- Royal Caribbean Group is a publicly traded cruise holding company with no single controlling owner. Ownership is widely distributed, and strategic control rests with the board of directors and executive leadership rather than any individual shareholder.

- Institutional investors dominate Royal Caribbean Group’s ownership structure, collectively holding approximately 80% to 85% of outstanding shares. This makes the company institutionally controlled from a governance and voting perspective.

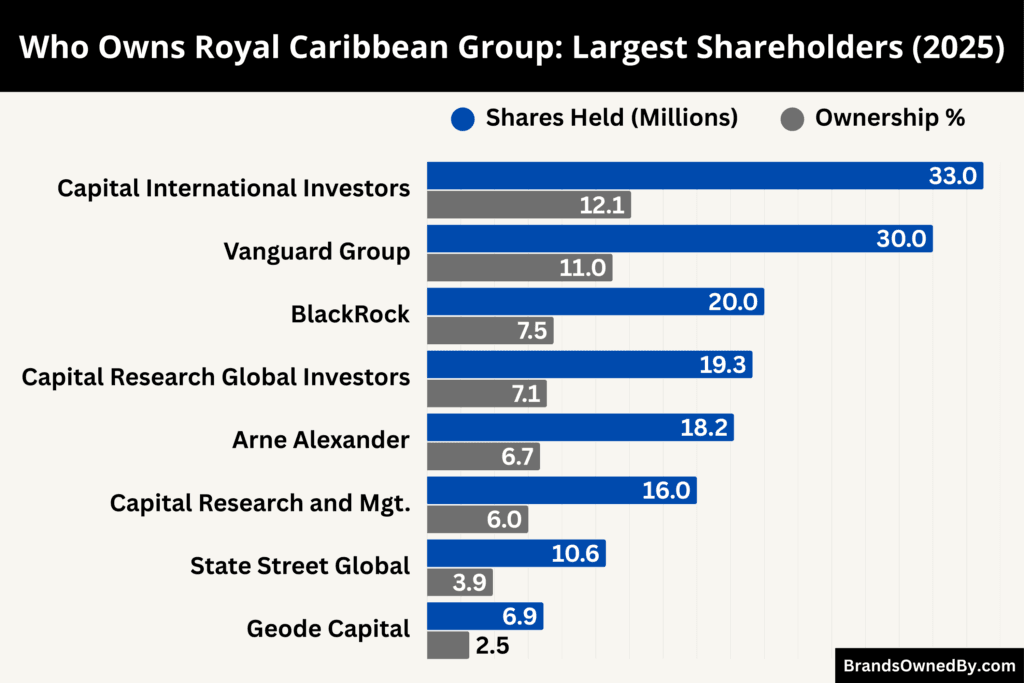

- The largest shareholders of Royal Caribbean Group include Capital International Investors with about 12% ownership, Vanguard Group with roughly 11%, BlackRock with around 7 to 8%, and Capital Research–affiliated entities with a combined stake of about 13%, together forming the most influential voting bloc.

- Individual and insider ownership accounts for the remaining 15% to 20%, including legacy shareholders such as Arne Alexander Wilhelmsen with around 6 to 7%, but no individual shareholder has the power to unilaterally control Royal Caribbean Group.

Royal Caribbean Group is one of the world’s leading cruise vacation companies. It operates a global fleet of more than 60 ships across multiple cruise brands, serving millions of guests.

Its focus is on delivering memorable travel experiences to destinations around the world. Royal Caribbean Group has a presence on all seven continents and continues to lead the industry in innovation. Its portfolio includes contemporary, premium, and luxury cruise offerings that appeal to a wide range of travelers.

The company also integrates unique private destinations into its itineraries to enhance guest experiences.

Royal Caribbean Group Founders

Royal Caribbean traces its origins to 1968, when three Norwegian shipping firms joined forces to create a cruise line focused on the emerging vacation market, particularly in the United States.

The founding partners were Anders Wilhelmsen & Company, I.M. Skaugen & Company, and Gotaas Larsen. These entities brought extensive maritime expertise and shared a vision for a modern cruise experience that emphasized comfort, innovation, and service.

Their collaboration led to the formal establishment of a new cruise company that would differentiate itself from traditional ocean liner services. The partners aimed to design ships that were purpose-built for leisure cruising in warmer climates. This strategy laid the foundation for Royal Caribbean’s ascent in the travel and tourism sector.

