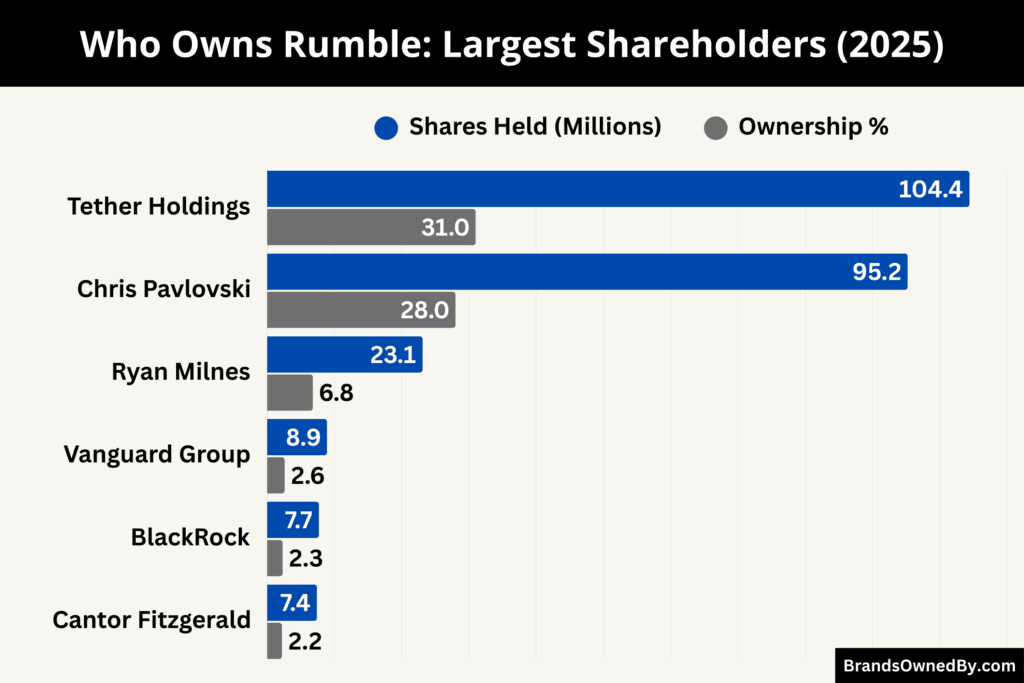

- Rumble is a publicly traded company, listed on NASDAQ, which provides transparency, liquidity, and access to capital markets while allowing public investors to participate in its growth.

- Chris Pavlovski, the founder and CEO, holds approximately 28% of the company, giving him significant influence over strategic decisions, platform policies, and executive leadership.

- Tether Holdings S.A. de C.V. owns 31% of Rumble, acting as the largest external investor and providing capital for expansion, cloud infrastructure, advertising growth, and strategic initiatives without controlling daily operations.

- Other major institutional shareholders include The Vanguard Group (2.6%), BlackRock (2.3%), and Cantor Fitzgerald (2.2%), offering credibility, liquidity, and long-term investor confidence, while additional stakes held by executives, board members, and retail shareholders (around 27% collectively) support governance participation and market stability.

Rumble is a publicly traded video-sharing and cloud services company. It operates a platform where users can upload, share, and monetize videos without the heavy content restrictions typically seen on mainstream platforms. Rumble also provides cloud infrastructure services to third-party partners.

It positions itself as an alternative to larger tech platforms by emphasizing free expression and creator autonomy. Rumble’s reach includes millions of monthly active users globally and a suite of products aimed at content creators and enterprise cloud clients.

Founders

Rumble was founded in October 2013 by the Canadian technology entrepreneur Chris Pavlovski. He grew up in the Greater Toronto Area and began building websites in his early teens. This early interest in technology laid the foundation for his career as a serial entrepreneur. Before Rumble, Pavlovski launched his first company, Jolted (later Jolt) Media Group, in 2001.

The company focused on online marketing and software solutions, and he served as its CEO, leading strategy and operations through the early 2000s.

In 2009, Pavlovski expanded his leadership experience by serving as the Director of Marketing for Next Giant Leap, a private space exploration initiative competing for the Google Lunar X Prize. In that role, he handled corporate sponsorships and internet marketing strategies until 2012.

