- Walgreens is privately owned by Sycamore Partners, a U.S.-based private equity firm, following the completed acquisition in 2025.

- The acquisition made Walgreens a fully private company, with Sycamore Partners controlling 100% ownership, including all retail, clinic, and specialty pharmacy operations.

- Walgreens’ ownership structure allows the company to operate multiple subsidiaries and brands, including Duane Reade, VillageMD clinics, CareCentrix, Boots U.S. operations, and No7 Beauty Company, under direct control.

- This private ownership enables strategic flexibility for expanding healthcare services, specialty pharmacy, telehealth, and private-label product offerings, without public market pressures.

Walgreens is one of the most recognizable pharmacy and retail health brands in the world. It forms part of Walgreens Boots Alliance, a global pharmacy-led, health and wellbeing enterprise that serves millions of customers daily across multiple countries.

Walgreens traces its roots to the early 20th century. The company was founded in Chicago by Charles Rudolph Walgreen Sr., who opened his first drugstore in 1901. This store catered to local customers with pharmaceutical services and products tailored to everyday health needs. Walgreens grew steadily through the early decades of the 1900s, expanding store count across the United States and innovating in pharmacy services.

In the mid-20th century, Walgreens embraced new technology for prescription management and expanded its retail offerings beyond medicines to include customer convenience products. Over time, initiatives such as computerized pharmacy systems and integrated store networks helped position Walgreens as a leader in retail pharmacy services.

Walgreens Boots Alliance, the parent company, was created in 2014 through a strategic combination of Walgreens and the European pharmacy group Alliance Boots. This move established one of the first truly global pharmacy-led health and wellbeing enterprises. The combined company brought together iconic retail pharmacy brands in the U.S. and Europe under one global structure.

As part of the company’s evolution, Walgreens Boots Alliance expanded into new markets, diversified its services, and incorporated wholesale pharmaceutical distribution networks into its operations.

In 2025, Walgreens Boots Alliance agreed to be acquired by private equity firm Sycamore Partners, a transaction that will transition the business back to private ownership and reshape its corporate structure for future strategic initiatives. This milestone reflects continuing shifts in the pharmacy and healthcare landscape.

Founders

Walgreens was founded by Charles Rudolph Walgreen Sr., an American pharmacist who played a major role in shaping modern retail pharmacy.

Charles R. Walgreen was born in 1873 in Dixon, Illinois. He trained as a pharmacist and gained early experience working in drugstores, where he learned both pharmaceutical practice and retail operations. In 1901, he opened his first drugstore in Chicago. His goal was to provide reliable pharmacy services combined with everyday consumer products in a welcoming environment.

Walgreen introduced several innovations that differentiated his stores. He emphasized customer service, standardized product quality, and store layouts that encouraged repeat visits. The inclusion of soda fountains helped transform Walgreens locations into community hubs rather than simple dispensaries.

The Walgreen family remained actively involved in leadership for decades. His son, Charles R. Walgreen Jr., later served in executive roles and helped guide the company through periods of national expansion and operational modernization.

The international side of today’s business comes from Boots, founded in 1849 in England by John Boot. Boots later expanded under Jessie Boot into a major pharmacy and retail brand.

In 2006, Boots merged with Alliance UniChem to form Alliance Boots, which later combined with Walgreens.

Together, these founders’ legacies shaped Walgreens into a global healthcare and pharmacy enterprise.

Major Milestones

- 1901: Charles R. Walgreen opens the first Walgreens drugstore in Chicago.

- 1905: Walgreens introduces its first private-label products, improving margins and quality control.

- 1909: Walgreens opens its second location, marking the start of multi-store operations.

- 1913: The company begins operating company-owned manufacturing facilities.

- 1916: Walgreens starts producing its own branded medicines at scale.

- 1919: Store count surpasses 20 locations across Illinois.

- 1922: Walgreens expands beyond Illinois into neighboring Midwestern states.

