access, and long-term stability. Ticketmaster’s ownership under Live Nation allows it to bundle ticketing with promotion and venue access, creating barriers that competitors struggle to overcome.

Most competitors rely on partnerships and contracts. Ticketmaster relies on ownership and integration. This distinction explains why, despite technological alternatives, Ticketmaster continues to dominate primary ticketing for major live events.

Who Controls Ticketmaster?

Control of Ticketmaster does not sit with the brand itself. It flows through its parent company and executive leadership. While Ticketmaster operates with its own management team, real authority over strategy, policy, and long-term direction rests at the Live Nation Entertainment level.

Parent-Level Control Through Live Nation Entertainment

Live Nation Entertainment exercises full control over Ticketmaster as its wholly owned subsidiary. Live Nation’s board of directors approves major decisions that directly affect Ticketmaster, including pricing frameworks, technology investments, regulatory responses, and long-term venue contracts.

Because Ticketmaster has no independent board or shareholders, it cannot override decisions made at the parent level. Control is centralized and aligned with Live Nation’s broader business objectives across concerts, venues, and artist services.

Role of the Chief Executive Officer

The most influential individual controlling Ticketmaster is Michael Rapino, the President and CEO of Live Nation Entertainment. Rapino has led the company since before the Ticketmaster merger and has remained in control for more than two decades.

Under Rapino’s leadership, Ticketmaster was fully integrated into Live Nation’s ecosystem. Strategic decisions such as exclusive venue partnerships, ticketing policies, and platform expansion ultimately report to him. While Ticketmaster has its own executives, they operate within strategic boundaries set by Rapino and the Live Nation board.

Ticketmaster’s Internal Management Structure

Ticketmaster maintains its own executive leadership team responsible for daily operations, technology, customer experience, and regional market execution. These executives manage platform performance, partnerships with venues, and operational efficiency across global markets.

However, this internal leadership does not have independent control. Major strategic moves, contract structures, and compliance decisions require alignment with Live Nation’s corporate leadership. Ticketmaster functions as an operating division rather than a self-governing company.

Board of Directors and Strategic Oversight

Control is reinforced through Live Nation’s board of directors. The board includes executives, independent directors, and representatives aligned with major shareholders. The board oversees executive performance, risk management, and long-term strategy that directly impacts Ticketmaster.

Because Ticketmaster does not have its own board, it is fully subject to decisions made at this level. Board priorities around growth, regulatory exposure, and market positioning shape how Ticketmaster operates.

Influence of Major Shareholders

While shareholders do not manage daily operations, large shareholders exert indirect influence. The most significant of these is Liberty Media, which holds roughly 30%–31% of Live Nation’s shares through its Liberty Live structure.

This stake gives Liberty Media meaningful influence over board appointments, executive compensation, and major corporate actions. As a result, Liberty Media plays a key role in shaping the governance environment in which Ticketmaster operates, even though it does not directly run the business.

Former Leadership and Control Before the Merger

Before the 2010 merger, Ticketmaster had its own leadership and independent control. Past CEOs included figures such as Fred Rosen, who led the company during its expansion and dominance as a standalone ticketing provider.

After the merger, independent control ended. Ticketmaster leadership roles were absorbed into Live Nation’s structure, and ultimate authority shifted permanently to Live Nation’s executive team.

Practical Control in Day-to-Day Terms

In practical terms, Ticketmaster is controlled through a layered structure. Live Nation’s CEO and board set strategy and policy. Ticketmaster’s executives execute those decisions across technology, sales, and operations. Shareholders influence governance at the top but do not intervene directly.

This centralized control model explains why Ticketmaster’s policies, pricing practices, and market behavior closely mirror Live Nation’s broader live entertainment strategy rather than functioning as an independent platform.