In 2011, he co-founded Cosmic Development, an IT and software services firm that grew to employ more than 150 people with offices in Europe and North America. The company earned recognition as one of Macedonia’s top employers and built software solutions for a range of clients, including Rumble itself.

Pavlovski launched Rumble with the vision of creating a video platform that prioritized content monetization and creator control over algorithmic bias seen in other platforms.

Major Milestones

- 2013: Rumble was officially launched in October 2013 by Chris Pavlovski. The platform was built to support independent creators and enable fair video distribution without algorithmic suppression.

- 2014: The platform crossed one million monthly video views. Early creator partnerships helped establish Rumble as a growing alternative to mainstream video platforms.

- 2015: Rumble’s proprietary video player received industry recognition for speed and performance, helping the company scale content delivery efficiently.

- 2016: ComScore ranked Rumble among the top 50 video websites. Creator monetization continued to expand, reinforcing Rumble’s creator-first positioning.

- 2017: Mobile usage increased significantly. Alexa rankings placed Rumble among the top 100 mobile websites, signaling wider audience adoption.

- 2018: Quantcast listed Rumble as a top 10 mobile site in the U.S. Deloitte also recognized the company as one of the fastest-growing technology firms in North America.

- 2019: Rumble Viral, the company’s flagship content channel, surpassed one million subscribers, boosting brand awareness and engagement.

- 2020: User growth accelerated rapidly as creators and audiences sought alternative platforms. Political commentary and independent media became major content categories.

- Early 2021: Rumble received strategic investment support from entities associated with Peter Thiel, significantly increasing visibility and long-term ambition.

- Mid-2021: Monthly active users reached tens of millions, positioning Rumble as a mainstream video platform rather than a niche service.

- Late 2021: Rumble acquired Locals, a creator subscription and community platform, adding memberships, direct fan payments, and community tools.

- 2022: Rumble became a publicly traded company following a SPAC merger and began trading on NASDAQ under the ticker RUM. The company also launched its internal advertising platform.

- 2023: Rumble acquired CallIn, expanding into live audio and podcasting, and increased its role in distributing major political content.

- 2024: Rumble expanded Rumble Cloud as an alternative infrastructure provider and announced a strategic investment agreement with Tether.

- 2025: Rumble continued scaling its cloud services, advertising ecosystem, and creator tools while maintaining strong founder-led control.

Who Owns Rumble: Major Shareholders

Rumble’s ownership reflects a combination of founder control, strategic partnerships, institutional investment, and public market participation. The company is publicly traded on NASDAQ under the ticker RUM, but a relatively small number of key shareholders hold large stakes that influence governance and strategic direction.

Founder and CEO Chris Pavlovski retains significant influence through his insider holdings and voting power. Strategic investors — particularly Tether Holdings S.A. de C.V. — hold substantial economic stakes.

Institutional investors such as Vanguard and BlackRock provide diversified financial support, while retail and other public holders account for market liquidity. This blend creates a balance between control and public participation.

Below is a list of the largest shareholders of Rumble as of December 2025:

| Shareholder | Number of Shares Held (Millions) | Ownership % | Relevant Details |

|---|---|---|---|

| Tether Holdings S.A. de C.V. | 104.4 | 31% | Largest strategic investor. Provides capital for expansion into cloud, advertising, and crypto initiatives. Influences major shareholder decisions but does not control board or operations. |

| Chris Pavlovski | 95.2 | 28% | Founder and CEO. Primary controlling shareholder with significant voting power. Directs long-term strategy, platform policies, and executive leadership decisions. |

| Ryan Milnes | 23.1 | 6.8% | Board member and senior insider. Participates in governance and strategic oversight alongside the founder. |

| The Vanguard Group, Inc. | 8.9 | 2.6% | Institutional investor holding shares through index funds and ETFs. Provides market credibility and liquidity, but no operational control. |

| BlackRock, Inc. | 7.7 | 2.3% | Institutional investor. Stake held via funds. Contributes to market stability and investor confidence without operational influence. |

| Cantor Fitzgerald Asset Management | 7.4 | 2.2% | Institutional investor with a financial stake. Signals institutional validation, supporting long-term market stability. |

| Other Insiders & Executives | Variable (collective, <5) | <5% | Includes COO, CFO, CTO, and other senior executives. Small individual holdings aligned with performance and retention incentives. |

| Retail & Public Shareholders | Remaining float (91.0) | 27% | Includes individual investors and smaller public holders. Provide liquidity and participate in routine shareholder votes but do not influence strategic decisions. |