- 1924: The company launches standardized store layouts for brand consistency.

- 1927: Walgreens becomes a publicly traded company.

- 1930: Walgreens operates more than 500 drugstores nationwide.

- 1934: The company introduces malted milkshakes, boosting in-store soda fountain traffic.

- 1940: Walgreens expands private-label and consumer health offerings nationwide.

- 1945: Post-war expansion accelerates as demand for retail pharmacy services grows.

- 1951: Walgreens opens its 1,000th store.

- 1958: Centralized warehousing and logistics systems are expanded.

- 1960: Walgreens strengthens national purchasing and distribution infrastructure.

- 1964: The company begins suburban expansion alongside urban growth.

- 1971: Computerized pharmacy systems are introduced to improve prescription accuracy.

- 1975: Walgreens rolls out nationwide pharmacy data standardization.

- 1981: Drive-thru pharmacy concepts are tested and later expanded.

- 1984: One-hour photo services are launched in select Walgreens stores.

- 1990: Walgreens surpasses 2,000 retail locations.

- 1995: Early digital pharmacy and e-commerce initiatives are introduced.

- 1999: Walgreens launches online prescription refill services.

- 2001: Walgreens celebrates its 100th anniversary.

- 2005: Expansion into health and wellness services accelerates.

- 2006: Boots Group and Alliance UniChem merge to form Alliance Boots.

- 2010: Walgreens expands in-store health clinics and immunization services.

- 2012: Walgreens acquires a controlling stake in Alliance Boots.

- 2014: Walgreens Boots Alliance is officially formed through a full combination.

- 2016: Global wholesale and retail operations are consolidated under WBA.

- 2018: Investment in primary care clinics and healthcare partnerships increases.

- 2020: Walgreens plays a nationwide role in COVID-19 testing and vaccinations.

- 2021: Digital health tools and same-day prescription services are expanded.

- 2023: Tim Wentworth is appointed CEO of Walgreens Boots Alliance.

- 2024: Store optimization and healthcare-focused restructuring initiatives continue.

- 2025: Walgreens Boots Alliance is acquired by Sycamore Partners, transitioning the company to private ownership.

Who Owns Walgreens in 2025?

As of December 2025, Walgreens is owned by Sycamore Partners, a U.S.-based private equity firm. The ownership change followed the completed acquisition of Walgreens Boots Alliance, the former publicly traded parent company. Through this transaction, Walgreens transitioned from public ownership to private ownership.

Walgreens continues to operate under the Walgreens Boots Alliance corporate structure, but ultimate ownership and control now reside with Sycamore Partners. This means Walgreens is no longer indirectly owned by public shareholders. All strategic and governance authority now flows from the private owner.

| Detail | Information |

|---|---|

| Company Name | Walgreens |

| Founded | 1901 |

| Founder | Charles Rudolph Walgreen Sr. |

| Headquarters | Deerfield, Illinois, United States |

| Parent Company | Walgreens Boots Alliance (privately held by Sycamore Partners) |

| Current Owner | Sycamore Partners (100% ownership) |

| Acquisition Year | 2025 |

| Acquisition Price | Approximately $10 billion, including assumed debt |

| Former Ownership | Publicly traded under NASDAQ: WBA prior to 2025 |

| CEO | Healthcare services expansion, store optimization, operational efficiency, and long-term growth under private ownership |

| Core Business | Retail pharmacy, health and wellness products, pharmacy services, clinic operations |

| Global Operations | United States, United Kingdom, and other international markets through Walgreens Boots Alliance |

| Company Type | Private, wholly owned subsidiary |

| Governance | Board appointed by Sycamore Partners; executive leadership manages daily operations |

| Stores | Thousands of company-owned retail locations across the U.S. |

| Major Subsidiaries / Brands | Walgreens (U.S.), Boots (UK), No7 Beauty Company, VillageMD, CareCentrix |

| Strategic Focus | Healthcare services expansion, store optimization, operational efficiency, and long-term growth under private ownership. |

Sycamore Partners

Sycamore Partners is the ultimate owner of Walgreens following the completed acquisition of Walgreens Boots Alliance in 2025. The firm is a U.S.-based private equity investor with a strong track record in consumer, retail, and healthcare-adjacent businesses. Its investment strategy centers on acquiring established brands, improving operational efficiency, and restructuring business portfolios for long-term value creation.