In 1970, the company launched its first ship, Song of Norway, marking a pivotal moment in its history. This vessel was notable for features that were innovative at the time and tailored to vacation cruising.

Major Milestones

- 1968: Royal Caribbean Cruise Line is founded in Norway by Anders Wilhelmsen & Company, I.M. Skaugen & Company, and Gotaas Larsen with a vision to create purpose-built cruise ships.

- 1970: The company launches its first cruise ship, Song of Norway, which enters service and marks Royal Caribbean’s official entry into the cruise industry.

- 1971: Nordic Prince joins the fleet, expanding capacity and strengthening the company’s Caribbean-focused itineraries.

- 1972: Sun Viking is introduced, further establishing Royal Caribbean as a growing cruise operator.

- 1982: Song of America debuts as one of the largest passenger cruise ships of its time, reflecting early innovation in ship design.

- 1988: Sovereign of the Seas launches and becomes the largest cruise ship in the world, introducing large-scale onboard amenities and redefining cruise expectations.

- 1993: Royal Caribbean becomes a publicly traded company, increasing access to capital and accelerating long-term expansion.

- 1995: Majesty of the Seas enters service, continuing the Sovereign-class growth strategy.

- 1997: Royal Caribbean merges with Celebrity Cruises, forming Royal Caribbean Cruises Ltd. and expanding into the premium cruise segment.

- 1999: Voyager of the Seas launches, introducing features such as the first ice-skating rink at sea and the Royal Promenade.

- 2004: The company debuts the first Freedom-class ships, pushing capacity and onboard entertainment further.

- 2006: Freedom of the Seas becomes the largest cruise ship in the world at the time of launch.

- 2009: Oasis of the Seas enters service, introducing neighborhood-style ship design and redefining large-ship cruising.

- 2014: Quantum of the Seas launches, bringing advanced technology such as robotic bartenders and smart ship features.

- 2016: Harmony of the Seas debuts as the world’s largest cruise ship, continuing the Oasis-class dominance.

- 2018: Royal Caribbean acquires a majority stake in Silversea Cruises, entering the ultra-luxury and expedition cruise markets.

- 2020: The company officially rebrands as Royal Caribbean Group, reflecting its multi-brand global structure.

- 2021: Royal Caribbean resumes operations following the global cruise shutdown, implementing new health and safety protocols.

- 2023: Icon of the Seas is delivered, introducing the Icon Class and setting new standards for size, design, and family-focused cruising.

- 2024: Royal Caribbean expands private destination offerings and enhances destination-based experiences across its itineraries.

- 2025: Star of the Seas, the second Icon-class ship, joins the fleet, reinforcing Royal Caribbean Group’s leadership in next-generation cruise innovation.

Who Owns Royal Caribbean Group: Top Shareholders

Royal Caribbean commonly refers to Royal Caribbean International, the global cruise brand familiar to travelers. Its parent company is Royal Caribbean Group, the publicly traded holding company that owns Royal Caribbean International and several other cruise brands. Royal Caribbean Group is the corporate entity that issues stock, signs financing and shipbuilding contracts, and answers to public shareholders.

Royal Caribbean Group is owned by many investors rather than a single controlling family or firm. Large institutional asset managers hold the biggest stakes. A small portion is held by individual and insider shareholders

Below is a list of the major shareholders of Royal Caribbean Group (the parent company of Royal Caribbean) as of December 2025:

Capital International Investors

Capital International Investors is the largest shareholder of Royal Caribbean Group as of 2025.

It owns approximately 33 million shares, representing just over 12% of the company’s outstanding stock.

This level of ownership gives Capital International Investors substantial voting power. While it does not control the company outright, it can meaningfully influence board elections and shareholder resolutions. The firm is known for long-term equity investing rather than short-term trading. Its large stake signals confidence in Royal Caribbean’s long-term business model, fleet strategy, and global demand for cruise travel.

Capital International Investors typically engages with management on governance quality, capital discipline, and long-term value creation. Its size also means Royal Caribbean leadership must consider its position when proposing strategic changes.

Vanguard Group

The Vanguard Group holds roughly 30 million shares, equivalent to about 11% ownership.

Vanguard’s shares are spread across index funds, ETFs, and institutional portfolios. Vanguard does not actively manage Royal Caribbean’s business operations. However, it is one of the most influential shareholders because of its consistent voting participation.