Chris Pavlovski – Founder, CEO, and Core Controlling Shareholder

Chris Pavlovski is the founder and CEO of Rumble and remains one of its most influential shareholders. As of December 2025, he holds approximately 95.2 million shares, representing about 28% of the company’s outstanding shares. This ownership gives him significant voting power and practical control over long-term strategy.

Pavlovski’s position allows him to guide product direction, partnerships, and platform philosophy without relying heavily on external approval. Even after Rumble’s public listing and major strategic investments, his ownership ensures continuity in leadership. His control is reinforced by his executive role and board influence, making him the central decision-maker within the company.

Tether Holdings S.A. de C.V.

Tether Holdings S.A. de C.V. is Rumble’s largest strategic investor and holds the biggest single block of shares by volume. As of December 2025, Tether owns approximately 104.4 million shares, accounting for roughly 31% of Rumble’s total outstanding shares.

This stake was built following a large strategic investment that closed in early 2025. Tether’s ownership gives it substantial economic exposure to Rumble’s performance. However, it does not exercise direct operational control. Governance remains with Rumble’s existing leadership and board. Tether does not appoint executives or dictate platform policies, but its size gives it influence in major corporate matters that require shareholder approval.

The relationship is primarily strategic. It supports Rumble’s expansion into infrastructure, advertising, and technology partnerships while preserving Rumble’s independence.

Ryan Milnes

Ryan Milnes is a senior insider and board member of Rumble. He holds approximately 23.1 million shares, representing close to 6.8% ownership of the company as of December 2025.

Milnes plays a governance role rather than an operational one. His ownership aligns his interests with long-term shareholder value and company stability. While he does not control Rumble, his stake is large enough to give him influence in board-level discussions, voting matters, and strategic oversight alongside the founder.

The Vanguard Group, Inc.

As of December 2025, Vanguard holds approximately 8.9 million shares, representing 2.6% of the company. Its holdings are primarily managed through index funds and ETFs, providing exposure to Rumble’s performance for a broad base of investors.

While Vanguard does not have direct involvement in Rumble’s management or strategic decision-making, its presence adds credibility to the stock in the eyes of other investors. Institutional backing from a firm of Vanguard’s size helps stabilize share price volatility and demonstrates that professional investors consider Rumble a viable long-term growth investment.

BlackRock, Inc.

BlackRock, another global asset management leader, owns around 7.7 million shares, or 2.3% of Rumble, through its range of mutual funds, ETFs, and institutional investment products.

BlackRock’s stake is primarily financial, yet its participation signals institutional confidence in Rumble’s platform, user growth, and monetization potential. While it does not control board decisions or operational policies, BlackRock contributes to market liquidity, governance oversight through shareholder voting, and supports long-term institutional validation.

Its ownership also ensures Rumble remains attractive to other large investors seeking professionally market-approved stocks.

Cantor Fitzgerald Asset Management

Cantor Fitzgerald Asset Management holds roughly 7.3 million shares, representing 2.2% of Rumble. This investment is primarily financial, but it positions Cantor Fitzgerald among the notable institutional supporters of Rumble. Its stake demonstrates confidence in the company’s strategic growth in video streaming, content monetization, and cloud services.

Though Cantor Fitzgerald does not participate in day-to-day operations or board governance, its presence signals institutional legitimacy and contributes to the overall market stability and investor confidence in Rumble’s stock.

Other Insiders and Executives

Beyond the founder and board members, several executives hold smaller stakes in Rumble, including the COO, CFO, CTO, and other senior leadership.

Collectively, these holdings are designed to align the executives’ interests with long-term shareholder value. While individual stakes are modest, they incentivize performance, retention, and strategic alignment.

By holding equity, these executives are financially motivated to contribute to growth, innovation, and operational efficiency, ensuring that leadership remains invested in Rumble’s success across all business segments.