The acquisition was completed in 2025 through Sycamore Partners’ private investment funds. The transaction valued Walgreens Boots Alliance at approximately $10 billion, including assumed debt.

As part of the deal, all outstanding public shares were acquired, and the company was delisted from public stock exchanges, ending its status as a publicly traded enterprise.

Following the transaction, Walgreens Boots Alliance became a privately held holding company, fully controlled by Sycamore Partners. Walgreens operates within this structure as the flagship U.S. retail pharmacy brand, while ownership, governance, and capital allocation authority rest entirely with the private equity owner.

Below is a list of the other major companies owned by Sycamore Partners as of December 2025:

- Staples (U.S. and Canada) – Acquired in 2017; office supply retailer, with focus on B2B services and supply solutions.

- Pure Fishing – Specialty outdoor and fishing equipment company; includes brands like Abu Garcia, Berkley, Fenwick, Hardy, Johnson, Mitchell, Penn, Pflueger, SpiderWire, Stren, and Ugly Stik.

- Belk – Department store chain in the Southeastern U.S., offering apparel, accessories, home goods, and beauty products; acquired in 2015.

- Hot Topic – Youth-oriented apparel and accessories retailer; part of Sycamore’s fashion and lifestyle portfolio.

- Torrid – Plus-size fashion retailer; Sycamore retains a significant stake after partial public offering.

- MGF Sourcing – Apparel supply chain and manufacturing services company.

- Talbots / KnitWell Group – Women’s apparel brands integrated under KnitWell Group alongside other fashion labels like Ann Taylor and LOFT.

- Premium Apparel LLC (Ascena brands) – Includes Ann Taylor, Lane Bryant, and other women’s fashion brands acquired from Ascena Retail Group.

- Azamara Cruises – Boutique luxury cruise line; part of Sycamore’s consumer-focused travel portfolio.

- Playa Bowls – Fast-growing superfruit bowl and smoothie franchise acquired in 2024.

- Other retail and consumer brands – Past or current investments include The Limited, Coldwater Creek, Nine West, and related fashion assets.

Parent Company Structure After the Acquisition

After the acquisition, Walgreens Boots Alliance continues to exist as the parent company, but it is now privately owned rather than publicly listed. Sycamore Partners controls the parent company through its investment vehicles, making it the indirect owner of Walgreens and all affiliated subsidiaries.

This structure preserves operational continuity. Walgreens continues to function under the same corporate umbrella, brand identity, and management framework, while strategic oversight is centralized at the private ownership level.

Ownership Control and Governance

Sycamore Partners holds full ownership rights over Walgreens Boots Alliance and its subsidiaries. This includes the authority to appoint and remove board members, approve executive leadership appointments, and determine long-term strategic priorities.

There are no minority public shareholders, institutional investors, or retail investors involved in the ownership structure. Control is consolidated under a single private owner, which simplifies governance and decision-making.

Executive leadership remains responsible for day-to-day operations, but major initiatives such as restructuring, divestitures, acquisitions, and capital deployment require approval from the owner-appointed board.

Strategic Implications of Private Ownership

Under Sycamore Partners’ ownership, Walgreens is positioned for long-term operational restructuring rather than short-term market performance. The private structure allows management to pursue store network optimization, cost restructuring, and healthcare service realignment without the constraints of quarterly earnings expectations.

Sycamore Partners has experience managing large retail portfolios and may evaluate individual business units within Walgreens Boots Alliance independently. This creates flexibility for selective investments, asset sales, or operational separation if deemed strategically beneficial.