Vanguard’s influence lies in governance stability. It regularly votes on board appointments, executive pay packages, and shareholder proposals. Because Vanguard holds shares for the long term, it favors predictable leadership, disciplined growth, and risk management. Its continued large stake reinforces institutional confidence in Royal Caribbean’s strategic direction.

BlackRock, Inc.

BlackRock owns approximately 20 million shares, representing around 7% to 8% of Royal Caribbean Group.

BlackRock’s holdings are distributed across ETFs, pension portfolios, and actively managed funds. While BlackRock does not seek operational control, it is a highly engaged institutional investor. Its size gives it leverage in discussions around governance standards, environmental policies, and long-term resilience.

BlackRock’s presence adds weight to shareholder oversight. When BlackRock supports or opposes governance measures, its vote often aligns with broader institutional sentiment. This makes it a key stakeholder in shaping Royal Caribbean’s corporate accountability.

Capital Research Global Investors

Capital Research Global Investors owns about 19 million shares, equal to roughly 7% of outstanding shares.

Unlike passive managers, Capital Research Global Investors is more active in portfolio management. Its investment approach focuses on long-term fundamentals, competitive advantages, and management quality.

Its ownership reflects confidence in Royal Caribbean’s brand portfolio, fleet renewal strategy, and global positioning. Capital Research funds often engage with management on strategic priorities and long-term capital allocation, making this stake influential despite not being a controlling interest.

Arne Alexander Wilhelmsen

Arne Alexander Wilhelmsen holds approximately 18 million shares, representing around 6% to 7% ownership.

This stake is especially significant because it is tied to Royal Caribbean’s founding heritage. The Wilhelmsen family was part of the original Norwegian shipping groups that helped establish the company. While Arne Alexander Wilhelmsen does not run daily operations, his ownership represents a long-term, legacy investment rather than a purely financial position.

Founder-related ownership often provides stability. It also reflects a vested interest in preserving brand reputation, operational discipline, and long-term independence. This makes Wilhelmsen one of the most influential individual shareholders.

Capital Research – World Investors and Related Funds

Capital Research and Management, through its World Investors and related funds, holds over 16 million shares, translating to roughly 6% ownership.

Although separate from Capital Research Global Investors, these funds are part of the same broader investment organization. When combined, Capital Research-related entities collectively represent one of the most powerful ownership blocs in Royal Caribbean Group.

This layered ownership structure allows Capital Research to influence governance from multiple voting positions while maintaining diversified portfolio exposure.

State Street Global Advisors

State Street Global Advisors owns approximately 10.5 million shares, or just under 4% of the company.

State Street primarily manages index and institutional portfolios. Its role is governance-focused rather than operational. State Street actively votes on proxy matters and supports shareholder rights initiatives.

While its ownership stake is smaller than Vanguard or BlackRock, it adds to the concentration of institutional control. When large asset managers vote in alignment, their combined influence is decisive.

Geode Capital Management

Geode Capital Management holds close to 7 million shares, representing around 2.5% ownership.

Geode’s holdings are largely index-based. Its influence comes from being part of the broader institutional shareholder base rather than from direct engagement. While smaller individually, Geode contributes to the overall institutional majority that governs Royal Caribbean Group.

Insider and Executive Ownership

Royal Caribbean executives and board members collectively own a small percentage of total shares, typically well below 2%. These holdings come primarily from stock-based compensation rather than large open-market purchases.

Although limited in size, insider ownership aligns leadership incentives with shareholder value. Executives benefit when the company performs well over the long term, reinforcing disciplined decision-making.

Who is the CEO of Royal Caribbean Group?

Royal Caribbean Group’s chief executive officer (CEO) is Jason T. Liberty, a long-serving executive who leads the entire corporate organization that owns major cruise brands such as Royal Caribbean International, Celebrity Cruises, Silversea Cruises, and joint ventures like TUI Cruises and Hapag-Lloyd Cruises.

Royal Caribbean Group operates a global fleet of more than 60 ships and employs nearly 100,000 people worldwide.

As CEO, Liberty is responsible for strategic planning, operational oversight, financial performance, and long-term growth initiatives across all brands and markets.

Michael Bayley: CEO of Royal Caribbean International

Michael Bayley is the President and Chief Executive Officer of Royal Caribbean International, the flagship cruise brand of Royal Caribbean Group. He has led the brand since 2014 and is one of the longest-serving brand-level CEOs in the global cruise industry.