Who is the CEO of Rumble?

The Chief Executive Officer of Rumble is Chris Pavlovski, the company’s founder and long‑time leader. He holds the top executive role, overseeing corporate strategy, product direction, partnerships, and public representation of the company.

As both CEO and Chairman of the board, Pavlovski plays a central role in guiding Rumble through public market operations, strategic expansion, and ongoing platform development.

His leadership has been a continuous thread from the company’s founding in 2013 through its public listing and into its current growth phase in 2025.

Early Career and Path to CEO

Chris Pavlovski grew up in Canada and became interested in technology at a young age. He attended the University of Toronto, worked briefly as a network administrator at Microsoft, and then transitioned into entrepreneurship.

Before Rumble, he founded several ventures, including Jolted Media Group and Cosmic Development, gaining experience in software, digital services, and business management.

In 2013, he launched Rumble with the vision of creating a video platform focused on creator monetization and minimal content restrictions. Over the years, he remained deeply involved in its growth, ultimately becoming CEO and Chairman upon its public listing.

Role and Responsibilities as CEO

As CEO, Pavlovski is responsible for setting Rumble’s strategic vision, managing senior leadership, and steering the company through competitive market dynamics.

He oversees product development, including expansion of Rumble’s video platform, cloud infrastructure services, and monetization tools for creators. His leadership also involves external engagements, such as strategic partnership negotiations and positioning Rumble in the broader media ecosystem.

Pavlovski’s dual role as Chairman reinforces his influence over governance. While public shareholders and strategic investors participate in governance through votes, Pavlovski’s insider holdings and executive mandate give him decisive influence over key decisions, including long‑term planning and resource allocation.

Compensation and Salary Details

In his role as CEO and Chairman, Pavlovski receives a compensation package that combines salary, bonus, and significant equity incentives.

For the 2024 fiscal year, his total reported compensation was approximately $4.39 million. This included a base salary of roughly $980,000, a cash bonus of about $233,000, and significant equity and option awards valued at over $2.5 million in total.

These equity‑based components are designed to align his incentives with long‑term shareholder value and performance outcomes, with stock and option awards vesting over multi‑year periods. The structure reflects a mix of cash and long‑term incentives typical for senior executives of publicly traded technology companies.

Net Worth and Financial Standing

As of December 2025, estimates of Chris Pavlovski’s net worth vary based on stock valuations and holdings. Major financial press analyses have identified him as a billionaire following strategic investment activity that boosted Rumble’s share price.

According to these assessments, his personal wealth is estimated at around $1.3 billion, driven primarily by his substantial Rumble shareholdings and equity positions. His CEO share ownership — combined with founder‑level stock and option positions — anchors his net worth, though estimates can differ depending on market conditions and valuation methodologies.