Who is the CEO of Walgreens?

As of December 2025, the Chief Executive Officer of Walgreens is Mike Motz. He took over the role following the completed acquisition of Walgreens by Sycamore Partners. His leadership marks a strategic shift toward retail operations and customer focus under the new private ownership structure.

Current CEO: Mike Motz

Mike Motz was appointed CEO of Walgreens effective August 28, 2025. His appointment came immediately after the company’s sale to Sycamore Partners was finalized.

Motz has deep experience in retail leadership. Before joining Walgreens, he served as CEO of Staples U.S. Retail, a role in which he led one of the largest office supply retail operations in the United States.

Prior to that, Motz was President of Shoppers Drug Mart, Canada’s leading pharmacy chain.

His responsibilities as CEO include overseeing Walgreens’ nationwide retail store network, pharmacy services, and customer experience improvements. Under private ownership, he also works closely with the board appointed by Sycamore Partners and Executive Chairman John Lederer to drive long-term strategic priorities.

Mike Motz succeeded Tim Wentworth, who served as CEO from October 2023 until August 2025. Wentworth led the company through part of its transition period, focusing on cost management and operational restructuring before moving into a board director role after the acquisition was completed.

Role and Responsibilities

As CEO, Motz oversees Walgreens’ nationwide operations, including its pharmacy network, retail stores, supply chain, and customer service divisions. His responsibilities include:

- Implementing strategic initiatives aligned with Sycamore Partners’ long-term vision.

- Driving operational efficiency and profitability across all U.S. stores.

- Expanding healthcare and pharmacy services within Walgreens stores.

- Collaborating with the board appointed by Sycamore Partners to guide corporate strategy.

- Fostering innovation in customer experience, digital services, and in-store healthcare offerings.

Leadership Style and Vision

Motz is known for a results-driven leadership style that emphasizes operational excellence, innovation, and customer-centric approaches. He prioritizes aligning store operations with evolving healthcare trends and ensuring Walgreens remains competitive in both retail pharmacy and healthcare services.

Under his leadership, Walgreens aims to strengthen its position as a leading U.S. pharmacy retailer, improve patient access to healthcare services, and enhance operational performance while leveraging the flexibility of private ownership.

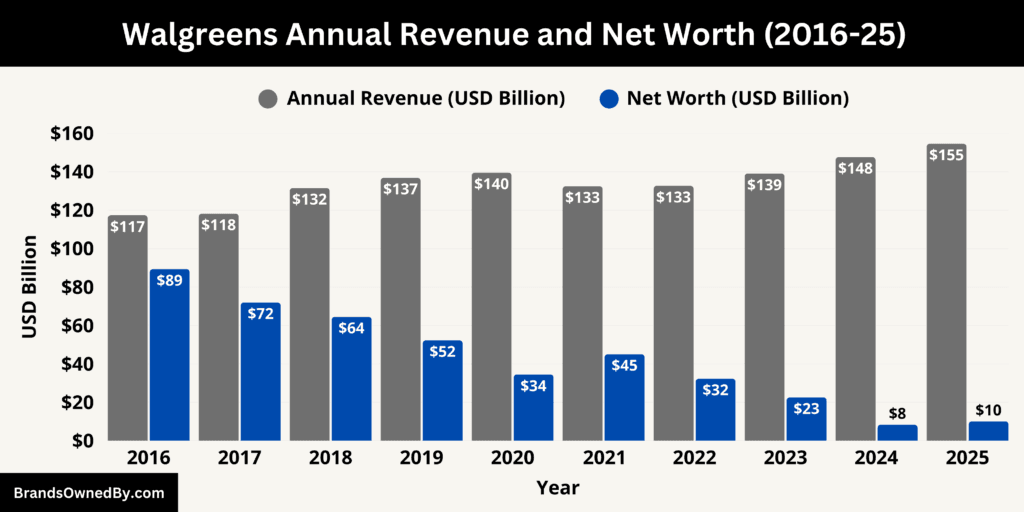

Walgreens Annual Revenue and Net Worth

As of December 2025, Walgreens reports an annual revenue of approximately $154.6 billion, reflecting its status as one of the largest pharmacy and health services companies in the United States. Following the completed acquisition by Sycamore Partners, the company’s enterprise value is estimated at $10 billion, representing its net worth as a privately held organization.