Royal Caribbean International operates the largest cruise ships in the world and represents the core revenue and brand identity of Royal Caribbean Group.

While strategic oversight comes from the parent company, Michael Bayley has direct responsibility for brand execution, guest experience, fleet deployment, and commercial performance.

Jason Liberty: Background and Career Path

Jason Liberty joined Royal Caribbean Group in 2005 as a finance executive. He held several leadership roles before becoming chief financial officer (CFO) in 2013. In his finance and strategy roles, he oversaw areas such as corporate planning, legal, technology, shared services, and key acquisitions, including Silversea Cruises and stakes in joint ventures.

His deep experience in finance and corporate strategy positioned him to guide the company through significant growth phases and market challenges.

Liberty was appointed president and CEO of Royal Caribbean Group in January 2022. His leadership has coincided with a strong recovery in cruising demand, fleet expansion, and execution of strategic financial targets.

Under his tenure, the company achieved key performance milestones earlier than planned and restored shareholder returns through dividends and capital allocation initiatives.

Leadership and Decision-Making Structure

As CEO, Liberty sets corporate strategy in collaboration with the board of directors. His role involves steering the company through market volatility, managing relationships with investors and regulators, and guiding major long-term investments such as new ship classes and destination development.

The CEO works alongside a senior executive team, including the CFO, maritime leadership, and presidents of individual cruise brands, to coordinate execution and achieve strategic objectives.

Board oversight ensures executive accountability and alignment with shareholder interests. Large institutional shareholders regularly participate in governance through proxy voting on board members and executive compensation plans, shaping expectations for leadership performance.

Compensation and Salary

In the 2024 fiscal year, Jason Liberty’s total compensation as president and CEO of Royal Caribbean Group was valued at approximately $19.5 million. This compensation package included:

- Base salary: approximately $1.3 million

- Bonus and cash incentives: approximately $4.9 million

- Stock awards: approximately $13 million

- Other compensation (benefits and perks): $0.24 million.

The significant stock-based component of his compensation reflects alignment with long-term shareholder performance, as equity incentives are designed to reward sustained company growth and stock appreciation.

CEO Net Worth

Jason Liberty’s net worth is estimated at approximately $65 million to $70 million as of late 2025. This estimate is based largely on his holdings in Royal Caribbean Group stock accumulated through equity compensation and grants. His insider share ownership represents a meaningful personal financial stake in the company’s success but does not approach a controlling ownership position.

Past CEOs and Leadership Legacy

Before Liberty, the most influential leader of Royal Caribbean Group was Richard D. Fain, who served as chairman and CEO for more than three decades until 2022. Fain guided the company through major expansions, innovation in ship design, and its navigation of challenging industry events, including global travel disruptions. Although he stepped down as CEO, Fain continues to serve on the board, providing continuity and strategic counsel.

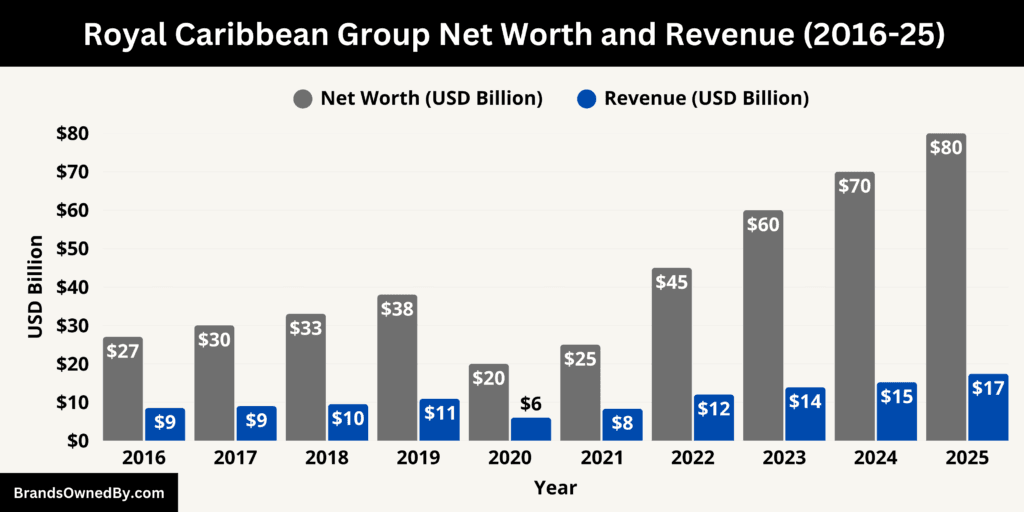

Royal Caribbean Annual Revenue and Net Worth

As of 2025, Royal Caribbean Group is operating at record scale. The company’s trailing twelve-month revenue is $17.4 billion, and its net worth is estimated at $80 billion as of December 2025. These figures reflect full fleet deployment, high capacity utilization, and sustained pricing strength across its core cruise brands, led by Royal Caribbean International.