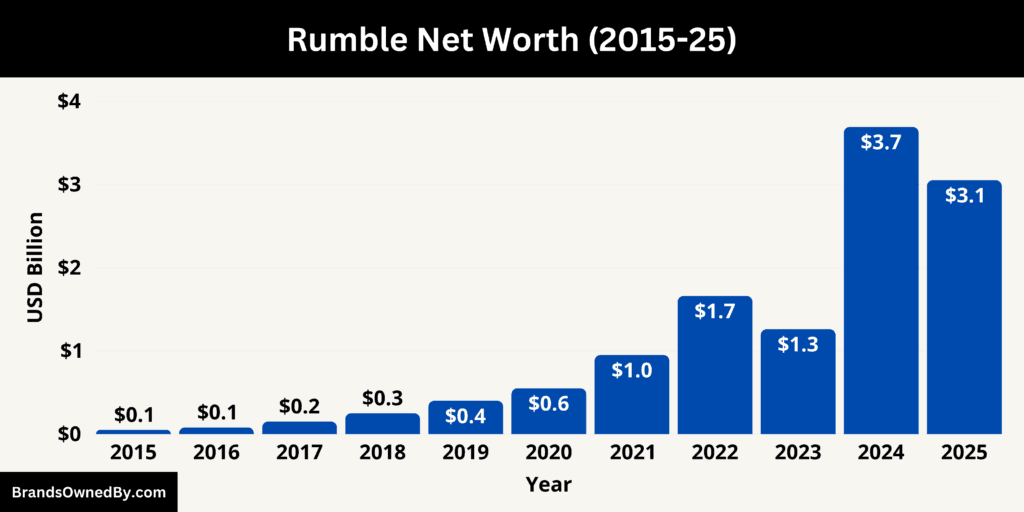

Rumble Annual Revenue and Net Worth

As of December 2025, the trailing twelve months (TTM) leading into late 2025, Rumble’s revenue totaled approximately $103.8 million, marking an increase of roughly 21% year‑over‑year compared to results from prior periods. At the same time, the company’s net worth is approximately $3.05 billion, indicating investor perception of its future growth potential and business traction in both media and cloud services.

Revenue in 2025

In 2025, Rumble’s quarterly revenue performance showed both stability and challenges tied to seasonality, user engagement trends, and monetization shifts.

For example, reported revenue in the third quarter of 2025 was approximately $24.8 million, nearly flat compared to the prior year’s corresponding period, though it reflected growth in average revenue per user (ARPU) due to stronger subscription and licensing income.

Overall, Rumble’s year‑to‑date revenue growth was supported by diversified sources beyond advertising alone, including partnerships, subscription bundles, and early infrastructure revenues.

It’s strategic focus on cloud services, expanded creator tools, and bundled offerings — such as subscription combinations with partners — helped offset slower audience growth in some segments.

Importantly, Rumble’s revenue performance in 2025 came against a backdrop of wider industry shifts. Changes in content engagement cycles outside of U.S. election periods affected monthly active user counts and ad revenue flow. However, increased monetization per user and emerging revenue lines helped sustain topline growth overall.

The company’s quarterly and annual revenue figures illustrate how Rumble is moving from pure advertising dependence toward a more diversified model, including recurring revenue components.

Net Worth 2025

Rumble’s net worth, as of December 2025, is around $3.05 billion, reflecting investor expectations of continued growth but also uncertainty tied to profitability challenges and competitive pressures. Rallying partnerships, infrastructure investments, and strategic moves into areas such as cloud services and potential AI‑related assets contributed to valuation dynamics.

This valuation contrasts with previous periods where Rumble’s market cap fluctuated significantly due to strategic investments and shifting investor sentiment. For example, the company’s valuation rose sharply with large strategic capital raises and then normalized as revenue and engagement patterns evolved throughout the year.

These market cap changes underscore how valuation for a technology and media company like Rumble is tied not only to current revenues but also to investor confidence in long‑term strategy execution and diversified business performance.

Profitability and Financial Context

While Rumble’s revenue has grown, the company has continued to report net losses in 2025. Quarterly results showed improvements in loss figures compared to prior years, demonstrating progress on cost optimization as Rumble scaled operations.

Reduced content costs, higher paid subscription and licensing streams, and efficiencies in operational spending contributed to narrowing net loss margins. Liquidity remained strong, supported by strategic investments and improved operational cash flow trends, giving the company runway to invest in cloud infrastructure and monetization innovations.

Rumble’s broader financial performance combines topline growth, strategic diversification, and improved loss management, painting a picture of a company transitioning toward a more robust revenue mix, even as net profitability remains a future milestone.

Brands Owned by Rumble

As of 2025, Rumble has expanded far beyond its core video platform, building a diverse portfolio of brands, acquisitions, and business entities. These include subscription and community platforms, cloud infrastructure services, original content initiatives, and regional operations.

Below is a list of the major brands owned by Rumble as of December 2025:

| Company / Brand | Description | Purpose / Role | Key Features |

|---|---|---|---|

| Rumble (Core Video Platform) | The main video‑sharing and publishing platform | Hosts user‑generated and professional video content | Advertising, creator uploads, search, engagement, monetization |

| Locals | Creator subscription and community platform | Enables direct creator‑to‑audience paid subscriptions | Subscription tiers, exclusive community content, messaging |

| Rumble Cloud | Cloud infrastructure and hosting services | Provides scalable cloud solutions to enterprises and media partners | Cloud storage, content delivery, enterprise hosting |

| Rumble Advertising Center | Advertising sales and ad tech division | Manages ad inventory and placements across Rumble properties | Targeted ads, campaign analytics, creator ad revenue share |