Annual Revenue

The $154.6 billion revenue in 2025 is primarily driven by retail pharmacy sales, prescription medications, in-store healthcare services, and front-of-store consumer products. Prescription drug sales remain the largest contributor, reflecting high volume and recurring demand. In-store healthcare services, including immunizations, clinic care, and wellness programs, add additional revenue while supporting the company’s healthcare integration strategy.

Front-of-store products, such as beauty, personal care, and convenience items, supplement the revenue mix. Walgreens’ nationwide store network, comprising thousands of company-owned locations, ensures consistent customer access and a steady revenue base. Operational efficiencies, improved supply chain management, and service expansion contribute to sustaining and growing total revenue.

Net Worth and Enterprise Value

Walgreens’ net worth, represented by its enterprise value of $10 billion, reflects the valuation agreed upon with Sycamore Partners during the 2025 acquisition. This figure includes both the company’s operational assets and assumed debt. As a privately held company, Walgreens’ valuation no longer depends on public stock markets but is instead derived from its earnings potential, assets, and strategic business value.

The enterprise value demonstrates the financial scale of the business under private ownership, highlighting the opportunities for operational optimization, cost management, and strategic investment in healthcare services and retail operations.

Strategic Implications

The 2025 revenue and enterprise value illustrate Walgreens’ strong position in the U.S. pharmacy sector and its ability to generate substantial income from multiple revenue streams. Under Sycamore Partners’ ownership, the company can focus on long-term growth initiatives, including expansion of healthcare services, modernization of store operations, and integration of digital health solutions.

This structure allows Walgreens to make strategic operational decisions without the pressure of quarterly public market reporting, ensuring sustainable revenue growth and maximized enterprise value.

Brands Owned by Walgreens

As of December 2025, Walgreens operates a diversified portfolio of retail, healthcare, and consumer health brands in the United States. Beyond its flagship retail pharmacy stores, the company owns multiple subsidiaries and private brands that extend its presence into healthcare services, specialty pharmacy, beauty, and home health solutions.

Below is a list of the major brands owned by Walgreens as of 2025:

| Company / Brand | Type / Function | Key Details | Strategic Role |

|---|---|---|---|

| Walgreens Retail Pharmacy | Retail Pharmacy | Thousands of stores across the U.S. offering prescription medications, over-the-counter drugs, wellness products, and in-store clinics | Core revenue driver; central platform for healthcare and retail operations |

| Duane Reade | Retail Pharmacy | Operates in the New York metropolitan area; urban-focused locations; integrated into Walgreens’ supply chain and digital platforms | Expands urban footprint; targets high-density customer markets |

| Boots U.S. Operations | Health & Beauty Retail | Premium health, beauty, and wellness products sold in stores and online | Enhances Walgreens’ premium and international brand portfolio |

| No7 Beauty Company | Skincare & Cosmetics | Proprietary brand for skincare, cosmetics, and personal care; sold in stores and online | Strengthens private-label and premium beauty offerings; improves margins and customer loyalty |

| VillageMD Clinics | Healthcare Clinics | Joint venture clinics co-located in Walgreens stores; offer primary care, chronic disease management, preventive services | Integrates medical care with retail pharmacy; drives patient engagement |

| CareCentrix | Home Healthcare Services | Provides in-home care, therapy, and durable medical equipment | Extends Walgreens’ healthcare reach beyond retail locations; supports chronic and post-acute care |

| Specialty Pharmacy Services | Pharmacy Division | Focused on complex, high-cost medications; includes patient care, adherence programs, and therapy management | Provides advanced pharmaceutical care; contributes high-margin revenue |