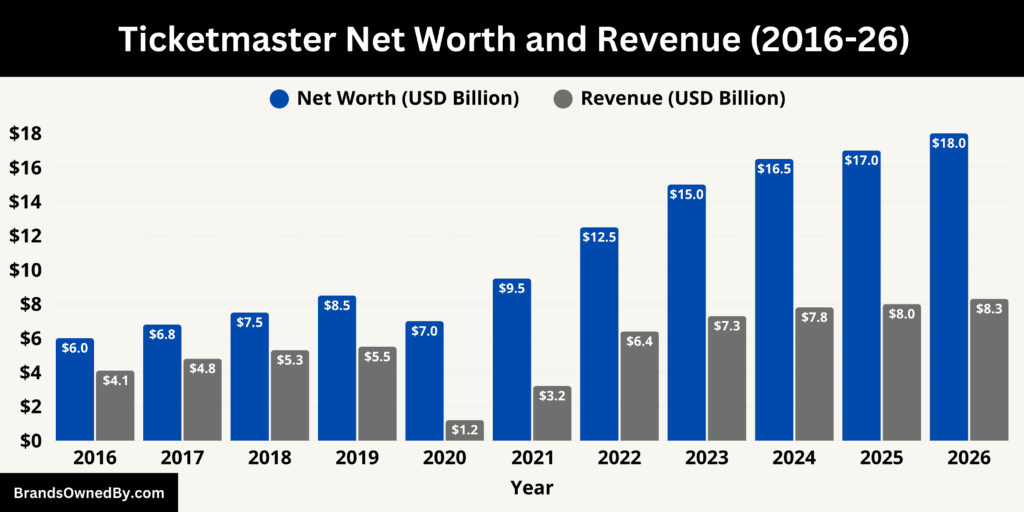

Ticketmaster Annual Revenue and Net Worth

As of January 2026, Ticketmaster generates an estimated $8.3 billion in annual revenue and holds an estimated net worth of $18 billion. These figures reflect Ticketmaster’s standalone business performance as a ticketing platform, separate from its parent company’s consolidated financials.

Revenue Breakdown 2026

Ticketmaster’s $8.3 billion revenue is primarily fee-based and tied directly to ticket transactions rather than ticket face value.

Primary ticketing service fees account for roughly 65%–70% of total revenue, or about $5.4–$5.8 billion. These fees are charged per ticket at the point of sale for concerts, sports, and live events. Average service fees typically range between 20% and 30% of the ticket’s base price, depending on the event and venue contract.

Secondary market and resale-related fees contribute approximately 15%–18% of revenue, or around $1.3–$1.5 billion. This includes Ticketmaster’s controlled resale platform, where fees are collected from both buyers and sellers. Growth in this segment has been driven by higher resale activity for major tours and dynamic pricing models.

Technology, venue services, and enterprise contracts make up about 10%–12% of revenue, equating to $830 million–$1.0 billion. This includes ticketing software, venue management tools, digital entry systems, and data services provided under long-term agreements with arenas, stadiums, and sports franchises.

Advertising, sponsorship tools, and ancillary services contribute the remaining 3%–5%, or roughly $250 million–$400 million. These revenues come from fan marketing tools, email campaigns, and brand placements integrated into Ticketmaster’s platform.

In volume terms, Ticketmaster processes 600+ million tickets annually worldwide as of 2026, which underpins the scale and predictability of its revenue base.

Net Worth 2026

Ticketmaster’s estimated $18 billion net worth is derived from a combination of earnings power, contractual assets, and strategic market position rather than physical assets.

Contractual venue rights and exclusivity agreements represent an estimated 40%–45% of total value, or roughly $7.2–$8.1 billion. These long-term contracts secure Ticketmaster as the primary ticketing provider for major arenas, stadiums, and sports leagues, often for periods of 5 to 10 years.

Recurring fee-based cash flows account for approximately 30%–35% of valuation, equivalent to $5.4–$6.3 billion. This reflects Ticketmaster’s ability to generate consistent, high-margin revenue from each ticket sold, transferred, or resold.

Technology platform and data assets contribute around 15%–20% of net worth, or $2.7–$3.6 billion. This includes proprietary ticketing infrastructure, fraud prevention systems, mobile ticketing, and consumer demand data covering hundreds of millions of buyers.

Brand dominance and market control make up the remaining 10%–15%, roughly $1.8–$2.7 billion. This valuation premium reflects Ticketmaster’s entrenched position in primary ticketing for large-scale events and the high barriers competitors face in replacing it.

Revenue Efficiency and Valuation Ratio

Based on 2026 estimates, Ticketmaster trades at an implied valuation of roughly 2.1× annual revenue. This multiple is higher than smaller ticketing platforms but lower than high-growth software companies, reflecting Ticketmaster’s maturity, regulatory exposure, and exceptional market control.