Trailing Twelve-Month Revenue: $17.4 Billion

Royal Caribbean Group generated $17.4 billion in revenue over the last twelve months, representing one of the highest revenue levels in the company’s history. Royal Caribbean International accounts for the majority of this total, driven by its large-capacity fleet and global itinerary network.

In 2025, Royal Caribbean Group operated more than 60 ships, with Royal Caribbean International alone operating over 45 vessels. Average fleet occupancy remained consistently above 100% on a double-occupancy basis, meaning ships frequently sailed with more passengers than their standard berth capacity. This level of utilization directly supports revenue stability.

Passenger ticket revenue made up the largest portion of the $17.4 billion total, followed by onboard revenue streams. Onboard revenue per passenger continued to rise due to higher spending on specialty dining, beverage packages, internet services, entertainment experiences, and shore excursions. Newer ships, particularly Oasis-class and Icon-class vessels, generate materially higher onboard revenue per sailing due to expanded entertainment districts, dining venues, and premium accommodations.

Private destination spending also contributed meaningfully to revenue. Royal Caribbean-owned destinations capture guest spending that would otherwise go to third-party ports, increasing revenue retention per passenger. These destination assets improve revenue yield without increasing fleet size.

Revenue Composition and Scale Metrics

Royal Caribbean Group’s $17.4 billion trailing revenue is supported by scale rather than price alone. The company carried tens of millions of passengers annually across its brands. Royal Caribbean International represents the largest share of passenger volume due to its focus on high-capacity ships and mainstream itineraries.

Revenue growth in 2025 was supported by:

- Full fleet utilization across all major regions

- Strong advance bookings extending well into future sailing seasons

- Higher onboard revenue per passenger compared to pre-pandemic levels

- Larger ships entering service with materially higher revenue-generating capacity

These factors collectively explain how the company sustains revenue at this level without relying on aggressive discounting.

Net Worth 2025

Royal Caribbean’s net worth of approximately $80 billion, as of December 2025, reflects the market’s valuation of the company’s total enterprise. This valuation incorporates the scale and earning power of its fleet, the long-term value of its brands, and expected future cash flows.

A significant portion of this net worth is tied to physical assets. Royal Caribbean owns one of the youngest and most technologically advanced fleets in the cruise industry. New ships represent multi-billion-dollar assets individually, and the cumulative replacement value of the fleet alone is substantial.

Brand value is another major contributor. Royal Caribbean International is one of the most recognizable cruise brands globally, with strong repeat customer rates and a large loyalty base. This brand equity supports long-term pricing power and booking visibility, which investors factor into valuation.

Relationship Between Revenue and Net Worth

The relationship between $17.4 billion in trailing revenue and an $80 billion net worth reflects expectations of sustained earnings rather than short-term performance alone. Investors value Royal Caribbean based on:

- Long asset life of ships, often exceeding 30 years

- Predictable demand from repeat cruisers

- High barriers to entry due to capital intensity

- Ability to scale revenue through larger ships without proportional cost increases.

Revenue supports cash generation, while net worth reflects confidence in future performance, fleet productivity, and brand durability.

Companies Owned by Royal Caribbean Group

Royal Caribbean Group operates a diversified portfolio of cruise brands, destination assets, and joint ventures. These businesses are owned and controlled directly by the group and form the operational backbone of its global cruise strategy.