| Walgreens Health Clinics | In-Store Clinics | Offer vaccinations, wellness programs, minor treatment, and preventive care | Supports healthcare service expansion and integration with retail pharmacy |

| Prescription Drug Mail Order & Home Delivery | Pharmacy Services | Home delivery of prescriptions with adherence support | Expands patient access; supports chronic care management |

| Care Coordination & Telehealth Services | Telehealth & Remote Care | Virtual consultations, remote monitoring, and diagnostics integrated with pharmacies and clinics | Expands healthcare access; additional revenue streams without third-party ownership |

| Private-Label Retail Brands (e.g., Nice!, Walgreens Health) | Retail Products | Proprietary health, wellness, and personal care products | Improves profit margins; enhances brand differentiation and customer loyalty |

Walgreens Retail Pharmacy

The Walgreens retail pharmacy chain is the cornerstone of the company’s operations. With thousands of stores across the U.S., Walgreens stores offer prescription medications, over-the-counter drugs, wellness products, and health services. Many stores feature in-store clinics and immunization programs, enabling Walgreens to provide both pharmaceutical and basic healthcare services under one roof.

Retail operations also include beauty and personal care products, convenience items, and seasonal merchandise, making Walgreens a one-stop destination for health and everyday needs. The retail chain continues to drive the majority of the company’s revenue and serves as the central platform for integrating new healthcare initiatives.

Duane Reade

Duane Reade is a fully owned subsidiary operating primarily in the New York metropolitan area. These stores are strategically located in urban and high-traffic locations, serving both local residents and commuters. Duane Reade offers pharmacy services, front-of-store retail products, and in-store health clinics. Since its acquisition by Walgreens, Duane Reade has been integrated into Walgreens’ supply chain, digital platforms, and loyalty programs, allowing for operational efficiency while maintaining a distinct brand identity in the New York market.

Boots U.S. Operations

Walgreens directly operates certain Boots-branded businesses in the U.S., focusing on premium health, beauty, and wellness products. These stores and products offer consumers access to skincare, cosmetics, over-the-counter medications, and personal care solutions that carry Boots’ international reputation for quality. Walgreens leverages Boots products both in-store and online, creating cross-brand synergies and expanding the company’s portfolio beyond traditional retail pharmacy offerings.

No7 Beauty Company

No7 Beauty Company is a wholly owned subsidiary specializing in skincare, cosmetics, and personal care products. No7 products are sold through Walgreens stores, digital channels, and in select promotional partnerships. The brand focuses on innovative skincare solutions, anti-aging products, and beauty care lines that appeal to a broad consumer base. By owning No7, Walgreens strengthens its private-label and premium health and beauty portfolio, increasing both margin potential and customer loyalty.

VillageMD Clinics

Walgreens operates VillageMD clinics through a joint venture, branded in many locations as “Walgreens + VillageMD.” These clinics provide primary care, chronic disease management, and preventive health services, integrating medical care with Walgreens’ pharmacy operations. The clinics are strategically co-located in retail stores to enhance patient convenience, improve medication adherence, and increase the frequency of customer engagement with Walgreens’ broader health offerings.

CareCentrix

CareCentrix is a home healthcare services subsidiary fully owned by Walgreens. It delivers in-home care, durable medical equipment, and therapy services to patients, including those with chronic or post-acute care needs. This subsidiary allows Walgreens to extend its healthcare footprint beyond retail locations, supporting patients who require care at home while integrating services with the company’s specialty pharmacy and clinic operations.

Specialty Pharmacy Services

Walgreens owns and operates a specialty pharmacy division focused on high-cost, complex medications for conditions such as oncology, immunology, and rare diseases. Specialty pharmacies provide personalized patient care, therapy management, and medication adherence programs, complementing the traditional retail pharmacy business. These services contribute significantly to revenue growth and position Walgreens as a provider of advanced pharmaceutical care.