In simple terms, Ticketmaster’s $8.3 billion revenue and $18 billion net worth in 2026 are supported by transaction volume, fee intensity, and long-term exclusivity rather than speculative growth. The numbers reflect a highly monetized infrastructure business embedded at the core of the global live entertainment industry.

Brands Owned by Ticketmaster

Ticketmaster operates multiple brands, platforms, and specialized entities that sit within Ticketmaster itself, not at the broader Live Nation corporate level. These businesses focus on ticketing technology, fan access, resale, and event management. As of January 2026, the following brands and entities are owned and directly operated by Ticketmaster:

| Company / Brand | Type | Year Integrated | Primary Function | Key Details |

|---|---|---|---|---|

| Ticketmaster Core Platform | Core business | 1976 (founding) | Primary ticketing | Global primary ticket sales for concerts, sports, and live events. Handles pricing, distribution, fraud prevention, and digital ticket delivery across dozens of countries. |

| Ticketmaster Resale | Secondary marketplace | 2013 (expanded) | Ticket resale | In-house resale platform integrated with primary ticketing. Guarantees authenticity and generates fees from buyers and sellers within the Ticketmaster ecosystem. |

| Ticketmaster Verified Fan | Access control program | 2016 | Identity-based access | Proprietary system to limit bots and scalpers. Uses account signals and registration to control access to high-demand onsales. |

| TicketWeb | Subsidiary platform | 2000 (acquired) | Small venue ticketing | Serves clubs, theaters, and independent promoters. Operates as a separate brand with lighter pricing while using Ticketmaster infrastructure. |

| Front Gate Tickets | Subsidiary platform | 2015 (acquired) | Festival ticketing | Specializes in multi-day festivals, passes, wristbands, and add-ons. Handles high-volume sales and physical credential logistics. |

| Universe | Self-service platform | 2015 (acquired) | Creator & brand events | Flexible ticketing for creators, brands, and venues. Supports customization, integrations, and both online and in-person events. |

| Ticketmaster Presence | Marketing platform | 2018 (rolled out) | Fan engagement | Provides email marketing, presales, segmentation, and demand targeting using Ticketmaster fan data. |

| TM1 Venue Platform | Enterprise software | 2000s (internal) | Venue management | Back-end system used by arenas and stadiums to manage inventory, pricing, seat maps, holds, and reporting. |

| Ticketmaster Digital Entry Systems | Technology stack | 2010s (developed) | Secure entry | Mobile-only tickets, rotating barcodes, and secure transfers that reduce fraud and keep transactions within Ticketmaster. |

Ticketmaster Core Platform

The Ticketmaster brand itself is the primary operating entity. It manages global primary ticket sales for concerts, sports, theater, and live entertainment. The core platform handles ticket distribution, pricing logic, fraud prevention, digital ticket delivery, and customer accounts across dozens of countries.

Ticketmaster’s core business also includes mobile ticketing, digital entry systems, queue management, and demand-based pricing tools used by venues and event organizers worldwide.

Ticketmaster Resale

Ticketmaster Resale is Ticketmaster’s in-house secondary marketplace. It allows fans to resell tickets they originally purchased through Ticketmaster’s platform.

This business unit is tightly integrated with primary ticketing. Ticket authenticity is guaranteed, and transfers occur digitally within Ticketmaster accounts. Revenue is generated through resale service fees charged to buyers and, in many cases, sellers. As of 2026, Ticketmaster Resale represents a major share of Ticketmaster’s secondary-market revenue.

Ticketmaster Verified Fan

Ticketmaster Verified Fan is an identity-based access system designed to reduce bots and bulk ticket scalping. It is not a separate company, but a proprietary Ticketmaster-owned program operated globally.

Verified Fan uses account history, behavior signals, and registration controls to determine access to high-demand ticket onsales. Artists and promoters frequently rely on this system for major tours. The product strengthens Ticketmaster’s value proposition by controlling who can access primary ticket inventory.

TicketWeb

TicketWeb is a Ticketmaster-owned ticketing platform focused on smaller venues, clubs, and independent promoters. It was acquired by Ticketmaster to serve events that do not require the full-scale Ticketmaster infrastructure.