| CallIn | Live audio and interaction platform | Supports live voice engagement and interactive sessions | Real‑time audio, audience participation, moderated talks |

| Rumble LatAm | Regional operations for Latin America | Localizes platform content and partnerships for the Latin American market | Regional content, local creators, targeted monetization |

| Rumble Originals | Content production and exclusive series division | Develops original shows and exclusive media content for Rumble | Exclusive series, documentaries, long‑form programming |

| Rumble Creators Studio | Creator support and production services | Provides tools and resources to help creators improve content and earnings | Workshops, production guidance, creator resources |

| Rumble Enterprise Services | Tailored solutions for businesses and institutional clients | Delivers custom streaming, cloud integration, and enterprise accounts | Custom streaming, secure distribution, tech support |

| Rumble Events | Live and hybrid events division | Organizes community and industry events related to Rumble and creators | Virtual and physical events, sponsorships, live experiences |

Rumble (Core Video Platform)

Rumble’s primary asset is its core video‑sharing platform. This platform competes with larger incumbents by focusing on minimal content restrictions, robust monetization, and incentives for independent creators.

Users can upload, share, and discover videos across a range of categories, from entertainment and commentary to educational content. Rumble’s video platform also integrates advertising placements, searchable content, and viewer engagement tools, making it a full‑featured alternative for both creators and audiences.

The platform supports direct payments to creators, partnerships with advertisers, and features that encourage audience retention and growth.

Locals

Locals is a creator subscription and community platform that Rumble acquired in 2021 for an estimated $50 million. The platform enables creators to build direct, monetized relationships with their audiences through paid memberships, exclusive content, and community engagement tools. Creators can offer tiered subscription levels, host semi-private communities, and engage members via posts, live chats, and interactive groups.

Rumble’s acquisition of Locals was strategically aimed at diversifying revenue streams beyond advertising. By integrating Locals, Rumble strengthened its subscription-based income model, allowing creators to earn recurring revenue and giving the company a steady, predictable cash flow. The purchase also provided Rumble with access to Locals’ existing user base and technology infrastructure, accelerating the company’s entry into community-driven monetization services.

Rumble Cloud

Rumble Cloud is Rumble’s infrastructure and cloud services brand. It provides cloud hosting, data storage, content delivery network (CDN) services, and enterprise‑grade infrastructure solutions. Rumble Cloud positions itself as an alternative to the major incumbent cloud providers by leveraging optimized video delivery and scaling capabilities.

Enterprises, media companies, and government entities can use Rumble Cloud for secure hosting, streaming, and backend support, making it a strategic diversification of Rumble’s business beyond its consumer video platform.

Rumble Advertising Center

Rumble Advertising Center is the brand through which the company manages its advertising products and partnerships. It supports direct ad placements on the Rumble video platform and associated properties.

The Advertising Center provides tools for marketers to target audiences, measure engagement, and optimize campaign performance. It also allows creators to monetize their content through shared ad revenue.

This entity underpins Rumble’s largest revenue stream and continues to evolve with partnerships, expanded ad formats, and tailored solutions for advertisers.

CallIn

CallIn is a live audio and interactive talk platform that Rumble acquired in 2022 for an estimated $15 million. The platform enables creators and hosts to engage directly with audiences through real-time voice interactions, moderated discussions, and live audience participation. It is particularly popular among podcasters, commentators, and community leaders who want to host interactive sessions beyond pre-recorded content.

The acquisition of CallIn was part of Rumble’s strategy to expand its creator engagement ecosystem and provide more diverse monetization opportunities.

Rumble LatAm

Rumble LatAm represents Rumble’s focused operations and branding in the Latin American market. This entity works with regional content creators, distribution partners, and advertisers to localize content, partnerships, and user engagement.

It tailors platform features, monetization models, and marketing to fit regional preferences and media consumption patterns. It underscores Rumble’s global expansion strategy and reflects a segment of operations that emphasizes localized audience growth.

Rumble Originals

Rumble Originals refers to content and production initiatives that are sponsored, commissioned, or developed exclusively for Rumble.