Walgreens Health Clinics

Walgreens operates in-store health clinics, offering vaccinations, wellness programs, minor treatment services, and preventive care. These clinics are staffed by medical professionals and integrate with Walgreens’ pharmacies to ensure coordinated patient care. The clinics also serve as a platform for expanding telehealth services, diagnostics, and chronic disease management programs.

Prescription Drug Mail Order and Home Delivery

Walgreens manages prescription drug mail order and home delivery services, allowing patients to receive medications at home. This service supports adherence programs, chronic care management, and convenience for customers unable to visit physical stores. The infrastructure for mail-order delivery is directly operated and controlled by Walgreens, ensuring quality, timeliness, and compliance with healthcare regulations.

Care Coordination and Telehealth Services

Walgreens owns and operates multiple care coordination programs and telehealth partnerships. These services include virtual consultations, remote monitoring, and diagnostics, fully integrated with Walgreens pharmacies and clinics. They allow the company to expand healthcare access, improve patient outcomes, and provide additional revenue streams without reliance on third-party ownership.

Private-Label Retail Brands

Walgreens owns a range of private-label brands in health, wellness, and personal care, including Nice!, Walgreens Health, and other proprietary lines. These products are exclusively sold through Walgreens stores and digital channels. Owning these brands enables higher profit margins, quality control, and brand differentiation, while strengthening the company’s retail portfolio alongside specialty and premium products like No7.

Final Thoughts

Understanding who owns Walgreens provides insight into the company’s strategic direction and operational flexibility. Under the ownership of Sycamore Partners, Walgreens operates a diverse portfolio of retail pharmacies, clinics, specialty pharmacies, and proprietary brands. This structure allows the company to expand healthcare services, enhance home care and telehealth offerings, and strengthen its private-label and premium product lines, ensuring it continues to serve as a leading provider of pharmacy and wellness solutions across the United States.

FAQs

Who is Walgreens’ parent company?

Walgreens does not have a parent company in the traditional sense. Following its acquisition in 2025, it is privately owned by Sycamore Partners, a U.S.-based private equity firm, which now functions as the controlling entity.

Who owns Walgreens drug stores?

All Walgreens drug stores are owned and controlled by Sycamore Partners through the Walgreens corporate structure. The company manages its retail pharmacies, clinics, and specialty divisions directly.

Who owns Walgreens?

Sycamore Partners is the current owner of Walgreens. They acquired the company in 2025, taking it private and assuming 100% ownership.

Who owns Walgreens and CVS?

Walgreens is privately owned by Sycamore Partners, while CVS Health is a publicly traded company with institutional and retail shareholders. They are separate entities with no common ownership.

Who is the largest shareholder of Walgreens?

The largest and sole shareholder of Walgreens is Sycamore Partners, which acquired full ownership of the company in 2025.

Is Walgreens a public company?

No, Walgreens is no longer a public company. It was taken private following the acquisition by Sycamore Partners in 2025.

Who owns Walgreens stores?

Every Walgreens store is owned and operated under the corporate structure of Walgreens, which is fully controlled by Sycamore Partners.

Who is the new owner of Walgreens?

The new owner of Walgreens is Sycamore Partners, a U.S.-based private equity firm that completed the acquisition in 2025.

Did Walmart own Walgreens?

No, Walmart never owned Walgreens. Walgreens has remained independent until its acquisition by Sycamore Partners.

Does BlackRock own Walgreens?

No, BlackRock does not own Walgreens. All shares are owned by Sycamore Partners following the 2025 acquisition.

Who was the original owner of Walgreens?

Walgreens was founded in 1901 by Charles R. Walgreen in Chicago. The original ownership was private, held by the Walgreen family.

What happened to Walgreens shareholders?

When Walgreens was acquired by Sycamore Partners in 2025, all public shareholders were bought out at the agreed acquisition price, and the company was taken private. As a result, Walgreens no longer has public shareholders.