Below is a list of the major companies and brands owned by Royal Caribbean Group as of December 2025:

| Company / Brand | Type | Ownership Structure | Primary Market / Segment | Key Details |

|---|---|---|---|---|

| Royal Caribbean International | Cruise brand | Wholly owned | Mass-market / family cruising | Flagship brand and largest revenue driver. Operates over 45 ships, including Oasis, Quantum, and Icon classes. Focuses on large-scale entertainment, private destinations, and global itineraries. |

| Celebrity Cruises | Cruise brand | Wholly owned | Premium cruising | Targets upscale travelers. Operates modern fleets such as Edge-class ships. Emphasizes modern design, fine dining, and destination-focused experiences. |

| Silversea Cruises | Cruise brand | Wholly owned | Ultra-luxury & expedition | All-inclusive luxury cruising with small ships. Specializes in expedition travel, polar routes, and remote destinations. High per-passenger revenue and premium positioning. |

| TUI Cruises | Joint venture | 50% owned | European / German market | Operates Mein Schiff fleet. Tailored for German-speaking travelers with longer itineraries and premium onboard offerings. |

| Hapag-Lloyd Cruises | Joint venture | 50% owned (via TUI Cruises) | Luxury & expedition (Europe) | Focuses on high-end and expedition cruising. Complements Silversea with a strong European customer base. |

| Royal Caribbean Private Destinations | Destination assets | Wholly owned | Private cruise destinations | Includes Perfect Day at CocoCay and other destination developments. Designed to capture guest spending and enhance itinerary exclusivity. |

| Royal Caribbean Shore Excursions & Destination Experiences | Travel services | Wholly owned | Onshore activities | Manages tours, transportation, and curated shore experiences sold directly to guests. Improves revenue retention and quality control. |

| Crown & Anchor Society | Loyalty program | Wholly owned | Customer retention | Proprietary loyalty program of Royal Caribbean International. Drives repeat bookings and long-term customer engagement. |

| Royal Caribbean Digital & Technology Platforms | Technology operations | Wholly owned | Booking & onboard tech | Proprietary booking systems, mobile apps, onboard connectivity, and personalization platforms used across brands. |

| Royal Caribbean Maritime & Technical Operations | Operational subsidiaries | Wholly owned | Fleet & ship management | Handles crewing, safety, compliance, maintenance, and shipbuilding coordination for the global fleet. |

Royal Caribbean International

Royal Caribbean International is the flagship and largest brand owned by Royal Caribbean Group. It operates the majority of the group’s fleet and is best known for running the largest cruise ships in the world. The brand focuses on mass-market and family-oriented cruising, offering large-scale entertainment, multiple dining venues, and destination-rich itineraries.

Royal Caribbean International is central to the group’s revenue generation. It operates more than 45 ships as of 2025 and drives most passenger volume. The brand has pioneered ship classes such as Oasis, Quantum, and Icon, each designed to increase onboard spending and enhance guest experience. It also plays a major role in private destination integration, where guests spend directly within Royal Caribbean-controlled environments.

Celebrity Cruises

Celebrity Cruises is Royal Caribbean Group’s premium cruise brand. It targets upscale travelers seeking a more refined experience compared to the mass-market offering of Royal Caribbean International. Celebrity Cruises emphasizes modern ship design, elevated dining, and culturally focused itineraries.

Celebrity operates a fleet of modern ships, including the Edge-class vessels, which are designed with smaller capacities and higher per-guest revenue potential. The brand plays a strategic role in attracting higher-spending passengers while maintaining strong brand differentiation within the group’s portfolio.

Silversea Cruises

Silversea Cruises is the ultra-luxury cruise brand owned by Royal Caribbean Group. It operates small, high-end ships offering all-inclusive experiences, personalized service, and access to remote destinations.

Silversea specializes in luxury and expedition cruising, including polar regions and less-traveled ports. This brand significantly expands Royal Caribbean Group’s reach into the high-margin luxury travel segment. Silversea’s customer base differs substantially from mass-market cruisers, allowing the group to diversify revenue streams and reduce reliance on a single traveler profile.

TUI Cruises (Joint Venture)

TUI Cruises is operated as a joint venture between Royal Caribbean Group and TUI Group. Royal Caribbean owns a 50% stake in this business. TUI Cruises primarily serves the German-speaking European market through the Mein Schiff brand.

The joint venture allows Royal Caribbean Group to participate in the European cruise market without fully integrating operations into its U.S.-centric brands. TUI Cruises focuses on longer itineraries, premium onboard offerings, and European departure ports, aligning with regional travel preferences.

Hapag-Lloyd Cruises (Joint Venture)

Hapag-Lloyd Cruises is another brand operated through Royal Caribbean Group’s joint venture structure with TUI Group. It serves the luxury and expedition segment, offering high-end cruises with a strong emphasis on destination immersion.

This brand strengthens Royal Caribbean Group’s footprint in the ultra-luxury European cruise market. Hapag-Lloyd Cruises complements Silversea by serving a similar demographic but with a distinct regional and cultural focus.