TicketWeb operates as a separate brand but is fully integrated into Ticketmaster’s backend systems. It allows Ticketmaster to capture volume across the long tail of live events while maintaining different pricing and service models suited to smaller operators.

Front Gate Tickets

Front Gate Tickets is operated by Ticketmaster and specializes in large-scale festivals and multi-day events. It focuses on complex ticket types such as multi-day passes, camping add-ons, wristband fulfillment, and early-access packages.

Front Gate Tickets supports some of the world’s largest music festivals and handles high-volume transactions, physical credential logistics, and fan communication. It operates as a distinct brand while relying on Ticketmaster’s technology and payment infrastructure.

Universe

Universe is a self-service ticketing and event management platform owned and operated by Ticketmaster. It is designed for creators, brands, and venues that want more control over ticketing, data, and customer experience.

Universe supports both online and in-person events, offering flexible pricing, integrations, and customization. It allows Ticketmaster to compete in the creator economy and smaller-scale event segment without diluting its core enterprise offering.

Ticketmaster Presence

Ticketmaster Presence is a marketing and fan-engagement platform operated by Ticketmaster. It provides tools for email marketing, fan segmentation, presales, and targeted promotions.

This entity leverages Ticketmaster’s proprietary consumer data to help event organizers drive ticket sales more efficiently. It is closely tied to Ticketmaster’s core platform and adds incremental revenue through marketing services rather than ticket fees alone.

TM1 Venue Platform

TM1 is Ticketmaster’s enterprise-grade venue and promoter interface. It is not consumer-facing but is critical to Ticketmaster’s operations.

TM1 allows venues and event organizers to manage inventory, pricing tiers, seat maps, holds, and reporting. It is used by major arenas, stadiums, and sports franchises globally. Control of TM1 gives Ticketmaster deep operational integration with venue partners.

Digital Ticketing and Entry Systems

Ticketmaster owns and operates its own digital ticketing and venue entry technologies, including mobile-only tickets, rotating barcodes, and secure transfer systems.

These technologies reduce fraud, limit unauthorized resale, and keep ticket activity inside the Ticketmaster ecosystem. They also increase switching costs for venues, reinforcing long-term contracts and platform dependence.

Conclusion

Understanding who owns Ticketmaster brings clarity to why the company operates the way it does and why its influence in live entertainment remains so strong. Ticketmaster is not an independent marketplace reacting to outside forces. It is a fully owned, deeply embedded business with its own ecosystem of platforms, technologies, and access controls that shape how tickets are sold, transferred, and used. Ownership, control, and scale intersect at every level of its operations, making Ticketmaster less of a simple ticket seller and more of an infrastructure provider for the global live events industry.

FAQs

Does Live Nation own Ticketmaster?

Yes. Live Nation Entertainment owns 100% of Ticketmaster. Ticketmaster operates as a wholly owned subsidiary and has no separate public shareholders or independent ownership structure.

Who founded Ticketmaster?

Ticketmaster was founded in 1976 by Albert Leffler, Peter Gadwa, and Gordon Gunn III. The company began as a computerized ticketing solution for venues before evolving into a global ticketing platform.

Who owns Ticketmaster tickets?

Tickets purchased through Ticketmaster are owned by the buyer, but usage is governed by the event organizer’s terms. This means promoters and venues retain control over resale rules, transferability, refunds, and entry conditions, even though the ticket sits in the buyer’s Ticketmaster account.

Who is the CEO of Ticketmaster?

Ticketmaster does not have a separate, standalone CEO. Ultimate executive control comes from its parent company. The CEO of Live Nation Entertainment, Michael Rapino, is the most senior executive overseeing Ticketmaster’s strategy and operations.

Why did Taylor Swift sue Ticketmaster?

Taylor Swift did not sue Ticketmaster. The confusion comes from the 2022 Eras Tour presale controversy, where Ticketmaster’s systems failed under extreme demand. Following the incident, Taylor Swift publicly criticized Ticketmaster, but the legal actions came from fans and regulators, not from Swift herself.

What artist broke Ticketmaster?

Taylor Swift is widely credited with “breaking” Ticketmaster during the Eras Tour presale. Demand was so high that Ticketmaster’s systems crashed, presales were canceled, and millions of fans were unable to buy tickets. The incident triggered congressional hearings and intensified scrutiny of Ticketmaster’s market power.