This brand encompasses original shows, series, and long‑form productions that premiere on the Rumble platform. By owning and operating original content projects, Rumble expands its content library and attracts exclusive viewership. These originals span various genres, including documentaries, commentary series, and entertainment programming that align with Rumble’s audience interests.

Rumble Creators Studio

Rumble Creators Studio is an entity that supports content creators with production tools, collaboration features, and monetization coaching. It acts as an internal support brand for creators who want to improve production quality, grow their audience, and increase revenue streams.

Through educational resources, workshops, and creative partnerships, Rumble Creators Studio enhances creator success on the platform. It also fosters a community of creators who share best practices and resources.

Rumble Enterprise Services

Rumble Enterprise Services is the division of Rumble focused on providing tailored solutions to businesses, media organizations, and institutional partners. This entity delivers customized streaming solutions, cloud integration support, and enterprise account services.

It helps high‑volume users leverage Rumble’s infrastructure for secure content distribution, private streaming, and hybrid cloud deployments. Rumble Enterprise Services reflects the company’s aspiration to serve beyond the consumer video market into institutional and corporate use cases.

Rumble Events

Rumble Events manages live and hybrid events, online summits, and creator meetups under the Rumble umbrella. This brand organizes, promotes, and hosts virtual and physical events that bring creators, advertisers, and audiences together.

Through ticketing, sponsorship, and interactive formats, Rumble Events extends the platform’s engagement ecosystem into real‑world and live digital experiences. It acts as a community outreach mechanism and an additional revenue line through event sponsorships and partnerships.

Final Thoughts

Rumble has evolved far beyond a simple video-sharing platform, building a diverse ecosystem of brands, acquisitions, and services that empower creators and expand its reach. From its core video platform to subscription communities, cloud services, and live interaction tools, Rumble continues to innovate and diversify revenue streams. Understanding who owns Rumble and how its leadership, investors, and subsidiaries operate offers a clear picture of the company’s strategy and growth potential. As the platform continues to expand globally and attract creators, Rumble’s influence in the media and tech landscape is only set to grow stronger.

FAQs

Who is Rumble owned by?

Rumble is primarily owned by its founder and CEO, Chris Pavlovski, along with strategic investors and public shareholders. As a publicly traded company on NASDAQ, ownership is distributed among individual and institutional investors, with Pavlovski and Tether Holdings holding the largest stakes.

Who is Rumble’s biggest shareholder?

The largest shareholder of Rumble is Tether Holdings S.A. de C.V., which owns approximately 31% of the company. This strategic investment provides capital for growth and key initiatives, though it does not control daily operations.

Who owns Rumble platform?

The Rumble platform is owned by Rumble Inc., the company itself. Major individual and institutional shareholders collectively hold ownership through publicly traded shares, with Chris Pavlovski as the founder and largest controlling shareholder.

Is Rumble privately owned?

No, Rumble is not privately owned. It is a publicly traded company listed on NASDAQ, which allows investors to buy and sell shares on the open market while providing transparency and regulatory oversight.

Is Rumble part of Trump Media?

No, Rumble is independent and not part of Trump Media. While it operates in a similar space of alternative media and social platforms, it is a standalone company with its own leadership, investors, and strategy.

Who are the investors in Rumble?

Rumble’s investors include Tether Holdings S.A. de C.V. (largest strategic investor, 31%), Chris Pavlovski (28%), and institutional investors such as The Vanguard Group (2.6%), BlackRock (2.3%), and Cantor Fitzgerald (2.2%). Additional stakes are held by executives, board members, and public shareholders, collectively making up the remaining float.

Who founded Rumble?

Rumble was founded in 2013 by Chris Pavlovski, a Canadian entrepreneur with a background in technology and digital media. He started the company with a vision to create a video platform focused on monetization and minimal content restrictions.

Why did Rumble start?

Rumble was started to provide an alternative video platform where creators could monetize their content freely without the strict content moderation and monetization constraints found on larger platforms. The goal was to empower independent creators and provide audiences with a diverse range of content.

Is Chris Pavlovski a billionaire?

Yes, as of 2025, Chris Pavlovski is considered a billionaire. His net worth is estimated around $1.3 billion, primarily driven by his founder shares and equity holdings in Rumble, along with his strategic investments in the company.