Royal Caribbean Private Destinations

Royal Caribbean Group owns and operates several private destination assets that are integral to its cruise itineraries. These destinations are not independent brands but are fully controlled entities designed to capture guest spending and improve itinerary exclusivity.

Perfect Day at CocoCay is the most prominent example. It functions as a controlled destination where nearly all guest spending flows back to Royal Caribbean. These private destinations are strategically important because they increase onboard and off-ship revenue while reducing dependency on third-party port operators.

The group continues to expand its private destination portfolio, viewing destination ownership as a long-term revenue driver and competitive differentiator.

Royal Caribbean Destination Experiences and Shore Excursions

Royal Caribbean Group also owns and operates excursion and destination experience businesses that manage shore activities offered to guests. These operations handle tours, transportation, and curated experiences sold directly through Royal Caribbean’s booking channels.

By controlling excursions rather than outsourcing them entirely, Royal Caribbean captures a larger share of vacation spending and maintains tighter quality control. These entities operate across multiple brands within the group and contribute to higher per-passenger revenue.

Technology, Loyalty, and Digital Platforms

Royal Caribbean Group owns proprietary technology platforms used across its brands, including booking systems, mobile applications, loyalty infrastructure, and onboard digital services. These platforms are operated internally rather than through third-party ownership.

The Crown & Anchor Society loyalty program is managed directly by Royal Caribbean International and plays a major role in repeat bookings and customer retention. Technology ownership allows the company to integrate pricing, personalization, and onboard spending more effectively.

Maritime and Operational Subsidiaries

The group operates multiple maritime and operational subsidiaries responsible for ship management, crewing, technical operations, and safety compliance. These entities manage fleet maintenance, shipbuilding coordination, and regulatory adherence across jurisdictions.

While not consumer-facing brands, these subsidiaries are essential to Royal Caribbean Group’s ability to operate one of the largest cruise fleets in the world efficiently and safely.

Final Thoughts

Understanding who owns Royal Caribbean Group reveals a company guided by institutional investors but managed by experienced executives. No single shareholder controls the company outright. Instead, governance is shaped by a balance of investor influence and professional management.

Royal Caribbean’s ownership structure supports long-term growth, innovation, and financial discipline. This balance has allowed the company to remain a leader in the global cruise industry.

FAQs

Who are the largest shareholders of Royal Caribbean?

The largest shareholders of Royal Caribbean are institutional investors at the parent company level, Royal Caribbean Group. The biggest holders include Capital International Investors with about 12% ownership, Vanguard Group with roughly 11%, BlackRock with around 7 to 8%, and Capital Research–affiliated entities with a combined stake of about 13%. Together, institutional investors control approximately 80% to 85% of the company’s outstanding shares.

When was Royal Caribbean founded?

Royal Caribbean was founded in 1968. The cruise line began operations in the early 1970s and has since grown into one of the largest cruise companies in the world through fleet expansion, innovation, and strategic acquisitions.

Who owns Royal Caribbean?

Royal Caribbean is owned by its publicly traded parent company, Royal Caribbean Group. The company has no single owner. Ownership is divided among institutional investors, individual shareholders, insiders, and public investors, with institutional shareholders holding the majority of shares.

What are the major companies owned by Royal Caribbean?

Royal Caribbean Group owns several major cruise brands and travel-related entities. These include Royal Caribbean International, Celebrity Cruises, and Silversea Cruises. The group also operates joint ventures such as TUI Cruises and Hapag-Lloyd Cruises, along with private destination assets and shore-excursion businesses.

Who owns the Royal Caribbean cruise line?

The Royal Caribbean cruise line, officially known as Royal Caribbean International, is wholly owned by Royal Caribbean Group. It is not independently owned and does not have separate shareholders from the parent company.

Where is Royal Caribbean based?

Royal Caribbean Group is headquartered in Miami, Florida. The company operates globally, but its corporate headquarters and primary executive offices are located in the United States.

What country owns Royal Caribbean?

No country owns Royal Caribbean. It is a privately managed, publicly traded corporation. While it operates worldwide, ownership is held by shareholders rather than any government or nation.

Is Royal Caribbean from the USA?

Yes, Royal Caribbean is considered a U.S.-based company. Although it was founded by Norwegian shipping interests, Royal Caribbean Group is headquartered in the United States and operates as an American publicly traded corporation.